The Freedom Bank of Virginia (OTCQX: FDVA) earned net income of

$1,600,397 for the year ending December 31, 2014, a 16.7%

increase over the $1,371,772 net profit at December 31,

2013. Total assets were $342,611,644 at December 31, 2014, up

24.9% from $274,202,059 the prior year. CEO Underhill indicated,

“Profitability is increasing based on strong loan growth. Our

investment in lenders the past two years is showing results. Our

Chief Lending Officer Kevin Curtis and his team had a strong

2013 and surpassed those impressive results in 2014.”

Chairman Litman noted, “The board is very

pleased with the increasing commercial loan volume of the

bank. In December 2014 the bank hired Richard Hutchison, who ran

Virginia Heritage Mortgage prior to its sale, to try to generate a

similar increase in mortgage lending in 2015. Kevin and

Richard have known each other for many years and we believe

they will work well together

providing Freedom Bank with exceptionally strong

lending leadership.”

Strong loan growth increased assets $68,409,585 to $342,611,644

at December 31, 2014. Loans had the highest yield and increased

$58,824,702 (26.7%) to $278,989,586. Government bonds, held to meet

liquidity needs, were the second highest yielding asset increased

$3,554,734 (15.0%) to $27,294,953. Together with fed funds of

$24,837,000 and cash of $5,941,254 total liquidity was $58,073,207

or 16.9% of total assets at December 31, 2014.

Asset growth was funded by large increases in deposits. Non

interest bearing accounts increased 31.6% from

$39,085,418 to $51,431,344 at December 31, 2014. Interest

checking deposits rose 39.2% from $47,370,151 to

$65,959,271 at December 31, 2014. Certificates of deposit

funded the balance rising by $34,666,451 or 22.1% to $191,660,139

at year end.

Capital was $29,769,220 at December 31, 2014, up from

$26,118,725 at December 31, 2013. Primary contributors were net

profit of $1,600,397 and a public stock sale generating net

proceeds of approximately $1,600,000 after expenses. Book value per

share increased from $6.85 at December 31, 2013 to $7.40 at

December 31, 2014. The bank is presently raising additional capital

through a rights offering to its current shareholders. All members

of the Board of Directors have participated in the offering which

ends January 31, 2015 unless extended by the bank.

Large increases in loans and investments increased total

interest income to $13,656,944 in 2014, up 21.3% from

$11,259,048 the prior year. Interest paid on deposits

increased $283,005 or 14.3% to $2,267,925. The provision for loan

losses increased $188,500 to $486,000 leaving net interest income

after provision at $10,903,019, at December 31, 2014, up $1,926,391

(21.5%) from $8,976,628 the prior year. Operating expenses

increased from $8,484,498 in 2013 to $9,863,144 in 2014. This

was a 16.3% increase, but it included a third branch operating for

half the year in 2014. The result was 2014 net income increased

16.7% to $1,600,397 from $1,371,772 the prior year. Earnings per

share were $0.40 for 2014 versus $0.36 for 2013 despite an increase

in shares outstanding from the capital campaign.

Freedom Bank continued improving asset quality.

Non performing assets as a percentage of loans decreased from

0.54% at December 31, 2013 to 0.11% at December 31, 2014. Loans

past due for regularly scheduled payments were 0.01% of loans at

December 31, 2013 versus 0.02% of loan at December 31, 2014. Both

compared very favorable with peer banks.

Freedom Bank is a community-oriented, locally-owned bank with

locations in Fairfax, Reston and Vienna, Virginia. For

information about Freedom Bank’s deposit and loan services, visit

the Bank’s website at www.freedombankva.com.

This release contains forward-looking statements, including our

expectations with respect to future events that are subject to

various risks and uncertainties. Factors that could cause actual

results to differ materially from management's projections,

forecasts, estimates and expectations include: fluctuation in

market rates of interest and loan and deposit pricing, adverse

changes in the overall national economy as well as adverse economic

conditions in our specific market areas, maintenance and

development of well-established and valued client relationships and

referral source relationships, and acquisition or loss of key

production personnel. Other risks that can affect the Bank are

detailed from time to time in our quarterly and annual reports

filed with the Federal Financial Institutions Examination Council.

We caution readers that the list of factors above is not exclusive.

