UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed

by the Registrant

x

Filed

by a Party other than the Registrant

¨

Check the appropriate box:

|

|

¨

|

Preliminary

Proxy Statement

|

|

|

¨

|

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

x

|

Definitive

Proxy Statement

|

|

|

¨

|

Definitive

Additional Materials

|

|

|

¨

|

Soliciting

Material Pursuant to Section 240.14a-12

|

CAVITATION

TECHNOLOGIES, INC.

(Name of Registrant as Specified in Its

Charter)

(Name of

Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

¨

|

Fee

computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title

of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

¨

|

Fee paid previously with preliminary materials.

|

|

|

¨

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

Cavitation Technologies, Inc.

10019 Canoga Avenue

Chattsworth, California 91311

(818) 718-0905

May 8, 2018

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To the Stockholders of Cavitation Technologies,

Inc.:

We hereby notify you

that the 2018 Annual Meeting of Stockholders of Cavitation Technologies, Inc., a Nevada corporation, will be held on June 27, 2018

at 9:30 a.m., Eastern Time, at the offices of our counsel, Gracin & Marlow, LLP, The Chrysler Building, 405 Lexington Avenue,

26

th

Floor, New York, New York 10174, for the following purposes:

|

|

(1)

|

to elect the two (2) nominees for director named herein to hold office until our next Annual Meeting of Stockholders and until their successors are elected;

|

|

|

(2)

|

to ratify the appointment of Weinberg & Company, P.A. as our independent registered public accounting firm for our fiscal year ending June 30, 2019;

|

|

|

(3)

|

to approve (in the event it is deemed advisable by our Board of Directors) an amendment to our Articles of Incorporation to effect a reverse stock split of our issued and outstanding shares of common stock, at a ratio to be determined in the discretion of our Board of Directors within a range of one (1) share of common stock for every four (4) to ten (10) shares of common stock (the “Reverse Stock Split”);

|

|

|

(4)

|

to authorize an adjournment of the Annual Meeting, if necessary, if a quorum is present, to solicit additional proxies if there are not sufficient votes in favor of Proposal 3 (the “Adjournment”);

|

|

|

(5)

|

to approve the Cavitation Technologies, Inc. 2018 Stock Incentive Plan;

|

|

|

(6)

|

to approve, on advisory basis, our named executive officers’ compensation;

|

|

|

(7)

|

to recommend, on an advisory basis, a three year frequency for holding an advisory vote on our named executive officers’ compensation; and

|

|

|

(8)

|

to transact such other business as may properly come before the meeting or any adjournments or postponements of the meeting.

|

The matters listed

in this notice of meeting are described in detail in the accompanying proxy statement. Our Board of Directors has fixed the close

of business on May 1, 2018 as the record date for determining those stockholders who are entitled to notice of and to vote at the

meeting or any adjournment or postponement of our 2018 Annual Meeting. The list of the stockholders of record as of the close of

business on May 1, 2018 will be made available for inspection at the meeting.

IMPORTANT NOTICE REGARDING THE AVAILABILITY

OF PROXY MATERIALS:

THE NOTICE OF ANNUAL

MEETING OF STOCKHOLDERS, THE PROXY STATEMENT AND OUR ANNUAL REPORT ON FORM 10-K FOR THE YEAR ENDED JUNE 30, 2017 ARE AVAILABLE

ELECTRONICALLY AT WWW.CTINANOTECH.COM.

Along with the attached proxy statement,

we are sending to you our Annual Report on Form 10-K for our fiscal year ended June 30, 2017. Such annual report, which includes

our audited consolidated financial statements, is not to be regarded as proxy solicitation material.

YOUR VOTE IS IMPORTANT

Even if you plan to

attend the meeting, please sign, date, and return the enclosed proxy card in the envelope provided so that your vote will be counted

if you later decide not to attend the meeting. No postage is required if the proxy card is mailed in the United States.

|

|

By order of the Board of Directors,

|

|

|

|

|

|

Igor Gorodinitsky

|

|

|

Chairman, and President

|

This Proxy Statement and the accompanying

proxy card are being mailed to stockholders on or about May 14, 2018.

TABLE OF CONTENTS

Cavitation Technologies, Inc.

10019 Canoga Avenue

Chattsworth, California 91311

(818) 718-0905

PROXY STATEMENT

For the Annual Meeting of Stockholders

to be held on June 27, 2018

GENERAL INFORMATION

We are providing these

proxy materials to holders of shares of common stock, par value $0.001 per share (the “Common Stock”) of Cavitation

Technologies, Inc., a Nevada corporation (referred to as “Cavitation,” the “Company,” “we,”

or “us”), in connection with the solicitation of proxies on behalf of our Board of Directors for use at our 2018 Annual

Meeting of Stockholders to be held on June 27, 2018, beginning at 9:30 a.m., Eastern Time at the offices of our counsel, Gracin &

Marlow, LLP, The Chrysler Building, 405 Lexington Avenue, 26

th

Floor, New York, New York 10174, and at any adjournment

or postponement of our 2018 Annual Meeting of Stockholders.

The notice of our

2018 Annual Meeting of Stockholders, this Proxy Statement, and a proxy card, together with our Annual Report on Form 10-K for the

year ended June 30, 2017, are being mailed to our stockholders on or about May 14, 2018. Such annual report, which includes our

audited financial statements, is not to be regarded as proxy solicitation material. We will bear the cost of our solicitation of

proxies. The original solicitation of proxies by mail may be supplemented by personal interview, telephone, or facsimile by our

directors, officers, or employees, who will receive no additional compensation for such services. Arrangements will be made with

brokerage houses and other custodians, nominees, and fiduciaries for the forwarding of solicitation material to the beneficial

owners of stock held by any such persons, and we will reimburse those custodians, nominees, and fiduciaries for the reasonable

out-of-pocket expenses incurred by them in doing so.

Our Board of Directors

is soliciting votes

FOR

each of the nominees for election to our Board of Directors,

FOR

the ratification of the

appointment of Weinberg & Company, P.A. as our independent registered public accounting firm for our fiscal year ending on

June 30, 2019,

FOR

the approval (in the event it is deemed advisable by our Board of Directors) of an amendment to our articles

of incorporation, as amended (the “Articles of Incorporation”) to effect a reverse stock split of our issued and outstanding

shares of common stock at a ratio to be determined in the discretion of our Board of Directors within a range of one (1) share

of common stock for every four (4) to ten (10) shares of common stock (the “Reverse Stock Split”);

FOR

authority

to adjourn the 2018 Annual Meeting of Stockholders, if necessary, if a quorum is present, to solicit additional proxies if there

are not sufficient votes in favor of the Reverse Stock Split (the “Adjournment”);

FOR

the approval of the Cavitation

Technologies, Inc. 2018 Stock Incentive Plan;

FOR

the approval, on an advisory basis, of the compensation of our named executive

officers; and

FOR

the recommendation, on an advisory basis, of a three year frequency for holding an advisory vote on the

compensation of our named executive officers.

