TIDMAPEO

RNS Number : 7399J

abrdn Private Equity Opp Trst plc

15 December 2022

abrdn Private Equity Opportunities Trust plc

Legal Entity Identifier (LEI): 2138004MK7VPTZ99EV13

15 December 2022

abrdn Private Equity Opportunities Trust plc ("APEO" or "the

Company") announces its estimated net asset value ("NAV") at 30

November 2022

-- Estimated NAV at 30 November 2022 was 730.4 pence per share

(estimated NAV at 31 October 2022 was 725.8 pence per share)

-- Excluding new investments, 95.9% by value of portfolio dated

30 September 2022 (estimated NAV at 31 October 2022 was 99.8% dated

30 June 2022)

-- APEO paid GBP4.6 million of drawdowns and received GBP0.2

million of distributions during the month of November

-- One new primary commitment to announce from the month of November

-- Outstanding commitments of GBP708.4 million at 30 November 2022

-- Liquid resources (cash balances plus undrawn credit

facilities) were GBP 258.9 million as at 30 November 2022

APEO's valuation policy for private equity funds and

co-investments is based on the latest valuations reported by the

managers of the funds and co-investments in which the Company has

interests. In the case of APEO's valuation at 30 November 2022,

excluding new investments, 95.9% by value of the portfolio

valuations were dated 30 September 2022. The value of the portfolio

is therefore calculated as the 30 September 2022 valuation,

adjusted for subsequent cashflows over the period to 30 November

2022.

This is an update from the estimated NAV at 31 October 2022,

whereby 99.8% of the portfolio valuations, excluding new

investments, were dated 30 June 2022, adjusted for subsequent

cashflows over the period to 31 October 2022.

Estimated NAV

At 30 November 2022, APEO's estimated NAV was 730.4 pence per

share (estimated net assets GBP1,123.0 million), representing a

0.6% per share increase from the estimated NAV at 31 October 2022

of 725.8 pence per share (estimated net assets GBP1,115.8 million).

The 4.6 pence increase in NAV per share reflected gains arising

primarily from a 0.7% uplift in the valuation of investments as at

30 September 2022 and a 0.7% appreciation in the euro versus

sterling during November, partially offset by a 3.4% depreciation

in the dollar versus sterling during November.

The 0.7% uplift in the valuation of investments was primarily

driven by strong earnings growth across a number of underlying

portfolio companies. In particular, APEO's co-investment portfolio

increased in value by 6.8% over the quarter to 30 September 2022,

driven by notable valuation uplifts at Action, Prollenium and ACT.

This offset a valuation decrease of 0.8% in the primary fund

investments portfolio over the same period, which was particularly

impacted by listed company exposures held from recent IPOs. Further

detail on the performance of the portfolio to 30 September 2022

will be included in the Company's annual results, due to be

released on or around 25 January 2023.

Drawdowns and distributions

APEO paid GBP4.6 million of drawdowns and received GBP0.2

million of distributions during the month of November. The

distributions received generated realized gains and income of

GBP0.2 million.

Investment activity

A new primary commitment of EUR30.0 million was made to Hg

Genesis 10, a mid-market buyout fund targeting investments in

software and services businesses primarily in Northern Europe.

Commitments

The Company had GBP708.4 million of outstanding commitments at

30 November 2022. The Manager believes that around GBP64.3 million

of the Company's existing outstanding commitments are unlikely to

be drawn.

Credit facility and cash balances

The Company has a GBP300.0 million syndicated revolving credit

facility provided by The Royal Bank of Scotland International

Limited, Societe Generale and State Street Bank International GmbH,

and it expires in December 2025. The Company made no repayments to

or drawdowns from the facility during the month of November, with a

total of GBP61.3 million drawn at 30 November 2022. The remaining

undrawn balance of the facility at 30 November 2022 was therefore

GBP238.7 million.

In addition, the Company had cash balances of GBP20.2 million at

30 November 2022 . Liquid resources, calculated as the total of

cash balances and the undrawn balance of the credit facility, were

therefore GBP258.9 million as at 30 November 2022.

Future announcements

The Company is expecting to announce its annual results on or

around 25 January 2023. Further details on the valuation of the

portfolio as at 30 September 2022 will be provided at that

time.

The Company is expecting to announce its estimated NAV at 31

December 2022 on or around 13 January 2023.

Additional detail about APEO's NAV and investment

diversification can be found on APEO's website. Neither the

contents of the Company's website nor the contents of any website

accessible from hyperlinks on the Company's website is incorporated

into, or forms part of, this announcement.

For further information please contact Alan Gauld at abrdn

Capital Partners LLP (0131 528 4424)

Notes:-

abrdn Private Equity Opportunities Trust plc is an investment

company managed by abrdn Capital Partners LLP, the ordinary shares

of which are admitted to listing by the UK Listing Authority and to

trading on the Stock Exchange and which seeks to conduct its

affairs so as to qualify as an investment trust under sections

1158-1165 of the Corporation Tax Act 2010. The Board of abrdn

Private Equity Opportunities Trust plc is independent of abrdn plc

and Phoenix Group Holdings.

The Company intends to release regular estimated NAV updates

around ten business days after each month end. A breakdown of

APEO's portfolio can be obtained in the latest monthly factsheet,

which is published on APEO's website at:

www.abrdnpeot.co.uk

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NAVEASALFEAAFFA

(END) Dow Jones Newswires

December 15, 2022 02:00 ET (07:00 GMT)

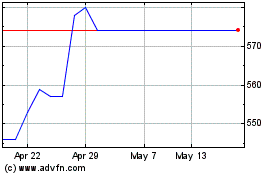

Abrdn Private Equity Opp... (LSE:APEO)

Historical Stock Chart

From Oct 2024 to Nov 2024

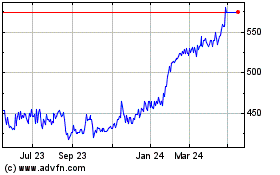

Abrdn Private Equity Opp... (LSE:APEO)

Historical Stock Chart

From Nov 2023 to Nov 2024