Southern Properties Capital, Transcontinental Realty Investors & Regis Property Management Signed Over Four Hundred Thousand ...

October 30 2017 - 8:00AM

Business Wire

Regis Property Management LLC leased over four hundred thousand

square feet so far for 2017. These leases were achieved with new

and renewing tenants representing over $32 million in gross

effective rent.

This press release features multimedia. View

the full release here:

http://www.businesswire.com/news/home/20171030005043/en/

Browning Place office complex at Mercer

Crossing in Dallas, Texas (Photo: Business Wire)

Regis’s most significant transaction was in Southern Properties

Capital asset Browning Place, located in the Mercer Crossing mixed

use development. Pacific Union Financial expanded into new space

increasing their footprint by over 132,000 square feet. Pacific

Union is a full-service mortgage company, located in Irving, Texas,

with fulfillment centers in Texas, California, Virginia, and North

Carolina and more than 40 branch locations across the country.

Pioneer RX, an industry leading pharmacy software development

and support company, also expanded their current lease to include

the entire 20,000 square foot top floor of Southern Properties

Capital asset 600 Las Colinas. Both deals were brokered by

Transwestern and Jones Lang LaSalle. Other new and renewed tenants

include Liberty Bankers Life Insurance Company, PBK Architects, CHC

Helicopter Services, and NTT Data Consulting.

Scott Porter, President of Regis Property Management, commented,

“Regis staff, Transwestern, and JLL continue to work together to

create successful leasing strategies for Regis’s commercial

portfolio. We’re looking forward to an even busier 2018 and

watching Mercer Crossing continue to grow right outside our

windows.”

Browning Place office community located at Lyndon B. Johnson

Freeway and Luna Road in Northwest Dallas is an office complex with

tree-lined boulevards forming the entrance. Browning Place consists

of four office buildings with a total of 627,560 square feet with

amenities that include a restaurant, bank, on-site Management, 24/7

courtesy officer and jogging trail.

Mercer Crossing is a mixed use development that will include

office, single family and multifamily residential, hotel, and

retail. There are currently several Class A apartment communities

in the area and construction is already under way east of Luna Road

for the master planned Ashington, Brighton, and Coventry

Communities. Verwood, Windemere, and Amesbury communities will soon

follow. Mercer South will also include a 200 room hotel with a

restaurant row and boardwalk, trails and parks, retail, and

grocery. Builders currently under contract include Beazer Homes,

M/I Homes, W3 Luxury Living, Oakdale Homes, Megatel Homes, Sienna

Homes, and First Texas Homes.

Southern Properties Capital LTD, a British Virgin Islands

corporation (“Southern”) is an indirect subsidiary

of Transcontinental Realty Investors Inc., (NYSE: TCI), a

Dallas-based real estate investment company. 85% of the company’s

properties are located in Texas, where management has intimate

familiarity with sub-markets and unique access to off-market deals.

Southern is committed to developing and managing multifamily assets

in areas with sustainable and viable economic growth; with a focus

on Class A HUD eligible assets that further achieve the company’s

growth strategy; which includes offering and sale of nonconvertible

Series A Bonds with the Tel Aviv Stock Exchange LTD (the

“TASE”).

Transcontinental Realty Investors maintains a strong

emphasis on creating greater shareholder value through acquisition,

financing, operation, developing, and sale of real estate across

every geographic region in the United States. A New York Stock

Exchange company, Transcontinental is traded under the symbol

"TCI". Transcontinental produces revenue through the professional

management of apartments, office buildings, warehouses, and retail

centers that are "undervalued" or "underperforming" at the time of

acquisition. Value is added under Transcontinental ownership, and

the properties are repositioned into higher classifications through

physical improvements and improved management. Transcontinental

also develops new properties, such as luxury apartment homes

principally on land it owns or acquires.

Regis Property Management, LLC is an affiliate of Pillar Income

Asset Management and currently manages 34 commercial properties

comprising in excess of 6 million sq ft. Properties range from

office, warehouse, industrial, to shopping centers. Regis was

selected to manage the property portfolios for three publicly

traded companies as well as several affiliated and nonaffiliated

private companies. Our focus is on individual attention, innovation

and customer satisfaction, a winning combination for everyone.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171030005043/en/

Pillar Income Asset ManagementChris Childress,

469-522-4275press@pillarincome.com

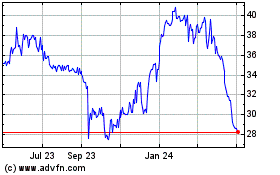

Transcontinental Realty ... (NYSE:TCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Transcontinental Realty ... (NYSE:TCI)

Historical Stock Chart

From Apr 2023 to Apr 2024