UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(c)

of the Securities Exchange Act of 1934

Check the appropriate box:

|

¨

|

Preliminary Information Statement

|

|

¨

|

Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)2))

|

|

x

|

Definitive Information Statement

|

|

VNUE, INC.

|

|

(Exact name of registrant as specified in charter)

|

Payment of Filing Fee (Check the appropriate box):

|

¨

|

Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11

|

|

|

1.

|

Title of each class of securities to which transaction applies:

|

|

|

2.

|

Aggregate number of securities to which transaction applies:

|

|

|

3.

|

Per unit price or other underlying value of transaction, computed pursuant to Exchange Act Rule O-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

4.

|

Proposed maximum aggregate value of transaction:

|

|

¨

|

Fee paid previously with preliminary materials.

|

|

¨

|

Check box if any part of the fee is offset as provided by Exchange Act Rule O-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

1.

|

Amount Previously Paid:

|

|

|

2.

|

Form Schedule or Registration Statement No.:

|

SCHEDULE 14C INFORMATION STATEMENT

Pursuant to Regulation 14C of the Securities Exchange Act

of 1934 as amended

Vnue, Inc.

104 W. 29th Street, 11th Floor

New York, NY 10001

WE ARE NOT ASKING YOU FOR A PROXY

AND YOU ARE REQUESTED NOT TO SEND US A PROXY

GENERAL INFORMATION

This Information Statement (the “Information Statement”) has been filed with the Securities and Exchange Commission and is being mailed, on or about February 22, 2017, pursuant to Section 14C of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), to the record holders as of February 2, 2017, (the “Stockholders”) of the common stock, par value $.0001 per share (the “Common Stock”), of Vnue, Inc., a Nevada Corporation (the “Company”). This Information Statement is circulated to advise the shareholders of actions already approved and taken, in lieu of an in-person annual meeting, by written consent of the holders of a majority of the Company’s outstanding voting common stock (the "Written Consent"), specifically management and two non-solicited stockholders, representing 357,435,391 shares of voting securities representing approximately 55.25% of the 646,901,239 total issued and outstanding shares of voting stock of the Company (the “Majority Stockholders”) as of the record date. Since the Information Statement is first being sent or given to security holders on March 3, 2017, the corporate actions described herein may be effective on or after March 23, 2017. A copy of the Written Consent is attached hereto as

Annex A

.

Please review this Information Statement for a more complete description of this matter. This Information Statement is being sent to you for informational purposes only.

WE ARE NOT ASKING YOU FOR A PROXY

AND YOU ARE REQUESTED NOT TO SEND US A PROXY

The actions to be effective 20 days after the mailing of this Information Statement are as follows:

|

1.

|

the election of Zach Bair, Matthew Carona, and Anthony Cardenas as directors of the Company to serve until the Company's 2018 Annual Meeting of Stockholders or until their successor is elected or their earlier death or resignation; and

|

|

|

|

|

2.

|

the ratification of the appointment of Weinberg and Company, P.A. as auditors for the Company.

|

The election of three directors of the Company as described in this Information Statement has been duly authorized and approved by the written consent of the holders of a majority of the voting capital shares of the Company’s issued and outstanding voting securities in lieu of an annual meeting of the stockholders and your vote or consent is not requested or required. The Information Statement is provided solely for your information as no notice is required by Section 78.320(3) of the Nevada Revised Statutes for any action which is authorized by written consent.

On February 2, 2017, a majority of the Board of Directors of the Company approved the engagement of Weinberg and Company, P.A. to be the auditors (the "Auditors") of the Company for the fiscal year 2016 audit, subject to Stockholder ratification. The Majority Stockholders ratified the engagement of the Auditors by written consent in lieu of an annual meeting on February 2, 2017. Accordingly, your consent is not required and is not being solicited in connection with the approval of the election of the Board of Directors or ratification of the Auditors. The election of the three directors will become effective twenty (20) days after this Definitive Information Statement is filed and mailed to Stockholders of record. The cost of preparing, assembling and mailing this Information Statement is being borne by the Company.

|

|

For the Board of Directors of

|

|

|

|

|

|

|

|

VNUE, INC.

