Globus Maritime Limited ("Globus," the “Company," “we,” or “our”)

(NASDAQ:GLBS), a dry bulk shipping company, today reported its

unaudited consolidated operating and financial results for the

quarter ended March 31, 2018.

First Quarter 2018 Financial

Highlights

- In Q1 2018, Total revenues

increased by about 52% compared to Q1 2017

|

|

Three months ended March 31, |

|

|

(Expressed in thousands of U.S dollars except for daily rates and

per share data) |

2018 |

|

2017 |

|

| Total

revenues |

3,938 |

|

2,595 |

|

| Adjusted

(LBITDA)/EBITDA (1) |

387 |

|

(373) |

|

| Total

comprehensive loss |

(1,535) |

|

(2,342) |

|

| Basic

loss per share (2) |

(0.05) |

|

(0.14) |

|

| Daily

Time charter equivalent rate (“TCE”) (3) |

8,039 |

|

5,079 |

|

| Average

operating expenses per vessel per day |

5,745 |

|

4,878 |

|

| Average

number of vessels |

5.0 |

|

5.0 |

|

(1) Adjusted (LBITDA)/EBITDA is a measure not in accordance with

generally accepted accounting principles (“GAAP”). See a later

section of this press release for a reconciliation of

(LBITDA)/EBITDA to total comprehensive (loss) and net cash (used

in)/ generated from operating activities, which are the most

directly comparable financial measures calculated and presented in

accordance with the GAAP measures.

(2) The weighted average number of shares for the three

month period ended March 31, 2018 was 31,896,777 compared to

17,017,133 shares for the three month period ended March 31,

2017.

(3) Daily Time charter equivalent rate (“TCE”) is a measure

not in accordance with generally accepted accounting principles

(“GAAP”). See a later section of this press release for a

reconciliation of Daily TCE to Voyage revenues.

Current Fleet Profile

As of the date of this press release, Globus’

subsidiaries own and operate five dry bulk carriers, consisting of

four Supramax and one Panamax.

|

Vessel |

Year Built |

Yard |

Type |

Month/Year Delivered |

DWT |

Flag |

|

Moon Globe |

2005 |

Hudong-Zhonghua |

Panamax |

June 2011 |

74,432 |

Marshall Is. |

|

Sun Globe |

2007 |

Tsuneishi Cebu |

Supramax |

Sept 2011 |

58,790 |

Malta |

|

River Globe |

2007 |

Yangzhou Dayang |

Supramax |

Dec 2007 |

53,627 |

Marshall Is. |

|

Sky Globe |

2009 |

Taizhou Kouan |

Supramax |

May 2010 |

56,855 |

Marshall Is. |

|

Star Globe |

2010 |

Taizhou Kouan |

Supramax |

May 2010 |

56,867 |

Marshall Is. |

| Weighted Average Age: 10.1 Years as of March 31,

2018 |

|

300,571 |

|

Current Fleet Deployment

All our vessels are currently operating on short

term time charters (“on spot”).

Management Commentary

Athanasios Feidakis, President, Chief Executive

Officer and Chief Financial Officer of Globus Maritime Limited,

stated:

“The first quarter of 2018 has finally welcomed

the long awaited improvement in the Dry Bulk market, largely

reflected by a strong demand growth, and a worldwide seaborne trade

expectation for a 3% increase in terms of tones for the year 2018.

Additional evidence of the growth and improvement in

the market is the significant hike on TC rates. During the

first quarter of 2018, we were pleased to see higher utilization of

our vessels as well as higher TC rates when compared to the same

quarter of 2017.

“At present we are more optimistic over the dry

bulk fundamentals.”

Management Discussion and Analysis of the

Results of Operations

First Quarter of the Year 2018 compared

to the First Quarter of the Year 2017Total comprehensive

loss for the first quarter of the year 2018 amounted to $1.5

million or $0.05 basic loss per share based on 31,896,777 weighted

average number of shares, compared to total comprehensive loss of

$2.3 million for the same period last year or $0.14 basic loss per

share based on 17,017,133 weighted average number of shares.