INFORMATION ABOUT VOTING

|

|

Q:

|

Why

am I receiving these materials?

|

|

|

A:

|

The

Board of Directors is providing these proxy materials to you in connection with our 2018 Annual Meeting of Stockholders, which

is scheduled to take place on June 27, 2018. As a stockholder of record as of May 1, 2018, you are invited to attend

the 2018 Annual Meeting of Stockholders and to vote on the items of business described in this proxy statement.

|

|

|

Q:

|

What

information is contained in these materials?

|

|

|

A:

|

The

information included in this proxy statement relates to the proposals to be voted on at the 2018 Annual Meeting of Stockholders,

the voting process, the compensation of our directors and executive officers, and other required information.

|

|

|

Q:

|

What

items of business will be voted on at the 2018 Annual Meeting of Stockholders?

|

|

|

A:

|

The

seven items of business scheduled to be voted on at the 2018 Annual Meeting of Stockholders are: (1) the election of our directors;

(2) the ratification of our independent registered public accounting firm; (3) the approval (in the event it is deemed advisable

by our Board of Directors) of an amendment to our Articles of Incorporation to effect a reverse stock split of our issued and

outstanding shares of common stock at a ratio to be determined in the discretion of our Board of Directors within a range of one

(1) share of common stock for every four (4) to ten (10) shares of common stock; (4) the adjournment of the 2018 Annual Meeting

of Stockholders, if necessary, if a quorum is present, to solicit additional proxies if there are not sufficient votes in favor

of the Reverse Stock Split; (5) the approval of our 2018 Stock Incentive Plan; (6) the approval, on an advisory basis, of the

compensation of our named executive officers; and (7) the recommendation, on an advisory basis, of a three year frequency for

holding an advisory vote on the compensation of our named executive officers.

|

|

|

Q:

|

How

does the Board of Directors recommend that I vote?

|

|

|

A:

|

The

Board of Directors recommends that you vote your shares

FOR

each of the nominees to our Board of directors;

FOR

the ratification of the appointment of Weinberg & Company, P.A. as our independent registered public accounting firm for our

fiscal year ending on June 30, 2019;

FOR

the approval (in the event it is deemed advisable by our Board of Directors)

of an amendment to our Articles of Incorporation to effect a reverse stock split of our issued and outstanding shares of common

stock at a ratio to be determined in the discretion of our Board of Directors within a range of one (1) share of common stock

for every four (4) to ten (10) shares of common stock;

FOR

authority to adjourn the 2018 Annual Meeting of Stockholders,

if necessary, if a quorum is present, to solicit additional proxies if there are not sufficient votes in favor of the Reverse

Stock Split;

FOR

the approval of the 2018 Stock Incentive Plan;

FOR

the approval, on an advisory basis, of the compensation

of our named executive officers; and

FOR

the recommendation, on an advisory basis, of a three year frequency for holding

an advisory vote on the compensation of our named executive officers.

|

|

|

Q:

|

What

shares can I vote?

|

|

|

A:

|

You

may vote or cause to be voted all shares owned by you as of the close of business on May 1, 2018, the record date. These shares

include: (1) shares held directly in your name as a stockholder of record; and (2) shares held for you, as the beneficial owner,

through a broker or other nominee, such as a bank.

|

|

|

Q:

|

What

is the difference between holding shares as a stockholder of record and as a beneficial owner?

|

|

|

A:

|

Most of our stockholders hold their shares through a broker or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

If your shares are registered directly in your name with our transfer agent, Nevada Agency and Transfer Company, you are considered, with respect to those shares, the stockholder of record and these proxy materials are being sent directly to you by us. As the stockholder of record, you have the right to grant your voting proxy directly to Igor Gorodinitsky and Naum Voloshin, or either of them, or to vote your shares in person at the meeting. The Board of Directors has enclosed a proxy card for you to use to grant a voting proxy.

|

|

|

|

If your shares are

held in a brokerage account or by another nominee, you are considered the beneficial owner of shares held in “street name,”

and these proxy materials are being forwarded to you by your broker or nominee together with a voting instruction card. As the

beneficial owner, you have the right to direct your broker or nominee how to vote and are also invited to attend the 2018 Annual

Meeting of Stockholders. Since you are not the stockholder of record, however, you may not vote these shares in person at the

meeting unless you obtain from the broker or nominee that holds your shares a valid proxy from them giving you the right to vote

the shares. Your broker or nominee should have enclosed or provided voting instructions for you to use in directing the broker

or nominee how to vote your shares. If you hold your shares through a broker and you do not give instructions to the record holder

on how to vote, the record holder will be entitled to vote your shares in its discretion on certain matters considered routine,

such as the ratification of the appointment of our independent auditors and the Reverse Stock Split. The uncontested election

of directors, the 2018 Stock Incentive Plan, the Adjournment, the advisory vote on executive compensation and the advisory vote

on frequency for holding the advisory vote are not considered a routine matter. Therefore, brokers do not have the discretion

to vote on the election of directors, the 2018 Stock Incentive Plan, the Adjournment, the advisory vote on executive compensation

and the advisory vote on frequency for holding the advisory vote. If you hold your shares in street name and you do not instruct

your broker how to vote in these matters, no votes will be cast on your behalf. These “broker non-votes” will be treated

as shares that are present and entitled to vote for purposes of determining the presence of a quorum, but not as shares entitled

to vote on a particular proposal.

|

|

|

Q:

|

May

I attend the 2018 Annual Meeting of Stockholders?

|

|

|

A:

|

You

are entitled to attend the 2018 Annual Meeting of Stockholders only if you were a stockholder as of the close of business on May

1, 2018, or you hold a valid proxy for the 2018 Annual Meeting of Stockholders. You should be prepared to present photo

identification for admittance. If you are not a record holder but hold shares beneficially through a broker or nominee (that is,

in “street name”), you should provide proof of beneficial ownership on the record date, such as your most recent account

statement prior to May 1, 2018, a copy of the voting instruction card provided by your broker or nominee, or other similar evidence

of ownership. If you do not provide photo identification or comply with the other procedures outlined above, you may not be admitted

to the 2018 Annual Meeting of Stockholders. The 2018 Annual Meeting of Stockholders will begin promptly at 9:30 a.m. (Eastern

Time). Check-in will begin at 9:00 a.m., and you should allow ample time for the check-in procedures.

|

|

|

Q:

|

How

can I vote my shares in person at the 2018 Annual Meeting of Stockholders?

|

|

|

A:

|

You

may vote by ballot in person at the 2018 Annual Meeting of Stockholders any shares that you hold as the stockholder of record.

You may only vote in person shares held in street name if you obtain from the broker or nominee that holds your shares a valid

proxy giving you the right to vote the shares.

|

|

|

Q:

|

How

can I vote my shares without attending the 2018 Annual Meeting of Stockholders?

|

|

|

A:

|

Whether you hold shares directly as the stockholder of record or beneficially in street name, you may, without attending the meeting, direct how your shares are to be voted.

