Amended Current Report Filing (8-k/a)

September 17 2014 - 6:06AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K/A

Amendment No. 1

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 30, 2014

|

Victory Energy Corporation

|

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

|

2-76219-NY

|

|

87-0564462

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

3355 Bee Caves Road, Suite 608

Austin, Texas

|

|

78746

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(512) 347-7300

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Explanatory Note

As previously disclosed in the Current Report on Form 8-K (the “Original 8-K”) of Victory Energy Corporation (the “Company”) filed on July 8, 2014 with the U.S. Securities and Exchange Commission (the “SEC”), on June 30, 2014, Aurora Energy Partners, a Texas general partnership (“Aurora”) of which the Company, is the managing partner and owner of a 50% partnership interest, entered into a purchase and sale agreement (the “PSA”) with TELA Garwood Limited, LP (the “Seller”). Pursuant to the PSA, Aurora acquired 10% of the Seller’s right, title and interest in certain oil and gas assets (the “Acquired Assets”) located in a project area in the Permian Basin, Texas known as the Fairway Project (the “Fairway Acquisition”). The closing of the Fairway Acquisition will occur on two separate dates, those being June 30, 2014 (the “First Closing Date”) and at a future date not yet determined (the “Second Closing Date”). On the First Closing Date, Aurora completed the acquisition of certain of the Acquired Assets from the Seller, including a 10% non-operated interest in the Seller’s Darwin, BOA and Wagga Wagga production leases (the “First Closing Fairway Assets”). On the Second Closing Date, Aurora will pay the balance of the purchase price in return for the assignment by the Seller of the remaining Acquired Assets to Aurora. The total purchase price to be paid for the Acquired Assets will be determined upon completion of curative title work of the remaining properties in the Fairway Prospect.

This Current Report on Form 8-K/A (“Form 8-K/A”) is being filed to amend Item 9.01(a) and Item 9.01 (b) of the Original Form 8-K to present certain financial statements and unaudited pro forma financial information for the Fairway Acquisition and other events. No other modifications to the Original Form 8-K are being made by this Form 8-K/A. This filing is also updating the pro forma financial information included in the Company’s Quarterly Report on Form 10-Q filed with the SEC on August 18, 2014 in the unaudited Financial Statements Footnote 2 – Acquisitions and Dispositions regarding the Revenues and Direct Operating Expenses for the Fairway Properties for the six months ended June 30, 2014 and 2013.

Item 9.01 Financial Statements and Exhibits.

|

(a)

|

Financial Statements of Businesses Acquired.

|

|

|

The audited statements of revenues and direct operating expenses of the First Closing Fairway Assets for the years ended June 30, 2014 and 2013 are attached hereto as Exhibit 99.1.

|

|

(b)

|

Pro Forma Financial Information

|

|

|

The unaudited pro forma combined financial statements giving effect to the acquisition of the First Closing Fairway Assets for the year ended December 31, 2013 and for the six months ended June 30, 2014 and 2013, which give effect to the acquisition of the First Closing Fairway Assets of the first closing, are attached hereto as Exhibit 99.2.

|

|

(c)

|

Shell Company Transactions

None.

|

| (d) |

Exhibits. |

| |

|

| 23.1 |

Consent of Independent Registered Public Accounting Firm – GBH CPAs, PC |

| |

|

| 99.1 |

Audited statements of revenues and direct operating expenses of the First Closing Fairway Assets for the years ended June 30, 2013 and 2014 and (Unaudited) Standardized Measure of Discounted Future Cash Flows for the years ended June 30, 2013 and 2014. |

| |

|

| 99.2 |

Unaudited pro forma combined financial statements giving effect to the acquisition of the First Closing Fairway Assets for the year ended December 31, 2013 and for the six months ended June 30, 2014 and 2013, which give effect to the acquisition of the First Closing Fairway Assets for the first closing. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Victory Energy Corporation

|

|

|

|

|

|

|

|

Dated: September 16, 2014

|

By:

|

/s/ Kenneth Hill

|

|

|

|

|

Kenneth Hill

|

|

| |

|

Chief Executive Officer |

|

EXHIBIT 23.1

CONSENT OF INDEPENDENT REGISTERED ACCOUNTING FIRM

We consent to the incorporation by reference in the Registration Statement (Form S-8 No. 333-194427) pertaining to the Victory Energy Corporation 2014 Long-Term Incentive Plan, of our report dated September 15, 2014 with respect to the statements of revenues and direct operating expenses of the Fairway Acquisition Properties for the years ended June 30, 2013 and 2014, which appears as Exhibit 99.1 in this Current Report on Form 8-K/A of Victory Energy Corporation filed on September 16, 2014.

