Page 9 of 31 Pages

|

|

|

|

|

|

|

|

|

1

|

|

NAMES OF

REPORTING PERSONS

Charles E. Gale Fidelity Rollover IRA

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (see instructions)

(a) ☐ (b) ☒

|

|

3

|

|

SEC USE ONLY

|

|

4

|

|

SOURCE OF FUNDS (see instructions)

OO

|

|

5

|

|

CHECK IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)

☐

|

|

6

|

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

Texas

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

|

7

|

|

SOLE VOTING POWER

0

|

|

|

8

|

|

SHARED VOTING POWER

342(a)

|

|

|

9

|

|

SOLE DISPOSITIVE POWER

0

|

|

|

10

|

|

SHARED DISPOSITIVE POWER

342(a)

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

342

|

|

12

|

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES (see instructions)

☐

|

|

13

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11)

0.002%

|

|

14

|

|

TYPE OF REPORTING PERSON (See

Instructions)

OO

|

|

(a)

|

Includes (i) 29 shares of Class A Common Stock and (ii) 313 shares of Class B Common Stock held in the Gale IRA for the benefit of Mr. Gale.

|

Page 10 of 31 Pages

|

|

|

|

|

|

|

|

|

1

|

|

NAMES OF

REPORTING PERSONS

Puffin Partners, L.P.

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (see instructions)

(a) ☐ (b) ☒

|

|

3

|

|

SEC USE ONLY

|

|

4

|

|

SOURCE OF FUNDS (see instructions)

WC

|

|

5

|

|

CHECK IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)

☐

|

|

6

|

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

Texas

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

|

7

|

|

SOLE VOTING POWER

0

|

|

|

8

|

|

SHARED VOTING POWER

811,546(a)

|

|

|

9

|

|

SOLE DISPOSITIVE POWER

0

|

|

|

10

|

|

SHARED DISPOSITIVE POWER

811,546(a)

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

811,546

|

|

12

|

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES (see instructions)

☐

|

|

13

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11)

4.4%

|

|

14

|

|

TYPE OF REPORTING PERSON (See

Instructions)

PN

|

|

(a)

|

Includes 811,546 shares of Class A Common Stock directly held by Puffin Partners, L.P.

|

Page 11 of 31 Pages

|

|

|

|

|

|

|

|

|

1

|

|

NAMES OF

REPORTING PERSONS

Puffin GP, LLC

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (see instructions)

(a) ☐ (b) ☒

|

|

3

|

|

SEC USE ONLY

|

|

4

|

|

SOURCE OF FUNDS (see instructions)

OO

|

|

5

|

|

CHECK IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)

☐

|

|

6

|

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

Texas

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

|

7

|

|

SOLE VOTING POWER

0

|

|

|

8

|

|

SHARED VOTING POWER

811,546(a)

|

|

|

9

|

|

SOLE DISPOSITIVE POWER

0

|

|

|

10

|

|

SHARED DISPOSITIVE POWER

811,546(a)

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

811,546

|

|

12

|

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES (see instructions)

☐

|

|

13

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11)

4.4%

|

|

14

|

|

TYPE OF REPORTING PERSON (See

Instructions)

OO

|

|

(a)

|

Includes 811,546 shares of Class A Common Stock held by Puffin Partners that Puffin GP is deemed to beneficially own as the general partner of Puffin Partners.

|

Page 12 of 31 Pages

|

|

|

|

|

|

|

|

|

1

|

|

NAMES OF

REPORTING PERSONS

Montrose Investments I, L.P.

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (see instructions)

(a) ☐ (b) ☒

|

|

3

|

|

SEC USE ONLY

|

|

4

|

|

SOURCE OF FUNDS (see instructions)

WC

|

|

5

|

|

CHECK IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)

☐

|

|

6

|

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

Texas

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

|

7

|

|

SOLE VOTING POWER

0

|

|

|

8

|

|

SHARED VOTING POWER

180,909(a)

|

|

|

9

|

|

SOLE DISPOSITIVE POWER

0

|

|

|

10

|

|

SHARED DISPOSITIVE POWER

180,909(a)

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

180,909

|

|

12

|

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES (see instructions)

☐

|

|

13

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11)

1.0%

|

|

14

|

|

TYPE OF REPORTING PERSON (See

Instructions)

PN

|

|

(a)

|

Includes 180,909 shares of Class A Common Stock directly held by Montrose LP.

