TIDMJZCP TIDMJZCC TIDMJZCN

NOT FOR RELEASE OR DISTRIBUTION IN OR INTO THE UNITED STATES.

JZ CAPITAL PARTNERS LIMITED (the "Company" or "JZCP")

(a closed-end collective investment scheme incorporated with limited liability

under the laws of Guernsey with registered number 48761)

LEI: 549300TZCK08Q16HHU44

Recommended Proposals to approve:

Amendments to the Company's investment policy

The Company's proposed investments in the US Side-Car Fund

The Company's proposed disposal of its entire ownership interest in

Xpress Logistics Solutions, Inc.

and

Notice of Extraordinary General Meeting

4 October 2019

Unless otherwise defined herein, capitalised terms used in this document have

the meanings given to them in the Circular of the Company dated 4 October 2019.

Further to the Company's announcement on 2 October 2019, the Company announces

today that it is posting a Circular to Shareholders containing details of a

revised investment policy for the purpose of enshrining the Company's strategy

of realising investments, paying down debt and materially reducing commitments

to new investments. As previously announced, the strategy is intended to enable

the Company to pay down a substantial amount of debt and to return a

substantial amount of capital to Shareholders while also meeting the capital

requirements of the Company's portfolio in order to achieve NAV growth.

In addition to containing details of the revised investment policy, the

Circular also convenes an Extraordinary General Meeting of the Company to

consider and, if thought fit, approve the following proposals:

* the proposed amendments to the Company's investment policy (the "Investment

Policy Amendment Proposal");

* the Company's proposed investments in the previously announced US Side-Car

Fund (the "US Side-Car Fund Proposal"); and

* the Company's proposed disposal of its entire ownership interest in one of

its portfolio companies, Xpress Logistics (the "Xpress Logistics Proposal"

),

(together, the "Proposals").

The Company notes that the US Side-Car Fund is being launched for the purpose

of directing the bulk of any new US microcap investments to it and is expected

to be substantially funded by third party limited partners with the Company's

level of proposed investments also being expected to put significantly less of

a burden on its future cash flows. Such investments are therefore considered by

the Board to be consistent with the Company's revised investment policy and its

strategy to materially reduce commitments to new investments. Similarly, the

Company's proposed disposal of its ownership interest in Xpress Logistics is

also considered by the Board to be consistent with the Company's revised

investment policy and its strategy of raising further liquidity by achieving

realisations from existing investments. Both of these Proposals would be

considered Related Party Transactions of the Company and accordingly

Shareholder approval is required for each of them.

As Shareholder approval is required for each of the above Proposals, an

Extraordinary General Meeting of the Company is being convened to be held at

1.00 p.m. on 24 October 2019. The Extraordinary General Meeting will be held at

the offices of Northern Trust International Fund Administration Services

(Guernsey) Limited, Trafalgar Court, Les Banques, St Peter Port, Guernsey GY1

3QL, Channel Islands. The Notice convening the Extraordinary General Meeting,

which contains the Resolutions to be proposed at that meeting concerning the

Proposals, is set out at the end of the Circular being posted to Shareholders.

Investment Policy Amendment Proposal

Firstly, the Company is proposing to amend and restate its investment policy to

enshrine the Company's strategy of realising investments, paying down debt and

materially reducing commitments to new investments.

The principal amendments to the Company's existing investment policy relate to

the Company's strategy and its implementation over the next few years. The

principal amendments are set out below:

* the strategy is to realise investments, pay down debt and materially reduce

commitments to new investments;

* the strategy is intended to enable the Company to pay down a substantial

amount of debt and to return a substantial amount of capital to

Shareholders while also meeting the capital requirements of the Company's

portfolio in order to achieve NAV growth;

* in implementing the strategy, the Company anticipates that no meaningful

capital will be dedicated to new investments other than honouring its

funding commitments and supporting its portfolio of assets. In relation to

its real estate investments, the Company does not expect to make any new

investments in this area other than in its existing real estate portfolio;

and

* as part of implementing the strategy, the Company intends to concentrate on

achieving realisations and working on its current portfolio of assets to

enhance values.

