Report of Foreign Issuer (6-k)

December 22 2017 - 6:33AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of December, 2017

Commission File Number 1-15250

BANCO BRADESCO S.A.

(Exact name of registrant as specified in its charter)

BANK BRADESCO

(Translation of Registrant's name into English)

Cidade de Deus, s/n, Vila Yara

06029-900 - Osasco - SP

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

.

|

Publicly-held Company

CNPJ no. 60.746.948/0001-12

|

To

SECURITIES AND EXCHANGE COMMISSION

Rua Sete de Setembro, 111/2-5º e 23-34º Andares,

Centro, Rio de Janeiro/RJ

Superintendence of Corporate Relations - SEP – CVM

Company Monitoring Management _ GEA 1

c/o Nilza Maria Silva de Oliveira, Manager

Re: Official Letter No. 416/2017/CVM/SEP/GEA-1

Subject: Request for clarifications on the news.

Dear Sirs,

We refer to the official letter highlighted and transcribed below:

“Rio de Janeiro, December 20, 2017.

Investor Relations Officer

BANCO BRADESCO S.A.

Núcleo Cidade de Deus, Prédio Vermelho, 4º andar

Vila Yara, Osasco, SP

CEP 06029-900

Telephone: (11) 3681-4011

Email: alexandre.gluher@bradesco.com.br

c/c: emissores@b3.com.br

Subject:

Request for clarifications on the news.

Dear Officer,

1. We refer to the news reported on this date, in the newspaper O Estado de São Paulo, in the Business & Economy section, under the title "Bradesco closes deal of R$ 111 million in Greenfield", which contained the following statements:

Bradesco signed a redress agreement with the Federal Public Prosecutor's Office (MPF) in Brasília in the scope of the Greenfield Operation, in which it undertook to pay R$ 111 million to the Petros pension funds, of employees from

Petrobras

, and Funcef, Caixa Econômica Federal, and to Agência de Fomento do Estado do Amazonas (Afeam).

In a statement issued yesterday, the MPF stated that the updated value corresponds to the amount that was invested in the

Private

Equity Investment Fund

(PIF) Enseada, between 2010 and 2017. The redress agreement of Bradesco was approved by the Federal Court of the Judiciary Section on December 14, 2017.

In addition to the payment, Bradesco has also assumed the commitment to appear before the Greenfield Task Force and the Federal Police to provide clarification where necessary, in addition to guide directors and employees to do the same and conduct an independent internal investigation, according to the MPF.

Operation Greenfield was launched in September of last year and involved a series of companies and managers of investment funds. The objective was to investigate suspected fraud in the Previ (Banco do Brasil), Petros, Postalis (Post Office) and Funcef

Pension Funds

.

In the case of Bradesco, the operation stated the broker firm BEM and asset manager BRAM, for having "in the past, exercised the administration and management of the Enseada investment fund”.

2. In this respect, we ask the company to provide a statement regarding the veracity of the news, and, if so, to explain the reasons for which they did not understand this as a relevant fact, as well as to comment on other information considered as important on the subject.

|

Publicly-held Company

CNPJ no. 60.746.948/0001-12

|

3. We would also emphasize the obligation provisioned in the sole paragraph of article 4 of CVM Instruction No. 358/02, of questioning directors and controlling shareholders of the Company, as well as other people with access to material facts or acts, with the aim of ascertaining whether they are aware of information that should be reported to the market.

4. This statement should be made through Sistema Empresa.NET, category:

Notice to the Market

, type:

Clarifications on questioning by CVM/B3

, subject:

News Reported on the Media

, which should include the transcript of this official letter.

5. We warn that, according to the order of the Superintendence of Corporate Relations, in the use of its legal attributions and, based on section II of article 9, of Law No. 6,385/76 and on CVM Instruction No. 452/07, the determination for the application of a punitive fine is incumbent,

to the sum of R$ 1,000.00

(one thousand reais), without prejudice to other administrative sanctions for non-compliance with the requirement contained in this official letter, sent exclusively by e-mail,

until December 21, 2017

, notwithstanding the provisions of the sole paragraph of art. 6 of CVM Instruction No. 358/02.”

In response to your request, please be advised that the matter reported in the press is true and was not treated as Material Fact, because: a) we believe that the amount involved is immaterial and compatible with the normal course of business of the Company; and b) it is based on a fact that was reported to the market on September 09, 2016.

Additionally, it communicates that with the payment made yesterday, the guarantee of public securities was released, provided before the Judgment of the 10

th

Federal Court of the Federal District, which was intended to ensure the payment for any losses of civil nature borne by institutional investors.

The Company made a thorough assessment of all the aspects related to FIP ENSEADA, having forwarded to the Federal Public Prosecutor's Office the respective Internal Inspector’s Report, without having noticed any deviation in the performance of its controlled companies and their managers.

Nevertheless, following the recommendation of its legal advisors, it believed the payment should be made, as a way of avoiding hassle and long discussions of judicial and administrative nature.

Cidade de Deus, Osasco, SP, December 21, 2017

Banco Bradesco S.A.

Alexandre da Silva Glüher

Executive Vice President,

Chief Risk Officer (CRO) and

Investor Relations Officer

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: December 21, 2017

|

BANCO BRADESCO S.A.

|

|

|

|

By:

|

|

/S/

Alexandre da Silva Glüher

|

|

|

|

Alexandre da Silva Glüher

Executive Vice President,

Chief Risk Officer (CRO)

and

Investor Relations Officer.

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

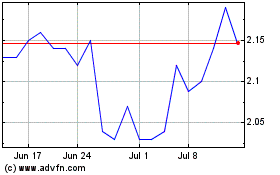

Banco Bradesco (NYSE:BBDO)

Historical Stock Chart

From Mar 2024 to Apr 2024

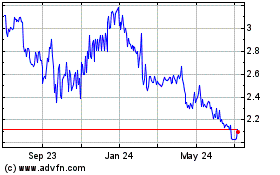

Banco Bradesco (NYSE:BBDO)

Historical Stock Chart

From Apr 2023 to Apr 2024