UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of March, 2023

Commission File Number: 001-09531

Telefónica, S.A.

(Translation of registrant's name into English)

Distrito Telefónica, Ronda de la Comunicación s/n,

28050 Madrid, Spain

+34 91-482 87 00

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Telefónica, S.A.

TABLE OF CONTENTS

| | | | | | | | |

| Item | | Sequential Page Number |

| | |

| 1. | Telefónica: 2023 AGM Results | 2 |

TELEFÓNICA, S.A., in compliance with the Securities Market legislation, hereby communicates the following

OTHER RELEVANT INFORMATION

The Annual General Shareholders’ Meeting of TELEFÓNICA, S.A. held at second call today, has approved all the resolutions submitted by the Board of Directors for deliberation and vote by the General Shareholders’ Meeting. Please find attached the proposed resolutions that have been approved.

Likewise, it is informed that the proposal made during the Meeting by a shareholder has been rejected.

The voting results are attached to this communication.

Madrid, March 31, 2023

ORDINARY GENERAL SHAREHOLDERS’ MEETING

OF TELEFÓNICA S.A. - 2023 -

PROPOSED RESOLUTIONS SUBMITTED BY THE BOARD OF DIRECTORS

TO THE SHAREHOLDERS FOR DECISION AT THE GENERAL SHAREHOLDERS’ MEETING

March 30-31, 2023

Proposal regarding Item I on the Agenda: Individual and Consolidated Annual Accounts, Consolidated Non-financial Information and Management of the Board of Directors of Telefónica, S.A. during fiscal year 2022.

I.1 Approval of the Annual Accounts and of the Management Report of both Telefónica, S.A. and its Consolidated Group of Companies for fiscal year 2022.

To approve the Individual Annual Accounts (Balance Sheet, Income Statement, Statement of Changes in Shareholders’ Equity, Cash Flow Statement and Notes), the Consolidated Financial Statements -Consolidated Annual Accounts- (Statement of Financial Condition, Income Statement, Global Income Statement, Statement of Changes in Shareholders’ Equity, Cash Flow Statement and Notes to the Consolidated Financial Statements), and the Management Reports of Telefónica, S.A. and its Consolidated Group of Companies for the fiscal year ended on December 31, 2022, as finalized by the Board of Directors at its meeting of February 22, 2023.

In the Individual Annual Accounts, the Balance Sheet as of December 31, 2022 discloses total assets, total liabilities and shareholders’ equity in the amount of 68,742 million euros each, and the Income Statement as of the end of the fiscal year shows a loss of 880 million euros.

In the Consolidated Financial Statements (Consolidated Annual Accounts), the Statement of Financial Condition as of December 31, 2022 discloses total assets, total liabilities, and shareholders’ equity in the amount of 109,642 million euros each, and the Income Statement as of the end of the year shows a profit attributable to the shareholders of the controlling Company in the amount of 2,011 million euros.

I.2 Approval of the Statement of Non-Financial Information of the Consolidated Group of Companies led by Telefónica, S.A. for fiscal year 2022 included in the Consolidated Management Report of Telefónica, S.A. and of its Group of Companies for such fiscal year.

To approve the Statement of Non-Financial Information of the Consolidated Group of Companies led by Telefónica, S.A. for fiscal year 2022 included in the Consolidated Management Report of Telefónica, S.A. and of its Group of Companies for such fiscal year, and, specifically, the information regarding climate change and the decarbonization targets included in section 2.2 of such report.

I.3 Approval of the management of the Board of Directors of Telefónica, S.A. during fiscal year 2022.

To approve the corporate management of the Board of Directors of Telefónica, S.A. during fiscal year 2022.

* * *

| | |

ORDINARY GENERAL SHAREHOLDERS’ MEETING 2023 2 of 10 |

Proposal regarding Item II on the Agenda: Approval of the Proposed Allocation of the Profits/Losses of Telefónica, S.A. for fiscal year 2022.

To approve the following Proposed Allocation of the Profits/Losses of Telefónica, S.A. for the fiscal year ended December 31, 2022:

To offset the negative result obtained by Telefónica, S.A. in the year 2022, in the amount of 880,147,424.65 euros, to be charged to Voluntary Reserves.

