BlackRock Latin American Investment Trust Plc Portfolio Update

December 04 2023 - 12:08PM

UK Regulatory

TIDMBRLA

The information contained in this release was correct as at 31 October 2023.

Information on the Company's up to date net asset values can be found on the

London Stock Exchange Website at

https://www.londonstockexchange.com/exchange/news/market-news/market-news

-home.html.

BLACKROCK LATIN AMERICAN INVESTMENT TRUST PLC (LEI - UK9OG5Q0CYUDFGRX4151)

All information is at 31 October 2023 and unaudited.

Performance at month end with net income reinvested

One Three One Three Five

month months year years years

% % % % %

Sterling:

Net asset value^ -7.0 -13.4 -1.6 54.0 6.4

Share price -8.3 -16.3 -2.3 43.6 11.1

MSCI EM Latin America -4.2 -8.5 -1.6 56.4 11.3

(Net Return)^^

US Dollars:

Net asset value^ -7.6 -18.3 3.7 44.5 1.1

Share price -8.9 -21.0 3.0 34.8 5.6

MSCI EM Latin America -4.8 -13.7 3.7 46.8 5.7

(Net Return)^^

^cum income

^^The Company's performance benchmark (the MSCI EM Latin America Index) may be

calculated on either a Gross or a Net return basis. Net return (NR) indices

calculate the reinvestment of dividends net of withholding taxes using the tax

rates applicable to non-resident institutional investors, and hence give a lower

total return than indices where calculations are on a Gross basis (which assumes

that no withholding tax is suffered). As the Company is subject to withholding

tax rates for the majority of countries in which it invests, the NR basis is

felt to be the most accurate, appropriate, consistent and fair comparison for

the Company.

Sources: BlackRock, Standard & Poor's Micropal

At month end

Net asset value - capital only: 419.88p

Net asset value - including income: 422.02p

Share price: 358.50p

Total assets#: £133.3m

Discount (share price to cum income 15.1%

NAV):

Average discount* over the month - 14.5%

cum income:

Net Gearing at month end**: 7.5%

Gearing range (as a % of net 0-25%

assets):

Net yield##: 9.2%

Ordinary shares in issue(excluding 29,448,641

2,181,662 shares held in treasury):

Ongoing charges***: 1.13%

#Total assets include current year revenue.

##The yield of 9.2% is calculated based on total dividends declared in the last

12 months as at the date of this announcement as set out below (totalling 40.06

cents per share) and using a share price of 435.02 US cents per share

(equivalent to the sterling price of 358.50 pence per share translated in to US

cents at the rate prevailing at 31 October 2023 of $1.213 dollars to £1.00).

2022 Q4 Interim dividend of 6.29 cents per share plus a Special Dividend of

13.00 cents per share (paid on 12 January 2023).

2023 Q1 Interim dividend of 6.21 cents per share (Paid on 16 May 2023)

2023 Q2 Interim dividend of 7.54 cents per share (Paid on 11 August 2023)

2023 Q3 Interim dividend of 7.02 cents per share (Payable on 09 November 2023)

*The discount is calculated using the cum income NAV (expressed in sterling

terms).

**Net cash/net gearing is calculated using debt at par, less cash and cash

equivalents and fixed interest investments as a percentage of net assets.

*** The Company's ongoing charges are calculated as a percentage of average

daily net assets and using the management fee and all other operating expenses

excluding finance costs, direct transaction costs, custody transaction charges,

VAT recovered, taxation and certain non-recurring items for the year ended 31

December 2022.

Geographic Exposure % of % of Equity MSCI EM Latin America Index

Total Portfolio *

Assets

Brazil 59.3 59.2 62.4

Mexico 26.9 26.9 27.9

Chile 5.7 5.7 5.5

Colombia 3.5 3.4 1.2

Argentina 3.3 3.3 0.0

Panama 1.5 1.5 0.0

Peru 0.0 0.0 3.0

Net current -0.2 0.0 0.0

Liabilities (inc.

fixed interest)

----- ----- -----

Total 100.0 100.0 100.0

===== ===== =====

^Total assets for the purposes of these calculations exclude bank overdrafts,

and the net current assets figure shown in the table above therefore excludes

bank overdrafts equivalent to 7.2% of the Company's net asset value.

Sector % of Equity Portfolio* % of Benchmark*

Financials 22.8 25.2

Consumer Staples 18.9 16.9

Materials 16.1 18.4

Energy 11.8 14.3

Industrials 11.1 9.5

Consumer Discretionary 9.1 1.8

Health Care 3.6 1.6

Real Estate 2.7 0.8

Communication Services 2.0 4.4

Information Technology 1.9 0.4

Utilites 0.0 6.7

----- -----

Total 100.0 100.0

===== =====

*excluding net current assets & fixed interest

Company Country of Risk % of % of

Equity Portfolio Benchmark

Vale - ADS Brazil 10.1 8.6

Petrobrás - ADR: Brazil

Equity 5.9 5.1

Preference 3.4 6.0

Shares

FEMSA - ADR Mexico 5.9 4.0

Banco Bradesco - Brazil

ADR:

