UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K

(Mark

One)

x

ANNUAL REPORT UNDER

SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

For the

fiscal year ended: December 31, 2008

o

TRANSITION REPORT UNDER

SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT

OF

1934

Commission

file number: 000-32585

SUNRISE

REAL ESTATE GROUP, INC.

(Name of

Small Business Issuer in its Charter)

|

Texas

|

6351

|

75-2713701

|

|

(State

or Other Jurisdiction of

Incorporation or

Organization)

|

(Primary

Standard Industrial

Classification Code Number)

|

(I.R.S.

Employer

Identification No.)

|

Suite

701, No. 333, Zhaojiabang Road

Shanghai,

PRC 200032

(Address

of Principal Executive Offices) (Zip Code)

Issuer's

telephone number: + 86-21-6422-0505

Securities

registered pursuant to Section 12(b) of the Act: None

Securities

registered pursuant to Section 12(g) of the Act: Common Stock, $0.01 par

value

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act.

Yes

¨

No

þ

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Act.

Yes

¨

No

þ

Check

whether the issuer(1) filed all reports required to be filed by Section 13 or

15(d) of the Exchange Act during the past 12 months (or for such shorter period

that the issuer was required to file such reports), and (2) has been subject to

such filing requirements for the past 90 days. Yes

þ

No

¨

Check if

there is no disclosure of delinquent filers in response to Item 405 of

Regulation S-B is contained in this form, and no disclosure will be contained,

to the best of registrant's knowledge, in definitive proxy or information

statements incorporated by reference in Part III of this Form 10-K or any

amendment to this Form 10-K.

þ

Indicate

by checkmark whether the registrant is a shell company (as defined in Rule 12b-2

of the Exchange Act):

Yes

¨

No

þ

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

the definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act.

|

|

Large

accelerated filer

¨

|

|

Accelerated

filer

¨

|

|

|

|

Non-accelerated

filer

¨

(Do

not check if a smaller reporting company)

|

|

Smaller

reporting company

þ

|

|

The

issuer's net revenues for its most recent fiscal year ended December 31, 2008

were US$8,075,193.

As of

March 31, 2009 the aggregate market value of the Common Stock held by

non-affiliates, 14,334,375 shares of Common Stock, was $4,371,984 based on an

average of the bid and ask prices of $0.305 per share of Common Stock on such

date.

The

number of shares outstanding of the issuer's Common Stock, $0.01 par value, as

of March 31, 2009 was 23,691,925 shares.

Transitional

Small Business Disclosure Format (check one): Yes

o

No

x

SUNRISE

REAL ESTATE GROUP, INC.

FORM

10-K

TABLE

OF CONTENTS

|

|

|

Page

|

|

PART I

|

|

|

|

Item

1.

|

Description

of Business

|

2

|

|

Item

2.

|

Description

of Property

|

7

|

|

Item

3.

|

Legal

Proceedings

|

7

|

|

Item

4.

|

Submission

of Matters to a Vote of Security Holders

|

7

|

|

PART

II

|

|

|

|

Item

5.

|

Market

for Common Equity and Related Stockholder Matters

|

8

|

|

Item

6.

|

Selected

Financial Data

|

8

|

|

Item

7.

|

Management's

Discussion and Analysis or Plan of Operation

|

8

|

|

Item

8.

|

Financial

Statements

|

22

|

|

Item

9.

|

Changes

In and Disagreements With Accountants on Accounting and Financial

Disclosure

|

37

|

|

Item

9A.

|

Controls

and Procedures

|

37

|

|

Item

9B.

|

Other

Information

|

38

|

|

PART

III

|

|

|

|

Item

10.

|

Directors,

Executive Officers, Promoters, Control Persons and Corporate Governance;

Compliance With Section 16(A) of the Exchange Act

|

39

|

|

Item

11.

|

Executive

Compensation

|

42

|

|

Item

12.

|

Security

Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters

|

43

|

|

Item

13.

|

Certain

Relationships and Related Transactions and Director

Independence

|

43

|

|

Item 14.

|

Principal

Accountant Fees and Services

|

44

|

|

Item

15.

|

Exhibits

|

45

|

PART I

ITEM 1. DESCRIPTION OF BUSINESS

Corporate

History

Sunrise

Real Estate Development Group, Inc. (“CY-SRRE”) was established in the Cayman

Islands on April 30, 2004 as a limited liability company. CY-SRRE was wholly

owned by Ace Develop Properties Limited, a corporation, (“Ace Develop”), of

which Lin Chi-Jung, an individual, is the principal and controlling shareholder.

