RNS No 5485d

SDX BUSINESS SYSTEMS PLC

8th June 1998

PART 1

Not for release, distribution or publication in whole or in

part in or into Canada, Australia or Japan.

Lucent Technologies Inc.

Recommended Cash Offer

for

SDX Business Systems plc

The Offer

The Boards of Lucent and SDX announce the terms of a

recommended cash offer for SDX.

The Offer will be 325p in cash for each SDX share, valuing

SDX's fully diluted share capital at approximately #124

million. A Loan Note alternative will be made available.

Under the terms of the Offer, SDX shareholders will retain

the right to receive the interim dividend of 1.0p (net) per

SDX share for the financial year ending 31 October, 1998

announced today and payable on 14 August, 1998.

The Offer, together with the interim dividend referred to

above, represents a premium of approximately 10.3 per cent.

over the closing middle market price of an SDX share on 7

May, 1998, the last dealing day prior to the announcement

on 8 May, 1998 that SDX had received an approach which

might or might not develop into an offer being made for

SDX, and a premium of approximately 61.0 per cent. over

the closing middle market price of an SDX share on 2

January of this year.

Lucent has received irrevocable undertakings to accept the

Offer from the directors of SDX and their wives and certain

of their related trusts who own SDX shares representing

approximately 20.9 per cent. of the issued share capital of

SDX.

Lucent designs, builds and delivers a wide range of public

and private phone networks, communications systems and

software, business telephone systems and microelectronics

components. Bell Labs is the research and development arm

for the company.

Commenting on today's announcement, Bill O'Shea, Group

President and President of Lucent's Business

Communications Systems division, said:

"Lucent believes that the acquisition of SDX represents an

important opportunity which will benefit both SDX and

Lucent. SDX brings additional strength to Lucent in certain

key products and technologies and a valuable network of

independent resellers and distributors."

Commenting on today's announcement, Maurice Pinto,

Chairman of SDX, said:

"This is a major strategic move which we believe will

benefit our customers and our employees. At this stage in

our company's development, it represents a fair value for

our shareholders, reflecting both our company's short term

growth prospects and the costs and risks of continuing to

grow the SDX Group in the medium and long term as an

independent entity. Lucent has an outstanding reputation

and we look forward eagerly to playing a full part in the

Lucent Group's future success. The Board unanimously

recommends shareholders to accept the Offer."

This summary should be read in conjunction with the full

text of the following announcement.

Press Enquiries:

Lucent Technologies Inc. Jennifer Samuel 0171 647 8025

Marianne Carlton 0019089537520

Morgan Stanley & Co. Limited Piers de Montfort 0171 425 5007

SDX Business Systems plc Jeremy Cooke 01707 392200

Dresdner Kleinwort Benson Jonathan Roe 0171 475 5962

Financial Dynamics Giles Sanderson 0171 831 3113

The Offer will not be made, directly or indirectly, in or

into Canada, Australia or Japan and the Offer will not be

capable of acceptance from within Canada, Australia or

Japan. Accordingly, copies of this announcement are not

being, and must not be, mailed or otherwise distributed or

sent in or into or from Canada, Australia or Japan. The

Loan Notes have not been and will not be registered under

the US Securities Act of 1933, as amended, nor the

securities laws of any state of the United States. The Loan

Notes may not be offered, sold or delivered, directly or

indirectly, in or into the United States, Canada, Australia

or Japan. The availability of the Offer to SDX

shareholders who are not resident in the United Kingdom

may be affected by the laws of the relevant jurisdictions.

SDX shareholders who are not resident in the United Kingdom

should inform themselves about and observe any applicable

requirements.

Morgan Stanley & Co. Limited, which is regulated by The

Securities and Futures Authority Limited, is acting for

Lucent and for no one else in connection with the Offer and

will not be responsible to anyone other than Lucent for

providing the protections afforded to customers of Morgan

Stanley & Co. Limited, nor for giving advice in relation to

the Offer.