|

Page 13 of 31 Pages

|

|

|

|

|

|

|

|

|

1

|

|

NAMES OF

REPORTING PERSONS

Montrose Investments GP, LLC

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (see instructions)

(a) ☐ (b) ☒

|

|

3

|

|

SEC USE ONLY

|

|

4

|

|

SOURCE OF FUNDS (see instructions)

OO

|

|

5

|

|

CHECK IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)

☐

|

|

6

|

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

Texas

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

|

7

|

|

SOLE VOTING POWER

0

|

|

|

8

|

|

SHARED VOTING POWER

180,909(a)

|

|

|

9

|

|

SOLE DISPOSITIVE POWER

0

|

|

|

10

|

|

SHARED DISPOSITIVE POWER

180,909(a)

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

180,909

|

|

12

|

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES (see instructions)

☐

|

|

13

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11)

1.0%

|

|

14

|

|

TYPE OF REPORTING PERSON (See

Instructions)

OO

|

|

(a)

|

Includes 180,909 shares of Class A Common Stock held by Montrose LP, which Montrose GP is deemed to beneficially own as the general partner of Montrose LP.

|

Page 14 of 31 Pages

This Amendment No. 7 to Schedule 13D (this “Amendment”) relates to the

Class A common stock, par value $0.001 per share (the “Class A Common Stock”), of Reata Pharmaceuticals, Inc., a Delaware corporation (the “Issuer”) and amends and supplements the statement on Schedule 13D originally

filed by Mr. Rose on June 6, 2016, as amended by that certain Amendment No. 1 to Schedule 13D filed on August 19, 2016, as amended by that certain Amendment No. 2 to Schedule 13D filed on December 7, 2016, as amended by

that certain Amendment No. 3 to Schedule 13D filed on January 3, 2017, as amended by that certain Amendment No. 4 to Schedule 13D filed on March 3, 2017, as amended by that certain Amendment No. 5 to Schedule 13D filed on

July 12, 2017, as amended by that certain Amendment No. 6 to Schedule 13D filed on August 2, 2017 (as amended, the “Prior Schedule 13D”). Except as otherwise specified in this Amendment, all items left blank remain unchanged

in all material respects and any items that are reported are deemed to amend and restate the corresponding items in the Prior Schedule 13D. Unless otherwise indicated, all capitalized terms used herein but not defined herein shall have the same

meanings ascribed to them in the Prior Schedule 13D.

ITEM 4. PURPOSE OF TRANSACTION.

Item 4 of the Prior Schedule 13D is hereby amended and supplemented by adding the following:

On December 7, 2017, the Estate partitioned community property and pursuant to such partition 67,735 shares of Class A Common Stock

and 1,877,998 shares of Class B Common Stock were transferred to the Survivor’s Trust. The Estate no longer owns any shares of Class A Common Stock or Class B Common Stock and, acorrdingly, has ceased to be part of this

stockholder group.

ITEM 5. INTEREST IN SECURITIES OF ISSUER.

Item 5 of the Prior Schedule 13D is hereby amended and restated as follows:

The information set forth in Item 2, Item 3 and Item 6 is hereby incorporated by reference in its entirety.

|

|

|

|

|

(a)

|

|

(1) Mr. Rose may be deemed to beneficially own 1,242,037 shares of Class A Common Stock, representing approximately 6.6% of the outstanding shares of Class A Common Stock.

|

|

|

|

|

|

|

(2) The Survivor Trust may be deemed to beneficially own 1,945,733 shares of Class A Common Stock, representing approximately 9.5% of the outstanding shares of Class A Common Stock.

|

|

|

|

|

|

|

(3) Mrs. Rose may be deemed to beneficially own 2,041,395 shares of Class A Common Stock, representing approximately 9.9% of the outstanding shares of Class A Common Stock.

|

|

|

|

|

|

|

(4) The Rose IRA may be deemed to beneficially own 95,662 shares of Class A Common Stock, representing approximately 0.5% of the outstanding shares of Class A Common Stock.

|

|

|

|

|

|

|

(5) The 2001 Trust may be deemed to beneficially own 235 shares of Class A Common Stock, representing approximately 0.001% of the outstanding shares of Class A Common Stock.

|

Page 15 of 31 Pages

(6) The 2002 Trust may be deemed to beneficially own 537 shares of Class A Common Stock,

representing approximately 0.003% of the outstanding shares of Class A Common Stock.