/s/ GBH CPAs, PC

GBH CPAs, PC

www.gbhcpas.com

Houston, Texas

September 16, 2014

EXHIBIT 99.1

The accompanying audited financial statements include revenues from oil and gas production and direct operating expenses associated with the Properties. The accompanying statements of revenues and direct operating expenses varies from a complete set of statements of operations in accordance with accounting principles generally accepted in the United States of America in that it does not reflect certain indirect expenses that were incurred in connection with the ownership and operation of the Properties including, but not limited to, general and administrative expenses, interest expense and federal and state income tax expenses. These costs were not separately allocated to the Properties in the accounting records of TELA. In addition, these allocations, if made using historical general and administrative structures and tax burdens, would not produce allocations that would be indicative of the historical performance of the Properties had they been part of Victory due to differing size, structure, operations and accounting policies. The accompanying statements also do not include the provisions for depreciation, depletion, amortization and accretion; as such amounts would not be indicative of the costs that will be incurred upon the allocation of the purchase price paid. Furthermore, no balance sheets have been presented because the acquired properties were not accounted for as a separate subsidiary or division of TELA and complete financial statements are not available, nor has information about the Properties operating, investing and financing cash flows been provided for similar reasons. Accordingly, the historical statements of revenues and direct operating expenses of the Properties are presented in lieu of the full financial statements required under Article 8-04 of Securities and Exchange Commission (“SEC”) Regulation S-X.

INDEX TO FINANCIAL STATEMENTS

| |

Page

|

|

| |

|

|

Fairway Acquisition Financials:

|

|

|

|

| |

|

|

Report of Independent Registered Public Accounting Firm

|

|

F-3

|

|

| |

|

|

Statements of Revenues and Direct Operating Expenses of the Fairway Properties for the Years Ended June 30, 2014 and 2013

|

|

F-4

|

|

| |

|

|

Notes to the Statements of Revenues and Direct Operating Expenses of the Fairway Properties

|

|

F-5

|

|

| |

|

|

Supplementary Oil and Gas Disclosures (Unaudited)

|

|

F-6

|

|

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors

Victory Energy Corp.

Austin, Texas

We have audited the accompanying statements of revenues and direct operating expenses of certain oil and gas properties acquired from TELA Garwood Limited, LP for the years ended June 30, 2014 and 2013. These financial statements are the responsibility of Victory Energy Corp.’s management. Our responsibility is to express an opinion on the financial statements based on our audits.

We conducted our audits in accordance with standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

The accompanying statements of revenues and direct operating expenses referred to above were prepared for the purpose of complying with the rules and regulations of the Securities and Exchange Commission and are not intended to be a complete financial statement presentation of the properties described above.

In our opinion, the financial statements referred to above presents fairly, in all material respects, the revenues and direct operating expenses of the oil and gas properties acquired from TELA Garwood Limited, LP for the years ended June 30, 2014 and 2013, in conformity with accounting principles generally accepted in the United States of America.

/s/ GBH CPAs, PC

GBH CPAs, PC

www.gbhcpas.com

Houston, Texas

September 15, 2014

STATEMENTS OF REVENUES AND DIRECT OPERATING EXPENSES

OF THE FAIRWAY PROPERTIES

For the Years Ended June 30, 2014 and 2013

| |

|

2014

|

|

|

2013

|

|

| |

|

|

|

|

|

|

|

Revenue

|

|

$ |

347,675 |

|

|

$ |

162,605 |

|

| |

|

|

|

|

|

|

|

|

|

Direct operating expenses

|

|

|

(83,979 |

) |

|

|

(39,269 |

) |

| |

|

|

|

|

|

|

|

|

|

Revenues in excess of direct operating expenses

|

|

$ |

263,696 |

|

|

$ |

123,336 |

|

The accompanying notes are an integral part of these financial statements.

NOTES TO THE STATEMENTS OF REVENUES AND DIRECT OPERATING EXPENSES

OF THE FAIRWAY PROPERTIES

(1) — Basis of Presentation

On June 30, 2014, Aurora Energy Partners (“Aurora”), a 50% owned consolidated subsidiary of Victory Energy Corporation (“Victory” or the “Company”), and TELA Garwood Limited, LP. (“TELA”), entered into a purchase and sale agreement (the “PSA”), in which Aurora acquired certain oil and gas properties of TELA. Among the properties included in the sale at the time of the first closing of the PSA are its working interest in 7 producing wells in the Fairway Area of Texas (the “Fairway Properties” or the “Properties”). The PSA contains customary representations and warranties, covenants, indemnification provisions and conditions and customary purchase price adjustments to closing.