Kleinwort Benson Securities Limited ("Dresdner Kleinwort

Benson"), which is regulated by The Securities and Futures

Authority Limited, is acting for SDX and for no one else

in connection with the Offer and will not be responsible to

anyone other than SDX for providing the protections afforded

to customers of Dresdner Kleinwort Benson, nor for giving

advice in relation to the Offer.

Not for release, distribution or publication in whole or in

part in or into Canada, Australia or Japan.

Lucent Technologies Inc.

Recommended Cash Offer

for

SDX Business Systems plc

The Boards of Lucent and SDX announce that they have

reached agreement on the terms of a recommended cash

offer to be made by Morgan Stanley on behalf of Lucent or

one of its wholly owned subsidiaries for all the issued and

to be issued share capital of SDX, valuing SDX on a fully

diluted basis at approximately #124 million and each SDX

share at 325p.

In addition, SDX shareholders will retain the right to

receive the interim dividend of 1.0p (net) per SDX share for

the financial year ending 31 October, 1998 announced today

and payable on 14 August, 1998.

The Board of SDX, which has been so advised by Dresdner

Kleinwort Benson, its financial adviser, considers the terms

of the Offer to be fair and reasonable. In providing advice

to the Board of SDX, Dresdner Kleinwort Benson has taken

account of the SDX directors' commercial assessments and,

in particular, the Board of SDX's views about the costs and

risks of continuing to grow the SDX Group in the medium

and longer term as an independent entity. The Board of

SDX will unanimously recommend SDX shareholders to

accept the Offer as the directors of SDX and their wives and

certain of their related trusts who hold SDX shares have

irrevocably undertaken to do in respect of their holdings,

which amount to 7,424,805 SDX shares, representing

approximately 20.9 per cent. of SDX's issued share capital.

Certain terms used in this announcement are defined in

Appendix IV.

The Offer

The Offer will be made, subject to the conditions and

further terms set out below and in Appendix I, on the

following basis:

for each SDX share 325p in cash

The Offer, together with the interim dividend of 1.0p (net)

per SDX share, represents a premium of approximately 10.3

per cent. over the closing middle market price of 295.5p for

an SDX share on 7 May, 1998, the last dealing day prior to

the announcement on 8 May, 1998 that SDX had received an

approach which might or might not develop into an offer

being made for SDX, and a premium of approximately 61.0

per cent. over the closing middle market price of 202.5p for

an SDX share on 2 January of this year.

The Loan Note Alternative

SDX shareholders, other than certain overseas shareholders,

who validly accept the Offer will be able to elect to

receive Loan Notes instead of some or all of the cash to

which they would otherwise become entitled under the terms

of the Offer. The Loan Note Alternative will be available

on the following basis:

for every #1 in cash consideration #1 nominal of Loan Notes

The Loan Notes, which will be unsecured, will be issued

credited as fully paid in multiples of #1 nominal amount and

any fractional entitlements will be disregarded. The Loan

Notes will be issued by Lucent or its wholly owned

subsidiary on whose behalf the Offer is made in which case

the Loan Notes will be unconditionally guaranteed by

Lucent.

The Loan Notes will carry interest at one half of one per

cent. below LIBOR. Such interest will be payable (less any

tax required to be deducted) semi-annually in arrears on 30

June and 31 December of each year, except that the first

payment of interest on the Loan Notes will be made on 31

December, 1998, in respect of the period from the date of

issue up to 30 December, 1998 (both dates inclusive).

The Loan Notes will be transferable (subject to certain

restrictions) but no application will be made for them to be

listed or dealt in on any stock exchange.

The Loan Note Alternative will remain open for acceptance

until the first closing date of the Offer. If the Offer

becomes unconditional as to acceptances while the Loan Note

Alternative is open, the Loan Note Alternative will be

extended for at least a further 14 days but may then be

closed. The right is reserved to keep the Loan Note

Alternative open for acceptance after a date on which it may

be closed. The Loan Note Alternative is conditional upon

the Offer becoming or being declared unconditional in all

respects.

