TIDMJZCP TIDMJZCC TIDMJZCN

JZ CAPITAL PARTNERS LIMITED (the "Company" or "JZCP")

(a closed-end investment company incorporated with limited liability under the

laws of Guernsey with registered number 48761)

ANNUAL RESULTS FOR THE TWELVE-MONTH PERIODED

28 FEBRUARY 2019

LEI: 549300TZCK08Q16HHU44

(Classified Regulated Information, under DTR 6 Annex 1 section 1.1)

8 May 2019

JZ Capital Partners, the London listed fund that invests in US and European

microcap companies and US real estate, announces its preliminary results for

the year ended 28 February 2019.

Results and Portfolio Highlights

· NAV per share of $10.04 (FYE 28/02/18: $9.98), an increase of 0.6%

during the period

· NAV of $810.3 million (FYE 28/02/18: $837.6 million)

· Total investments of $183.7 million including: new Flexible Packaging

and Flow Controls verticals, a new co-investment, Deflecto, as well as

follow-on investments in our Testing Services and Industrial Services Solutions

verticals. The Company also made additional investments in our properties

located in Brooklyn, New York and South Florida.

· Realisation of three investments significantly above NAV: Paragon Water

Systems ("Paragon"), Bolder Healthcare Solutions ("BHS") and TWH Water

Treatment Industries Inc. ("TWH"), with gross proceeds of more than $160

million, including escrows and potential earn-out proceeds.

· In December 2018, the Company entered into a joint venture partnership

with HomeFed, a real estate investor and developer in the US, with regards to

the Fulton Mall Assemblage. JZCP received gross proceeds of approximately $40.7

million from the minority sale.

· In September 2018, JZCP refinanced Esperante, its office building in

West Palm Beach, Florida, resulting in gross proceeds to JZCP of $8.3 million.

· As of 28 February 2019, the portfolio comprised:

o US microcap: 24 businesses, which includes five 'verticals' and 14

co-investments, across eleven industries.

o European microcap: 17 companies across six industries and seven countries.

o US real estate: 61 properties (including one post year-end acquisition)

across five major assemblages in New York and South Florida all in various

stages of (re)/development.

· JZCP made one post-period realization (April 2019) and one post-period

refinancing (March 2019): Waterline Renewal and Felix Storch.

Strategic Initiatives

· JZCP's Board will be seeking shareholder approval for the return of

approximately $100 million in capital to shareholders at a price no more than a

5% discount to NAV, via a series of tender offers, the first of which we are

targeting in July 2019 for approximately $30 million.

· Additionally, we plan to repay approximately $100 million of debt. The

$200 million of cash required to support these initiatives will be generated

from realizations and the secondary sale of certain portfolio assets that are

planned for this calendar year and next.

· In order to conserve cash for these strategic initiatives, we will be

investing in fewer new deals or investing a smaller percentage in each new

deal. As such, a strategy similar to our investment in JZI Fund III, L.P. for

European microcap companies is intended to be developed, where, in effect, JZCP

puts up a much smaller percentage in each new investment.

· In the coming months, we will also be seeking shareholder approval for a

US Side-Car Fund ("JZ Partners II"), which will be approximately $450 million

and used to invest side-by-side with JZCP in US microcap deals.

· Finally, as we are two to three years out from redeeming our Zero

Dividend Preference Shares and Convertible Unsecured Loan Stock, we believe our

goal should be to retire these obligations, as well as a meaningful portion of

the Guggenheim term loan in the next thirty six months.

Outlook

· Strong pipeline of realizations and refinancings in the Company's

overall portfolio over the next 12 months.

· Balance sheet remains strong and the Company is focused on using the

liquidity achieved from realizations and refinancings to fund the series of

tender offers (subject to shareholder approval) and paying down debt.

· As we repay debt, we will be de-risking JZCP overall; additionally, as

we undertake tender offers of our stock (at close to NAV), we will be returning

capital to shareholders.