Save for those principal amendments as set out above, the Company is not

otherwise proposing to make any other changes to its existing investment policy

(including its corporate objective and borrowing policy) and, as such, the

existing investment policy otherwise remains largely unchanged. The Company's

amended and restated investment policy is set out in full in the Circular with

copies of the same being on display and available for inspection as described

in the Circular.

The Board considers that the amendments to the Company's investment policy and

the enshrining of the Company's strategy therein (including with the intention

of enabling the Company to pay down a substantial amount of debt, return a

substantial amount of capital to Shareholders and also to meet the capital

requirements of the Company's portfolio) are in the best interests of the

Company and the Ordinary Shareholders.

The Company has previously voluntarily agreed that, in line with Chapter 15 of

the Listing Rules (with which the Company voluntarily complies and insofar as

the Listing Rules are applicable to the Company by virtue of its voluntary

compliance), it would not materially alter its existing investment policy

without the prior approval of Shareholders. The Investment Policy Amendment

Proposal is considered to be a material change to the investment policy and

Shareholder approval is accordingly being sought for the proposed amendments to

the same.

As such, a Resolution is to be proposed at the Extraordinary General Meeting in

relation to the Investment Policy Amendment Proposal and is being proposed to

seek Shareholder approval for the amended and restated investment policy to be

approved and adopted as the investment policy of the Company in substitution

for, and to the exclusion of, the Company's existing investment policy.

US Side-Car Fund Proposal

Secondly, the Company is proposing to make investments in a new US Side-Car

Fund expected to be launched shortly by the Company's Investment Adviser, JZAI,

which is targeting approximately US$500 million of aggregate capital

commitments for investments in the fund. The Company's proposed investments in

the US Side-Car Fund will be made jointly with David Zalaznick and Jay Jordan

(together, the JZAI Founders who are the founders and principals of the

Investment Adviser, JZAI) and various members of the JZAI US microcap

investment team (together with the JZAI Founders, the US Side-Car Fund

Principals), each as Related Parties of the Company.

The Company's Investment Adviser, JZAI, intends to establish the US Side-Car

Fund, which will be a Delaware limited partnership. The general partner of the

US Side-Car Fund will also be a Delaware limited partnership of which JZAI (or

an affiliated entity) will be the general partner. The US Side-Car Fund will be

managed by JZAI (or an affiliated entity). The US Side-Car Fund will be a US

microcap buyout fund and is being established to make new US microcap

investments. Acquisitions are intended to be made with a focus on buyouts and

build-ups of companies and in growth company platforms in the US microcap

market, generally with:

* enterprise values of between US$30 million and US$150 million;

* a focus on businesses generating or capable of generating EBITDA of US$5

million to US$20 million per annum; and

* principal offices and a majority of their operating assets located in the

United States or revenues associated with persons located in or associated

with the United States.

The timing for the first closing of the US Side-Car Fund on capital commitments

by investors is anticipated to be in the fourth quarter of the Company's

current financial year. At or around the time of the first closing, it is

proposed that:

(i) the Company will undertake a capital commitment to make investments in

the US Side-Car Fund (through the general partner of the fund) of up to

approximately US$25 million; and

(ii) the US Side-Car Fund Principals will undertake a capital commitment to

make investments in the US Side-Car Fund (also through the general partner of

the fund) of up to approximately US$25 million.

As such, the Company will be investing jointly with the US Side-Car Fund

Principals in the US Side-Car Fund in the proportions of approximately 50:50.

It is anticipated that the Company's proposed investment will be called over a

five-year period. With respect to the balance of the targeted aggregate capital

commitments to the US Side-Car Fund, these amounts are expected to be funded by

other third party limited partners extending capital commitments to make

investments in the fund.

