Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

|

Filed by the Registrant

x

|

|

|

|

Filed by a Party other than the Registrant

o

|

|

|

|

Check the appropriate box:

|

|

o

|

Preliminary Proxy Statement

|

|

o

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

x

|

Definitive Proxy Statement

|

|

o

|

Definitive Additional Materials

|

|

o

|

Soliciting Material under §240.14a-12

|

|

|

|

Veeco Instruments Inc.

|

|

(Name of Registrant as Specified In Its Charter)

|

|

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

|

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

x

|

No fee required.

|

|

o

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

|

o

|

Fee paid previously with preliminary materials.

|

|

o

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

(3)

|

Filing Party:

|

|

|

|

|

|

|

(4)

|

Date Filed:

|

|

|

|

|

|

|

|

|

|

Table of Contents

|

1 Terminal Drive

|

·

Plainview, New York 11803 U.S.A.

|

·

Phone (516) 677-0200

|

·

Fax (516) 677-0380

|

·

www.veeco.com

|

March 19, 2018

2018 Annual Meeting of Stockholders

Dear Fellow Stockholder:

It is my pleasure to invite you to join me at the 2018 Annual Meeting of Stockholders of Veeco Instruments Inc. to be held on Thursday, May 3, 2018, at 8:30 a.m. Eastern Time, at 333 South Service Road, Plainview, New York 11803.

At this year’s meeting, we will vote on the election of two directors and on the ratification of KPMG LLP as Veeco’s independent registered public accounting firm. We will also conduct a non-binding advisory vote to approve the compensation of the Company’s named executive officers.

We use the U.S. Securities and Exchange Commission rule that allows companies to furnish proxy materials to their stockholders over the internet. We believe this expedites stockholder’s receipt of proxy materials, lowers annual meeting costs and conserves natural resources. Thus, we are mailing to many stockholders a Notice of Internet Availability of Proxy Materials (“Notice”), rather than copies of the Proxy Statement and our 2017 Annual Report to Stockholders on Form 10-K. The Notice contains instructions on how to access the proxy materials online, vote online and obtain your copy of our proxy materials.

Your vote is very important. I encourage you to sign and return your proxy card, or use telephone or internet voting prior to the meeting, so that your shares will be represented and voted at the meeting.

Sincerely,

John R. Peeler

Chairman and Chief Executive Officer

Table of Contents

VEECO INSTRUMENTS INC.

NOTICE OF 2018 ANNUAL MEETING OF STOCKHOLDERS

|

DATE AND TIME:

|

|

Thursday, May 3, 2018, 8:30 a.m., Eastern Time

|

|

|

|

|

|

PLACE:

|

|

333 South Service Road, Plainview, New York 11803

|

|

|

|

|

|

ITEMS OF BUSINESS:

|

|

1. To elect two directors to hold office until the 2021 Annual Meeting of Stockholders;

|

|

|

|

|

|

|

|

2. To hold a non-binding advisory vote on 2017 named executive officer compensation;

|

|

|

|

|

|

|

|

3. To ratify the appointment of KPMG LLP as our independent registered public accounting firm for 2018; and

|

|

|

|

|

|

|

|

4. To consider such other business as may properly come before the meeting.

|

|

|

|

|

|

WHO CAN VOTE:

|

|

You must be a stockholder of record at the close of business on March 12, 2018 to vote at the Annual Meeting.

|

|

|

|

|

|

INTERNET AVAILABILITY:

|

|

We are using the internet as our primary means of furnishing proxy materials to most of our stockholders. Rather than sending those stockholders a paper copy of our proxy materials, we are sending them a notice with instructions for accessing the materials and voting via the internet.

This Proxy Statement and our 2017 Annual Report on Form 10-K are available free of charge at www.veeco.com.

|

|

|

|

|

|

PROXY VOTING:

|

|

We cordially invite you to participate in the Annual Meeting, either by attending and voting in person or by voting through other acceptable means. Your participation is important, regardless of the number of shares you own. You may vote by telephone, through the internet or by mailing your completed proxy card.

|

|

|

|

|

|

|

|

By order of the Board of Directors,

|

|

|

|

|

|

|

|

Gregory A. Robbins

|

|

|

|

Senior Vice President, General Counsel and Secretary

|

|

|

|

|

|

|

|

March 19, 2018

|

|

|

|

Plainview, New York

|

Table of Contents

PROXY STATEMENT SUMMARY

To assist you in reviewing the proposals to be acted upon at the Veeco Instruments Inc. (“Veeco” or the “Company”) 2018 Annual Meeting of Stockholders (the “Annual Meeting”), we call your attention to the following information about the proposals and voting recommendations, the Company’s director nominees, and highlights of the Company’s corporate governance and executive compensation. The following description is only a summary. For more complete information about these topics, please review the complete proxy statement.

Proposals and Voting Recommendations

|

Voting Matters

|

|

Board Vote

Recommendation

|

|

Proposal 1:

|

Election of two nominees named herein as directors

|

|

FOR each nominee

|

|

Proposal 2:

|

Advisory vote to approve the compensation of our Named Executive Officers, or “Say on Pay”

|

|

FOR

|

|

Proposal 3:

|

Ratification of the appointment of our independent registered public accounting firm for 2018

|

|

FOR

|

Summary of Information Regarding the Board of Directors

Members of Veeco’s Board of Directors (“Board of Directors” or the “Board”) are listed below. Messrs. D’Amore and Jackson have been nominated for re-election to the Board.

|

|

|

|

|

Director

|

|

|

|

Committee Membership

|

|

Name

|

|

Age

|

|

since

|

|

Independent (1)

|

|

AC

|

|

CC

|

|

GC

|

|

SPC

|

|

Kathleen A. Bayless

|

|

61

|

|

2016

|

|

Yes

|

|

M/FE

|

|

|

|

|

|

|

|

Richard A. D’Amore

|

|

64

|

|

1990

|

|

Yes (Lead Independent Director)

|

|

|

|

M

|

|

|

|

M

|

|

Gordon Hunter

|

|

66

|

|

2010

|

|

Yes

|

|

|

|

C

|

|

M

|

|

M

|

|

Keith D. Jackson

|

|

62

|

|

2012

|

|

Yes

|

|

M/FE

|

|

|

|

C

|

|

|

|

John R. Peeler

|

|

63

|

|

2007

|

|

No

|

|

|

|

|

|

|

|

C

|

|

Peter J. Simone

|

|

70

|

|

2004

|

|

Yes

|

|

C/FE

|

|

|

|

M

|

|

M

|

|

Thomas St. Dennis

|

|

64

|

|

2016

|

|

Yes

|

|

|

|

M

|

|

|

|

M

|

(1)

Independence determined based on NASDAQ rules.