If valid elections for the Loan Note Alternative would not

result in the issue of at least #1 million in nominal value

of Loan Notes, no Loan Notes will be issued unless the Board

of the Offeror otherwise determines.

The Loan Notes have not been and will not be registered

under the US Securities Act of 1933, as amended, nor the

securities laws of any state of the United States. The Loan

Notes may not be offered, sold or delivered, directly or

indirectly, in or into the United States, Canada, Australia

or Japan. The availability of the Loan Note Alternative to

SDX shareholders who are not resident in the United Kingdom

may be affected by the laws of the relevant jurisdictions.

SDX shareholders who are not resident in the United Kingdom

should inform themselves about and observe any applicable

requirements.

Further particulars of the Loan Notes are set out in

Appendix II.

Further Terms and Conditions of the Offer

SDX shares will be acquired fully paid and free from all

liens, equities, charges, encumbrances and any other third

party rights of any nature whatsoever and together with all

rights now or hereafter attaching thereto, including the

right to receive and retain all dividends and other

distributions declared, made or payable hereafter, except

for the interim dividend of 1.0p (net) per SDX share for

the financial year ending 31 October, 1998 announced today

and payable on 14 August, 1998. Acceptance of the Offer

will not prevent SDX shareholders from receiving and

retaining this dividend.

The conditions and certain further terms of the Offer are

set out in Appendix I. Financial and other information on

the Offer is set out in Appendix III.

Information on Lucent

Lucent was formed from the systems and technology units

that were formerly part of AT&T Corp., including the

research and development capabilities of Bell Laboratories.

In April 1996, Lucent completed an initial public offering

on the NYSE and, on 30 September, 1996, became an

independent company when AT&T distributed all of its

remaining Lucent shares to its shareholders.

Lucent designs, builds and delivers a wide range of public

and private phone networks, communications systems and

software, business telephone systems and microelectronics

components. Bell Labs is the research and development arm

for the company.

For the financial year ended 30 September, 1997, Lucent

reported net income of $541 million (1996: loss $793

million) on sales of $26,360 million (1996: $23,286

million). As at 30 September, 1997, Lucent reported net

assets of $3,387 million (1996: $2,686 million).

For the 6 months ended 31 March, 1998, Lucent reported net

income of $815 million (1997: $925 million) on sales of

$14,881 million (1997: $13,087 million). As at 31 March,

1998, Lucent reported net assets of $5,036 million (30

September, 1997: $3,387 million).

Lucent currently has a market capitalisation of

approximately $95.8 billion.

Information on SDX

SDX is an established, high growth technology company

focused on the design, development and distribution of

business telephone systems, with expertise in supplying and

supporting a network of independent resellers and

distributors. The SDX Group is a recognised leader in the

UK in the converging market-place of voice, data and

computer telephony integration (CTI) solutions.

The SDX Group's principal products are voice and data

switching systems and technologies, which include the

INDeX switching platform and the Network Alchemy

router-based PBX-Argent Office. The SDX Group sub-

contracts its manufacturing and its products are sold in the

UK via appointed resellers and by distributors overseas.

For the financial year ended 31 October, 1997, SDX

reported audited consolidated profit on ordinary activities

before taxation of #4.4 million (1996: #3.2 million) on

turnover of #45.3 million (1996: #33.2 million). As at 31

October, 1997, SDX reported audited net assets of #12.0

million (1996: #4.5 million).

For the six months ended 30 April, 1998, SDX reported an

unaudited profit on ordinary activities before taxation of

#2.9 million (1997: #1.9 million) on turnover of #28.5

million (1997: #20.7 million). As at 30 April, 1998, SDX

reported unaudited net assets of #13.6 million (1997: #11.0

million).