The following table corresponds to the breakdown

of the factors that led to the decrease in total comprehensive loss

during the first quarter of 2018 compared to the first quarter of

2017 (expressed in $000’s):

| 1st Quarter of 2018 vs 1st quarter of

2017 |

|

|

Net loss for the 1st Quarter of 2017 |

(2,342) |

|

| Increase

in voyage revenues |

1,374 |

|

| Decrease

in Management fee income |

(31) |

|

| Increase

in Voyage expenses |

(133) |

|

| Increase

in Vessels operating expenses |

(390) |

|

| Decrease

in Depreciation |

101 |

|

| Increase

in Depreciation of dry docking costs |

(3) |

|

| Decrease

in Total administrative expenses |

36 |

|

| Decrease

in Other income, net |

(96) |

|

| Increase

in Interest expense and finance costs |

(21) |

|

| Increase

in Foreign exchange losses |

(30) |

|

|

Net loss for the 1st Quarter of 2018 |

(1,535) |

|

Voyage revenues

During the three-month period ended March 31,

2018 and 2017, our Voyage revenues reached $3.9 million and $2.6

million respectively. The 50% increase in Voyage revenues was

mainly attributed to the increase in the average time charter rates

achieved by our vessels during the first quarter of 2018 compared

to the same period in 2017. The Daily Time Charter Equivalent rate

(“TCE”) for the first quarter of 2018 was $8,039 per vessel per day

versus $5,079 per vessel per day during the same period in 2017

representing an increase of 58%.

Voyage expenses

Voyage expenses reached $0.4 million during the

first quarter of 2018 compared to $0.3 million during the same

period last year. Voyage expenses include commissions on revenues,

port and other voyage expenses and bunker expenses. Bunker expenses

mainly refer to the cost of bunkers consumed during periods that

our vessels are travelling seeking employment. Voyage expenses for

the first quarter of 2018 and 2017 are analyzed as follows:

| In

$000’s |

2018 |

2017 |

|

Commissions |

59 |

40 |

| Bunkers

expenses |

277 |

189 |

| Other

voyage expenses |

83 |

57 |

|

Total |

419 |

286 |

|

|

|

|

Vessel operating expenses

Vessel operating expenses, which include crew

costs, provisions, deck and engine stores, lubricating oils,

insurance, maintenance and repairs, increased by $0.4 million or

18% to $2.6 million during the three month period ended March 31,

2018 compared to $2.2 million during the same period in 2017. The

breakdown of our operating expenses for the three month period

ended March 31, 2018 and 2017 is as follows:

|

|

2018 |

2017 |

| Crew

expenses |

47% |

53% |

| Repairs

and spares |

25% |

24% |

|

Insurance |

6% |

8% |

|

Stores |

15% |

8% |

|

Lubricants |

5% |

4% |

|

Other |

2% |

3% |

Average daily operating expenses during the

three month period ended March 31, 2018 and 2017 were $5,745 per

vessel per day and $4,878 per vessel per day respectively,

corresponding to an increase of 18%. We deem this as an

extraordinary event with no lasting impact on our operating

expenses which we expect to decrease throughout the year.

Depreciation

Depreciation charge during the first quarter of

2018 decreased by $0.1 million and reached $1.1 million compared to

$1.2 million recognized during the same period in 2017. The

decrease is attributed to the increase of scrap rate from $250/ton

to $300/ton due to the increased scrap rates worldwide.

Interest expense and finance

costs

Interest expense and finance costs for the first

quarter of 2018 and 2017 reached $0.5 million for both quarters and

are analyzed as follows:

| In

$000’s |

2018 |

2017 |

| Interest

payable on long-term borrowings |

463 |

428 |

| Bank

charges |

8 |

9 |

|

Amortization of debt discount |

19 |

22 |

| Other

finance expenses |

1 |

11 |

|

Total |

491 |

470 |

|

|

|

|

Liquidity and capital

resources

As of March 31, 2018 and 2017 our cash and cash

equivalents were $2.1 million and $1.3 million respectively.

Net cash used in operating

activities for the three-month period ended March 31, 2018

was $0.1 million compared to Net cash used in operating activities

of $0.9 million during the respective period in 2017. The increase

in our cash from operations was mainly attributed to the increase

from adjusted LBITDA of $0.4 million during the first quarter of

2017 to adjusted EBITDA of $0.4 million during the three-month

period under consideration.

Net cash used in financing

activities during the three-month period ended March 31,

2018 and 2017 were as follows:

|

|

Three months ended March

31, |

|

| In

$000’s |

2018 |

2017 |

|

|

Repayment of long term debt |

(694) |

(1,406) |

|

| Proceeds

from issuance of share capital |

600 |

5,000 |

|

|

Restricted cash |

(140) |

- |

|

| Interest

paid |

(528) |

(1,564) |

|

|

Net cash used in financing activities |

(762) |

2,030 |

|

|

|

|

|

|

As of March 31, 2018 and 2017, we and our

vessel-owning subsidiaries had outstanding borrowings under our

Loan agreement with DVB Bank SE and the Loan agreement with HSH

Nordbank AG of an aggregate of $41 million and $44.4 million

respectively gross of unamortized debt discount.