The accompanying audited financial statements include revenues from oil and gas production and direct operating expenses associated with the Properties. The accompanying statements of revenues and direct operating expenses varies from a complete set of statements of operations in accordance with accounting principles generally accepted in the United States of America in that it does not reflect certain indirect expenses that were incurred in connection with the ownership and operation of the Properties including, but not limited to, general and administrative expenses, interest expense and federal and state income tax expenses. These costs were not separately allocated to the Properties in the accounting records of TELA. In addition, these allocations, if made using historical general and administrative structures and tax burdens, would not produce allocations that would be indicative of the historical performance of the Properties had they been part of Victory due to differing size, structure, operations and accounting policies. The accompanying statements also do not include the provisions for depreciation, depletion, amortization and accretion; as such amounts would not be indicative of the costs that will be incurred upon the allocation of the purchase price paid. Furthermore, no balance sheets have been presented because the acquired properties were not accounted for as a separate subsidiary or division of TELA and complete financial statements are not available, nor has information about the Properties, operating, investing and financing cash flows been provided for similar reasons. Accordingly, the historical statements of revenues and direct operating expenses of the Properties are presented in lieu of the full financial statements required under Article 8-04 of Securities and Exchange Commission (“SEC”) Regulation S-X.

These statements of revenues and direct operating expenses are not indicative of the results of operations for the Properties on a go forward basis.

(2) — Summary of Significant Accounting Policies

Use of Estimates — The statements of revenues and direct operating expenses were derived from the historical operating statements of TELA. Accounting principles generally accepted in the United States of America require management to make estimates and assumptions that affect the amounts reported in the statements of revenues and direct operating expenses. Actual results could be different from those estimates.

Revenue Recognition — Oil and natural gas revenues reflect the sales method of accounting. Under the sales method, revenues are recognized based on actual volumes of oil and natural gas sold to purchasers. Management believes there were no significant imbalances with other revenue interest owners attributable to the Properties during any of the periods presented in these statements.

Direct Operating Expenses — Direct operating expenses are recognized on an accrual basis and consist of direct expenses of operating the Properties. The direct operating expenses include lease operating expenses, severance and ad valorem taxes.

(3) — Contingencies

The Properties may be subject to potential claims and litigation in the normal course of operations. The Company does not believe that any liability resulting from any pending or threatened litigation will have a material adverse effect on the operations or financial results of the Properties.

(4) — Subsequent Events

The Company has evaluated subsequent events through the issuance date of this report and has concluded no additional events need to be reported.

Supplementary Oil and Gas Disclosures

(Unaudited)

Supplemental Reserve Information

The following unaudited supplemental reserve information summarizes the net proved reserves of oil and gas and the standardized measure thereof for the years ended June 30, 2014 and 2013 attributable to the Properties. All of the reserves are located in the United States. The reserve disclosures are based on reserve studies prepared in accordance with guidelines established by the SEC.

There are numerous uncertainties inherent in estimating quantities and values of proved reserves and in projecting future rates of production and the amount and timing of development expenditures, including many factors beyond the property owner’s control. Reserve engineering is a subjective process of estimating the recovery from underground accumulations of oil and gas that cannot be measured in an exact manner, and the accuracy of any reserve estimate is a function of the quality of available data and of engineering and geological interpretation and judgment. Because all reserve estimates are to some degree subjective, the quantities of oil and gas that are ultimately recovered, production and operating costs, the amount and timing of future development expenditures and future oil and gas sales prices may each differ from those assumed in these estimates. In addition, different reserve engineers may make different estimates of reserve quantities and cash flows based upon the same available data. The standardized measure shown below represents estimates only and should not be construed as the current market value of the estimated oil and gas reserves attributable to the Properties. In this regard, the information set forth in the following tables includes revisions of reserve estimates attributable to proved properties included in the preceding year’s estimates. Such revisions reflect additional information from subsequent development activities, production history of the Properties and any adjustments in the projected economic life of such property resulting from changes in product prices.

