Amended Statement of Beneficial Ownership (sc 13d/a)

August 10 2017 - 4:46PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

13D

Under

the Securities Exchange Act of 1934

(Amendment

No. 2)*

PYXIS

TANKERS INC.

(Name

of Issuer)

COMMON

STOCK, $0.001 PAR VALUE

(Title

of Class of Securities)

Y71726

106

(CUSIP

Number)

c/o

Pyxis Maritime Corp.

K.

Karamanli 59

Maroussi

15125, Greece

+30-210-638-0200

Attn:

President

(Name,

Address and Telephone Number of Person Authorized

to

Receive Notices and Communications)

August

10, 2017

(Date

of Event which Requires Filing of this Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule

13D, and is filing this schedule because of §§240.13d-l(e), 240.13d-l(f) or 240.13d-1(g), check the following box. [ ]

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See

§240.13d-7 for other parties to whom copies are to be sent.

*

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to

the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided

in a prior cover page.

The

information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section

18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act

but shall be subject to all other provisions of the Act (however, see the Notes).

CUSIP

NO. Y71726 106

|

1

|

Name

of Reporting Person; S.S. or I.R.S. Identification No. of Above Person (entities only)

Maritime

Investors Corp.

|

|

2

|

Check

the Appropriate Box if a Member of a Group

|

(a)

|

[ ]

|

|

|

|

(b)

|

[x]

|

|

3

|

SEC

Use Only

|

|

4

|

Source

of Funds: OO

|

|

5

|

Check

if Disclosure of Legal Proceedings is Required Pursuant

to Items 2(d) or 2(e)

|

[ ]

|

|

6

|

Citizenship

or Place of Organization: Republic of the Marshall Islands

|

|

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

REPORTING

PERSON

WITH

|

7

|

Sole

Voting Power:

0

|

|

8

|

Shared

Voting Power:

17,002,445

|

|

9

|

Sole

Dispositive Power:

0

|

|

10

|

Shared

Dispositive Power:

17,002,445

|

|

11

|

Aggregate

Amount Beneficially Owned by Reporting Person:

17,002,445

|

|

12

|

Check

if the Aggregate Amount in Row 11 Excludes Certain

Shares (See Instructions)

|

[ ]

|

|

13

|

Percent

of Class Represented by Amount In Row 11

93.0%

|

|

14

|

Type

of Reporting Person:

CO

|

|

|

|

|

|

|

|

CUSIP

NO. Y71726 106

|

1

|

Name

of Reporting Person; S.S. or I.R.S. Identification No. of Above Person (entities only)

Valentios

Valentis

|

|

2

|

Check

the Appropriate Box if a Member of a Group

|

(a)

|

[ ]

|

|

|

|

(b)

|

[x]

|

|

3

|

SEC

Use Only

|

|

4

|

Source

of Funds: Not applicable

|

|

5

|

Check

if Disclosure of Legal Proceedings is Required Pursuant

to Items 2(d) or 2(e)

|

[ ]

|

|

6

|

Citizenship

or Place of Organization: Greece

|

|

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

REPORTING

PERSON

WITH

|

7

|

Sole

Voting Power:

5,000*

|

|

8

|

Shared

Voting Power:

17,002,445**

|

|

9

|

Sole

Dispositive Power:

5,000*

|

|

10

|

Shared

Dispositive Power:

17,002,445**

|

|

11

|

Aggregate

Amount Beneficially Owned by Reporting Person:

17,007,445*, **

|

|

12

|

Check

if the Aggregate Amount in Row 11 Excludes Certain

Shares (See Instructions)

|

[ ]

|

|

13

|

Percent

of Class Represented by Amount In Row 11

93.0%

|

|

14

|

Type

of Reporting Person:

IN

|

|

|

|

|

|

|

|

*

Shares held through Thousand Islands Lake Corp., a Marshall Islands company controlled by Mr. Valentis.

**

Shares held by Maritime Investors Corp.

This

Amendment No. 2 (“

Amendment No. 2

”) amends and supplements the Schedule 13D filed with the Securities and Exchange

Commission (the “

SEC

”) on November 10, 2015 and amended by Amendment No.1 filed with the SEC on June 13, 2017

(as amended, the “

Schedule 13D

”) by Maritime Investors Corp. (“

MIC

”) and Mr. Valentios Valentis

(collectively with MIC, the “

Reporting Persons

”). The Reporting Persons may constitute a “group”

for reporting purposes of Rule 13d-5 under the Securities Exchange Act of 1934, as amended, with respect to their respective beneficial

ownership of the Shares (as defined below). Capitalized terms used herein and not defined herein have the meanings ascribed thereto

in the Schedule 13D.

