TIDMJZCP TIDMJZCC TIDMJZCN

JZ CAPITAL PARTNERS LIMITED (the "Company" or "JZCP")

(a closed-end collective investment scheme incorporated with limited liability

under the laws of Guernsey with registered number 48761)

LEI: 549300TZCK08Q16HHU44

Recommended Proposals to approve:

The Company's proposed reduction of its commitments to Spruceview Capital

Partners

Amendments to the Company's investment policy

and

Notice of Extraordinary General Meeting

15 July 2020

Unless otherwise defined herein, capitalised terms used in this announcement

have the meanings given to them in the Circular of the Company dated 15 July

2020.

On 27 November 2019, the Company announced its interim results for the six

month period ended 31 August 2019, in which it was explained that the Company's

Investment Adviser, Jordan/Zalaznick Advisers, Inc. ("JZAI"), was working with

the Board to reduce the Company's commitments and future subscription

obligations to certain managed funds. The Board is now pleased to announce

that, as foreshadowed in the Company's annual results for the year ended 29

February 2020, it has secured agreement with David W. Zalaznick and John (Jay)

Jordan II (together, being the "JZAI Founders", who are the founders and

principals of JZAI) (or their respective affiliates) for the proposed reduction

of the Company's commitments to its investments in Spruceview Capital Partners

("Spruceview") in the amount of approximately US$8.640 million. Accordingly,

the Board is now requesting approval from Shareholders for such proposed

reduction of the Company's commitments to Spruceview (the "Spruceview Proposal"

). The Spruceview Proposal would be considered a Related Party Transaction of

the Company thereby requiring Shareholder approval to be sought and obtained.

In addition, as also set out in the Company's annual results, it remains the

case that the JZAI Founders have also agreed to relieve the Company of certain

of its commitments to the Orangewood Fund by each of them assuming the

obligation of US$2 million and with the balance of the Company's remaining

commitments of US$20 million intended to be transferred to third parties. The

Company will make further announcements as required in relation to the status

of its commitments to the Orangewood Fund as matters progress.

Separately, on 22 April 2020, the Company announced a proposed change to its

investment policy, pursuant to which the Company will make no further

investments except in respect of which it has existing obligations or to the

extent that investment is applied to support certain selected existing

investments (the "Investment Policy Amendment Proposal" and together with the

Spruceview Proposal, the "Proposals"). The intention of the change is to

realise the maximum value of the Company's investments and, after repayment of

all debt, to return capital to Shareholders. The Board is now also pleased to

announce that, as previously indicated, including most recently in the

Company's annual results, it is requesting approval from Shareholders for the

proposed amendments to, and restatement of, its investment policy.

Further details of the Proposals are set out in the sections of this

announcement below.

Notice of Extraordinary General Meeting

The Company is today posting a Circular to Shareholders containing details of

the Proposals and convening an Extraordinary General Meeting of the Company in

order for Shareholders to consider and, if thought fit, approve the Proposals.

The Extraordinary General Meeting of the Company is being convened to be held

at 1.15 p.m. on 12 August 2020 (or as soon thereafter as the Annual General

Meeting of the Company convened for the same day and place has been concluded

or adjourned). The Extraordinary General Meeting will be held at the offices of

Northern Trust International Fund Administration Services (Guernsey) Limited,

Trafalgar Court, Les Banques, St Peter Port, Guernsey GY1 3QL, Channel Islands.

The Notice convening the Extraordinary General Meeting, which contains the

Resolutions to be proposed at that meeting concerning the Proposals, is set out

at the end of the Circular being posted to Shareholders.

Attendance at the Extraordinary General Meeting

The Company has been closely monitoring the evolving situation relating to the

outbreak of Coronavirus (COVID-19), including the current guidance and

restrictions on travel and public gatherings and social distancing. The

priority of the Company's Board at this time is the health, safety and

wellbeing of all Shareholders and Directors.

With effect from 20 June 2020, the States of Guernsey implemented Phase 5 of

its transitional plan to ease the stay at home and travel restrictions

originally introduced on 25 March 2020 in light of COVID-19. Whilst

restrictions within Guernsey have been eased, permitting gatherings to take

place within Guernsey, any persons arriving into Guernsey are presently

required to self-isolate for a period of 14 days upon arrival.

In light of the restrictions in place from 20 June 2020, whilst Guernsey based

Shareholders are permitted to attend the Extraordinary General Meeting in

person, Shareholders from outside of Guernsey are strongly encouraged to

appoint the Chairman of the meeting or the Company Secretary as their proxy and

provide voting instructions in advance of the Extraordinary General Meeting, in

accordance with the instructions explained in the Notice of Extraordinary

General Meeting set out at the end of the Circular.

