UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Consent Solicitation

Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant

☒

Filed by a Party other than the Registrant

☐

Check the appropriate box:

☒

Preliminary Proxy Statement

☐

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐

Definitive Proxy Statement

☐

Definitive Additional Materials

☐

Soliciting Material Pursuant to Rule 14a-12.

NUO THERAPEUTICS, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒

No fee required.

☐

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

(1)

|

Title of each class of securities to which transaction applies.

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which trans action applies:

|

|

|

|

|

|

|

(3)

|

Per unit price or other underlying value of trans action computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of trans action:

|

|

|

|

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing

.

|

|

|

|

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

207A Perry Parkway, Suite 1

Gaithersburg, MD 20877

(240) 499-2680

December

, 2017

NOTICE OF CONSENT SOLICITATION

Dear Stockholder:

The Company is filing th

e accompanying consent solicitation statement on Schedule 14A (the “Consent Solicitation Statement”) in order to solicit from its stockholders written consents approving and authorizing (the “Action”) an amendment (the “Amendment”) to the Company’s second amended and restated certificate of incorporation for the purposes of effecting a reverse stock split at a ratio of 1-for-5 (the “Reverse Split”) of the Company’s common stock, par value $0.0001 per share, and to authorize the Board to determine, in its discretion, the timing of the Reverse Split, so long as the Reverse Split is effected at any time prior to March 31, 2018.

The Action is described in more detail in the accompanying Consent Solicitation Statement.

We have established the close of business on December 8

, 2017 as the record date for determining stockholders entitled to submit written consents. Stockholders constituting the holders of a majority in voting power of the Company’s outstanding capital stock as of the close of business on the record date must consent in order for the Action to be approved by stockholders.

The Company

’s Board of Directors recommends that all stockholders consent to the Action by marking the box entitled “FOR” and submitting to the Company the Action by Written Consent form, which is attached as

Annex B

to the Consent Solicitation Statement.

The Consent Solicitation Statement is being sent on or about December

, 2017 to all holders of record of the Company’s capital stock as of December 8, 2017. The date of the accompanying Consent Solicitation Statement is December , 2017.

|

|

Sincerely,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

David E. Jorden

Chief Executive Officer and Chief Financial Officer

|

|

207A Perry Parkway, Suite 1

Gaithersburg, MD 20877

(240) 499-2680

CONSENT SOLICITATION STATEMENT

This Consent Solicitation Statement is being furnished in connection with the solicitation of written consents (the “Consent Solicitation”) of the stockholders of Nuo Therapeutics, Inc. (the “Company,” “we,” “our,” or “us”) approving and authorizing (the “Action”) an amendment (the “Amendment”) to the Company

’s second amended and restated certificate of incorporation (“Certificate of Incorporation”) for the purposes of effecting a reverse stock split at a ratio of 1-for-5 (the “Reverse Split”) of the Company’s common stock, par value $0.0001 per share (the “Common Stock”), and to authorize the Company’s Board of Directors (the “Board”) to determine, in its discretion, the timing of the Reverse Split, so long as the Reverse Split is effected at any time prior to March 31, 2018.

Our Board unanimously approved and authorized the Amendment as of

November 26

, 2017 and recommends that stockholders consent to the Action

.

The Company has decided to seek the written consent of stockholders through a consent solicitation process rather than holding a special meeting of stockholders in order to eliminate the costs and management time involved in holding a special meeting.

The Reverse Split is primarily intended to facilitate the Company’s ability to obtain equity financing and to otherwise provide adequate authorized shares for its short- to medium-term needs.

Voting materials, which include this Consent Solicitation Statement and an Action by Written Consent form (attached as

Annex B

), are being mailed to all stockholders of record on or about December , 2017. Our Board set the close of business on December 8, 2017 as the record date for the determination of stockholders entitled to act with respect to the Consent Solicitation (the “

Record Date

”).

Important notice regarding the availability of voting materials for the Action:

This Consent Solicitation Statement and the Action by Written Consent form are also available on our website at the following address: http://www.nuot.com/investors/.

As of December 8

, 2017, there were 22,727,112 shares of Common Stock issued and outstanding. Each share of Common Stock entitles its holder to one vote on all matters requiring stockholder approval. As of such date, there were 29,038 shares of the Company’s Series A preferred stock, par value $0.0001 per share (“Series A Preferred Stock”), issued and outstanding. Each share of Series A Preferred Stock entitles its holder to five votes on all matters on which holders of Common Stock have the right to vote, except as otherwise provided in the Certificate of Designations of the Series A Preferred Stock. In the aggregate, the holder(s) of Series A Preferred Stock therefore have 145,190 votes. The holder(s) of Series A Preferred Stock are entitled to vote together with holders of Common Stock as a single class with respect to the Action. Stockholders constituting the holders of a majority in voting power of the Company’s outstanding capital stock as of the close of business on the record date must consent in order for the Action to be approved by the stockholders.

If your shares are held in a brokerage account in your broker

’s name (“street name”), you have the right to direct your broker or nominee to consent or withhold consent with regard to the Action. You should follow the instructions provided by your broker or nominee. You may complete and mail an instruction card to your broker or nominee or, if your broker allows, submit voting instructions to your broker by telephone or the internet. If you provide specific voting instructions by mail, telephone or the internet, your broker or nominee will vote your shares as you have directed. If you do not provide voting instructions to your broker or nominee, your broker or nominee may not use its discretion to consent or withhold consent with regard to the Action.

Stockholders who wish to consent must deliver their executed Action by Written Consent form to the Company. The Company reserves the right (but is not obligated) to accept any written consent received by any other reasonable means or in any form that reasonably evidences the giving of consent to the approval of the Action.

The failure to submit a written consent or, if your shares are held in “street name,” to give appropriate instructions to your broker or nominee, will have the same effect as voting against the Action. Abstentions also have the same effect as voting against the Action.

The final results of this Consent Solicitation will be published in a Current Report on Form

8-K by the Company and posted on its website in satisfaction of the notice requirement under Section 228 of the Delaware General Corporation Law (“DGCL”).

We pay the costs for preparing, printing and mailing the consent soliciting materials. Our officers, directors and other regular employees may, without additional compensation, solicit consents personally or by facsimile, telephone, e-mail or special letter. We will reimburse banks, brokers and other custodians, nominees and fiduciaries for their costs of sending the consent soliciting materials to our beneficial owners.

Our executive offices are located at 207A Perry Parkway, Suite 1, Gaithersburg, MD 20877 and our telephone number is (240) 499-2680.

