Cumulus Media Inc. (NASDAQ: CMLS) (the “Company,” “we,” “us,” or

“our”) today announced operating results for the three and six

months ended June 30, 2018. As described in more detail below,

results for the 2018 periods reflect the combined results of the

Successor and Predecessor Companies in connection with the

Company's emergence from Chapter 11. For the three months ended

June 30, 2018, the Company reported net revenue of $285.2

million, down 1.8% from the three months ended June 30, 2017,

net income of $706.1 million and Adjusted EBITDA of $66.4 million,

which was down 1.5% from the three months ended June 30, 2017.

For the six months ended June 30, 2018, the Company reported

net revenue of $548.9 million, down 1.0% from the six months ended

June 30, 2017, net income of $701.1 million and Adjusted

EBITDA of $106.6 million, which was up 0.5% from the six months

ended June 30, 2017. Net income for the three and six months

ended June 30, 2018 included after-tax gains associated with the

Company's emergence from Chapter 11 of $671.0 million and $641.0

million, respectively.

As previously disclosed, on November 29, 2017, the Company and

certain of its subsidiaries filed voluntary petitions for relief

under Chapter 11 of Title 11 of the United States Code (“Chapter

11”) in the United States Bankruptcy Court for the Southern

District of New York (the “Court”). On May 10, 2018, the Court

entered an order confirming the Company’s Plan of Reorganization

(the “Plan”). On June 4, 2018, the Plan became effective in

accordance with its terms and the Company emerged from Chapter

11.

The Company's operating results and key operating performance

measures on a consolidated basis, as well as within the Cumulus

Radio Station Group and Westwood One, were not materially impacted

by the reorganization. For the purposes of the analysis of the

results presented herein, the Company is presenting the combined

results of operations for (1) the period June 4, 2018 to June 30,

2018 of the Successor Company with the period April 1, 2018 to June

3, 2018 of the Predecessor Company, and (2) the period June 4, 2018

to June 30, 2018 of the Successor Company with the period January

1, 2018 to June 3, 2018 of the Predecessor Company. Although, this

presentation is not in accordance with accounting principles

generally accepted in the United States, the Company believes

presenting and analyzing the combined results allows for a more

meaningful comparison of results for the three and six month

periods ended June 30, 2018 to the three and six months ended

June 30, 2017. For more information regarding the Predecessor

and Successor Company results, please see the Company’s Form 10-Q

for the quarter ended June 30, 2018 to be filed with the

Securities and Exchange Commission (the “SEC”) on August 20,

2018.

Mary Berner, President and Chief Executive Officer of CUMULUS

MEDIA said, “In the second quarter, we emerged from Chapter 11 with

new and supportive ownership, a billion dollars less debt and

results that demonstrate our operational and financial momentum,

despite industry challenges and the distractions posed by our

Chapter 11 proceedings. Normalizing those results for $4.8

million of write-offs related to United States Traffic Network’s

well-publicized financial problems, our Adjusted EBITDA grew in the

quarter by 5.5%.”

Berner continued, “Looking forward, we are excited about the

potential of our digital products, improved pricing and inventory

management across the entire platform and our young but

fast-growing podcasting business to supplement the performance of

our core business. These growth drivers, combined with our

continued focus on operating fundamentals, our reduced debt load,

our ability to generate significant free cash flow and our renewed

focus on optimization of our portfolio of assets, position us well

to build substantial shareholder value in the quarters and years to

come.”

Operating Summary (in thousands, except percentages and

per share data):

| |

|

|

|

|

|

|

|

| |

Successor Company |

|

|

Predecessor Company |

Combined Predecessor and

Successor |

Predecessor Company |

|

| |

Period from June 4, 2018 through June 30,

2018 |

|

|

Period from April 1, 2018 through June 3,

2018 |

Three Months Ended June 30, 2018 |

Three Months Ended June 30, 2017 |

% Change |

| Net revenue |

$ |

95,004 |

|

|

|

$ |

190,245 |

|

$ |

285,249 |

|

$ |

290,531 |

|

(1.8 |

)% |

| Net income |

$ |

4,980 |

|

|

|

$ |

701,157 |

|

$ |

706,137 |

|

$ |

5,672 |

|

** |

| Adjusted EBITDA

(1) |

$ |

26,115 |

|

|

|

$ |

40,241 |

|

$ |

66,356 |

|

$ |

67,400 |

|

(1.5 |

)% |

| Basic income per

share |

$ |

0.25 |

|

|

|

$ |

23.90 |

|

** |

$ |

0.19 |

|

** |

| Diluted income per

share |

$ |

0.25 |

|

|

|

$ |

23.90 |

|

** |

$ |

0.19 |

|

** |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

Successor Company |

|

|

Predecessor Company |

Combined Predecessor and

Successor |

Predecessor Company |

|

| |

Period from June 4, 2018 through June 30,

2018 |

|

|

Period from January 1, 2018 through June 3,

2018 |

Six Months Ended June 30, 2018 |

Six Months Ended June 30, 2017 |

% Change |

| Net revenue |

$ |

95,004 |

|

|

|

$ |

453,924 |

|

$ |

548,928 |

|

$ |

554,561 |

|

(1.0 |

)% |

| Net income (loss) |

$ |

4,980 |

|

|

|

$ |

696,156 |

|

$ |

701,136 |

|

$ |

(1,723 |

) |

** |

| Adjusted EBITDA

(1) |

$ |

26,115 |

|

|

|

$ |

80,512 |

|

$ |

106,627 |

|

$ |

106,133 |

|

0.5 |

% |

| Basic income (loss) per

share |

$ |

0.25 |

|

|

|

$ |

23.73 |

|

** |

$ |

(0.06 |

) |

** |

| Diluted income (loss)

per share |

$ |

0.25 |

|

|

|

$ |

23.73 |

|

** |

$ |

(0.06 |

) |

** |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Adjusted EBITDA is not a financial measure calculated

or presented in accordance with accounting principles generally

accepted in the United States of America (“GAAP”). For additional

information, see “Non-GAAP Financial Measure”.