Exercise of Warrants

In January 2018, an investor partially exercised

his warrant by purchasing 375,000 of the Company’s common shares

for aggregate gross proceeds to the Company of $600,000. For

guidance please refer to our last published Annual Report

discussing in detail t the Company’s Share and Warrant Purchase

Agreement of February 8, 2017 (“February 2017 private

placement”)

As of March 31, 2018, in connection with the

February 2017 private placement, the February 2017 Warrants

outstanding were exercisable for an aggregate of 30,523,209 common

shares.

Subsequent Events

Receipt of Nasdaq Notice of

Deficiency

On May 4, 2018, we announced that we had

received written notification from The Nasdaq Stock Market

(“Nasdaq”) dated April 30, 2018, indicating that because the

closing bid price of our common stock for the last 30 consecutive

business days was below $1.00 per share, we no longer meet the

minimum bid price continued listing requirement for the Nasdaq

Capital Market, as set forth in Nasdaq Listing Rule 5450(a)(1).

Pursuant to Nasdaq Listing Rules, the applicable grace period to

regain compliance is 180 days, or until October 29, 2018.

We intend to monitor the closing bid price of

our common stock between now and October 29, 2018 and are

considering our options, including a potential reverse stock split,

in order to regain compliance with the Nasdaq Capital Market

minimum bid price requirement. We can cure this deficiency if the

closing bid price of its common stock is $1.00 per share or higher

for at least ten consecutive business days during the grace period.

In the event we do not regain compliance within the 180‐day grace

period and we meet all other listing standards and requirements we

may be eligible for an additional 180‐ day grace period.We intend

to cure the deficiency within the prescribed grace period. During

this time, our common stock will continue to be listed and trade on

the Nasdaq Capital Market. Our business operations are not affected

by the receipt of the notification.

Selected Consolidated Financial &

Operating Data

|

|

Three months ended |

|

|

|

March 31, |

|

|

|

2018 |

|

2017 |

|

| (in thousands of U.S.

dollars, except per share data) |

(unaudited) |

| Consolidated

statement of comprehensive loss data: |

|

|

|

| Voyage revenues |

3,938 |

|

2,564 |

|

| Management fee

income |

- |

|

31 |

|

| Total

Revenues |

3,938 |

|

2,595 |

|

| |

|

|

|

| Voyage expenses |

(419) |

|

(286) |

|

| Vessel operating

expenses |

(2,585) |

|

(2,195) |

|

| Depreciation |

(1,134) |

|

(1,235) |

|

| Depreciation of dry

docking costs |

(213) |

|

(210) |

|

| Administrative

expenses |

(397) |

|

(462) |

|

| Administrative expenses

payable to related parties |

(136) |

|

(106) |

|

| Share-based

payments |

(10) |

|

(10) |

|

| Other

(expenses)/income, net |

(4) |

|

91 |

|

| Operating

(loss)/profit before financing activities |

(960) |

|

(1,818) |

|

| Interest expense and

finance costs |

(491) |

|

(470) |

|

| Foreign exchange

(losses)/gains, net |

(84) |

|

(54) |

|

| Total finance

costs, net |

(575) |

|

(524) |

|

| Total

comprehensive loss for the period |

(1,535) |

|

(2,342) |

|

|

|

|

|

|

| Basic

& diluted loss per share for the period(1) |

(0.05) |

|

(0.14) |

|

|

Adjusted (LBITDA)/EBITDA (2) |

387 |

|

(373) |

|

(1) The weighted average number of shares for

the three month period ended March 31, 2018 was 31,896,777,

compared to 17,017,133 shares for the three month period ended

March 31, 2017.

(2) Adjusted (LBITDA)/EBITDA represents net

(loss)/earnings before interest and finance costs net, gains or

losses from the change in fair value of derivative financial

instruments, foreign exchange gains or losses, income taxes,

depreciation, depreciation of dry-docking costs, amortization of

fair value of time charter acquired, impairment and gains or losses

on sale of vessels. Adjusted (LBITDA)/EBITDA does not represent and

should not be considered as an alternative to total comprehensive

income/(loss) or cash generated from operations, as determined by

IFRS, and our calculation of Adjusted (LBITDA)/EBITDA may not be

comparable to that reported by other companies. Adjusted

(LBITDA)/EBITDA is not a recognized measurement under IFRS.

Adjusted (LBITDA)/EBITDA is included herein

because it is a basis upon which we assess our financial

performance and because we believe that it presents useful

information to investors regarding a company’s ability to service

and/or incur indebtedness and it is frequently used by securities

analysts, investors and other interested parties in the evaluation

of companies in our industry.