David Zalaznick, JZCP's Co-Founder and Investment Adviser, said: "We are

pleased with the continued strong underlying performance of the US and European

microcap portfolios during the period. In addition, we expect the ongoing

improvement in real estate performance to continue going forward, following the

successful completion of the previously announced Fulton Mall Assemblage joint

venture partnership.

We have continued to make significant progress in realising portfolio assets,

at or above NAV, which will help fund the strategic initiatives announced today

for a series of tender offers and the repayment of debt. We believe these

proposals will benefit all shareholders whilst strengthening JZCP's balance

sheet, hopefully ensuring our underlying performance translates into positive

long-term shareholder value."

David Macfarlane, Chairman of JZCP, said: "We have worked hard during the

period to better prepare the Company for a more secure, long-term future, and

we fully support our Investment Adviser's ability to execute the plan our Board

has approved to de-risk the Company and return capital to shareholders via a

series of tender offers. We have confidence in the value of JZCP's assets and

believe the measures outlined today will greatly benefit all shareholders."

Presentation details:

There will be an audiocast presentation for investors and analysts at 2pm

(London, UK) / 9am (New York, US) on Wednesday 8 May, 2019. The presentation

can be accessed here and by dialing +44 (0)330 336 9125 (UK) or +1 323-794-2575

(US) with the participant access code 9765331.

__________________________________________________________________________________

Market Abuse Regulation

The information contained within this announcement is inside information as

stipulated under MAR. Upon the publication of this announcement, this inside

information is now considered to be in the public domain. The person

responsible for arranging for the release of this announcement on behalf of the

Company is David Macfarlane, Chairman.

For further information:

Ed Berry / Kit Dunford

+44 (0)20 3727 1046 / 1143

FTI Consulting

David Zalaznick

+1 212 485 9410

Jordan/Zalaznick Advisers, Inc.

Sharon Henderson

+44 (0)

1481 745403

Northern Trust International Fund

Administration Services (Guernsey) Limited

About JZ Capital Partners

JZ Capital Partners ("JZCP") is one of the oldest closed-end investment

companies listed on the London Stock Exchange. It seeks to provide shareholders

with a return by investing selectively in US and European microcap companies

and US real estate. JZCP receives investment advice from Jordan/Zalaznick

Advisers, Inc. ("JZAI") which is led by David Zalaznick and Jay Jordan. They

have worked together for more than 35 years and are supported by teams of

investment professionals in New York, Chicago, London and Madrid. JZAI's

experts work with the existing management of microcap companies to help build

better businesses, create value and deliver strong returns for investors. For

more information please visit www.jzcp.com.

Chairman's Statement

I am pleased to report the results of JZ Capital Partners ("JZCP" or the

"Company") for the year ended 28 February 2019.

Performance

The Company's performance over the last twelve months has been set against a

backdrop of continued global market uncertainty, led by a widespread increase

in populism, mounting trade tensions and financial conditions tightening

globally. Meanwhile, prolonged Brexit negotiations and US trade tariffs

continue to undermine business confidence and investment.

Despite this, the US economy remains in a period of economic expansion, driven

by large tax cuts, spending increases and falling unemployment levels.

Comparatively, the European economic outlook remains gloomy. A series of

surprising election results in Italy, Sweden and Ukraine saw voters move away

from traditional parties, signifying the appeal of populist rhetoric across the

region, and economic expansion in 2018 occurred at a much slower pace than

predicted.

Within this market environment, the Company delivered marginal net asset value

("NAV") growth during the year, with JZCP's NAV per share increasing 0.6% from

$9.98 to $10.04. The positive underlying performance of the US and European

micro-cap portfolio was offset principally by the pre-development and carrying

costs in our real estate portfolio.

Strategic Initiatives

The Board is seeking shareholder approval for specific initiatives that we

believe will greatly benefit all of our shareholders and strengthen JZCP's

balance sheet. We have formulated this plan in conjunction with our advisers,

David Zalaznick and Jay Jordan, who are supportive.