(7) Mr. Gale may be deemed to beneficially

own 2,787,007 shares of Class A Common Stock, representing approximately 13.6% of the outstanding shares of Class A Common Stock.

(8) The Gale IRA may be deemed to beneficially own 342 shares of Class A Common Stock, representing approximately 0.002% of the

outstanding shares of Class A Common Stock.

(9) Puffin Partners may be deemed to beneficially own 811,546 shares of Class A

Common Stock, representing approximately 4.4% of the outstanding shares of Class A Common Stock.

(10) Puffin GP may be deemed to

beneficially own 811,546 shares of Class A Common Stock, representing approximately 4.4% of the outstanding shares of Class A Common Stock.

(11) Montrose LP may be deemed to beneficially own 180,909 shares of Class A Common Stock, representing approximately 1.0% of the

outstanding shares of Class A Common Stock.

(12) Montrose GP may be deemed to beneficially own 180,909 share of Class A Common

Stock, representing approximately 1.0% of the outstanding shares of Class A Common Stock.

(b) (1) Mr. Rose may be deemed to

have sole voting power with respect to 150,916 shares of common stock (comprised of 11,618 shares of Class A Common Stock and 129,308 shares of Class B Common Stock and 12,222 shares of Class B common stock issuable pursuant to stock

options exercisable within 60 days of the date hereof), shared voting power with respect to 993,227 shares of common stock (comprised of 992,520 shares of Class A Common Stock and 707 shares of Class B Common Stock), sole dispositive power

with respect to 150,916 shares of common stock (comprised of 11,618 shares of Class A Common Stock and 129,308 shares of Class B Common Stock and 12,222 shares of Class B common stock issuable pursuant to stock options exercisable

within 60 days of the date hereof), and shared dispositive power with respect to 993,227 shares of common stock (comprised of 992,520 shares of Class A Common Stock and 707 shares of Class B Common Stock).

(2) The Survivor Trust may be deemed to have sole voting power with respect to 0 shares of common stock, shared voting power with respect to

1,945,733 shares of common stock (comprised of 67,735 shares of Class A Common Stock and 1,877,998 shares of Class B Common Stock), sole dispositive power with respect to 0 shares of common stock, and shared dispositive power with respect

to 1,945,733 shares of common stock (comprised of 67,735 shares of Class A Common Stock and 1,877,998 shares of Class B Common Stock).

(3) Mrs. Rose may be deemed to have sole voting power with respect to 0 shares of common stock, shared voting power with respect to 95,662

shares of common stock (comprised of 7,886 shares of Class A Common Stock and 87,776 shares of Class B Common Stock), sole dispositive power with respect to 0 shares of common stock, and shared dispositive power with respect to 95,662

shares of common stock (comprised of 7,886 shares of Class A Common Stock and 87,776 shares of Class B Common Stock).

Page 16 of 31 Pages

(4) The Rose IRA may be deemed to have sole voting power with respect to 0 shares of common

stock, shared voting power with respect to 95,662 shares of common stock (comprised of 7,886 shares of Class A Common Stock and 87,776 shares of Class B Common Stock), sole dispositive power with respect to 0 shares of common stock, and

shared dispositive power with respect to 95,662 shares of common stock (comprised 7,886 shares of Class A Common Stock and 87,776 shares of Class B Common Stock).

(5) The 2001 Trust may be deemed to have sole voting power with respect to 0 shares of common stock, shared voting power with respect to 235

shares of common stock (comprised of 20 shares of Class A Common Stock and 215 shares of Class B Common Stock), sole dispositive power with respect to 0 shares of common stock, and shared dispositive power with respect to 235 shares of

common stock (comprised of 20 shares of Class A Common Stock and 215 shares of Class B Common Stock).

(6) The 2002 Trust may be

deemed to have sole voting power with respect to 0 shares of common stock, shared voting power with respect to 537 shares of common stock (comprised of 45 of Class A Common Stock and 492 shares of Class B Common Stock), sole dispositive

power with respect to 0 shares of common stock, and shared voting power with respect to 537 shares of common stock (comprised of 45 shares of Class A Common Stock and 492 shares of Class B Common Stock).