| |

|

|

|

|

|

|

| |

|

Successor |

|

Predecessor |

|

|

| |

|

June 30, 2018 |

|

December 31, 2017 |

|

% Change |

| Cash and cash

equivalents |

|

$ |

37,444 |

|

|

$ |

102,891 |

|

|

(63.6 |

)% |

| |

|

|

|

|

|

|

| Term loan |

|

$ |

1,300,000 |

|

|

$ |

— |

|

|

** |

| Predecessor term

loan |

|

$ |

— |

|

|

$ |

1,722,209 |

|

|

(100.0 |

)% |

| 7.75% senior notes |

|

$ |

— |

|

|

610,000 |

|

|

(100.0 |

)% |

| Total debt |

|

$ |

1,300,000 |

|

|

$ |

2,332,209 |

|

|

(44.3 |

)% |

| |

|

|

|

|

|

|

|

|

|

|

|

**

Calculation not meaningful

| |

|

|

|

|

|

|

|

|

| |

Successor Company |

|

|

Predecessor Company |

Combined Predecessor and

Successor |

Predecessor Company |

|

|

| |

Period from June 4, 2018 through June 30,

2018 |

|

|

Period from April 1, 2018 through June 3,

2018 |

Three Months Ended June 30, 2018 |

Three Months Ended June 30, 2017 |

|

% Change |

| Capital

expenditures |

$ |

1,969 |

|

|

|

$ |

5,014 |

|

$ |

6,983 |

|

$ |

7,467 |

|

|

(6.5 |

)% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

Successor Company |

|

|

Predecessor Company |

Combined Predecessor and

Successor |

Predecessor Company |

|

|

| |

Period from June 4, 2018 through June 30,

2018 |

|

|

Period from January 1, 2018 through June 3,

2018 |

Six Months Ended June 30, 2018 |

Six Months Ended June 30, 2017 |

|

% Change |

| Capital

expenditures |

$ |

1,969 |

|

|

|

$ |

14,019 |

|

$ |

15,988 |

|

$ |

13,203 |

|

|

21.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, 2018

Net Revenue

The Company operates in two reportable segments, the Cumulus

Radio Station Group and Westwood One. Cumulus Radio Station Group

revenue is derived primarily from the sale of broadcasting time to

local, regional and national advertisers. Westwood One revenue is

generated primarily through network advertising.

Corporate and Other includes overall executive, administrative

and support functions for both of the Company’s reportable

segments, including accounting, finance, legal, human resources,

information technology functions and programming.

The following tables present our net revenue by segment (dollars

in thousands).

| |

|

|

| |

|

Period from June 4, 2018 through June 30, 2018

(Successor Company) |

| |

|

Cumulus Radio Station Group |

|

Westwood One |

|

Corporate and Other |

|

Consolidated |

| Net revenue |

|

$ |

68,357 |

|

|

$ |

26,356 |

|

|

$ |

291 |

|

|

$ |

95,004 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

| |

|

Period from April 1, 2018 through June 3, 2018

(Predecessor Company) |

| |

|

Cumulus Radio Station Group |

|

Westwood One |

|

Corporate and Other |

|

Consolidated |

| Net revenue |

|

$ |

135,093 |

|

|

$ |

54,924 |

|

|

$ |

228 |

|

|

$ |

190,245 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

| |

|

Three Months Ended June 30, 2018 (Combined

Predecessor and Successor) |

| |

|

Cumulus Radio Station Group |

|

Westwood One |

|

Corporate and Other |

|

Consolidated |

| Net revenue |

|

$ |

203,450 |

|

|

$ |

81,280 |

|

|

$ |

519 |

|

|

$ |

285,249 |

|

| % of total revenue |

|

71.3 |

% |

|

28.5 |

% |

|

0.2 |

% |

|

100.0 |

% |

| $ change from three

months ended June 30, 2017 |

|

$ |

(5,146 |

) |

|

$ |

46 |

|

|

$ |

(182 |

) |

|

$ |

(5,282 |

) |

| % change from three

months ended June 30, 2017 |

|

(2.5 |

)% |

|

0.1 |

% |

|

(26.0 |

)% |

|

(1.8 |

)% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

| |

|

Three Months Ended June 30, 2017 (Predecessor

Company) |

| |

|

Cumulus Radio Station Group |

|

Westwood One |

|

Corporate and Other |

|

Consolidated |

| Net revenue |

|

$ |

208,596 |

|

|

$ |

81,234 |

|

|

$ |

701 |

|

|

$ |

290,531 |

|

| % of total revenue |

|

71.8 |

% |

|

28.0 |

% |

|

0.2 |

% |

|

100.0 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Net Income (Loss)

The following tables present our net income (loss) by segment

(dollars in thousands).