Adjusted (LBITDA)/EBITDA has limitations as an

analytical tool, and you should not consider it in isolation, or as

a substitute for analysis of our results as reported under IFRS.

Some of these limitations are:

- Adjusted (LBITDA)/EBITDA does not reflect our cash expenditures

or future requirements for capital expenditures or contractual

commitments;

- Adjusted (LBITDA)/EBITDA does not reflect the interest expense

or the cash requirements necessary to service interest or principal

payments on our debt;

- Adjusted (LBITDA)/EBITDA does not reflect changes in or cash

requirements for our working capital needs; and

- Other companies in our industry may calculate Adjusted

(LBITDA)/EBITDA differently than we do, limiting its usefulness as

a comparative measure.

Because of these limitations, Adjusted

(LBITDA)/EBITDA should not be considered a measure of discretionary

cash available to us to invest in the growth of our business.

The following table sets forth a reconciliation

of Adjusted (LBITDA)/EBITDA to total comprehensive loss and net

cash (used in)/ generated from operating activities for the periods

presented:

|

|

Three months ended |

|

|

|

March 31, |

|

|

(Expressed in thousands of U.S. dollars) |

2018 |

|

2017 |

|

|

|

|

(Unaudited) |

|

|

|

|

|

Total comprehensive loss for the period |

(1,535) |

|

(2,342) |

|

| Interest

and finance costs, net |

491 |

|

470 |

|

| Foreign

exchange losses/(gains) net, |

84 |

|

54 |

|

|

Depreciation |

1,134 |

|

1,235 |

|

|

Depreciation of dry docking costs |

213 |

|

210 |

|

| Adjusted

(LBITDA)/EBITDA |

387 |

|

(373) |

|

|

Share-based payments |

20 |

|

10 |

|

| Payment

of deferred dry docking costs |

(120) |

|

(128) |

|

| Net

(increase)/decrease in operating assets |

(819) |

|

243 |

|

| Net

(decrease)/increase in operating liabilities |

651 |

|

(571) |

|

|

Provision for staff retirement indemnities |

1 |

|

1 |

|

| Foreign

exchange gains/(losses) net, not attributed to cash and cash

equivalents |

(20) |

|

(91) |

|

|

Net cash generated from/(used in) operating

activities |

100 |

|

(909) |

|

|

|

Three months ended |

|

|

|

March 31, |

|

|

(Expressed in thousands of U.S. dollars) |

2018 |

|

2017 |

|

|

|

(Unaudited) |

|

Statement of cash flow data: |

|

| Net cash

(used in)/generated from operating activities |

100 |

|

(909) |

|

| Net cash

(used in)/generated from investing activities |

(26) |

|

(7) |

|

| Net cash

(used in)/generated from financing activities |

(762) |

|

2,030 |

|

|

|

As of March 31, |

As of December 31, |

|

(Expressed in thousands of U.S. Dollars) |

2018 |

2017 |

|

|

(Unaudited) |

|

Consolidated condensed statement of financial

position: |

|

|

|

Vessels, net |

86,637 |

87,320 |

| Other

non-current assets |

48 |

53 |

|

Total non-current assets |

86,685 |

87,373 |

| Cash

and cash equivalents |

2,068 |

2,756 |

| Other

current assets |

2,434 |

1,474 |

|

Total current assets |

4,502 |

4,230 |

|

Total assets |

91,187 |

91,603 |

|

Total equity |

43,053 |

43,968 |

| Total

debt net of unamortized debt discount |

40,864 |

41,538 |

| Other

liabilities |

7,270 |

6,097 |

|

Total

liabilities |

48,134 |

47,635 |

|

Total equity and liabilities |

91,187 |

91,603 |

Consolidated statement of changes in

equity:

|

(Expressed in thousands of U.S. Dollars) |

Issued share |

Share |

(Accumulated |

|

Total |

|

|

|

Capital |

Premium |

Deficit) |

|

Equity |

|

|

As at December 31, 2017 |

126 |

139,571 |

(95,729) |

|

43,968 |

|

| Loss

for the period |

- |

- |

(1,535) |

|

(1,535) |

|

|

Issuance of common stock due to exercise of warrants (1) |

2 |

598 |

- |

|

600 |

|

|

Share-based payments |

- |

20 |

- |

|

30 |

|

|

As at March 31,

2018 |

128 |

140,189 |

(97,264) |

|

43,053 |

|

(1) Pursuant to the “February 2017 private

placement”, warrants to buy 375,000 common shares were exercised

during the 1st quarter of 2018.

|

|

|

|

|

Three months ended March 31, |

|

|

|

2018 |

|

2017 |

|

|

|

|

|

|

Ownership days (1) |

450 |

|

450 |

|

|

Available days (2) |

438 |

|

449 |

|

|

Operating days (3) |

429 |

|

432 |

|

| Fleet

utilization (4) |

98.1% |

|

96.3% |

|

|

Average number of vessels (5) |

5 |

|

5 |

|

| Daily

time charter equivalent (“TCE”) rate (6) |

8,039 |

|

5,079 |

|

| Daily

operating expenses (7) |

5,745 |

|

4,878 |

|

Notes:

(1) Ownership days are the aggregate number of days in a period

during which each vessel in our fleet has been owned by us.

