JZ Capital Ptnrs Ltd Smaller Related Party Transaction

September 17 2020 - 2:00AM

UK Regulatory

TIDMJZCP TIDMJZCN

JZ CAPITAL PARTNERS LIMITED (the "Company" or "JZCP")

(a closed-end collective investment scheme incorporated with limited liability

under the laws of Guernsey with registered number 48761)

LEI: 549300TZCK08Q16HHU44

REDUCTION OF COMMITMENTS TO ORANGEWOOD

Smaller Related Party Transaction

17 September 2020

On 15 July 2020, the Company announced that David W. Zalaznick and John (Jay)

Jordan II (together, being the "JZAI Founders", who are the founders and

principals of the Company's investment adviser, Jordan/Zalaznick Advisers, Inc.

("JZAI")) had agreed in principle to relieve the Company of certain of its

commitments to Orangewood Partners II-A, L.P. (the "Orangewood Fund") by each

of them assuming the obligation of approximately US$2 million of those

commitments.

Further to that announcement, the Company is now pleased to report that it has

yesterday entered into an agreement with the JZAI Founders (or their respective

affiliates) for the reduction of the Company's commitments to its investments

in the Orangewood Fund in the amount of US$4.25 million (the "Orangewood

Transaction"). The Orangewood Transaction is considered to be a smaller related

party transaction of the Company pursuant to chapter 11 of the listing rules

made by the Financial Conduct Authority pursuant to section 73A of the

Financial Services and Markets Act 2000, as amended (the "Listing Rules")

(insofar as they apply to the Company by virtue of its voluntary compliance

with the same).

Prior to the Orangewood Transaction, the Company had capital commitments to the

Orangewood Fund of US$23.25 million, of which approximately US$7.85 million had

been funded (the "JZCP Funded Commitments") and approximately US$15.40 million

remained as being unfunded (the "JZCP Unfunded Commitments").

Consistent with the Company's previously announced desire to reduce its

commitments and future subscription obligations in accordance with its recently

amended investment policy, the Company has therefore reduced its commitments to

the Orangewood Fund by US$4.25 million pursuant to the Orangewood Transaction,

with such commitments being taken over by the JZAI Founders (or their

respective affiliates). Specifically, the reduction in the Company's

commitments to the Orangewood Fund has been effected by the JZAI Founders (or

their respective affiliates) having:

a. sold, transferred and assigned to them approximately US$1.43 million of the

JZCP Funded Commitments (the "Transferred JZCP Funded Commitments"); and

b. assumed approximately US$2.82 million of the commitments, liabilities,

duties, responsibilities and obligations in respect of the JZCP Unfunded

Commitments (the "Transferred JZCP Unfunded Commitments").

The price payable by the JZAI Founders (or their respective affiliates) to the

Company for the transfer of their commitments is approximately US$1.51 million,

which is equivalent to the Transferred JZCP Funded Commitments of US$1.43

million plus interest accrued thereon at a rate of 8 per cent. per annum from

the date such commitments were funded to 15 September 2020. The Company intends

to utilise the proceeds received in connection with the Orangewood Transaction

in accordance with the Company's recently revised investment policy.

The resultant effect of the Orangewood Transaction is that the Company has had

its commitments to the Orangewood Fund reduced by US$4.25 million, with the

Company receiving an amount of approximately US$1.51 million in cash, less

expenses associated with the Orangewood Transaction. In addition, the Company

is being relieved of its obligations to fund in cash commitments of

approximately US$2.82 million relating to the Transferred JZCP Unfunded

Commitments.

JZAI is the Company's investment adviser pursuant to an investment advisory and

management agreement dated 23 December 2010 between the Company and JZAI, as

amended from time to time, and, under the Listing Rules, would therefore be

considered a "Related Party" of the Company (as defined in the Listing Rules

insofar as they apply to the Company by virtue of its voluntary compliance with

the same). As founders and principals of JZAI, the JZAI Founders are associates

of JZAI and would also be considered Related Parties of the Company. In

addition, each of the JZAI Founders are substantial shareholders of the Company

as they are each entitled to exercise or to control the exercise of 10 per

cent. or more of the votes able to be casted at a general meeting of the

Company. As such, each of the JZAI Founders are considered to be Related

Parties of the Company on this basis as well. The Orangewood Transaction, which

involves the JZAI Founders as Related Parties of the Company, would be

considered to involve arrangements between the Company and its Related Parties.

The Orangewood Transaction does however fall within Listing Rule 11.1.10 R and

is a smaller related party transaction under the Listing Rules (insofar as they

apply to the Company by virtue of its voluntary compliance with the same). The

Company has obtained written confirmation from J.P. Morgan Securities plc

(which conducts its UK investment banking business as J.P. Morgan Cazenove)

that the terms of the Orangewood Transaction are fair and reasonable as far as

the shareholders of the Company are concerned. This announcement is made in

accordance with Listing Rule 11.1.10 R (c).

In addition to the Orangewood Transaction, the Company is pleased to announce

that it intends to enter into an agreement with a third party institutional

investor to effect a further reduction of the Company's commitments to its

investments in the Orangewood Fund in the amount of US$5 million. Pursuant to

this agreement, if entered into and completed, the Company would reduce its

commitments to the Orangewood Fund by a further US$5 million, of which

approximately US$1.69 million would represent funded commitments and

approximately US$3.31 million would represent unfunded commitments to the

Orangewood Fund. The price that would be payable by the relevant third party

institutional investor to the Company for the transfer of these commitments

would be approximately US$1.78 million, which is equivalent to the funded

commitments of US$1.69 million plus interest accrued thereon at a rate of 8 per

cent. per annum from the date such commitments were funded to the date of

closing. This agreement would be subject to certain conditions to closing and

upon being entered into would be expected to close and become effective on or

about 21 September 2020.

Following completion of the Orangewood Transaction and this other agreement

with the third party investor (assuming it is entered into and completed on the

terms described above), the Company's remaining commitments to the Orangewood

Fund would amount to US$14 million, of which approximately US$4.72 million

would represent funded commitments and approximately US$9.28 million would

represent unfunded commitments. The Company's intention with respect to any

remaining commitments to the Orangewood Fund is still, as previously announced,

to further reduce them such that the balance of its commitments are if and to

the extent possible transferred in full.

For further information:

Ed Berry +44 (0) 20 3727 1046

FTI Consulting

David Zalaznick +1 (212) 485 9410

Jordan/Zalaznick Advisers, Inc.

Sam Walden +44 (0) 1481 745385

Northern Trust International Fund

Administration Services (Guernsey)

Limited

END

(END) Dow Jones Newswires

September 17, 2020 02:00 ET (06:00 GMT)

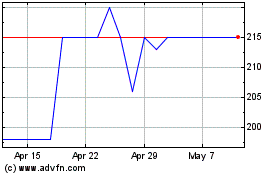

Jz Capital Partners (LSE:JZCP)

Historical Stock Chart

From Jun 2024 to Jul 2024

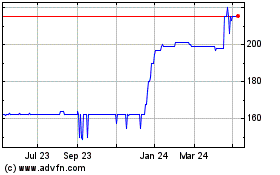

Jz Capital Partners (LSE:JZCP)

Historical Stock Chart

From Jul 2023 to Jul 2024