If the travel industry was amongst the hardest hit by the economic impact of the pandemic, then, it should benefit most from the reopening. Theoretically yes. The only problem is that no one knows for sure when the crisis will end and governments will lift restrictions.

When countries launched vaccination campaigns, investors turned their eyes on the cyclical stocks and those companies that could rebound from the “return to normality”. As a result, analytics all over the world began recommending travel companies’ stocks, including airlines and cruise lines. The only question is how many years it will take them to earn positive free cash flow, considering the about of debt that has been raised during the pandemic.

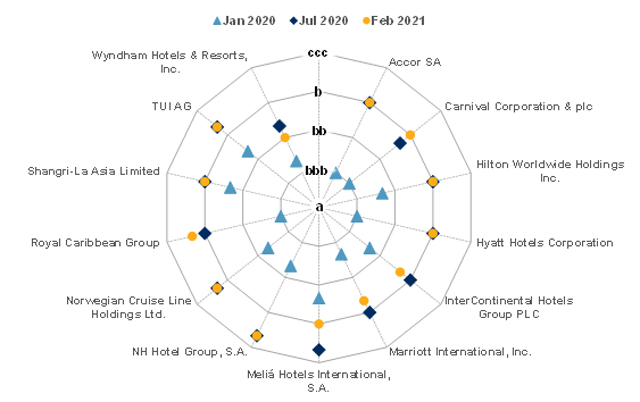

In this context, it shouldn’t be a surprise that even giants like Royal Caribbean Group and Norwegian Cruise Line Holdings were put on watch for a credit-ratings downgrade. Rating agencies are obviously concerned about the recent extensions of U.S. cruise suspensions. It is important to keep in mind that operators of cruise ships continue to incur maintenance costs even if trips are canceled.

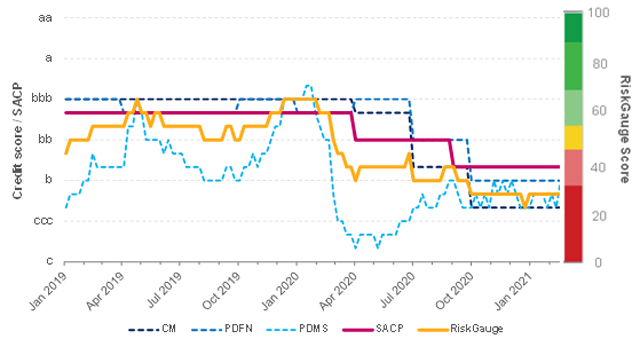

As well noted by SP Global research, continued high levels of infections, ongoing travel restrictions, and possible changes in consumer demand make this sector particularly vulnerable, and also highly sensitive to the wider availability of effective COVID-19 vaccines. It is worth adding an evolution of credit risk for a selected set of larger corporations in this sector:

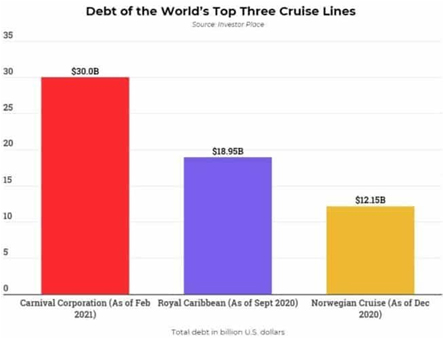

Without any doubt, cruise line companies are already facing a difficult financial situation and in the near future will need to navigate long-term impacts on their business risk profile. Now, consider this one, the three dominant cruise-line operators—Carnival, Norwegian Cruise Line Holdings, and Royal Caribbean Group—have raised a total of about $40 billion through debt and equity sales. Investors now should weigh which companies will be able to get on the train of profitability first. Additionally, they should bear in mind the restrictions on dividends and buybacks + serving a giant at growing rates. Most probably, normal FCF will not be seen at least until 2023-24.