Estimated Quantities of Oil and Gas Reserves

The following table sets forth certain data pertaining to the Properties, proved reserves for the years ended June 30, 2014 and 2013:

| |

|

For the Years Ended

June 30,

|

|

| |

|

2014

|

|

|

2013

|

|

|

Oil:

|

|

|

|

|

|

|

|

Proved developed producing reserves (Bbl):

|

|

|

|

|

|

|

|

|

|

Beginning of year

|

|

|

42,659

|

|

|

|

44,422

|

|

|

Production

|

|

|

(3,256

|

)

|

|

|

(1,763

|

)

|

|

Proved reserves, at end of year

|

|

|

39,403

|

|

|

|

42,659

|

|

| |

|

For the Years Ended

June 30,

|

|

| |

|

2014

|

|

|

2013

|

|

|

Natural Gas:

|

|

|

|

|

|

|

|

Proved developed producing reserves (Mcf):

|

|

|

|

|

|

|

|

|

|

Beginning of year

|

|

|

62,412

|

|

|

|

64,103

|

|

|

Production

|

|

|

(5,273

|

)

|

|

|

(1,691

|

)

|

|

Proved reserves, at end of year

|

|

|

57,139

|

|

|

|

62,412

|

|

| |

|

For the Years Ended

June 30,

|

|

| |

|

2014

|

|

|

2013

|

|

|

Total Oil and Natural Gas:

|

|

|

|

|

|

|

|

Proved developed producing reserves (BOE) (6 Mcf/Bbl):

|

|

|

|

|

|

|

|

|

|

Beginning of year

|

|

|

53,061

|

|

|

|

55,106

|

|

|

Production

|

|

|

(4,135

|

)

|

|

|

(2,045

|

)

|

|

Proved reserves, at end of year

|

|

|

48,926

|

|

|

|

53,061

|

|

PV-10 of Estimated Quantities of Proved Oil and Gas

The following table is a summary of PV-10 attributable to the acquired Properties at June 30, 2013.

|

Reserve Category

|

|

Net Oil

Reserves

(Bbls)

|

|

|

Net Gas

Reserves

(Mcf)

|

|

|

Net Present

Value

Undiscounted

|

|

|

Net Present

Value

Discounted

10%

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Proved developed producing

|

|

|

42,659 |

|

|

|

62,412 |

|

|

$ |

1,091,069 |

|

|

$ |

1,039,187 |

|

|

Proved developed non-producing

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Proved undeveloped

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Combined proved reserves

|

|

|

42,659 |

|

|

|

62,412 |

|

|

$ |

1,091,069 |

|

|

$ |

1,039,187 |

|

The following table is a summary of PV-10 attributable to the acquired Properties at June 30, 2014.

|

Reserve Category

|

|

Net Oil

Reserves

(Bbls)

|

|

|

Net Gas

Reserves

(Mcf)

|

|

|

Net Present

Value

Undiscounted

|

|

|

Net Present

Value

Discounted

10%

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Proved developed producing

|

|

|

39,403 |

|

|

|

57,139 |

|

|

$ |

2,119,117 |

|

|

$ |

2,018,350 |

|

|

Proved developed non-producing

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Proved undeveloped

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Combined proved reserves

|

|

|

39,403 |

|

|

|

57,139 |

|

|

$ |

2,119,117 |

|

|

$ |

2,018,350 |

|

Standardized Measure of Discounted Future Net Cash Flows

Summarized below is the Standardized Measure related to the Properties’ proved oil and natural gas reserves. The following summary is based on a valuation of proved reserves using discounted cash flows based on prices as prescribed by the SEC, current costs and economic conditions and a 10% discount rate. Accordingly, the present value of future net cash flows does not purport to be an estimate of the fair market value of the Properties’ proved reserves, nor should it be indicative of any trends. An estimate of fair value would also take into account, among other things, anticipated changes in future prices and costs, the expected recovery of reserves in excess of proved reserves and a discount factor more representative of the time value of money, and the risks inherent in producing oil and natural gas.