It is also noted that, at or around the time of the first closing, the US

Side-Car Fund will purchase from the Company one or more US microcap warehoused

investments which may be made by the Company on the expectation that either all

or a portion of them will be sold to the US Side-Car Fund upon it being

established. Any such warehoused investments will be sold at the Company's cost

plus interest at a rate of 8 per cent. per annum and allocated fees and

expenses.

The Board considers that the Company's proposed investments and participation

in the US Side-Car Fund (and in particular that other third party limited

partners are expected to take up a larger proportion of each US microcap

investment going forward) are consistent with the Company's amended and

restated investment policy (including its strategy to materially reduce

commitments to new investments) and are in the best interests of the Company

and the Ordinary Shareholders.

The US Side-Car Fund Proposal would be considered a Related Party Transaction

under Chapter 11 of the Listing Rules (with which the Company voluntarily

complies and insofar as the Listing Rules are applicable to the Company by

virtue of its voluntary compliance). The US Side-Car Fund Principals comprise

the JZAI Founders and various members of the JZAI US microcap investment team

each being considered to be Related Parties of the Company. The JZAI Founders

are the founders and principals of the Company's Investment Adviser, JZAI

(which includes the JZAI US microcap investment team) and are also substantial

Shareholders of the Company as they are entitled to exercise or to control the

exercise of 10 per cent. or more of the votes able to be cast at a general

meeting of the Company. The Company's proposed investments in the US Side-Car

Fund which involves the US Side-Car Fund Principals as Related Parties of the

Company would be considered to be arrangements whereby the Company and its

Related Parties invest in, or provide finance to, another undertaking or asset.

Accordingly, the US Side-Car Fund Principals as Related Parties and the US

Side-Car Fund Proposal as arrangements between them would be considered a

Related Party Transaction of the Company under Chapter 11 of the Listing Rules

(with which the Company voluntarily complies and insofar as the Listing Rules

are applicable to the Company by virtue of its voluntary compliance) and

Shareholder approval is accordingly being sought. A fair and reasonable written

confirmation in a form prescribed by the Listing Rules has been received in

relation to the US Side-Car Fund Proposal.

As such, a Resolution is to be proposed at the Extraordinary General Meeting in

relation to the US Side-Car Fund Proposal and is being proposed to seek

Shareholder approval for the Company's proposed investments in the US Side-Car

Fund.

Xpress Logistics Proposal

Third and finally, the Company is also proposing to dispose of its entire

ownership interest in Xpress Logistics, a subsidiary of one of the Company's

portfolio companies, U.S. Logistics. The Company's proposed disposal of its

ownership interests will in effect be made to Capstone Logistics which is a

portfolio company of Resolute Fund III, being one of the funds managed by The

Jordan Company. David Zalaznick and Jay Jordan (together the JZAI Founders who

are the founders and principals of the Company's Investment Adviser, JZAI),

each as Related Parties of the Company, are also the founders of The Jordan

Company (with Jay Jordan being the non-executive Chairman) and have an economic

interest in Resolute Fund III or its affiliated funds.

On 26 September 2019, Xpress Logistics entered into a merger agreement with

Capstone in relation to a proposed Merger between them. The Merger, if

effected, will have the effect of the Company realising its investment in

Xpress Logistics by disposing of its entire ownership interests as well as its

debt investments therein.

The shareholders of Xpress Logistics, including U.S. Logistics, will receive

for the Merger, in aggregate, Initial Consideration of approximately US$45

million in cash upon the Merger becoming effective, subject to closing

adjustments. Under the terms of the Merger, an amount of US$450,000 from the

Initial Consideration will be held in escrow to be released in accordance with

final closing adjustments to the Initial Consideration. The closing adjustments

will be made to reflect the amount of cash, indebtedness, working capital and

transaction expenses at the time of closing in respect of Xpress Logistics and

its subsidiaries, being the Priority Express Business, as well as adjustments

for certain minority shareholder repurchases, equity appreciation rights and

preferred share redemptions relating to the Priority Express Business required

to effect the Merger. In addition, the shareholders of Xpress Logistics may

receive contingent Earn-Out Consideration of up to, in aggregate, approximately

US$5 million in cash based on certain adjusted EBITDA targets of the Priority

Express Business for the year ending 31 December 2019.

