JZ Capital Ptnrs Ltd Q1 2019 Interim Management Statement

June 28 2019 - 2:00AM

UK Regulatory

TIDMJZCP TIDMJZCN TIDMJZCC

JZ CAPITAL PARTNERS LIMITED

(a closed-end investment company incorporated with limited liability under the

laws of Guernsey with registered number 48761)

Q1 2019 Interim Management Statement

28 June 2019

LEI: 549300TZCK08Q16HHU44

(Classified Regulated Information, under DTR 6 Annex 1 section 1.1)

JZ Capital Partners Limited (LSE: JZCP.L, the "Company" or "JZCP"), the London

listed fund that selectively invests in US and European micro-cap companies and

US real estate, today releases its Interim Management Statement for the period

1 March 2019 to 31 May 2019.

Results Highlights

* Net Asset Value ("NAV") of $800.2 million (28/02/19: $810.3 million)

* NAV per share of $9.92, a decrease of 1.2% for the quarter (28/02/19:

$10.04)

* $53.1 million realized, including:

+ $23.3 million from the sale of Waterline Renewal

+ $14.0 million from the refinancing of Felix Storch

+ $14.1 million from JZI Fund III, L.P., related to the sale of portfolio

company Petrocorner and refinancing of Collingwood and Fincontinuo

* $25.6 million invested, including:

+ $2.4 million in Exer Urgent Care

+ $21.4 million in follow-on real estate investments in our assemblages

in Brooklyn, New York, and South Florida

* At the end of the period, the portfolio consisted of 41 micro-cap

investments across nine industries and five major real estate "assemblages"

located in New York and South Florida

David Zalaznick, Founder and Investment Advisor of JZCP said: "The period was

characterized by a series of successful realizations as part of our continued

commitment to using proceeds to make distributions to shareholders and pay down

debt. As part of that, we are delighted to have received shareholder support

for a series of tender offers, the first $30 million of which we intend to

launch in July. We believe these strategic initiatives will greatly benefit all

shareholders and provide the Company with more flexibility as the balance sheet

strengthens."

Net Asset Value

NAV per share for the quarter decreased from $10.04 to $9.92, or 1.2%.

NAV Returns

Net Asset Value per Ordinary Share as of 1 March 2019 $10.04

Change in NAV per share due to capital gains and income received / accrued

on investments

US Micro-cap 0.13

European Micro-cap (0.12)

Real Estate (0.04)

Other changes in NAV per share

Finance Costs (0.07)

Foreign Exchange Effect 0.06

Expenses and Taxation (0.08)

Net Asset Value per Ordinary Share as of 31 May 2019. $9.92

The US micro-cap portfolio had a net increase of 13 cents, primarily due to

write-ups at our co-investment Orizon (6 cents), net accrued income of 6 cents

and escrows of 2 cents. These increases were offset by a write-down at our

Water vertical (1 cent).

The European micro-cap portfolio had a net decrease of 12 cents, primarily due

to write-ups at multiple JZI Fund III, L.P. portfolio companies (3 cents) and 1

cent of accrued income, offset by a 16 cent write-down of the accrued interest

on JZCP's loan to Ombuds.

The real estate portfolio had a decrease of 4 cents for the quarter, due to

carrying costs and pre-development expenses at the property level.

The chart below summarizes the cumulative total NAV returns and total

shareholder returns for the most recent three-month, twelve-month, three-year

and five-year period.

31/05/19 28/02/19 31/05/18 31/05/16 31/05/14

Share price (in GBP) GBP4.79 GBP4.35 GBP4.64 GBP3.90 GBP4.41

NAV per share (in USD) $9.92 $10.04 $9.78 $10.32 $10.08

NAV to market price 39.1% 42.4% 36.9% 45.0% 26.6%

discount

3 month 12 month 3 year 5 year

return return return return

Dividends paid (in USD) - - - $0.16 $0.79

Total Shareholders' return - 10.1% 3.2% 25.9% 23.0%

(GBP)1

Total NAV return per share - (1.2)% 1.4% (2.4)% 6.4%

(USD)1

Total Adjusted NAV return - (1.2)% (0.1)% (4.0)% 15.4%

per share (USD)1/2

______________

1. Total returns are cumulative and assume that dividends were reinvested

2. Adjusted NAV returns reflect the return per share before (i) the dilution

resulting from the issue of 18,888,909 ordinary shares at a discount to NAV

on 30 September 2015 and (ii) subsequent appreciation of the buyback of

ordinary shares at a discount

RECENT ACTIVITIES

Upcoming Tender Offer

JZCP's board has received shareholder approval to return approximately $100

million in capital to shareholders via a series of tender offers at a price no

more than a 5% discount to NAV.

We expect to send out documents regarding the first tender offer of

approximately $30 million in July 2019.

Significant Investments and Realizations

Co-investments

In March 2019, JZCP invested approximately $2.4 million in Exer Urgent Care,

one of the largest urgent care operators in Greater-Los Angeles and Orange

County, California.

Real Estate Investments

In the three-month period ended 31 May 2019, JZCP invested a total of $21.4

million in follow-on investments in our assemblages in Brooklyn, New York, and

South Florida.

Realizations

Waterline Renewal

In April 2019, Waterline Renewal was acquired by Behrman Capital, a private

equity investment firm based in New York and San Francisco.

