Post-effective Amendment Filed Solely to Add Exhibits to a Registration Statement (pos Ex)

March 23 2018 - 5:23PM

Edgar (US Regulatory)

As filed with the Securities and Exchange

Commission on March 23, 2018

Securities Act File No. 333-212436

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-2

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

x

(Check appropriate box or boxes)

Pre-Effective Amendment No.

Post-Effective Amendment No. 8

NEWTEK BUSINESS SERVICES CORP.

(Exact name of Registrant as specified

in charter)

1981 Marcus Avenue, Suite 130

Lake Success, NY 11042

(Address of Principal Executive Offices)

Registrant’s telephone number,

including Area Code: (212) 356-9500

Barry Sloane

Chief Executive Officer and President

Newtek Business Services Corp.

1981 Marcus Avenue, Suite 130

Lake Success, NY 11042

(Name and address of agent for service)

COPIES TO:

Steven B. Boehm

Cynthia M. Krus

Eversheds Sutherland (US) LLP

700 Sixth Street NW, Suite 700

Washington, DC 20001

(202) 383-0100

Fax: (202) 637-3593

Approximate date of proposed public offering:

From time to time after the effective date of this Registration Statement.

If any securities being registered on this

form will be offered on a delayed or continuous basis in reliance on Rule 415 under the Securities Act of 1933, other than securities

offered in connection with a dividend reinvestment plan, check the following box.

x

EXPLANATORY NOTE

This Post-Effective Amendment No. 8 to

the Registration Statement on Form N-2 (File No. 333-212436) of Newtek Business Services Corp. is being filed pursuant

to Rule 462(d) under the Securities Act of 1933, as amended (the “Securities Act”), solely for the purpose of adding

exhibits to such Registration Statement. Accordingly, this Post-Effective Amendment No. 8 consists only of a facing page,

this explanatory note and Part C of the Registration Statement on Form N-2. This Post-Effective Amendment No. 8 does not change

the form of prospectus relating to the Registration Statement on Form N-2 previously filed with the Securities and Exchange Commission

(the “SEC”). Pursuant to Rule 462(d) under the Securities Act, this Post-Effective Amendment No. 8 shall become effective

immediately upon filing with the SEC.

PART C — OTHER INFORMATION

ITEM 25. FINANCIAL STATEMENTS AND EXHIBITS

1. Financial Statements

The following financial statements of Newtek

Business Services Corp. are included in Part A “Information Required to be in the Prospectus” of the Registration Statement.

NEWTEK BUSINESS SERVICES CORP. AND SUBSIDIARIES

INDEX TO FINANCIAL STATEMENTS

Table of Contents

|

|

PAGE

NO.

|

|

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

|

|

Report of Independent Registered Public Accounting Firm

|

|

F-3

|

|

|

Report of Independent Registered Public Accounting Firm on Internal Control Over Financial Reporting

|

|

F-4

|

|

|

Consolidated Statements of Assets and Liabilities as of December 31, 2016 and 2015

|

|

F-5

|

|

Consolidated Statements of Operations for the years ended December 31, 2016 and 2015

and the periods November 12, 2014 to December 31, 2014 and January 1, 2014 to November 11, 2014

|

|

F-6

|

|

|

Consolidated Statements of Changes in Net Assets/Stockholders' Equity for the years ended December 31, 2016 and 2015, the period from November 12, 2014 to December 31, 2014 and the period from January 1, 2014 to November 11, 2014

|

|

F-8

|

|

|

Consolidated Statements of Cash Flows for the years ended December 31, 2016 and 2015 and the periods from November 12, 2014 to December 31, 2014 and January 1, 2014 to November 11, 2014

|

|

F-10

|

|

|

Consolidated Schedules of Investments as of December 31, 2016 and 2015

|

|

F-13

|

|

|

Notes to Consolidated Financial Statements

|

|

F-104

|

|

|

Universal Processing Services of Wisconsin, LLC Financial Statements

|

|

Independent Auditor’s Report

|

|

F-148

|

|

|

Financial Statements

|

|

|

|

|

Balance Sheet

|

|

F-149

|

|

|

Statement of Income

|

|

F-150

|

|

|

Statement of Changes in Member’s Deficit

|

|

F-151

|

|

|

Statement of Cash Flows

|

|

F-152

|

|

|

Notes to Financial Statements

|

|

F-153

|

|

|

|

PAGE

NO.

|

|

INDEX TO CONSOLIDATED INTERIM FINANCIAL STATEMENTS

|

|

Condensed Consolidated Statements of Assets and Liabilities as of June 30, 2017 (Unaudited) and December 31, 2016

|

|

F-183

|

|

|

Condensed Consolidated Statements of Operations (Unaudited) for the three and six months ended June 30, 2017 and 2016

|

|

F-184

|

|

|

Condensed Consolidated Statement of Changes in Net Assets (Unaudited) for the six months ended June 30, 2017

|

|

F-185

|

|

|

Condensed Consolidated Statements of Cash Flows (Unaudited) for the six months ended June 30, 2017 and 2016

|

|

F-186

|

|

|

Consolidated Schedule of Investments as of June 30, 2017 (Unaudited) and December 31, 2016

|

|

F-188

|

|

|

Notes to Condensed Consolidated Financial Statements (Unaudited)

|

|

F-296

|

|

2. Exhibits

Exhibit

Number

|

|

Description

|

|

a.