The Company holds a 37.74 per cent. ownership interest in Xpress Logistics by

way of both its 37.72 per cent. ownership interest in U.S. Logistics (which

owns 90.5 per cent. of Xpress Logistics) and its 3.6 per cent. ownership

interest directly in Xpress Logistics. Accordingly, the Merger effectively

involves the Company disposing of its direct and indirect ownership interest in

Xpress Logistics. The Company expects to receive in connection with the Merger

a total amount of approximately US$16,939,000. Such amount includes: (i)

approximately US$8,000,000 (plus unpaid interest) from the redemption by Xpress

Logistics of certain loan notes held by the Company; (ii) approximately

US$7,747,607 (plus accrued dividends) pursuant to the redemption of the

Company's preferred interests in U.S. Logistics; and (iii) approximately

US$863,000 from the Initial Consideration, subject to the final determination

of the aforementioned closing adjustments. In addition, the Company may receive

potentially up to approximately US$1,382,000 from any Earn-Out Consideration

that may be paid subject to the relevant adjusted EBITDA targets being met. The

proceeds that the Company receives in connection with the disposal of its

ownership interests are intended to be used towards the implementation of the

aims of the amended and restated investment policy and for the Company's

general corporate purposes.

The portfolio company the subject of the disposal, Xpress Logistics, is

incorporated in Delaware and the Priority Express Business comprising its

subsidiaries includes one direct subsidiary, Priority Express Courier, Inc.,

which in turn has a subsidiary, Priority Express, Inc. both of which are

incorporated in Delaware. The Priority Express Business was founded in 2005 and

provides over 500 customers in the healthcare and e-commerce end markets with

expedited freight and distribution services, scheduled routed delivery services

and on-demand delivery services. The business conducts its warehousing and

logistics activities in five cross docking facilities strategically located

across New Jersey, Delaware, New York, Connecticut, Virginia, Maryland,

Pennsylvania and the Middle Atlantic region of the United States and has a

network of more than 450 independent third party drivers for its delivery

functions. The Priority Express Business has adjusted EBITDA of approximately

US$4.5 million, revenue of approximately US$38.4 million and total gross assets

of approximately US$20.1 million for the 12 months ending 30 April 2019. These

figures, all of which are unaudited, are attributable to the whole of the

Priority Express Business and not the proportionate 37.7 per cent. ownership

interest held and proposing to be disposed of by the Company through the

Merger.

The Board considers that the proposed disposal by the Company of its ownership

interests in Xpress Logistics currently provides the best opportunity to

realise an attractive and certain value for its ownership interests. The

selection of Capstone as the preferred bidder for Xpress Logistics was

undertaken following a competitive auction process managed by an investment

bank and an assessment that Capstone presented the superior offer. The

Company's Investment Adviser, JZAI, (for reasons explained below) has also

advised the Company that it considers the terms of the Xpress Logistics

Proposal are fair and reasonable as far as Ordinary Shareholders are concerned.

The Board considers that this assessment is further supported by the

participation of Edgewater Growth Capital Partners (one of the Company's major

Shareholders) in the transaction as one of the other selling shareholders of

Xpress Logistics on the same terms as the Company. Accordingly, the Board

considers the Xpress Logistics Proposal to be in the best interests of the

Company and the Ordinary Shareholders. The Board also notes that it considers

the Xpress Logistics Proposal to be consistent with the Company's amended and

restated investment policy and its strategy of raising further liquidity by

achieving realisations from existing investments.