Shareholders are strongly encouraged to exercise their voting rights by

completing and submitting a Form of Proxy. It is highly recommended that

Shareholders submit their Form of Proxy as early as possible to ensure that

their votes are counted at the Extraordinary General Meeting.

The Company will continue to closely monitor the situation in the lead up to

the Extraordinary General Meeting and will make any further updates as required

about the meeting on its website at www.jzcp.com.

Spruceview Proposal

As mentioned above, the Board has secured agreement with the JZAI Founders (or

their respective affiliates) for the proposed reduction of the Company's

commitments to its investments in Spruceview in the amount of approximately

US$8.640 million. Spruceview, which is a portfolio investment of the Company,

includes its affiliated funds from time to time, and in particular CERPI.

Spruceview is an asset management business in the United States and aims to

address the demand from corporate pensions, endowments, family offices and

foundations for fiduciary management services through an Outsourced Chief

Investment Officer model as well as specific products per asset class. CERPI is

an investment fund established and managed by Spruceview for its client, a

Mexican retirement fund administrator. As the general partner of CERPI,

Spruceview is required to make co-investments in CERPI which are permitted to

be made by various of its affiliates, including the Company and the JZAI

Founders (or their respective affiliates). The key individuals important to the

Spruceview business are Richard Sabo (Partner, CEO and Co-CIO) and Neetesh

Kumar (Partner).

The Company has previously obtained Shareholder approval for certain

investments in Spruceview jointly with the JZAI Founders (or their respective

affiliates). Such approvals included, in March 2019, the Company increasing its

investment together with the JZAI Founders (or their respective affiliates) in

Spruceview Capital Partners by an additional US$1.475 million from the Company

(with a further US$1.475 million being contributed by the JZAI Founders (or

their respective affiliates)). This increase was considered by the Company not

to be a material change to the terms of the 2015 Spruceview Approval (as

defined in the circular) and, therefore, Shareholder approval was not obtained

for such increase. All of the Company's increased investment of US$1.475

million (being the "2015 Spruceview No Material Change Approval"), was to be

used to support Spruceview's share of the co-investment in CERPI. In addition,

in June 2019, Shareholders approved the Company's proposed joint investment of

US$30 million (with the Company investing US$15 million, and a further US$15

million being contributed by the JZAI Founders (or their respective

affiliates)) (the "2019 Spruceview Approval").

Of the US$1.475 million and the US$15 million approved for investment by the

Company pursuant to the 2015 Spruceview No Material Change Approval and the

2019 Spruceview Approval respectively, approximately US$8.640 million

represents the Company's maximum potential commitments to CERPI, with the

remaining approximately US$7.835 million representing its maximum potential

commitments to Spruceview (excluding CERPI).

With respect to the Company's commitments in CERPI and in light of the

Company's desire to reduce its commitments and future subscription obligations,

it is proposed that the Company will have its CERPI commitments reduced in full

(by approximately US$8.640 million), with such commitments being taken over by

the JZAI Founders (or their respective affiliates). Those commitments also

include an amount of approximately US$969,000 in respect of certain commitments

to CERPI to which the Company did not fully subscribe and were instead

subscribed to by affiliates of the JZAI Founders on an interim basis. The

Company is therefore being relieved of an aggregate amount of approximately

US$8.640 million of commitments.

Shareholders should note that the CERPI commitments comprise funded

commitments, unfunded commitments and potential future commitments, in each

case to CERPI, which are subject to change between 10 July 2020 and the time of

the JZAI Founders (or their respective affiliates) taking over the commitments

(expected to be the later of 14 August 2020 and the second business day

following receipt of Shareholders approving the Spruceview Proposal). The price

payable by the JZAI Founders (or their respective affiliates) to the Company

for the transfer of their commitments will be equal to a price equivalent to

the net asset value of the aggregate funded commitments, which is equal to (a)

the total amount of such funded commitments (being as at 10 July 2020 an amount

equal to approximately US$1.287 million), less (b) the total accumulated net

realised and unrealised capital gains and losses of the Company's wholly owned

subsidiary (which has made the subscriptions) with respect to such commitments

to 31 March 2020 (being the date of their most recent valuation) (and being as

at 10 July 2020 an amount equal to approximately US$4,500). The Company intends

to utilise the proceeds received in connection with the Spruceview Proposal in

accordance with the Company's revised investment policy as further detailed

below.

