TIDMRR.

RNS Number : 1918L

Rolls-Royce Holdings plc

12 May 2022

12 May 2022

ROLLS-ROYCE HOLDINGS PLC AGM STATEMENT AND TRADING UPDATE

Rolls-Royce Holdings plc is holding its Annual General Meeting

today and is hosting a site visit to its Civil Aerospace business

tomorrow. Alongside these events, Rolls-Royce has issued the

following trading update for the first four months of 2022 and also

medium term outlook for its Civil Aerospace business.

In his address to shareholders, Chief Executive Warren East will

comment:

"In 2021, we delivered improved financial performance and

continued to deliver on our commitments. As a result of the actions

we have taken, we have made significant progress on the path to

recovery from the impact of COVID-19 and are emerging as a better

balanced and more resilient business with a sustainable future,

focused on the long-term business opportunities presented by the

global energy transition. I would like to thank our colleagues for

their commitment and achievements this year and all our

stakeholders for their support and engagement.

It has been a privilege to lead Rolls-Royce and I am fully

committed to driving our business while we work towards a smooth

leadership transition this year. We are confident that we have

positioned the business to achieve positive profit and cash this

year, driven by the benefits of our cost reductions and increased

engine flying hours in Civil Aerospace together with a strong

performance in Defence and Power Systems, and balanced by our

commitment to invest in technology and systems that are critical to

the leading sustainable solutions we are delivering now and in the

future."

Trading update and outlook

Financial performance year-to-date has been in line with

expectation and our financial guidance for 2022 is unchanged. We

are well positioned for the anticipated growth in our end markets

and continue to expect positive momentum in our financial

performance in 2022 despite the ongoing risks around macroeconomic

uncertainties. We are working closely with our global supply chain

to limit the impact of disruption and will continue to adapt our

plans as the global situation evolves. Our long-term sourcing

agreements and hedging policies designed to limit volatility in raw

material inflation, give some near-term protection and we have

increased inventory levels to help mitigate the impact. We are

working with our suppliers to monitor and manage these risks and

challenges.

In Civil Aerospace, large engine long term service agreement

(LTSA) flying hours for the first four months of 2022 were 42%

higher than the prior year period. Passenger demand is recovering

on routes where travel restrictions have been lifted, such as in

Europe and the Americas, but additional COVID-19 restrictions have

resulted in fewer flights in China where the situation is still

evolving. Flying hours in Business Aviation have remained strong.

Shop visits and original equipment (OE) deliveries of installed and

spare engines are expected to accelerate during the course of the

year. We are continuing to capitalise on new opportunities. For

instance, Qantas recently committed to a deal for 12 Airbus

A350-1000s for its long-haul Project Sunrise initiative, powered by

our Trent XWB-97 engines. Rolls-Royce and Qantas have also

committed to sign a TotalCare (R) service agreement for the Trent

XWB-97 engines that will power the 12 aircraft.

In Defence, the products and services we provide are delivered

and maintained over decades of service to our large number of

customers and as such they are not immediately exposed to

individual geopolitical events. Our strong order backlog gives us

confidence on revenue, profit and cash conversion against the

headwinds of inflation and supply chain risk. As guided previously,

our operating margin is expected to be lower in 2022 compared with

2021, reflecting original equipment and aftermarket mix changes and

the planned increase in investment in Defence to support new

programme wins. Governments are increasing their long-term budget

allocations towards defence activities, underpinning the long-term

growth outlook we hold for Defence.

In Power Systems, the first four months of order intake has been

very strong across the entire business and particularly in both

power generation and defence end markets. We are working to limit

the impact of supply chain disruption, in part through holding

increased inventory, which as previously guided will impact cash

conversion this year. Interest in sustainable solutions is

increasing: the first engines for power generation, construction

and industrial applications have been approved for operation with

sustainable fuels and we are developing hydrogen engines.

Our New Markets businesses, Rolls-Royce Electrical and

Rolls-Royce SMR, continue to make good progress supported by

Rolls-Royce and third-party investment. We have commenced the

multi-year UK Generic Design Assessment process for our SMR design

and we are encouraged by the recent commitment to nuclear energy by

the UK Government. In Rolls-Royce Electrical, alongside the

aircraft manufacturer Tecnam and engine manufacturer Rotax, we have

completed the successful flight-testing of a hybrid-electric

demonstrator aircraft powered by a parallel-hybrid propulsion

system.

We are progressing well with our programme of disposals and are

confident in achieving the commitment to generate around GBP2bn in

total proceeds once the sale of ITP Aero completes, which is

expected to be in the first half of this year, subject to

regulatory approvals. The proceeds from the programme of disposals

will be used to repay debt.