Shanghai Xin Ji Yang Real Estate Consultation Company Limited (“SHXJY”) was

established in the People’s Republic of China (the “PRC”) on August 14, 2001 as

a limited liability company. SHXJY was originally owned by a

Taiwanese company, of which the principal and controlling shareholder was Lin

Chi-Jung. On June 8, 2004, all the fully paid up capital of SHXJY was

transferred to CY-SRRE. On June 25, 2004 SHXJY and two individuals established a

subsidiary, namely, Suzhou Xin Ji Yang Real Estate Consultation Company Limited

(“SZXJY”) in the PRC, at which point in time, SHXJY held a 90% equity interest

in SZXJY. On December 24, 2004, SHXJY acquired 85% of equity interest in Beijing

Xin Ji Yang Real Estate Consultation Company Limited (“BJXJY”), a PRC company

incorporated on April 16, 2003 with limited liability. On August 9,

2005, SHXJY sold a 10% equity interest in SZXJY to a company owned by a director

of SZXJY, and transferred a 5% equity interest in SZXJY to

CY-SRRE. Following the disposal and the transfer, CY-SRRE effectively

held an 80% equity interest in SZXJY. On November 24, 2006, CY-SRRE, SHXJY, a

director of SZXJY and a third party established a subsidiary, namely, Suzhou

Shang Yang Real Estate Consultation Company Limited (“SZSY”) in the PRC, with

CY-SRRE holding a 12.5% equity interest, SHXJY holding a 26% equity interest and

the director of SZXJY holding a 12.5% equity interest in SZSY. At the date of

incorporation, SRRE and the director of SZXJY entered into a voting agreement

that SRRE is entitled to exercise the voting right in respect of his 12.5%

equity interest in SZSY. Following that, SRRE effectively holds 51% equity

interest in SZSY. On September 24, 2007, CY-SRRE sold a 5% equity interest in

SZXJY to a company owned by a director of SZXJY. Following the

disposal, CY-SRRE effectively holds 75% equity interest in SZXJY. On

November 1, 2007, SZXJY established a wholly owned subsidiary, Suzhou Xin Ji

Yang Real Estate Brokerage Company Limited (“SZXJYB”) in the PRC as a limited

liability company. On May 8, 2008, SHXJY established a wholly owned

subsidiary, Kunshan Shang Yang Real Estate Brokerage Company Limited (“KSSY”) in

the PRC as a limited liability company.

LIN RAY

YANG Enterprise Ltd. (“LRY”) was established in the British Virgin Islands on

November 13, 2003 as a limited liability company. LRY was owned by

Ace Develop, Planet Technology Corporation (“Planet Tech”) and Systems &

Technology Corporation (“Systems Tech”). On February 5, 2004, LRY

established a wholly owned subsidiary, Shanghai Shang Yang Real Estate

Consultation Company Limited (“SHSY”) in the PRC as a limited liability company.

On January 10, 2005, LRY and a PRC third party established a subsidiary, Suzhou

Gao Feng Hui Property Management Company Limited (“SZGFH”), in the PRC, with LRY

holding 80% of the equity interest in SZGFH. On May 8, 2006, LRY acquired 20% of

the equity interest in SZGFH from the third party. Following the acquisition,

LRY effectively holds 100% of the equity interest in SZGFH. On September 11,

2007 SHSY and other third parties established a subsidiary, namely, Suzhou Bin

Fen Nian Dai Administration Consultancy Company Limited (“SZBFND”) in the PRC,

with SHSY holding a 19% equity interest in SZBFND. On September 18, 2008, SHSY

established a wholly owned subsidiary, San Ya Shang Yang Real Estate

Consultation Company Limited (“SYSY”) in the PRC as a limited liability

company.

SHXJY,

SZXJY, BJXJY, SHSY, SZGFH, SZSY, SZXJYB, KSSY and SYSY commenced operations in

November 2001, June 2004, January 2004, February 2004, January 2005, November

2006, November 2007, May 2008 and September 2008 respectively. Each

of SHXJY, SZXJY, BJXJY, SHSY, SZGFH, SZSY, SZXJYB and KSSY has been granted a

twenty-year operation period and SYSY has been granted a thirty-year operation

period from the PRC, which can be extended with approvals from relevant PRC

authorities.

On August

31, 2004, Sunrise Real Estate Group, Inc. (“SRRE”), CY-SRRE and Lin Chi-Jung, an

individual and agent for the beneficial shareholder of CY-SRRE, i.e., Ace

Develop, entered into an exchange agreement under which SRRE issued 5,000,000

shares of common stock to the beneficial shareholder or its designees, in

exchange for all outstanding capital stock of CY-SRRE. The

transaction closed on October 5, 2004. Lin Chi-Jung is Chairman of

the Board of Directors of SRRE, the President of CY-SRRE and the principal and

controlling shareholder of Ace Develop.