| |

|

|

| |

|

Period from June 4, 2018 through June 30, 2018

(Successor Company) |

| |

|

Cumulus Radio Station Group |

|

Westwood One |

|

Corporate and Other |

|

Consolidated |

| Net income (loss) |

|

$ |

18,327 |

|

|

$ |

5,796 |

|

|

$ |

(19,143 |

) |

|

$ |

4,980 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

| |

|

Period from April 1, 2018 through June 3, 2018

(Predecessor Company) |

| |

|

Cumulus Radio Station Group |

|

Westwood One |

|

Corporate and Other |

|

Consolidated |

| Net (loss) income |

|

$ |

(506,774 |

) |

|

$ |

253,619 |

|

|

$ |

954,312 |

|

|

$ |

701,157 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

| |

|

Three Months Ended June 30, 2018 (Combined

Predecessor and Successor) |

| |

|

Cumulus Radio Station Group |

|

Westwood One |

|

Corporate and Other |

|

Consolidated |

| Net (loss) income |

|

$ |

(488,447 |

) |

|

$ |

259,415 |

|

|

$ |

935,169 |

|

|

$ |

706,137 |

|

| $ change from three

months ended June 30, 2017 |

|

$ |

(535,250 |

) |

|

$ |

248,439 |

|

|

$ |

987,276 |

|

|

$ |

700,465 |

|

| % change from three

months ended June 30, 2017 |

|

** |

|

** |

|

** |

|

** |

| |

|

|

|

|

|

|

|

|

**

Calculation not meaningful

| |

|

|

| |

|

Three Months Ended June 30, 2017 (Predecessor

Company) |

| |

|

Cumulus Radio Station Group |

|

Westwood One |

|

Corporate and Other |

|

Consolidated |

| Net income (loss) |

|

$ |

46,803 |

|

|

$ |

10,976 |

|

|

$ |

(52,107 |

) |

|

$ |

5,672 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA

The following tables present our Adjusted EBITDA by segment

(dollars in thousands).

| |

|

|

| |

|

Period from June 4, 2018 through June 30, 2018

(Successor Company) |

| |

|

Cumulus Radio Station Group |

|

Westwood One |

|

Corporate and Other |

|

Consolidated |

| Adjusted EBITDA |

|

$ |

20,860 |

|

|

$ |

7,690 |

|

|

$ |

(2,435 |

) |

|

$ |

26,115 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

| |

|

Period from April 1, 2018 through June 3, 2018

(Predecessor Company) |

| |

|

Cumulus Radio Station Group |

|

Westwood One |

|

Corporate and Other |

|

Consolidated |

| Adjusted EBITDA |

|

$ |

39,824 |

|

|

$ |

6,554 |

|

|

$ |

(6,137 |

) |

|

$ |

40,241 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

| |

|

Three Months Ended June 30, 2018 (Combined

Predecessor and Successor) |

| |

|

Cumulus Radio Station Group |

|

Westwood One |

|

Corporate and Other |

|

Consolidated |

| Adjusted EBITDA |

|

$ |

60,684 |

|

|

$ |

14,244 |

|

|

$ |

(8,572 |

) |

|

$ |

66,356 |

|

| $ change from three

months ended June 30, 2017 |

|

$ |

814 |

|

|

$ |

(2,698 |

) |

|

$ |

840 |

|

|

$ |

(1,044 |

) |

| % change from three

months ended June 30, 2017 |

|

1.4 |

% |

|

(15.9 |

)% |

|

(8.9 |

)% |

|

(1.5 |

)% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

| |

|

Three Months Ended June 30, 2017 (Predecessor

Company) |

| |

|

Cumulus Radio Station Group |

|

Westwood One |

|

Corporate and Other |

|

Consolidated |

| Adjusted EBITDA |

|

$ |

59,870 |

|

|

$ |

16,942 |

|

|

$ |

(9,412 |

) |

|

$ |

67,400 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended June 30, 2018

Net Revenue

The following tables present our net revenue by segment (dollars

in thousands).

| |

|

|

| |

|

Period from June 4, 2018 through June 30, 2018

(Successor Company) |

| |

|

Cumulus Radio Station Group |

|

Westwood One |

|

Corporate and Other |

|

Consolidated |

| Net revenue |

|

$ |

68,357 |

|

|

$ |

26,356 |

|

|

$ |

291 |

|

|

$ |

95,004 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

| |

|

Period from January 1, 2018 through June 3,

2018 (Predecessor Company) |

| |

|

Cumulus Radio Station Group |

|

Westwood One |

|

Corporate and Other |

|

Consolidated |

| Net revenue |

|

$ |

303,317 |

|

|

$ |

149,715 |

|

|

$ |

892 |

|

|

$ |

453,924 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

| |

|

Six Months Ended June 30, 2018 (Combined

Predecessor and Successor) |

| |

|

Cumulus Radio Station Group |

|

Westwood One |

|

Corporate and Other |

|

Consolidated |

| Net revenue |

|

$ |

371,673 |

|

|

$ |

176,071 |

|

|

$ |

1,184 |

|

|

$ |

548,928 |

|

| % of total revenue |

|

67.7 |

% |

|

32.1 |

% |

|

0.2 |

% |

|

100.0 |

% |

| $ change from six

months ended June 30, 2017 |

|

$ |

(10,524 |

) |

|

$ |

4,981 |

|

|

$ |

(90 |

) |

|

$ |

(5,633 |

) |

| % change from six

months ended June 30, 2017 |

|

(2.8 |

)% |

|

2.9 |

% |

|

(7.1 |

)% |

|

(1.0 |

)% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

| |

|

Six Months Ended June 30, 2017 (Predecessor

Company) |

| |

|

Cumulus Radio Station Group |

|

Westwood One |

|

Corporate and Other |

|

Consolidated |

| Net revenue |

|

$ |

382,197 |

|

|

$ |

171,090 |

|

|

$ |

1,274 |

|

|

$ |

554,561 |

|

| % of total revenue |

|

68.9 |

% |

|

30.9 |

% |

|

0.2 |

% |

|

100.0 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Net (Loss) IncomeThe following tables present

our net (loss) income by segment (dollars in thousands).