|

|

Amended and Restated Articles of Incorporation of Newtek (Incorporated by reference to Exhibit A to Newteks Pre-Effective Amendment No. 3 to its Registration Statement on Form N-2, No. 333-191499, filed November 3, 2014).

|

|

b.

|

|

Bylaws of Newtek (Incorporated by reference to Exhibit 2 to Newteks Registration Statement on Form N-14, No. 333-195998, filed September 24, 2014).

|

|

c.

|

|

Not applicable.

|

|

d.1

|

|

Form of Common Stock Certificate (Incorporated by reference to Exhibit 5 to Newteks Registration Statement on Form N-14, No. 333-195998, filed September 24, 2014).

|

|

d.2

|

|

Base Indenture, dated as of September 23, 2015, between Newtek, as issuer, and U.S. Bank National Association, as trustee (Incorporated by reference to Exhibit D.2 to Newteks Post-Effective Amendment No. 1 to its Registration Statement on Form N-2, No. 333-204915, filed September 23, 2015).

|

|

d.3

|

|

First Supplemental Indenture, dated as of September 23, 2015, between Newtek, as issuer, and U.S. Bank National Association, as trustee (Incorporated by reference to Exhibit D.3 to Newteks Post-Effective Amendment No. 1 to its Registration Statement on Form N-2, No. 333-204915, filed September 23, 2015).

|

|

d.4

|

|

Form of Global Note with respect to the 7.5% Notes due 2022 (Included as Exhibit A of Exhibit D.3) (Incorporated by reference to Exhibit D.4 to Newteks Post-Effective Amendment No. 1 to its Registration Statement on Form N-2, No. 333-204915, filed September 23, 2015).

|

|

d.5

|

|

Second Supplemental Indenture, dated as of April 22, 2016, between Newtek, as issuer, and U.S. Bank National Association, as trustee (Incorporated by reference to Exhibit D.6 to Post-Effective Amendment No. 3 to its Registration Statement on Form N-2, No. 333-204915, filed April 22, 2016).

|

|

d.6

|

|

Form of Global Note with respect to the 7.00% Notes due 2021 (Included as Exhibit A of Exhibit D.5) (Incorporated by reference to Exhibit D.6 to Post-Effective Amendment No. 3 to its Registration Statement on Form N-2, No. 333-204915, filed April 22, 2016).

|

|

d.7

|

|

Statement of Eligibility of Trustee on Form T-1 (Incorporated by reference to Exhibit d.7 to Newteks Pre-Effective Amendment No. 2 to its Registration Statement on Form N-2, No 333-212436, filed August 25, 2016).

|

|

d.8

|

|

Third Supplemental Indenture, dated as of February

21, 2018, between Newtek, as issuer, and U.S. Bank National Association, as trustee (Incorporated by reference to Exhibit

d.8 to Newteks Post-Effective Amendment No. 7 to its Registration Statement on Form N-2, No. 333-212436, filed February 21,

2018).

|

|

d.9

|

|

Form of Global Note with respect to the 6.25% Notes due 2023 (Incorporated by reference to Exhibit d.8 to Newteks Post-Effective Amendment No. 7 to its Registration Statement on Form N-2, No 333-212436, filed February 21, 2018)

|

|

e.

|

|

Form of Dividend Reinvestment Plan (Incorporated by reference to Exhibit E to Newteks Pre-Effective Amendment No. 3 to its Registration Statement on Form N-2, No. 333-191499, filed November 3, 2014).

|

|

f.1

|

|

Lease and Master Services Agreement dated March 15, 2007 between CrystalTech Web Hosting, Inc. and i/o Data Centers (Incorporated by reference to Exhibit 10.4 to Newteks Quarterly Report on Form 10-Q for the quarter ended March 31, 2007, filed May 15, 2007).

|

|

f.2.1

|

|

Guaranty of Payment and Performance, dated as of April 30, 2010, between Newtek Business Services, Inc. and Capital One Bank, N.A. (Incorporated by reference herein to Exhibit 10.16.2 to Newteks Current Report on Form 8-K, filed May 5, 2010).

|

|

f.3.1

|

|

Loan and Security Agreement, dated as of December 15, 2010, between Newtek Small Business Finance, Inc. and Capital One Bank, N.A. (Incorporated by reference herein to Exhibit 10.18.1 to Newteks Current Report on Form 8-K, filed December 20, 2010, as amended on March 2, 2011).

|

|

f.3.2

|

|

Guaranty Agreement, dated as of December 15, 2010, between Newtek Business Services, Inc. and Capital One Bank, N.A. (Incorporated by reference herein to Exhibit 10.18.2 to Newteks Current Report on Form 8-K, filed December 20, 2010, as amended on March 2, 2011).

|

Exhibit

Number

|

|

Description

|

|

f.3.3

|

|

Amended and Restated Loan and Security Agreement, dated as of June 16, 2011, by and between Newtek Small Business Finance, Inc. and Capital One, N.A. (Incorporated by reference herein to Exhibit 10.8.3 to Newteks Current Report on Form 8-K, filed June 21, 2011).