Information

contained herein with respect to each Reporting Person is given solely by such Reporting Person, and no other Reporting Person

has responsibility for the accuracy or completeness of information supplied by such other Reporting Person.

Item

1. Security and Issuer

This

Amendment No. 2 relates to shares of common stock, $0.001 par value per share (the “

Shares

”), of Pyxis Tankers

Inc., a Marshall Islands corporation (the “

Issuer

”). The Issuer’s principal executive offices are located

at c/o Pyxis Maritime Corp., K. Karamanli 59, Maroussi 15125, Greece.

Item

3. Source and Amount of Funds or Other Consideration

The

information set forth in Item 3 of the Schedule 13D is hereby amended and supplemented by adding the following information thereto:

The

information set forth in Item 6 of this Amendment No. 2 is hereby incorporated by reference.

Item

4. Purpose of Transaction

The

information set forth in Item 4 of the Schedule 13D is hereby amended and supplemented by adding the following information thereto:

On

July 13, 2017, the Issuer filed with the SEC a request seeking withdrawal of the Registration Statement on Form F-1 (File No.

333-217498) relating to the follow-on offering due to the Issuer’s decision not to proceed with the follow-on offering at

this time. One of the closing conditions of the Issuer’s purchase of Ninthone pursuant to the SPA was the consummation of

the follow-on offering. The SPA will terminate automatically without further action by the parties if the closing of the follow-on

offering does not occur on or prior to August 31, 2017.

The

information set forth in Item 6 of this Amendment No. 2 is hereby incorporated by reference.

It

should be noted that the plans or intentions of the Reporting Persons are subject to change at any time, and that the Reporting

Persons may from time to time, acquire or dispose, or cause to be acquired or disposed, additional securities of the Issuer, in

the open market, in privately negotiated transactions or otherwise or formulate other purposes, plans or proposals regarding the

Issuer or any of its securities, to the extent deemed advisable in light of general investment policies of the Reporting Persons,

the Issuer’s business, financial condition and operating results, general market and industry conditions or other factors.

Except

as set forth above and in the Schedule 13D, as of the date of this Amendment No. 2, none of the Reporting Persons has any plans

or proposals which relate to or would result in any of the actions set forth in parts (a) through (j) of Item 4 of the Schedule

13D. Such persons may at any time reconsider and change their plans or proposals relating to the foregoing.

Item

6. Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer

The

information set forth in Item 6 of the Schedule 13D is hereby amended and supplemented by adding the following information thereto:

MIC

has informed the Issuer that MIC desires to purchase up to 200,000 Shares of the Issuer’s outstanding public Shares through

Holdings, its wholly owned subsidiary, in one or more open market or privately negotiated purchases at times and prices considered

to be appropriate using cash on hand. Any purchase of Shares will be made for investment purposes.

Except

as disclosed in this Amendment No. 2, there are no contracts, arrangements, understandings or relationships (legal or otherwise)

with respect to any securities of the Issuer (i) among the Reporting Persons and, to the best of their knowledge, any of the other

persons identified pursuant to Item 2 of the Schedule 13D and (ii) between (a) the Reporting Persons and, to the best of their

knowledge, any of the other persons identified pursuant to Item 2 of the Schedule 13D and (b) any other person.

[SCHEDULE

13D SIGNATURE PAGE]

After

reasonable inquiry and to the best of my knowledge and belief, the undersigned certify that the information set forth in this

statement is true, complete and correct.

|

|

MARITIME

INVESTORS CORP.

|

|

|

|

|

|

|

By:

|

/s/

Valentios Valentis

|

|

|

Name:

|

Valentios

Valentis

|

|

|

Title:

|

Director

|

|

|

|

|

|

|

/s/

Valentios Valentis

|

|

|

Valentios

Valentis

|

|

|

|

|

Dated:

August 10, 2017

|

|

|

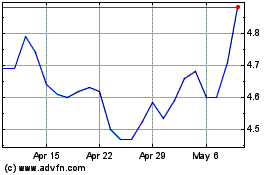

Pyxis Tankers (NASDAQ:PXS)

Historical Stock Chart

From Mar 2024 to Apr 2024

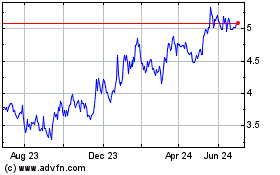

Pyxis Tankers (NASDAQ:PXS)

Historical Stock Chart

From Apr 2023 to Apr 2024