The Wells Fargo Global Dividend Opportunity Fund (NYSE:EOD), a

closed-end fund, announced today that the fund’s Board of Trustees

has approved several changes with respect to the fund:

- Adoption of a multisleeve investment

approach and changes to investment policies

- Use of leverage

- Changes to portfolio management

arrangements

- Commencement of a managed distribution

plan of at least 10% annually, commencing with the dividend to be

paid in July 2017

The fund is and will continue to be a closed-end fund investing

in a diversified portfolio of common and/or preferred stocks of

U.S. and non-U.S. companies. With the changes discussed below, the

fund will also invest a portion of its assets in

below-investment-grade (high-yield) debt securities and loans. The

fund’s primary investment objective is to seek a high level of

current income. The fund’s secondary objective is long-term growth

of capital. These objectives are not changing.

Multisleeve investment approach

Effective on or about May 1, 2017, the fund will adopt a

multisleeve investment approach and will allocate its assets among

two separate investment strategies. Under normal market conditions,

the fund will allocate approximately 80% of its total assets to an

equity sleeve, which will be comprised primarily of common stocks

and up to 20% preferred stocks. The remaining 20% of the fund’s

total assets will be allocated to a separate sleeve, which will

primarily be invested in below-investment-grade (high-yield) debt

securities, loans, and preferred stocks.

Investment policy changes (equity sleeve)

The fund’s principal investment strategy has

been to primarily invest in common and/or preferred stocks of U.S.

and non-U.S. companies and any other equity securities that offer

an above-average potential for current and/or future dividends.

Except for the strategy changes specifically discussed below (that

is, relating to foreign securities, preferred stock, and dividend

capture), the principal investment strategy, limitations, and

restrictions currently in place for the fund will apply only to the

equity sleeve of the fund, which will comprise approximately 80% of

the fund’s total assets. These include, among others, the

following:

- At least 65% of the equity sleeve’s

total assets will be invested in securities of issuers in the

utilities, energy, and telecommunication services sectors.

- Up to 30% of the equity sleeve’s total

assets may be invested in short sales on equity securities.

- The fund may write call options with an

aggregate net notional amount of up to 50% of the value of the

equity sleeve’s total assets.

- Up to 5% of the equity sleeve’s total

assets may be invested in debt securities that are convertible into

common or preferred stocks or that the subadvisor otherwise

believes provide an investment return comparable with, or more

favorable than, investment in equity securities.

The normal allocation range for foreign investments in the

equity sleeve will be modified to be a typical range of 40% to 70%

of the equity sleeve’s total assets in foreign securities, rather

than a typical range of 30% to 70% of the fund’s total assets in

foreign securities.

The normal allocation for preferred stocks in the equity sleeve

will be no more than 20% of the equity sleeve’s total assets.

Under normal conditions, the fund will no longer make

significant use of the dividend capture strategy that the fund has

used significantly since inception to generate income in the

portfolio. This change is intended to provide flexibility to allow

the fund to more effectively seek its primary and secondary

investment objectives.

Investment policies (high-yield sleeve)

Under normal market conditions, the high-yield sleeve, which

will comprise approximately 20% of the fund’s total assets, expects

to be primarily invested in below-investment-grade (high-yield)

debt securities, loans, and preferred stocks. These securities are

rated Ba or lower by Moody’s or BB or lower by S&P or are

unrated securities of comparable quality as determined by the

advisor. Debt securities rated below investment grade are commonly

referred to as junk bonds and are considered speculative with

respect to the issuer’s capacity to pay interest and repay

principal. They involve greater risk of loss, are subject to

greater price volatility, and are less liquid (especially during

periods of economic uncertainty or change) than higher-rated debt

securities. The sleeve’s investments in high-yield securities may

have fixed or variable principal payments and all types of interest

rate and dividend payment and reset terms, including fixed-rate,

adjustable-rate, zero-coupon, contingent, deferred,

payment-in-kind, and auction-rate features. The sleeve may invest

up to 10% of its total assets in U.S. dollar–denominated securities

of foreign issuers, excluding emerging markets securities. The

sleeve may invest in securities of any credit quality at the time

of purchase. However, securities rated CCC or lower cannot be added

to the portfolio if, at the time of purchase, more than 20% of the

sleeve’s assets are rated CCC or lower. The sleeve will invest in

securities with a broad range of maturities.