The following table sets forth estimates of the standardized measure of discounted future net cash flows from proved reserves of oil and natural gas for the years ended June 30, 2014 and 2013.

| |

|

For the Years Ended

June 30,

|

|

| |

|

2014

|

|

|

2013

|

|

| |

|

|

|

|

|

|

|

|

|

Future cash inflows

|

|

$

|

4,651,572

|

|

|

$

|

3,177,902

|

|

|

Production costs

|

|

|

(1,440,788

|

)

|

|

|

(1,524,767

|

)

|

|

Development costs

|

|

|

-

|

|

|

|

-

|

|

|

Income tax expense

|

|

|

(1,091,667)

|

|

|

|

(562,066)

|

|

|

Future net cash flows

|

|

|

2,119,117

|

|

|

|

1,091,069

|

|

|

10% annual discount for estimated timing of cash flow

|

|

|

(100,767

|

)

|

|

|

(51,882

|

)

|

| |

|

|

|

|

|

|

|

|

|

Standardized measure of discounted future cash flows

|

|

$

|

2,018,350

|

|

|

$

|

1,039,187

|

|

Changes in Standardized Measure of Discounted Future Cash

| |

|

Year Ended June 30, |

|

| |

|

2014 |

|

|

2013 |

|

| |

|

|

|

|

|

|

|

Beginning of the year

|

|

$ |

1,039,187 |

|

|

$ |

1,443,311 |

|

|

Sales of oil and gas, net of production costs

|

|

|

(263,696 |

) |

|

|

(123,336 |

) |

|

Discoveries, extensions and development

|

|

|

1,610,794 |

|

|

|

217,460 |

|

|

Purchases of reserves-in-place

|

|

|

- |

|

|

|

- |

|

|

Sale of reserves-in-place

|

|

|

- |

|

|

|

- |

|

|

Accretion of discount

|

|

|

(14,611 |

) |

|

|

(7,523 |

) |

|

Income taxes

|

|

|

(353,323 |

) |

|

|

(490,726 |

) |

|

End of the year

|

|

$ |

2,018,350 |

|

|

$ |

1,039,187 |

|

F-8

EXHIBIT 99.2

INDEX TO FINANCIAL STATEMENTS

|

Unaudited Combined Pro Form Financial Information:

|

|

|

|

| |

|

|

|

|

Unaudited Pro Forma Combined Balance Sheet for the Year Ended December 31, 2013

|

|

|

F-2 |

|

| |

|

|

|

|

|

Unaudited Pro Forma Combined Statements of Operations for the Six Months Ended June 30, 2014

|

|

|

F-3 |

|

| |

|

|

|

|

|

Unaudited Pro Forma Combined Statements of Operations for the Six Months Ended June 30, 2013

|

|

|

F-4 |

|

| |

|

|

|

|

|

Notes to Pro Forma Combined Financial Statements

|

|

|

F-5 |

|

VICTORY ENERGY CORPORATION AND SUBSIDIARIES

UNAUDITED PRO FORMA COMBINED BALANCE SHEET

AS OF DECEMBER 31, 2013

|

|

|

12/31/2013

(As Reported)

|

|

|

Acquisition

|

|

|

Disposition

|

|

|

12/31/2013

(Pro-Forma Combined)

|

|

| ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

20,858 |

|

|

$ |

(2,491,888) |

(a) |

|

$ |

4,021,000 |

(d) |

|

$ |

1,549,970 |

|

|

Accounts receivable - less allowance for doubtful accounts of $200,000

|

|

|

116,542 |

|

|

|

|

|

|

|

|

|

|

|

116,542 |

|

|

Accounts receivable - affiliate

|

|

|

68,571 |

|

|

|

|

|

|

|

|

|

|

|

68,571 |

|

|

Prepaid expenses

|

|

|

38,663 |

|

|

|

- |

|

|

|

- |

|

|

|

38,663 |

|

|

Total current assets

|

|

|

244,634 |

|

|

|

(2,491,888 |

) |

|

|

4,021,000 |

|

|

|

1,773,746 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fixed Assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Furniture and equipment

|

|

|

43,173 |

|

|

|

- |

|

|

|

- |

|

|

|

43,173 |

|

|

Accumulated depreciation

|

|

|

(11,597 |

) |

|

|

- |

|

|

|

- |

|

|

|

(11,597 |

) |

|

Total furniture and fixtures, net

|

|

|

31,576 |

|

|

|

- |

|

|

|

- |

|

|

|

31,576 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Oil and gas properties (successful efforts method)

|

|

|

3,715,648 |

|

|

|

2,491,888 |

(a) |

|

|

(2,122,738) |

(d) |

|

|

4,091,619 |

|

| |

|

|

|

|

|

|

6,821 |

(c) |

|

|

|

|

|

|

|

|

|

Accumulated depletion, depreciation and amortization

|

|

|

(1,517,836 |

) |

|

|

- |

|

|

|

247,151 |

(b) |

|

|

(1,270,685 |

) |

|

Total oil and gas properties, net

|

|

|

2,197,812 |

|

|

|

2,498,709 |

|

|

|

(1,875,587 |

) |

|

|

2,820,934 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Assets

|

|

$ |

2,474,022 |

|

|

$ |

6,821 |

|

|

$ |

2,145,413 |

|

|

$ |

4,626,256 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Liabilities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$ |