The Xpress Logistics Proposal would be considered a Related Party Transaction

under Chapter 11 of the Listing Rules (with which the Company voluntarily

complies and insofar as the Listing Rules are applicable to the Company by

virtue of its voluntary compliance). The JZAI Founders are the founders and

principals of the Company's Investment Adviser, JZAI, and are also substantial

Shareholders of the Company as they are entitled to exercise or to control the

exercise of 10 per cent. or more of the votes able to be cast at a general

meeting of the Company. Each of the JZAI Founders is considered to be a Related

Party of the Company. As mentioned above, the counterparty to the Merger,

Capstone, is a portfolio company of Resolute Fund III which has a 94 per cent.

ownership interest in Capstone and is one of the funds managed by The Jordan

Company. The JZAI Founders, each as Related Parties of the Company, are also

the founders of The Jordan Company (with Jay Jordan being the non-executive

Chairman) and have an economic interest in Resolute Fund III or its affiliated

funds. As such, the Xpress Logistics Proposal would be considered a Related

Party Transaction under Chapter 11 of the Listing Rules (with which the Company

voluntarily complies and insofar as the Listing Rules are applicable to the

Company by virtue of its voluntary compliance) and Shareholder approval is

accordingly being sought.

Notwithstanding the foregoing, Shareholders should note that, whilst the

Listing Rules provide for written confirmation to be obtained from a sponsor

that the terms of a Related Party Transaction are fair and reasonable as far as

shareholders are concerned, such a confirmation has not been received in

relation to the Xpress Logistics Proposal. Shareholders are reminded that the

Company also departed from the same requirement in relation to the Deflecto and

Water Treatment transactions last year and the Avante-MERS and Orizon

transactions earlier this year, all of which were approved by Shareholders. The

reason for this being the case is because, as was the same for the

aforementioned historic transactions, whilst the Company has sought to obtain a

fair and reasonable written confirmation for the Xpress Logistics Proposal, it

has been unable to do so at a cost which can be justified relative to its size

and within the time constraints needed to be met in order to transact on and

complete the transaction on the terms negotiated. The Company again reiterates

its understanding that the costs and time for obtaining such a confirmation can

be greater for a Related Party Transaction that concerns an acquisition or

disposal, such as the Xpress Logistics Proposal.

The Company has therefore decided to depart from the requirement to obtain a

fair and reasonable written confirmation on this occasion but notwithstanding

that, and as was also the case with the historic transactions, the Company's

Investment Adviser, JZAI, has instead provided written confirmation to the

Company that the terms of the Xpress Logistics Proposal are fair and reasonable

as far as Ordinary Shareholders are concerned. JZAI has a selective and

disciplined approach to investing which is applied across all investments

including in the case of Xpress Logistics. In addition, whilst the JZAI

Founders do have an economic interest in Resolute Fund III or its affiliated

funds as described above, the Company notes that the Merger and the selection

of Capstone as the preferred bidder for Xpress Logistics was undertaken

following a competitive auction process managed by an investment bank and an

assessment of Capstone as presenting the superior offer as determined on the

basis of price and ability to complete the Merger in a short time frame with

certainty. The Company also notes again that Edgewater is participating in the

transaction on the same terms as the Company, which the Board considers to

provide additional support for JZAI's assessment that the terms of the Xpress

Logistics Proposal are fair and reasonable. Shareholders are also reminded that

the Company is not subject to, but rather voluntarily complies with, the

Listing Rules and, save for the absence of a fair and reasonable written

confirmation in a form prescribed by the Listing Rules, the Xpress Logistics

Proposal is otherwise being treated in accordance with the Listing Rules

including in respect of the requirement to obtain Shareholder approval.

As such, a Resolution is to be proposed at the Extraordinary General Meeting in

relation to the Xpress Logistics Proposal and is being proposed to seek

Shareholder approval for the Company's proposed disposal of its ownership

interests in Xpress Logistics.

Notice of Extraordinary General Meeting and Shareholder Circular

Notice is hereby given that the Extraordinary General Meeting of the Company

will be held at the offices of Northern Trust International Fund Administration

Services (Guernsey) Limited, Trafalgar Court, Les Banques, St Peter Port,

Guernsey GY1 3QL, Channel Islands at 1.00 p.m. on 24 October 2019.