Also on

August 31, 2004, SRRE, LRY and Lin Chi-Jung, an individual and agent for

beneficial shareholders of LRY, i.e., Ace Develop, Planet Tech and Systems Tech,

entered into an exchange agreement under which SRRE issued 10,000,000 shares of

common stock to the beneficial shareholders, or their designees, in exchange for

all outstanding capital stock of LRY. The transaction was closed on

October 5, 2004. Lin Chi-Jung is Chairman of the Board of Directors of SRRE, the

President of LRY and the principal and controlling shareholder of Ace

Develop. Regarding the 10,000,000 shares of common stock of SRRE

issued in this transaction, SRRE issued 8,500,000 shares to Ace Develop, 750,000

shares to Planet Tech and 750,000 shares to Systems Tech.

As a

result of the acquisition, the former owners of CY-SRRE and LRY hold a majority

interest in the combined entity. Generally accepted accounting

principles require in certain circumstances that a company whose shareholders

retain the majority voting interest in the combined business be treated as the

acquirer for financial reporting purposes. Accordingly, the

acquisition has been accounted for as a “reverse acquisition” arrangement

whereby CY-SRRE and LRY are deemed to have purchased SRRE. However,

SRRE remains the legal entity and the Registrant for Securities and Exchange

Commission reporting purposes. All shares and per share data prior to

the acquisition have been restated to reflect the stock issuance as a

recapitalization of CY-SRRE and LRY.

SRRE was

initially incorporated in Texas on October 10, 1996, under the name of Parallax

Entertainment, Inc. (“Parallax”). On December 12, 2003, Parallax

changed its name to Sunrise Real Estate Development Group, Inc. On

April 25, 2006, Sunrise Estate Development Group, Inc. filed Articles of

Amendment with the Texas Secretary of State, changing the name of Sunrise Real

Estate Development Group, Inc. to Sunrise Real Estate Group, Inc., effective

from May 23, 2006.

SRRE and

its subsidiaries, namely, CY-SRRE, LRY, SHXJY, SZXJY, SZXJYB, SZSY, KSSY, BJXJY,

SHSY, SZGFH and SYSY are sometimes hereinafter collectively referred to as “the

Company.”

The

principal activities of the Company are property brokerage services, real estate

marketing services, property leasing services and property management services

in the PRC

.

General

Business Description

SRRE was

incorporated on October 10, 1996 as a Texas corporation and was formerly known

as Parallax Entertainment, Inc. SRRE has gone through a series of transactions

leading to the completion of a reverse merger on October 5, 2004. Prior to the

closing of the exchange agreements described in “Corporate History” above, SRRE

was an inactive "shell" company. Following the closing, SRRE, through its two

wholly owned subsidiaries, CY-SRRE and LRY, has engaged in the property

brokerage services, real estate marketing services, property leasing services

and property management services in the PRC

.

The

Company recognizes that in order to differentiate itself from the market, it

should avoid direct competition with large-scale property developers who have

their own marketing departments. Our objective is to develop a niche position

with marketing alliances with medium size and smaller developers, and become

their outsourcing marketing and sales agents.

SRRE

operates through a tier of wholly owned subsidiaries of Sunrise Real Estate

Development Group, Inc., a Cayman Islands corporation ("CY-SRRE") and LIN RAY

YANG Enterprise, Ltd., a British Virgin Islands company ("LRY"). Neither CY-SRRE

nor LRY have operations but conduct operations in Mainland China through their

respective subsidiaries that are based in the PRC. CY-SRRE operates through its

wholly owned subsidiary, SHXJY. LRY operates through its two wholly owned

subsidiaries, SHSY and SZGFH. SHXJY and SHSY are property agency business

earning commission revenue from marketing and sales services to developers. The

main business of SZGFH is to render property rental service, buildings

management and maintenance service for office buildings. Our company

organization chart is as follows:

Figure 1:

Company Organization Chart

Our major

business was agency sales, whereby our Chinese subsidiaries contracted with

property developers to market and sell their newly developed property

units. For these services we earned a commission fee calculated as a

percentage of the sales prices. We have focused our sales on the whole China

market, especially in secondary cities. To expand our agency business, we have

established subsidiaries in Shanghai, Suzhou, Beijing, Kunshan and Hainan, and

branches in NanChang, YangZhou, NanJing and ChongQing.