| |

|

|

| |

|

Period from June 4, 2018 through June 30, 2018

(Successor Company) |

| |

|

Cumulus Radio Station Group |

|

Westwood One |

|

Corporate and Other |

|

Consolidated |

| Net income (loss) |

|

$ |

18,327 |

|

|

$ |

5,796 |

|

|

$ |

(19,143 |

) |

|

$ |

4,980 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

| |

|

Period from January 1, 2018 through June 3,

2018 (Predecessor Company) |

| |

|

Cumulus Radio Station Group |

|

Westwood One |

|

Corporate and Other |

|

Consolidated |

| Net (loss) income |

|

$ |

(477,966 |

) |

|

$ |

259,441 |

|

|

$ |

914,681 |

|

|

$ |

696,156 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

| |

|

Six Months Ended June 30, 2018 (Combined

Predecessor and Successor) |

| |

|

Cumulus Radio Station Group |

|

Westwood One |

|

Corporate and Other |

|

Consolidated |

| Net (loss) income |

|

$ |

(459,639 |

) |

|

$ |

265,237 |

|

|

$ |

895,538 |

|

|

$ |

701,136 |

|

| $ change from three

months ended June 30, 2017 |

|

$ |

(534,980 |

) |

|

$ |

251,996 |

|

|

$ |

985,843 |

|

|

$ |

702,859 |

|

| % change from three

months ended June 30, 2017 |

|

** |

|

** |

|

** |

|

** |

| |

|

|

|

|

|

|

|

|

**

Calculation not meaningful

| |

|

|

| |

|

Six Months Ended June 30, 2017 (Predecessor

Company) |

| |

|

Cumulus Radio Station Group |

|

Westwood One |

|

Corporate and Other |

|

Consolidated |

| Net income (loss) |

|

$ |

75,341 |

|

|

$ |

13,241 |

|

|

$ |

(90,305 |

) |

|

$ |

(1,723 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA

The following tables present our Adjusted EBITDA by segment

(dollars in thousands).

| |

|

|

| |

|

Period from June 4, 2018 through June 30, 2018

(Successor Company) |

| |

|

Cumulus Radio Station Group |

|

Westwood One |

|

Corporate and Other |

|

Consolidated |

| Adjusted EBITDA |

|

$ |

20,860 |

|

|

$ |

7,690 |

|

|

$ |

(2,435 |

) |

|

$ |

26,115 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

| |

|

Period from January 1, 2018 through June 3,

2018 (Predecessor Company) |

| |

|

Cumulus Radio Station Group |

|

Westwood One |

|

Corporate and Other |

|

Consolidated |

| Adjusted EBITDA |

|

$ |

76,009 |

|

|

$ |

19,210 |

|

|

$ |

(14,707 |

) |

|

$ |

80,512 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

| |

|

Six Months Ended June 30, 2018 (Combined

Predecessor and Successor) |

| |

|

Cumulus Radio Station Group |

|

Westwood One |

|

Corporate and Other |

|

Consolidated |

| Adjusted EBITDA |

|

$ |

96,869 |

|

|

$ |

26,900 |

|

|

$ |

(17,142 |

) |

|

$ |

106,627 |

|

| $ change from six

months June 30, 2017 |

|

$ |

(2,042 |

) |

|

$ |

989 |

|

|

$ |

1,547 |

|

|

$ |

494 |

|

| % change from six

months ended June 30, 2017 |

|

(2.1 |

)% |

|

3.8 |

% |

|

(8.3 |

)% |

|

0.5 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

| |

|

Six Months Ended June 30, 2017 (Predecessor

Company) |

| |

|

Cumulus Radio Station Group |

|

Westwood One |

|

Corporate and Other |

|

Consolidated |

| Adjusted EBITDA |

|

$ |

98,911 |

|

|

$ |

25,911 |

|

|

$ |

(18,689 |

) |

|

$ |

106,133 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings Call InformationThe Company will host

a conference call today at 4:30 PM EDT to discuss its second

quarter 2018 operating results.

A link to the webcast of the conference call will be available

on the investor section of the Company’s website

(www.cumulusmedia.com/investors/). The conference call dial-in

number for domestic callers is 877-830-7699, and international

callers should dial 248-847-2515 for call access. If prompted, the

conference ID number is 9993757. Please call five to ten minutes in

advance to ensure that you are connected prior to the call.

Following completion, a telephonic replay can be accessed until

11:59 PM EDT on September 20, 2018, by dialing 855-859-2056 or

404-537-3406 and using the replay code 9993757. An archive of the

webcast will be available beginning 24 hours after the call for a

period of 30 days and can be accessed via the same link on our

website by using the password “cumulusmedia”.

Forward-Looking StatementsCertain statements in

this press release may constitute “forward-looking” statements

within the meaning of the Private Securities Litigation Reform Act

of 1995 and other federal securities laws. Such statements are

statements other than historical fact and relate to our intent,

belief or current expectations, primarily with respect to our

future operating, financial and strategic performance. Any such

forward-looking statements are not guarantees of future performance

and involve risks and uncertainties. Actual results may differ from

those contained in or implied by the forward-looking statements as

a result of various factors including, but not limited to, risks

and uncertainties related to our recently completed financial

restructuring and other risk factors described from time to time in

our filings with the Securities and Exchange Commission. Many of

these risks and uncertainties are beyond our control, and the

unexpected occurrence or failure to occur of any such events or

matters could significantly alter the actual results of our

operations or financial condition. CUMULUS MEDIA assumes no

responsibility to update any forward-looking statement as a result

of new information, future events or otherwise.

About CUMULUS MEDIAA leader in the radio

broadcasting industry, CUMULUS MEDIA (NASDAQ: CMLS) combines

high-quality local programming with iconic, nationally syndicated

media, sports and entertainment brands to deliver premium content

choices to the 245 million people reached each week through

its 441 owned-and-operated stations broadcasting in 90 U.S. media

markets (including eight of the top 10), approximately 8,000

broadcast radio stations affiliated with its Westwood One network

and numerous digital channels. Together, the Cumulus Radio Station

Group and Westwood One platforms make CUMULUS MEDIA one of the few

media companies that can provide advertisers with national reach

and local impact. The Cumulus Radio Station Group and Westwood One

are the exclusive radio broadcast partners to some of the largest

brands in sports, entertainment, news, and talk, including the NFL,

the NCAA, the Masters, the Olympics, the GRAMMYs, the Academy of

Country Music Awards, the American Music Awards, the Billboard

Music Awards, and more. Additionally, the Company is the nation's

leading provider of country music and lifestyle content through its

NASH brand, which serves country fans nationwide through radio

programming, exclusive digital content, and live events. For

more information, visit www.cumulusmedia.com.