Background to and Reasons for the Offer

The Board of Lucent believes that the acquisition of SDX

represents an important opportunity which will benefit both

SDX and Lucent.

SDX brings additional strength to Lucent in certain key

products and technologies, provides a platform for

expansion into Europe for Lucent's voice call centre and

data communications products and will expand Lucent's

capabilities in the UK. SDX's business has grown rapidly

both in the UK, and, increasingly, in the fast growing

European markets, as a supplier of an integrated voice-data

switch called hybrid PBX. Additionally, SDX's independent

channel expertise will be valuable in Lucent's drive to

expand its business through independent channels.

Management and Employees

Lucent attaches great importance to the skills and

experience of the existing management and employees of SDX

and believes that they will benefit from greater

opportunities within the enlarged group. Lucent has given

assurances to the Board of SDX that the existing rights of

employees of the SDX Group, including pension rights, will

be fully safeguarded.

SDX Share Option Schemes

The Offer will extend to any SDX shares issued on the

exercise of options granted under the SDX Share Option

Schemes before the time at which the Offer closes. To the

extent that such options are not exercised, and if the Offer

becomes or is declared unconditional in all respects, Lucent

has agreed that it will offer holders of options under the

SDX Share Option Schemes a payment equal to the

difference between 325p and the exercise price payable

under such options in respect of each SDX share the subject

of such options in exchange for the cancellation of the

options. Further information about the choices available to

holders of options will be sent to them in due course.

General

To the best of Lucent's knowledge and belief, and save as

disclosed herein, neither Lucent nor any director of Lucent,

nor any person acting in concert with Lucent, owns or

controls any SDX shares or any options to purchase any

SDX shares.

The consideration payable under the Offer is to be financed

from Lucent's own resources.

Offer Document

Morgan Stanley, which is acting as financial adviser to

Lucent, will dispatch the formal Offer Document to SDX

shareholders as soon as practicable.

Appendix IV contains a list of definitions of the terms used

in this announcement.

Press Enquiries:

Lucent Technologies Inc. Jennifer Samuel 0171 647 8025

Marianne Carlton 0019089537520

Morgan Stanley & Co. Limited Piers de Montfort 0171 425 5007

SDX Business Systems plc Jeremy Cooke 01707 392200

Dresdner Kleinwort Benson Jonathan Roe 0171 475 5962

Financial Dynamics Giles Sanderson 0171 831 3113

Morgan Stanley & Co. Limited, which is regulated by The

Securities and Futures Authority Limited, is acting for

Lucent and for no one else in connection with the Offer and

will not be responsible to anyone other than Lucent for

providing the protections afforded to customers of Morgan

Stanley & Co. Limited, nor for giving advice in relation to

the Offer.

Kleinwort Benson Securities Limited ("Dresdner Kleinwort

Benson"), which is regulated by The Securities and Futures

Authority Limited, is acting for SDX and for no one else in

connection with the Offer and will not be responsible to

anyone other than SDX for providing the protections afforded

to customers of Dresdner Kleinwort Benson, nor for giving

advice in relation to the Offer.

The Offer will not be made, directly or indirectly, in or

into Canada, Australia or Japan and the Offer will not be

capable of acceptance from within Canada, Australia or

Japan. Accordingly, copies of this announcement are not

being, and must not be, mailed or otherwise distributed or

sent in or into or from Canada, Australia or Japan. The

Loan Notes have not been and will not be registered under

the US Securities Act of 1933, as amended, nor the

securities laws of any state of the United States. The Loan

Notes may not be offered, sold or delivered, directly or

indirectly, in or into the United States, Canada, Australia

or Japan. The availability of the Offer to SDX shareholders

who are not resident in the United Kingdom may be affected

by the laws of the relevant jurisdictions. SDX shareholders

who are not resident in the United Kingdom should inform

themselves about and observe any applicable requirements.