|

AC

— Audit Committee

|

C

— Chairperson

|

|

CC

— Compensation Committee

|

M

— Member

|

|

GC

— Governance Committee

|

FE

— Audit committee financial expert (as determined based on SEC rules)

|

|

SPC

— Strategic Planning Committee

|

Corporate Governance Highlights

|

Board and Other Governance Information

|

|

As of March 19, 2018

|

|

Size of Board as Nominated

|

|

7

|

|

Average Age of Director Nominees and Continuing Directors

|

|

64

|

|

Average Tenure of Director Nominees and Continuing Directors

|

|

8.7 years

|

|

Percentage of Continuing Directors and Nominees who are Independent

|

|

85.7%

|

|

Percentage of Directors who attended all Board Meetings

|

|

100%

|

|

Number of Director Nominees and Continuing Directors Who Serve on More Than Three Public Company Boards

|

|

0

|

|

Directors Subject to Stock Ownership Guidelines (3 times annual cash retainers)

|

|

Yes

|

|

Annual Election of Directors

|

|

No

|

|

Voting Standard

|

|

Majority

|

1

Table of Contents

|

Board and Other Governance Information

|

|

As of March 19, 2018

|

|

Plurality Voting Carve-out for Contested Elections

|

|

Yes

|

|

Separate Chairman and CEO

|

|

No

|

|

Lead Independent Director

|

|

Yes

|

|

Independent Directors Meet Without Management Present

|

|

Yes

|

|

Annual Board, Committee and Individual Director Self-Evaluations, Including Use of External Governance Advisor at Least Every 3 Years

|

|

Yes

|

|

Annual Independent Director Evaluation of CEO

|

|

Yes

|

|

Risk Oversight by Full Board and Committees

|

|

Yes

|

|

Board Orientation/Education Program

|

|

Yes

|

|

Code of Conduct Applicable to Directors

|

|

Yes

|

|

Stockholder Ability to Call Special Meetings

|

|

50% of Outstanding Shares

|

|

Stockholder Ability to Act by Written Consent

|

|

No

|

|

Poison Pill

|

|

No

|

Executive Compensation Highlights

Here’s What We Do…

Pay for Performance.

We ensure that the compensation of the Chief Executive Officer (“CEO”) and the other named executive officers listed in the Summary Compensation Table below (collectively, the “NEOs”) tracks the Company’s performance. Our compensation programs reflect our belief that the ratio of performance-based compensation to fixed compensation should increase with the level of the executive, with the greatest amount of performance-based compensation at the CEO level.

Peer Group Selection.

We made changes to our Peer Group for 2017 to more appropriately reflect our industry and size as measured by revenue and market capitalization. As a result, certain of the companies previously included in our peer group were removed for 2017 based on their much larger size.

Performance-based Long Term Incentives.

The majority of the long term incentive compensation provided to our CEO and other NEOs is awarded in the form of performance-based restricted stock units that feature a minimum three-year target performance period, are capped at 150% of target, and are subject to 100% forfeiture.

Minimum Vesting.

Our 2010 Stock Incentive Plan specifies a one year minimum vesting period for all equity awards (including, beginning in 2017, stock option awards), except for up to 5% of the maximum number of shares available or in the event of certain circumstances (e.g., death, disability, corporate transactions). Time-based awards granted to executives feature vesting periods ranging from three to four years.

Stock Option Provisions.

Our 2010 Stock Incentive Plan prohibits the cash buyout of underwater stock options and the repricing of stock options without stockholder approval; the Company has not engaged in either of these practices.

Double-Trigger Change in Control Arrangements.

Our Senior Executive Change in Control Policy features a narrow change in control definition, requiring an actual change in control and termination of employment before change in control benefits are triggered. The situations where an executive is eligible to resign with “good reason” are limited to: (i) reductions in base salary, (ii) relocation by more than 50 miles, (iii) significant reductions in total benefits, for Messrs. Peeler and Maheshwari only, and (iv) for Mr. Peeler only, a diminution in position.

2

Table of Contents

These provisions are not triggered by bankruptcy. See “Potential Payments Upon Termination or Change in Control” below for more information.

Clawback Policy.

Our Compensation Recoupment Policy provides that in the event of a financial restatement due to fraud or intentional illegal conduct as determined by the independent members of the Board of Directors, a culpable executive officer may be required to reimburse the Company for performance-based cash compensation if the amount of such compensation would have been lower had it been calculated based on such restated financial statements.

Stock Ownership Guidelines.

Our stock ownership guidelines require our NEOs and our Board of Directors to hold Veeco stock in a specified multiple of their base salaries or annual cash retainers, subject to a phase-in period. For example, Veeco’s CEO is required to hold Veeco stock with a value equal to at least four times his base salary. Pursuant to these guidelines, covered individuals are required to hold at least 50% of the net after-tax shares realized upon vesting or exercise until the ownership guidelines are met.

Hedging and Pledging Restrictions.

Our insider trading policy prohibits all employees and directors from hedging or pledging their Veeco shares.

Annual Bonus.

Amounts that can be earned under our annual incentive programs are based solely on performance against corporate financial and individual goals. Awards under the programs are not guaranteed and are capped at 200% of target.

Annual Say-on-Pay Vote.

We conduct an annual Say-on-Pay advisory vote.

Stockholder Engagement.

We routinely engage with stockholders and, as appropriate, with proxy advisory firms, to better understand their perspective regarding executive compensation best practices and have incorporated many of these practices in our executive compensation programs.

Here’s What We Don’t Do…

No Multi-Year Guarantees.

We do not offer multi-year guarantees for salary increases, bonuses or equity awards.

No Overly Generous Change in Control Benefits.

We have used change in control protections sparingly and have limited cash payments to 1.5 to 3.0 times base salary and bonus.

No Gross-Ups.

We do not provide tax gross ups for benefits that may become payable in connection with a change in control.

Limited Pension Benefits.

We do not maintain a defined benefit pension plan or a supplemental executive retirement plan. The Company’s 401(k) savings plan is its only pension benefit.

No Retirement Benefits.

We do not offer retirement health and welfare benefits to our employees.

No Excessive Perquisites

. We do not provide executives with perquisites such as financial planning, corporate aircraft, etc.

3

Table of Contents

STOCK OWNERSHIP

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth certain information regarding the beneficial ownership of Veeco common stock as of March 12, 2018 (unless otherwise specified below) by (i) each person known by Veeco to own beneficially more than five percent of the outstanding shares of Veeco common stock, (ii) each director of Veeco, (iii) each NEO, and (iv) all executive officers and directors of Veeco as a group. Unless otherwise indicated, Veeco believes that each of the persons or entities named in the table exercises sole voting and investment power over the shares of Veeco common stock that each of them beneficially owns, subject to community property laws where applicable.

|

|

|

Shares of Common Stock

Beneficially Owned (1)

|

|

Percentage of

Total Shares

Outstanding

|

|

|

|

|

Shares

|

|

Options

|

|

Total

|

|

(1)

|

|

|

5% or Greater Stockholders:

|

|

|

|

|

|

|

|

|

|

|

BlackRock, Inc. (2)

|

|

6,683,401

|

|

—

|

|

6,683,401

|

|

13.9

|

%

|

|

The Vanguard Group (3)

|

|

4,633,758

|

|

—

|

|

4,633,758

|

|

9.6

|

%

|

|

Dimensional Fund Advisors LP (4)

|

|

2,962,158

|

|

—

|

|

2,962,158

|

|

6.2

|

%

|

|

Frontier Capital Management Co., LLC (5)

|

|

2,614,375

|

|

—

|

|

2,614,375

|

|

5.4

|

%

|

|

Directors:

|

|

|

|

|

|

|

|

|

|

|

Kathleen A. Bayless

|

|

10,585

|

|

—

|

|

10,585

|

|

*

|

|

|

Richard A. D’Amore

|

|

95,290

|

|

—

|

|

95,290

|

|

*

|

|

|

Gordon Hunter

|

|

28,949

|

|

—

|

|

28,949

|

|

*

|

|

|

Keith D. Jackson

|

|

25,149

|

|

—

|

|

25,149

|

|

*

|

|

|

John R. Peeler

|

|

371,436

|

|

282,610

|

|

654,046

|

|

1.4

|

%

|

|

Peter J. Simone

|

|

24,332

|

|

—

|

|

24,332

|

|

*

|

|

|

Thomas St. Dennis

|

|

10,597

|

|

—

|

|

10,597

|

|

*

|

|

|

Named Executive Officers:

|

|

|

|

|

|

|

|

|

|

|

John R. Peeler

|

|

371,436

|

|

282,610

|

|

654,046

|

|

1.4

|

%

|

|

William J. Miller, Ph.D.

