Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

December 05 2017 - 5:06PM

Edgar (US Regulatory)

ISSUER FREE WRITING PROSPECTUS

(RELATING TO PRELIMINARY PROSPECTUS SUPPLEMENT

DATED DECEMBER 4, 2017)

FILED

PURSUANT TO RULE 433

REGISTRATION NUMBER 333-221380

Equinix, Inc.

This

Final Term Sheet is qualified in its entirety by reference to the Preliminary Prospectus Supplement. The information in this Final Term Sheet supplements the Preliminary Prospectus Supplement and supersedes the information in the Preliminary

Prospectus Supplement to the extent inconsistent with the information in the Preliminary Prospectus Supplement. Capitalized terms used herein without definition shall have the meanings ascribed thereto in the Preliminary Prospectus Supplement.

Note that the terms reflected below are a modification from the terms included in the Preliminary Prospectus Supplement previously distributed, including

changes to maturity and redemption terms.

|

|

|

|

|

2.875% Senior Notes due 2026

|

|

|

|

|

|

|

Issuer:

|

|

Equinix, Inc. (“

Equinix

” or the “

Issuer

”)

|

|

|

|

|

Securities:

|

|

2.875% Senior Notes due 2026 (the “

notes

”)

|

|

|

|

|

Principal Amount:

|

|

€1,000,000,000

|

|

|

|

|

Coupon (Interest Rate):

|

|

2.875% per annum

|

|

|

|

|

Yield:

|

|

2.875%

|

|

|

|

|

Spread to Benchmark Treasury:

|

|

+278 bps

|

|

|

|

|

Benchmark Treasury:

|

|

DBR 0.500% due February 15, 2026

|

|

|

|

|

Scheduled Maturity Date:

|

|

February 1, 2026

|

|

|

|

|

Public Offering Price:

|

|

100.000% plus accrued interest, if any, from December 12, 2017.

|

|

|

|

|

Gross Proceeds:

|

|

€1,000,000,000

|

|

|

|

Net Proceeds to Issuer before

Estimated Expenses:

|

|

€989,000,000

|

|

|

|

|

Payment Dates:

|

|

February 1 and August 1 of each year, commencing on August 1, 2018.

|

|

|

|

|

Record Dates:

|

|

January 15 and July 15 of each year.

|

|

|

|

|

Optional Redemption:

|

|

At any time prior to February 1, 2021, the Issuer may on any one or more occasions redeem up to 35% of the aggregate principal amount of the notes (calculated giving effect to any issuance of Additional Notes) outstanding under the

Supplemental

|

|

|

|

|

|

|

|

Indenture, at a redemption price equal to 102.875% of the principal amount of the notes to be redeemed, plus accrued and unpaid interest to, but not including, the redemption date, with the net cash proceeds of one or more Equity

Offerings;

provided

that:

|

|

|

(1)

|

at least 65% of the aggregate principal amount of the notes (calculated giving effect to any issuance of Additional Notes) issued under the Supplemental Indenture remains outstanding immediately after the occurrence of

such redemption (excluding notes held by the Issuer and its subsidiaries); and

|

|

|

(2)

|

the redemption must occur within 90 days of the date of the closing of such Equity Offering.

|

|

|

|

|

|

|

|

|

|

|

On or after February 1, 2021, the Issuer may redeem all or a part of

the notes, on any one or more occasions, at the redemption prices (expressed as percentages of principal amount) set forth below plus accrued and unpaid interest thereon, if any, to, but not including, the applicable redemption date, if redeemed

during the twelve-month period beginning on February 1 of each of the years indicated below:

|

|

|

|

|

|

Year

|

|

Redemption

price of the notes

|

|

2021

|

|

101.438%

|

|

2022

|

|

100.719%

|

|

2023 and thereafter

|

|

100.000%

|

|

|

|

|

|

|

|

|

|

|

At any time prior to February 1, 2021, the Issuer may also redeem all or a part of the notes at a redemption price equal to 100% of the principal amount of the notes to be redeemed plus the Applicable Premium as of, and accrued

and unpaid interest, if any, to, but not including, the date of redemption (the “

Redemption Date

”), subject to the rights of holders of record of notes on the relevant record date to receive interest due on the relevant interest

payment date.

|

|

|

|

|

|

|

“

Applicable Premium

” means, with respect to any note on any Redemption Date, the greater of:

|

|

|

(1)

|

1.0% of the principal amount of the note; and

|

|

|

|

|

|

|

|

|

|

|

(a) the present value at such Redemption Date of (i) the redemption price of the note at February 1, 2021 (such

redemption price being set forth in the table appearing above under the caption “—Redemption”), plus (ii) all required interest payments due on the note through February 1, 2021 (excluding accrued but unpaid interest, if any, to, but

not including, the Redemption Date), computed using a discount rate equal to the Bund Rate as of such Redemption Date plus 50 basis points; over

|

-2-

|

|

|

|

|

|

|

|

|

|

(b) the principal amount of the note, if greater.

