TIDMRR.

RNS Number : 8289U

Rolls-Royce Holdings plc

28 November 2023

28 November 2023

ROLLS-ROYCE TARGETS A STEP CHANGE IN MID-TERM PERFORMANCE

-- Clear vision and strategy will create a high performing,

competitive, resilient and growing business

-- Mid-term targets set to deliver record future performance:

operating profit of GBP2.5bn-GBP2.8bn, operating margin

of 13-15%, free cashflow of GBP2.8bn-GBP3.1bn and return

on capital of 16-18%

-- Improved financial performance will create a stronger balance

sheet and investment grade profile for the benefit of all

stakeholders

-- Focused strategy has identified investment priorities, partnership

opportunities and supports a GBP1bn-GBP1.5bn gross disposal

programme over next 5 years

-- Current trading is in line with expectations and guidance

for 2023 reconfirmed

Rolls-Royce is today holding a Capital Markets Day in which we

are setting mid-term financial targets that will represent a step

change in our financial performance.

Chief Executive Tufan Erginbilgic said:

"Rolls-Royce is at a pivotal point in its history. After a

strong start to our transformation programme, we are today laying

out a clear vision for the journey we need to take and the areas

where we must focus. We are creating a high performing,

competitive, resilient and growing Rolls-Royce that will have the

financial strength to control and shape its own destiny. We are

confident in our ability to achieve these ambitions and have a

clear and granular plan to deliver on our targets. We have made

significant progress, with 2023 profit and cash forecast to be

materially ahead of 2022.

"We are setting compelling and achievable financial targets for

the mid-term which will take Rolls-Royce significantly beyond any

previous financial performance. This will benefit not just our

shareholders but our people, customers and partners. We are

building 'one Rolls-Royce'. A company that can fully realise its

potential, ensuring the excellence and innovation that helped shape

the modern world, endures long into the future."

Mid-term targets

We aim to make Rolls-Royce financially stronger and more

resilient than it has been before. In the mid-term this means

achieving:

-- Operating profit of GBP2.5bn-GBP2.8bn,

-- Operating margin of 13-15% with

-- Free Cash Flow of GBP2.8bn-GBP3.1bn and

-- Return on capital of 16-18%.

We have also set divisional mid-term targets for operating

margin:

-- Civil Aerospace has the biggest step change, improving from 2.5% in 2022 to 15-17%.

-- In Defence we plan to improve from 11.8% in 2022 to 14-16%.

-- In Power Systems, our shortest cycle and most diverse business, we plan to improve from 8.4%

in 2022 to 12-14%.

These targets are based upon our expectations for a 2027

timeframe. We expect a progressive, but not necessarily linear,

improvement year-on-year, and if we can accelerate the achievement

of our ambitions we will. These targets, the performance

improvements that underpin them and the actions we require to

achieve them, are owned across the Group and supported through

rigorous performance management and clear lines of accountability.

Our strong start to 2023 provides further confidence in our ability

to deliver.

Strategic update

In February, we launched our transformation programme and

strategic review to set out what we needed to do to take us to a

new level of performance. We are building on our strong foundations

and advantaged businesses to create a Rolls-Royce that can unlock

its full potential.

Our new strategy will deliver our Rolls-Royce proposition

to:

-- build a high performing, competitive and resilient business with profitable growth,

-- grow sustainable free cash flows and

-- build a strong balance sheet and grow shareholder returns.

It is based on four pillars:

1. Portfolio choices & partnerships: The markets we are

choosing to operate in, businesses we want to invest

in, and partnerships that will create truly winning positions.

2. Advantaged businesses & strategic initiatives: How we

will create a competitive business, expand our earnings

potential and improve our performance.

3. Efficiency & simplification: The importance of a company-wide

focus to drive synergies that enable us to be more competitive

and simplify the way we operate; and

4. Lower carbon & digitally enabled businesses: Our commitment

to the energy transition, building on the tangible progress

we have made to date, and capturing the benefits of becoming

more digitally enabled.