APPENDIX I

Conditions and Certain Further Terms of the Offer

The Offer will be subject to the following conditions:

(a) valid acceptances being received (and not, where

permitted, withdrawn) by not later than 3.00pm on

the first closing date of the Offer (or such later

time(s) and/or date(s) as the Offeror may, with the

consent of the Panel or subject to the rules of the

Code, decide) in respect of not less than 90 per

cent. (or such lesser percentage as the Offeror may

decide) in nominal value of SDX shares to which the

Offer relates, provided that this condition will not

be satisfied unless the Offeror (together with any

other member of the Lucent Group) shall have

acquired or agreed (unconditionally or subject only

to conditions which will be fulfilled upon the Offer

becoming or being declared unconditional in all

respects) to acquire (pursuant to the Offer or

otherwise) SDX shares carrying in aggregate more

than 50 per cent. of the voting rights then

normally exercisable at a general meeting of SDX

including for this purpose, to the extent (if any)

required by the Panel, any votes attributable to or

attaching to any SDX shares which have been

unconditionally allotted or issued before the date

on which the Offer becomes or is declared

unconditional as to acceptances, whether pursuant

to the exercise of conversion or subscription

rights or otherwise and for this purpose:

(i) the expression "SDX shares to which

the Offer relates" shall be construed in

accordance with Sections 428 to 430 (F) of

the Companies Act; and

(ii) SDX shares which have been unconditionally

allotted but not issued shall be deemed to

carry the voting rights they will carry

upon their being entered in the register of

members of SDX;

(b) the Office of Fair Trading indicating, in terms

satisfactory to the Offeror, that it is not the

intention of the Secretary of State for Trade and

Industry to refer the proposed acquisition of SDX

by the Offeror or any matter arising therefrom to

the Monopolies and Mergers Commission;

(c) all necessary filings having been made, all

appropriate waiting periods (including any

extension(s) thereof) under any applicable

legislation or regulations of any jurisdiction

having expired, lapsed or been terminated and no

notice of any intention to revoke any of the same

having been received, in each case in respect of

the Offer or the acquisition of any SDX shares,

or of control of SDX, by any member of the Wider

Lucent Group and all necessary statutory or

regulatory obligations in any jurisdiction having

been complied with;

(d) no government or governmental, quasi-governmental,

supranational, statutory, regulatory or

investigative body, court, trade agency,

professional association or any other person or

body in any jurisdiction (each a "Relevant

Authority") having instituted, implemented or

threatened, or having decided to institute,

implement or threaten, any action, proceeding, suit,

investigation, enquiry or reference, or having made,

proposed or enacted any statute, regulation or order

or taken any other steps, and there not continuing

to be outstanding any statute, regulation or order

thereof, which would or might reasonably be

expected to:

(i) make the Offer or its implementation, or

the proposed acquisition by the Offeror of

any or all of the SDX shares, or the

proposed acquisition of control of SDX by

the Lucent Group void, illegal or

unenforceable or materially directly or

indirectly restrict, restrain, prohibit

or otherwise interfere with the

implementation of, or impose additional

conditions or obligations with respect to,

or otherwise materially challenge or

interfere with the Offer or the acquisition

of all or any of the SDX shares or control

of SDX by the Lucent Group;

(ii) require or prevent the divestiture by any

member of the Wider SDX Group or by any

member of the Wider Lucent Group of all or

a material portion of their respective

businesses, assets or properties or impose

any material limitation on the ability of

any of them to conduct their businesses or

own their respective assets or properties

or any material part of them;

(iii) impose any material limitation on, or

result in a material delay in, the ability

of any member of the Wider Lucent Group to

acquire, directly or indirectly, or to hold

or to exercise effectively any rights of

ownership in respect of the SDX shares or

other securities (or the equivalent) in any

member of the Wider Lucent Group or of the

Wider SDX Group or to exercise management

control over any such member in a manner

which is material in the context of the

Wider Lucent Group or the Wider SDX Group,

respectively, taken as a whole;

