BASF Cuts 2018 EBIT Outlook, Expects 'Considerable Decrease'

December 10 2018 - 2:28AM

Dow Jones News

By Cristina Roca

BASF SE (BAS.XE) has lowered its forecast for full-year earnings

before interest and taxes, citing pricing pressures at its

chemicals division, higher-than-expected costs related to low water

levels on the Rhine river, and a decline in its auto industry

business.

The German chemicals company now expects "a considerable

decrease" in EBIT for 2018, it said late on Friday, having

previously forecast a decline of up to 10%.

BASF said a sharp drop in isocyanate prices and lower margins

for steam crackers at its chemicals division were the main reason

for the guidance cut, but also noted that it now expects the

effects of the Rhine's low water levels will cost it up to 200

million euros ($227.5 million) in the fourth quarter, more than

previously anticipated.

The Rhine's water levels have affected a number of industrial

companies this year, including Thyssenkrupp AG (TKA.XE) and

ArcelorMittal (MT.FR).

BASF in October said it had to reduce production because the low

water levels restricted raw-material supplies and reduced the

availability of water, which it uses for cooling processes.

BASF said its automotive business has continued to decline since

the third quarter, as demand from China slowed significantly,

dragged down, in part, by the U.S.-China trade conflict.

Write to Cristina Roca at cristina.roca@dowjones.com;

@_cristinaroca

(END) Dow Jones Newswires

December 10, 2018 02:13 ET (07:13 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

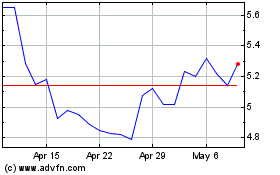

Thyssenkrupp (PK) (USOTC:TKAMY)

Historical Stock Chart

From May 2024 to Jun 2024

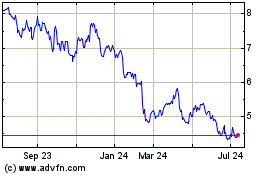

Thyssenkrupp (PK) (USOTC:TKAMY)

Historical Stock Chart

From Jun 2023 to Jun 2024