Tesco Declares First Year-End Dividend in Four Years

April 11 2018 - 3:01AM

Dow Jones News

By Maryam Cockar

Tesco PLC (TSCO.LN) on Wednesday declared its first year-end

dividend in four years and said that its pretax profit increased

multifold.

The U.K.'s No. 1 grocer by market share made a profit of 1.30

billion pounds ($1.85 billion) in the financial year ended Feb. 24,

compared with GBP145.0 million the year earlier when it booked a

GBP235.0 million charge related to a 2014 accounting scandal. The

consensus estimate was for a profit of GBP1.03 billion, according

to FactSet and based on seven analysts' forecasts.

Revenue rose to GBP57.50 billion from GBP55.92 billion a year

earlier. Group sales growth was 2.3% and U.K. like-for-like sales

growth was 2.2%.

FTSE 100-listed Tesco declared a dividend of 2 pence a share,

its first end-of-year dividend since fiscal 2014, when it axed

payments due to the accounting scandal. The full-year dividend is 3

pence.

Tesco, which recently bought food wholesaler Booker Group PLC

for GBP3.70 billion, said it expects a synergy benefit of about

GBP60 million in the first year, growing to around GBP140.0 million

in the second year and reaching a recurring run rate of GBP200

million a year by the end of the third year of ownership.

The company said it is on track to deliver the medium-term

targets it set out in October 2016 to reduce costs by GBP1.50

billion, to generate GBP9.00 billion of retail cash from operations

and to improve operating margins to between 3.5% and 4% by fiscal

2020.

Write to Maryam Cockar at maryam.cockar@dowjones.com

(END) Dow Jones Newswires

April 11, 2018 02:46 ET (06:46 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

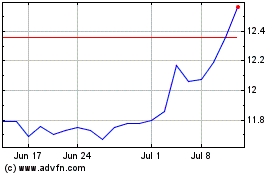

Tesco (PK) (USOTC:TSCDY)

Historical Stock Chart

From Jun 2024 to Jul 2024

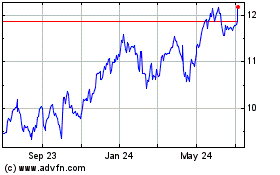

Tesco (PK) (USOTC:TSCDY)

Historical Stock Chart

From Jul 2023 to Jul 2024