351,435 |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

351,435 |

|

|

Accrued liabilities

|

|

|

196,913 |

|

|

|

- |

|

|

|

- |

|

|

|

196,913 |

|

|

Accrued liabilities - related parties

|

|

|

18,542 |

|

|

|

- |

|

|

|

- |

|

|

|

18,542 |

|

|

Liability for unauthorized preferred stock issued

|

|

|

9,283 |

|

|

|

- |

|

|

|

- |

|

|

|

9,283 |

|

|

Total current liabilities

|

|

|

576,173 |

|

|

|

- |

|

|

|

- |

|

|

|

576,173 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Liabilities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Asset retirement obligations

|

|

|

51,954 |

|

|

|

6,821 |

(c) |

|

|

(14,179) |

(e) |

|

|

44,596 |

|

|

Long term note payable

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total long term liabilities

|

|

|

51,954 |

|

|

|

6,821 |

|

|

|

(14,179 |

) |

|

|

44,596 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities

|

|

|

628,127 |

|

|

|

6,821 |

|

|

|

(14,179 |

) |

|

|

620,769 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders' Equity

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Common stock |

|

|

27,564 |

|

|

|

- |

|

|

|

- |

|

|

|

27,564 |

|

|

Additional paid-in capital

|

|

|

34,404,239 |

|

|

|

- |

|

|

|

- |

|

|

|

34,404,239 |

|

|

Accumulated earnings (deficit)

|

|

|

(36,901,894 |

) |

|

|

- |

|

|

|

1,079,796 |

(f) |

|

|

(35,822,098 |

) |

|

Total Victory Energy Corporation stockholders' equity (deficit)

|

|

|

(2,470,091 |

) |

|

|

- |

|

|

|

1,079,796 |

|

|

|

(1,390,295 |

) |

|

Non-controlling interest

|

|

|

4,315,986 |

|

|

|

- |

|

|

|

1,079,796 |

(f) |

|

|

5,395,782 |

|

|

Total stockholders' equity

|

|

|

1,845,895 |

|

|

|

- |

|

|

|

2,159,592 |

|

|

|

4,005,487 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Liabilities and Stockholders' Equity

|

|

$ |

2,474,022 |

|

|

$ |

6,821 |

|

|

$ |

2,145,413 |

|

|

$ |

4,626,256 |

|

The accompanying notes are an integral part of these pro forma combined financial statements.

VICTORY ENERGY CORPORATION AND SUBSIDIARIES

UNAUDITED PRO FORMA COMBINED STATEMENT OF OPERATIONS

FOR THE SIX MONTHS ENDED JUNE 30, 2014

| |

|

6/30/2014

(As Reported)

|

|

|

Acquisition

|

|

|

6/30/14

(Pro Forma Combined)

|

|

| |

|

|

|

(g)

|

|

|

|

|

|

Revenues

|

|

|

|

|

|

|

|

|

|

|

Oil and gas sales

|

|

$ |

432,960 |

|

|

$ |

215,609 |

|

|

$ |

648,569 |

|

|

Total revenues

|

|

|

432,960 |

|

|

|

215,609 |

|

|

|

648,569 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lease operating costs

|

|

|

115,632 |

|

|

|

35,413 |

|

|

|

151,045 |

|

|

Production taxes

|

|

|

25,262 |

|

|

|

11,180 |

|

|

|

36,442 |

|

|

Exploration

|

|

|

24,172 |

|

|

|

- |

|

|

|

24,172 |

|

|

General and administrative

|

|

|

1,463,628 |

|

|

|

- |

|

|

|

1,463,628 |

|

|

Depreciation/depletion/amortization

|

|

|

170,071 |

|

|

|

- |

|

|

|

170,071 |

|

|

Total operating expenses

|

|

|

1,798,765 |

|

|

|

46,593 |

|

|

|

1,845,358 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) from operations

|

|

|

(1,365,805 |

) |

|

|

169,016 |

|

|

|

(1,196,789 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Income (Expense):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gain on sale of oil and gas properties