|

|

97,542

|

|

117,310

|

|

214,852

|

|

*

|

|

|

Shubham Maheshwari

|

|

72,887

|

|

54,000

|

|

126,887

|

|

*

|

|

|

John Kiernan

|

|

32,079

|

|

49,854

|

|

81,933

|

|

*

|

|

|

All Directors and Executive Officers as a Group (10 persons)

|

|

776,793

|

|

503,774

|

|

1,272,620

|

|

2.6

|

%

|

*

Less than 1%.

(1)

A person is deemed to be the beneficial owner of securities owned or which can be acquired by such person within 60 days of the measurement date upon the exercise of stock options. Shares owned include unvested restricted stock awards (but do not include unvested restricted stock units). Each person’s percentage ownership is determined by assuming that stock options beneficially owned by such person (but not those owned by any other person) have been exercised.

(2)

Share ownership information is based on information contained in a Schedule 13G/A filed with the SEC on February 8, 2018. The address of this holder is 55 East 52

nd

Street, New York, New York 10055.

(3)

Share ownership information is based on information contained in a Schedule 13G/A filed with the SEC on February 9, 2018. The address of this holder is 100 Vanguard Boulevard, Malvern, Pennsylvania 19355.

4

Table of Contents

(4)

Share ownership information is based on information contained in a Schedule 13G/A filed with the SEC on February 9, 2018. The address of this holder is Building One, 6300 Bee Cave Road, Austin, Texas 78746.

(5)

Share ownership information is based on information contained in a Schedule 13G/A filed with the SEC on February 7, 2018. The address of this holder is 99 Summer Street, Boston, Massachusetts 02110.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) requires Veeco’s officers and directors, and persons who own more than 10% of Veeco’s common stock, to file reports of ownership and changes in ownership with the Securities and Exchange Commission (“SEC”). These persons are required by SEC regulations to furnish Veeco with copies of all Section 16(a) forms they file. SEC regulations require us to identify in this proxy statement anyone who filed a required report late or failed to file a required report. Based on our review of forms we received, or written representations from reporting persons, we believe that during 2017 all Section 16(a) filing requirements were satisfied on a timely basis.

5

Table of Contents

GOVERNANCE

Governance Highlights

Veeco’s Board of Directors and management are committed to responsible corporate governance to ensure that Veeco is managed for the long-term benefit of its stockholders. To that end, the Board of Directors and management review published guidelines and recommendations of institutional stockholder organizations and current best practices of similarly situated public companies. The Board and management periodically evaluate and, when appropriate, revise Veeco’s corporate governance policies and practices in light of these guidelines and other findings, and to comply with the requirements of the Sarbanes-Oxley Act of 2002 and the rules and listing standards issued by the SEC and by The NASDAQ Stock Market LLC (“NASDAQ”).

Veeco’s Corporate Governance Guidelines provide that at least two-thirds of the Board of Directors must be independent in accordance with the NASDAQ listing standards. In fact, 85.7% of Veeco’s seven continuing directors and nominees are independent, and none serve on more than two other public company boards. All of Veeco’s directors attended each Board meeting held in 2017, and at least 75% of applicable committee meetings. Veeco undergoes an annual Board, committee and individual director self-evaluation process, and the independent directors, guided by the independent Lead Director, meet regularly without management and perform an annual performance assessment of the Chief Executive Officer.

Governance Policies and Practices

Veeco has instituted a variety of policies and practices to foster and maintain corporate governance, including the following:

Corporate Governance Guidelines

-

Veeco adheres to written Corporate Governance Guidelines, adopted by the Board and reviewed by the Governance Committee from time to time. The Corporate Governance Guidelines govern director qualifications, conflicts of interest, succession planning, periodic board self-assessment and other governance matters. The Board has used an outside governance advisor to facilitate the board self-assessment at least every three years.

Code of Business Conduct

-

Veeco maintains written standards of business conduct applicable to all of its employees worldwide.

Code of Ethics for Senior Officers

-

Veeco maintains a Code of Ethics that applies to its Chief Executive Officer, President, Chief Financial Officer and Chief Accounting Officer.

Environmental, Health & Safety Policy

- Veeco maintains a written policy that applies to all of its employees with regard to environmental, health and safety matters.

Director Education Policy

- Veeco has adopted a written policy under which it encourages directors to attend, and provides reimbursement for the cost of attending, director education programs. A majority of Veeco’s Board members has attended one or more director education programs within the past five years.

Disclosure Policy

-

Veeco maintains a written policy that applies to all of its employees with regard to the dissemination of information.

6

Table of Contents

Board Committee Charters

-

Each of Veeco’s Audit, Compensation, Governance and Strategic Planning Committees has a written charter adopted by Veeco’s Board that establishes practices and procedures for each committee in accordance with applicable corporate governance rules and regulations.

Copies of each of these documents can be found on the Company’s website (www.veeco.com) via the “Investors” page.

Independence of the Board

Veeco’s Corporate Governance Guidelines provide that at least two-thirds of the Board of Directors must be independent in accordance with the NASDAQ listing standards. In addition, service on other boards must be consistent with Veeco’s conflict of interest policy and the nature and time involved in such service is reviewed when evaluating suitability of individual directors for election.

Independence of Current Directors.

Veeco’s Board of Directors has determined that all of the directors are “independent” within the meaning of the applicable NASDAQ listing standards, except Mr. Peeler, the Company’s Chairman and Chief Executive Officer.

Independence of Committee Members.

All members of Veeco’s Audit, Compensation and Governance Committees are required to be and are independent in accordance with NASDAQ listing standards.

Compensation Committee Interlocks and Insider Participation.

During 2017, none of Veeco’s executive officers served on the board of directors of any entity whose executive officers served on Veeco’s Compensation Committee. No current or past executive officer of Veeco serves on our Compensation Committee. The members of our Compensation Committee are Messrs. D’Amore, Hunter and St. Dennis.

Board Access to Independent Advisors.

The Board members have full and free access to the officers and employees of Veeco and are permitted to retain independent legal, financial or other advisors as the Board or a Committee deems necessary.

Director Resignation Upon Change in Employment.

The Corporate Governance Guidelines provide that a director shall submit his resignation if he changes his principal employment, from what it was when he was elected as a director, or undergoes a change affecting his qualification as a director or fails to receive the required number of votes for re-election. Upon such submission, the Board shall determine whether to accept or reject the resignation. If the resignation is tendered for failure to receive the required number of votes for re-election, the Governance Committee will also inform the Board of any other action it recommends be taken.