|

|

f.3.4

|

|

Amended and Restated Guaranty of Payment and Performance, dated as of June 16, 2011, by and between Newtek Business Services, Inc., and Capital One, N.A. (Incorporated by reference herein to Exhibit 10.8.4 to Newteks Current Report on Form 8-K, filed June 21, 2011).

|

|

f.3.5

|

|

Amendment to Loan Documents, dated October 6, 2011, by and among Newtek Small Business Finance, Inc., Capital One Bank, N.A. and each of the guarantors listed on the signature pages thereto (Incorporated by reference herein to Exhibit 10.8.5 to Newteks Current Report on Form 8-K, filed October 11, 2011).

|

|

f.3.6

|

|

Amended and Restated Loan and Security Agreement, dated as of July 16, 2013, by and between Newtek Small Business Finance, Inc. and Capital One, National Association (Incorporated by reference herein to Exhibit 10.1 to Newteks Current Report on Form 8-K, filed July 19, 2013).

|

|

f.3.7

|

|

Guaranty and Security Agreement Letter Amendment, dated as of July 16, 2013, by and between Capital One, National Association and Newtek Business Services, Inc. (Incorporated by reference herein to Exhibit 10.2 to Newteks Current Report on Form 8-K, filed July 19, 2013).

|

|

f.3.8

|

|

Amended and Restated Loan and Security Agreement, dated as of October 29, 2014, by and between Newtek Small Business Finance, Inc. and Capital One, National Association (Incorporated by reference herein to Exhibit 10.1 to Newteks Current Report on Form 8-K, filed October 30, 2014).

|

|

f.3.9

|

|

Guaranty and Security Agreement Letter Agreement, dated as of October 29, 2014, by and between Capital One, National Association and Newtek Business Services, Inc. (Incorporated by reference herein to Exhibit 10.2 to Newteks Current Report on Form 8-K, filed October 30, 2014).

|

|

f.3.10

|

|

First Amendment, dated as of June 18, 2015, to the Amended and Restated Loan and Security Agreement dated as of October 29, 2014, by and between Newtek Small Business Finance, LLC (successor-in-interest by merger to Newtek Small Business Finance, Inc.), Capital One, National Association and Newtek Business Services Corp. (Incorporated by reference herein to Exhibit 10.1 to Newteks Current Report on Form 8-K, filed June 24, 2015).

|

|

f.3.11

|

|

Amended and Restated Guaranty of Payment and Performance, dated as of June 18, 2015, by Newtek Business Services Corp. (successor-in-interest to Newtek Business Services, Inc.) in favor of Capital One, National Association (Incorporated by reference herein to Exhibit 10.2 to Newteks Current Report on Form 8-K, filed June 24, 2015).

|

|

f.3.12

|

|

Fourth Amended and Restated Loan and Security Agreement, dated as of May 11, 2017, by and among Newtek Small Business Finance, LLC, Capital One, National Association and UBS Bank USA as Lenders, and Capital One, National Association as Administrative Agent, Sole Bookrunner and Sole Lead Arranger (Incorporated by reference herein to Exhibit 10.1 to Newteks Current Report on Form 8-K, filed May 16, 2017) .

|

|

f.3.13

|

|

Second Amended and Restated Guaranty of Payment and Performance, dated as of May 11, 2017, delivered by Newtek Business Services Corp. in favor of Capital One, National Association, in its capacity as administrative agent, and the Lenders under the Fourth Amended and Restated Loan and Security Agreement (Incorporated by reference herein to Exhibit 10.2 to Newteks Current Report on Form 8-K, filed May 16, 2017).

|

|

f.4.1

|

|

Newtek Small Business Loan Trust Class A Notes, dated December 22, 2010 (Incorporated by reference herein to Exhibit 10.19.1 to Newteks Current Report on Form 8-K, filed December 23, 2010).

|

Exhibit

Number

|

|

Description

|

|

f.4.2

|

|

Amended Newtek Small Business Loan Trust Class A Notes, dated December 29, 2011 (Incorporated by reference herein to Exhibit 10.19.2 to Newteks Current Report on Form 8-K, filed January 5, 2012).

|

|

f.4.3

|

|

Additional Newtek Small Business Loan Trust Class A Notes, dated December 29, 2011 (Incorporated by reference herein to Exhibit 10.19.3 to Newteks Current Report on Form 8-K, filed January 5, 2012).

|

|

f.5.1

|

|

Loan and Security Agreement, dated as of February 28, 2011, by and between CDS Business Services, Inc. and Sterling National Bank (Incorporated by reference herein to Exhibit 10.10.1 to Newteks Current Report on Form 8-K, filed March 3, 2011).

|

|

f.5.2

|

|

Guaranty, dated as of February 28, 2011, by and between Newtek Business Services, Inc. and Sterling National Bank (Incorporated by reference herein to Exhibit 10.10.2 to Newteks Current Report on Form 8-K, filed March 3, 2011).

|

|

f.5.3

|

|

Amendment No. 1, dated December 5, 2012, to Loan and Security Agreement, dated as of February 28, 2011, by and between CDS Business Services, Inc. and Sterling National Bank (Incorporated by reference herein to Exhibit 10.9.3 to Newteks Current Report on Form 8-K, filed December 11, 2012).