(iv) save pursuant to the Offer or Part XIIIA of

the Companies Act, require any member of the

Wider Lucent Group or the Wider SDX Group to

offer to acquire any shares in any member of

the Wider SDX Group owned by any third party

in a manner which is material in the context

of the Wider Lucent Group or the Wider SDX

Group, respectively, taken as a whole; or

(v) otherwise adversely affect the business,

profits or prospects of any member of the

Wider Lucent Group or of the Wider SDX Group

in each case as would be material in the

context of the relevant group taken as a

whole; and

all regulatory and statutory obligations having been

complied with and all applicable waiting and other

time periods during which any such Relevant

Authority could decide to take, institute, implement

or threaten any such action, proceeding, suit,

investigation, enquiry or reference under the laws

of any jurisdiction having expired, lapsed or been

terminated;

(e) all authorisations, orders, recognitions, grants,

consents, licences, confirmations, clearances,

permissions and approvals ("Authorisations")

necessary or appropriate for, or in respect of, the

Offer or the proposed acquisition of any securities

in, or control of, SDX, by any member of the Wider

Lucent Group or to carry on the business of any

member of the SDX Group which is material in the

context of the Wider SDX Group taken as a whole,

having been obtained, in terms and in a form

reasonably satisfactory to Lucent, from all

appropriate Relevant Authorities and from persons

or bodies with whom any member of the Wider SDX

Group has entered into contractual arrangements and

all such Authorisations remaining in full force and

effect and there being no notice or intimation of

any intention to revoke or not to renew any of the

same (in each case where the absence of

Authorisation would have a material adverse effect

on the Wider SDX Group taken as a whole);

(f) there being no provision of any arrangement,

agreement, lease, licence, permit or other

instrument to which any member of the Wider SDX

Group is a party or by or to which any such member

or any of its assets is or are bound, entitled or

subject and which could, in consequence of the Offer

or the proposed acquisition of any SDX shares by

the Offeror, or because of a change in the control

or management of SDX, result in:

(i) any monies borrowed by, or other

indebtedness actual or contingent of, any

such member being or becoming repayable or

capable of being declared repayable

immediately or prior to their stated

maturity or the ability of such member to

incur any indebtedness being withdrawn or

prohibited or being capable of being

withdrawn or prohibited;

(ii) the creation or enforcement of any

mortgage, charge or other security interest

over the whole or any part of the business,

property or assets of any such member;

(iii) any such arrangement, agreement, lease,

licence, permit or instrument being or

becoming capable of being terminated or

adversely modified or affected or any action

being taken of an adverse nature or any

obligation or liability arising thereunder;

(iv) any assets or interests of any such member

being disposed of or charged or any right

arising under which any such asset or

interest could be required to be disposed of

or charged, other than in the ordinary

course of business;

(v) the interests or business of any such member

in or with any firm or body or person, or

any arrangements relating to such interests

or business, being terminated or adversely

modified or adversely affected;

(vi) the respective financial or trading

position, profits or prospects of any such

member being prejudiced or adversely

affected; or

(vii) any such member ceasing to be able to

carry on business under any name under

which it at present does so

(in any such case to an extent which is material in

the context of the Wider SDX Group or the Wider

Lucent Group, respectively, taken as a whole) and

no event having occurred which, under any provision

of any agreement, arrangement, licence, permit or

other instrument to which any member of the Wider

SDX Group is a party or by or to which any such

member or any of its assets is bound, entitled or

subject, is likely to result in any of the events or

circumstances as are referred to in sub-paragraphs

(i) to (vii) of this paragraph (f) (in any such case

to an extent which is material in the context of the

Wider SDX Group, taken as a whole);

(g) no member of the Wider SDX Group having, since 31

October, 1997 (or, in the case of any company which

has since that date become a member of the Wider

SDX Group, since the date it became such a member):