|

|

|

|

|

|

|

|

Date: February 2, 2017

|

By:

|

/s/ Zach Bair

|

|

|

|

|

Zach Bair

|

|

|

|

|

Chief Executive Officer and Director

|

|

RECOMMENDATION OF THE BOARD OF DIRECTORS

ACTIONS TAKEN

ACTION I – BOARD ELECTION

The Board of Directors has determined that since the Company intends to focus on the business model of VNUE, Inc. a new Board of Directors would better reflect the nature of the Company’s new business direction. The Company's By-Laws provide that the Board consists of one class of directors, and all directors will be subject to reelection each year. Pursuant to the Nevada corporate statutes and the Company's Articles of Incorporation, directors are elected by a plurality of votes cast. The following persons have been elected by the Majority Stockholders as members of the Board of Directors of the Company:

|

Name

|

|

Age

|

|

Position

|

|

M. Zach Bair

|

|

54

|

|

Chief Executive Officer and Chairman

|

|

Matthew Carona

|

|

32

|

|

Chief Operations Officer and Director

|

|

Anthony Cardenas

|

|

50

|

|

Chief Creative Officer

|

Our directors serve as directors until our next annual shareholders’ meeting or until a successor is elected and qualified. Officers hold their positions at the discretion of the Board of Directors. There are no arrangements, agreements or understandings between non-management shareholders and management under which non-management shareholders may directly or indirectly participate in or influence the management of our affairs.

M. Zach Bair, 54, Chairman of the Board of Directors, Chief Executive Officer and Chief Accounting Officer

joined VNUE, Inc. in May 2016. Prior to his employment with VNUE, Mr. Bair was founder, president and chief executive officer for DiscLive Network/RockHouse Live Media Productions, Inc. from January 2007 to May 2016. From March 2001 to December 2006 Mr. Bair was founder, chairman and chief executive officer of Immediatek, Inc. a music tech company Mr. Bair took public in 2002. Bair is an accomplished audio and video producer, and is a voting member of the Recording Academy (the Grammys™). Bair has a significant history of implementing and commercializing the "instant media" business model, acquiring pioneer DiscLive in 2004. After selling DiscLive in 2006 Mr. Bair started a similar instant media company in 2007 under the RockHouse brand. From 2009-2012, Bair aligned RockHouse with EMI Music, under the Abbey Road Live moniker, and in April of 2012, Bair rebranded the live operation "DiscLive Network".

Matthew P. Carona, 32, Director and Chief Operations Officer

joined VNUE, Inc. as Chief Executive Officer and Director in April 2014. From November 2010 to March 2014 Mr. Carona was Chief Strategy Officer of Quello, LLC and from June 2008 to November 2010 was head of mobile business development for Billboard Magazine at Billboard, Inc. Prior to Billboard, Mr. Carona was an account executive for Show Media, Inc. from October 2007 to November 2008 and Director of Sales and Founder at World Trade Publication from September 2006 to October 2007. Mr. Carona has a Bachelor's Degree in Business Administration and Management from Western New England University.

Anthony Cardenas, 50, Chief Creative Officer-Vice President of Artist Relations

joined VNUE, Inc. in May, 2016. Before his engagement with the company, Mr. Cardenas was employed by DiscLive Network/RockHouse Live Media Productions, Inc. from January 2012 to May 2016 in product development and marketing and from January 2002 to January 2012 was employed by DiskFactory.com, Inc. where he was president and co-founder of the enterprise.

Nominees for Election

The Board does not have a formal policy regarding the consideration of diversity in identifying director nominees. In determining whether to recommend a director nominee, the nomination and governance committee may consider and discuss diversity, among many other factors, with a broad view toward the needs of the entire Board. When identifying and recommending director nominees, the committee views diversity expansively to include, without limitation, factors such as race, gender, national origin, differences of viewpoint, professional experience, education, skill and other qualities or attributes that can contribute to board heterogeneity. The committee believes that including diversity as one of the many factors considered in selecting director nominees is consistent with the committee's goal of creating a board of directors that best serves the needs of the Company and the interests of its stockholders. The board performs a review of the experiences, qualifications, attributes and skills of the board's current membership, including the director nominees and the other members of the board, and believes that the current members of the board, including the director nominees, as a whole possess a variety of complementary skills and characteristics, including the following:

|

|

·

|

successful business or professional experience;

|

|

|

|

|

|

|

·

|

various areas of expertise or experience, which are valuable to the Company's current business, such as financial and general management practices, music entertainment and recording sector knowledge, investment and commercial banking relationships;

|

|

|

|

|

|

|

·

|

personal and professional integrity and accountability, as well as sound business judgment;

|

|

|

|

|

|

|

·

|

willingness and ability to commit the necessary time to fully discharge the responsibilities of board membership;

|

|

|

|

|

|

|

·

|

leadership and consensus building skills; and

|

|

|

|

|

|

|

·

|

a commitment to the long-term success of the Company.

