Report of Foreign Issuer (6-k)

August 21 2017 - 5:20PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13A-16 OR 15D-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of August, 2017

Commission File Number: 001-38027

CANADA GOOSE HOLDINGS INC.

(Translation of registrant’s name into English)

250 Bowie Ave

Toronto, Ontario, Canada

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F

x

Form 40-F

¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Amendment to Agreement Governing Term Loan Facility

On August 15, 2017, the Company entered into an amendment (the “Term Loan Amendment”) to the Term Loan Agreement, originally dated as of December 2, 2016, among the Company, Canada Goose Inc., as Borrower, Credit Suisse AG, Cayman Islands Branch, as administrative agent and collateral agent, and certain financial institutions as lenders (the “Term Loan Credit Agreement”). The Term Loan Amendment was executed in connection with the syndication of the outstanding term loans by the existing term loan lenders and, among other things: (i) added a provision whereby the Company would be required to pay a 1% prepayment premium on any prepayment of the term loans made in connection with a “Repricing Transaction” (as defined in the Term Loan Amendment) or in connection with an amendment that constitutes a Repricing Transaction, in each case, within six months from August 15, 2017 and (ii) reset the “most-favored nation” protection in favor of the term loan lenders in the incremental facilities provisions of the Term Loan Credit Agreement, whereby if the Company were to issue additional term loans under such incremental facilities provisions within 18 months from August 15, 2017 and the all-in yield on such additional term loans were to exceed the all-in-yield on the existing term loans by more than 50 basis points, the all-in-yield on such existing term loans would be increased so that the all-in-yield of the additional term loans does not exceed the all-in-yield on the existing term loans by more than 50 basis points.

The foregoing description of the Term Loan Amendment does not purport to be complete and is qualified in its entirety by reference to the Term Loan Amendment, which is attached as Exhibit 99.1.

Amendment to Agreement Governing Revolving Facility

On August 15, 2017, the Company entered into an amendment (the “ABL Amendment”) to the senior secured asset-based revolving facility, originally dated as of June 3, 2016, among the Company, certain of its wholly-owned subsidiaries, Canadian Imperial Bank of Commerce, as administrative agent, and certain financial institutions as lenders. The ABL Amendment increased the commitments to $200.0 million with a seasonal increase of up to $250.0 million during peak season (June 1 through November 30).

The foregoing description of the ABL Amendment does not purport to be complete and is qualified in its entirety by reference to the ABL Amendment, which is attached as Exhibit 99.2.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Canada Goose Holdings Inc.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ David Forrest

|

|

|

|

Name:

|

David Forrest

|

|

|

|

Title:

|

General Counsel, Senior Vice President

|

|

|

Date: August 21, 2017

|

|

|

|

EXHIBIT INDEX

|

|

|

|

|

|

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

99.1

|

|

First Amendment to Credit Agreement dated August 15, 2017, by and among Canada Goose Holdings Inc., Canada Goose Inc. and Credit Suisse AG, Cayman Islands Branch

|

|

99.2

|

|

Third Amending Agreement to Credit Agreement dated August 15, 2017, by and among Canada Goose Holdings Inc., Canada Goose Inc., Canada Goose International AG and Canadian Imperial Bank of Commerce

|

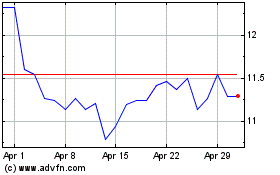

Canada Goose (NYSE:GOOS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Canada Goose (NYSE:GOOS)

Historical Stock Chart

From Apr 2023 to Apr 2024