Portfolio choices and partnerships: We are today setting out the

strategic choices that we have made across the Group and providing

details of the strategic initiatives that will deliver the step

change in financial performance we are targeting.

In Civil Aerospace, we will focus on the widebody commercial

airline market and business aviation where we can leverage the

value from our Trent and Pearl engine families while investing for

the future with our world-leading UltraFan engine programme. In

Defence, we have opportunities for stronger performance and an

increase in customer-funded investment across Transport, Combat and

Submarines, where recently announced platform wins and

international co-operations will drive further future growth. We

can also leverage our expertise in adjacent nuclear fields such as

Small Modular Reactors (SMRs) and micro-reactors, which have both

defence and civilian applications. In Power Systems, we will focus

on our Power Generation, Governmental and Marine end-markets, where

we see the strongest demand and an opportunity for better returns

from our power-dense and reliable solutions.

In specific instances, partnerships can help to strengthen our

market positions, build capability and scale, as well as de-risk

and reduce capital investment. Our mid-term targets are not reliant

upon securing such new partnerships and we will only partner if the

potential for further value creation exists. In Civil Aerospace, we

believe we are well positioned to re-enter the narrowbody market,

by choosing a partnership approach for the next new engine

programme, and our UltraFan technology is a vital step towards

this. For our SMR venture, a broad set of partners will strengthen

our position to deliver the overall solution and reduce the future

capital call. In Power Systems, our focused strategy in power

generation will make this business more efficient and competitive,

and drive faster, profitable growth. We are also considering

potential partnerships in Power Generation and Battery Energy

Storage Systems to further grow our market position, broaden our

offering and benefit from cross business synergies.

We are also clear where we will not invest and re-allocate

capital to parts of the business where we can generate more value.

We are today announcing a Group-wide divestment program, targeting

gross proceeds of between GBP1.0bn and GBP1.5bn over the next five

years, which do not form part of our Free Cash Flow targets. We

will only sell assets at the right time and at the right price. For

example, in Rolls-Royce Electrical we are looking at options to

exit in the short run or alternatively for the right value, reduce

our position to minority with an intention to exit fully in the

mid-term. We believe, given the world-class capability we have

built in Advanced Air Mobility, that this will represent good value

to a third party and will allow us to focus on our core electrical

engineering activities in Power Systems, Defence and Civil

Aerospace.

Strategic Initiatives and Efficiency & Simplification

Our strategy is underpinned by granular strategic initiatives

that are owned by each division. The largest step change in

performance is in our Civil Aerospace division, where our 6 levers

to improve widebody LTSA margins (extending time on wing, lowering

shop visit costs, reducing product costs, keeping engines earning,

implementing a new value-driven pricing strategy, and driving

rigour on contractual terms and conditions) are key to achieving

our targets. Time and material, spare engines and original

equipment also contribute to improving profitability. Business

Aviation initiatives also deliver strong performance improvement.

In Power Systems, significant improvements are expected from

initiatives focused on cost optimisation and key accounts in Power

Generation and near-term growth in Governmental. In Defence,

performance was already good, but there is still an opportunity to

improve with commercial optimisation and efficiency initiatives.

Across all of our businesses our efficiency initiatives and the

choices we make will deliver sustainable savings of GBP400m-GBP500m

in the mid-term, making us more competitively advantaged, resilient

and fit for the future.

Financial Framework

We are building a stronger balance sheet and aiming to achieve

an investment grade profile in the near-term. From a leverage

perspective, we will significantly improve our net debt to EBITDA

ratio. This is supported by our sustainable growth in free cash

flows, some of which we will deploy to reduce our gross debt. The

increasing strength of our resulting liquidity position means we

may look to close some of our more expensive undrawn facilities

early. Once we have strengthened the balance sheet, we intend to

re-establish shareholder distributions. Thereafter, we will

optimise between shareholder distributions and further investing in

the business.