For further information, please

contact:Cumulus Media Inc.Collin

JonesInvestor Relationscollin@cumulus.com404-260-6600

CUMULUS MEDIA

INC.Unaudited Condensed Consolidated Statements of

Operations(Dollars in thousands)

| |

|

|

|

|

|

|

Successor Company |

|

|

Predecessor Company |

|

|

Period from June 4, 2018 through June

30, |

|

|

Period from April 1, 2018 through June

3, |

| |

2018 |

|

|

2018 |

| Net revenue |

$ |

95,004 |

|

|

|

$ |

190,245 |

|

| Operating

expenses: |

|

|

|

|

| Content

costs |

27,685 |

|

|

|

59,117 |

|

| Selling,

general and administrative expenses |

38,719 |

|

|

|

85,097 |

|

|

Depreciation and amortization |

4,379 |

|

|

|

10,065 |

|

| Local

marketing agreement fees |

358 |

|

|

|

702 |

|

| Corporate

expenses |

2,532 |

|

|

|

5,883 |

|

|

Stock-based compensation expense |

652 |

|

|

|

65 |

|

|

Acquisition-related restructuring costs |

6,941 |

|

|

|

734 |

|

| Loss on

sale or disposal of assets or stations |

— |

|

|

|

147 |

|

| Total

operating expenses |

81,266 |

|

|

|

161,810 |

|

| Operating

income |

13,738 |

|

|

|

28,435 |

|

| Non-operating (expense)

income: |

|

|

|

|

|

Reorganization items, net |

— |

|

|

|

496,368 |

|

| Interest

expense |

(6,176 |

) |

|

|

(132 |

) |

| Interest

income |

4 |

|

|

|

21 |

|

| Other

income (expense), net |

20 |

|

|

|

(276 |

) |

| Total

non-operating (expense) income, net |

(6,152 |

) |

|

|

495,981 |

|

| Income

before income tax (expense) benefit |

7,586 |

|

|

|

524,416 |

|

| Income tax (expense)

benefit |

(2,606 |

) |

|

|

176,741 |

|

| Net

income |

$ |

4,980 |

|

|

|

$ |

701,157 |

|

| |

|

|

|

|

|

|

|

|

CUMULUS MEDIA

INC.Unaudited Condensed Consolidated Statements of

Operations(Dollars in thousands)

| |

|

|

|

|

|

|

Successor Company |

|

|

Predecessor Company |

|

|

Period from June 4, 2018 through June

30, |

|

|

Period from January 1, 2018 through June

3, |

| |

2018 |

|

|

2018 |

| Net revenue |

$ |

95,004 |

|

|

|

$ |

453,924 |

|

| Operating

expenses: |

|

|

|

|

| Content

costs |

27,685 |

|

|

|

159,681 |

|

| Selling,

general and administrative expenses |

38,719 |

|

|

|

199,482 |

|

|

Depreciation and amortization |

4,379 |

|

|

|

22,046 |

|

| Local

marketing agreement fees |

358 |

|

|

|

1,809 |

|

| Corporate

expenses |

2,532 |

|

|

|

14,483 |

|

|

Stock-based compensation expense |

652 |

|

|

|

231 |

|

|

Acquisition-related restructuring costs |

6,941 |

|

|

|

2,455 |

|

| Loss on

sale or disposal of assets or stations |

— |

|

|

|

158 |

|

| Total

operating expenses |

81,266 |

|

|

|

400,345 |

|

| Operating

income |

13,738 |

|

|

|

53,579 |

|

| Non-operating (expense)

income: |

|

|

|

|

|

Reorganization items, net |

— |

|

|

|

466,201 |

|

| Interest

expense |

(6,176 |

) |

|

|

(260 |

) |

| Interest

income |

4 |

|

|

|

50 |

|

| Other

income (expense), net |

20 |

|

|

|

(273 |

) |

| Total

non-operating (expense) income, net |

(6,152 |

) |

|

|

465,718 |

|

| Income

before income tax (expense) benefit |

7,586 |

|

|

|

519,297 |

|

| Income tax (expense)

benefit |

(2,606 |

) |

|

|

176,859 |

|

| Net

income |

$ |

4,980 |

|

|

|

$ |

696,156 |

|

| |

|

|

|

|

|

|

|

|

CUMULUS MEDIA

INC.Unaudited Condensed Consolidated Statements of

Operations(Dollars in thousands)