* * *

| | |

ORDINARY GENERAL SHAREHOLDERS’ MEETING 2023 3 of 10 |

Proposal regarding Item III on the Agenda: Re-election of the Statutory Auditor for fiscal year 2023.

Pursuant to the proposal made by the Audit and Control Committee, the Board of Directors submits the following resolution for approval of the shareholders at the General Shareholders’ Meeting:

To re-elect PricewaterhouseCoopers Auditores S.L, with registered office at Madrid, Torre PwC, Paseo de la Castellana 259 B and Tax Identification Code (C.I.F.) B-79031290 as Auditor of Telefónica, S.A. and its Consolidated Group of Companies, for fiscal year 2023.

* * *

| | |

ORDINARY GENERAL SHAREHOLDERS’ MEETING 2023 4 of 10 |

Proposal regarding Item IV on the Agenda: Reduction of share capital through the cancellation of own shares, excluding the right of creditors to object, amending the text of Article 6 of the By-Laws relating to share capital.

A) To reduce the share capital of Telefónica, S.A. (“Telefónica” or the “Company”) by the amount of 24,779,409 euros, by means of the cancellation of 24,779,409 own shares of the Company currently held as treasury stock (representing approximately 0.43% of the Company's current share capital).

The reduction in share capital will not entail a return of contributions to the shareholders, since the Company itself is the owner of the shares which, where appropriate, will be cancelled, and will be made with a charge to unrestricted reserves, by means of the funding of a reserve for cancelled share capital in an amount equal to the par value of the cancelled shares (i.e., in the amount of 24,779,409 euros), which may only be used in compliance with the same requirements as those established for a reduction in share capital, by application of the provisions of Section 335 c) of the Companies Act (Ley de Sociedades de Capital).

Accordingly, as laid down in such section, the creditors of the Company will not have the right to oppose the reduction provided for in Section 334 of the Companies Act in connection with the approved reduction in share capital.

It is hereby stated for the record, in order to comply with the provisions of Section 411.1 of the Companies Act, that the consent of the bondholders’ syndicate for the outstanding issues of debentures and bonds is not required, since the approved capital reduction does not reduce the original ratio between the sum of capital plus reserves and the amount of the debentures pending repayment.

The capital reduction must be implemented within one year from the adoption of this resolution.

B) To authorize the Board of Directors so that, within a period of one year from the adoption of this resolution, it may determine those circumstances that have not been expressly established in this resolution or that are a result thereof, and to adopt the resolutions, take the actions and execute the public or private documents that may be necessary or appropriate for the full execution of the approved reduction in share capital, including, by way of example, publication of the legally required notices, submission of the appropriate applications and giving the appropriate notices to delist the cancelled shares from the Stock Exchange. The delegation includes the power to amend the text of Article 6 of the By-Laws relating to share capital.

The Board of Directors is expressly authorized to in turn delegate to the Executive Commission or the Executive Chairman of the Board of Directors the powers referred to in this resolution, without prejudice to the powers of attorney that may be granted to any person for specific acts of execution.

* * *

| | |

ORDINARY GENERAL SHAREHOLDERS’ MEETING 2023 5 of 10 |

Proposal regarding Item V on the Agenda: Shareholder compensation. Distribution of dividends from unrestricted reserves.

To approve the distribution of dividends in cash with a charge to unrestricted reserves, through the payment in 2023 of the fixed amount of 0.30 euros, payable in two tranches, to each of the existing shares of Telefónica, S.A. entitled to participate in such distribution on the following payment dates.

-The first payment of 0.15 euros per share in cash will be carried out on June 15, 2023 through the entities participating in Sociedad de Gestión de los Sistemas de Registro, Compensación y Liquidación de Valores, S.A.U. (IBERCLEAR).

-The second payment of 0.15 euros per share in cash will be paid on December 14, 2023 through the entities participating in Sociedad de Gestión de los Sistemas de Registro, Compensación y Liquidación de Valores, S.A.U. (IBERCLEAR).

* * *

| | |

ORDINARY GENERAL SHAREHOLDERS’ MEETING 2023 6 of 10 |

Proposal regarding Item VI on the Agenda: Authorization for the acquisition of own shares, directly or through Group companies.