VOTE REQUIRED; MANNER OF APPROVAL

Each share of our Common Stock entitles its holder to one vote. Each share of our Series A Preferred Stock entitles its holder to five votes on all matters on which holders of Common Stock have the right to vote, except as otherwise provided in the Certificate of Designations of the Series A Preferred Stock. The holder(s) of Series A Preferred Stock are entitled to vote together with holders of Common Stock as a single class. Under Section 2.5(d) of our By-Laws, approval of the Action requires the affirmative vote of the holders of a majority of the votes cast. In addition, pursuant to Section 228 of the DGCL and Section 2.9 of our By-Laws, any action that may be taken at any annual or special meeting of the Company

’s stockholders can be effected through the written consent of those stockholders having not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting of stockholders at which all shares entitled to vote on such action were present and voted, so long as a majority of the Board approves in advance the taking of such action by means of written consent of stockholders (which has occurred in this case). Prompt notice of the action taken by written consent must be provided to all other stockholders.

The Company has no class of voting stock outstanding other than the Common Stock and Series A Preferred Stock. As noted above, as of December 8

, 2017, there were 22,727,112 shares of Common Stock and 29,038 shares of Series A Preferred Stock issued and outstanding. Accordingly, the votes or written consents of stockholders holding at least 11,436,152 shares of the issued and outstanding Common Stock, or at least 11,290,962 shares of the issued and outstanding Common Stock and all 29,038 shares of the issued and outstanding Series A Preferred Stock (the latter representing 145,190 votes), are necessary to implement the Action.

The Company

’s Board of Directors recommends that all stockholders consent to the Action by marking the box entitled “FOR” and submitting to the Company an executed Action by Written Consent form which is attached as

Annex B

to the Consent Solicitation Statement. If you sign and send in the Action by Written Consent form but do not indicate how you want to vote as to the Action, your consent form will be treated as a consent “FOR” the Action.

Stockholders who wish to consent must deliver their executed Action by Written Consent form to the Company. The Company reserves the right (but is not obligated) to accept any written consent received by any other reasonable means or in any form that reasonably evidences the giving of consent to the approval of the Action.

CONSENT IS IRREVOCABLE

Executed written consents delivered to the Company before the effective date of the Action shall not be revocable.

EFFECTIVE DATE OF ACTION

Pursuant to DGCL Section 228, the Action will become effective on such date as the Company has received, in accordance with such section, written consents signed by holders of our outstanding capital stock having not less than a majority of the voting power

of such outstanding capital stock as of the close of business on the record date, so long as such written consents are delivered within 60 days of the record date.

DISSENTERS

’ RIGHTS

Under Delaware law, stockholders will not have any dissenters

’ or appraisal rights in connection with the Action or any of the matters described in this Consent Solicitation Statement.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Some of the information in this Consent Solicitation Statement contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are inherently subject to risks and uncertainties and actual results and outcomes may differ materially from the results and outcomes discussed in or anticipated by the forward-looking statements. Forward-looking statements include, without limitation, any statement that may predict, forecast, indicate, or imply future results, performance, or achievements, and may contain the words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “the facts suggest,” “will,” “will be,” “will continue,” “will likely result,” “could,” “may” and words of similar import. These statements reflect the Company

’s current view of future events and are subject to certain risks and uncertainties as noted in the Company’s filings with the Securities and Exchange Commission, including the Company’s Annual Report on Form 10-K filed on March 29, 2017, its Quarterly Reports on Form 10-Q filed on May 15, 2017, August 14, 2017 and November 13, 2017, as well as its Forms 8-K.

Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results could differ materially from those anticipated in these forward-looking statements. In addition to the risks identified in the above filings, new risk factors emerge from time to time, and it is not possible for management to predict all such risk factors, nor can it assess the impact of all such risk factors on the Company

’s business, or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Given these risks and uncertainties, investors should not place undue reliance on forward-looking statements as a prediction of actual results.

The Company undertakes no obligation and does not intend to update, revise or otherwise publicly release any revisions to its forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of any unanticipated events.

Your consent is important!

Please sign, date and promptly return your written consent form.

PROPOSED ACTION:

APPROVAL OF AN AMENDMENT TO OUR CERTIFICATE OF INCORPORATION TO EFFECT A REVERSE STOCK SPLIT

Upon recommendation of the Board, stockholders of the Company are being asked to execute written consents approving and authorizing (the “Action”) an amendment (the “Amendment”) to the Company

’s second amended and restated certificate of incorporation (the “Certificate of Incorporation”) for the purposes of effecting a reverse stock split at a ratio of 1-for-5 (the “Reverse Split”) of the Company’s common stock, par value $0.0001 per share (the “Common Stock”), and to authorize the Board to determine, in its discretion, the timing of the Amendment and the Reverse Split, so long as the Reverse Split is effected at any time prior to March 31, 2018.

At any time after the effective date of the Action, and prior to

March 31, 2018, the Board will determine whether to proceed with the Reverse Split. The total number of authorized shares of capital stock (i.e., Common Stock and preferred stock), and the par value of such shares of stock, will remain unchanged. The Board will effect the Reverse Split by filing with the Delaware Secretary of State an amendment to the Certificate of Incorporation, a copy of which has been attached hereto as

Annex A

, at any time on or after the effective date of the Action but prior to March 31, 2018.

If the Board decides to effect the Reverse Split, it

intends to separately seek an amendment to the Certificate of Designations relating to the Company’s Series A preferred stock, par value $0.0001 per share (the “Series A Preferred Stock”), to effect a comparable reverse split of the Series A Preferred Stock in order to maintain the proportionate voting rights of the Company’s capital stock, but which will maintain the liquidation preference of the Series A Preferred Stock at its current amount of $29,038,000. Only holders of Series A Preferred Stock will have the right to vote on such amendment to the Certificate of Designations. However, there can be no assurances that, if the Board seeks a comparable reverse split of the Series A Preferred Stock, the holder of such stock will approve such action.

In deciding whether to implement the Reverse Split, the Board will be guided by the best

interests of the Company and its stockholders, and will consider the following factors at the time of its decision:

|

|

(i)

|

the number of shares that will be outstanding

or reserved for issuance after the Reverse Split, and the number of shares available for issuance in the future, including in connection with a contemplated equity financing;

|

|

|

(ii)

|

the market price of the Common Stock in light of the Company

’s ability to have its Common Stock no longer qualify as a “penny stock”;

|

|

|

(iii)

|

stockholders

’ equity at the time of the Reverse Split; and

|

|

|

(iv)

|

the nature of the Company

’s operations.

|

The Board maintains the right to elect not to proceed with the Reverse Split if it determines, in its sole discretion, that the proposal is no longer in the best interests of the Company and its stockholders.