|

|

f.5.4

|

|

Amendment No. 2, dated August 27, 2015, to Loan and Security Agreement, dated as of February 28, 2011, by and between CDS Business Services, Inc. and Sterling National Bank (Incorporated by reference herein to Exhibit 10.1 to Newteks Current Report on Form 8-K filed September 1, 2015).

|

|

f.5.5

|

|

Loan and Security Agreement, dated as of August 27, 2015, by and between CDS Business Services, Inc., as borrower, Sterling National Bank, as administrative agent and collateral agent, and Newtek, as a guarantor (Incorporated by reference herein to Exhibit 10.2 to Newteks Current Report on Form 8-K filed September 1, 2015).

|

|

f.5.6

|

|

Guaranty, dated as of August 27, 2015, by and between Newtek and Sterling National Bank (Incorporated by reference herein to Exhibit 10.3 to Newteks Current Report on Form 8-K filed September 1, 2015).

|

|

f.5.7

|

|

Amendment No. 2 to the Loan and Security Agreement, dated as of August 27, 2015, by and between CDS Business Services, Inc. and Sterling National Bank (Incorporated by reference herein to Exhibit 10.1 to Newteks Current Report on Form 8-K, filed December 9, 2015).

|

|

f.5.8

|

|

Amended and Restated Loan and Security Agreement, dated as of December 1, 2015, by and between CDS Business Services, Inc., Sterling National Bank and BankUnited, N.A. (Incorporated by reference herein to Exhibit 10.2 to Newteks Current Report on Form 8-K, filed December 9, 2015).

|

|

f.5.9

|

|

Guaranty, dated as of December 1, 2015, by and between Newtek and Sterling National Bank (Incorporated by reference herein to Exhibit 10.3 to Newteks Current Report on Form 8-K, filed December 9, 2015).

|

|

f.6

|

|

Credit Agreement by and between Newtek Business Services, Inc. and Capital One, National Association, dated as of June 26, 2014 (Incorporated by reference to Exhibit 10.1 to Newteks Current Report on Form 8-K filed July 1, 2014).

|

|

f.7

|

|

Credit and Guaranty Agreement, dated as of June 23, 2015, by and between Universal Processing Services of Wisconsin LLC, CrystalTech Web Hosting, Inc., as borrowers, Goldman Sachs Bank USA, as Administrative Agent, Collateral Agent and Lead Arranger, various lenders, and Newtek, Newtek Business Services Holdco 1, Inc. and certain subsidiaries of Newtek Business Services Holdco 1, Inc., as guarantors (Incorporated by reference herein to Exhibit 10.1 to Newteks Current Report on Form 8-K, filed June 25, 2015).

|

Exhibit

Number

|

|

Description

|

|

f.8

|

|

Amended and Restated Credit and Guaranty Agreement, dated June 21, 2017, by and among Universal Processing Services of Wisconsin LLC, CrystalTech Web Hosting, Inc., Small Business Lending, LLC, ADR Partners, LLC, Premier Payments LLC, Newtek Business Services Corp., Wilshire Holdings I, Inc., The Whitestone Group, LLC, Newtek Business Services Holdco 1, Inc., Banc-Serv Acquisition, Inc., certain subsidiaries of Newtek Business Services Holdco 1, Inc. and Banc-Serv Acquisition, Inc., including Newtek LSP Holdco, LLC, CRY Sales, LLC and UPSWI Sales, LLC, the Lenders party thereto from time to time, Goldman Sachs Bank USA, as Administrative Agent and Collateral Agent, and Goldman Sachs Specialty Lending Group, L.P., as Lead Arranger (incorporated by reference to Exhibit 10.1 to Newteks Current Report on Form 8-k, filed June 23, 2017).

|

|

g.

|

|

Not Applicable.

|

|

h.1

|

|

Form of Equity Underwriting Agreement (Incorporated by reference to Exhibit h.1 to Newteks Pre-Effective Amendment No. 2 to its Registration Statement on Form N-2, No 333-212436, filed August 25, 2016).

|

|

h.2

|

|

Form of Debt Underwriting Agreement (Incorporated by reference to Exhibit h.2 to Newteks Pre-Effective Amendment No. 2 to its Registration Statement on Form N-2, No 333-212436, filed August 25, 2016).

|

|

h.3

|

|

Form of Equity Distribution Agreement (Incorporated by reference to Exhibit h.3 to Newteks Pre-Effective Amendment No. 2 to its Registration Statement on Form N-2, No 333-212436, filed August 25, 2016).

|

|

h.4

|

|

Underwriting Agreement, dated as of January 25, 2017, by and among Newtek and Keefe, Bruyette & Woods, Inc., Raymond James & Associates, Inc., and UBS Securities LLC (Incorporated by reference to Exhibit h.4 to Newteks Post-Effective Amendment No. 1 to its Registration Statement on Form N-2, No. 333-212436, filed January 30, 2017).