Board Leadership Structure

Mr. Peeler, the Company’s Chief Executive Officer, also serves as Chairman of the Board. We have a separate, independent Lead Director. Although we do not have a formal policy addressing the topic, we believe that when the Chairman of the Board is an employee of the Company or otherwise not independent, it is important to have a separate Lead Director, who is an independent director.

Mr. D’Amore serves as the Lead Director. In that role, he presides over the Board’s executive sessions, during which our independent directors meet without management, and he serves as the principle liaison between management and the independent directors of the Board. The Lead Director also:

7

Table of Contents

·

Confers with the Chairman of the Board regarding Board meeting agendas;

·

Has the authority to call meetings of the independent directors;

·

Chairs meetings of the independent directors including, where appropriate, setting the agenda and briefing the Chairman of the Board on issues discussed during the meeting;

·

Oversees the annual performance evaluation of the CEO;

·

Consults with the Governance Committee and the Chairman of the Board regarding assignment of Board members to various committees; and

·

Performs such other functions as the Board may require.

Mr. D’Amore has served as Lead Director since 2016.

We believe the combination of Mr. Peeler as our Chairman of the Board and an independent director as our Lead Director is an effective structure for the Company. The division of duties and the additional avenues of communication between the Board and our management associated with this structure provide the basis for the proper functioning of our Board and its oversight of management.

Oversight of Risk Management

The Board has an active role, as a whole and also at the committee level, in overseeing management of the Company’s risks. The Board regularly reviews information regarding the Company’s strategy, finances and operations, as well as the risks associated with each. The Audit Committee is responsible for oversight of Company risks relating to accounting matters, financial reporting, internal controls and legal and regulatory compliance. The Audit Committee undertakes, at least annually, a review to evaluate these risks. Individual members of the Audit Committee are each assigned an area of risk to oversee. The members then meet separately with management responsible for such area, including the Company’s chief accounting officer, internal auditor and general counsel, and report to the Audit Committee on any matters identified during such discussions with management. In addition, the Governance Committee manages risks associated with the independence of the Board and potential conflicts of interest. The Company’s Compensation Committee is responsible for overseeing the management of risks relating to the Company’s executive compensation plans and arrangements. While each committee is responsible for evaluating certain risks and overseeing the management of such risks, the entire Board is regularly informed about such risks through committee reports.

Compensation Risk

Our Compensation Committee conducted a risk-assessment of our compensation programs and practices and concluded that our compensation programs and practices, as a whole, are appropriately structured and do not pose a material risk to the Company. Our compensation programs are intended to reward the management team and other employees for strong performance over the long-term, with consideration of near-term actions and results that strengthen and grow our Company. We believe our compensation programs provide the appropriate balance between short-term and long-term incentives, focusing on sustainable operating success for the Company. We consider the potential risks in our business when designing and administering our compensation programs, and we believe our balanced approach to performance measurement and compensation decisions mitigates the likelihood that individuals will be encouraged to undertake excessive or inappropriate risk. Further, our compensation program administration is subject to considerable internal controls and when determining the principal outcomes — performance assessments and compensation decisions — we rely on principles of sound governance and good business judgment.

8

Table of Contents

Board Meetings and Committees

During 2017, Veeco’s Board held eight meetings. It is the policy of the Board to hold executive sessions without management at every regularly scheduled board meeting and as requested by a director. The Lead Director or Committee Chairperson, as appropriate, presides over these executive sessions. All members of the Board are welcome to attend the Annual Meeting of Stockholders. In 2017, Mr. Peeler was the only director who attended the Annual Meeting. The Board has established the following committees: an Audit Committee, a Compensation Committee, a Governance Committee and a Strategic Planning Committee.

Audit Committee

.

As defined in Section 3(a)(58)(A) of the Exchange Act, the Company established an Audit Committee which reviews the scope and results of the audit and other services provided by Veeco’s independent registered public accounting firm. The Audit Committee consists of Ms. Bayless and Messrs. Jackson and Simone (Chairman). The Board has determined that all members of the Audit Committee are financially literate as that term is defined by NASDAQ and by applicable SEC rules. The Board has determined that each of Ms. Bayless and Messrs. Jackson and Simone is an “audit committee financial expert” as defined by applicable SEC rules. During 2017, the Audit Committee met five times.

Compensation Committee.

The Compensation Committee sets the compensation levels of senior management and administers Veeco’s equity compensation plans. All members of the Compensation Committee are “non-employee directors” (within the meaning of Rule 16b-3 of the Exchange Act), and “outside directors” (within the meaning of Section 162(m) of the Internal Revenue Code of 1986, as amended). None of the members of the Compensation Committee has interlocking relationships as defined by the SEC. The Compensation Committee consists of Messrs. D’Amore, St. Dennis and Hunter (Chairman). During 2017, the Compensation Committee met nine times.

Governance Committee.

The Company’s Governance Committee addresses Board organizational issues and develops and reviews corporate governance principles applicable to Veeco. In addition, the committee searches for persons qualified to serve on the Board of Directors and makes recommendations to the Board with respect thereto, as more fully described below. The Governance Committee is comprised entirely of independent directors, as defined by the NASDAQ listing standards, and currently consists of Messrs. Hunter, Simone and Jackson (Chairman). During 2017, the Governance Committee met four times.

Strategic Planning Committee.

The Company’s Strategic Planning Committee oversees the Company’s strategic planning process. The Strategic Planning Committee consists of Messrs. D’Amore, Hunter, Simone, St. Dennis and Peeler (Chairman). During 2017, strategic planning matters were addressed by the full Board and, as a result, the Strategic Planning Committee did not meet in 2017.

Board Composition and Nomination Process

Pursuant to our Corporate Governance Guidelines, the Governance Committee will evaluate the suitability of potential nominees for membership on the Board, taking into consideration the Board’s current composition, including expertise, diversity and balance of inside, outside and independent directors, and considering the general qualifications of the potential nominees, including those characteristics described in the Corporate Governance Guidelines as in effect from time to time. In selecting the director nominees, the Board endeavors to establish a diversity of background and experience in a number of areas of core competency, including business judgment, management, accounting and finance, knowledge of the industries in which the Company operates, understanding of manufacturing and services, strategic vision,

9

Table of Contents

knowledge of international markets, marketing, research and development and other areas relevant to the Company’s business. Under our Corporate Governance Guidelines, the Board periodically conducts a critical self-evaluation, including an assessment of the make-up of the Board as a whole. In any particular situation, the Governance Committee may focus on persons possessing a particular background, experience or qualifications which the committee believes would be important to enhance the effectiveness of the Board. The full Board reviews and has final approval authority on all potential director candidates being recommended to the stockholders for election.

Compensation of Directors

As of January 1, 2017, Veeco’s Director Compensation Policy provided that members of the Board of Directors who are not employees of Veeco shall be paid quarterly retainers as follows: for service as a Board member, $17,500; as chair of the Audit Committee, $5,000; as chair of the Compensation Committee, $3,750; as chair of the Governance Committee, $2,500; as chair of the Strategic Planning Committee, $2,500; and as Lead Director, $4,250. Changes to Veeco’s Director Compensation Policy were approved by the Board at a meeting held on August 1, 2017. In particular, effective as of October 1, 2017: (i) the quarterly retainer for service as Lead Director increased to $5,125, and (ii) quarterly retainers are now paid for certain non-chair committee membership, specifically in the amount of $2,500 for Audit Committee membership, $1,875 for Compensation Committee membership, and $1,250 for Governance Committee membership. Board members do not receive fees for attending meetings either in person or telephonically.

