TIDMVCP

RNS Number : 6172R

Victoria PLC

09 March 2021

VICTORIA PLC

THIS ANNOUNCEMENT IS INTENDED FOR

HOLDERS OF THE SENIOR SECURED NOTES DUE 2024

Conditional Notice of Redemption to the Holders of the

EUR500,000,000 5.25% Senior Secured Notes due 2024

ISIN: XS2032590189 (Rule 144A) and XS2032590007 (Reg S)

Common Code: 203259018 (Rule 144A) and 203259000 (Reg S)

Victoria PLC (the "Issuer") hereby gives notice to the holders

(the "Holders") of its EUR500,000,000 Senior Secured Notes due 2024

(the "Notes") (i) that it has elected to redeem all of the Notes

that remain outstanding on March 19, 2021 (the "Fully Redeemed

Notes"), subject to the satisfaction or waiver of the Issuer's own

Financing Condition (as defined below) (the "Full Redemption"), and

(ii) in the event that the Financing Condition is not satisfied or

waived, that it will alternatively partially redeem (the "Partial

Redemption") EUR72,082,000 in aggregate principal amount of the

then outstanding principal amount of Notes (the "Partially Redeemed

Notes"), in accordance with paragraphs 6 and 8 of the Notes and

Sections 3.03, 3.04 and 3.07 of the indenture, dated as of July 26,

2019, by and among, inter alios, the Issuer, Deutsche Trustee

Company Limited (the "Trustee"), National Westminster Bank plc, as

security agent, Deutsche Bank AG, London Branch, as principal

paying agent (the "Paying Agent"), and Deutsche Bank Luxembourg

S.A., as transfer agent (the "Original Indenture"), as supplemented

by a first supplemental indenture dated September 16, 2019 (the

"First Supplemental Indenture"), a second supplemental indenture

dated February 3, 2020 (the "Second Supplemental Indenture") and a

third supplemental indenture dated February 22, 2021 (the "Third

Supplemental Indenture," collectively with the Original Indenture,

the First Supplemental Indenture and the Second Supplemental

Indenture, the "Indenture").

Pursuant to a notice of conditional redemption dated February

23, 2021, the Issuer notified Holders of its intention to redeem

EUR50,000,000 in aggregate principal amount of the Notes then

outstanding at a redemption price of 103.000%, plus accrued and

unpaid interest from January 31, 2021, to, the planned redemption

date of March 9 (the "First Redemption").

Terms used, but not otherwise defined, in this notice of

conditional redemption shall have the meanings ascribed to them in

the Indenture.

The terms and conditions of the redemption are as follows:

1. The redemption date for the Fully Redeemed Notes or the

Partially Redeemed Notes, as applicable, will be March 19, 2021

(the "Redemption Date") and the record date will be March 18, 2021

(unless postponed in accordance with paragraph 4 hereof). The

aggregate redemption price for the Fully Redeemed Notes (assuming

the Redemption Date for the Fully Redeemed Notes is not postponed

in accordance with paragraph 4 hereof) or the Partially Redeemed

Notes, as applicable, is:

a. EUR337,746,551.37, which comprises of (i) EUR322,082,000 in

aggregate principal amount of the outstanding principal amount of

the Notes (after giving effect to the First Redemption) at a

redemption price of 100.000%, (ii) the Applicable Redemption

Premium equal to EUR13,363,007.08 million and (iii) accrued and

unpaid interest from January 31, 2021, to, the Redemption Date of

EUR2,301,544.29 (the "Full Redemption Price"); or

b. In the event the Financing Condition is not satisfied,

EUR75,587,728.95, which comprises of (i) EUR72,082,000 in aggregate

principal amount of the outstanding principal amount of the Notes

(after giving effect to the First Redemption) at a redemption price

of 100.000%, (ii) the Applicable Redemption Premium equal to

EUR2,990,642.99 million and (iii) accrued and unpaid interest from

January 31, 2021, to, the Redemption Date of EUR515,085.96 (the

"Partial Redemption Price").

