Results of offering

July 05 2007 - 9:12AM

UK Regulatory

RNS Number:7362Z

Plaza Centers N.V.

05 July 2007

5 July, 2007

PLAZA CENTERS N.V. ANNOUNCES RESULTS OF A

PRIVATE ISSUANCE OF DEBENTURES IN ISRAEL

Plaza Centers N.V. ("Plaza" or the "Company"), a leading emerging markets

property developer, today announces that it has agreed with Israeli

institutional investors to issue an aggregate principal amount of approximately

New Israeli Shekels ("NIS") 305 million (approximately Euro53.3 million) Par Value

of series one of unsecured non-convertible debentures to institutional investors

in Israel. The debentures are rated by Maalot - The Israel Securities Rating

Company Ltd., an affiliate of Standard & Poor's - at a local rating of A+/

Positive.

The debentures are payable in eight equal annual installments, on December 31 of

each of the years 2010 to 2017, inclusive. The debentures bear an annual

interest rate of 4.5%, payable in semi-annual installments on December 31 and

July 1 of each of the years 2007 to 2017 (the first installment to be effected

on December 31, 2007 and the last installment to be effected on December 31,

2017). Both the principal and interest of the debentures are linked to changes

in the Israeli Consumer Price Index. As described more fully below, the interest

rate on the Debentures will be increased so long as the debentures are not

registered for trade on the Tel Aviv Stock Exchange (the "TASE").

As the Company's functional currency is the Euro, the Company will hedge the

future expected payments in NIS (principal and interest) to correlate with the

Euro.

The debentures also provide that the debentures will be prepaid by the Company,

inter alia, at the option of the trustee or the holders of the debentures if the

Company delays the publication of its financial reports for more than 60 days

from the dates provided by applicable law or if the debentures cease to be rated

for a period of more than 60 days.

The debentures will be listed for trade on the Institutional Retzef System,

which is a trading system for institutional investors in Israel. The Company may

also, in its sole discretion, register the debentures for trade on the TASE. So

long as the Debentures are not registered for trade on the TASE, the Company has

undertaken (i) to pay an additional interest at an annual rate of 0.5% (namely

5%) until a prospectus is published for the registration of the debentures for

trade on the TASE; (ii) to pay an additional interest rate at an annual rate of

0.25% in the event the rating of the debentures decreases to (BBB+) rating on a

local scale by Maalot - The Israel Securities rating Company Ltd. or an

equivalent rating by another Rating Company and (iii) to prepay the debentures

at the option of the trustee or the holders of the debentures if made a special

resolution on their general meeting upon the occurrence of each of the following

events: (A) Should the rating of the debentures in Israel decrease below the

BBB+ investment level rating of Maalot - The Israel Securities Rating Co. Ltd.

or other equivalent rating by another rating company; (B) if the Company is

required to prepay another series of debentures issued by the Company; or (C) if

the holdings of Elbit Medical Imaging Ltd., the indirect parent of the Company,

fall below 25% of the Company's issued and outstanding share capital. Such

undertakings would be terminated upon the registration for trade of the

debentures on the TASE.

Commenting on the approval, Ran Shtarkman, President and CEO, Plaza Centers N.V.

said:

"As we indicated to shareholders in our announcement on 30 May, our A+/Positive

rating from Maalot has enabled us to issue corporate bonds in the Israeli

Institutional Market to finance our growth. Maalot's rating is based on issuance

of up to US$400 million, and following the registration of our debentures on the

TASE we can issue additional debentures at these favorable interest rates. This

will provide us with significant financial flexibility and firepower both to

drive our ongoing development programme and to further diversify and enrich the

Company's portfolio through the development of high quality shopping and

entertainment centers and other mixed used projects both in the Central and

Eastern European region and India."

For further details please contact:

Plaza

Mordechay Zisser, Chairman +972 3 6086000

Ran Shtarkman, President and CEO +36 1 462 7221

Roy Linden, CFO +36 1 462 7105

Financial Dynamics

Stephanie Highett/ Dido Laurimore +44 20 7831 3113

Notes to Editors

* Plaza Centers N.V. (www.plazacenters.com) is a leading emerging markets

developer of shopping and entertainment centres, focusing on constructing

new centres and, where there is significant redevelopment potential,

redeveloping existing centres, in both capital cities and important regional

centres. The Company is an indirect subsidiary of Elbit Medical Imaging Ltd.

("EMIL"), an Israeli public company whose shares are traded on both the Tel

Aviv Stock Exchange in Israel and the NASDAQ Global Market in the United

States.

* Plaza Centers is a member of the Europe Israel Group of companies which is

controlled by its founder, Mr Mordechay Zisser. It has been active in real

estate development in emerging markets for over 10 years

This information is provided by RNS

The company news service from the London Stock Exchange

END

IODMGGGNFKGGNZM

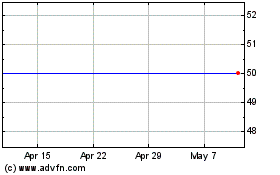

Plaza Centers N.v (LSE:PLAZ)

Historical Stock Chart

From Jun 2024 to Jul 2024

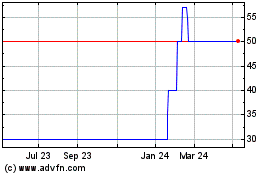

Plaza Centers N.v (LSE:PLAZ)

Historical Stock Chart

From Jul 2023 to Jul 2024