Each non-employee Director shall also receive an annual grant of shares of restricted stock having a fair market value in the amount determined by the Compensation Committee from time to time. For 2017, the Compensation Committee determined that the value of this annual award should be $120,000 per director. The restrictions on these shares lapse on the earlier of the first anniversary of the date of grant and the date immediately preceding the date of the next annual meeting of stockholders. In addition, the Company’s Director Compensation Policy in effect for 2017 gives the Board the authority to compensate directors who perform significant additional services on behalf of the Board or a Committee. Such compensation is to be determined by the Board in its discretion, taking into consideration the scope and extent of such additional services. Directors who are employees, such as Mr. Peeler, do not receive additional compensation for serving as directors.

The following table provides information on compensation awarded or paid to the non-employee directors of Veeco for the fiscal year ended December 31, 2017.

|

Name

|

|

Fees Earned

or Paid in

Cash ($)(1)

|

|

Stock

Awards

($)(2)(3)

|

|

All Other

Compensation

($)

|

|

Total ($)

|

|

|

Kathleen A. Bayless

|

|

72,500

|

|

119,973

|

|

—

|

|

192,473

|

|

|

Richard A. D’Amore

|

|

89,750

|

|

119,973

|

|

—

|

|

209,723

|

|

|

Gordon Hunter

|

|

86,250

|

|

119,973

|

|

—

|

|

206,223

|

|

|

Keith D. Jackson

|

|

82,500

|

|

119,973

|

|

—

|

|

202,473

|

|

|

Peter J. Simone

|

|

91,250

|

|

119,973

|

|

—

|

|

211,223

|

|

|

Thomas St. Dennis

|

|

71,875

|

|

119,973

|

|

—

|

|

191,848

|

|

(1)

Represents the sum of quarterly retainers paid for Board service during 2017.

(2)

Reflects awards of 3,592 shares of restricted stock to each director on May 5, 2017. These restricted stock awards vest on the earlier of (i) the first anniversary of the date of grant, and (ii) the date immediately preceding the date of the next annual meeting of stockholders.

10

Table of Contents

In accordance with SEC rules, the amounts shown reflect the grant date fair value of the award, which was $33.40 per share.

(3)

As of December 31, 2017, there were outstanding the following aggregate number of stock awards and option awards held by each non-employee director of the Company:

Outstanding Equity Awards at Fiscal Year End

|

Name

|

|

Stock

Awards (#)

|

|

Option

Awards (#)

|

|

|

Kathleen A. Bayless

|

|

3,592

|

|

—

|

|

|

Richard A. D’Amore

|

|

3,592

|

|

—

|

|

|

Gordon Hunter

|

|

3,592

|

|

—

|

|

|

Keith D. Jackson

|

|

3,592

|

|

—

|

|

|

Peter J. Simone

|

|

3,592

|

|

—

|

|

|

Thomas St. Dennis

|

|

3,592

|

|

—

|

|

Stock Ownership Guidelines: Directors

Under the Company’s Stock Ownership Guidelines, Directors are required to hold Veeco stock with a value equal to at least three times the Directors’ annual cash retainers (excluding retainers for committee or lead director service), measured as of February 1

st

of the most recently completed year and subject to a 5-year phase-in period.

Certain Contractual Arrangements with Directors and Executive Officers

Veeco has entered into indemnification agreements with each of its directors, executive officers and certain senior officers and anticipates that it will enter into similar agreements with any future directors and executive officers. Generally, the indemnification agreements are designed to provide the maximum protection permitted under Delaware law with respect to indemnification of a director or executive officer. The indemnification agreements provide that Veeco will indemnify such persons against certain liabilities that may arise by reason of their status or service as a director or executive officer of the Company and that the Company will advance expenses incurred as a result of proceedings against them as to which they may be indemnified. Under the indemnification agreements, a director or executive officer will receive indemnification if he or she is found to have acted in good faith and in a manner he or she reasonably believed to be in, or not opposed to, the best interests of Veeco and with respect to any criminal action, if he or she had no reasonable cause to believe his or her conduct was unlawful.

11

Table of Contents

COMPENSATION

Executive Officers

The executive officers of Veeco, their ages and positions as of March 12, 2018, are as follows:

|

Name

|

|

Age

|

|

Position

|

|

John R. Peeler

|

|

63

|

|

Chairman and Chief Executive Officer

|

|

William J. Miller, Ph.D.

|

|

49

|

|

President

|

|

Shubham Maheshwari

|

|

46

|

|

Executive Vice President and Chief Financial Officer

|

|

John P. Kiernan

|

|

55

|

|

Senior Vice President, Finance, Chief Accounting Officer and Treasurer

|

John R. Peeler

has been Chief Executive Officer and a Director of Veeco since July 2007, and Chairman since May 2012. Prior thereto, Mr. Peeler was Executive Vice President of JDS Uniphase Corp. (“JDSU”) and President of the Communications Test & Measurement Group of JDSU, which he joined upon the closing of JDSU’s merger with Acterna in August 2005. Before joining JDSU, Mr. Peeler served as President and Chief Executive Officer of Acterna. Mr. Peeler joined a predecessor of Acterna in 1980 and served in a series of increasingly senior leadership roles including Vice President of Product Development, Executive Vice President and Chief Operating Officer, and President and CEO of TTC, a communications test equipment company. Mr. Peeler also serves on the board of IPG Photonics Corporation.

William J. Miller, Ph.D.

has been President since January 2016, overseeing all of Veeco’s global business units. Dr. Miller was named Executive Vice President, Process Equipment in December 2011, and was Executive Vice President, Compound Semiconductor from July 2010 until December 2011. Prior thereto, Dr. Miller was Senior Vice President and General Manager of Veeco’s MOCVD business beginning in January 2009. From January 2006 to January 2009, Dr. Miller was Vice President, General Manager of Veeco’s Data Storage equipment business. He held leadership positions of increasing responsibility in both the engineering and operations organizations since he joined Veeco in November 2002. Prior to joining Veeco, Dr. Miller held engineering and operations leadership positions at Advanced Energy Industries, Inc.

Shubham (Sam) Maheshwari

has been Executive Vice President and Chief Financial Officer of Veeco since May 2014. Mr. Maheshwari oversees Veeco’s Finance, Information Technology, Supply Chain and Global Manufacturing functions. From 2011 to 2014, Mr. Maheshwari served as Chief Financial Officer of OnCore Manufacturing LLC, a global manufacturer of electronic products in the medical, aerospace, defense and industrial markets. From 2009 to 2011, he held various finance roles including Senior Vice President Finance, Treasury, Tax and Investor Relations at Spansion, Inc., a global leader in flash memory based embedded system solutions. Mr. Maheshwari helped lead Spansion’s emergence from bankruptcy to become a successful public company. From 1998 to 2009, he was with KLA-Tencor Corporation, a global semiconductor capital equipment manufacturing company, in various senior level corporate development and finance roles, including Vice President of Corporate Development and Corporate Controller. Mr. Maheshwari also serves on the board of Kateeva, Inc.