| |

|

|

|

|

| |

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

|

2018 |

|

2017 |

|

2018 |

|

2017 |

| |

|

Combined Predecessor and

Successor |

|

Predecessor Company |

|

Combined Predecessor and

Successor |

|

Predecessor Company |

| Net revenue |

|

$ |

285,249 |

|

|

$ |

290,531 |

|

|

$ |

548,928 |

|

|

$ |

554,561 |

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

| Content

costs |

|

86,802 |

|

|

93,289 |

|

|

187,366 |

|

|

195,069 |

|

| Selling,

general and administrative expenses |

|

123,816 |

|

|

120,506 |

|

|

238,201 |

|

|

234,896 |

|

|

Depreciation and amortization |

|

14,444 |

|

|

16,120 |

|

|

26,425 |

|

|

32,402 |

|

| Local

marketing agreement fees |

|

1,060 |

|

|

2,713 |

|

|

2,167 |

|

|

5,420 |

|

| Corporate

expenses |

|

8,413 |

|

|

9,476 |

|

|

17,015 |

|

|

18,742 |

|

|

Stock-based compensation expense |

|

717 |

|

|

530 |

|

|

883 |

|

|

1,068 |

|

|

Acquisition-related and restructuring costs |

|

7,675 |

|

|

467 |

|

|

9,396 |

|

|

1,618 |

|

| Loss

(gain) on sale or disposal of assets or stations |

|

147 |

|

|

104 |

|

|

158 |

|

|

(2,502 |

) |

| Total

operating expenses |

|

243,074 |

|

|

243,205 |

|

|

481,611 |

|

|

486,713 |

|

| Operating

income |

|

42,175 |

|

|

47,326 |

|

|

67,317 |

|

|

67,848 |

|

| Non-operating income

(expense): |

|

|

|

|

|

|

|

|

|

Reorganization items, net |

|

496,368 |

|

|

— |

|

|

466,201 |

|

|

— |

|

| Interest

expense |

|

(6,308 |

) |

|

(34,344 |

) |

|

(6,436 |

) |

|

(68,407 |

) |

| Interest

income |

|

25 |

|

|

35 |

|

|

54 |

|

|

72 |

|

| Other

expense, net |

|

(256 |

) |

|

(111 |

) |

|

(253 |

) |

|

(28 |

) |

| Total

non-operating income (expense), net |

|

489,829 |

|

|

(34,420 |

) |

|

459,566 |

|

|

(68,363 |

) |

| Income

(loss) before income tax benefit (expense) |

|

532,004 |

|

|

12,906 |

|

|

526,883 |

|

|

(515 |

) |

| Income tax benefit

(expense) |

|

174,135 |

|

|

(7,234 |

) |

|

174,253 |

|

|

(1,208 |

) |

| Net

income (loss) |

|

$ |

706,139 |

|

|

$ |

5,672 |

|

|

$ |

701,136 |

|

|

$ |

(1,723 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Financial Measure

From time to time we utilize certain financial measures that are

not prepared or calculated in accordance with GAAP to assess our

financial performance and profitability. Consolidated adjusted

earnings before interest, taxes, depreciation, and amortization

(“Adjusted EBITDA”) and segment Adjusted EBITDA are the financial

metrics by which management and the chief operating decision maker

allocate resources of the Company and analyze the performance of

the Company as a whole and each of our reportable segments,

respectively. Management also uses this measure to determine the

contribution of our core operations to the funding of our corporate

resources utilized to manage our operations and our non-operating

expenses including debt service and acquisitions. In addition,

consolidated Adjusted EBITDA is a key metric for purposes of

calculating and determining our compliance with certain covenants

contained in our credit agreement.

In determining Adjusted EBITDA, the Company excludes from net

income items not related to core operations and those that are

non-cash including: interest, taxes, depreciation, amortization,

stock-based compensation expense, gain or loss on the exchange,

sale, or disposal of any assets or stations, early extinguishment

of debt, local marketing agreement fees (as such fees are excluded

from the definition of such term for purposes of calculating

covenant compliance under the credit agreement), expenses relating

to acquisitions, restructuring costs, reorganization items and

non-cash impairments of assets, if any.

Management believes that Adjusted EBITDA, although not a measure

that is calculated in accordance with GAAP, is commonly employed by

the investment community as a measure for determining the market

value of a media company and comparing the operational and

financial performance among media companies. Management has also

observed that Adjusted EBITDA is routinely utilized to evaluate and

negotiate the potential purchase price for media companies. Given

the relevance to our overall value, management believes that

investors consider the metric to be extremely useful.

Adjusted EBITDA should not be considered in isolation or as a

substitute for net income (loss), operating income, cash flows from

operating activities or any other measure for determining the

Company’s operating performance or liquidity that is calculated in

accordance with GAAP. In addition, Adjusted EBITDA may be defined

or calculated differently by other companies, and comparability may

be limited.

The following tables reconcile net income (loss), the most

directly comparable financial measure calculated and presented in

accordance with GAAP, to segment and consolidated Adjusted EBITDA

for the period from June 4, 2018 through June 30, 2018, the period

from April 1, 2018 through June 3, 2018, the period from January 1,

2018 through June 3, 2018 and the three and six months ended

June 30, 2018 and 2017 (dollars in thousands):

| |

|

|

| |

|

Period from June 4, 2018 through June 30, 2018

(Successor Company) |

| |

|

Cumulus Radio Station Group |

|

Westwood One |

|

Corporate and Other |

|

Consolidated |

| GAAP net income

(loss) |

|

$ |

18,327 |

|

|

$ |

5,796 |

|

|

$ |

(19,143 |

) |

|

$ |

4,980 |

|

| Income

tax expense |

|

— |

|

|

— |

|

|

2,606 |

|

|

2,606 |

|

|

Non-operating (income) expense, including net interest expense |

|

(4 |

) |

|

47 |

|

|

6,109 |

|

|

6,152 |

|

| Local

marketing agreement fees |

|

358 |

|

|

— |

|

|

— |

|

|

358 |

|

|

Depreciation and amortization |

|

2,179 |

|

|

1,949 |

|

|

251 |

|

|

4,379 |

|

|

Stock-based compensation expense |

|

— |

|

|

— |

|

|

652 |

|

|

652 |

|

|

Acquisition-related and restructuring costs |

|

— |

|

|

(102 |

) |

|

7,043 |

|

|

6,941 |

|

| Franchise

and state taxes |

|

— |

|

|

— |

|

|

47 |

|

|

47 |

|

| Adjusted EBITDA |

|

$ |

20,860 |

|

|

$ |

7,690 |

|

|

$ |

(2,435 |

) |

|

$ |

26,115 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

| |

|

Period from April 1, 2018 through June 3, 2018

(Predecessor Company) |

| |

|

Cumulus Radio Station Group |

|

Westwood One |

|

Corporate and Other |

|

Consolidated |

| GAAP net (loss)