(2) Available days are the number of ownership days less the

aggregate number of days that our vessels are off-hire due to

scheduled repairs or repairs under guarantee, vessel upgrades or

special surveys. (3) Operating days are the number of

available days less the aggregate number of days that the vessels

are off-hire due to any reason, including unforeseen circumstances

but excluding days during which vessels are seeking employment.

(4) We calculate fleet utilization by dividing the number of

operating days during a period by the number of available days

during the period. (5) Average number of vessels is measured

by the sum of the number of days each vessel was part of our fleet

during a relevant period divided by the number of calendar days in

such period. (6) TCE rates are our voyage revenues less net

revenues from our bareboat charters less voyage expenses during a

period divided by the number of our available days during the

period excluding bareboat charter days, which is consistent with

industry standards. TCE is a measure not in accordance with GAAP.

(7) We calculate daily vessel operating expenses by dividing

vessel operating expenses by ownership days for the relevant time

period excluding bareboat charter days.

Voyage Revenues to Daily Time Charter

Equivalent (“TCE”) Reconciliation

|

|

Three months ended March

31, |

|

|

2018 |

2017 |

|

|

(Unaudited) |

| Voyage

revenues |

3,938 |

2,564 |

| Less:

Voyage expenses |

419 |

286 |

| Net

revenues excluding bareboat charter revenues |

3,519 |

2,278 |

| Available

days net of bareboat charter days |

438 |

449 |

| Daily TCE

rate* |

8,039 |

5,079 |

*Subject to rounding.

About Globus Maritime

Limited

Globus is an integrated dry bulk shipping

company that provides marine transportation services worldwide and

presently owns, operates and manages a fleet of five dry bulk

vessels that transport iron ore, coal, grain, steel products,

cement, alumina and other dry bulk cargoes internationally. Globus’

subsidiaries own and operate five vessels with a total carrying

capacity of 300,571 Dwt and a weighted average age of 10.1 years as

of March 31, 2018.

Safe Harbor Statement

This communication contains “forward-looking

statements” as defined under U.S. federal securities laws.

Forward-looking statements provide the Company’s current

expectations or forecasts of future events. Forward-looking

statements include statements about the Company’s expectations,

beliefs, plans, objectives, intentions, assumptions and other

statements that are not historical facts or that are not present

facts or conditions. Words or phrases such as “anticipate,”

“believe,” “continue,” “estimate,” “expect,” “intend,” “may,”

“ongoing,” “plan,” “potential,” “predict,” “project,” “will” or

similar words or phrases, or the negatives of those words or

phrases, may identify forward-looking statements, but the absence

of these words does not necessarily mean that a statement is not

forward-looking. Forward-looking statements are subject to known

and unknown risks and uncertainties and are based on potentially

inaccurate assumptions that could cause actual results to differ

materially from those expected or implied by the forward-looking

statements. The Company’s actual results could differ materially

from those anticipated in forward-looking statements for many

reasons specifically as described in the Company’s filings with the

Securities and Exchange Commission. Accordingly, you should not

unduly rely on these forward-looking statements, which speak only

as of the date of this communication. Globus undertakes no

obligation to publicly revise any forward-looking statement to

reflect circumstances or events after the date of this

communication or to reflect the occurrence of unanticipated events.

You should, however, review the factors and risks Globus describes

in the reports it will file from time to time with the Securities

and Exchange Commission after the date of this communication.

For further information please

contact:

Globus Maritime Limited+30 210 960

8300Athanasios Feidakis, CEOa.g.feidakis@globusmaritime.gr

Capital Link – New York +1 212 661 7566Nicolas

Bornozis globus@capitallink.com

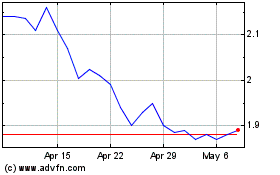

Globus Maritime (NASDAQ:GLBS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Globus Maritime (NASDAQ:GLBS)

Historical Stock Chart

From Apr 2023 to Apr 2024