John P. Kiernan

has been Senior Vice President, Finance, Chief Accounting Officer and Treasurer since December 2011, and also served as Corporate Controller from December 2011 through December 2017. From July 2005 to November 2011, Mr. Kiernan was Senior Vice President, Finance, Chief Accounting Officer and Corporate Controller. Prior thereto, he was Vice President, Finance and Corporate Controller of Veeco from April 2001 to June 2005, Vice President and Corporate Controller from November 1998 to March 2001, and Corporate Controller from February 1995 to November 1998. Prior to joining Veeco, Mr. Kiernan was an

12

Table of Contents

Audit Senior Manager at Ernst & Young LLP from October 1991 through January 1995 and held various audit staff positions with Ernst & Young LLP from June 1984 through September 1991.

Compensation Discussion and Analysis

Veeco develops, manufactures, sells, and supports semiconductor process equipment to meet the demands of key global trends, such as enhancing mobility, increasing connectivity, and improving energy efficiency. Our primary technologies include metal organic chemical vapor deposition (“MOCVD”), advanced packaging lithography, wet etch and clean, laser annealing, ion beam, molecular beam epitaxy, wafer inspection, and atomic layer deposition systems. These technologies play an integral role in producing light emitting diodes (“LEDs”) for solid-state lighting and displays, and in the fabrication and packaging of advanced semiconductor devices. We have sales and service operations across the Asia-Pacific region, Europe, and North America to address our customers’ needs.

We are focused on:

·

Providing differentiated semiconductor process equipment to address customers’ current production requirements and next generation product development roadmaps;

·

Investing to win through focused research and development in markets that we believe provide significant growth opportunities or are at an inflection point in semiconductor process equipment requirements, including LED, power electronics, photonics, front-end semiconductor, and advanced packaging technologies;

·

Leveraging our sales channel and local process applications support teams to build strong strategic relationships with technology leaders;

·

Expanding our services portfolio to improve the performance of our systems, including spare parts, upgrades, and consumables to drive growth, reduce our customers’ cost of ownership, and improve customer satisfaction;

·

Cross-selling our product portfolio across our broad customer base and end markets to both maximize sales opportunities and diversify our business;

·

Utilizing a combination of outsourced and internal manufacturing strategies to flex manufacturing capacity through industry investment cycles without compromising quality or performance; and

·

Pursuing partnerships and acquisitions to expand our product portfolio into new and adjacent markets to drive sales growth.

Our products are sold to semiconductor and advanced packaging device manufacturers in the following four markets: Advanced Packaging, MEMS & RF Filters; LED Lighting, Display & Compound Semiconductor; Front-End Semiconductor; and Scientific & Industrial.

2017 Business Highlights

·

We completed the acquisition of Ultratech, Inc. in May 2017. With the addition of Ultratech, we diversified our business, establishing ourselves as a leading equipment supplier in the advanced packaging market and greatly increasing our critical mass in the front-end semiconductor equipment market.

·

We increased sales to $484.8 million, a 46% increase over 2016, driven in part by improvements in LED industry conditions and sales into the front-end semiconductor and advanced packaging markets.

·

We achieved non-GAAP gross margins of 40.6%, delivering on our objective to realize gross margins of 40% or better.

·

We increased non-GAAP Operating Income to $31.3 million, as compared to a loss of $8.5 million in 2016.

·

We increased bookings to $571 million, an improvement of 53% over 2016.

13

Table of Contents

·

We built our backlog to $334 million (the highest in 6 years), providing good first half 2018 visibility.

·

We continued to strengthen our MOCVD product portfolio with the successful launch of the EPIK 868 MOCVD system, a higher productivity tool with a superior cost of ownership for our customers.

·

We consolidated manufacturing in our New Jersey facility to improve efficiency and reduce costs.

·

We announced a share repurchase program of up to $100 million to be completed over the next two years.

2017 Business Challenges

Despite the accomplishments and steps taken as described under “2017 Business Highlights” above, our stock price performance has been disappointing. We attribute this, in part, to the highly-specialized, cyclical nature of our business, which is characterized by periods of significant volatility and is often difficult to predict. Also, during 2017, we faced three specific challenges, among others:

1.

Ultratech Cyclicality

. Following the Ultratech acquisition, orders from advanced packaging customers decreased, as customers delayed adoption of new technologies. We maintained our market share through this period but were negatively impacted by a down cycle in the advanced packaging lithography market.

2.

Increased Chinese Competition

. We saw the emergence of Chinese MOCVD competitors who benefitted from Chinese “buy local” sourcing initiatives and government incentives which allowed them to sell MOCVD equipment at significantly lower prices which, in turn, had a negative effect on Veeco’s financial performance.

3.

Patent Disputes

. During 2017, we were engaged in intellectual property disputes with a Chinese competitor and a domestic supplier. These disputes were settled in February 2018 but were expensive and added uncertainty to our business.

Our executive compensation programs are designed to face these challenges, to align our costs with prevailing market conditions, to balance the short- and long-term interests of both stockholders and executives and, at the same time, retain and continue to attract executives throughout inherent downturns, motivating them for our longer term success.

The Company seeks to foster a performance-oriented culture by linking a significant portion of each executive’s compensation to the achievement of performance targets important to the success of the Company and its stockholders. This Compensation Discussion and Analysis describes Veeco’s current compensation programs and policies, which are subject to change.

We structure our executive compensation program each year so that a meaningful percentage of compensation is tied to the achievement of objectives that, at the time they are established, are considered challenging in light of the then anticipated market conditions.

Executive Compensation Strategy and Objectives

The Company’s executive compensation strategy is designed to deliver competitive, performance-based total compensation that reflects our culture and the markets we serve. The primary objectives of Veeco’s executive compensation programs are to attract, retain and motivate executives critical to the Company’s long-term growth and success. The Company’s executive compensation programs are designed to reward executives for increasing stockholder value without subjecting the Company or stockholders to unnecessary or unreasonable risks. The Company has adopted the following guiding principles:

14

Table of Contents

|

Performance-based:

|

Compensation levels should be determined based on Company financial performance and individual results compared to quantitative and qualitative performance priorities set at the beginning of the performance period. Additionally, the ratio of performance-based compensation to fixed compensation should increase with the level of the executive, with the greatest amount of performance-based compensation at the CEO level. Performance-based compensation should be subject to a complete risk of forfeiture.

|

|

|

|

|

Stockholder-aligned:

|

A significant portion of potential compensation should be performance- and equity-based to more closely align the interests of executives with those of our stockholders.

|

|

|

|

|

Fair and Competitive:

|

Compensation levels should be fair, internally and externally, and competitive with overall compensation levels at other companies with which we compete for talent. Our compensation programs should promote our ability to both attract and retain our employees, including our executives.

|

Our target pay mix places significant emphasis on variable compensation comprised of performance-based restricted stock unit (“PRSU”) awards, time-based equity awards and an annual target bonus. As illustrated in the following charts, 71.9% and 68.5% of the target compensation packages for our CEO and our other named executive officers (“NEOs”), respectively, are comprised of equity-based and performance-based compensation. (Veeco’s NEOs are identified in the Summary Compensation Table.)

|

CEO Compensation Elements

|

Other NEO Compensation Elements

|

|

|

|

Executive Compensation Governance and Procedures

The Compensation Committee (hereinafter in this Compensation Discussion and Analysis section, the “Committee”) administers the Company’s compensation programs operating under a charter adopted by the Board. This charter authorizes the Committee to interpret the Company’s compensation and equity plans and establish rules for their implementation and administration. The Committee consists of three independent directors who are appointed

15

Table of Contents

annually. The Committee works closely with the CEO and the Senior Vice President, Human Resources and relies on information provided by independent compensation consultants.