Effects of Reverse Split

Following the effectiveness of the Reverse Split, current holders of Common Stock would own a lower number of shares of Common Stock than prior to the Reverse Split

. For example, following the Reverse Split, a stockholder owning 1,000 shares of Common Stock prior to the Reverse Split would hold 200 shares.

Because the number of authorized shares of Common Stock will remain unchanged and the number of outstanding shares of Common Stock will decrease following the proposed Reverse Split, the Reverse Split

would result in an increase in the number of unissued shares of Common Stock that the Company could issue in the future.

Except for any changes as a result of the treatment of fractional shares, each stockholder will hold the same percentage of Common Stock outstanding immediately after the Reverse Split as such stockholder held immediately prior to the Reverse Split.

The Amendment will not change the terms of the Common Stock. After the Reverse Split, the shares of Common Stock will have the same voting rights and rights to dividends and distributions and will be identical in all other respects to the Common Stock now authorized. Each stockholder

’s percentage ownership of Common Stock will not be altered except for the effect of eliminating fractional shares. The par value of the Common Stock will not change, and the outstanding Common Stock will remain fully paid and non-assessable.

In addition, as described above, if the Board decides to effect the Reverse Split, it will separately seek an amendment to the Certificate of Designations relating to the Series A Preferred Stock to effect a comparable reverse split of the Series A Preferred Stock in order to maintain the proportionate voting rights of the Company

’s capital stock, but which will maintain the liquidation preference of the Series A Preferred Stock at its current amount of $29,038,000. Only holders of Series A Preferred Stock will have the right to vote on such amendment to the Certificate of Designations. However, there can be no assurances that, if the Board seeks a comparable reverse split of the Series A Preferred Stock, the holder of such stock will approve such action.

The Reverse Split is not intended as, and

is not considered to have the effect of, a “going private transaction” covered by Rule 13e-3 under the Exchange Act. Following the Reverse Split, we will continue to have the same number of stockholders and we will still be subject to the periodic reporting requirements of the Exchange Act. Please refer to the section titled “

Risks Associated with the Reverse Split

” below for the description of a potential change of control.

Purposes of the Reverse Split

The Reverse Split is primarily intended to facilitate the Company

’s ability to obtain equity financing and to otherwise provide adequate authorized shares for its short- to medium-term needs.

The Board believes that the Amendment will (i) effectively increase the number of authorized but unissued shares of Common Stock that the Company could issue in the future, including in connection with a contemplated equity financing, and (ii) improve the Company’s chances of not having its Common Stock designated a “penny stock.”

In April

2017, the Company solicited, and in May 2017, it obtained, the requisite stockholder consent for a reverse split of its Common Stock in connection with a contemplated listing on Nasdaq. The Company did not proceed with this reverse split and the Nasdaq listing and ultimately withdrew its attempted registered offering of Common Stock and contemplated Series A Preferred Stock exchange transaction. During the quarter ended September 30, 2017, the Company exercised its rights in full under its 2016 backstop commitment agreements with certain accredited investors. As a result of that exercise, the Company issued an aggregate of 12,800,000 shares of Common Stock for gross proceeds of $3.0 million.

As of the Record Date, the Company had

31,500,000 shares of Common Stock authorized for issuance under its Certificate of Incorporation and 22,727,112 shares of Common Stock outstanding. Taking into account 6,180,000 shares of Common Stock issuable upon the exercise of outstanding warrants, 1,111,250 shares of Common Stock issuable upon the exercise of outstanding options awarded under the Company’s 2016 Omnibus Incentive Compensation Plan, as amended (the “Plan”), and a maximum of 478,750 shares of Common Stock that, under the terms of the Plan, may yet be awarded in the future (not including increases in Plan size under the Plan’s evergreen provision), only 1,002,888 authorized shares of Common Stock have not been either issued or reserved for issuance. This represents only approximately 3% of the authorized shares of Common Stock. Effecting the Reverse Split would increase the number of unissued and unreserved shares of Common Stock to approximately 81 % of the Company’s authorized shares of Common Stock.

Such unissued and unreserved shares could be used for capital raising transactions or other corporate opportunities that may develop.

The Company is currently negotiating a potential equity financing involving the issuance of shares of its Common Stock to an existing investor to fund the Company’s operating activities. However, we cannot assure you that this contemplated capital raise or any other financing transaction will in fact be successfully completed following the Reverse Split, or that it will be completed on terms currently contemplated or terms that are acceptable to the Company. See “

Risks Associated with the Reverse Split

” for important additional information.

In addition

to effectively increasing the number of authorized but unissued shares of Common Stock that the Company could issue in the future and potentially improving the Company’s chances of not having its Common Stock designated a “penny stock,” the Board believes that the Reverse Split may reduce the relatively high transaction costs and commissions incurred by our stockholders due to our currently low per share trading price. The structure of trading commissions, when they are set at a fixed price per share, can have an adverse impact on holders of lower-priced securities because the brokerage commissions generally represent a higher percentage of the sales prices of lower-priced securities than they do on higher-priced issues, which may discourage trading in such lower-priced securities. If the price of our shares is higher, then the adverse impact of these commissions could be reduced.

Finally, the Reverse Split may attract and retain employees who may be less likely to work for a company with a low stock price.

Following the approval of this Action, the Board will

effect the Reverse Split only upon the Board’s determination that the Reverse Split would be in the best interests of the Company and its stockholders at that time. The Board maintains the right to elect not to proceed with the Reverse Split if it determines, in its sole discretion, that the proposal is no longer in the best interests of the Company and its stockholders. If the Board were to effect the Reverse Split, the Board would set the timing for such a split. No further action on the part of stockholders will be required to either implement or abandon the Reverse Split. If the Board determines to implement the Reverse Split, we would communicate to the public, at or prior to the effective date of the Reverse Split, additional details regarding the Reverse Split.

Risks Associated with the Reverse Split

After the effective date of the Reverse Split, each stockholder will own fewer shares of our stock than prior to the Reverse Split. The number of authorized shares of capital stock (i.e., Common Stock and preferred stock), and the par value of such shares, will remain unchanged. The Reverse

Split, and a corresponding reverse split of the Series A Preferred Stock, would therefore result in an increase in the number of authorized and unissued shares of Common Stock and preferred stock, making additional shares available to the Company for issuance. The Board does not currently intend to seek stockholder approval prior to any issuance of shares of Common Stock, including those that would become available for issuance as a result of the Reverse Split, unless otherwise required by law or regulation.