income |

|

$ |

(506,774 |

) |

|

$ |

253,619 |

|

|

$ |

954,312 |

|

|

$ |

701,157 |

|

| Income

tax benefit |

|

— |

|

|

— |

|

|

(176,741 |

) |

|

(176,741 |

) |

|

Non-operating (income) expense, including net interest expense |

|

(1 |

) |

|

77 |

|

|

311 |

|

|

387 |

|

| Local

marketing agreement fees |

|

702 |

|

|

— |

|

|

— |

|

|

702 |

|

|

Depreciation and amortization |

|

4,111 |

|

|

4,488 |

|

|

1,466 |

|

|

10,065 |

|

|

Stock-based compensation expense |

|

— |

|

|

— |

|

|

65 |

|

|

65 |

|

| Loss on

sale or disposal of assets or stations |

|

3 |

|

|

— |

|

|

144 |

|

|

147 |

|

|

Reorganization items, net |

|

541,903 |

|

|

(251,669 |

) |

|

(786,602 |

) |

|

(496,368 |

) |

|

Acquisition-related and restructuring costs |

|

(120 |

) |

|

39 |

|

|

815 |

|

|

734 |

|

| Franchise

and state taxes |

|

— |

|

|

— |

|

|

93 |

|

|

93 |

|

| Adjusted EBITDA |

|

$ |

39,824 |

|

|

$ |

6,554 |

|

|

$ |

(6,137 |

) |

|

$ |

40,241 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

| |

|

Three Months Ended June 30, 2018 (Combined

Predecessor and Successor) |

| |

|

Cumulus Radio Station Group |

|

Westwood One |

|

Corporate and Other |

|

Consolidated |

| GAAP net (loss)

income |

|

$ |

(488,447 |

) |

|

$ |

259,415 |

|

|

$ |

935,169 |

|

|

$ |

706,137 |

|

| Income

tax benefit |

|

— |

|

|

— |

|

|

(174,135 |

) |

|

(174,135 |

) |

|

Non-operating (income) expense, including net interest expense |

|

(5 |

) |

|

124 |

|

|

6,420 |

|

|

6,539 |

|

| Local

marketing agreement fees |

|

1,060 |

|

|

— |

|

|

— |

|

|

1,060 |

|

|

Depreciation and amortization |

|

6,290 |

|

|

6,437 |

|

|

1,717 |

|

|

14,444 |

|

|

Stock-based compensation expense |

|

— |

|

|

— |

|

|

717 |

|

|

717 |

|

| Loss on

sale or disposal of assets or stations |

|

3 |

|

|

— |

|

|

144 |

|

|

147 |

|

|

Reorganization items, net |

|

541,903 |

|

|

(251,669 |

) |

|

(786,602 |

) |

|

(496,368 |

) |

|

Acquisition-related and restructuring costs |

|

(120 |

) |

|

(63 |

) |

|

7,858 |

|

|

7,675 |

|

| Franchise

and state taxes |

|

— |

|

|

— |

|

|

140 |

|

|

140 |

|

| Adjusted EBITDA |

|

$ |

60,684 |

|

|

$ |

14,244 |

|

|

$ |

(8,572 |

) |

|

$ |

66,356 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

| |

|

Three Months Ended June 30, 2017 (Predecessor

Company) |

| |

|

Cumulus Radio Station Group |

|

Westwood One |

|

Corporate and Other |

|

Consolidated |

| GAAP net income

(loss) |

|

$ |

46,803 |

|

|

$ |

10,976 |

|

|

$ |

(52,107 |

) |

|

$ |

5,672 |

|

| Income

tax expense |

|

— |

|

|

— |

|

|

7,234 |

|

|

7,234 |

|

|

Non-operating (income) expense, including net interest expense |

|

(1 |

) |

|

133 |

|

|

34,288 |

|

|

34,420 |

|

| Local

marketing agreement fees |

|

2,713 |

|

|

— |

|

|

— |

|

|

2,713 |

|

|

Depreciation and amortization |

|

10,251 |

|

|

5,449 |

|

|

420 |

|

|

16,120 |

|

|

Stock-based compensation expense |

|

— |

|

|

— |

|

|

530 |

|

|

530 |

|

| Loss on

sale or disposal of assets or stations |

|

104 |

|

|

— |

|

|

— |

|

|

104 |

|

|

Acquisition-related and restructuring costs |

|

— |

|

|

384 |

|

|

83 |

|

|

467 |

|

| Franchise

and state taxes |

|

— |

|

|

— |

|

|

140 |

|

|

140 |

|

| Adjusted EBITDA |

|

$ |

59,870 |

|

|

$ |

16,942 |

|

|

$ |

(9,412 |

) |

|

$ |

67,400 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

| |

|

Period from June 4, 2018 through June 30, 2018

(Successor Company) |

| |

|

Cumulus Radio Station Group |

|

Westwood One |

|

Corporate and Other |

|

Consolidated |

| GAAP net income

(loss) |

|

$ |

18,327 |

|

|

$ |

5,796 |

|

|

$ |

(19,143 |

) |

|

$ |

4,980 |

|

| Income

tax expense |

|

— |

|

|

— |

|

|

2,606 |

|

|

2,606 |

|

|

Non-operating (income) expense, including net interest expense |

|

(4 |

) |

|

47 |

|

|

6,109 |

|

|

6,152 |

|

| Local

marketing agreement fees |

|

358 |

|

|

— |

|

|

— |

|

|

358 |

|

|

Depreciation and amortization |

|

2,179 |

|

|

1,949 |

|

|

251 |

|

|

4,379 |

|

|

Stock-based compensation expense |

|

— |

|

|

— |

|

|

652 |

|

|

652 |

|

|

Acquisition-related and restructuring costs |

|

— |

|

|

(102 |

) |

|

7,043 |

|

|

6,941 |

|

| Franchise

and state taxes |

|

— |

|

|

— |

|

|

47 |

|

|

47 |

|

| Adjusted EBITDA |

|

$ |

20,860 |

|

|

$ |

7,690 |

|

|

$ |

(2,435 |

) |

|

$ |

26,115 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

| |

|

Period from January 1, 2018 through June 3,

2018 (Predecessor Company) |

| |

|

Cumulus Radio Station Group |

|

Westwood One |

|

Corporate and Other |

|

Consolidated |

| GAAP net (loss)