When making compensation decisions, the Committee considers the compensation practices and the competitive market for executives at companies with which we compete for talent. To this end, the Company utilizes a number of resources which, during 2017, included: meetings with Compensation Strategies, Inc., an independent compensation consultant; compensation surveys prepared by Radford; and executive compensation information compiled by Compensation Strategies, Inc. from the proxy statements of other companies, including a peer group.

Veeco’s peer group (the “Peer Group”) reflects the companies that closely resemble Veeco based on industry and competition for talent. The Peer Group has been comprised of companies smaller than, similar to and larger than Veeco. In 2017, the Compensation Committee reviewed our Peer Group strategy and made changes to more closely align with Veeco’s market segments and size as measured by revenue and market capitalization. This resulted in a 2017 Peer Group consisting of the following seventeen companies:

|

3D Systems Corporation*

|

|

MACOM Technology Solutions*

|

|

Advanced Energy Industries, Inc.

|

|

MKS Instruments, Inc.

|

|

Badger Meter, Inc.*

|

|

OSI Systems, Inc.*

|

|

Brooks Automation, Inc.

|

|

Photronics, Inc.*

|

|

Cabot Microelectronics Corporation*

|

|

Pure Storage, Inc.*

|

|

Cray Inc.*

|

|

Rudolph Technologies, Inc.

|

|

Entegris, Inc.*

|

|

Semtech Corporation*

|

|

FormFactor, Inc.*

Kulicke and Soffa Industries, Inc.

|

|

Xperi Corporation (formerly Tessera Holding

Corporation)*

|

*New member of the Peer Group following the Committee’s 2017 review.

Applied Materials, Inc., Axcelis Technologies, Inc., Cohu, Inc., KLA Tencor Corporation, Lam Research Corporation, Nanometrics Incorporated, Newport Corporation, Teradyne, Inc., Ultratech, Inc., and Xcerra Corporation were removed from our Peer Group in 2017 as these companies were either no longer independent entities or did not align with Veeco’s market segments and size as measured by revenue and market capitalization.

The Company considers the executive compensation practices of the companies in its Peer Group and the Radford survey (hereinafter collectively, the “market data”) as one of several factors used in setting compensation. The Company’s compensation consultant uses statistical regression techniques to adjust market data to construct representative 50

th

-75

th

percentile market pay levels that are reflective of Veeco’s size based on revenues. Although the Committee considers the executive compensation practices of the Peer Group companies and broader market data in setting compensation, it does not benchmark compensation to any specific percentile or ranking within our Peer Group. Individual compensation levels may vary within a range around market as a result of Veeco’s financial and operating performance, personal performance, experience, and criticality, as well as competitive factors.

For 2017, total target compensation opportunities of Veeco’s NEOs and other executives were generally reflective of the 50

th

percentile of market. Given the performance emphasis present in Veeco’s executive compensation program, actual compensation earned or received can vary significantly with results; actual compensation for 2017 was below targeted opportunity levels.

In addition to reviewing the market data, the Committee meets with the Company’s CEO and Senior Vice President, Human Resources to consider recommendations with respect to

16

Table of Contents

compensation for the NEOs and other executives. These recommendations include base salary levels, cash bonus targets and awards, and equity compensation awards. The Committee considers these recommendations along with other factors in determining specific compensation levels for the NEOs. The Committee discusses the elements of the CEO’s compensation with him, but makes the final decisions regarding his compensation without him present.

Decisions regarding the Company’s compensation program elements are made by the Committee in regularly scheduled and ad hoc meetings. Issues of significant importance are frequently discussed over several meetings. This practice provides the Committee with the opportunity to raise and address concerns before arriving at a decision. Prior to each meeting, the Committee is provided with the written materials, information and analyses as may be required to assist the Committee in its decision-making process. To the extent possible, meetings of the Committee are conducted in person. When this is not possible, meetings are conducted telephonically. The CEO and the Senior Vice President, Human Resources are regularly invited to attend Committee meetings but the Committee meets privately in executive sessions to consider certain matters including, but not limited to, the compensation of the CEO.

Elements of Our Executive Compensation Program

Our compensation programs are comprised of four elements: base salary, annual cash bonus, equity-based compensation and benefits and perquisites. Each of these elements is used to attract executives and reward them for performance results as described below:

|

Element

|

|

Description / Characteristics

|

|

|

|

Primary Objectives

|

|

|

|

|

|

|

|

|

|

Base Salary

|

|

·

Annual cash compensation

|

|

|

|

·

Attract and retain highly qualified talent

|

|

|

|

|

|

|

|

|

|

Annual Cash Incentive

|

|

·

100% performance-based cash compensation

·

Mix of annual financial and individual goals

·

Awards range from 0% to 200% of targets established for each executive

|

|

|

|

·

Align executive compensation with annual goals important to the success of the Company

·

Promote a pay-for-performance culture

|

|

|

|

|

|

|

|

|

|

Equity-based Compensation

|

|

·

Combination of time- and performance-based awards (performance-based comprising the majority)

·

Long-term (typically 3 — 4 years) stock-based compensation

·

PRSU awards granted with target performance period of 3 years

·

PRSU awards earned based on financial metrics and subject to forfeiture

|

|

|

|

·

Incentivize long-term performance

·

Serve as a retention incentive

·

Align the interests of executives with stockholders in the creation of long-term value

·

Foster a culture of stock ownership

|

|

|

|

|

|

|

|

|

|

Benefits & Perquisites

|

|

·

Senior Executive Change in Control Policy

·

Company-subsidized health and welfare benefits

·

401(k) savings plan

|

|

|

|

·

Encourage executives to act in the best interests of stockholders

·

Promote productivity, remain competitive, and increase employee loyalty to the Company

|

17

Table of Contents

The Company evaluates each element of each executive’s compensation individually and in the aggregate against market data for the position, experience, individual performance and the ability to affect future Company performance. The sections below describe the process for determining each of the four elements of the executive compensation program.

Base Salary

The Company pays base salaries to attract and retain executives. Base salaries are determined in accordance with the responsibilities of each executive, market data for the position and the executive’s experience and individual performance. The Company considers each of these factors but does not assign a specific value to any one factor.

Base salaries for executives are typically set during the first half of the year in conjunction with the Company’s annual performance management process. In 2017, following a review of the market data and management’s recommendations, the Committee increased base salaries as follows:

|

Name

|

|

April 2016

|

|

April 2017

|

|

Percent Increase

|

|

|

J. Peeler

|

|

$

|

700,000

|

|

$

|

700,000

|

|

No Change(1)

|

|

|

W. Miller

|

|

$

|

460,000

|

|

$

|

474,000

|

|

3.0%

|

|

|

S. Maheshwari

|

|

$

|

430,000

|

|

$

|

443,000

|

|

3.0%

|

|

|

J. Kiernan

|

|

$

|

300,000

|

|

$

|

300,000

|

|

No Change

|

|

(1)

Mr. Peeler’s base salary has not been increased since April 2011.