The Company's stockholders will not realize any dilution in their ownership or voting rights as a

direct

result of the Reverse Split, but will most likely experience dilution when the Company issues shares of Common Stock in the future, including in the contemplated equity financing discussed below. Because our stockholders have no preemptive rights to purchase or subscribe for any of our unissued stock, the issuance of additional shares of Common Stock or preferred stock will, if such shares are issued at prices below what current stockholders paid for their shares, reduce stockholders’ equity per share and dilute the value of current stockholders’ shares. An

issuance of additional shares of our Common Stock could have an adverse effect on the potential realizable value of a stockholder’s investment.

The Company is currently negotiating a potential equity financing involving the issuance of shares of its Common Stock to an existing investor (the “

Potential Purchaser”) to fund the Company’s operating activities. The Potential Purchaser could also seek to acquire a portion of a second stockholder’s existing holdings in Common Stock. We cannot assure you that either or both of these contemplated transactions or any other financing transaction will in fact be successfully completed following the Reverse Split, or that they will be completed on terms currently contemplated or terms that are acceptable to the Company. If these transactions are in fact completed as contemplated under at least one scenario, they could provide the Potential Purchaser with ownership of the majority of the Company’s shares of Common Stock outstanding immediately after completion of such transactions, the majority in voting power of the Company’s capital stock then outstanding, and two Board seats.

The increase in authorized but

unissued shares of Common Stock as a result of the Reverse Split therefore enables the Board to issue shares of Common Stock to a holder who might thereby obtain control of the Company. The Potential Purchaser could therefore control business strategies and policies of the Company and the outcome of all corporate actions that require the approval of our stockholders, including the election of our directors, adoption of employee compensation plans and transactions involving a change of control. The Potential Purchaser could, for example, ensure that any proposal to effect certain business combinations or amendments to the Company's Certificate of Incorporation or Bylaws would not receive the required stockholder approval.

Stockholders should also note that the effect of the Reverse Split upon the market price for our Common Stock cannot be accurately predicted. In particular, we cannot assure you that prices for shares of our Common Stock after the Reverse Split will be five times the prices for shares of our Common Stock immediately prior to the Reverse Split. The market price of our Common Stock may also be affected by other factors which may be unrelated to the Reverse Split or the number of shares outstanding.

Furthermore, even if the market price of our Common Stock does rise following the Reverse Split, we cannot assure you that the market price of our Common Stock immediately after the proposed Reverse Split will be maintained for any period of time.

Even if an increased per-share price can be maintained, the Reverse Split may not achieve the desired results that have been outlined above. Moreover, because some investors may view the Reverse Split negatively, we cannot assure you that the Reverse Split will not adversely impact the market price of our Common Stock. Accordingly, our total market capitalization after the Reverse Split may be lower than the market capitalization before the Reverse Split.

There also can be no assurances that the Reverse Split would result in a per share price that would increase our ability to attract and retain employees.

If the Reverse Split is implemented, some stockholders may consequently own less than 100 shares of Common Stock. A purchase or sale of less than 100 shares (an “odd lot” transaction) may result in incrementally higher trading costs through certain brokers, particularly “full service” brokers. Therefore, those stockholders who own less than 100 shares following the Reverse Split may be required to pay higher transaction costs if they sell their shares in the Company.

Common and Preferred Stock

As discussed above, the Reverse Split

, and a corresponding reverse split of the Series A Preferred Stock, would result in an increase in the number of authorized and unissued shares of Common Stock and preferred stock.

All outstanding options and warrants to purchase shares of our Common Stock, including any held by our officers and directors, would also be adjusted as a result of the Reverse Split. In particular, the number of shares issuable upon the exercise of each warrant would be reduced, and the exercise price per share, if applicable, would be increased, in accordance with the terms of the warrant and based on the ratio of the Reverse Split. In addition, our Board has determined that the number of shares issuable upon the exercise of each option and the exercise price per share of each option, would be adjusted accordingly, as permitted by the terms of the options.

The below

tables outline the capital structure as described above and prior to and immediately following the proposed Reverse Split and a corresponding reverse split of the Series A Preferred Stock. The number of shares disclosed in the column “Number of shares of Common (or Preferred) Stock before Reverse Split” reflects the number of shares as of December 8, 2017. The number of shares disclosed in the column “Number of shares of Common (or Preferred) Stock after 1:5 Reverse Split” gives further effect to the Reverse Split and a corresponding reverse split of the Series A Preferred Stock but does not give effect to any other changes, including any issuance of securities after December 8, 2017. In addition, the number of shares after the Reverse Split shown in the tables below do not take into account the effect of rounding up at the level of each individual holder, and the actual number of shares after the Reverse Split may therefore be somewhat higher than shown below.

|

|

Number

of shares of Common

Stock

before Reverse Split

|

|

Number

of shares of Common

Stock

after 1:5

Reverse Split

|

|

Authorized

|

31,500,000

|

|

31,500,000

|

|

|

|

|

|

|

Issued and Outstanding

|

22,727,112

|

|

4,545,423

|

|

|

|

|

|

|

Reserved for Issuance

|

7,291,250

|

|

1,458,250

|

|

|

|

|

|

|

Authorized but Unissued

|

1,481,638

|

|

25,496,327

|

|

|

Number

of shares of Preferred

Stock

before Reverse Split

|

|

Number

of shares of Preferred

Stock

after 1:5

Reverse Split*

|

|

Authorized

|

1,000,000

|

|

1,000,000

|

|

|

|

|

|

|

Issued and Outstanding

|

29,038

|

|

5,808

|

|

|

|

|

|

|

Reserved for Issuance

|

-

|

|

-

|

|

|

|

|

|

|

Authorized but Unissued

|

970,962

|

|

994,192

|

* Aggregate liquidation preference of the Series A Preferred Stock will remain at its pre-reverse split amount of $29,038,000, and per-share liquidation preference will be increased proportionally.

Any additional shares of Common Stock and preferred stock that would become available for issuance following the Reverse Split, and a corresponding reverse split of the Series A Preferred Stock, could also be used by the Company

’s management to delay or prevent a change of control.