|

The Board has affirmatively determined that each of the nominees qualifies for election under the criteria for evaluation of directors described in this section. The Board was not able to locate a suitable director nominee that would qualify as an independent director and therefore the current Board will operate without one until such time as a qualified nominee can be found. Stockholders and potential investors in the Company are cautioned that until a qualified independent director is elected to the Board there will be no independent members of the audit or compensation committees. Each individual director has qualifications and skills that, when taken together as a whole, create a strong and well-balanced board. Biographical and director qualification information regarding each director, including each director nominee, is provided under above.

The Board and the Majority Stockholders elected Messrs. Bair, Carona and Cardenas to the Board, each to serve until the 2018 annual meeting or their successor is elected or their earlier death or resignation.

Code of Ethics

We have adopted a code of ethics (within the meaning of Item 406(b) of Regulation S-K) that applies to the Board, Chief Executive Officer, Chief Financial Officer and such other persons designated by the Board or an appropriate committee thereof. The code of ethics is designed to deter wrongdoing and to promote honest and ethical conduct and full, fair, accurate, timely and understandable disclosure in the Company's SEC reports and other public communications. The code of ethics promotes compliance with applicable governmental laws, rules and regulations. The Company's policy will be posted on its website, WWW.VNUE.com once the website has finished development.

Composition of the Board

The Board currently consists of four members, including the Company's Chief Executive Officer. The Company is currently seeking additional directors that qualify as independent directors under the independence requirements of Rule 10A-3 of the Exchange Act.

Board Leadership Structure

The Board understands that there is no single generally accepted approach to providing board leadership and that given the dynamic and competitive environment in which the Company operates; the right board leadership structure may vary as circumstances warrant. To this end, the Board has no policy mandating the combination or separation of the roles of Chairman and Chief Executive Officer and believes the matter should be discussed and considered from time to time as circumstances change. Currently, the roles of Chairman and Chief Executive Officer are not filled by the separate individuals. This leadership structure is appropriate for us at this time as the Company is a smaller company and it believes this structure provides clarity of leadership.

Board Oversight of Risk Management

Our full Board oversees our risk management process. Our Board oversees a company-wide approach to risk management, carried out by management. Our full Board determines the appropriate risk for us generally, assesses the specific risks faced by our company and reviews the steps taken by management to manage those risks.

While the full Board maintains the ultimate oversight responsibility for the risk management process, its committees oversee risk in certain specified areas. In particular, our compensation committee is responsible for overseeing the management of risks relating to the Company's executive compensation plans and arrangements and the incentives created by the compensation awards it administers. Our audit committee oversees management of enterprise risks as well as financial risks and potential conflicts of interests. Pursuant to the Board's instruction, management regularly reports on applicable risks to the relevant committee or the full Board, as appropriate, with additional review or reporting on risks conducted as needed or as requested by the Board and its committees.

Audit Committee and Audit Committee Financial Experts

We do not have a separate audit committee, all audit committee functions are carried out by our Board of Directors as a whole. Our board of directors therefore has the responsibility relating to the accounting, reporting and financial practices of our company, and has general responsibility for oversight of internal controls, accounting and audit activities and legal compliance of our company. However, the Board's audit function is one of oversight only and does not relieve our management of its responsibilities for preparing financial statements which accurately and fairly present our financial results and conditions or the responsibilities of the independent registered public accounting firm relating to the audit or review of financial statements. We deem our Chairman Zach Bair as an "audit committee financial expert" as defined in Item 407(d)(5)(ii) of Regulation S-K. The Board has not adopted a charter for the audit committee as no committee exists

Nominating and Compensation Committees

The Board does not have standing nominating or compensation committees, or committees performing similar functions. The Board believes that it is not necessary to have a standing compensation committee at this time because the functions of such committee are adequately performed by the Board as a whole. The Board has not adopted a charter for the compensation committee as there is no such committee.