(7) Mr. Gale may be deemed to have sole voting power with respect to 29,386 shares of common stock (comprised of 13,517 shares of

Class A Common Stock and 15,869 shares of Class B Common Stock), shared voting power with respect to 2,757,621 shares of common stock (comprised of 879,310 shares of Class A Common Stock and 1,878,311 shares of Class B Common

Stock), sole dispositive power with respect to 29,386 shares of common stock (comprised of 13,517 shares of Class A Common Stock and 15,869 shares of Class B Common Stock), and shared dispositive power with respect to 2,757,621 shares of

common stock (comprised of 879,310 shares of Class A Common Stock and 1,878,311 shares of Class B Common Stock).

(8) The Gale

IRA may be deemed to have sole voting power with respect to 0 shares of common stock, shared voting power with respect to 342 shares of common stock (comprised of 29 shares of Class A Common Stock and 313 shares of Class B Common Stock),

sole dispositive power with respect to 0 shares of common stock, and shared dispositive power with respect to 342 shares of common stock (comprised of 29 shares of Class A Common Stock and 313 shares of Class B Common Stock).

(9) Puffin Partners may be deemed to have sole voting power with respect to 0 shares of common stock, shared voting power with respect to

811,546 shares of common stock (comprised of 811,546 shares of Class A Common Stock), sole dispositive power with respect to 0 shares of common stock, and shared dispositive power with respect to 811,546 shares of common stock (comprised of

811,546 shares of Class A Common Stock).

(10) Puffin GP may be deemed to have sole voting power with respect to 0 shares of common

stock, shared voting power with respect to 811,546 shares of common stock (comprised of 811,546 shares of Class A Common Stock), sole dispositive power with respect to 0 shares of common stock, and shared dispositive power with respect to

811,546 shares of common stock (comprised of 811,546 shares of Class A Common Stock).

Page 17 of 31 Pages

(11) Montrose LP may be deemed to have sole voting power with respect to 0 shares of common

stock, shared voting power with respect to 180,909 shares of common stock (comprised of 180,909 shares of Class A Common Stock), sole dispositive power with respect to 0 shares of common stock, and shared dispositive power with respect to

180,909 shares of common stock (comprised of 180,909 shares of Class A Common Stock).

(12) Montrose GP may be deemed to have sole

voting power with respect to 0 shares of common stock, shared voting power with respect to 180,909 shares of common stock (comprised of 180,909 shares of Class A Common Stock), sole dispositive power with respect to 0 shares of common stock,

and shared dispositive power with respect to 180,909 shares of common stock (comprised of 180,909 shares of Class A Common Stock).

(c) The information provided in Item 4 above is hereby incorporated herein by reference.

(d) The right to receive dividends from, and proceeds from the sale of, the shares of Class A Common Stock and Class B Common Stock

held of record and/or beneficially owned by Puffin Partners, Puffin GP, Montrose LP, and Montrose GP is governed by their respective limited partnership agreements and limited liability regulations, as applicable, of each of such entities, and such

dividends or proceeds may be distributed with respect to numerous general and limited partnership or membership interests.

(e) Not

applicable.

ITEM 6. CONTRACTS, ARRANGEMENTS, UNDERSTANDINGS OR RELATIONSHIPS WITH RESPECT TO SECURITIES OF THE ISSUER.

Item 6 of the Prior Schedule 13D is hereby amended and supplemented by adding the following:

Page 18 of 31 Pages

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

complete and correct.

|

|

|

|

|

|

|

|

|

Date: December 7, 2017

|

|

|

|

/s/ Charles E. Gale,

Attorney-In-Fact

|

|

|

|

|

|

William E. Rose

|

Page 19 of 31 Pages

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

complete and correct.

|

|

|

|

|

|

|

|

|

Date: December 7, 2017

|

|

|

|

/s/ Charles E. Gale,

Attorney-In-Fact

|

|

|

|

|

|

Evelyn P. Rose

|

Page 20 of 31 Pages

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

complete and correct.

|

|

|

|

|

|

|

|

|

Date: December 7, 2017

|

|

|

|

/s/ Charles E. Gale,

Attorney-In-Fact

|

|

|

|

|

|

Estate of Edward W. Rose III

|

Page 21 of 31 Pages

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

complete and correct.

|

|

|

|

|

|

|

|

|

Date: December 7, 2017

|

|

|

|

EVELYN P. ROSE SEP IRA

|

|

|

|

|

|

|

|

|

|

/s/ Charles E. Gale, Attorney-in-Fact

|

|

|

|

|

|

Evelyn P. Rose

|

Page 22 of 31 Pages

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

complete and correct.