Anti-Takeover Effects of a Reverse Split

Release No. 34-15230 of the Staff of the Secur

ities and Exchange Commission requires disclosure and discussion of the effects of any action, including the proposals discussed herein, that may be used as an anti-takeover mechanism. The Amendment (and any corresponding amendment of the Certificate of Designations relating to the Series A Preferred Stock) will result in a relative increase in the number of authorized but unissued shares of our capital stock (i.e., Common Stock and preferred stock) vis-à-vis the outstanding shares of our capital stock and, could, under certain circumstances, have an anti-takeover effect, although this is not the purpose or intent of our Board. An increase in the relative number of authorized number of shares of capital stock could have other effects on our stockholders, depending upon the exact nature and circumstances of any actual issuances of authorized but unissued shares. An increase in our outstanding shares could potentially deter takeovers, in that additional shares could be issued (within the limits imposed by applicable law) in one or more transactions that could make a change of control or takeover more difficult. For example, we could issue additional shares so as to dilute the stock ownership or voting rights of persons seeking to obtain control without our agreement. Similarly, the issuance of additional shares to certain persons allied with our management could have the effect of making it more difficult to remove our current management by diluting the stock ownership or voting rights of persons seeking to cause such removal. The Reverse Split therefore may have the effect of discouraging unsolicited takeover attempts. By potentially discouraging initiation of any such unsolicited takeover attempts, the Reverse Split may limit the opportunity for our stockholders to dispose of their shares at the higher price generally available in takeover attempts or that may be available under a merger proposal.

As further detailed under “

Risks Associated with the Reverse Split

” above, t

he Company is currently negotiating a potential equity financing involving the issuance of shares of its Common Stock to an existing investor (the “

Potential Purchaser”) to fund the Company’s operating activities. The Potential Purchaser could also seek to acquire a portion of a second stockholder’s existing holdings in Common Stock. We cannot assure you that either or both of these contemplated transactions or any other financing transaction will in fact be successfully completed following the Reverse Split, or that they will be completed on terms currently contemplated or terms that are acceptable to the Company. If these transactions are in fact completed as contemplated under at least one scenario, they could provide the Potential Purchaser with ownership of the majority of the Company’s shares of Common Stock outstanding immediately after completion of such transactions, the majority in voting power of the Company’s capital stock then outstanding, and two Board seats. The Potential Purchaser could therefore control business strategies and policies of the Company and the outcome of all corporate actions that require the approval of our stockholders, including the election of our directors, adoption of employee compensation plans and transactions involving a change of control. The Potential Purchaser could, for example, ensure that any proposal to effect certain business combinations or amendments to the Company's Certificate of Incorporation or Bylaws would not receive the required stockholder approval.

Exchange of Shares

Upon the effectiveness of the Reverse Split, five shares of our Common Stock will automatically be changed into one share of Common Stock.

All holders of our Common Stock who hold their shares in certificated form or electronically in book-entry form with the transfer agent will be sent a statement to their respective address of record indicating the number of shares of Common Stock held in their respective accounts following the Reverse Split. No action needs to be taken by such stockholders to receive post-Reverse Split shares.

Holders of our Common Stock in certificated form will not be required to exchange their certificates representing shares of Common Stock held prior to the Reverse Split for new certificates representing shares of Common Stock. Therefore, it is not necessary for you to send us your stock certificates. If, however, a stockholder wishes to exchange such stockholder

’s certificates, the stockholder may do so by surrendering its certificate to the Company’s transfer agent with a request for a replacement certificate and the appropriate stock transfer fee.

Upon the Reverse Split, we intend to treat shares held by stockholders in “street name,” through a bank, broker or other nominee, in the same manner as registered stockholders whose shares are registered in their names. Banks, brokers or other nominees will be instructed to effect the Reverse Split for their beneficial holders holding our Common Stock in “street name.” However, these banks, brokers or other nominees may have different procedures than registered stockholders for processing the Reverse Split. If a stockholder holds shares of our Common Stock with a bank, broker or other nominee and has any questions in this regard, the stockholder is encouraged to contact their bank, broker or other nominee.

Fractional Shares

No fractional shares of our Common Stock will be issued as a result of the Reverse Split. In the event the proposed Reverse Split leaves a stockholder with a fraction of a share, the number of shares due to the stockholder will be rounded up. For example, if the proposed Reverse Split leaves an individual stockholder with one and one half shares, the stockholder will be issued, post proposed Reverse Split, two whole shares. If an individual stockholder would own less than one share, the stockholder will be issued, post proposed Reverse Split, one whole share. The shares of Series A Preferred Stock would be treated accordingly in a reverse split of those shares.

No Dissenters Rights

In connection with the approval of the Reverse Split, stockholders of the Company will not have a right to dissent and obtain payment for their shares under the Delaware General Corporation Law, the Certificate or the By-Laws.

Tax Consequences to Common Stockholders

The following discussion sets forth the material United States federal income tax consequences that management believes will apply with respect to the Company and the stockholders of the Company who are United States holders at the effective time of the Reverse Split. This discussion does not address the tax consequences of transactions effectuated prior to or after the Reverse Split, including, without limitation, the tax consequences of the exercise of options, warrants or similar rights to purchase stock. For this purpose, a United States holder is a stockholder that is: (i) a citizen or resident of the United States, (ii) a domestic corporation, (iii) an estate whose income is subject to United States federal income tax regardless of its source, or (iv) a trust if a United States court can exercise primary supervision over the trust

’s administration and one or more United States persons are authorized to control all substantial decisions of the trust. This discussion does not describe all of the tax consequences that may be relevant to a holder in light of his particular circumstances or to holders subject to special rules (such as dealers in securities, financial institutions, insurance companies, tax-exempt organizations, foreign individuals and entities and persons who acquired their Common Stock as compensation). In addition, this summary is limited to stockholders who hold their Common Stock as capital assets. This discussion also does not address any tax consequences arising under the laws of any state, local or foreign jurisdiction. Accordingly, each stockholder is strongly urged to consult with a tax adviser to determine the particular federal, state, local or foreign income or other tax consequences to such stockholder related to the Reverse Split.

In general, no gain or loss should be recognized by a stockholder upon his or her exchange of pre-Reverse Split shares for post-Reverse Split shares except for those associated with any additional shares the stockholder receives as a result of rounding up any post-Reverse Split fractional shares. The aggregate tax basis of the post-Reverse Split shares received in the Reverse Split should be the same as the stockholder

’s aggregate tax basis in the pre-Reverse Split shares. The stockholder’s holding period for the post-Reverse Split shares should include the period during which the stockholder held the pre-Reverse Split shares surrendered in the Reverse Split. As discussed above, no fractional shares of Common Stock will be issued as a result of the Reverse Split. Instead, if the Reverse Split leaves a stockholder with fractional shares, the number of shares due to the holder will be rounded up. The United States federal income tax consequences of the receipt of such additional fraction of a share of Common Stock are not clear, and each stockholder is strongly urged to consult with their own tax adviser.

Required Consent

Approval of the Action requires the receipt of the written consents of stockholders constituting the holders of a majority in voting power of the Company

’s outstanding capital stock as of the close of business on the Record Date.