Stockholder of Record — Shares Registered in Your Name:

If you are a stockholder of record, in addition to voting in person at the 2018 Annual Meeting of Stockholders, you may vote by proxy through the internet, or vote by proxy using a proxy card. Whether or not you plan to attend the 2018 Annual Meeting of Stockholders, we urge you to vote by proxy to ensure your vote is counted. You may still attend the meeting and vote in person even if you have already voted by proxy.

|

|

|

•

|

Vote

by Internet

, by going to the web address www.stocktrack.simplyvoting.com and following the instructions for internet voting

shown on your proxy card. Your Internet vote must be received by 11:59 p.m., Eastern Time, on June 26, 2018

|

|

|

•

|

Vote by Proxy Card

, by completing, signing, dating and mailing the enclosed proxy card in the envelope provided. If you return your signed proxy card to us before the 2018 Annual Meeting of Stockholders, we will vote your shares as you direct. If you vote by internet, please do not mail your proxy card.

|

|

|

|

Beneficial Owner — Shares Registered in the Name

of a Broker or Bank:

If you are a beneficial owner of shares registered in the name of your broker, bank, or other agent,

you should have received an instruction card containing voting instructions from that organization rather than from us. You will

be provided with instructions to vote by internet or to vote by mailing in your instruction card. Simply follow the voting instructions

in the voting instruction card to ensure that your vote is counted.

|

|

|

|

We provide internet proxy

voting to allow you to vote your shares online, with procedures designed to ensure authenticity and correctness of your proxy vote

instructions. Please be aware, however, that you must bear any costs associated with your internet access, such as usage charges

from internet access providers and telephone companies.

|

|

|

|

|

|

|

Q:

|

Can I change my vote?

|

|

|

A:

|

You

may change your vote at any time prior to the vote at the 2018 Annual Meeting of Stockholders. For shares held directly in your

name, you may accomplish this by granting a new proxy bearing a later date (which automatically revokes the earlier proxy) or

by attending the 2018 Annual Meeting of Stockholders and voting in person. Attendance at the meeting will not cause your previously

granted proxy to be revoked unless you specifically so request. For shares you hold beneficially, you may change your vote by

submitting new voting instructions to your broker or nominee or, if you have obtained a valid proxy from your broker or nominee

giving you the right to vote your shares, by attending the meeting and voting in person. You may also change your vote by sending

a written notice of revocation to the Corporate Secretary, Cavitation Technologies, Inc., 10019 Canoga Avenue, Chattsworth, California

91311.

Even if you plan to attend the 2018 Annual Meeting of Stockholders, we recommend that you also submit your proxy

or voting instructions or vote through the internet so that your vote will be counted if you later decide not to attend the 2018

Annual Meeting of Stockholders.

|

|

|

Q:

|

Can

I revoke my proxy?

|

|

|

A:

|

You

may revoke your proxy before it is voted at the 2018 Annual Meeting of Stockholders. To revoke your proxy, notify our Corporate

Secretary in writing at 10019 Canoga Avenue, Chattsworth, California 91311, or deliver to our corporate secretary a duly executed

proxy bearing a later date. You may also revoke your proxy by appearing at the 2018 Annual Meeting of Stockholders in person and

voting your shares. Attendance at the meeting will not, by itself, revoke a proxy. If you vote by internet, you may also revoke

your proxy by granting a subsequent proxy by telephone or internet. Attendance at the 2018 Annual Meeting of Stockholders will

not, by itself, revoke a proxy. If your shares are held by your broker or bank as nominee or agent, you should follow the instructions

provided by your broker or bank.

|

|

|

Q:

|

Who

can help answer my questions?

|

|

|

A:

|

If

you have any questions about the 2018 Annual Meeting of Stockholders or how to vote or revoke your proxy, or you need additional

copies of this proxy statement or voting materials, you should contact the Corporate Secretary, Cavitation Technologies, Inc.,

10019 Canoga Avenue, Chattsworth, California 91311 (818) 718-0905.

|

|

|

Q:

|

How

are votes counted?

|

|

A

|

In the election of directors (Proposal No. 1), you may vote FOR each of the two (2) nominees or you may direct your vote to be WITHHELD with respect to any one of the two (2) nominees.

|

|

|

|

|

|

With respect to Proposals 2,

3, 4, 5 and 6 you may vote FOR, AGAINST, or ABSTAIN. On these proposals, if you vote ABSTAIN, it has the same effect as a vote

AGAINST. With respect to Proposal 7, you may vote one year, two years, three years or ABSTAIN.

|

|

|

|

|

|

If you provide specific instructions,

your shares will be voted as you instruct. If you sign and return your proxy card but do not give voting instructions, the shares

represented by that proxy will be voted

FOR

each of the two (2) nominees for election as director,

FOR

the ratification

of the appointment of Weinberg & Company, P.A. as the Company’s independent registered public accounting firm for the

fiscal year ending June 30, 2019,

FOR

the approval (in the event it is deemed advisable by our Board of Directors) of an

amendment to our Articles of Incorporation to effect a reverse stock split of our issued and outstanding shares of common stock

at a ratio to be determined in the discretion of our Board of Directors within a range of one (1) share of common stock for every

four (4) to ten (10) shares of common stock;

FOR

authority to adjourn the 2018 Annual Meeting of Stockholders, if necessary,

if a quorum is present, to solicit additional proxies if there are not sufficient votes in favor of the Reverse Stock Split;

FOR

the approval of the Company’s 2018 Stock Incentive Plan,

FOR

the approval, on an advisory basis, of the compensation

of our named executive officers, and

FOR

the recommendation, on an advisory basis, of a three year frequency for holding

an advisory vote on the compensation of our named executive officers.

|

|

Q:

|

What is a quorum and why is it necessary?

|

|

A:

|

Conducting business at the meeting requires

a quorum. The presence, either in person or by proxy, of the holders of a majority of our shares of common stock outstanding on

May 1, 2018 is necessary to constitute a quorum. On the record date, there were 197,197,906 shares outstanding and entitled to

vote. Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your

broker, bank or other nominee) or if you vote in person at the 2018 Annual Meeting of Stockholders. Abstentions and broker non-votes

(which result when your shares are held in “street name” and you do not tell the nominee how to vote your shares and

are described in detail below) are treated as present for purposes of determining whether a quorum exists. Broker non-votes are

relevant in determining whether a quorum is present at the meeting.

|

|

Q:

|

What are Broker Non-Votes?

|

|

|

|

|

A:

|

Under the rules of the New York Stock Exchange,

member brokers who hold shares in street name for their customers that are the beneficial owners of those shares have the authority

to only vote on certain “routine” items in the event that they have not received instructions from beneficial owners.

Under New York Stock Exchange rules, when a proposal is not a “routine” matter and a member broker has not received

voting instructions from the beneficial owner of the shares with respect to that proposal, the brokerage firm may not vote the

shares on that proposal since it does not have discretionary authority to vote those shares on that matter. A “broker non-vote”

is submitted when a broker returns a proxy card and indicates that, with respect to particular matters, it is not voting a specified

number of shares on that matter, as it has not received voting instructions with respect to those shares from the beneficial owner

and does not have discretionary authority to vote those shares on such matters. “Broker non-votes” are not entitled

to vote at the 2018 Annual Meeting of Stockholders with respect to the matters to which they apply; however, “broker non-votes”

will be included for purposes of determining whether a quorum is present at the 2018 Annual Meeting of Stockholders.

Proposals 1, 4, 5, 6 and 7 are considered

“non-routine” matters. As a result, brokers that do not receive instructions with respect to any of Proposals 1, 4,

5, 6 and 7 from their customers will not be entitled to vote on such proposal.