2. The Notes will be redeemed in accordance with paragraph 6 of the Notes.

3. The redemption of the Fully Redeemed Notes is conditional

upon receipt by the Paying Agent of sufficient funds to pay the

Full Redemption Price payable to the Holders on or before the

Redemption Date from the issuance of new senior secured debt

securities by the Issuer (the "Financing Condition"). In the event

that the Financing Condition set forth herein is not satisfied or

waived by the Issuer, only the Partially Redeemed Notes shall be

deemed due and payable on the Redemption Date. The Issuer will

inform Holders of Notes by press release as to whether the

Financing Condition will, in the sole discretion of the Issuer , be

satisfied or waived. If the Financing Condition is not satisfied or

waived, any Notes previously surrendered to the relevant Paying

Agent in excess of the aggregate principal amount of Partially

Redeemed Notes shall be returned to the Holders thereof and the

redemption will be revoked.

4. In the event that, in the Issuer's reasonable belief, the

Financing Condition will be satisfied at a date later than the

Redemption Date, the Issuer may postpone the Redemption Date for

the Fully Redeemed Notes by issuing a supplemental notice one (1)

Business Day prior to the Redemption Date; provided that (i) the

postponed Redemption Date is at least ten (10) days and not more

than sixty (60) days after the date of this Conditional Notice of

Redemption and (ii) the Issuer sends the supplemental notice

indicating the postponed Redemption Date, corresponding record date

and the Redemption Price.

5. The Fully Redeemed Notes or Partially Redeemed Notes (as

applicable) must be presented and surrendered to the Paying Agent,

which is Deutsche Bank AG, London Branch, Winchester House, 1 Great

Winchester House, London EC2N 2DB, United Kingdom (Attention: Debt

& Agency Services; Facsimile No.: +44 207 547 6149; Email:

tss-gds.eur@db.com), to collect the Redemption Price.

6. Unless the Issuer and the Guarantors default in paying the

Full Redemption Price or the Partial Redemption Price (as

applicable), interest and Additional Amounts, if any, on the Fully

Redeemed Notes (or a portion thereof) or the Partially Redeemed

Notes (or a portion thereof), as applicable, shall cease to accrue

on and after the Redemption Date. Subsequent to the Full

Redemption, if applicable, the only remaining right of Holders of

the Notes is to receive payment on the Redemption Date of the Full

Redemption Price upon surrender to the Paying Agent of the Notes

redeemed.

7. The ISIN and Common Code numbers in relation to the Notes

being redeemed are as set forth above. No representation is made as

to the correctness or accuracy of such numbers listed in this

Conditional Notice of Redemption or printed on the Notes. Reliance

may be placed only on the other identification numbers printed on

the Notes.

8. This conditional notice of redemption is given on March 9, 2021.

This notice is given by Victoria PLC.

Enquiries about the above notice should be directed to the

Issuer as set out below:

Victoria PLC

Worcester Road, Kidderminster,

Worcestershire DY10 1JR

United Kingdom

This announcement does not constitute an offer to sell by

Victoria PLC as Issuer or the solicitation of an offer to buy

securities in any jurisdiction. No money, securities or other

consideration is being solicited, and, if sent in response to the

information contained herein, will not be accepted. It may be

unlawful to distribute this document in certain jurisdictions.

This announcement contains certain forward-looking statements

with respect to certain of the Issuer's current expectations and

projections about future events. These statements, which sometimes

use words such as "intend," "proposed," "plan," "expect," and words

of similar meaning, reflect management's beliefs and expectations

and involve a number of risks, uncertainties and assumptions

(including the completion of the transactions described in this

announcement) that could cause actual results and performance to

differ materially from any expected future results or performance

expressed or implied by the forward-looking statement. Statements

contained in this announcement regarding past trends or activities

should not be taken as a representation that such trends or

activities will continue in the future. The information contained

in this announcement is subject to change without notice and,

except as required by applicable law, the Issuer assumes no

responsibility or obligation to update publicly or review any of

the forward-looking statements contained in it. Readers should not

place undue reliance on forward-looking statements, which speak

only as at the date of this announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFIFITVEIAIIL

(END) Dow Jones Newswires

March 09, 2021 03:30 ET (08:30 GMT)

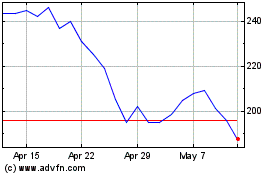

Victoria (LSE:VCP)

Historical Stock Chart

From Aug 2024 to Sep 2024

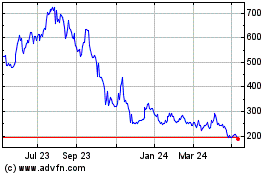

Victoria (LSE:VCP)

Historical Stock Chart

From Sep 2023 to Sep 2024