Transcontinental Realty Investors, Inc. (NYSE: TCI), a

Dallas-based real estate investment company, today reported results

of operations for the first quarter ended March 31, 2018. For the

three months ended March 31, 2018, we reported a net loss

applicable to common shares of $0.5 million or ($0.05) per diluted

loss per share compared to a net loss applicable to common shares

of $5.4 million or ($0.61) per diluted loss per share for the same

period ended 2017.

During this period the company adhered to its overall business

strategy to focus only on high value assets and with this in mind,

we disposed of several underperforming properties. Though this

created a slight reduction in revenue, the overall operating income

was virtually consistent with the first quarter of 2017. As the

company has been redeploying capital in new residential apartment

properties, we fully anticipate increases in both revenue and

operating income.

Going forward we further believe that operating expenses should

remain very manageable as we continue to replace older

underperforming assets with newer class A properties.

Revenues

Rental and other property revenues were $31.1 million for the

three months ended March 31, 2018. This represents a decrease of

approximately $0.4 million, compared to the prior period revenues

of $31.5 million. This change, by segment, is an increase in the

apartment portfolio of $0.9 million, and a decrease in the

commercial portfolio of $1.3 million.

Expense

Property operating expenses were $14.5 million for the three

months ended March 31, 2018. This represents a decrease of $1.4

million, compared to the prior period operating expenses of $15.9

million. This change, by segment, is a decrease in the apartment

portfolio of $0.2 million, a decrease in the commercial portfolio

of $0.9 million and a decrease in the land portfolio of $0.2

million.

Depreciation and amortization expenses were $6.4 million for the

three months ended March 31, 2018. This represents an increase of

$0.1 million as compared to prior period depreciation of $6.3

million.

Mortgage and loan interest expense was $14.1 million for the

three months ended March 31, 2018. This represents a decrease of

$1.1 million, as compared to the prior period expense of $15.2

million. The change by segment is an increase in the other

portfolio of $0.4 million and a decrease in the apartment portfolio

of $1.4 million, and an increase in the commercial portfolio of

$0.2 million. Within the other portfolio, the increase is primarily

due to $2.3 million of interest expense related to the bonds.

Other income was $3.6 million for the three months ended March

31, 2018. This represents an increase of $2.5 million compared to

prior period other income of $1.1 million. This increase is due to

forgiveness of debt of $1.5 million during the first quarter and

$1.8 million of foreign currency translation gain due to change in

currency exchange rate.

Gain on land sales increased for the three months ended March

31, 2018, compared to the prior period. In the current period we

sold 62 acres of land for a sales price of $3.0 million and

recorded a gain of $1.3 million. For the same period in 2017, we

sold 2.49 acres of land for a sales price of $1.1 million and

recorded a gain of $0.4 million.

About Transcontinental Realty Investors, Inc.

Transcontinental Realty Investors, Inc., a Dallas-based real

estate investment company, holds a diverse portfolio of equity real

estate located across the U.S., including apartments, office

buildings, shopping centers, and developed and undeveloped land.

The Company invests in real estate through direct ownership, leases

and partnerships and invests in mortgage loans on real estate. For

more information, visit the Company’s website at

www.transconrealty-invest.com.

TRANSCONTINENTAL REALTY INVESTORS, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS (unaudited)

For the Three Months Ended March

31, 2018 2017 (dollars in

thousands, except share and par value amounts) Revenues:

Rental and other property revenues (including $208 and $190 for the

three months ended 2018 and 2017, respectively, from related

parties) $ 31,082 $ 31,535

Expenses: Property

operating expenses (including $227 and $228 for the three months

ended 2018 and 2017, respectively, from related parties) 14,455

15,889 Depreciation and amortization 6,446 6,303 General and

administrative (including $1,093 and $732 for the three months

ended 2018 and 2017, respectively, from related parties) 2,192

1,780 Net income fee to related party 53 60 Advisory fee to related

party 2,748 2,305 Total operating

expenses 25,894 26,337 Net operating

income 5,188 5,198

Other income (expenses): Interest

income (including $3,236 and $3,169 for the three months ended 2018

and 2017, respectively, from related parties) 3,876 3,421 Other

income (expense) 1,826 1,442 Mortgage and loan interest (including

$318 and $151 for the three months ended 2018 and 2017,

respectively, from related parties) (14,093 ) (15,190 ) Foreign

currency translation gain (loss) 1,756 (323 ) Earnings (losses)

from unconsolidated joint ventures and investees 11

(8 ) Total other expenses (6,624 ) (10,658 )