Proposals 2 and 3 are considered a “routine”

matter. As a result, brokers that do not receive instructions with respect to Proposals 2, 3 and 4 from their customers will be

entitled to vote on such proposal.

|

|

|

Q:

|

What is the voting requirement to approve each of the proposals?

|

|

|

A:

|

|

•

|

In the election of directors (Proposal 1), the two (2) persons receiving the highest number of votes at the Annual Meeting will be elected. Accordingly, withheld votes and broker non-votes have no effect on the election of any nominee (Proposal 1). You do not have the right to cumulate your votes.

|

|

|

•

|

To be approved, Proposal 2, which relates to the ratification of the appointment of Weinberg & Company, P.A, as our independent registered public accounting firm for the year ending June 30, 2019, must receive FOR votes from the holders of a majority of shares present in person or represented by proxy and entitled to vote at the 2018 Annual Meeting of Stockholders. Abstentions will have the same effect as an AGAINST vote. This is a matter on which brokers, banks, or other nominees have discretionary voting authority and thus we do not expect any broker non-votes with respect to Proposal 2. This vote is advisory, and therefore is not binding on us, the Audit Committee or our Board of Directors. If our stockholders fail to ratify the appointment, the Audit Committee will reconsider whether or not to retain that firm. Even if the appointment is ratified, the Audit Committee in its discretion may direct the appointment of different independent auditors at any time during the year if they determine that such a change would be in the best interests of the Company and its stockholders.

|

|

|

•

|

To be approved, Proposal 3 (the Reverse Stock Split), which relates to the approval of a reverse stock split must receive FOR votes from the holders of a majority of the issued and outstanding shares of common stock as of the record date. Accordingly, abstentions with respect to this proposal will have the same effect as voting AGAINST this proposal. This is a matter on which brokers, banks, or other nominees have discretionary voting authority and thus we do not expect any broker non-votes with respect to Proposal 3.

|

|

|

|

|

|

|

•

|

To be approved, Proposal 4 (the Adjournment), which relates to the approval of an adjournment of the 2018 Annual Meeting must receive FOR votes from the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the 2018 Annual Meeting of Stockholders. Accordingly, abstentions with respect to this proposal will have the same effect as voting AGAINST. Broker non-votes will have no effect on this proposal.

|

|

|

•

|

To be approved, Proposal 5 (the 2018 Plan), which relates to the 2018 Stock Incentive Plan, must receive FOR votes from the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the 2018 Annual Meeting of Stockholders. Accordingly, Abstentions with respect to this proposal will have the same effect as voting AGAINST this proposal. Broker non-votes will have no effect on this proposal.

|

|

|

|

|

|

|

•

|

To be approved, Proposal 6 (Executive Compensation Advisory Vote), which relates to the approval of the executive compensation, must receive FOR votes from the holders of a majority of shares present in person or represented by proxy and entitled to vote at the 2018 Annual Meeting of Stockholders. Accordingly, Abstentions with respect to this proposal will have the same effect as voting AGAINST this proposal. Broker non-votes will have no effect on this proposal. The say-on-pay vote is advisory, and therefore not binding on the Company or our Board of Directors. Our Board of Directors values the opinions of our stockholders and, to the extent there is any significant vote against the named executive officer compensation as disclosed in the proxy statement, we will consider our stockholders’ concerns and the Board of Directors will evaluate whether any actions are necessary to address those concerns.

|

|

|

|

|

|

|

•

|

To be approved, Proposal 7 (Frequency of Advisory Vote), which is an advisory vote on the frequency of the advisory vote on executive compensation, the preferred voting frequency that receives the highest number of votes cast by stockholders will be the frequency for the advisory vote on executive compensation going forward. Accordingly, abstentions and broker non-votes will have no effect. Stockholders have an option of choosing one, two or three years for the frequency of the advisory vote on executive compensation or they may abstain. This vote is advisory, and therefore is not binding on us or our Board of Directors and therefore we can change the frequency in our discretion if we determine that such a change would be in the best interests of the Company and its stockholders.

|

|

|

Q:

|

What

should I do if I receive more than one set of voting materials?

|

|

|

A:

|

You

may receive more than one set of voting materials, including multiple copies of this proxy statement and multiple proxy cards

or voting instruction cards. For example, if you hold your shares in more than one brokerage account, you will receive a separate

voting instruction card for each brokerage account in which you hold shares. If you are a stockholder of record and

your shares are registered in more than one name, you will receive more than one proxy card. Please complete, sign, date, and

return each proxy card and voting instruction card that you receive.

|

|

|

Q:

|

Where

can I find the voting results of the 2018 Annual Meeting of Stockholders?

|

|

|

A:

|

We

intend to announce preliminary voting results at the 2018 Annual Meeting of Stockholders and publish final results in a Current

Report on Form 8-K which will be filed within four days of the meeting.

|

|

|

Q:

|

What

happens if additional matters are presented at the 2018 Annual Meeting of Stockholders?

|

|

|

A:

|

Other

than the seven items of business described in this proxy statement, we are not aware of any other business to be acted upon at

the 2018 Annual Meeting of Stockholders. If you grant a proxy, the persons named as proxy holders, Mr. Igor Gorodinitsky, our

President, and Naum Voloshin our Chief Financial Officer, will have the discretion to vote your shares on any additional matters

properly presented for a vote at the meeting. If for any unforeseen reason any of our nominees are not available as a candidate

for director, the persons named as proxy holders will vote your proxy for any one or more other candidates nominated by the Board

of Directors.

|

|

|

Q:

|

How

many shares are outstanding and how many votes is each share entitled?

|

|

|

A:

|

Each

share of our common stock that is issued and outstanding as of the close of business on May 1, 2018, the record date, is entitled

to be voted on all items being voted on at the 2018 Annual Meeting of Stockholders, with each share being entitled to one vote

on each matter. On the record date, 197,197,906 shares of common stock were issued and outstanding.

|

|

|

Q:

|

Who

will count the votes?

|

|

|

A:

|

One

or more inspectors of election will tabulate the votes.

|

|

|

Q:

|

Is

my vote confidential?

|

|

|

A:

|

Proxy

instructions, ballots, and voting tabulations that identify individual stockholders are handled in a manner that protects your

voting privacy. Your vote will not be disclosed, either within the Company or to anyone else, except: (1) as necessary to meet

applicable legal requirements; (2) to allow for the tabulation of votes and certification of the vote; or (3) to facilitate a

successful proxy solicitation.

|

|

|

Q:

|

Who

will bear the cost of soliciting votes for the 2018 Annual Meeting of Stockholders?

|

|

|

A:

|

The

Board of Directors is making this solicitation on behalf of the Company, which will pay the entire cost of preparing, assembling,

printing, mailing, and distributing these proxy materials. Certain of our directors, officers, and employees, without any additional

compensation, may also solicit your vote in person, by telephone, or by electronic communication. On request, we will reimburse

brokerage houses and other custodians, nominees, and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy

and solicitation materials to stockholders.

|

|

|

Q:

|

May

I propose actions for consideration at next year’s Annual Meeting of Stockholders?

|

|

|

A:

|

You

may submit proposals for consideration at future stockholder meetings. In order for a stockholder proposal to be considered for

inclusion in the proxy statement for our Annual Meeting next year, however, the written proposal must be received by us by January

8, 2019. Those proposals also must comply with Securities and Exchange Commission (the “SEC”) regulations under Rule

14a-8 regarding the inclusion of stockholder proposals in company-sponsored Proxy materials.

|

PROPOSAL 1

ELECTION OF DIRECTORS

The Board of Directors

nominated for annual election as director each of the individuals identified below, all of whom are incumbent directors.