Waterline Renewal is a leading provider of engineered products used in the

trenchless rehabilitation of wastewater infrastructure for municipal,

commercial, industrial, and residential applications. The company's patented

line of products and technologies allows its customers to deliver long-lasting

solutions that repair sewer systems and wastewater lines without the need for

excavation or property damage, and prevent overflow created by excess inflow

and infiltration of ground water into the wastewater system.

JZCP expects to realize approximately $24.6 million in gross proceeds

(including escrows) from the sale.

Felix Storch

In March 2019, JZCP refinanced Felix Storch, its manufacturer of small and

custom refrigeration appliances. This refinancing resulted in gross proceeds to

JZCP of approximately $14.0 million, which returned JZCP's entire March 2017

investment in Felix Storch of $12.0 million. Felix Storch has continued to

exhibit strong growth and we expect it to return more capital in the future.

PORTFOLIO SUMMARY

At 31 May 2019, the Company's portfolio consisted of 41 micro-cap investments

across nine major industries and five major real estate "assemblages" located

in New York and South Florida.

($'000)

At 31/05/19 At 28/02/19 % Gross Assets

31/05/19

US Micro-cap Portfolio 453,706 478,970 40.9%

European Micro-cap Portfolio 102,176 128,698 9.2%

Real Estate Portfolio 461,495 443,044 41.6%

Other Portfolio

19,520 19,082 1.8%

Total Private Investments 1,036,897 1,069,794 93.5%

Cash and Liquid Investments 73,174 54,308 6.5%

Total Investments (and Cash) 1,110,071 1,124,102 100.0%

Other Current Assets 563 506 0.0%

Total Investments (and Cash) 1,110,634 1,124,608 100.0%

At 31 May 2019, 6.5% of gross assets were invested in liquid assets (cash). The

remaining portion of the portfolio was invested in private investments in US or

European micro-cap companies or real estate. Our micro-cap investments are

valued at fair value by JZCP's directors each quarter whereas our real estate

portfolio is valued at least annually and based upon third-party appraisals,

generally done prior to JZCP's fiscal year end.

We value our privately held businesses cautiously. Our average multiple used

for our US micro-cap businesses is 8.1x trailing EBITDA. In addition, we do

not have substantial debt in these businesses. The multiple of debt senior to

JZCP's position is approximately 3.8x EBITDA.

Top Ten Investments

Our ten largest investments as of 31 May 2019 are summarized below:

($000's) Asset Valuation % Gross

Category 31/05/19 Assets

31/05/19

Industrial Services Solutions US 95,893 8.6%

Vertical

Design District - Southern Parcel Real Estate 91,994 8.3%

Greenpoint Real Estate 59,768 5.4%

Fulton Mall Assemblage Real Estate 53,226 4.8%

TierPoint US 46,813 4.2%

Deflecto US 42,401 3.8%

Avante US 40,850 3.7%

Williamsburg Retail - North 6th Real Estate 37,188 3.3%

Redbridge Bedford Real Estate 32,372 2.9%

Peaceable Street Capital US 27,634 2.5%

Top Ten Investments 528,139 47.6%

Remaining Assets 582,495 52.4%

Gross Assets 1,110,634 100.0%

Balance Sheet

Below is a summary of JZCP's balance sheet as of the relevant dates:

($000's) 31/05/19 28/02/19

Cash and cash equivalents 73,174 54,308

Investments & other assets 1,037,460 1,070,300

(-) Other net liabilities (249,186) (250,508)

(-) ZDPs due 2022 (61,266) (63,838)

Net Asset Value 800,182 810,262

At 31 May 2019, "other net liabilities" includes $51.4 million from the

issuance of Convertible Unsecured Loan Stock ("CULS") in July 2014, which

carries an interest rate of 6%, and $149.3 million from a six-year term loan

with Guggenheim Partners, which carries an interest rate of LIBOR plus 5.75%.

For Further Information:

Ed Berry / Kit Dunford +44 (0) 20 3727 1046 / 1143

FTI Consulting

David Zalaznick +1 212 485 9410

Jordan/Zalaznick Advisers, Inc.

Sam Walden +44 (0) 1481 745385

JZ Capital Partners Limited

About JZCP

JZ Capital Partners ("JZCP") is one of the oldest closed-end investment

companies listed on the London Stock Exchange. It seeks to provide shareholders

with a return by investing selectively in US and European micro-cap companies

and US real estate. JZCP receives investment advice from Jordan/Zalaznick

Advisers, Inc. ("JZAI") which is led by David Zalaznick and Jay Jordan. They

have worked together for more than 35 years and are supported by teams of

investment professionals in New York, Chicago, London and Madrid. JZAI's

experts work with the existing management of micro-cap companies to help build

better businesses, create value and deliver strong returns for investors. For

more information please visit www.jzcp.com.

END

(END) Dow Jones Newswires

June 28, 2019 02:00 ET (06:00 GMT)

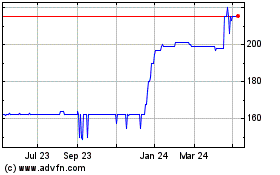

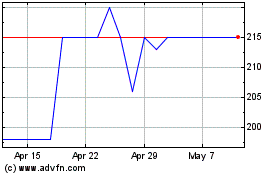

Jz Capital Partners (LSE:JZCP)

Historical Stock Chart

From May 2024 to Jun 2024

Jz Capital Partners (LSE:JZCP)

Historical Stock Chart

From Jun 2023 to Jun 2024