|

|

h.5

|

|

Equity Distribution Agreement, dated as of March 20, 2017, by and among Newtek, JMP Securities LLC, Compass Point Research & Trading, LLC, and Ladenburg Thalmann & Co. Inc. (Incorporated by reference to Exhibit h.5 to Newteks Post-Effective Amendment No. 2 to its Registration Statement on Form N-2, No. 333-212436, filed March 21, 2017).

|

|

h.6

|

|

Amended and Restated Equity Distribution Agreement, dated as of September 6, 2017, by and among Newtek, JMP Securities LLC, Compass Point Research & Trading, LLC, Ladenburg Thalmann & Co. Inc., and D.A. Davidson & Co. (Incorporated by reference herein to Newteks Post-Effective Amendment No. 6 to its Registration Statement on Form N-2, No. 212436, filed September 8, 2017).

|

|

h.7

|

|

Underwriting Agreement, dated as of February 21, 2018, by and among Newtek and Keefe, Bruyette & Woods, Inc., as Representative of the several Underwriters named in Schedule A thereto (Incorporated by reference to Exhibit h.7 to Newteks Post-Effective Amendment No. 7 to its Registration Statement on Form N-2, No. 333-212436, filed February 21, 2018).

|

|

i.

|

|

Newtek 2014 Stock Incentive Plan (Incorporated by reference herein to Exhibit 8.6 to Newteks Pre-Effective Amendment No. 2 to its Registration Statement on Form N-14, No. 333-195998, filed September 24, 2014).

|

|

j.1

|

|

Form of Custodian Agreement (Incorporated by reference to Exhibit J to Newteks Pre-Effective Amendment No. 3 to its Registration Statement on Form N-2, No. 333-191499, filed November 3, 2014).

|

|

j.2

|

|

Amended and Restated Form of Custodian Agreement (Incorporated by reference to Exhibit 99.1 to Newteks Quarterly Report on Form 10-Q for the quarter ended September 30, 2015, filed November 5, 2015).

|

|

k.1

|

|

Employment Agreement with Barry Sloane, dated March 15, 2017, (Incorporated by reference to Exhibit 10.1 to Newteks Current Report on Form 8-K filed April 28, 2017).

|

|

k.2

|

|

Employment Agreement with Jennifer C. Eddelson, dated March 15, 2017 (Incorporated by reference to Exhibit 10.2 to Newteks Current Report on Form 8-K filed April 28, 2017).

|

|

k.3

|

|

Employment Agreement with Michael A. Schwartz, dated March 15, 2017, (Incorporated by reference to Exhibit 10.3 to Newteks Current Report on Form 8-K filed April 28, 2017).

|

|

l.1.

|

|

Opinion of Eversheds Sutherland (US) LLP (Incorporated by reference to Exhibit l to Newteks Pre-Effective Amendment No. 2 to its Registration Statement on Form N-2, No 333-212436, filed August 25, 2016).

|

Exhibit

Number

|

|

Description

|

|

l.2

|

|

Opinion of Sutherland Asbill & Brennan LLP related to the issuance of 2,587,500 shares of Newteks common stock (Incorporated by reference to Exhibit l.2 of Newteks Post-Effective Amendment No. 1 to its Registration Statement on Form N-2, No 333-212436, filed January 30, 2017).

|

|

l.3

|

|

Opinion of Eversheds Sutherland (US) LLP related to issuance and sale, from time to time, of up to 2,900,000 shares of Newteks common stock (Incorporated by reference to Exhibit l.3 to Newteks Post-Effective Amendment No. 2 to its Registration Statement on Form N-2, No. 333-212436, filed March 21, 2017).

|

|

1.4

|

|

Opinion of Eversheds Sutherland (US) LLP (Incorporated by reference to Exhibit l.4 to Newteks Post-Effective Amendment No. 7 to its Registration Statement on Form N-2, No. 333-212436, filed February 21, 2018).

|

|

m.

|

|

Not applicable.

|

|

n.1

|

|

Consent of Sutherland Asbill & Brennan LLP (Incorporated by reference to Exhibit l to Newteks Pre-Effective Amendment No. 2 to its Registration Statement on Form N-2, No 333-212436, filed August 25, 2016).

|

|

n.2

|

|

Report of Independent Registered Public Accounting Firm (incorporated by reference to Exhibit n.2 to Newteks Post-Effective Amendment No. 5 to its Registration Statement on Form N-2, No. 333-212436, filed August 29, 2017).

|

|

n.3

|

|

Consent of Independent Registered Public Accounting Firm (incorporated by reference to Exhibit n.3 to Newteks Post-Effective Amendment No. 5 to its Registration Statement on Form N-2, No. 333-212436, filed August 29, 2017).

|

|

n.4

|

|

Consent of Independent Auditor (incorporated by reference to Exhibit n.4 to Newteks Post-Effective Amendment No. 5 to its Registration Statement on Form N-2, No. 333-212436, filed August 29, 2017).

|

|

n.5

|

|

Consent of Independent Auditor (incorporated by reference to Exhibit n.5 to Newteks Post-Effective Amendment No. 5 to its Registration Statement on Form N-2, No. 333-212436, filed August 29, 2017).

|

|

n.6

|

|

Consent of Independent Auditor.*

|

|

o.

|

|

Not applicable.

|

|

p.

|

|

Not applicable.