The following table

sets forth the name, age and position of each of our director nominees:

|

Person

|

|

Age

|

|

Position

|

|

|

|

|

|

|

|

Igor Gorodnitsky

|

|

56

|

|

President, PEO, Secretary and Director

|

|

James Fuller

|

|

75

|

|

Director

|

Our Audit Committee

standing member is James Fuller. We anticipate forming compensation, governance, and other committees as necessary.

Our directors and

officers serve until their successor is elected and qualified, or until their earlier resignation or removal.

THE NOMINEES

Currently, the Board

of Directors consists of two (2) members: Igor Gorodinitsky and James Fuller. The Board of Directors believes that it is in our

best interests to elect the below-described nominees, each to serve as a director until the next Annual Meeting of stockholders

and until his or her successor shall have been duly elected and qualified. All of the nominees have consented to being named in

this proxy statement and to serve as a director if elected. At the time of the 2018 Annual Meeting of Stockholders, if any of the

nominees named above is not available to serve as director (an event that the Board of Directors does not currently have any reason

to anticipate), all proxies will be voted for any one or more other persons that the Board of Directors designates in their place.

The Board believes

that each of our directors is highly qualified to serve as a member of the Board and each has contributed to the mix of skills,

core competencies and qualifications of the Board of Directors. When evaluating candidates for election to the Board, the Board

seeks candidates with certain qualities that it believes are important, including experience, skills, expertise, personal and professional

integrity, character, business judgment, time availability in light of other commitments, dedication, conflicts of interest, those

criteria and qualifications described in each director’s biography below and such other relevant factors that the Board considers

appropriate in the context of the needs of the Board of Directors.

INFORMATION ABOUT THE NOMINEES

Set forth below are

summaries of the background, business experience and descriptions of the principal occupation for at least the past five years

of each of our current nominees for election as directors:

Igor Gorodnitsky.

Mr. Gorodnitsky has been our President and member of the Board of Directors since October 26, 2008, and he became our Secretary

and Principal Executive Officer in November of 2012. Mr. Gorodnitsky developed expertise in handling and processing hazardous waste

material. As a Senior Haz-Mat Specialist, he coordinated and successfully completed more than 500 emergency response Haz-mat clean-ups

over the past 20 years. He coordinated and supervised Haz Mat projects, emergency and routine spill clean-ups, and confined space

entry tasks. He coordinated and scheduled manpower and purchased and scheduled equipment and materials for containment and treatment

of spills. He successfully managed, coordinated and supervised projects including Hazscanning, sampling, lab-packing, manifesting,

profiling, labeling, and other special procedures for a variety of commercial clients and municipalities. He is a chemist by training

and holds numerous certifications and licenses including Hazwoper Training Program, Confined Space Entry and Gas Vapour HazCating,

Certified Uniform Waste Manifest Training, Basic and Intermediate HazCating, On-Scene Incident Commander Emergency, Site Remediation

Methods, Underground Storage Tank Removal, Health & Safety Supervisor Certification, Hazardous Certification, and Tosco Refinery

Safety. Mr. Gorodnitsky was president of Express Environmental Corp. since its inception in 1980 until he sold his interest in

January 2009. Based on his significant industry experience and management skills it was determined that Mr. Gorodnitsky should

serve on our Board.

James Fuller

. Mr. Fuller has been a director since February, 2010. He was formerly a Vice President of the New York Stock Exchange and director

of the Securities Investor Protection Corporation. In addition to his over 30 years of experience in the securities markets, Mr.

Fuller sat on the Board of Trustees of the University of California, Santa Cruz and previously served as Chairman of their Audit

Committee and Independent Financial Expert. Jim has been a partner at Baytree Capital Associates, LLC since March 2008. He received

his BS in Political Science from San Jose State University and his MBA from California State University - Fresno. Mr. Fuller also

served as a Director of Propell Technologies Group, Inc (OTCQB: PROP), a public company engaged in oil and gas exploration from

October 14, 2011 until February 17, 2015. Since May 2017, Mr. Fuller has served as a Director of QPAGOS (OTCQB: QPAG), a provider

of next generation physical and virtual payment services in Mexican. Based on Mr. Fuller’s extensive experience in finance

as well as his prior public company experience it was determined that Mr. Fuller should serve on our Board.

DIRECTOR INDEPENDENCE

We have determined

that James Fuller is an “independent” director under the definition set forth in the listing standards of the NASDAQ

Capital Markets. Mr. Gorodnitsky is not independent due to his position with us.

INFORMATION REGARDING EXECUTIVE OFFICERS

WHO ARE NOT DIRECTORS

Set forth below are

summaries of the background, business experience and descriptions of the principal occupation for at least the past five years

of each of our executive officers who are not directors:

Naum Voloshin.

Mr. Voloshin, age 54, has over 20 years of experience in investment banking, business operations and marketing. Prior to joining

us in November 2012, Mr. Voloshin worked for several developmental stage companies in US, Europe and Asia. The scope of his duties

was to provide management, supervision, business experience and marketing skills.

Leadership Structure

Our President also

serves as our Chairman of the Board and we do not have a formal policy on whether the same person should (or should not) serve

as both the President and Chairman of the Board. Our Board does not have a lead independent director. Our Board has determined

its leadership structure is appropriate and effective for us given our stage of development.

INFORMATION REGARDING THE COMMITTEES

OF THE BOARD OF DIRECTORS

Our Audit Committee

is comprised of James Fuller, who is an “audit committee financial expert.” We do not have a Compensation Committee

or a Nominating Committee.

Audit Committee

The Audit Committee

met four (4) times during the year ended June 30, 2017. The primary purpose of the Audit Committee is to act on behalf of the Board

of Directors in its oversight of all material aspects of our accounting and financial reporting processes, internal controls and

audit functions, including our compliance with Section 404 of the Sarbanes-Oxley Act of 2002.

The duties of the

Audit Committee include the hiring and retaining of our independent registered public accounting firm, which reports to the Audit

Committee. The Audit Committee reviews with our independent registered public accounting firm the scope and results of the audit

engagement and the system of internal controls and procedures. The Audit Committee also reviews the effectiveness of procedures

intended to prevent violations of laws. The Audit Committee also reviews, prior to publication, our quarterly earnings releases

and our reports to the SEC on Forms 10-K and 10-Q. The formal report of the Audit Committee for the year ended June 30, 2017 is

set forth under the caption “Report of the Audit Committee” in Proposal 2.

Our Board of Directors

has determined that the member of the Audit Committee is “independent” under the applicable rules of the NYSE MKT and

that the member is an “audit committee financial expert” within the meaning of the regulations of the SEC.

Audit Committee members

must also satisfy the independence criteria set forth in Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the

“Exchange Act”). In order to be considered to be independent for purposes of Rule 10A-3, a member of an Audit Committee

of a listed company may not, other than in his or her capacity as a member of the Audit Committee, the Board of Directors, or any

other board committee: (1) accept, directly or indirectly, any consulting, advisory or other compensatory fee from the listed company

or any of its subsidiaries or (2) be an affiliated person of the listed company or any of its subsidiaries. Each member of our

Audit Committee is “independent” under Rule 10A-3 of the Exchange Act.

The Audit Committee

has adopted a formal written charter, a copy of which is available on our website at www.ctinanotech.com in the Investors

section.

Process For Selection

of Director Nominees

Due to the size of

the Board and the fact that each Board member participates in the consideration for director nominees, we do not believe that we

require a standing Nominating Committee.