Loss before gain on land sales, non-controlling interest, and taxes

(1,436 ) (5,460 ) Gain on land sales 1,335 445

Net loss from continuing operations before taxes (101

) (5,015 ) Net loss from continuing operations (101 ) (5,015

) Net loss (101 ) (5,015 ) Net (income) attributable to

non-controlling interest (132 ) (119 ) Net loss

attributable to Transcontinental Realty Investors, Inc. (233 )

(5,134 ) Preferred dividend requirement (222 ) (222 )

Net loss applicable to common shares $ (455 ) $ (5,356 )

Earnings per share - basic Net loss from

continuing operations $ (0.05 ) $ (0.61 )

Earnings per

share - diluted Net loss from continuing

operations $ (0.05 ) $ (0.61 ) Weighted average common

shares used in computing earnings per share 8,717,767 8,717,767

Weighted average common shares used in computing diluted earnings

per share 8,717,767 8,717,767

Amounts attributable to

Transcontinental Realty Investors, Inc. Net loss from

continuing operations $ (233 ) $ (5,134 ) Net loss applicable to

Transcontinental Realty, Investors, Inc. $ (233 ) $ (5,134 )

TRANSCONTINENTAL REALTY INVESTORS, INC.

CONSOLIDATED BALANCE SHEETS

March 31, December 31, 2018 2017

(unaudited) (audited) (dollars in thousands,

except share and par value amounts) Assets Real estate,

at cost $ 1,111,346 $ 1,112,721 Real estate subject to sales

contracts at cost 45,739 45,739 Less accumulated depreciation

(179,100 ) (178,590 ) Total real estate 977,985

979,870 Notes and interest receivable: Performing (including

$48,553 in 2018 and $45,155 in 2017 from related parties)

83,342 70,166 Total notes and interest

receivable 83,342 70,166 Cash and cash equivalents 40,894 42,705

Restricted cash 55,400 45,637 Investments in unconsolidated joint

ventures and investees 2,483 2,472 Receivable from related party

115,734 111,665 Other assets 54,751 60,907

Total assets $ 1,330,589 $ 1,313,422

Liabilities and Shareholders’ Equity Liabilities: Notes and

interest payable $ 885,831 $ 892,149 Notes related to real estate

held for sale 376 376 Notes related to real estate subject to sales

contracts 347 1,957 Bond and bond interest payable 146,888 113,047

Deferred revenue (including $40,584 in 2018 and $40,574 in 2017 to

related parties) 60,960 60,949 Accounts payable and other

liabilities (including $6,701 in 2018 and $7,236 in 2017 to related

parties) 28,249 36,683 Total

liabilities 1,122,651 1,105,161 Shareholders’ equity:

Preferred stock, Series C: $0.01 par value, authorized 10,000,000

shares; issued and outstanding zero shares in 2018 and 2017. Series

D: $0.01 par value, authorized, issued and outstanding 100,000

shares in 2018 and 2017 (liquidation preference $100 per share) 1 1

Common stock, $0.01 par value, authorized 10,000,000 shares; issued

8,717,967 shares in 2018 and 2017; outstanding 8,717,767 shares in

2018 and 2017 87 87 Treasury stock at cost, 200 shares in 2018 and

2017 (2 ) (2 ) Paid-in capital 268,727 268,949 Retained deficit

(80,098 ) (79,865 ) Total Transcontinental Realty

Investors, Inc. shareholders' equity 188,715 189,170

Non-controlling interest 19,223 19,091

Total shareholders' equity 207,938 208,261

Total liabilities and shareholders' equity $ 1,330,589

$ 1,313,422

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180515006796/en/

Transcontinental Realty Investors, Inc.Investor

RelationsGene Bertcher,

800-400-6407investor.relations@transconrealty-invest.com

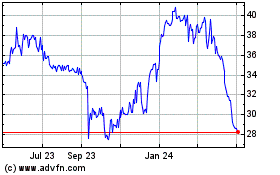

Transcontinental Realty ... (NYSE:TCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Transcontinental Realty ... (NYSE:TCI)

Historical Stock Chart

From Apr 2023 to Apr 2024