Further details of the Proposals are included in the Notice convening the

Extraordinary General Meeting and in the Circular.

The Notice convening the Extraordinary General Meeting is being distributed to

members of the Company and will shortly be uploaded to the Company's website at

www.jzcp.com. Copies of the Circular the Company is posting to Shareholders are

available for viewing, during normal business hours, at the registered office

of the Company at Trafalgar Court, Les Banques, St Peter Port, Guernsey GY1 3QL

and will shortly be available for viewing at www.morningstar.co.uk/uk/nsm.

The Notice convening the Extraordinary General Meeting is also included within

the Circular.

For further information:

Ed Berry / Kit Dunford +44 (0) 20 3727 1046 / 1143

FTI Consulting

David Zalaznick +1 (212) 485 9410

Jordan/Zalaznick Advisers, Inc.

Sam Walden +44 (0) 1481 745385

Northern Trust International Fund

Administration Services (Guernsey)

Limited

About JZCP

JZ Capital Partners ("JZCP") is one of the oldest closed-end investment

companies listed on the London Stock Exchange. It seeks to provide shareholders

with a return by investing selectively in US and European microcap companies

and US real estate. JZCP receives investment advice from Jordan/Zalaznick

Advisers, Inc. ("JZAI") which is led by David Zalaznick and Jay Jordan. They

have worked together for more than 35 years and are supported by teams of

investment professionals in New York, Chicago, London and Madrid. JZAI's

experts work with the existing management of microcap companies to help build

better businesses, create value and deliver strong returns for investors. For

more information please visit www.jzcp.com.

Important Notice

This announcement is not an offering of securities. Any securities offered have

not been and will not be registered under the US Securities Act and may not be

offered or sold in the United States absent registration or an applicable

exemption from registration requirements.

This announcement also includes statements that are, or may be deemed to be,

"forward-looking statements". These forward-looking statements can be

identified by the use of forward-looking terminology, including the terms

"believes", "estimates", "anticipates", "expects", "intends", "may", "will" or

"should" or, in each case, their negative or other variations or comparable

terminology. These forward-looking statements relate to matters that are not

historical facts. By their nature, forward-looking statements involve risks and

uncertainties because they relate to events and depend on circumstances that

may or may not occur in the future. Forward-looking statements are not

guarantees of future performance. The Company's actual investment performance,

results of operations, financial condition, liquidity, policies and the

development of its strategies may differ materially from the impression created

by the forward-looking statements contained in this announcement. In addition,

even if the investment performance, result of operations, financial condition,

liquidity and policies of the Company and development of its strategies, are

consistent with the forward-looking statements contained in this announcement,

those results or developments may not be indicative of results or developments

in subsequent periods. These forward-looking statements speak only as at the

date of this announcement. Subject to their legal and regulatory obligations,

each of the Company, the Investment Adviser and their respective affiliates

expressly disclaims any obligations to update, review or revise any

forward-looking statement contained herein whether to reflect any change in

expectations with regard thereto or any change in events, conditions or

circumstances on which any statement is based or as a result of new

information, future developments or otherwise.

END

(END) Dow Jones Newswires

October 04, 2019 02:00 ET (06:00 GMT)

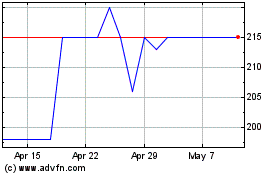

Jz Capital Partners (LSE:JZCP)

Historical Stock Chart

From May 2024 to Jun 2024

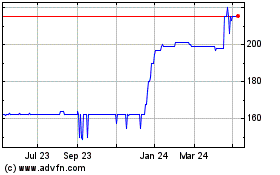

Jz Capital Partners (LSE:JZCP)

Historical Stock Chart

From Jun 2023 to Jun 2024