Candidates for director

should have certain minimum qualifications, including the ability to understand basic financial statements, being over 21 years

of age, having relevant business experience (taking into account the business experience of the other directors), and having high

moral character.

In evaluating an incumbent

director whose term of office is set to expire, the Board reviews such director’s overall service to us during such director’s

term, including the number of meetings attended, level of participation, quality of performance, and any transactions with us engaged

in by such director during his term.

When selecting a new

director nominee, the Board first determines whether the nominee must be independent for Audit Committee purposes or whether the

candidate must qualify as an “audit committee financial expert.” The Board then uses its network of contacts to compile

a list of potential candidates, but may also engage, if it deems appropriate, a professional search firm to assist in the identification

of qualified director candidates. The Board also will consider nominees recommended by our stockholders. The Board does not distinguish

between nominees recommended by our stockholders and those recommended by other parties. The Board evaluates the suitability of

potential nominees, taking into account the current composition of the Board of Directors, including expertise, diversity and the

balance of inside and independent directors. The Board endeavors to establish a diversity of background and experience in a number

of areas of core competency, including business judgment, management, accounting, finance, knowledge of our industry, strategic

vision, research and development and other areas relevant to our business.

Stockholders wishing

to directly recommend candidates for election to the Board of Directors at our next annual meeting to be included in our Proxy

Statement must do so by giving written notice to: Chairman of the Board, at Cavitation Technologies, Inc., 10019 Canoga Avenue,

Chattsworth, California 91311. Any such notice must be delivered to the Chairman not less than 120 days prior to the anniversary

of the preceding year’s proxy statement . The notice must state: (1) the name and address of the stockholder making the recommendations;

(2) the name, age, business address, and residential address of each person recommended; (3) the principal occupation or employment

of each person recommended; (4) the class and number of shares of the Company’s stock that are beneficially owned by each

person recommended and by the recommending stockholder; (5) any other information concerning the persons recommended that must

be disclosed in nominee and proxy solicitations in accordance with Regulation 14A of the Exchange Act; and (6) a signed consent

of each person recommended stating that he or she consents to serve as a director of the Company if elected.

In considering any

person recommended by one of our stockholders, the Board will look for the same qualifications that it looks for in any other person

that it is considering for a position on the Board of Directors. Any stockholder nominee recommended by the Board of Directors

for election at the next annual meeting of stockholders will be included in the Company’s Proxy Statement for that annual

meeting.

Family Relationships

There are no family

relationships between any of our directors or officers.

Code of Conduct and Ethics

We adopted a Code

of Conduct and Ethics. Our Code of Conduct and Ethics obligates our directors, officers and employees to disclose potential conflicts

of interest and prohibits those persons from engaging in conflict-of-interest transactions without our consent. Our Code of Conduct

and Ethics is included in our Governance section of our Internet website,

www.ctinanotech.com

.

Vote Required

Provided that a quorum

is present, the nominees for director receiving a plurality of the votes cast at the Annual Meeting in person or by proxy will

be elected.

OUR BOARD OF DIRECTORS RECOMMENDS

THAT YOU VOTE

YOUR SHARES FOR THE ELECTION OF EACH OF THESE NOMINEES.

STOCKHOLDER

COMMUNICATIONS WITH THE BOARD OF DIRECTORS

The Board has established

a process to receive communications from stockholders. Stockholders may contact any member or all members of the Board, any Board

committee, or any chair of any such committee by mail. To communicate with the Board of Directors, any individual director or any

group or committee of directors, correspondence should be addressed to the Board of Directors or any such individual director or

group or committee of directors by either name or title. All such correspondence should be sent “c/o Corporate Secretary”

at Cavitation Technologies, Inc., 10019 Canoga Avenue, Chattsworth, California 91311.

This centralized process

assists the Board of Directors in reviewing and responding to stockholder communications in an appropriate manner. If a stockholder

wishes to direct any communication to a specific member of the Board of Directors, the name of that member of the Board of Directors

should be noted in the communication. The Board of Directors has instructed the Corporate Secretary to forward stockholder correspondence

only to the intended recipients, and has also instructed the Corporate Secretary to review all stockholder correspondence and,

in the Corporate Secretary’s discretion, refrain from forwarding any items deemed to be of a commercial or frivolous nature

or otherwise inappropriate for the Board of Directors’ consideration. Any such items may be forwarded elsewhere in the Company

for review and possible response.

BOARD AND COMMITTEE MEETINGS

During our fiscal

year ended June 30, 2017, our Board of Directors held six (6) meetings and our Audit Committee held four (4) meetings. Each of

our incumbent directors that were directors during our fiscal year ended June 30, 2017 attended at least 75% of the meetings of

the Board of Directors and Board committees on which such director served during 2017.

DIRECTOR ATTENDANCE AT ANNUAL MEETINGS

Our directors are encouraged, but not required,

to attend the 2018 Annual Meeting of Stockholders.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING

COMPLIANCE

Section 16(a) of the

Exchange Act requires our executive officers, directors and persons who beneficially own more than 10 percent of a registered class

of our equity securities, to file with the SEC initial reports of ownership and reports of changes in ownership of our common stock.

Such officers, directors and persons are required by SEC regulation to furnish us with copies of all Section 16(a) forms that they

file with the SEC.

Based solely on a

review of the copies of such forms that were received by us, or written representations from certain reporting persons that no

Forms 5 were required for those persons, we are not aware of any failures to file reports or report transactions in a timely manner

during the year ended June 30, 2017 other than a Form 4 with respect to the issuance of a warrant to purchase 3,000,000 shares

of common stock granted in January 2017 to each of Messrs. Gorodnitsky, Gordon and Voloshin and a Form 4 with respect to the issuance

of a warrant to purchase 1,000,000 shares of common stock granted in January 2017 issued to Mr. Fuller.

CORPORATE GOVERNANCE

Risk Oversight

The Board has an

active role, as a whole and also at the committee level, in overseeing management of our risks. The Board regularly reviews information

regarding our strategy, finances and operations, as well as the risks associated with each. The Audit Committee is responsible

for oversight of Company risks relating to accounting matters, financial reporting, internal controls and legal and regulatory

compliance. The Audit Committee undertakes, at least annually, a review to evaluate these risks and then meets separately with

management responsible for such area, including our Chief Financial Officer, and report to the Board on any matters identified

during such discussions with management. In addition, the Board of Directors considers risks related to the attraction and retention

of talent as well as risks relating to the design of compensation programs and arrangements. The Board of Directors manages risks

associated with the composition of the Board and corporate governance. While the Audit Committee is responsible for evaluating

certain risks and overseeing the management of such risks, the entire Board is regularly informed through committee reports about

such risks. The full Board considers strategic risks and opportunities and regularly receives detailed reports from the committee

regarding risk oversight in their respective areas of responsibility.

Review and Approval of Transactions with Related Persons

The Board of Directors

has adopted policies and procedures for review, approval and monitoring of transactions involving the Company and “related

persons” (directors and executive officers or their immediate family members, or stockholders owning five percent or greater

of our outstanding stock). The policy covers any related person transaction that meets the minimum threshold for disclosure in

the Proxy Statement under the relevant rules of the SEC. Pursuant to our charter, our Audit Committee shall review on an on-going

basis for potential conflicts of interest, and approve if appropriate, all our “Related Party Transactions.” For purposes

of the Audit Committee Charter, “Related Party Transactions” shall mean those transactions required to be disclosed

pursuant to SEC Regulation S-K, Item 404.