With respect to the Company's commitments in Spruceview (excluding CERPI), it

is proposed that those commitments (of approximately US$7.835 million) are to

remain in place with the Company continuing to invest together with, and

jointly alongside, the JZAI Founders (or their respective affiliates) on a 50:

50 basis economically and on the same terms and conditions as above for the

2019 Spruceview Approval, albeit limited to Spruceview (excluding CERPI) and

excluding the Company's commitments to CERPI as so taken over by the JZAI

Founders (or their respective affiliates). Specifically, the Company would

propose to continue to invest approximately US$7.835 million (with a further

approximately US$7.835 million to be contributed by the JZAI Founders (or their

respective affiliates)) in Spruceview (excluding CERPI). The proposed joint

investment would, as above, be on the same terms as the joint investment in

Spruceview approved by the 2019 Spruceview Approval, being 50:50 economically

and on the same terms and conditions but with certain structural features

intended to afford each side appropriate US tax protections.

The proposed reduction in the Company's commitments in CERPI and the proposed

joint investments in Spruceview (excluding CERPI), would be considered to be a

material change to the 2019 Spruceview Approval, and would therefore be

considered a Related Party Transaction under Chapter 11 of the Listing Rules

(with which the Company voluntarily complies and insofar as the Listing Rules

are applicable to the Company by virtue of its voluntary compliance). JZAI is

the Company's investment adviser pursuant to the Investment Advisory Agreement

and, under the Listing Rules, would therefore be considered a Related Party of

the Company. As founders and principals of JZAI, the JZAI Founders are

associates of JZAI and would also be considered Related Parties of the Company.

In addition, each of the JZAI Founders are substantial shareholders of the

Company as they are each entitled to exercise or to control the exercise of 10

per cent. or more of the votes able to be casted at a general meeting of the

Company. As such, each of the JZAI Founders are considered to be Related

Parties of the Company on this basis as well. The Spruceview Proposal, which

involves the JZAI Founders as Related Parties of the Company, would be

considered to involve arrangements between the Company and its Related Parties.

Accordingly, the JZAI Founders as Related Parties and the Spruceview Proposal

as arrangements between them would be considered a Related Party Transaction

under Chapter 11 of the Listing Rules, insofar as the Listing Rules are

applicable to the Company by virtue of its voluntary compliance with the same.

As such, the Spruceview Proposal, as a Related Party Transaction of the

Company, requires approval of Shareholders to reduce its commitments in CERPI

by divesting them to the JZAI Founders (or their respective affiliates) and for

the Company to invest jointly together with them in Spruceview (excluding

CERPI).

As such, a Resolution is to be proposed at the Extraordinary General Meeting in

relation to the Spruceview Proposal as a Related Party Transaction of the

Company and is being proposed to seek Shareholder approval for the Company's

proposed reduction of its CERPI commitments and joint investments in Spruceview

(excluding CERPI).

Investment Policy Amendment Proposal

Also as mentioned above, the Company is proposing to amend and restate its

investment policy to enshrine the Company's new strategy of making no further

investments except in respect of which it has existing obligations or to the

extent that investment is applied to support certain selected existing

investments. The intention of the change is to realise the maximum value of the

Company's investments and, after repayment of all debt, to return capital to

Shareholders.

The rationale for this change in policy is that, whilst JZAI, as the Company's

Investment Adviser, has been working assiduously in difficult circumstances to

stabilise the Company's investments, the Board recognises that, as a result of

the disappointing and significant losses in value of its real estate portfolio

and poor performance, and having reviewed all available options, there has to

be a change in investment policy. The policy of making no further investments

(with a limited number of exceptions), whilst representing only a change in

emphasis from the existing investment policy, is nonetheless a significant

change and is considered to be material alteration to the policy.

The principal amendment to the Company's existing investment policy relates to

the Company's approach with regard to new investments. The Company's existing

investment policy provides that the Company anticipates that no meaningful

capital will be dedicated to new investments other than honouring its funding

commitments and supporting its portfolio of assets. The Company is now

proposing to alter the emphasis of this concept by amending the policy to

provide that no new investments will be made except in respect of which it has

existing obligations or to the extent that investment is applied to support

certain selected existing investments. The Company's strategy for implementing

the policy will also be changed to realising the maximum value of the Company's

investments and, after repayment of all debt, to returning capital to

Shareholders. The strategy will remove the other existing objectives and will

not be expressed as being limited in duration to the next few years.

