Current Report Filing (8-k)

August 13 2018 - 2:22PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): August 13, 2018 (August 9, 2018)

MJ

Holdings, Inc.

(Exact

name of registrant as specified in its charter)

|

|

|

333-167824

|

|

20-8235905

|

|

(State

or other jurisdiction

|

|

(Commission

File Number)

|

|

(IRS

Employer

|

|

of

incorporation)

|

|

|

|

Identification No.)

|

3275 South Jones Blvd., Suite 104, Las

Vegas, NV 89146

(Address

of principal executive offices) (Zip Code)

Registrant’s

telephone number, including area code: 702-879-4440

Not

Applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

☐ Written communications pursuant to Rule

425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12

under the Exchange Act (17 CFR 240.14a-12)

☐

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Section 3 – Securities and Trading Markets

Item 3.02 Unregistered Sales of Equity Securities.

On August 9, 2018 (the “Transaction

Date”), MJ Holdings, Inc. (the “Company”), entered into a Securities Purchase Agreement, pursuant to which the

Company sold and issued 2,500 shares of its Series A Convertible Preferred Stock (the “Preferred Stock”) to a single

institutional, accredited investor for $1,000 per share or an aggregate subscription of $2,500,000. Subject to a standard “4.99%

Beneficial Ownership Limitation blocker,” the Preferred Stock is convertible into 3,333,334 shares of the Company’s

Common Stock at a conversion price of $0.75 per share, subject to adjustment as described in the Certificate of Designation.

The foregoing description of the Securities

Purchase Agreement is a summary and is qualified in its entirety by reference to the provisions thereof, a copy of which is attached

to this Current Report as Exhibit 10.3, which is incorporated by reference herein.

The Company also entered into a Registration

Rights Agreement with the purchaser, pursuant to which the Company is obligated to file a registration statement with the Securities

and Exchange Commission (the “Commission”), within 30 calendar days of the Transaction Date, to register for resale

the shares of common stock underlying the Preferred Stock. If the Commission has not declared the registration statement effective

by the 60th calendar day following the Transaction Date (or, in the event of a “full review” by the Commission, the

90th calendar day following the Transaction Date), or upon the occurrence of other events, then the Company shall pay to the purchaser

an amount in cash, as partial liquidated damages and not as a penalty, equal to the product of 4.0% multiplied by the aggregate

subscription amount paid by the purchaser pursuant to the Purchase Agreement on a monthly basis until the event has been cured.

If the Commission limits

the number of shares of common stock that the Company otherwise would include in a registration statement for the benefit of the

purchaser (notwithstanding that the Company used diligent efforts to advocate with the Commission for the registration of all

or a greater portion of such shares), unless otherwise directed in writing by the purchaser, the Company shall reduce or eliminate

any securities to be included other than the purchaser’s shares; and if there be more than one holder of Preferred Stock,

then the reduction shall be pro rata between or among them.

The issuances of the shares of Preferred

Stock and the shares of common stock issuable upon conversion thereof were exempt from registration pursuant to the provisions

Section 4(a)(2) of the Securities Act of 1933, as amended, and Rule 506(b) of Regulation D, as promulgated by the Commission.

The shares of Preferred Stock and the shares of common stock into which they may be converted constitute restricted securities

that may not be offered or sold absent their registration for resale or the availability of an exemption therefrom.

The foregoing description of the Registration

Rights Agreement is a summary and is qualified in its entirety by reference to the provisions thereof, a copy of which is attached

to this Current Report as Exhibit 10.4, which is incorporated by reference herein.

Section 5 – Corporate Governance and Management

Item 5.03 Amendments to Articles of Incorporation or Bylaws;

Change in Fiscal Year.

O

n August 13, 2018, the Company filed

a Certificate of Designation of its Series A Convertible Preferred Stock with the Secretary of State of the State of Nevada to

designate a series of its convertible preferred stock, consisting of 2,500 shares. The stated value of each share of Preferred

Stock is $1,000. Subject to a standard “4.99% Beneficial Ownership Limitation blocker,” each share of Preferred Stock

is convertible into shares of the Company’s common stock at any time or from time to time at a conversion price equivalent

of $0.75 per share, subject to adjustment as described in Certificate of Designation.

The foregoing description of the Certificate of Designation is a

summary and is qualified in its entirety by reference to the provisions thereof, a copy of which is attached to this Current Report

as Exhibit 3.3, which is incorporated by reference herein.

Section

9 – Financial Statements and Exhibits

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date:

August 13, 2018

|

MJ HOLDINGS, INC.

|

|

|

|

|

|

|

By:

|

/s/ Paris Balaouras

|

|

|

Paris Balaouras

|

|

|

Chief Executive Officer

|

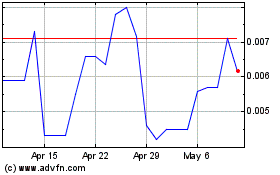

MJ (PK) (USOTC:MJNE)

Historical Stock Chart

From Mar 2024 to Apr 2024

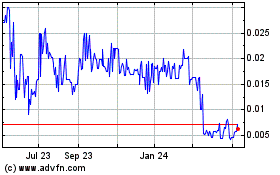

MJ (PK) (USOTC:MJNE)

Historical Stock Chart

From Apr 2023 to Apr 2024