A discussion of our

current related person transactions appears in this Proxy Statement under “Certain Relationships and Related Transactions.”

LIMITS ON LIABILITY AND INDEMNIFICATION

Our Articles of Incorporation

provide that we will indemnify each person who serves at any time as a director, officer, employee, or agent of the Company to

the fullest extent permitted by Nevada law or any other law then in effect or as it may hereafter be amended.

We believe that this

indemnification covers at least negligence and gross negligence on the part of the indemnified parties. Insofar as indemnification

for liabilities under the Securities Act of 1933, as amended (the “Securities Act”), may be permitted to directors,

officers, and controlling persons of the Company under the foregoing provisions or otherwise, we have been advised that in the

opinion of the SEC that indemnification is against public policy as expressed in the Securities Act, and is therefore unenforceable.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS AND MANAGEMENT

The following table

provides information regarding the beneficial ownership of our common stock as of May 1, 2018, (the “Evaluation Date”)

by: (i) each of our current directors, (ii) each of our named executive officers, and (iii) all such directors and

executive officers as a group. We know of no other person or group of affiliated persons who beneficially own more than five percent

of our common stock. The table is based upon information supplied by our officers, directors and principal stockholders and a review

of Schedules 13D and 13G, if any, filed with the SEC. Unless otherwise indicated in the footnotes to the table and subject to community

property laws where applicable, we believe that each of the stockholders named in the table has sole voting and investment power

with respect to the shares indicated as beneficially owned.

Applicable percentages

are based on 197,197,906 shares outstanding as of the Evaluation Date, adjusted as required by rules promulgated by the SEC. These

rules generally attribute beneficial ownership of securities to persons who possess sole or shared voting power or investment power

with respect to those securities. In addition, the rules include shares of our common stock issuable pursuant to the exercise of

stock options or warrants that are either immediately exercisable or exercisable within 60 days of the Evaluation Date. These shares

are deemed to be outstanding and beneficially owned by the person holding those options for the purpose of computing the percentage

ownership of that person, but they are not treated as outstanding for the purpose of computing the percentage ownership of any

other person.

|

|

|

|

|

|

|

Amount and

|

|

|

|

|

|

|

|

|

|

|

|

Nature of

|

|

|

|

|

|

|

|

|

|

Title of

|

|

Beneficial

|

|

|

Percent of

|

|

|

Name of Beneficial Owner

|

|

|

|

Class

|

|

Ownership

|

|

|

Class (2)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Igor Gorodnitsky

|

|

(1)

|

|

Common Stock

|

|

|

17,250,000

|

|

|

|

8.2

|

%(3)

|

|

President, Principal Executive Officer, Director

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

James Fuller

|

|

(1)

|

|

Common Stock

|

|

|

1,837,500

|

|

|

|

|

*%(4)

|

|

Chairman of Audit Committee, Director

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Roman Gordon

|

|

(1)

|

|

Common Stock

|

|

|

19,323,015

|

|

|

|

9.6

|

%(5)

|

|

Senior Technology Manager

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Naum Voloshin

|

|

(1)

|

|

Common Stock

|

|

|

6,000,000

|

|

|

|

3.0

|

%(6)

|

|

Principal Accounting Officer

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Jon Gruber, trustee of John D. &

Linda W. Gruber Revocable Trust

|

|

(1)

|

|

Common Stock

|

|

|

10,979,051

|

|

|

|

5.4

|

%(7)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

West Point Partners LLC

|

|

(1)

|

|

Common Stock

|

|

|

17,220,000

|

|

|

|

8.0

|

%(8)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Directors and Officers

|

|

|

|

Common Stock

|

|

|

45,410,515

|

|

|

|

20.4

|

%

|

|

(as a group, four individuals)

|

|

|

|

|

|

|

|

|

|

|

|

|

*less than 1%

|

(1)

|

Unless otherwise set forth below, the mailing address of Executive Officers, Directors and 5% or greater holders is c/o the Company, 10019 Canoga Avenue, Chatsworth, California 91311. The address of the John D. & Linda W. Gruber Revocable Trust is 300 Tamal Plaza, Suite 280, Corte Madera, California 94925. The address of West Point partners LLC is 9909 Topanga Blvd, Suite 215, Chatsworth, California 91311.

|

|

(2)

|

Based on 197,197,906 issued and outstanding shares of common stock as of May 1, 2018.

|

|

(3)

|

Includes 5,000,000 shares of common stock, warrants to purchase 8,000,000 shares of common stock that are currently exercisable and an option to purchase 4,250,000 shares of common stock that are currently exercisable.

|

|

(4)

|

Includes 837,500 shares of common stock and warrants to purchase 1,000,000 shares of common stock that are currently exercisable.

|

|

(5)

|

Includes 14,523,015 shares of common stock and warrants to purchase 4,800,000 shares of common stock that are currently exercisable.

|

|

(6)

|

Includes warrants to purchase 6,000,000 shares of common stock that are currently exercisable.

|

|

(7)

|

Includes 5,979,051 shares of common stock and warrants to purchase 5,000,000 shares of common stock that are currently exercisable. Mr. Gruber is the trustee of the John D. & Linda W. Gruber Revocable Trust.

|

|

(8)

|

Includes 9,610,000 shares of common stock and warrants to purchase 7,610,000 shares of common stock that are currently exercisable. Miracle Mile Management is the manager of West Point Partners LLC and Galina Voloshin has the power to make disposition and voting decisions for Miracle Mile Management.

|

PROPOSAL 2

RATIFICATION OF APPOINTMENT

OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee

of the Board of Directors has appointed Weinberg & Company, P.A as our independent registered public accounting firm for the

year ending June 30, 2019.

Ratification of the

appointment of Weinberg & Company, P.A by our stockholders is not required by law, our bylaws or other governing documents.

As a matter of policy, however, the appointment is being submitted to our stockholders for ratification at the 2018 Annual Meeting

of Stockholders. If our stockholders fail to ratify the appointment, the Audit Committee will reconsider whether or not to retain

that firm. Even if the appointment is ratified, the Audit Committee in its discretion may direct the appointment of different independent

auditors at any time during the year if they determine that such a change would be in the best interests of the Company and its

stockholders.

At the 2018 Annual

Meeting of Stockholders, representatives of Weinberg & Company, P.A will be afforded an opportunity to make a statement if

they so desire and are expected to be available by telephone to respond to appropriate questions.

REPORT OF THE AUDIT COMMITTEE

OF THE BOARD OF DIRECTORS

1

Our Audit Committee

reviews our financial reporting process on behalf of our Board of Directors. In April 2018, our Board of Directors adopted a written

charter for our Audit Committee, which it re-evaluates annually in connection with the filing of our Annual Report on Form 10-K

with the SEC. In fulfilling its responsibilities, the Audit Committee has reviewed and discussed the audited financial statements

contained in the Annual Report on Form 10-K for the year ended June 30, 2017, with our management and our independent registered

public accounting firm for such year, Weinberg & Company, P.A. Our management is responsible for the financial statements and

the reporting process, including the system of internal controls. The independent registered public accounting firm is responsible

for expressing an opinion on the conformity of those audited financial statements with accounting principles generally accepted

in the United States.