|

|

q.

|

|

Not applicable.

|

|

r.

|

|

Code of Ethics (Incorporated by reference to Exhibit R to Newteks Registration Statement on Form N-2, No. 333-191499, filed November 3, 2014).

|

|

99.1

|

|

Code of Business Conduct and Ethics of Registrant (Incorporated by reference to Exhibit 99.1 to Newteks Registration Statement on Form N-2, No. 333-191499, filed November 3, 2014).

|

|

99.2

|

|

Form of Prospectus Supplement for Common Stock Offerings (Incorporated by reference to Exhibit 99.2 to Newteks Pre-Effective Amendment No. 2 to its Registration Statement on Form N-2, No 333-212436, filed August 25, 2016).

|

|

99.3

|

|

Form of Prospectus Supplement for Preferred Stock Offerings (Incorporated by reference to Exhibit 99.3 to Newteks Pre-Effective Amendment No. 2 to its Registration Statement on Form N-2, No 333-212436, filed August 25, 2016).

|

|

99.4

|

|

Form of Prospectus Supplement for At-the-Market Offerings (Incorporated by reference to Exhibit 99.4 to Newteks Pre-Effective Amendment No. 2 to its Registration Statement on Form N-2, No 333-212436, filed August 25, 2016).

|

|

99.5

|

|

Form of Prospectus Supplement for Rights Offerings (Incorporated by reference to Exhibit 99.5 to Newteks Pre-Effective Amendment No. 2 to its Registration Statement on Form N-2, No 333-212436, filed August 25, 2016).

|

|

99.6

|

|

Form of Prospectus Supplement for Warrants (Incorporated by reference to Exhibit 99.6 to Newteks Pre-Effective Amendment No. 2 to its Registration Statement on Form N-2, No 333-212436, filed August 25, 2016).

|

|

99.7

|

|

Form of Prospectus Supplement for Retail Note Offerings (Incorporated by reference to Exhibit 99.7 to Newteks Pre-Effective Amendment No. 2 to its Registration Statement on Form N-2, No 333-212436, filed August 25, 2016).

|

|

99.8

|

|

Form of Prospectus Supplement for Institutional Note Offering (Incorporated by reference to Exhibit 99.8 to Newteks Pre-Effective Amendment No. 2 to its Registration Statement on Form N-2, No 333-212436, filed August 25, 2016).

|

ITEM 26. MARKETING ARRANGEMENTS

The information contained under the heading

“Underwriting” on this Registration Statement is incorporated herein by reference.

ITEM 27. OTHER EXPENSES OF ISSUANCE AND DISTRIBUTION

|

SEC registration fee

|

|

$

|

30,210

|

*

|

|

FINRA filing fee

|

|

$

|

13,479

|

*

|

|

Nasdaq Global Market

|

|

$

|

30,000

|

**

|

|

Printing and postage

|

|

$

|

150,000

|

**

|

|

Legal fees and expenses

|

|

$

|

250,000

|

**

|

|

Accounting fees and expenses

|

|

$

|

250,000

|

**

|

|

Total

|

|

$

|

723,689

|

|

|

|

*

|

This amount has been offset

against filing fees associated with unsold securities registered under a previous registration statement.

|

|

|

**

|

Estimated for filing purposes.

|

ITEM 28. PERSONS CONTROLLED BY OR UNDER COMMON CONTROL

See “Management,” “Certain

Relationships and Transactions,” “Portfolio Companies” and “Control Persons and Principal Stockholders”

in the Prospectus contained herein.

ITEM 29. NUMBER OF HOLDERS OF SECURITIES

The following table sets forth the number

of record holders of the Registrant’s common stock at August 28, 2017:

|

Title of Class

|

|

Number of

Record Holders

|

|

|

Common Stock, par value $0.02 per share

|

|

|

138

|

|

ITEM 30. INDEMNIFICATION

Directors and Officers

Reference is made to Section 2-418 of the

Maryland General Corporation Law, Article VII of the Registrant’s charter and Article XI of the Registrant’s bylaws.

Maryland law permits a Maryland corporation

to include in its charter a provision limiting the liability of its directors and officers to the corporation and its stockholders

for money damages except for liability resulting from (a) actual receipt of an improper benefit or profit in money, property or

services or (b) active and deliberate dishonesty established by a final judgment as being material to the cause of action. The

Registrant’s charter contains such a provision which eliminates directors’ and officers’ liability to the maximum

extent permitted by Maryland law, subject to the requirements of the Investment Company Act of 1940, as amended (the “1940

Act”).