We will be seeking approval for the return of approximately $100 million in

capital to shareholders at a maximum discount to NAV of 5%, via a series of

tender offers. In addition, the Company plans to repay approximately $100

million of debt. The $200 million of cash required to support these initiatives

will be generated from ordinary realizations and the secondary sale of certain

portfolio assets that are planned for this calendar year and next.

We intend to begin implementation of this plan immediately, with the first

tender offer for the repurchase of shares and/or repayment of debt planned to

take place in July 2019. Since we have many illiquid investments, it is

important to sell them in an orderly fashion in order not to diminish their

intrinsic value. Therefore, the first tender offer is intended to be for

approximately $30 million.

In order to conserve cash for successive share buybacks and debt repayment, we

will be investing in fewer new deals or investing a smaller percentage in each

new deal. As such, the Board has asked our Investment Adviser to develop a

strategy similar to our investment in JZI Fund III, L.P. for European microcap

companies, where, in effect, JZCP puts up a much smaller percentage in each new

investment.

In the coming months, we will be seeking shareholder approval for a US Side-Car

Fund ("JZ Partners II"), which will be approximately $450 million and will be

used to invest side-by-side with JZCP in US microcap deals. JZ Partners II,

which will be substantially funded by third-party limited partners, should

allow JZCP to conserve considerable cash over the next five years, as JZ

Partners II will take up a larger percentage of each new US microcap deal. The

current thinking is to hold a first closing for JZ Partners II in the fourth

quarter of JZCP's current financial year.

As we are two to three years out from redeeming our Zero Dividend Preference

Shares ("ZDPs") and Convertible Unsecured Loan Stock ("CULS"), we believe our

goal should be to retire these obligations, as well as a meaningful portion of

the Guggenheim term loan in the next thirty six months.

The Board believes that this plan will benefit all shareholders by returning

capital (via tender offers at close to NAV) and by retiring debt, which

de-risks JZCP overall.

Portfolio Update

It has been another active investment period for the Company, putting $183.7

million to work across our three major asset classes, whilst realisations and

refinancings totaled $207.2 million, primarily through the sale of Bolder

Healthcare Solutions ("BHS"), TWH Water Treatment Industries ("TWH"), Paragon

Water Systems ("Paragon") and a minority stake in our Fulton Mall Assemblage.

The portfolio continues to diversify geographically across Western Europe and

by asset type. At the end of the year, the Company's portfolio consisted of 41

US and European micro-cap businesses across eleven industries, and five primary

real estate 'assemblages' (61 total properties) located in Brooklyn, New York

and South Florida.

U.S. and European Micro-cap

The Board is pleased with the continued positive performance of the US

micro-cap portfolio, which has delivered a net valuation increase of 49 cents

per share during the year. This was primarily due to net accrued income (19

cents), increased earnings at Felix Storch (13 cents) and Priority Express (2

cents) and writing our Water Treatment and Waterline Renewal investments up to

their respective sale values (36 cents).

The portfolio was valued at 8.1x EBITDA, after applying an average 23%

marketability discount to public comparables.

The European micro-cap sector remains a strategically important segment of the

business. It now represents approximately 11 per cent of the Investment

Portfolio ($129 million) and consists of 17 companies across six industries and

seven countries.

The portfolio performed very well during the year and has seen a valuation

increase of 22 cents per share, primarily due to net accrued income (9 cents)

and write-ups at Petrocorner, Fincontinuo, S.A.C, Alianzas en Aceros and

Eliantus (13 cents combined).

During the year, JZCP acquired a stake in one new business through its 18.8%

ownership of JZI Fund III, L.P. ("Fund III"): Karium, a platform investment

which will support a strategy to acquire under-invested consumer brands in the

UK and European personal care sector.

Real Estate

The Company continues to make significant progress in building a diversified

portfolio of retail, office and residential properties in Brooklyn, New York,

and South Florida.

As of 28 February 2019, JZCP, in partnership with its long-term real estate

partner, RedSky Capital, had invested approximately $374 million in 61

properties, all currently in various stages of development and re-development.