The Audit Committee

(1) discussed with Weinberg & Company, P.A the matters required to be discussed by the Public Company Accounting Oversight

Board (“PCAOB”) Auditing Standard No. 1301,

Communications with Audit Committees

, as amended and adopted by

the PCAOB in Rule

;

(2) received the written disclosures and the letter from Weinberg & Company, P.A required by PCAOB

Ethics and Independence Rule 3526,

Communication with Audit Committees Concerning Independence

; and (3) discussed with

Weinberg & Company, P.A its independence. The Audit Committee also considered whether, and determined that, the independent

registered public accounting firm’s provision of other non-audit services to us was compatible with maintaining Weinberg

& Company, P.A’s independence.

You should note the

member of our Audit Committee is not our employee and is not performing the functions of auditors or accountants. Accordingly,

it is not the duty or responsibility of the Audit Committee or its members to conduct “field work” or other types of

auditing or accounting reviews or procedures or to set auditor independence standards. Members of the Audit Committee necessarily

rely on the information provided to them by management and the independent auditors. Accordingly, the Audit Committee’s considerations

and discussions referred to above do not constitute assurance that the audit of our financial statements has been carried out in

accordance with generally accepted accounting principles or that our auditors are in fact independent.

Based on the review

and discussions referred to above, the Audit Committee recommended to our Board of Directors (and our Board of Directors approved)

that the audited financial statements be included in our Annual Report on Form 10-K for the year ended June 30, 2017, for filing

with the SEC. In addition, the Audit Committee recommended to our Board of Directors and our Board of Directors approved that Weinberg

& Company, P.A be appointed as our independent registered public accounting firm for the year ending June 30, 2019 and that

this appointment be presented to stockholders for ratification.

|

|

Sole Member of the Audit Committee:

|

|

|

|

|

|

James Fuller

|

|

|

1

|

The material in this report is not “soliciting material,” is not deemed “filed” with the SEC and is not to be incorporated by reference in any filing of the Company under the Securities Act or the Exchange Act, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.

|

FEES PAID TO THE INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

The following table

provides information regarding the fees billed to us by Weinberg & Company, P.A. for the years ended June 30, 2017 and 2016.

All fees described below were approved by the Board:

|

|

|

June 30,

2017

|

|

|

June 30,

2016

|

|

|

|

|

|

|

|

|

|

|

Audit Fees and Expenses (1)

|

|

$

|

68,140

|

|

|

$

|

76,730

|

|

|

Audit Related Fees (2)

|

|

|

|

|

|

|

|

|

|

All Other Fees

|

|

$

|

19,409

|

|

|

$

|

8,440

|

|

|

|

(1)

|

Audit fees and expenses were for professional services rendered for the audit and reviews of the consolidated financial statements of the Company, professional services rendered for issuance of consents and assistance with review of documents filed with the SEC.

|

|

|

(2)

|

The audit related fees were for professional services rendered for additional filing for registration statements and forms with the SEC.

|

Pre-Approval Policies and Procedures

Consistent with SEC

policies regarding auditor independence, the Audit Committee has responsibility for appointing, setting compensation and overseeing

the work of the independent registered public accounting firm. In recognition of this responsibility, the Audit Committee has established

a policy to pre-approve all audit and permissible non-audit services provided by the independent registered public accounting firm.

Prior to the engagement

of the independent registered public accounting firm for the next year’s audit, management will submit a list of services

and related fees expected to be rendered during that year for audit services, audit-related services, tax services and other fees

to the Audit Committee for approval.

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS

THAT YOU VOTE FOR RATIFICATION OF THE SELECTION OF WEINBERG & COMPANY, P.A. AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING

FIRM FOR THE YEAR ENDING JUNE 30, 2019.

PROPOSAL 3

APPROVAL (IN THE EVENT IT IS DEEMED ADVISABLE

BY OUR BOARD OF DIRECTORS) OF AN AMENDMENT TO OUR ARTICLES OF INCORPORATION TO EFFECT A REVERSE STOCK SPLIT OF OUR ISSUED AND OUTSTANDING

SHARES OF COMMON STOCK AT A RATIO TO BE DETERMINED IN THE DISCRETION OF OUR BOARD OF DIRECTORS WITHIN A RANGE OF ONE (1) SHARE

OF COMMON STOCK FOR EVERY FOUR (4) TO TEN (10) SHARES OF COMMON STOCK

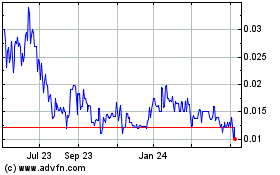

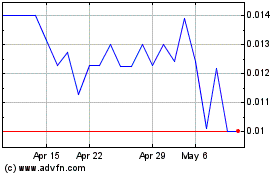

Our Board of Directors

has adopted and is recommending that our stockholders approve a proposed certificate of amendment (in the event it is deemed by

the Board to be advisable) to our Articles of Incorporation to effect a Reverse Stock Split of our issued and outstanding shares

of common stock. Holders of our common stock are being asked to approve the proposal that Section 3.1 of our Articles of Incorporation

be amended to effect a Reverse Stock Split of our common stock at a ratio to be determined in the discretion of our Board of Directors

within the range of one (1) share of our common stock for every four (4) to ten (10) shares of our common stock and also to decide

whether or not to proceed to effect a Reverse Stock Split or instead to abandon the proposed certificate of amendment altogether.

Pursuant to the laws of the State of Nevada, our state of incorporation, the Board must adopt an amendment to our Articles of Incorporation

to effect the Reverse Stock Split, and submit the amendment to stockholders for their approval. The form of the proposed certificate

of amendment to our Articles of Incorporation to effect the Reverse Stock Split is attached as

Appendix A

to this proxy

statement. If a certificate of amendment is filed with the Secretary of State of the State of Nevada, the certificate of amendment

to the Articles of Incorporation will effect the Reverse Stock Split by reducing the outstanding number of shares of our common

stock by the ratio to be determined by the Board. If the Board does not implement an approved Reverse Stock Split prior to the

one-year anniversary of this meeting, the Board will seek stockholder approval before implementing any Reverse Stock Split after

that time.

By approving this

proposal, stockholders will approve the certificate of amendment to our Articles of Incorporation pursuant to which any whole number

of outstanding shares, between and including four (4) and ten (10), would be combined into one share of common stock, and authorize

the Board to file such certificate of amendment, as determined by the Board in the manner described herein. If approved, the Board

may also elect not to effect any Reverse Stock Split and consequently not to file any certificate of amendment to the Articles

of Incorporation. Our Board of Directors believes that stockholder approval of an amendment granting our Board of Directors this

discretion, rather than approval of a specified exchange ratio, provides our Board of Directors with maximum flexibility to react

to then-current market conditions and, therefore, is in the best interests of the Company and its stockholders. The Board may also

elect not to do any reverse stock split. The Board’s decision as to whether and when to effect the Reverse Stock Split will

be based on a number of factors, including market conditions and existing and expected trading prices for our common stock. Although

our stockholders may approve the Reverse Stock Split, we will not effect the Reverse Stock Split if the Board of Directors does

not deem it to be in our best interests and our stockholders best interest. The Reverse Stock Split, if authorized pursuant to

this resolution and if deemed by the Board of Directors to be in the best interests of the Company and its stockholders, will be