|

|

|

|

|

|

|

|

|

Date: December 7, 2017

|

|

|

|

EVELYN POTTER ROSE SURVIVOR’S TRUST

|

|

|

|

|

|

|

|

|

|

/s/ Charles E. Gale

|

|

|

|

|

|

Charles E. Gale

|

|

|

|

|

|

Co-Trustee

|

Page 23 of 31 Pages

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

complete and correct.

|

|

|

|

|

|

|

|

|

Date: December 7, 2017

|

|

|

|

CHARLES HENRY ROSE 2001 TRUST

|

|

|

|

|

|

|

|

|

|

/s/ Charles E. Gale,

Attorney-In-Fact

|

|

|

|

|

|

William E. Rose

|

|

|

|

|

|

Co-Trustee

|

Page 24 of 31 Pages

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

complete and correct.

|

|

|

|

|

|

|

|

|

Date: December 7, 2017

|

|

|

|

JOHN WILLIAM ROSE 2002 TRUST

|

|

|

|

|

|

|

|

|

|

/s/ Charles E. Gale,

Attorney-In-Fact

|

|

|

|

|

|

William E. Rose

|

|

|

|

|

|

Co-Trustee

|

Page 25 of 31 Pages

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

complete and correct.

|

|

|

|

|

|

|

|

|

Date: December 7, 2017

|

|

|

|

|

|

|

|

|

|

/s/ Charles E. Gale

|

|

|

|

|

|

Charles E. Gale

|

Page 26 of 31 Pages

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

complete and correct.

|

|

|

|

|

|

|

|

|

Date: December 7, 2017

|

|

|

|

CHARLES E. GALE FIDELITY ROLLOVER IRA

|

|

|

|

|

|

|

|

|

|

/s/ Charles E. Gale

|

|

|

|

|

|

Charles E. Gale

|

Page 27 of 31 Pages

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

complete and correct.

|

|

|

|

|

|

|

|

|

Date: December 7, 2017

|

|

|

|

PUFFIN PARTNERS, L.P.

|

|

|

|

|

|

By: PUFFIN GP, LLC

|

|

|

|

|

|

|

|

|

|

/s/ Charles E. Gale

|

|

|

|

|

|

Charles E. Gale

|

|

|

|

|

|

Co-Manager

|

Page 28 of 31 Pages

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

complete and correct.

|

|

|

|

|

|

|

|

|

Date: December 7, 2017

|

|

|

|

PUFFIN GP, LLC

|

|

|

|

|

|

|

|

|

|

/s/ Charles E. Gale

|

|

|

|

|

|

Charles E. Gale

|

|

|

|

|

|

Co-Manager

|

|

|

|

|

|

|

|

|

Page 29 of 31 Pages

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

complete and correct.

|

|

|

|

|

|

|

|

|

Date: December 7, 2017

|

|

|

|

MONTROSE INVESTMENTS I, L.P.

|

|

|

|

|

|

By: MONTROSE INVESTMENTS GP, LLC

|

|

|

|

|

|

|

|

|

|

/s/ Charles E. Gale,

Attorney-In-Fact

|

|

|

|

|

|

William E. Rose

|

|

|

|

|

|

Sole Member

|

Page 30 of 31 Pages

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

complete and correct.

|

|

|

|

|

|

|

|

|

Date: December 7, 2017

|

|

|

|

MONTROSE INVESTMENTS GP, LLC

|

|

|

|

|

|

|

|

|

|

/s/ Charles E. Gale,

Attorney-In-Fact

|

|

|

|

|

|

William E. Rose

|

|

|

|

|

|

Sole Member

|

Page 31 of 31 Pages

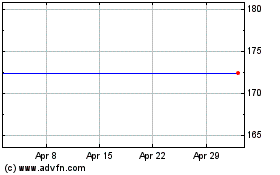

Reata Pharmaceuticals (NASDAQ:RETA)

Historical Stock Chart

From Mar 2024 to Apr 2024

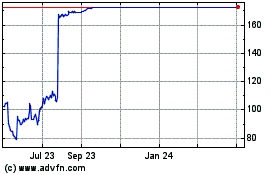

Reata Pharmaceuticals (NASDAQ:RETA)

Historical Stock Chart

From Apr 2023 to Apr 2024