Board Recommendation

The Board recommends that stockholders consent to the proposed

amendment to our Certificate of Incorporation to effect a reverse stock split.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Security Ownership of Certain Beneficial Owners

The following table sets forth information regarding the ownership of our Common Stock as of December 8

, 2017 by all those known by the Company to be beneficial owners of more than five percent of its voting securities, other than executive officers and directors of the Company (whose ownership is disclosed separately below). This table is prepared in reliance upon beneficial ownership statements filed by such stockholders with the SEC under Section 13(d) or 13(g) of the Exchange Act and/or the best information available to the Company.

|

Name of

Beneficial Owner

|

|

Beneficial

Ownership

(1)

|

|

|

Percent

of

Class

(1)

|

|

|

Charles E. Sheedy

|

|

|

11,189,677

|

(2)

|

|

|

43.7

|

%

|

|

Boyalife Investment Fund I, Inc.

|

|

|

6,650,000

|

(3)

|

|

|

27.2

|

%

|

|

(1)

|

Percentage ownership is based upon 22,727,112 shares of Common Stock issued and outstanding as of December 8

, 2017. For purposes of determining the amount and percentage of securities beneficially owned, share amounts include all voting stock owned outright, plus all shares of voting stock issuable upon the exercise of options or warrants exercisable as of the date above, or exercisable within 60 days after such date, in each case by such beneficial owner but not any other stockholders. In addition to the shares of Common Stock outstanding, 29,038 shares of Series A Preferred Stock are outstanding. Except with respect to the election of directors, holders of the Series A Preferred Stock are generally entitled to vote together with holders of Common Stock, with each share of Series A Preferred Stock corresponding to five votes. Consolidating the voting power of Common Stock and Series A Preferred Stock, the beneficial ownership percentages for Mr. Sheedy and Boyalife Investment Fund I, Inc. would be 43.4% and 27.0%, respectively. We believe that, except as otherwise noted below, each named beneficial owner has sole voting and investment power with respect to the shares listed.

|

|

|

|

|

(2)

|

Charles E. Sheedy

’s beneficial ownership includes 8,286,312 shares of Common Stock held by Charles E. Sheedy and 3,365 shares of Common Stock held in five separate trusts for the benefit of Mr. Sheedy’s children. It also includes 2,900,000 shares of Common Stock issuable upon exercise of warrants, which are exercisable at an exercise price of $0.50 per share. Mailing address for Mr. Sheedy is: Two Houston Center, Suite 2907, 909 Fannin Street, Houston, TX 77010.

|

|

|

|

|

(3)

|

Boyalife Investment Fund I, Inc.

’s beneficial ownership includes 1,750,000 shares of Common Stock issuable upon exercise of warrants, which are exercisable at an exercise price of $0.65 per share. As disclosed in its Schedule 13D/A filed on September 21, 2017, Boyalife’s President is Xiaochun Xu and its mailing address is: c/o Boyalife Group, Ltd, 2343 S. Archer Ave., Suite B, Chicago, IL 60616.

|

Security Ownership of Management

The following table sets forth information regarding the ownership of our Common Stock as of December 8

, 2017 by: (i) each director; (ii) each of the named executive officers; and (iii) all executive officers and directors of the Company as a group. This table is prepared in reliance upon beneficial ownership statements filed by such stockholders with the SEC under Section 13(d) or 13(g) of the Exchange Act and/or the best information available to the Company.

|

Name of Beneficial Owner

|

|

Beneficial

Ownership

(1)

|

|

|

Percent

of

Class

(1)

|

|

|

Paul D. Mintz, MD

|

|

|

18,750

|

(2)

|

|

|

*

|

|

|

|

|

|

|

|

|

|

|

|

|

Scott M. Pittman

|

|

|

4,105,800

|

(3)

|

|

|

17.2

|

%

|

|

|

|

|

|

|

|

|

|

|

|

David E. Jorden

|

|

|

719,8

36

|

(4)

|

|

|

3.1

|

%

|

|

|

|

|

|

|

|

|

|

|

|

Peter A. Clausen

|

|

|

84,675

|

(5)

|

|

|

*

|

|

|

|

|

|

|

|

|

|

|

|

|

C. Eric Winzer

|

|

|

65,000

|

(6)

|

|

|

*

|

|

|

|

|

|

|

|

|

|

|

|

|

Lawrence S. Atinsky

|

|

|

40,000

|

(7)

|

|

|

*

|

|

|

|

|

|

|

|

|

|

|

|

|

Group consisting of executive officers and directors (6 in total)

|

|

|

5,034,061

|

(8)

|

|

|

20.8

|

%

|

|

*

|

Less than 1%.

|

|

|

|

|

(1)

|

Percentage ownership is based upon 22,727,112 shares of Common Stock issued and outstanding as of December 8

, 2017. For purposes of determining the amount and percentage of securities beneficially owned, share amounts include all voting stock owned outright, plus all shares of voting stock issuable upon the exercise of options or warrants exercisable as of the date above, or exercisable within 60 days after such date, in each case by such beneficial owner but not any other stockholders. In addition to the shares of Common Stock outstanding, 29,038 shares of Series A Preferred Stock are outstanding. Except with respect to the election of directors, holders of the Series A Preferred Stock are generally entitled to vote together with holders of Common Stock, with each share of Series A Preferred Stock corresponding to five votes. Consolidating the voting power of Common Stock and Series A Preferred Stock, the beneficial ownership percentages for Messrs. Pittman and Jorden would be 17.1% and 3.1%, respectively, and the beneficial ownership percentage for all executive officers and directors as a group would be 20.7%. We believe that, except as otherwise noted below, each named beneficial owner has sole voting and investment power with respect to the shares listed. Unless otherwise indicated, the mailing address of all persons named in this table is: c/o Nuo Therapeutics, Inc., 207A Perry Parkway, Suite 1, Gaithersburg, MD 20877.

|

|

|

|

|

(2)

|

Independent Director of the Company.

Represents 18,750 shares Dr. Mintz may acquire upon the exercise of stock options under the Omnibus Plan (all of which are exercisable).

|

|

(3)

|

Independent director of the Company. Includes shares of Common Stock held in an IRA for the benefit of Mr. Pittman. Includes 1,130,000 shares of Common Stock issuable upon exercise of warrants (held directly and in an IRA for the benefit of Mr. Pittman), which are exercisable at exercise prices of $0.75 per share (with respect to 850,000 shares) and $0.50 per share (with respect to 280,000 shares). Also includes 40,000 shares Mr.