Cash Bonus Plan

The Company provides the opportunity for cash bonuses under its annual bonus plan to attract executives and reward them for performance consistent with the belief that a significant portion of the compensation of its executives should be performance-based. As a result, individuals are compensated based on the achievement of specific financial and individual performance goals intended to correlate closely with stockholder value. The Company believes that the opportunity to earn cash bonuses motivates executives to meet Company performance objectives that, in turn, are linked to the creation of stockholder value. The Company utilizes profitability, as measured by adjusted operating income, as the financial element of its bonus plan. To help achieve our goal of retaining key talent, executives must generally be employees at the time awards are paid to be eligible to receive a bonus for that period.

On February 8, 2017, the Committee approved the 2017 Bonus Plan (the “2017 Plan”) and the specific metrics thereof. Under the 2017 Plan, the bonus is based on the financial performance of the Company, as measured by adjusted operating income (“Operating Income”). We define Operating Income as earnings before the cost of bonuses, interest, taxes, and amortization, adjusted to exclude share-based compensation expense, one-time charges relating to restructuring initiatives, non-cash asset impairments, certain other non-operating gains and losses, and acquisition-related items such as one-time transaction costs and the stepped-up cost of goods sold associated with the purchase accounting of acquired inventory.

The Committee elected to use Operating Income as the 2017 Plan financial metric since it closely aligns operating performance to earnings per share, a key driver of shareholder value. If 2017 Operating Income is greater than $2 million (the threshold performance level), a bonus pool is funded with a fixed percentage of Operating Income. The bonus pool is not funded and bonus awards will not be earned if Operating Income results are less than the threshold performance level. The bonus pool would be fully funded and awards paid at 100% of target for Operating Income equal to $45.8 million. Awards to participants will be made from this fixed pool in accordance with their target bonus amounts. 25% of a participant’s target bonus, after adjustment for Operating Income results, will be modified based on individual performance.

18

Table of Contents

Awards for individual performance will be paid from this fixed pool and may range from zero to 150%.

The total bonus award for an individual is capped at 200% of target bonus.

On May 26, 2017, the Company acquired Ultratech, Inc. Shortly thereafter, the Committee approved a proposal to exclude Ultratech operating income from the 2017 Plan financial results. However, following a review of year-end financial results, the Committee decided to include Ultratech results in the 2017 Plan financial results, which had the effect of reducing 2017 bonus awards as a result of losses incurred at Ultratech during 2017.

For 2017, Operating Income of $42.0 million exceeded the threshold and the bonus pool was funded at 91.6% of target, as follows:

|

Performance Level

|

|

Operating Income

($ million)

|

|

Award Percentage

|

|

|

Maximum

|

|

$

|

91.8

|

|

200

|

%

|

|

Target

|

|

$

|

45.8

|

|

100

|

%

|

|

Actual

|

|

$

|

42.0

|

|

91.6

|

%

|

|

Threshold

|

|

$

|

2.0

|

|

26.6

|

%

|

Under the 2017 Plan, 25% of the adjusted target may be adjusted based on individual performance measured against pre-established performance goals (the “Individual Element”), provided the minimum level of Operating Income required to fund the bonus is achieved. Actual awards for individual performance will be paid from a fixed pool, and may range from zero to 150% of the target for individual performance.

For the NEOs other than Mr. Peeler, actual awards for NEO individual performance were based on results compared to goals set by Mr. Peeler at the beginning of the year in connection with the Company’s performance management process. The individual performance goals for these NEOs included functional objectives and individual objectives related to specific initiatives. The goals were not weighted and the award was considered on the totality of the individual performance results for each executive. After evaluation, Mr. Peeler made individual performance recommendations to the Committee for each of these NEOs, as set forth in the table below, reflecting the challenges faced during 2017.

Mr. Peeler’s individual performance goals for 2017 were set by the Board at the beginning of the year and included: (1) increasing revenue versus a specific goal, (2) improving profitability versus a specific goal, (3) executing the Company’s acquisition strategy, (4) developing the Company’s organization and leadership, and (5) leading the Company through unexpected adversity and opportunity to maximize shareholder value. Following the plan year, it was determined that: (1) excluding acquisition results, revenue increased by 26%; (2) profit increased eleven-fold; (3) the Company completed the Ultratech acquisition in May 2017; (4) leaders in all of the Company’s businesses and key functions are performing well; and (5) an intellectual property dispute with a Chinese competitor was successfully resolved. The Committee discussed Mr. Peeler’s overall performance in executive session and awarded 50% ($92,173) (out of a maximum of 150%) of the value for the Individual Element of his bonus in recognition of his strong leadership during this challenging year but acknowledging, nonetheless, disappointment in the stock price.

19

Table of Contents

Messrs. Peeler, Maheshwari and Kiernan and Dr. Miller earned 2017 Plan awards as follows:

|

Name

|

|

Target Bonus

(Total Amount /

% of Base

Salary)

|

|

Financial

Performance

Adjusted Target

(91.6% of

Target)

|

|

Financial

Performance

Award

(75% of Adjusted

Target)

|

|

Individual

Performance

Target

(25% of

Adjusted

Target)

|

|

Individual

Performance

Award

% / $

|

|

Final Bonus

Award

(Total Amount /

% of Target)

|

|

|

J. Peeler

|

|

$805,000/115%

|

|

$

|

737,380

|

|

$

|

553,035

|

|

$

|

184,345

|

|

50%/$92,173

|

|

$645,208 / 80.2%

|

|

|

W. Miller

|

|

$474,000/100%

|

|

$

|

434,184

|

|

$

|

325,638

|

|

$

|

108,546

|

|

75%/$81,410

|

|

$407,048 / 85.9%

|

|

|

S. Maheshwari

|

|

$354,400/80%

|

|

$

|

324,631

|

|

$

|

243,473

|

|

$

|

81,158

|

|

75%/$60,868

|

|

$304,341 / 85.9%

|

|

|

J. Kiernan

|

|

$150,000/50%

|

|

$

|

137,400

|

|

$

|

103,050

|

|

$

|

34,350

|

|

90%/$30,915

|

|

$133,965 / 89.3%

|

|

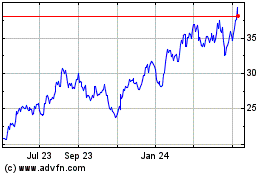

On February 6, 2018, the Committee approved the 2018 Bonus Plan (the “2018 Plan”). Under the 2018 Plan, bonuses will be based on the financial performance of the Company, as measured by Operating Income. If Operating Income exceeds a predetermined threshold, which is increased to $10.0 million in 2018, a bonus pool will be funded with a predetermined fixed percentage of Operating Income. The bonus pool will not be funded and bonus awards will not be earned if Operating Income results are less than the threshold performance level. Awards to participants will be made from this fixed pool in accordance with their target bonus amounts. 25% of a participant’s target bonus, adjusted for Operating Income results, will be modified based on individual performance. Awards for individual performance will be paid from this fixed pool and may range from zero to 150%.