|

|

|

2,159,592 |

|

|

|

- |

|

|

|

2,159,592 |

|

|

Management fee income

|

|

|

88,892 |

|

|

|

- |

|

|

|

88,892 |

|

|

Interest expense

|

|

|

(31,008 |

) |

|

|

- |

|

|

|

(31,008 |

) |

|

Total other income

|

|

|

2,217,476 |

|

|

|

- |

|

|

|

2,217,476 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income

|

|

|

851,671 |

|

|

|

169,016 |

|

|

|

1,020,687 |

|

|

Less: Net income attributable to non –controlling interest

|

|

|

1,014,785 |

|

|

|

84,508 |

|

|

|

1,099,293 |

|

|

Net income (loss) attributable to Victory Energy Corporation

|

|

$ |

(163,114 |

) |

|

$ |

84,508 |

|

|

$ |

(78,606 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from continuing operations per common share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted

|

|

$ |

(0.01 |

) |

|

|

|

|

|

$ |

(0.00 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted

|

|

|

27,898,958 |

|

|

|

|

|

|

|

27,898,958 |

|

These accompanying notes are an integral part of the pro forma combined financial statements.

VICTORY ENERGY CORPORATION AND SUBSIDIARIES

UNAUDITED PRO FORMA COMBINED STATEMENT OF OPERATIONS

FOR THE SIX MONTHS ENDED JUNE 30, 2013

| |

|

6/30/13

(As Reported)

|

|

|

Acquisition

|

|

|

6/30/13

(Pro Forma Combined)

|

|

| |

|

|

|

|

(h)

|

|

|

|

|

|

Revenues

|

|

|

|

|

|

|

|

|

|

|

Oil and gas sales

|

|

$ |

255,678 |

|

|

$ |

147,525 |

|

|

$ |

403,203 |

|

|

Total revenues

|

|

|

255,678 |

|

|

|

147,525 |

|

|

|

403,203 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lease operating costs

|

|

|

74,986 |

|

|

|

21,081 |

|

|

|

96,067 |

|

|

Dry hole costs

|

|

|

3,610 |

|

|

|

- |

|

|

|

3,610 |

|

|

Production taxes

|

|

|

20,603 |

|

|

|

6,580 |

|

|

|

27,183 |

|

|

Exploration

|

|

|

15,577 |

|

|

|

- |

|

|

|

15,577 |

|

|

General and administrative

|

|

|

900,443 |

|

|

|

- |

|

|

|

900,443 |

|

|

Depreciation/depletion/amortization

|

|

|

77,899 |

|

|

|

- |

|

|

|

77,899 |

|

|

Total operating expenses

|

|

|

1,093,118 |

|

|

|

27,661 |

|

|

|

1,120,779 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from operations

|

|

|

(837,440 |

) |

|

|

119,864 |

|

|

|

(717,576 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Income (Expense):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense

|

|

|

(946 |

) |

|

|

- |

|

|

|

(946 |

) |

|

Total other expense

|

|

|

(946 |

) |

|

|

- |

|

|

|

(946 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss)

|

|

|

(838,386 |

) |

|

|

119,864 |

|

|

|

(718,522 |

) |

|

Less: Net income (loss) attributable to non –controlling interest

|

|

|

(112,289 |

) |

|

|

59,932 |

|

|

|

(52,357 |

) |

|

Net income (loss) attributable to Victory Energy Corporation

|

|

$ |

(726,097 |

) |

|

$ |

59,932 |

|

|

$ |

(666,165 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from continuing operations per common share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted

|

|

$ |

(0.03 |

) |

|

|

|

|

|

$ |

(0.03 |

) |

|

Weighted average common shares outstanding:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted

|

|

|

27,563,619 |

|

|

|

|

|

|

|

27,563,619 |

|

The accompanying notes are an integral part of the pro forma combined financial statements.

VICTORY ENERGY CORPORATION AND SUBSIDIARIES

NOTES TO UNAUDITED PRO FORMA COMBINED FINANCIAL STATEMENTS

1. Basis of Presentation

Victory is the managing partner of Aurora, and holds a 50% partnership interest in Aurora. Aurora, a subsidiary of the Company, is consolidated with Victory for financial statement purposes, as the terms of the partnership agreement that governs the operations of Aurora give Victory effective control of the partnership. The financial statements include the accounts of Victory and the accounts of Aurora. The Company’s management, in considering accounting policies pertaining to consolidation, has reviewed the relevant accounting literature. The Company follows that literature in assessing whether the rights of the non-controlling interests should overcome the presumption of consolidation when a majority voting or controlling interest in its investee “is a matter of judgment that depends on facts and circumstances.” In applying the circumstances and contractual provisions of the partnership agreement, management determined that the non-controlling rights do not, individually or in the aggregate, provide for the non-controlling interest to “effectively participate in significant decisions that would be expected to be made in the ordinary course of business.” The rights of the non-controlling interest are protective in nature. All intercompany balances have been eliminated in consolidation.

