JZ Capital Ptnrs Ltd Share Buybacks

June 27 2019 - 12:53PM

UK Regulatory

TIDMJZCP TIDMJZCC TIDMJZCN

JZ CAPITAL PARTNERS LIMITED (the "Company" or "JZCP")

(a closed-end investment company incorporated with limited liability under the

laws of Guernsey with registered number 48761)

SHARE BUYBACKS

27 JUNE 2019

At the Annual General Meeting of the Company held on 27 June 2019, the

shareholders of the Company approved the purchase by the Company of shares in

the capital of the Company (the "On-Market Buy Backs"). The authorities

authorised the Company to, amongst other things, make market acquisitions of

the Company's shares up to a maximum number of, 12,091,959 ordinary shares and

1,784,967 zero dividend redeemable preference shares representing approximately

14.99 per cent of each class of those shares in issue as at 7 May 2019 (the

"On-Market Buy Back Authority").

It is also noted that, in order for the Company to undertake share buybacks of

ordinary shares, in addition to repurchasing shares through the above mentioned

market acquisitions, the Company will need to repurchase ordinary shares

through effecting a number of resultant off-market mandatory repurchases from

certain of the Company's large US shareholders pursuant to and as required by

its Articles of Incorporation. The process of the Company buying back ordinary

shares in this way reflects the implementation of the CFC Buy Back Arrangement

as further described in the Company's Circular to shareholders dated 20 April

2017 (the "Off-Market Buy Backs"). As such, at the Annual General Meeting, the

shareholders of the Company also approved the Company to make off-market

acquisitions of ordinary shares in the capital of the Company pursuant to its

Articles of Incorporation (the "Off-Market Buy Back Authority" and together

with the On-Market Buy Back Authority, the "Buy Back Authorities"). The

intention is for such Buy Back Authorities to be renewed annually by the

Company at its Annual General Meetings as has been the case in previous years.

Shareholders are also reminded that, at the Extraordinary General Meeting of

the Company held after the conclusion of the Annual General Meeting on 27 June

2019, the shareholders of the Company approved additional buy back authorities

in order to return capital to ordinary shareholders by way of a tender offer

(or a series of tender offers) and resultant off-market acquisitions of the

Company's ordinary shares (the "Tender Offer Authorities") as further described

in the Company's Circular dated 29 May 2019. It is now the intention of the

Company to undertake acquisitions of its ordinary shares by way of a tender

offer (or series of tender offers) pursuant to the Tender Offer Authorities

however the Company may, in addition and where appropriate, make acquisitions

of both its ordinary shares and zero dividend preference shares by way of share

buy backs pursuant to the Buy Back Authorities.

For the purpose of any On-Market Buy Backs forming part of the Buy Back

Authorities, the Company has instructed J.P. Morgan Securities plc to act as

its broker in respect of such transactions. With respect to any Off-Market Buy

Backs resulting from such On-Market Buy Backs, on any relevant day, the Company

will carry out any required off-market repurchases pursuant to and as required

by the Company's Articles of Incorporation. The price at which ordinary shares

are repurchased pursuant to the Off-Market Buy Backs will be equal to the

volume weighted average price payable per ordinary share in respect of the

ordinary shares agreed to be repurchased by J. P. Morgan Securities plc

pursuant to the On-Market Buy Backs during the course of any relevant day. The

Company will announce the results of any share buyback related to the Buy Back

Authorities by no later than 7.30 a.m. on the business day following the

calendar day on which such repurchases occurred. The details of any share

buyback undertaken by way of tender offer and relying on the Tender Offer

Authorities will be contained in a separate shareholder circular(s) that will

be sent to shareholders at the time the Company decides to undertake buybacks

in this way.

Although the Company retains the power to do so, it is not obliged to carry out

share buybacks of its shares, and as such, the Company may undertake buybacks

when it so chooses including (as applicable) as and when opportunities in the

market permit and as its cash resources allow at the time.

For further information:

William Simmonds +44 (0) 20 7742 4000

J.P. Morgan Cazenove

Ed Berry / Kit Dunford +44 (0) 20 3727 1046 / 1143

FTI Consulting

David Zalaznick +1 (212) 485 9410

Jordan/Zalaznick Advisers, Inc.

Sam Walden +44 (0) 1481 745385

Northern Trust International Fund

Administration Services (Guernsey)

Limited

About JZ Capital Partners

JZ Capital Partners ("JZCP") is one of the oldest closed-end investment

companies listed on the London Stock Exchange. It seeks to provide shareholders

with a return by investing selectively in US and European microcap companies

and US real estate. JZCP receives investment advice from Jordan/Zalaznick

Advisers, Inc. ("JZAI") which is led by David Zalaznick and Jay Jordan. They

have worked together for more than 35 years and are supported by teams of

investment professionals in New York, Chicago, London and Madrid. JZAI's

experts work with the existing management of microcap companies to help build

better businesses, create value and deliver strong returns for investors. For

more information please visit www.jzcp.com.

END

(END) Dow Jones Newswires

June 27, 2019 12:53 ET (16:53 GMT)

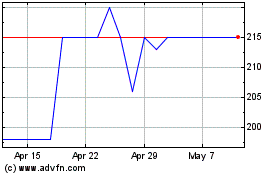

Jz Capital Partners (LSE:JZCP)

Historical Stock Chart

From May 2024 to Jun 2024

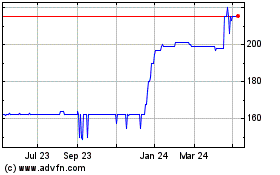

Jz Capital Partners (LSE:JZCP)

Historical Stock Chart

From Jun 2023 to Jun 2024