Convertible securities: The high-yield sleeve’s investments in

fixed-income securities may include bonds and preferred stocks that

are convertible into the equity securities of the issuer. The

sleeve will not invest more than 20% of its total assets in

convertible instruments. Depending upon the relationship of the

conversion price to the market value of the underlying securities,

convertible securities may trade more like equity securities than

debt instruments.

Corporate loans: The high-yield sleeve may invest a portion of

its total assets in loan participations and other direct claims

against a corporate borrower. The corporate loans in which the

sleeve invests primarily consist of direct obligations of a

borrower. The sleeve may invest in a corporate loan at origination

as a co-lender or by acquiring in the secondary market

participations in, assignments of, or novations of a corporate

loan. By purchasing a participation, the fund acquires some or all

of the interest of a bank or other lending institution in a loan to

a corporate borrower.

Asset-backed securities: The high-yield sleeve may invest in

asset-backed securities but will not invest in mortgage-backed

securities. Asset-backed securities represent participations in and

are secured by and payable from assets such as installment sales or

loan contracts, leases, credit card receivables and other

categories of receivables.

Real estate investment trusts (REITs): The high-yield sleeve may

invest in REITs. REITs are companies that invest primarily in real

estate or real estate–related loans. Interests in REITs are

significantly affected by the market for real estate and are

dependent upon management’s skills and on cash flows.

Derivatives: The high-yield sleeve may invest up to 10% of its

total assets in futures and options on securities and indexes and

in other derivatives. In addition, the sleeve may enter into

interest-rate swap transactions with respect to the total amount

the fund is leveraged in order to hedge against adverse changes in

interest rates affecting dividends payable on any preferred shares

or interest payable on borrowings constituting leverage. In

connection with any such swap transaction, the fund will segregate

liquid securities in the amount of its obligations under the

transaction. A derivative is a security or instrument whose value

is determined by reference to the value or the change in value of

one or more securities, currencies, indexes, or other financial

instruments. The fund does not use derivatives as a primary

investment technique and generally does not anticipate using

derivatives for non-hedging purposes. In the event the advisor uses

derivatives for non-hedging purposes, no more than 3% of the

sleeve’s total assets will be committed to initial margin for

derivatives for such purposes. The fund may use derivatives for a

variety of purposes, including:

- As a hedge against adverse changes in

securities market prices or interest rates

- As a substitute for purchasing or

selling securities

Use of leverage by the fund

As permitted under the fund’s investment strategies, the fund

intends to borrow money as a form of leverage in order to seek to

obtain a higher return for shareholders than if it did not use

leverage. Specifically, the fund will seek to borrow money in an

amount that is approximately 16.5% of the fund’s net assets as of

January 31, 2017. Leveraging is a speculative technique, and there

are special risks involved. There can be no assurance that any

leveraging strategies, if employed by the fund, will be successful,

and such strategies can result in losses to the fund.

Management of the fund

For the purposes of managing the new high-yield sleeve,

effective May 1, 2017, the advisor will employ Wells Capital

Management, Inc., one of the current subadvisors of the fund. In

light of this additional role, the subadvisory fee paid to Wells

Capital Management will increase from 0.10% of average daily total

assets per year to 0.20% of average daily total assets per year. It

is important to note that this subadvisory fee is paid from the

advisor’s own assets and is not paid by the fund. Therefore, the

management fee charged to the fund’s shareholders will not change

as a result. The portfolio managers for this sleeve will be

Niklas Nordenfelt, CFA, and Philip Susser.

Mr. Nordenfelt is currently managing director and senior

portfolio manager of the U.S. High Yield Fixed Income team at Wells

Capital Management. Mr. Nordenfelt joined the U.S. High Yield Fixed

Income team at Wells Capital Management in February 2003 as an

investment strategist. Mr. Nordenfelt began his investment career

in 1991 and has managed portfolios ranging from quantitative-based

and tactical asset allocation strategies to credit-driven

portfolios. Previous to joining Wells Capital Management, Mr.

Nordenfelt was at Barclays Global Investors (BGI) from 1996 to

2002, where he was a principal. At BGI, he worked on the company’s

international and emerging markets equity strategies after having

managed its asset allocation products. Prior to this, Mr.

Nordenfelt was a quantitative analyst at Fidelity and a portfolio

manager and group leader at Mellon Capital Management. He earned a

bachelor’s degree in economics from the University of California,

Berkeley, and has earned the right to use the Chartered Financial

Analyst® (CFA®) designation.