income |

|

$ |

(477,966 |

) |

|

$ |

259,441 |

|

|

$ |

914,681 |

|

|

$ |

696,156 |

|

| Income

tax benefit |

|

— |

|

|

— |

|

|

(176,859 |

) |

|

(176,859 |

) |

|

Non-operating (income) expense, including net interest expense |

|

(2 |

) |

|

204 |

|

|

281 |

|

|

483 |

|

| Local

marketing agreement fees |

|

1,809 |

|

|

— |

|

|

— |

|

|

1,809 |

|

|

Depreciation and amortization |

|

10,251 |

|

— |

|

9,965 |

|

|

1,830 |

|

|

22,046 |

|

|

Stock-based compensation expense |

|

— |

|

|

— |

|

|

231 |

|

|

231 |

|

| Loss on

sale or disposal of assets or stations |

|

14 |

|

|

— |

|

|

144 |

|

|

158 |

|

|

Reorganization items, net |

|

541,903 |

|

|

(251,487 |

) |

|

(756,617 |

) |

|

(466,201 |

) |

|

Acquisition-related and restructuring costs |

|

— |

|

|

1,087 |

|

|

1,368 |

|

|

2,455 |

|

| Franchise

and state taxes |

|

— |

|

|

— |

|

|

234 |

|

|

234 |

|

| Adjusted EBITDA |

|

$ |

76,009 |

|

|

$ |

19,210 |

|

|

$ |

(14,707 |

) |

|

$ |

80,512 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

| |

|

Six Months Ended June 30, 2018 (Combined

Predecessor and Successor) |

| |

|

Cumulus Radio Station Group |

|

Westwood One |

|

Corporate and Other |

|

Consolidated |

| GAAP net (loss)

income |

|

$ |

(459,639 |

) |

|

$ |

265,237 |

|

|

$ |

895,538 |

|

|

$ |

701,136 |

|

| Income

tax benefit |

|

— |

|

|

— |

|

|

(174,253 |

) |

|

(174,253 |

) |

|

Non-operating (income) expense, including net interest expense |

|

(6 |

) |

|

251 |

|

|

6,390 |

|

|

6,635 |

|

| Local

marketing agreement fees |

|

2,167 |

|

|

— |

|

|

— |

|

|

2,167 |

|

|

Depreciation and amortization |

|

12,430 |

|

|

|

11,914 |

|

|

2,081 |

|

|

26,425 |

|

|

Stock-based compensation expense |

|

— |

|

|

— |

|

|

883 |

|

|

883 |

|

| Loss on

sale or disposal of assets or stations |

|

14 |

|

|

— |

|

|

144 |

|

|

158 |

|

|

Reorganization items, net |

|

541,903 |

|

|

(251,487 |

) |

|

(756,617 |

) |

|

(466,201 |

) |

|

Acquisition-related and restructuring costs |

|

— |

|

|

985 |

|

|

8,411 |

|

|

9,396 |

|

| Franchise

and state taxes |

|

— |

|

|

— |

|

|

281 |

|

|

281 |

|

| Adjusted EBITDA |

|

$ |

96,869 |

|

|

$ |

26,900 |

|

|

$ |

(17,142 |

) |

|

$ |

106,627 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

| |

|

Six Months Ended June 30, 2017 (Predecessor

Company) |

| |

|

Cumulus Radio Station Group |

|

Westwood One |

|

Corporate and Other |

|

Consolidated |

| GAAP net income

(loss) |

|

$ |

75,341 |

|

|

$ |

13,241 |

|

|

$ |

(90,305 |

) |

|

$ |

(1,723 |

) |

| Income

tax expense |

|

— |

|

|

— |

|

|

1,208 |

|

|

1,208 |

|

|

Non-operating (income) expense, including net interest expense |

|

(3 |

) |

|

275 |

|

|

68,091 |

|

|

68,363 |

|

| Local

marketing agreement fees |

|

5,420 |

|

|

— |

|

|

— |

|

|

5,420 |

|

|

Depreciation and amortization |

|

20,655 |

|

|

10,903 |

|

|

844 |

|

|

32,402 |

|

|

Stock-based compensation expense |

|

— |

|

|

— |

|

|

1,068 |

|

|

1,068 |

|

| Gain on

sale of assets or stations |

|

(2,502 |

) |

|

— |

|

|

— |

|

|

(2,502 |

) |

|

Acquisition-related and restructuring costs |

|

— |

|

|

1,492 |

|

|

126 |

|

|

1,618 |

|

| Franchise

and state taxes |

|

— |

|

|

— |

|

|

279 |

|

|

279 |

|

| Adjusted EBITDA |

|

$ |

98,911 |

|

|

$ |

25,911 |

|

|

$ |

(18,689 |

) |

|

$ |

106,133 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

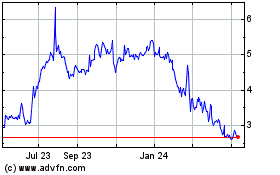

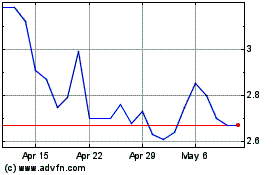

Cumulus Media (NASDAQ:CMLS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cumulus Media (NASDAQ:CMLS)

Historical Stock Chart

From Apr 2023 to Apr 2024