A) To authorize the derivative acquisition by Telefónica, S.A. of its own fully paid-up shares — either directly or through one of its subsidiaries — by purchase, exchange or other legal title, in accordance with the provisions of Sections 144 et seq. of the Companies Act, at any time and as often as it deems appropriate.

The minimum acquisition price or the minimum value of the consideration shall correspond to the par value of own shares acquired, and the maximum acquisition price or the maximum value of the consideration shall be equal to the listing price of the own shares acquired on an official secondary market at the time of acquisition.

This authorization is granted for a period of 5 years from the date of this Meeting and is expressly subject to the limitation that the par value of the own shares directly or indirectly acquired pursuant to this authorization, together with the value of the shares already held by Telefónica, S.A. and all its subsidiaries, may not at any time exceed the maximum amount permitted by law from time to time, and that the restrictions on the acquisition of own shares established by the regulatory authorities of the markets in which Telefónica, S.A. shares are admitted to trading must be complied with.

It is expressly noted that the authorization granted to acquire own shares may be used, in whole or in part, to acquire shares of Telefónica, S.A. that Telefónica, S.A. must deliver or transfer to board members or employees of the Company or of companies in its group, either directly or as a result of the exercise of the option rights owned thereby, all within the framework of duly authorized compensation systems linked to the listing price of the Company’s shares.

B) To authorize the Board of Directors, on the broadest terms, to exercise the authority covered by this resolution and to carry out the other provisions contained herein, which authority may be delegated by the Board of Directors to the Executive Commission, the Executive Chairman of the Board of Directors, the Chief Operating Officer or any other person expressly authorized by the Board of Directors for such purpose.

C) To rescind, to the extent not used, the authorization granted under item V on the Agenda of the Ordinary General Shareholders’ Meeting of the Company held on June 8, 2018.

* * *

| | |

ORDINARY GENERAL SHAREHOLDERS’ MEETING 2023 7 of 10 |

Proposal regarding Item VII on the Agenda: Approval of the Telefónica, S.A. Directors’ Remuneration Policy

To approve the Directors’ Remuneration Policy of Telefónica, S.A., the full text of which has been made available to the shareholders, along with the other documentation relating to this General Shareholders’ Meeting since the date of the call to meeting.

The Directors’ Remuneration Policy will apply since the date of its approval and throughout the three following fiscal years: 2024, 2025 and 2026.

* * *

| | |

ORDINARY GENERAL SHAREHOLDERS’ MEETING 2023 8 of 10 |

Proposal regarding Item VIII on the Agenda: Delegation of powers to formalize, interpret, rectify and carry out the resolutions adopted by the shareholders at the General Shareholders’ Meeting.

To authorize, on a several basis, the Executive Chairman of the Board of Directors, the Chief Operating Officer, the Secretary of the Board of Directors and the Deputy Secretary of the Board of Directors, such that, without prejudice to any other delegations included in the foregoing resolutions and any existing powers of attorney to convert resolutions into public instruments, any of them may formalize and implement the foregoing resolutions, with the power for such purpose to execute the public or private documents that may be necessary or appropriate (including documents for purposes of interpretation, clarification, further development, supplementation, correction of errors and curing of defects) for the most correct performance thereof and for the registration thereof, to the extent required, with the Commercial Registry or any other public registry, as well as to deposit the accounts of the Company and its Group.

* * *

| | |

ORDINARY GENERAL SHAREHOLDERS’ MEETING 2023 9 of 10 |

Proposal regarding Item IX on the Agenda: Consultative vote on the 2022 Annual Report on Director Remuneration.

To approve, on a consultative basis, the Annual Report on Director Remuneration for fiscal year 2022.

It is hereby stated for the record that the full text of such Report has been made available to the shareholders, along with the other documentation relating to this General Shareholders’ Meeting, since the date of the call to meeting.