Mr. Susser is currently managing director and senior portfolio

manager for the U.S. High Yield team at Wells Capital Management.

Mr. Susser joined the team as a senior research analyst in 2001. He

has extensive research experience in the cable/satellite, gaming,

hotels, restaurants, printing/publishing, telecom, REIT, lodging,

and distressed sectors. Mr. Susser’s investment experience began in

1995, spending three years as a securities lawyer at Cahill Gordon

and Shearman & Sterling representing underwriters and issuers

of high-yield debt. Later, he evaluated venture investment

opportunities for MediaOne Ventures before joining Deutsche Bank as

a research analyst. He earned a bachelor’s degree in economics from

the University of Pennsylvania and a law degree from the University

of Michigan Law School.

Crow Point Partners, LLC, and Wells Capital Management, the

current subadvisors for the fund, will continue to serve as

subadvisors for the equity sleeve. Timothy O'Brien, CFA, of

Crow Point Partners, along with Kandarp Acharya, CFA, FRM®,

and Christian Chan, CFA, of Wells Capital Management will

continue in their roles as portfolio managers.

Managed distribution plan

The fund’s Board of Trustees has approved the commencement of a

managed distribution plan, effective beginning with the quarterly

distribution to be declared in May 2017 and paid in July 2017, that

provides for the declaration of quarterly distributions to common

shareholders of the fund at an annual minimum fixed rate of 10%

based on the fund’s average monthly net asset value (NAV) per share

over the prior 12 months. Under the managed distribution plan,

quarterly distributions may be sourced from income, paid-in

capital, and/or capital gains, if any. Shareholders may elect to

reinvest distributions received pursuant to the managed

distribution plan in the fund under the existing dividend

reinvestment plan, which is described in the fund’s shareholder

reports.

Supplemental risk disclosures

Leverage risk: The fund may enter into transactions including,

among others, options, futures and forward contracts, loans of

portfolio securities, swap contracts, and other derivatives, as

well as when-issued, delayed delivery, or forward commitment

transactions, that may in some circumstances give rise to a form of

leverage. The fund would likely use some or all of these

transactions from time to time in the management of its portfolio,

for hedging purposes, to adjust portfolio characteristics, or more

generally for purposes of attempting to increase the fund’s

investment return. The fund may also offset derivatives positions

against one another or against other assets to manage effective

market exposure resulting from derivatives in its portfolio. To the

extent that any offsetting positions do not behave in relation to

one another as expected, the fund may perform as if it were

leveraged. The fund also borrows money for leveraging purposes.

Although it has no current intention to do so, the fund reserves

the flexibility to issue preferred shares and debt securities, for

leveraging purposes. The fund’s use of leverage would create the

opportunity for increased common share net income but also would

result in special risks for common shareholders. There is no

assurance that any leveraging strategies, if employed by the fund,

will be successful, and such strategies can result in losses to the

fund. Leverage creates the likelihood of greater volatility of the

NAV and market price of and distributions on common shares. Because

the fees received by the advisor and the subadvisor are based on

the total assets of the fund (including assets represented by any

preferred shares and certain other forms of leverage outstanding),

the advisor and the subadvisor have a financial incentive for the

fund to issue preferred shares or use such leverage, which may

create a conflict of interest between the advisor and the

subadvisor, on one hand, and the common shareholders, on the other

hand. To the extent the investment return derived from securities

purchased with funds received from leverage exceeds the cost of

leverage, the fund’s return will be greater than if leverage had

not been used. Conversely, if the investment return from the

securities purchased with such funds is not sufficient to cover the

cost of leverage or if the fund incurs capital losses, the return

of the fund will be less than if leverage had not been used, and

the amount available for distribution to shareholders as dividends

and other distributions will be reduced or potentially eliminated.

Leverage creates risks which may adversely affect the return for

the holders of common shares, including, for example, the

following: (i) the likelihood of greater volatility of the NAV, the

market price, or the dividend rate of the common shares; (ii)

fluctuations in the dividend rates on any preferred shares or in

interest rates on borrowings and short-term debt; (iii) increased

operating costs, which may reduce the fund’s total return; and (iv)

the potential for a decline in the value of an investment acquired

with borrowed funds, while the fund’s obligations under such

borrowing remain fixed. Certain types of borrowings may result in

the fund being subject to covenants in credit agreements, including

those relating to asset coverage, borrowing base, and portfolio

composition requirements and additional covenants that may affect

the fund’s ability to pay dividends and distributions on common

shares in certain instances. The fund also may be required to

pledge its assets to the lenders in connection with certain types

of borrowing. The fund may be subject to certain restrictions on

investments imposed by guidelines of one or more nationally

recognized rating organizations, which may issue ratings for any

preferred shares or short-term debt instruments issued by the fund.