The Board also is of the view that it is appropriate for it not to have a standing nominating committee because the Board has performed and is expected to perform adequately the functions of a nominating committee. The Board has not adopted a charter for the nominating committee. There has not been any defined policy or procedure requirements for stockholders to submit recommendations or nomination for directors. The Board does not believe that a defined policy with regard to the consideration of candidates recommended by stockholders is necessary at this time because it believes that, at this stage of the Company's development, a specific nominating policy would be premature and of little assistance until its business operations are at a more advanced level. There are no specific, minimum qualifications that the Board believes must be met by a candidate recommended by the Board. There is neither a defined, nor a typical process of identifying and evaluating nominees for director.

The Company is currently seeking nominations for independent directors to potentially serve on the nominating and compensation committee. The Board has determined that all of the members of the nominating and corporate governance committee will need to satisfy the requirements to serve as "independent" directors, as those requirements have been defined by Rule 10A-3 of the Exchange Act.

Director Compensation

The Board is made up of current officers of the Company consequently there does not exist a separate Board member compensation policy.

Meetings of the Board of Directors

During the year ended December 31, 2016, the Board held 6 meetings. No director attended fewer than 75% of the Board meetings held during this period. The Board encourages, but does not require, its directors to attend the Company's annual meeting of stockholders.

Communications with Directors

Stockholders and other parties interested in communicating directly and confidentially with the directors as a group may do so by writing to: Board of Directors, Attn: Corporate Secretary, Vnue, Inc., 104 W. 29th Street, 11th Floor, New York, NY 10001 in an envelope marked "Confidential." The Corporate Secretary of the Company will promptly forward, unopened, to the Chairman of the Board of Directors all such correspondence. In addition, if you wish to communicate generally with the board you may do so by writing to: Corporate Secretary, Vnue, Inc., 104 W. 29th Street, 11th Floor, New York, NY 10001. The Corporate Secretary will review all such non-confidential correspondence and will either forward to the board of directors a summary of the correspondence, or a copy of the actual correspondence that, in the opinion of the Corporate Secretary, deals with the functions of the board of directors or its committees or that he otherwise determines requires board attention. Directors may at any time review a log of all correspondence received by the Company that is addressed to members of the board of directors and request copies of any such non-confidential correspondence.

Any stockholder or employee may submit at any time a good faith complaint regarding any accounting, accounting controls, internal controls or auditing matters concerning the Company without fear of dismissal or retaliation of any kind.

These policies and procedures are not intended to alter or amend the requirements a stockholder must satisfy in order to (i) present a stockholder proposal at a meeting of stockholders, (ii) nominate a candidate for the board of directors, or (iii) recommend a candidate for the board of directors for consideration by the corporate governance and nominating committee, whether set forth in the Company's Amended By-laws, the policies or procedures regarding director nominations followed by the corporate governance and nominating committee or Rule 14a-8 of the Exchange Act, to the extent applicable.

ACTION 2

RATIFICATION OF THE APPOINTMENT OF

WEINBERG AND COMPANY, P.A.

INDEPENDENT AUDITORS OF THE COMPANY

The Board has selected Weinberg and Company, P.A. as the Company's independent registered public accountants for the fiscal year ending December 31, 2016 and recommends that stockholders vote for ratification of such selection. Although ratification by the stockholders is not required by law, the Company determined that it is desirable to request ratification of this selection by the stockholders. Notwithstanding its selection, the Board of Directors, in its discretion, may appoint new independent registered public accountants at any time during the year if the Board believes that such a change would be in the best interests of the Company and its stockholders. If the Majority Stockholders did not ratify the selection of Weinberg and Company, P.A. the Board may have reconsidered its selection.