* * *

| | |

ORDINARY GENERAL SHAREHOLDERS’ MEETING 2023 10 of 10 |

SHAREHOLDERS´ MEETING 2023

QUORUM AND RESULTS OF THE VOTING

ATTENDANCE AT THE SHAREHOLDERS´MEETING

| | | | | |

| Shareholders attending | 5,391 |

| Shareholders represented | 24,752 |

| TOTAL SHAREHOLDERS | 30,143 |

| | | | | |

| Shares attending | 191,057,281 |

| Shares represented | 3,167,152,333 |

| TOTAL SHARES | 3,358,209,614 |

| | | | | |

| PERCENTAGE OF SHARE CAPITAL | 58.1484% |

VOTES ON RESOLUTIONS MADE

Below we list the resolutions put toward at the shareholders´ meeting and the results of the voting for each of them. For a more detailed description of the resolutions passed, please see the “Proposed Resolutions” document.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Number on the Agenda | Summary of the resolution | Votes in favour | Votes Against

| Abstentions | Result of the Voting |

| I.1 | Approval of the 2022 Annual Accounts and of the Management Report. | 3,235,737,432 (99.2465%) | 2,246,098 (0.0689%) | 22,319,854 (0.6846%) | Passed |

| I.2 | Approval of the Non-Financial Information Statement. | 3,239,543,372 (99.3632%) | 2,324,234 (0.0713%) | 18,435,778 (0.5655%) | Passed |

| I.3 | Approval of the management of the Board of Directors. | 3,220,748,832 (98.7868%) | 14,087,367 (0.4321%) | 25,467,185 (0.7811%) | Passed |

| II. | Approval of the Proposed Allocation of the Profits/Losses. | 3,233,653,846 (99.1826%) | 9,359,222 (0.2871%) | 17,290,316 (0.5303%) | Passed |

| III. | Re-election of the Statutory Auditor for fiscal year 2023. | 3,234,477,459 (99.2079%) | 5,437,173 (0.1668%) | 20,388,752 (0.6254%) | Passed |

| IV. | Reduction of share capital through the cancellation of own shares. | 3,240,995,518 (99.4078%) | 3,124,636 (0.0958%) | 16,183,230

(0.4964%) | Passed |

| V. | Shareholder compensation by means of the distribution of dividends. | 3,236,019,301 (99.2552%) | 8,643,966 (0.2651%) | 15,640,117

(0.4797%) | Passed |

| VI. | Authorization for the acquisition of own shares. | 3,206,273,928 (98.3428%) | 37,803,487 (1.1595%) | 16,225,969

(0.4977%) | Passed |

| VII. | Approval of the Directors´ Remuneration Policy. | 3,020,923,718 (92.6577%) | 134,916,023 (4.1381%) | 104,463,643

(3.2041%) | Passed |

| VIII. | Delegation of powers. | 3,228,767,786 (99.0327%) | 4,264,923 (0.1308%) | 27,270,675 (0.8364%) | Passed |

| IX. | Consultative vote on the 2022 Annual Report on Director Remuneration. | 3,025,867,375 (92.8094%) | 204,714,432 (6.2790%) | 29,721,577

(0.9116%) | Passed |

* Proposed resolution not included in the Agenda: Removal of the Chairman. | 145,239 (0.0045%) | 3,259,344,727 (99.9706%) | 813,418 (0.0249%) | Rejected |

Telefónica holds treasury shares which, in accordance with the provisions of article 148 of the Capital Companies Law, are counted at the General Shareholders’ Meeting for the purposes of the quorum for constitution and adoption of resolutions, but do not vote as the exercise of voting and other political rights attached to them are suspended.

When calculating the percentage that the votes for and against and abstentions represent among the attending share capital and which is published on the web page, the effect derived from the treasury shares has been taken into account.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | | | | | | | |

| | Telefónica, S.A. |

| Date: | March 31, 2023 | | By: | /s/ Pablo de Carvajal González |

| | | | Name: | Pablo de Carvajal González |

| | | | Title: | Secretary to the Board of Directors |

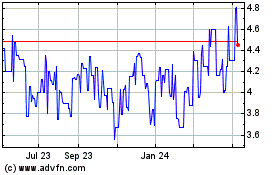

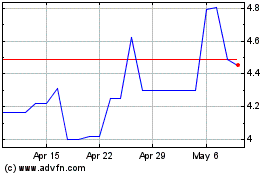

Telefonica (PK) (USOTC:TEFOF)

Historical Stock Chart

From Apr 2024 to May 2024

Telefonica (PK) (USOTC:TEFOF)

Historical Stock Chart

From May 2023 to May 2024