Pittman may acquire upon the exercise of stock options granted under the Omnibus Plan (all of which are exercisable).

|

|

|

|

|

(4)

|

Chief Executive and Chief Financial Officer of the Company. Includes 55,915 shares held in an IRA for the benefit of Mr. Jorden and 190 shares held in the name of Mr. Jorden

’s children, over which Mr. Jorden has or shares voting and dispositive power. Includes 162,500 shares Mr. Jorden may acquire upon the exercise of stock options granted under the Omnibus Plan (all of which are exercisable currently or within 60 days). In addition to such options to purchase 162,500 shares, which are solely subject to time vesting, Mr. Jorden received an option to purchase 100,000 shares subject to performance conditions, which is not reflected in the above table.

|

|

|

|

|

(5)

|

Chief Scientific Officer of the Company.

Includes 80,000 shares Dr. Clausen may acquire upon the exercise of stock options granted under the Omnibus Plan (all of which are exercisable currently or within 60 days). In addition to such options to purchase 80,000 shares, which are solely subject to time vesting, Dr. Clausen received an option to purchase 95,000 shares subject to performance conditions, which is not reflected in the above table.

|

|

(6)

|

Independent director of the Company. Includes 40,000 shares Mr.

Winzer may acquire upon the exercise of stock options granted under the Omnibus Plan (all of which are exercisable).

|

|

|

|

|

(7)

|

Independent director of the Company. Represents 40,000 shares Mr.

Atinsky may acquire upon the exercise of stock options granted under the Omnibus Plan (all of which are exercisable). Mr. Atinsky, a Partner at Deerfield Management Company, L.P., has no pecuniary interest in the securities reported herein and disclaims beneficial ownership of such securities.

|

|

|

|

|

(8)

|

Includes options to purchase an aggregate of 387,500 shares of Common Stock granted under the Omnibus Plan that are exercisable or will become exercisable within 60 days.

|

Other than as described below under “

Interest of Certain Persons in Matters

to be

Acted Upon

,” which description is incorporated herein by reference, there are no current arrangements, known to the Company, including any pledge by any person of securities of the Company, the operation of which may, at a subsequent date, result in a change of control of the Company.

INTEREST OF CERTAIN PERSONS IN

MATTERS

TO BE

ACTED UPON

Other than as described below, no

director, executive officer, nominee for election as a director, or associate of any director, executive officer or nominee has any substantial interest, direct or indirect, by security holdings or otherwise, resulting from the matters described herein, which is not shared by all other shareholders pro-rata, and in accordance with their respective interests. As further detailed under “

Risks Associated with the Reverse Split

” above, which detail is incorporated herein by reference, the Company is currently negotiating a potential equity financing involving the issuance of shares of its Common Stock to an existing investor (the “Potential Purchaser”) to fund the Company’s operating activities. The Potential Purchaser could also seek to acquire a portion of a second stockholder’s existing holdings in Common Stock. We cannot assure you that either or both of these contemplated transactions or any other financing transaction will in fact be successfully completed following the Reverse Split, or that they will be completed on terms currently contemplated or terms that are acceptable to the Company. If these transactions are in fact completed as contemplated under at least one scenario, they could provide the Potential Purchaser with ownership of the majority of the Company’s shares of Common Stock outstanding immediately after completion of such transactions, the majority in voting power of the Company’s capital stock then outstanding, and two Board seats. The Potential Purchaser and the second stockholder therefore have an incentive to vote for the Reverse Split.

HOUSEHOLDING

Owners of Common Stock who share a single address may receive only one copy of the Consent Solicitation Statement, unless the Company has received contrary instructions from one or more of such owners. This practice, known as “householding,

” is designed to reduce printing and mailing costs.

We undertake to deliver promptly upon written or oral request to us at the address or telephone number listed below a separate copy of such notice to a stockholder at a shared address to which a single copy of the notice was delivered. If multiple stockholders sharing an address have received one copy of the Consent Solicitation Statement and would prefer us to mail each stockholder a separate copy of future mailings, they may notify us at the address or telephone number listed below. Additionally, if current stockholders with a shared address wish to receive a separate copy of this Consent Solicitation Statement, or if the stockholder received multiple copies of this Consent Solicitation Statement and would prefer us to mail one copy of future mailings to stockholders at the shared address, notification of that request may also be made by mail or telephone call to our principal executive offices as follows: Corporate Secretary, Nuo Therapeutics, Inc., 207A Perry Parkway, Suite 1, Gaithersburg, MD 20877, or by telephone request at (240) 499-2680 or the email address set forth in the Consent Solicitation Statement.

WHERE YOU CAN FIND MORE INFORMATION

The Company files annual, quarterly and current reports and other information with the SEC. The Company

’s SEC filings are available to the public over the Internet at the SEC’s website at http://www.sec.gov. You may also read and copy any document the Company files with the SEC at its public reference room, located at 100 F Street, N.E., Washington, D.C. 20549. You may obtain information on the operation of the public reference room by calling the SEC at (800) SEC-0330.

FUTURE PROPOSALS OF STOCKHOLDERS

In order for proposals of stockholders and stockholder nominations for directors to be eligible for inclusion in our proxy materials relating to the Company

’s next annual meeting of stockholders pursuant to SEC Rule 14a-8, they must be submitted in writing to the Company’s Secretary and received by the Company at the Company’s executive offices a reasonable time before we begin to print and send the proxy materials for such annual meeting.

Notice to the Company of a stockholder proposal submitted outside of Rule 14a-8 will be considered timely under SEC Rule 14a-4(c) if received by the Company at its executive offices not later than the close of business on the 90th day nor earlier than the opening of business on the 120th day before the anniversary date of the immediately preceding annual meeting of stockholders; provided, however, that if the annual meeting is called for a date that is more than 30 days earlier or more than 60 days later than such anniversary date, notice by the stockholder to be timely must be so received not earlier than the opening of business on the 120th day before the meeting and not later than the later of (x) the close of business on the 90th day before the meeting or (y) the close of business on the 10th day following the day on which public announcement of the date of the annual meeting is first made by the Company.

All stockholder proposals for inclusion in the Company

’s proxy materials will be subject to the requirements of the proxy rules adopted under the Exchange Act and, as with any stockholder proposal (regardless of whether it is included in the Company’s proxy materials), the Company’s Certificate of Incorporation, By-Laws and Delaware law.

By Order of the Board of Directors,

_______________________________________

Chief Executive Officer and Chief Financial Officer

December

, 2017

ANNEX A

Certificate of Amendment

TO the

SECOND AMENDED AND RESTATED Certificate of Incorporation

of

NUO THERAPEUTICS, INC.