(i) issued or authorised or proposed or

announced its intention to authorise or

propose the issue of additional shares of

any class, or securities convertible into,

or rights, warrants or options to subscribe

for or acquire, any such shares or

convertible securities (save as between SDX

and wholly-owned subsidiaries of SDX and

save for options granted, and for any SDX

shares allotted upon exercise of options

granted, under the SDX Share Option

Schemes);

(ii) save for the interim dividend of 1.0 p

(net) per SDX share in respect of the

financial year ending 31 October, 1998,

recommended, declared, paid or made or

proposed to recommend, declare, pay or make

any bonus in respect of shares, dividends

or other distribution whether payable in

cash or otherwise other than to SDX or

wholly-owned subsidiaries of SDX;

(iii) (save for transactions solely with

wholly-owned subsidiaries of SDX), merged

with any body corporate or (other than in

the ordinary course of business)

authorised, proposed or announced an

intention to authorise or propose any merger

or acquisition, demerger, disposal or

transfer, or granted or created any

mortgage, charge, security or other

encumbrance over assets (including shares

and trade investments) or over any right,

title or interest in any asset which is

material in the context of the Wider SDX

Group taken as a whole;

(iv) authorised, proposed or announced its

intention to authorise or propose any change

to its share or loan capital (save for any

SDX shares allotted upon the exercise of

options granted under the SDX Share Option

Schemes);

(v) issued or proposed the issue of any

debentures or (save in the ordinary course

of business) incurred any indebtedness or

contingent liability which is material in

the context of the Wider SDX Group taken as

a whole;

(vi) entered into any arrangement, agreement,

transaction or commitment which is material

in the context of the Wider SDX Group taken

as a whole (whether in respect of capital

expenditure, trading obligations or

otherwise) or which is other than in the

ordinary course of business or which would

be restrictive on the business of any

member of the Wider SDX Group in any way

which is material in the context of the

Wider SDX Group taken as a whole;

(vii) entered into or varied the terms of, or

made any offer (which remains open for

acceptance) to enter into or vary the terms

of, any service agreement or agreement for

services with any director of SDX;

(viii)announced a proposal to purchase, redeem

or repay, or purchased, redeemed or repaid,

any of its own shares or other securities;

(ix) proposed any voluntary winding-up;

(x) implemented, authorised, proposed or

announced its intention to implement,

authorise or propose any reconstruction,

amalgamation, scheme, commitment or other

transaction or arrangement otherwise than

in the ordinary course of business;

(xi) waived or compromised any claim which is

material in the context of the Wider SDX

Group taken as a whole;

(xii) terminated or varied the terms of any

agreement or arrangement between any member

of the Wider SDX Group and any other person

in a manner which would or might reasonably

be expected to have a material adverse

effect on the financial position or

prospects of the Wider SDX Group taken as a

whole;

(xiii) taken any corporate action with a view to

or resulting in its winding-up, dissolution

or reorganisation or the appointment of a

receiver, administrative receiver,

administrator, trustee or similar officer

of all or any of its assets or revenues or

any analogous proceedings in any

jurisdiction or had any such person

appointed; or

(xiv) entered into or made an offer (which

remains open for acceptance) to enter into

any arrangement, agreement or commitment or

passed any resolution with respect to any of

the transactions or events referred to in

this paragraph (g);

(h) since 31 October, 1997:

(i) there having been no material adverse change

in the business, financial or trading

position or profits or prospects of the

Wider SDX Group taken as a whole;

(ii) no litigation, arbitration proceedings,

prosecution or other legal proceedings

having been threatened, announced, intimated

or instituted by or remaining outstanding

against any member of the Wider SDX Group

(whether as plaintiff or defendant or

otherwise) and no investigation by a

Relevant Authority against or in respect of

any member of the Wider SDX Group having

been instituted, threatened or announced by

or against or remaining outstanding in

respect of any member of the Wider SDX

Group which in any such case might

reasonably be expected to have a materially

adverse effect on the Wider SDX Group taken

as a whole; or

(iii) no contingent or other liability having

arisen which is likely to have a materially

adverse effect on the Wider SDX Group taken

as a whole;