SERVICES PROVIDED BY THE INDEPENDENT PUBLIC ACCOUNTANT AND FEES PAID

The following table represents fees for the professional audit services and fees billed for other services rendered by our prior auditors, Malone Bailey LLP, for the audit of our annual financial statements for the fiscal year ended December 31, 2014 and Weinberg and Company, P. A. for our December 31, 2015 audit.

|

|

|

Year Ended December 31,

2015

|

|

|

Year Ended December 31,

2014

|

|

|

Audit fees

|

|

$

|

50,354

|

|

|

$

|

19,000

|

|

|

Audit-related fees

|

|

|

0

|

|

|

|

0

|

|

|

Tax fees

|

|

|

0

|

|

|

|

0

|

|

|

All other fees

|

|

|

0

|

|

|

|

0

|

|

|

Total

|

|

$

|

50,354

|

|

|

$

|

19,000

|

|

Since our inception, our Board of Directors, performing the duties of the Audit Committee, reviews all audit and non-audit related fees at least annually. The Board of Directors as the Audit Committee pre-approved all audit related services in fiscal 2015.

REPORT OF THE AUDIT COMMITTEE

The Board of Directors acting as the Audit Committee has reviewed and discussed with the Company's management and Weinberg and Company, P.A. the audited financial statements of the Company contained in the Company's Annual Report on Form 10-K for the year ended December 31, 2015. The Audit Committee has also discussed with Weinberg and Company, P.A. the matters required to be discussed pursuant to SAS No. 61, as amended (AICPA Professional Standards, Vol. 1, AU section 380), as adopted by the Public Company Accounting Oversight Board in Rule 3200T.

The Board of Directors has received and reviewed the written disclosures and the letter from Weinberg and Company, P.A. required by applicable requirements of the Public Company Accounting Oversight Board regarding Weinberg and Company, P.A. communications with the Audit Committee concerning independence, and has discussed with Weinberg and Company, P.A. their independence.

Based on the review and discussions referred to above, the Board of Directors agreed that the audited financial statements be included in the Company's Annual Report on Form 10-K for the year ended December 31, 2015 filed with the SEC.

Respectfully submitted,

Zach Bair

Matthew Carona

EXECUTIVE COMPENSATION

The following table sets forth the compensation paid to our principal executive officers during the last two completed fiscal years.

|

Summary Compensation Table

|

|

Name and

Principal

Position

|

|

Year

|

|

Salary

|

|

|

Bonus

|

|

|

Stock

Awards

|

|

|

Option

Awards

|

|

|

Non-Equity

Incentive

Plan

Compensation

|

|

|

Nonqualified

Deferred

Compensation

Earnings

|

|

|

All Other

Compensation

|

|

|

Total

|

|

|

|

|

|

|

($)

|

|

|

($)

|

|

|

($)

|

|

|

($)

|

|

|

|

|

|

($)

|

|

|

($)

|

|

|

($)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Matthew Carona

|

|

2015

|

|

$

|

150,000

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

$

|

0

|

|

|

CEO

|

|

2014

|

|

$

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

$

|

0

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Collin Howard*

|

|

2015

|

|

$

|

150,000

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

$

|

0

|

|

|

CFO

|

|

2014

|

|

$

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

$

|

0

|

|

|

|

*

|

Collin Howard ceased being an officer of the Company in May 2016.

|

Option Grants

We did not grant any stock options or other similar securities to our directors or officers during the years ended December 31, 2014 or 2015. Our directors and officers do not own any stock options or other similar securities of our company.

Management Agreements

We currently have not entered into any management agreements.

Compensation upon Change of Control

As of the date of this information statement, we had no pension plans or compensatory plans or other arrangements, which provide compensation in the event of the termination of directors, officers or employees or a change in control of our company.

The officers of the Company have business interests outside of those of the Company for which they receive compensation either in the form of salary or partnership distributions. These outside business activities of the officers of the Company will continue for the foreseeable future and until curtailed may be a conflict of interest with the Company.

Compensation of Directors

We did not pay director's fees or other cash compensation to our directors for services rendered as directors in the year ended December 31, 2014 or 2015. We have no standard arrangements pursuant to which our directors are compensated for their services in their capacity as directors. The Board of Directors may award special remuneration to any director undertaking any special services on behalf of our company other than services ordinarily required of a director. No director has received and/or accrued any compensation for his services as a director, including committee participation and/or special assignments.

COMPLIANCE WITH SECTION 16(a) OF THE SECURITIES EXCHANGE ACT OF 1934

Section 16(a) of the Exchange Act requires the Company's executive officers and directors and persons who own more than 10% of the Common Stock to file with the U.S. Securities and Exchange Commission (the "

SEC

") initial statements of beneficial ownership, reports of changes in ownership and annual reports concerning their ownership of the Common Stock and other equity securities, on Forms 3, 4 and 5 respectively. Executive officers, directors and greater than 10% stockholders are required by the SEC regulations to furnish copies of all Section 16(a) reports that they file.