These guidelines may impose asset coverage or portfolio composition

requirements that are more stringent than those imposed by the 1940

Act.

Derivatives involve risks, including interest-rate risk, credit

risk, the risk of improper valuation, and the risk of

noncorrelation to the relevant instruments they are designed to

hedge or closely track. There are numerous risks associated with

transactions in options on securities and/or indexes. As a writer

of an index call option, the fund forgoes the opportunity to profit

from increases in the values of securities held by the fund.

However, the fund has retained the risk of loss (net of premiums

received) should the price of the fund’s portfolio securities

decline. Similar risks are involved with writing call options or

secured put options on individual securities and/or indexes held in

the fund’s portfolio. This combination of potentially limited

appreciation and potentially unlimited depreciation over time may

lead to a decline in the net asset value of the fund. Foreign

investments may contain more risk due to the inherent risks

associated with changing political climates, foreign market

instability, and foreign currency fluctuations. Risks of foreign

investing are magnified in emerging or developing markets. Small-

and mid-cap securities may be subject to special risks associated

with narrower product lines and limited financial resources

compared with their large-cap counterparts, and, as a result,

small- and mid-cap securities may decline significantly in market

downturns and may be more volatile than those of larger companies

due to their higher risk of failure. When interest rates decline,

interest that a fund is able to earn on its investments in debt

securities may also decline, but the value of those securities may

increase. Changes in market conditions and governmental policies

may lead to periods of heightened volatility in the debt securities

market and reduced liquidity for certain fund investments.

Interest-rate changes and their impact on the funds and their NAVs

can be sudden and unpredictable. High-yield, lower-rated bonds may

contain more risk due to the increased possibility of default.

Illiquid securities may be subject to wide fluctuations in market

value. The fund may be subject to significant delays in disposing

of illiquid securities. Accordingly, the fund may be forced to sell

these securities at less than fair market value or may not be able

to sell them when the advisor or subadvisor believes that it is

desirable to do so. This closed-end fund is no longer available as

an initial public offering and is only offered through

broker/dealers on the secondary market.

Additional information

For more information on Wells Fargo’s closed-end funds, please

visit our website.

Unlike an open-end mutual fund, a closed-end fund offers a fixed

number of shares for sale. After the initial public offering,

shares are bought and sold through broker/dealers in the secondary

marketplace, and the market price of the shares is determined by

supply and demand, not by NAV, and is often lower than the NAV. A

closed-end fund is not required to buy its shares back from

investors upon request.

Wells Fargo Asset Management (WFAM) is a trade name used by the

asset management businesses of Wells Fargo & Company. Wells

Fargo Funds Management, LLC, a wholly owned subsidiary of Wells

Fargo & Company, provides investment advisory and

administrative services for Wells Fargo Funds. Other affiliates of

Wells Fargo & Company provide subadvisory and other services

for the funds. This material is being prepared by Wells Fargo

Funds Distributor, LLC, Member FINRA, an affiliate of Wells

Fargo & Company. Neither Wells Fargo Funds Management nor Wells

Fargo Funds Distributor has fund customer accounts/assets, and

neither provides investment advice/recommendations or acts as an

investment advice fiduciary to any investor.

Some of the information contained herein may include

forward-looking statements about the expected investment activities

of the funds. These statements provide no assurance as to the

funds’ actual investment activities or results. The reader must

make his/her own assessment of the information contained herein and

consider such other factors as he/she may deem relevant to his/her

individual circumstances.

301824 03-17

NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170301006689/en/

Wells Fargo & CompanyShareholder

inquiries1-800-730-6001orFinancial advisor

inquiries1-888-877-9275orJohn Roehm,

415-222-5338john.o.roehm@wellsfargo.com

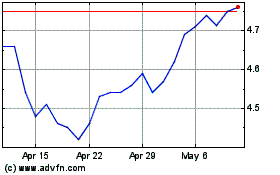

Allspring Global Dividen... (NYSE:EOD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Allspring Global Dividen... (NYSE:EOD)

Historical Stock Chart

From Apr 2023 to Apr 2024