Neither the Trustee nor any paying agent shall have any obligation to calculate or

verify the calculation of the Applicable Premium.

|

|

|

|

|

|

|

“

Bund Rate

” means, with respect to any relevant date, the greater of (1) 0.0% and (2) the rate per annum equal to the equivalent yield to maturity as of such date of the Comparable German Bund Issue, assuming a

price for the Comparable German Bund Issue (expressed as a percentage of its principal amount) equal to the Comparable German Bund Price for such relevant date.

|

|

|

|

|

Redemption Upon a Tax Event:

|

|

In the event of certain developments affecting taxation, the notes may be redeemed in whole, but not in part, at any time at the option of Equinix, at a redemption price equal to 100% of the principal amount of the notes being

redeemed, plus accrued and unpaid interest to, but excluding, the redemption date, and any Additional Amounts then due and which will become due on the notes on the redemption date, subject to the rights of holders of record of notes on the relevant

record date to receive interest due on the relevant interest payment date and Additional Amounts, if any, in respect thereof.

|

|

|

|

|

Common Code:

|

|

173432879

|

|

|

|

|

ISIN:

|

|

XS1734328799

|

|

|

|

|

Distribution:

|

|

SEC Registered (Registration No. 333-221380)

|

|

|

|

|

Listing:

|

|

Equinix will apply, following the completion of this offering, to have the notes listed on The International Stock Exchange (the “

Exchange

”) and admitted for trading on the Official List of the Exchange on or prior

to the first interest payment date. However, no assurance can be given that the notes will become or will remain listed. If such listing is obtained, Equinix has no obligation to maintain such listing, and Equinix may delist the notes at any

time.

|

|

|

|

|

Trade Date:

|

|

December 5, 2017

|

|

|

|

|

Settlement Date:

|

|

It is expected that delivery of the notes will be made against payment therefor on or about December 12, 2017, which is the fifth business day following the date of pricing of the notes (such settlement cycle being referred to as

“T+5”). Under Rule 15c6-1 under the Securities Exchange Act of 1934, as amended, trades in the secondary market generally are required to settle in two business days unless the parties to any such trade expressly agree otherwise.

Accordingly, purchasers who wish to trade the notes on the date of pricing or the next succeeding two business days will be required, by virtue of the fact that the notes initially will settle in T+5, to specify an alternative settlement cycle at

the time of any such trade to prevent failed settlement and should consult their own advisors.

|

-3-

|

|

|

|

|

|

|

|

Use of Proceeds:

|

|

As set forth in the Preliminary Prospectus Supplement.

|

|

|

|

|

Joint Book-Running Managers:

|

|

Merrill Lynch International

Citigroup Global

Markets Inc.

J.P. Morgan Securities plc

MUFG Securities EMEA

plc

RBC Europe Limited

|

|

|

|

|

Co-Managers:

|

|

Barclays Bank plc

Goldman Sachs & Co.

LLC

HSBC Securities (USA) Inc.

ING Bank N.V., London

Branch

TD Securities (USA) LLC

Wells Fargo Securities

International Limited

BNP Paribas

Mizuho International

plc

Morgan Stanley & Co. LLC

PNC Capital Markets LLC

Scotiabank Europe plc

SMBC Nikko Capital Markets Limited

U.S. Bancorp Investments, Inc.

|

The Issuer has filed a registration statement (including a prospectus) and a preliminary prospectus supplement with the SEC

for the offering to which this communication relates. Before you invest, you should read the preliminary prospectus supplement and the accompanying prospectus and other documents the Issuer has filed with the SEC for more complete information about

the Issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, copies of the preliminary prospectus supplement and accompanying prospectus and, when available, the final

prospectus supplement relating to this offering may be obtained from Merrill Lynch International, 2 King Edward Street, London EC1A 1HQ, Attention: High Yield Syndicate Desk, or by calling +44-(0)20-7995-1999, or Citigroup Global Markets Inc., 388

Greenwich Street, New York, NY, Attention: High Yield Syndicate Desk, or by calling

1-800-831-9146,

or J.P. Morgan Securities

LLC, c/o Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood, NY 11717, Attention Prospectus Department, or by calling 1-866-803-9204, or MUFG Securities EMEA plc, 25 Ropemaker Street, London EC2Y 9AJ, Attention: Syndicate, or by

calling +44-(0)20-7577-2218, or RBC Europe Limited, Riverbank House, 2 Swan Lane, London EC4R 3BF, Attention New Issues Syndicate Desk, or by calling + 44-(0)20-7029-7031.

ANY DISCLAIMERS OR OTHER NOTICES THAT MAY APPEAR BELOW ARE NOT APPLICABLE TO THIS COMMUNICATION AND SHOULD BE DISREGARDED. SUCH DISCLAIMERS OR OTHER

NOTICES WERE AUTOMATICALLY GENERATED AS A RESULT OF THIS COMMUNICATION BEING SENT VIA BLOOMBERG OR ANOTHER EMAIL SYSTEM.

-4-

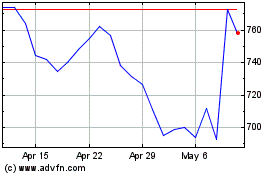

Equinix (NASDAQ:EQIX)

Historical Stock Chart

From Mar 2024 to Apr 2024

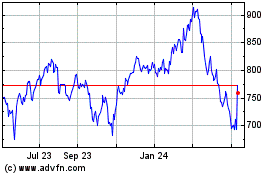

Equinix (NASDAQ:EQIX)

Historical Stock Chart

From Apr 2023 to Apr 2024