Based solely on the Board's review of the copies of such forms received by us, or written representations from certain reporting persons, it believes that during fiscal years ended December 31, 2014 and 2015, all filing requirements applicable to the Company's officers, directors and greater than 10% percent beneficial owners have not been met. The Company intends to remedy this situation within our current fiscal year by encouraging all required individuals to complete their Section 16(a) compliance.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table set forth the ownership, as of the date of this Prospectus, of our common stock by each person known by us to be the beneficial owner of more than 5% of our outstanding common stock, our directors, and our executive officers and directors as a group. To the best of our knowledge, the persons named have sole voting and investment power with respect to such shares, except as otherwise noted. There are not any pending or anticipated arrangements that may cause a change in control.

The information presented below regarding beneficial ownership of our voting securities has been presented in accordance with the rules of the Securities and Exchange Commission and is not necessarily indicative of ownership for any other purpose. Under these rules, a person is deemed to be a "beneficial owner" of a security if that person has or shares the power to vote or direct the voting of the security or the power to dispose or direct the disposition of the security. A person is deemed to own beneficially any security as to which such person has the right to acquire sole or shared voting or investment power within 60 days through the conversion or exercise of any convertible security, warrant, option or other right. More than one person may be deemed to be a beneficial owner of the same securities. The percentage of beneficial ownership by any person as of a particular date is calculated by dividing the number of shares beneficially owned by such person, which includes the number of shares as to which such person has the right to acquire voting or investment power within 60 days, by the sum of the number of shares outstanding as of such date plus the number of shares as to which such person has the right to acquire voting or investment power within 60 days. Consequently, the denominator used for calculating such percentage may be different for each beneficial owner. Except as otherwise indicated below, we believe that the beneficial owners of our common stock listed below have sole voting and investment power with respect to the shares shown. The mailing address for all persons is at 104 W. 29th Street, 11th Floor, New York, NY 10001

|

Shareholders

|

|

# of Shares

|

|

|

Percentage

|

|

|

Zach Bair, CEO

|

|

|

122,788,266

|

|

|

|

19

|

%

|

|

Matthew Carona, COO

|

|

|

122,788,266

|

|

|

|

19

|

%

|

|

Collin Howard, Director*

|

|

|

45,559,177

|

|

|

|

7

|

%

|

|

All directors and executive officers as a group

|

|

|

291,135,708

|

|

|

|

45

|

%

|

|

Christopher Mann

|

|

|

81,858,860

|

|

|

|

13

|

%

|

_____________

* Upon this information statement becoming effective Collin Howard will no longer be a director of the Company.

Transfer Agent

Shares of Common Stock are issued in registered form. VStock Transfer, LLC, 18 Lafayette Place, Woodmere, NY 11598, 212-828-8436 ; Email: info@vstocktransfer.com is the Company's registrar and transfer agent for shares of our common stock.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE

The Corporation may indemnify and advance litigation expenses to its directors, officers, employees and agents to the extent permitted by law, the Articles or these Bylaws, and shall indemnify and advance litigation expenses to its directors, officers, employees and agents to the extent required by law, the Articles or these Bylaws. The Corporation’s obligations of indemnification, if any, shall be conditioned on the Corporation receiving prompt notice of the claim and the opportunity to settle and defend the claim. The Corporation may, to the extent permitted by law, purchase and maintain insurance on behalf of an individual who is or was a directors, officer, employee or agent of the Corporation. Since the beginning of our last fiscal year, we have not entered into any transactions, and there are no currently proposed transactions, with our officers, directors, beneficial owners of 5% or more of our common stock, or family members of these persons wherein the amount involved in the transaction or a series of similar transactions exceeds the lesser of $120,000 or 1% of the average of our total assets for the last two fiscal years.

While we do not have any special committee, policy or procedure related to the review, approval or ratification of transactions with related persons, our board of directors reviews all such transactions.

STOCKHOLDER MATTERS

Stockholder Proposals for Inclusion in this Information Statement

No security holder has requested the Company to include any proposal in this Information Statement.