The Registrant’s charter authorizes

the Registrant, to the maximum extent permitted by Maryland law and subject to the requirements of the 1940 Act, to indemnify any

present or former director or officer or any individual who, while serving as the Registrant’s director or officer and at

the Registrant’s request, serves or has served another corporation, real estate investment trust, partnership, joint venture,

trust, employee benefit plan or other enterprise as a director, officer, partner or trustee, from and against any claim or liability

to which that person may become subject or which that person may incur by reason of his or her service in any such capacity and

to pay or reimburse their reasonable expenses in advance of final disposition of a proceeding. The Registrant’s bylaws obligate

the Registrant, to the maximum extent permitted by Maryland law and subject to the requirements of the 1940 Act, to indemnify any

present or former director or officer or any individual who, while serving as the Registrant’s director or officer and at

the Registrant’s request, serves or has served another corporation, real estate investment trust, partnership, joint venture,

trust, employee benefit plan or other enterprise as a director, officer, partner or trustee and who is made, or threatened to be

made, a party to the proceeding by reason of his or her service in that capacity from and against any claim or liability to which

that person may become subject or which that person may incur by reason of his or her service in any such capacity and to pay or

reimburse his or her reasonable expenses in advance of final disposition of a proceeding. The charter and bylaws also permit the

Registrant to indemnify and advance expenses to any person who served a predecessor of the Registrant in any of the capacities

described above and any of the Registrant’s employees or agents or any employees or agents of the Registrant’s predecessor.

In accordance with the 1940 Act, the Registrant will not indemnify any person for any liability to which such person would be subject

by reason of such person’s willful misfeasance, bad faith, gross negligence or reckless disregard of the duties involved

in the conduct of his or her office.

Maryland law requires a corporation (unless

its charter provides otherwise, which the Registrant’s charter does not) to indemnify a director or officer who has been

successful in the defense of any proceeding to which he or she is made, or threatened to be made, a party by reason of his or her

service in that capacity. Maryland law permits a corporation to indemnify its present and former directors and officers, among

others, against judgments, penalties, fines, settlements and reasonable expenses actually incurred by them in connection with any

proceeding to which they may be made, or threatened to be made, a party by reason of their service in those or other capacities

unless it is established that (a) the act or omission of the director or officer was material to the matter giving rise to the

proceeding and (1) was committed in bad faith or (2) was the result of active and deliberate dishonesty, (b) the director or officer

actually received an improper personal benefit in money, property or services or (c) in the case of any criminal proceeding, the

director or officer had reasonable cause to believe that the act or omission was unlawful. However, under Maryland law, a Maryland

corporation may not indemnify for an adverse judgment in a suit by or in the right of the corporation or for a judgment of liability

on the basis that a personal benefit was improperly received unless, in either case, a court orders indemnification, and then only

for expenses. In addition, Maryland law permits a corporation to advance reasonable expenses to a director or officer in advance

of final disposition of a proceeding upon the corporation’s receipt of (a) a written affirmation by the director or officer

of his or her good faith belief that he or she has met the standard of conduct necessary for indemnification by the corporation

and (b) a written undertaking by him or her or on his or her behalf to repay the amount paid or reimbursed by the corporation if

it is ultimately determined that the standard of conduct was not met.

ITEM 31. BUSINESS AND OTHER CONNECTIONS OF INVESTMENT ADVISER

Not applicable.

ITEM 32. LOCATION OF ACCOUNTS AND RECORDS

All accounts, books, and other documents

required to be maintained by Section 31(a) of the 1940 Act, and the rules thereunder are maintained at the offices of:

|

|

(1)

|

the Registrant, Newtek Business Services Corp., 1981 Marcus Avenue, Suite 130, Lake Success, NY 11042;

|

|

|

(2)

|

the Transfer Agent, American Stock Transfer and Trust Company, 6201 15

th

Avenue, Brooklyn, NY 11219; and

|

|

|

(3)

|

the Custodian, U.S. Bank National Association, 615 East Michigan Street, Milwaukee, Wisconsin 53202

|

ITEM 33. MANAGEMENT SERVICES

Not applicable.

|

|

(1)

|

Registrant undertakes to

suspend the offering of the shares covered hereby until it amends its prospectus contained herein if (a) subsequent to the effective

date of this Registration Statement, its net asset value declines more than 10% from its net asset value as of the effective date

of this Registration Statement, or (b) its net asset value increases to an amount greater than its net proceeds as stated in the

prospectus contained herein.

|

|

|

(3)

|

Registrant undertakes in

the event that the securities being registered are to be offered to existing stockholders pursuant to warrants or rights, and

any securities not taken by shareholders are to be reoffered to the public, to supplement the prospectus, after the expiration

of the subscription period, to set forth the results of the subscription offer, the transactions by the underwriters during the

subscription period, the amount of unsubscribed securities to be purchased by underwriters, and the terms of any subsequent underwriting

thereof. Registrant further undertakes that if any public offering by the underwriters of the securities being registered is to

be made on terms differing from those set forth on the cover page of the prospectus, the Registrant shall file a post-effective

amendment to set forth the terms of such offering.

|

|

|

(4)

|

The Registrant hereby undertakes:

|

|

|

(a)

|

To file, during any period

in which offers or sales are being made, a post-effective amendment to the registration statement:

|

|

|

(i)

|

to include any prospectus

required by Section 10(a)(3)of the 1933 Act;

|

|

|

(ii)

|

to reflect in the prospectus

any facts or events after the effective date of the registration statement (or the most recent post-effective amendment thereof)

which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement;

and

|

|

|

(iii)

|

to include any material

information with respect to the plan of distribution not previously disclosed in the registration statement or any material change

to such information in the registration statement.