Save for those amendments as set out above, the Company is not otherwise

proposing to make any other material changes to its existing investment policy

(including its corporate objective and borrowing policy) and, as such, the

existing investment policy otherwise remains largely unchanged. The Company's

amended and restated investment policy is set out in full in the Circular, with

copies of the same being on display and available for inspection as described

in the Circular.

The Company has previously voluntarily agreed that, in line with Chapter 15 of

the Listing Rules (with which the Company voluntarily complies and insofar as

the Listing Rules are applicable to the Company by virtue of its voluntary

compliance), it would not materially alter its existing investment policy

without the prior approval of Shareholders. The Investment Policy Amendment

Proposal is considered to be a material change to the investment policy and

Shareholder approval is accordingly being sought for the proposed amendments to

the same.

As such, a Resolution is to be proposed at the Extraordinary General Meeting in

relation to the Investment Policy Amendment Proposal and is being proposed to

seek Shareholder approval for the amended and restated investment policy to be

approved and adopted as the investment policy of the Company in substitution

for, and to the exclusion of, the Company's existing investment policy.

Notice of Extraordinary General Meeting and Shareholder Circular

Notice is hereby given that the Extraordinary General Meeting of the Company

will be held at the offices of Northern Trust International Fund Administration

Services (Guernsey) Limited, Trafalgar Court, Les Banques, St Peter Port,

Guernsey GY1 3QL, Channel Islands at 1.15 p.m. on 12 August 2020 (or as soon

thereafter as the Annual General Meeting of the Company convened for the same

day and place has been concluded or adjourned).

Further details of the Proposals are included in the Notice convening the

Extraordinary General Meeting and in the Circular.

The Notice convening the Extraordinary General Meeting is being distributed to

members of the Company and will shortly be uploaded to the Company's website at

www.jzcp.com. Copies of the Circular the Company is posting to Shareholders are

available for viewing, during normal business hours, at the registered office

of the Company at Trafalgar Court, Les Banques, St Peter Port, Guernsey GY1 3QL

and will shortly be available for viewing at www.morningstar.co.uk/uk/nsm.

The Notice convening the Extraordinary General Meeting is also included within

the Circular.

For further information:

Ed Berry / Kit Dunford +44 (0) 20 3727 1046 / 1143

FTI Consulting

David Zalaznick +1 (212) 485 9410

Jordan/Zalaznick Advisers, Inc.

Sam Walden +44 (0) 1481 745385

Northern Trust International Fund

Administration Services (Guernsey)

Limited

Important Notice

This announcement is not an offering of securities. Any securities offered have

not been and will not be registered under the US Securities Act and may not be

offered or sold in the United States absent registration or an applicable

exemption from registration requirements.

This announcement also includes statements that are, or may be deemed to be,

"forward-looking statements". These forward-looking statements can be

identified by the use of forward-looking terminology, including the terms

"believes", "estimates", "anticipates", "expects", "intends", "may", "will" or

"should" or, in each case, their negative or other variations or comparable

terminology. These forward-looking statements relate to matters that are not

historical facts. By their nature, forward-looking statements involve risks and

uncertainties because they relate to events and depend on circumstances that

may or may not occur in the future. Forward-looking statements are not

guarantees of future performance. The Company's actual investment performance,

results of operations, financial condition, liquidity, policies and the

development of its strategies may differ materially from the impression created

by the forward-looking statements contained in this announcement. In addition,

even if the investment performance, result of operations, financial condition,

liquidity and policies of the Company and development of its strategies, are

consistent with the forward-looking statements contained in this announcement,

those results or developments may not be indicative of results or developments

in subsequent periods. These forward-looking statements speak only as at the

date of this announcement. Subject to their legal and regulatory obligations,

each of the Company, the Investment Adviser and their respective affiliates

expressly disclaims any obligations to update, review or revise any

forward-looking statement contained herein whether to reflect any change in

expectations with regard thereto or any change in events, conditions or

circumstances on which any statement is based or as a result of new

information, future developments or otherwise.

END

(END) Dow Jones Newswires

July 15, 2020 02:00 ET (06:00 GMT)

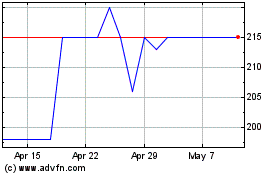

Jz Capital Partners (LSE:JZCP)

Historical Stock Chart

From Jun 2024 to Jul 2024

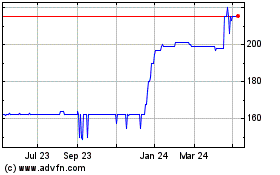

Jz Capital Partners (LSE:JZCP)

Historical Stock Chart

From Jul 2023 to Jul 2024