Stockholder Proposals for Inclusion in Next Year's Proxy Statement

Stockholders who wish to have proposals for action (including nominations of candidates for election to the Board of Directors) at the Company's next annual meeting of stockholders considered for inclusion in the Company's proxy statement and form of proxy for the Company's next annual meeting of stockholders pursuant to Rule 14a-8, "Stockholder Proposals," of the SEC, must cause their proposals to be received in writing by the Company no later than December 31, 2017. Such proposals must be submitted in writing to the attention of the Corporate Secretary, at 104 W. 29th Street, 11th Floor, New York, NY 10001. Proposals may be included in next year's proxy materials if they comply with the rules and regulations promulgated by the SEC and the Company's bylaws. The deadline for submitting a stockholder proposal or a nomination for director that is not to be included in such proxy statement and proxy is also December 31, 2017. Stockholders are also advised to review the Company's articles of incorporation and bylaws, which contain additional advance notice requirements for proposals submitted outside the processes of Rule 14a-8. No business shall be conducted at any annual meeting except in accordance with the procedures set forth in the bylaws.

OTHER MATTERS

No matters other than those discussed in this Information Statement are contained in the written consent signed by the holders of a majority of the voting power of the Company.

WHERE YOU CAN FIND ADDITIONAL INFORMATION

The Company is subject to the informational requirements of the Exchange Act, and in accordance therewith files reports and other information with the SEC relating to its business, financial condition and other matters. Such reports and other information can be inspected and copied at the public reference facilities maintained at the SEC at 100 F Street NW, Washington, D.C. 20549. Copies of such material can be obtained upon written request addressed to the SEC, Public Reference Section, 100 F Street NW, Washington D.C. 20549, at prescribed rates. The SEC maintains a website on the Internet (http://www.sec.gov) that contains the Exchange Act Filings filed electronically with the SEC through the Electronic Data Gathering, Analysis and Retrieval System.

INTERESTS OF CERTAIN PERSONS IN OR OPPOSITION TO MATTERS ACTED UPON

No officer or director of the Company has any substantial interest in the matters acted upon, other than his or her role as an officer or director of the Company. No director of the Company opposed the actions disclosed herein.

EXPENSE OF INFORMATION STATEMENT

The expenses of mailing this Information Statement will be borne by the Company, including expenses in connection with the preparation and mailing of this Information Statement and all documents that now accompany or may hereafter supplement it. It is contemplated that brokerage houses, custodians, nominees and fiduciaries will be requested to forward the Information Statement to the beneficial owners of Common Stock held of record by such persons and that the Company will reimburse them for their reasonable expenses incurred in connection therewith.

DELIVERY OF DOCUMENTS TO SECURITY HOLDERS SHARING AN ADDRESS

Only one Information Statement is being delivered to multiple security holders sharing an address unless the Company has received contrary instructions from one or more of the security holders. The Company shall deliver promptly upon written or oral request a separate copy of the Information Statement to a security holder at a shared address to which a single copy of the documents was delivered. A security holder can notify the Company that the security holder wishes to receive a separate copy of the Information Statement by sending a written request to the Company at the address below or by calling the Company at the number below and requesting a copy of the Information Statement. A security holder may utilize the same address and telephone number to request either separate copies or a single copy for a single address for all future information statements and annual reports.

COMPANY CONTACT INFORMATION

All inquiries regarding the Company should be addressed to the Company's principal executive office as follows:

Vnue, Inc.

Attn: Chief Executive Officer

104 W. 29th Street, 11th Floor, New York, NY 10001

Telephone: 857-777-6190

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

By Order of the Board of Directors

|

|

|

|

|

|

|

|

|

By:

|

/s/ Zach Bair

|

|

|

|

|

Zach Bair

|

|

|

|

|

Chairman

|

|

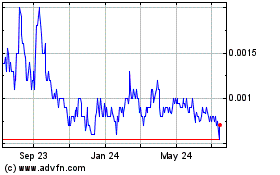

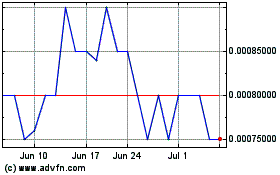

VNUE (PK) (USOTC:VNUE)

Historical Stock Chart

From May 2024 to Jun 2024

VNUE (PK) (USOTC:VNUE)

Historical Stock Chart

From Jun 2023 to Jun 2024