Equity 4.3 0.7

Preference 1.6 2.7

Shares

Walmart de México y Mexico 4.9 3.4

Centroamérica

B3 Brazil 4.7 2.4

AmBev - ADR Brazil 4.4 2.2

Grupo Financiero Mexico 3.9 3.9

Banorte

Itaú Unibanco - ADR Brazil 3.4 4.7

Grupo Aeroportuario Mexico 3.0 0.8

del Pacifico - ADS

Commenting on the markets, Sam Vecht and Christoph Brinkmann, representing the

Investment Manager noted;

The Company's NAV was down by 7.0% in October, underperforming the benchmark,

MSCI Emerging Markets Latin America Index, which returned -4.2% on a net basis

over the same period. All performance figures are in sterling terms with

dividends reinvested.

During October, Latin America performed poorly with all regional markets losing

ground. Chile (-9.1%) fell most but Mexico (-6.2%) and Brazil (-3.7%) also

fell. Brazil's equity market was negatively impacted by rising US interest

rates which put pressure on the Brazilian currency.

On the political front, Argentina had the first rounds of a general election

where the market was surprised by the victory of Sergio Massa, the current

finance minister. Massa and Javier Milei, who was expected to take first place,

will go to a runoff vote in late November. In Colombia, regional elections took

place, where the opposition party won in the main cities.

In October, our Colombian holdings added value, driven mainly by our holding in

Ecopetrol. Alternatively, Brazil detracted, as our holdings in the consumer

discretionary and financial sectors continued to sell-off. Hapvida, a health

care operator, Vamos, a truck leasing company, EZ Tec, a real estate developer

and MRV, a homebuilder, were amongst the top five detractors to performance in

October. Elsewhere in Brazil materials company, Vale, reported good third

quarter results following strong iron ore pricing.

The main negative contributor to the portfolio performance during the period

from an issuer level was Grupo Aeroportuario del Pacifico (GAPB), a Mexican

airport operator. The entire Mexican airport sector declined after the

announcement of regulatory changes, which implied lower profit margins for the

sector. However, we believe that the market reaction was overdone and that the

impact may be less severe than initially anticipated. We added to GAPB, to

maintain our position weight post the sell-off.

In Brazil, we trimmed our position in Assai, while we added to our holding in EZ

Tec. We also added to Chilean lithium miner, SQM, following some weakness in the

share price. In Mexico we added to Wal Mart Mexico and FEMSA as we like the

defensive quality of these businesses, while we reduced our position in Banorte

following strong relative performance.

Our largest overweight exposure is to Argentina, driven by two off-benchmark

holdings. Our second largest overweight position is in Colombia via our stock

specific positions in the energy and financial sector. On the other hand, we are

underweight to Peru, due to its political and economic uncertainty. We remain

positive on the outlook for Brazil and have been selective in our positioning

with preference to domestic businesses that will benefit more from further rate

cuts.

Outlook

We remain optimistic about the outlook for Latin America. Central banks have

been proactive in increasing interest rates to help control inflation, which has

now started to fall across most countries in the region. As such we have started

to see central banks beginning to lower interest rates, which should support

both economic activity and asset prices. In addition, the whole region is

benefitting from being relatively isolated from global geopolitical conflicts.

We believe that this will lead to an increase in foreign direct investment.

Brazil is the showcase of this thesis - with the central bank cutting the policy

rate by another 50bps in October (100bps in total cut in previous two months).

The government's fiscal framework being more orthodox than market expectations

also helped to reduce uncertainty regarding the fiscal outlook and was key for

confidence. We expect further upside to the equity market in the next 12-18

months as local capital starts flowing back into the market.

We remain positive on the outlook for the Mexican economy as it is a key

beneficiary of the friend-shoring of global supply chains, though we have

reduced our overweight, locking in outperformance versus our positioning a year

ago. We also note that the Mexican economy will be relatively more sensitive to

a potential slowdown in economic activity in the United States.

1Source: BlackRock, as of 31 October 2023.

4 December 2023

ENDS

Latest information is available by typing www.blackrock.com/uk/brla on the

internet, "BLRKINDEX" on Reuters, "BLRK" on Bloomberg or "8800" on Topic 3 (ICV

terminal). Neither the contents of the Manager's website nor the contents of

any website accessible from hyperlinks on the Manager's website (or any other

website) is incorporated into, or forms part of, this announcement.

This information was brought to you by Cision http://news.cision.com

END

(END) Dow Jones Newswires

December 04, 2023 12:08 ET (17:08 GMT)

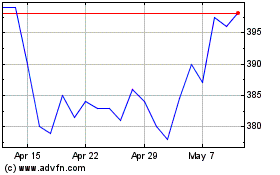

Blackrock Latin American... (LSE:BRLA)

Historical Stock Chart

From May 2024 to Jun 2024

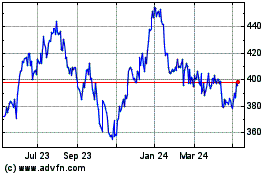

Blackrock Latin American... (LSE:BRLA)

Historical Stock Chart

From Jun 2023 to Jun 2024