Civil Aerospace medium term outlook and site visit

We are hosting a site visit at our Civil Aerospace facilities in

Derby tomorrow, 13 May. The event will include tours of our

facilities and a presentation with Q&A. We will set out our key

Civil Aerospace value drivers, highlight the operational side of

our business and provide a deeper understanding of how the changes

we have implemented are making it a better quality, more resilient,

and more agile business which is set up to increase returns and

deliver long-term sustainable growth.

The presentation will include our view of the medium-term

financial outlook for Civil Aerospace based on the actions we have

taken to improve cost efficiency and productivity, combined with

the current assumed recovery in demand, which is subject to risks

and uncertainties based on prevailing market and macroeconomic

conditions. In the medium term, we expect Civil Aerospace

underlying revenue to grow at a low double-digit percentage

compound average growth rate from 2021 with an operating margin

percentage in the high single digits, and with trading cashflow

comfortably exceeding operating profit.

Due to physical capacity constraints, the event is by invitation

only but there will also be a webcast starting at 10am UK time on

13 May and lasting for approximately two hours. The webcast details

and presentation materials will be shared on our website

www.rolls-royce.com/investors and a replay will be made available

after the event.

Our next scheduled trading update will be on 4 August 2022, when

we will publish our Half Year 2022 results.

This announcement has been determined to contain inside

information.

For further information, please contact:

Investors

Isabel Green

Head of Investor Relations, Rolls-Royce plc

Tel +44 (0) 7880 160976

Isabel.Green@Rolls-Royce.com

www.Rolls-Royce.com

Media

Richard Wray

Director of External Communications & Brand, Rolls-Royce

plc

Tel +44 (0) 7810 850055

Richard.Wray@Rolls-Royce.com

About Rolls-Royce Holdings plc

1. Rolls-Royce pioneers the power that matters to connect, power

and protect society. We have pledged to achieve net zero greenhouse

gas emissions in our operations by 2030 (excluding product testing)

and joined the UN Race to Zero campaign in 2020, affirming our

ambition to play a fundamental role in enabling the sectors in

which we operate achieve net zero carbon by 2050.

2. Rolls-Royce has customers in more than 150 countries,

comprising more than 400 airlines and leasing customers, 160 armed

forces and navies, and more than 5,000 power and nuclear

customers.

3. Annual underlying revenue was GBP10.95 billion in 2021,

underlying operating profit was GBP414m and we invested GBP1.18

billion on research and development. We also support a global

network of 28 University Technology Centres, which position

Rolls-Royce engineers at the forefront of scientific research.

4. Rolls-Royce Holdings plc is publicly traded company (LSE:

RR., ADR: RYCEY, LEI: 213800EC7997ZBLZJH69)

Note on forward-looking statements

This press release may contain projections and forward-looking

statements. The words "believe", "expect", "anticipate", "intend"

and "plan" and similar expressions identify forward-looking

statements. All statements other than statements of historical

facts included in this press release, including, without

limitation, those regarding the Company's financial position,

potential business strategy, potential plans and potential

objectives, are forward-looking statements. Such forward-looking

statements involve known and unknown risks, uncertainties and other

factors which may cause the Company's actual results, performance

or achievements to be materially different from any future results,

performance or achievements expressed or implied by such

forward-looking statements. Such forward-looking statements are

based on numerous assumptions regarding the Company's present and

future business strategies and the environment in which the Company

will operate in the future. Further, certain forward-looking

statements are based upon assumptions of future events which may

not prove to be accurate. The forward-looking statements in this

press release speak only as at the date of this press release and

the Company assumes no obligation to update or provide any

additional information in relation to such forward-looking

statements.

The merits or suitability of investing in any securities

previously issued or issued in future by the Company for any

investor's particular situation should be independently determined

by such investor. Any such determination should involve, inter

alia, an assessment of the legal, tax, accounting, regulatory,

financial, credit and other related aspects of the transaction in

question.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

AGMBKDBPDBKBDPD

(END) Dow Jones Newswires

May 12, 2022 02:02 ET (06:02 GMT)

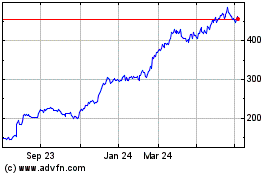

Rolls-royce (LSE:RR.)

Historical Stock Chart

From Oct 2024 to Nov 2024

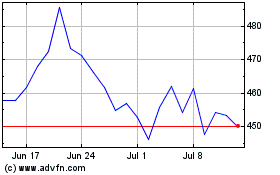

Rolls-royce (LSE:RR.)

Historical Stock Chart

From Nov 2023 to Nov 2024