|

|

|

(b)

|

That, for the purpose of

determining any liability under the 1933 Act, each such post-effective amendment shall be deemed to be a new registration statement

relating to the securities offered herein, and the offering of those securities at that time shall be deemed to be the initial

bona fide offering thereof; and

|

|

|

(c)

|

To remove from registration

by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering;

and

|

|

|

(d)

|

That, for the purpose of

determining liability under the 1933 Act to any purchaser, if the Registrant is subject to Rule 430C: Each prospectus filed pursuant

to Rule 497(b), (c), (d) or (e) under the 1933 Act as part of a registration statement relating to an offering, other than prospectuses

filed in reliance on Rule 430A under the 1933 Act, shall be deemed to be part of and included in the registration statement as

of the date it is first used after effectiveness; Provided, however, that no statement made in a registration statement or prospectus

that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration

statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior

to such first use, supersede or modify any statement that was made in the registration statement or prospectus that was part of

the registration statement or made in any such document immediately prior to such date of first use.

|

|

|

(e)

|

That, for the purpose of determining liability of the Registrant under the 1933 Act to any purchaser in the initial distribution of securities, the undersigned Registrant undertakes that in a primary offering of securities of the undersigned Registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned Registrant will be a seller to the purchaser and will be considered to offer or sell such securities to the purchaser:

|

|

|

(i)

|

any preliminary prospectus or prospectus of the undersigned Registrant relating to the offering required to be filed pursuant to Rule 497 under the 1933 Act;

|

|

|

(ii)

|

the portion of any advertisement pursuant to Rule 482 under the 1933 Act relating to the offering containing material information about the undersigned Registrant or its securities provided by or on behalf of the undersigned Registrant; and

|

|

|

(iii)

|

any other communication that is an offer in the offering made by the undersigned Registrant to the purchaser.

|

|

|

(f)

|

To file a post-effective amendment to the registration statement, and to suspend any offers or sales pursuant the registration statement until such post-effective amendment has been declared effective under the 1933 Act, in the event the shares of the Registrant is trading below its net asset value and either (i) Registrant receives, or has been advised by its independent registered accounting firm that it will receive, an audit report reflecting substantial doubt regarding the Registrant’s ability to continue as a going concern or (ii) Registrant has concluded that a material adverse change has occurred in its financial position or results of operations that has caused the financial statements and other disclosures on the basis of which the offering would be made to be materially misleading.

|

|

|

(7)

|

The Registrant undertakes

to file a post-effective amendment to the registration statement during any period in which offers or sales of the Registrant’s

securities are being made at a price below the net asset value per share of the Registrant’s common stock as of the date

of the commencement of such offering and such offering will result in greater than 15% dilution to the net asset value per share

of the Registrant’s common stock.

|

SIGNATURES

Pursuant to the requirements of the Securities

Act of 1933, as amended, the Registrant has duly caused this Registration Statement on Form N-2 to be signed on its behalf by the

undersigned, thereunto duly authorized, in the City of New York, in the State of New York, on March 23, 2018.

|

|

NEWTEK BUSINESS SERVICES CORP.

|

|

|

|

|

|

|

BY:

|

/s/ Barry Sloane

|

|

|

|

Barry Sloane

|

|

|

|

Chief Executive Officer, President and Chairman of the Board of Directors

|

Pursuant to the requirements of the Securities

Act of 1933, as amended, Amendment No. 8 to this Registration Statement on Form N-2 has been signed by the following persons in

the capacities and on the dates indicated.

|

Signature

|

|

Title

|

|

Date

|

|

/s/ Barry Sloane

|

|

Chief Executive Officer, President and Chairman of the

|

|

March 23, 2018

|

|

Barry Sloane

|

|

Board of Directors (Principal Executive Officer)

|

|

|

|

|

|

|

|

|

|

/s/ Jennifer Eddelson

|

|

Executive Vice President and Chief Accounting Officer

|

|

March 23, 2018

|

|

Jennifer Eddelson

|

|

(Principal Financial and Accounting Officer)

|

|

|

|

|

|

|

|

|

|

/s/ Richard J. Salute*

|

|

Director

|

|

March 23, 2018

|

|

Richard J. Salute

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Gregory L. Zink*

|

|

Director

|

|

March 23, 2018

|

|

Gregory L. Zink

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Salvatore F. Mulia*

|

|

Director

|

|

March 23, 2018

|

|

Salvatore F. Mulia

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Peter Downs*

|

|

Director

|

|

March 23, 2018

|

|

Peter Downs

|

|

|

|

|

|

|

*

|

Signed by Barry Sloane

pursuant to a power of attorney signed by each individual and filed with post-effective amendment No. 3 to this registration statement

on June 6, 2017.

|

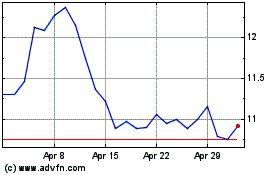

NewtekOne (NASDAQ:NEWT)

Historical Stock Chart

From Mar 2024 to Apr 2024

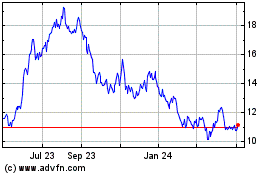

NewtekOne (NASDAQ:NEWT)

Historical Stock Chart

From Apr 2023 to Apr 2024