Whilst the real estate portfolio is performing in line with expectations, it

produced a net decrease of 33 cents per share, primarily due to operating

expenses and debt service at the property level. As previously announced, the

Company has held discussions with several institutional joint venture partners

in order to address the impact of these costs on JZCP's NAV.

In December 2018, JZCP and HomeFed Corporation ("HomeFed"), a real estate

investor and developer of mixed-use projects in the United States, announced a

joint venture partnership with regards to JZCP's Fulton Mall assemblage. As

part of this, HomeFed acquired a minority stake in JZCP's Fulton Mall

assemblage for approximately $52.5 million, of which approximately $40.7

million is attributable to JZCP. JZCP and RedSky Capital plan to develop the

Fulton Mall assemblage in partnership with HomeFed.

Realisations

The Company generated realisations and refinancings totaling $207.2 million

during the year, primarily through the sale of three US micro-cap companies and

the joint venture partnership with HomeFed.

The Company realised its investment in BHS, a healthcare revenue cycle

management services company, and expects to achieve a gross multiple of capital

invested of 4.0x and a gross IRR of 33.7%. In addition, the Company received

initial gross proceeds of $31.3 million from the merger of TWH and DuBois

Chemicals, Inc., and expects to realize approximately $16.2 million in gross

proceeds from the sale of Paragon Water Systems.

Board

In June 2018, Sharon Parr was appointed to the Board following a proposal by

the Nomination Committee. Sharon was considered a suitable candidate due to her

wealth of industry experience and her audit and accounting expertise, which

will be essential as she replaces Patrick Firth as Chairman of the Audit

Committee.

Patrick therefore intends to retire as Chairman of the Audit Committee and as a

Director. The Board is extremely grateful for the substantial contribution that

he has made to the Company and wishes him well.

The Board's policy on the Chairman's tenure is that continuity and experience

are considered to add significantly to the strength of the Board and as such

these attributes need to be weighed against any advantages that a new

appointment may bring. Therefore, no limit on the overall length of service of

the Chairman is imposed.

However, given my tenure on the Board since the Company's inception in April

2008, as well as that of other long-serving directors, the Board acknowledges

that succession to the role needs to be anticipated in line with effective

succession planning. We are therefore currently considering a plan for my

succession as Chairman of JZCP, and for the refreshment of the Board, and it is

intended that a new Chairman will be appointed to the Board in 2021. As part of

the wider succession planning, we will also be looking to recruit new directors

before then.

Outlook

The Board has great confidence in the value of JZCP's assets; we believe our

NAV has been fairly, if not conservatively, valued.

We have worked hard during the year to better prepare the Company for a more

secure, long-term future, and we hope shareholders will support our proposals

for a series of tender offers (at close to NAV) and the repayment of debt. It

is our hope that the stock price will adjust to reflect these improvements to

shareholder returns and JZCP's strengthened balance sheet overall.

The Board is confident in the Investment Adviser's ability to execute on the

proposed initiatives for the benefit of all shareholders.

David Macfarlane

Chairman

7 May 2019

Please click on the below link or paste the link into your broswer to view the

complete announcement.

https://mma.prnewswire.com/media/883852/JZ_CAPITAL_PARTNERS.pdf

END

(END) Dow Jones Newswires

May 08, 2019 03:06 ET (07:06 GMT)

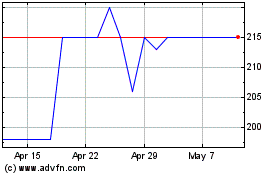

Jz Capital Partners (LSE:JZCP)

Historical Stock Chart

From May 2024 to Jun 2024

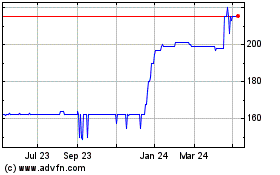

Jz Capital Partners (LSE:JZCP)

Historical Stock Chart

From Jun 2023 to Jun 2024