Trading update and outlook

Our current trading is in line with the guidance provided with

our Half Year results on 3 August 2023 and our guidance for the

year is unchanged. Engine flying hours for large civil engines on

long term service agreements were 86% of 2019 levels for the 10

months to end of October and in line with our expectation for

80%-90% for the full year. Our next scheduled update will be on 22

February 2024, when we will publish our Full Year 2023 results and

provide guidance for 2024.

Due to physical capacity constraints, the Capital Markets Day

event is by invitation only but there will also be a webcast

starting at 12:30pm UK time today lasting for approximately four

hours. The webcast details are available our website

www.rolls-royce.com/investors and a replay will be made available

after the event.

For further information, please contact:

Investors

Isabel Green

Head of Investor Relations, Rolls-Royce plc

Tel +44 (0) 7880 160976

Isabel.Green@Rolls-Royce.com

Media

Richard Wray

Director of External Communications & Brand, Rolls-Royce

plc

Tel +44 (0) 7810 850055

Richard.Wray@Rolls-Royce.com

About Rolls-Royce Holdings plc

1. Rolls-Royce develops and delivers complex power and

propulsion solutions for safety-critical applications in the air,

at sea and on land. Our products and service packages enable our

customers to connect people, societies, cultures and economies

together; they meet the growing need for power generation across

multiple industries; and enable governments to equip their armed

forces with the power required to protect their citizens.

2. Rolls-Royce has customers in more than 150 countries,

comprising more than 400 airlines and leasing customers, 160 armed

forces and navies, and more than 5,000 power and nuclear customers.

We are committed to making our products compatible with net zero

carbon emissions to meet customer demand for more sustainable

solutions.

3. Annual underlying revenue was GBP12.69 billion in 2022, and

underlying operating profit was GBP652m.

4. Rolls-Royce Holdings plc is a publicly traded company (LSE:

RR., ADR: RYCEY, LEI: 213800EC7997ZBLZJH69)

www.rolls-royce.com

Note on forward-looking statements

This press release may contain projections and forward-looking

statements. The words "believe", "expect", "anticipate", "intend"

and "plan" and similar expressions identify forward-looking

statements. All statements other than statements of historical

facts included in this press release, including, without

limitation, those regarding the Company's financial position,

potential business strategy, potential plans and potential

objectives, are forward-looking statements. Such forward-looking

statements involve known and unknown risks, uncertainties and other

factors which may cause the Company's actual results, performance

or achievements to be materially different from any future results,

performance or achievements expressed or implied by such

forward-looking statements. Such forward-looking statements are

based on numerous assumptions regarding the Company's present and

future business strategies and the environment in which the Company

will operate in the future. Further, certain forward-looking

statements are based upon assumptions of future events which may

not prove to be accurate. The forward-looking statements in this

press release speak only as at the date of this press release and

the Company assumes no obligation to update or provide any

additional information in relation to such forward-looking

statements.

The merits or suitability of investing in any securities

previously issued or issued in future by the Company for any

investor's particular situation should be independently determined

by such investor. Any such determination should involve, inter

alia, an assessment of the legal, tax, accounting, regulatory,

financial, credit and other related aspects of the transaction in

question.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDEAEFXAAFDFAA

(END) Dow Jones Newswires

November 28, 2023 02:00 ET (07:00 GMT)

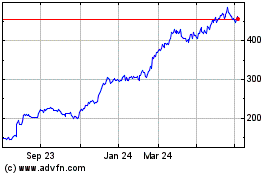

Rolls-royce (LSE:RR.)

Historical Stock Chart

From Mar 2024 to Apr 2024

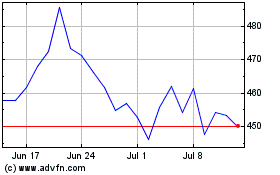

Rolls-royce (LSE:RR.)

Historical Stock Chart

From Apr 2023 to Apr 2024