Nuo Therapeutics, Inc., a corporation organized and existing under the laws of the State of Delaware (the “

Corporation

”), DOES HEREBY CERTIFY AS FOLLOWS:

FIRST:

The Second Amended and Restated Certificate of Incorporation of the Corporation (the “

Certificate of Incorporation

”) was filed with the Secretary of State of the State of Delaware on May 5, 2016.

SECOND:

That the Board of Directors of the Corporation, by unanimous written consent, adopted the following amendment to the Certificate of Incorporation:

Section 4.1 of the Certificate of Incorporation is hereby amended and restated in its entirety as follows:

Section 4.1

Authorized Capital Stock.

The total number of shares of all classes of capital stock that the Corporation is authorized to issue is 32,500,000 shares, consisting of 31,500,000 shares of common stock, par value $0.0001 per share (the “

Common Stock

”), and 1,000,000 shares of preferred stock, par value $0.0001 per share (the “

Preferred Stock

”).

Upon the filing and effectiveness (the “

Effective Time

”) pursuant to the General Corporation Law of the State of Delaware of this Certificate of Amendment to the Second Amended and Restated Certificate of Incorporation of the Corporation, each five (5) shares of Common Stock issued and outstanding immediately prior to the Effective Time shall, automatically and without any action on the part of the respective holders thereof, be combined and converted into one (1) share of Common Stock (the “

Reverse Split

”). No fractional shares shall be issued in connection with the Reverse Split. In the event the Reverse Split leaves a stockholder with a fraction of a share, the number of shares due to such stockholder will be rounded up.

The Reverse Split shall occur whether or not the certificates representing such shares of Common Stock are surrendered to the Corporation or its transfer agent. The par value of each share of capital stock following the Reverse Split shall be as stated above in this Section 4.1.

THIRD:

That said amendment has been consented to and authorized by the Board of Directors of the Corporation and the holders of the necessary number of shares of the issued and outstanding stock of the corporation entitled to vote by written consent given in accordance with the provisions of Section 228 and 242 of the General Corporation Law of the State of Delaware.

FOURTH:

That the aforesaid amendments were duly adopted in accordance with the applicable provisions of Sections 228 and 242 of the General Corporation Law of the State of Delaware.

IN WITNESS WHEREOF,

Nuo Therapeutics, Inc. has caused this Certificate of Amendment to the Second Amended and Restated Certificate of Incorporation to be duly executed in its name and on its behalf by its Chief Executive Officer this [___] day of [_____], 2017.

|

|

Nuo Therapeutics, Inc.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

|

|

|

|

Name: David Jorden

|

|

|

|

|

Title: Chief Executive Officer

|

|

ANNEX B

ACTION BY WRITTEN CONSENT

OF THE STOCKHOLDERS OF

NUO THERAPEUTICS, INC.

This written consent is solicited by the Board of Directors of Nuo Therapeutics, Inc. Executed counterparts of this Action by Written Consent form delivered after the definitive Consent Solicitation Statement (as defined below) is sent to the stockholders but prior to the effective date of the Action by Written Consent shall not be revocable.

The undersigned stockholder of Nuo Therapeutics, Inc., a Delaware corporation (the “

Company

”), acknowledges receipt of the Notice of Consent Solicitation dated December , 2017 and Consent Solicitation Statement (collectively, the “

Consent Solicitation Statement

”) and hereby consents (by checking the FOR box) or withholds consent (by checking the AGAINST or ABSTAIN box) to the approval of an amendment to the Company’s Second Amended and Restated Certificate of Incorporation (the “

Certificate of Incorporation

”) as follows:

|

☐

CONSENT (FOR)

☐

CONSENT WITHHELD (AGAINST)

☐

ABSTAIN

|

RESOLVED

, that the Certificate of Incorporation be amended, for the purposes of effecting a reverse stock split of the Company’s Common Stock at a ratio of 1-for-5 (the “

Reverse Split

”), by amending and restating Section 4.1 of the Certificate of Incorporation in its entirety as follows:

Section 4.1

Authorized Capital Stock.

The total number of shares of all classes of capital stock that the Corporation is authorized to issue is 32,500,000 shares, consisting of 31,500,000 shares of common stock, par value $0.0001 per share (the “

Common Stock

”), and 1,000,000 shares of preferred stock, par value $0.0001 per share (the “

Preferred Stock

”).

Upon the filing and effectiveness (the “

Effective Time

”) pursuant to the General Corporation Law of the State of Delaware of this Certificate of Amendment to the Second Amended and Restated Certificate of Incorporation of the Corporation, each five (5) shares of Common Stock issued and outstanding immediately prior to the Effective Time shall, automatically and without any action on the part of the respective holders thereof, be combined and converted into one (1) share of Common Stock (the “

Reverse Split

”). No fractional shares shall be issued in connection with the Reverse Split. In the event the Reverse Split leaves a stockholder with a fraction of a share, the number of shares due to such stockholder will be rounded up.

The Reverse Split shall occur whether or not the certificates representing such shares of Common Stock are surrendered to the Corporation or its transfer agent. The par value of each share of capital stock following the Reverse Split shall be as stated above in this Section 4.1.

RESOLVED

, that the Board is authorized to determine, in its discretion, the timing of the Reverse Split, so long as the Reverse Split is effected at any time prior to March 31, 2018.

By signing and returning this Action by Written Consent, the undersigned stockholder will be deemed to have voted all shares of capital stock owned by the undersigned in the manner directed above with respect to the proposed amendment. If the undersigned stockholder signs and returns this consent but does not check a box, the undersigned will be deemed to have consented FOR approval of the proposed amendment.

Please execute this written consent as your name appears hereon. When shares are held by joint tenants, both should sign. When signing as attorney, executor, administrator, trustee or guardian, please give full title as such. If a corporation, please sign in full corporate name by the president or other authorized officer. If a partnership, please sign in partnership name by an authorized person.

|

|

|

|

Signature [Please sign within the box]

|

Date

|

|

|

|

|

Signature [Please sign within the box]

|

Date

|

B-2

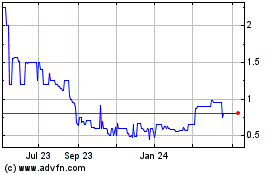

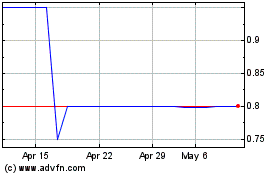

Nuo Therapeutics (QB) (USOTC:AURX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nuo Therapeutics (QB) (USOTC:AURX)

Historical Stock Chart

From Apr 2023 to Apr 2024