The forward-looking statements are made as of the date of this

release, and we may not undertake steps to update the

forward-looking statements to reflect the impact of any

circumstances or events that arise after the date the

forward-looking statements are made. In addition, our past results

of operations are not necessarily indicative of future

performance.

The Freedom Bank of Virginia Statements of

Financial Condition

(UNAUDITED)

ASSETS 12/31/2014 12/31/2013 Cash and due from

banks $4,917,099 $8,171,071 Federal funds sold 24,837,000

16,817,000 Interest Bearing Balances with Banks 1,024,155 1,020,078

Investment securities available for sale, at fair value 27,294,953

23,740,219 Investment securities held to maturity 5,610 44,679 FHLB

and Federal Reserve Bank stock 1,104,000 778,000 Loans held for

sale 649,975 768,900 Loans receivable 278,989,586 220,164,884

Allowance for possible loan losses (2,685,807 ) (2,587,363 ) Net

Loans 276,303,779 217,577,521 Premises and equipment,

net 830,770 292,377 Accrued interest and other receivables 864,224

697,326 Other Real Estate Owned Other assets 2,619,512 2,193,284

Bank Owned Life Insurance 2,160,567 2,101,603 Total Assets

$342,611,644 $274,202,059

LIABILITIES AND

STOCKHOLDERS' EQUITY Liabilities: Demand

deposits: Non-interest bearing deposits $51,431,344 $39,085,418

Interest Checking 65,959,271 47,370,151 Savings deposits 2,637,231

3,704,290 Time deposits 191,660,138 156,993,688 Total Deposits

311,687,984 247,153,547 Other accrued expenses

1,062,136 852,477 Accrued interest payable 92,304 77,309 Total

Liabilities 312,842,424 248,083,334 Stockholders'

Equity: Common stock, $3.16 par value. (5,000,000

shares authorized: 4,025,348 shares issued and outstanding December

31, 2014 3,810,822 shares issued and outstanding December 31, 2013)

12,707,042 12,042,200 Additional paid-in capital 17,457,152

16,371,940 Accumulated other comprehensive income (118,889 )

(418,932 ) Retained earnings (deficit) (276,085 ) (1,876,483 )

Total Stockholders' Equity 29,769,220 26,118,725

Total Liabilities and Stockholders' Equity

$342,611,644 $274,202,059

The

Freedom Bank of Virginia Statements of Operations

(UNAUDITED) For the year ended December

31, 2014 2013 Interest Income

Interest and fees on loans $ 13,098,078 $ 10,728,017 Interest on

investment securities 535,438 498,274 Interest on Federal funds

sold 23,428 32,757 Total Interest Income 13,656,944

11,259,048

Interest Expense Interest on deposits

2,267,925 1,984,920 Net Interest Income

11,389,019 9,274,128

Provision for Possible Loan

Losses 486,000 297,500

Net Interest Income after Provision for

Possible Loan Losses

10,903,019 8,976,628

Other Income Service charges and

other income 501,558 821,214 Increase in cash surrender value of

bank-owned life insurance 58,964 58,428 Total Other

Income 560,522 879,642

Operating Expenses Officers

and employee compensation and benefits 5,974,486 5,224,922

Occupancy expense 622,690 533,771 Equipment and depreciation

expense 370,921 240,302 Insurance expense 237,421 213,319

Professional fees 844,756 636,913 Data and item processing 816,954

733,474 Business development 185,868 163,386 Franchise tax 260,048

248,180 Other operating expenses 550,000 490,231

Total Operating Expenses 9,863,144 8,484,498

Income before Income Taxes 1,600,397 1,371,772

Provision for

Income Taxes - -

Net Income $

1,600,397 $ 1,371,772

Net Income Per Common Share $

0.40 $ 0.36

The Freedom Bank of VirginiaCraig S. Underhill, Chief Executive

Officer703-242-5300cunderhill@freedombankva.com

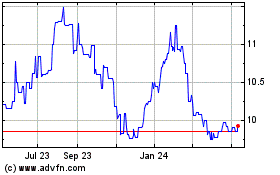

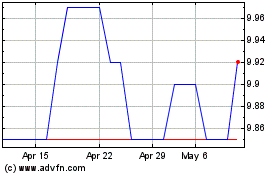

Freedom Financial (QX) (USOTC:FDVA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Freedom Financial (QX) (USOTC:FDVA)

Historical Stock Chart

From Apr 2023 to Apr 2024