On June 30, 2014, Aurora completed the initial closing (the “First Closing”) of a purchase of a 10% working and 7.5% net revenue interest in the proved and unproved Permian Basin Fairway Operations from a third party (the “Fairway Seller”) for $2,491,888 in cash, subject to customary purchase price adjustments. On the First Closing, the Fairway Seller assigned certain of the assets in its Permian Basin Fairway Operation (the “First Closing Assets”) to Aurora. On the Second Closing Date, Aurora will pay the balance of the purchase price in return for the assignment by the Seller of the remaining Acquired Assets to Aurora. The total purchase price to be paid for the Acquired Assets will be determined upon completion of curative title work of the remaining properties in the Fairway Prospect. The Effective Date for the transfer of all assets is May 1, 2014. The acquisition of the First Closing Assets includes 7 producing wells and 4 wells completed and awaiting production start-up.

The unaudited Pro Forma Financial Combined Statements are presented for illustrative purposes only and do not purport to represent what our financial position or results of operations would have been if the transactions had occurred as presented, or to project our financial position or results of operations for any future periods. The pro forma adjustments are based on available information and certain assumptions that management believes are reasonable. The pro forma adjustments are directly attributable to the Transactions and are expected to have a continuing impact on our results of operations. In the opinion of management, all adjustments necessary to present fairly the unaudited Combined Pro Forma Financial Statements have been made.

2. Acquisition and Disposition Accounting

The Acquisition first closing was on June 30, 2014 for cash consideration of $2,491,888 and had an effective date of May 1, 2014. The assets acquired and liabilities assumed are presented based on their estimated acquisition date fair values. Transaction costs associated with the acquisition are expensed as incurred.

The following table summarizes the estimated acquisition date fair values of the net assets to be acquired in the transaction:

|

Assets

|

|

|

|

|

|

Oil and gas properties

|

|

$

|

2,498,709

|

|

|

Liabilities

|

|

|

|

|

|

Asset retirement obligations

|

|

|

(6,821

|

)

|

|

Net assets to be acquired

|

|

$

|

2,491,888

|

|

VICTORY ENERGY CORPORATION AND SUBSIDIARIES

NOTES TO UNAUDITED PRO FORMA COMBINED

FINANCIAL STATEMENTS — (CONTINUED)

On June 5, 2014, Aurora completed the disposition of all of its interest in the Lightnin’ property for cash consideration of $4,021,000. The effective date for the transaction was April 1, 2014. Aurora held a 20% working and 15% net revenue interest in the Lightnin’ property operated by a third party. The Company recognized a gain on the sale of the Lightnin’ property of $2,159,592.

3. Pro Forma Adjustments

Combined Balance Sheets

|

(a)

|

To record the assets and liabilities acquired.

|

|

(b)

|

To record the accumulated depletion on assests disposed.

|

|

(c)

|

To record the asset retirement obligation associated with the acquired properties.

|

|

(d)

|

To record the assets and liabilities disposed of.

|

|

(e)

|

To record the asset retirement obligation associated with the disposition.

|

|

(f)

|

To record the non-controlling interest portion of the gain on sale of properties

|

Combined Statements of Operations

|

(g)

|

To record the revenues and operating expenses associated with the acquisition for the six months ended June 30, 2014, less amounts attributable to non-controlling interest since acquired properties were purchased by the Company’s 50% owned subsidiary.

|

|

(h)

|

To record the revenues and operating expenses associated with the acquisition for the six months ended June 30, 2013, less amounts attributable to non-controlling interest since acquired properties were purchased by the Company’s 50% owned subsidiary.

|

F-6

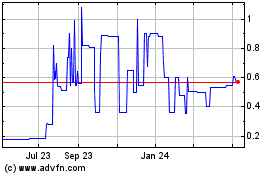

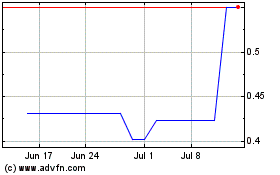

Victory Oilfield Tech (PK) (USOTC:VYEY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Victory Oilfield Tech (PK) (USOTC:VYEY)

Historical Stock Chart

From Jul 2023 to Jul 2024