(i) Lucent or the Offeror not having discovered that:

(i) the financial or business information

concerning the Wider SDX Group as contained

in the information disclosed at any time by

or on behalf of any member of the Wider SDX

Group either contains a misrepresentation of

any fact which is material in the context of

the Offer or omits to state a fact necessary

to make the information contained therein

not misleading to an extent which is

material;

(ii) any past or present member of the Wider SDX

Group has not complied with all applicable

laws, statutes, ordinances and regulations

of any jurisdiction and other requirements

of any Relevant Authority with regard to

environmental matters or that there has

been a disposal discharge, spillage,

storage, treatment, transport, leak or

emission of waste or hazardous substance or

any substance or matter which may cause

harm to the environment or human health (a

"Discharge"), which non-compliance or

Discharge would or might give rise to any

liability (whether actual or contingent)

which is material in the context of the

Wider SDX Group taken as a whole;

(iii) there is, or is likely to be, any liability

(whether actual or contingent) to make good,

repair, reinstate or clean up any property

now or previously owned, occupied or made

use of by any past or present member of the

Wider SDX Group or any controlled waters

under any environmental legislation,

regulation, notice, circular or order of

any Relevant Authority or otherwise in any

jurisdiction which is material in the

context of the Wider SDX Group taken as a

whole; or

(iv) any member of the Wider SDX Group was at

the relevant date subject to any liability,

contingent or otherwise, which was not

disclosed in the annual report and accounts

of SDX for the financial year ended 31

October, 1997 or the interim report for the

six months ended 30 April, 1998 and which

is material in the context of the Wider

SDX Group taken as a whole.

None of the conditions will be deemed to be unfulfilled as a

consequence of any matter the subject of written disclosure

made to Lucent by or on behalf of SDX prior to 5.00pm on 7

June, 1998 or which has been publicly disclosed by SDX by

such date and time.

The Offeror reserves the right to waive, in whole or in

part, all or any of conditions (b) to (i) inclusive.

Conditions (b) to (i) both inclusive must be satisfied as

at, or waived on or before, midnight on the 21st day after

the later of the first closing date of the Offer and the

date on which condition (a) is satisfied (or in each case

such later date as the Panel may agree), or the Offer will

lapse. The Offeror shall be under no obligation to waive

or treat as satisfied any of conditions (b) to (i) both

inclusive by a date earlier than the latest date specified

above for the satisfaction thereof notwithstanding that the

other conditions of the Offer may, at such earlier date,

have been waived or satisfied and that there are at such

earlier date no circumstances indicating that the relevant

condition may not be capable of satisfaction.

If the Offeror is required by the Panel to make an offer for

SDX shares under the provisions of Rule 9 of the City Code,

the Offeror may make such alterations to the above

conditions, including condition (a) above, as are necessary

to comply with the provisions of that Rule.

The Offer will lapse if the proposed acquisition of SDX is

referred to the Monopolies and Mergers Commission before

3.00pm on the first closing date of the Offer or on the date

on which the Offer becomes or is declared unconditional as

to acceptances, whichever is the later. If the Offer so

lapses, the Offer will cease to be capable of further

acceptance and accepting SDX shareholders and the Offeror

will cease to be bound by any Forms of Acceptance submitted

before the time when the Offer lapses.

MORE TO FOLLOW

OFFUBUAPQBGRPPM

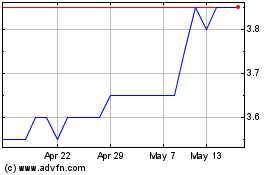

Sdx Energy (LSE:SDX)

Historical Stock Chart

From Jun 2024 to Jul 2024

Sdx Energy (LSE:SDX)

Historical Stock Chart

From Jul 2023 to Jul 2024