During

the year of 2005 and 2006, SZGFH entered into leasing agreements with certain

buyers of the Sovereign Building underwriting project to lease the properties

for them. These leasing agreements on these properties are for 62% of the floor

space that was sold to third party buyers. In accordance with the leasing

agreements, the owners of the properties can have an annual rental return of

8.5% and 8.8% per annum for a period of 5 years and 8 years,

respectively. The leasing period started in the second quarter, 2006,

and the Company has the right to sublease the leased properties to cover these

lease commitments in the leasing period. As of March 31, 2009, 116 sub-leasing

agreements have been signed, the area of these sub-leasing agreements

represented 90% of total area with these lease commitments.

With a

relatively short history and smaller capital base, we recognize that in order to

differentiate ourselves from the market, we need to avoid direct competition

with large-scale property developers, who have their own marketing departments.

We plan to utilize our professional experience to carve a niche and position by

developing marketing alliances with medium size and smaller developers. This

strategic plan is designed to expand our activities beyond our existing revenue

base, enabling us to assume higher investment risk and giving us flexibility in

collaborating with partnering developers. The plan is aimed at improving our

capital structure, diversifying our revenue base, creating higher values and

equity returns.

In the

past seven years, we have established a reputation as a sales and marketing

agency for new projects. With our accumulated expertise and experience, we

intend to take a more aggressive role by participating in property investments.

We plan to select property developers with outstanding qualifications as our

strategic partners, and continue to build strength in design, planning,

positioning and marketing services.

Business

Activities

Our main

operating subsidiaries, SHXJY and SHSY, have engaged in sales and marketing

agency work for newly built property units. We also have developed a

good network of landowners and earned the trust of developers, allowing us to

explore opportunities in property investments.

In order

to build a cushion against the cyclical nature of the real estate industry and

have a more diversified revenue base, we established another operating

subsidiary, SZGFH, to deal with property management and rental

operations.

Commission Based

Services

Commission

based services refer to marketing and sales agency operations, which provide the

following services:

a.

Integrated Marketing Planning

b.

Advertising Planning & Execution

c. Sales

Planning and Execution

In this

type of business, we sign a marketing and sales agency agreement with property

developers to undertake the marketing and sales activities of a specific

project. The scope of service varies according to clients' needs; it could be a

full package of all the above services, a combination of any two of the above

services or any single service.

A major

part of our existing revenue comes from commission-based services. We secure

these projects via bidding or direct appointments. As a result of our

relationships with existing clients and our sales track record, we have secured

a number of cases from prior clients on subsequent phases of

projects.

Normally,

before a developer retains us, we will evaluate and determine the Average Sales

Value of a project. This value will be proposed to the developer, and the

parties will determine and agree on an Average Sales Value as the basis of our

agency agreement. The actual sales price of the project is generally priced

higher than the Average Sales Value depending on market conditions. On average,

we have been to sell the property at a small premium over Average Sales

Value.

Our

normal commission structure is a combination of the following:

a) Base

Commission of 1.0% - 1.5% based on the Average sales value.

b)

Surplus Commission of 10% - 30% based on the difference between Average Sales

Value and actual sales price.

Our

wholly owned subsidiaries, SHXJY and SHSY, engage in this sales and marketing

phase of our business.

Mainland China's Property

Sector

The

industry's macro environment is opening up, and the property sector is gradually

developing to be a more regulated market. Stable economic growth provides a

solid and secure base for investment returns in the property

sector.

GDP

Growth of PRC for the period of 2004 through 2008

|

|

|

GDP

GROWTH

|

|

|

2004

|

|

|

10.1

|

%

|

|

2005

|

|

|

10.4

|

%

|

|

2006

|

|

|

10.7

|

%

|

|

2007

|

|

|

11.4

|

%

|

|

2008

|

|

|

9.0

|

%

|

Government

regulation

On

January 3, 2008 the State Council issued the Circular of the State Council on

Promoting Efficient and Intensive Land Use. The Circular calls for strict

reviews of planning and standards for land use. It also puts forward specific

rules aiming to reduce the amount of idle lands and better implement economic

mechanisms for a more efficient use of land.

The

Measures for Land Registration went into effect in China on February 1, 2008,

signifying a step by the Ministry of Land and Resources to implement the

relevant provisions in the Property Law, which went into effect on October 1,

2007. The Measures delineate the categories of land-related rights that should

be registered, streamline the registration process, and add new types of

registration to better protect the holders of various rights.

In order

to regulate transactions involving state-owned land-use rights and to add

transparency to the transaction process, the Shanghai Municipal People’s

Government (the Shanghai Government) opened the Shanghai Land Exchange on March

1, 2008. In conjunction with the administration of the Exchange, the Shanghai

Government issued the Administrative Measures for the Shanghai Land Exchange on

February 28, 2008 and the Measures took effect on March 1, 2008.

On

December 20, 2008, the General Office of the State Council issued the Several

Opinions on Promoting the Sound Development of the Real Estate Market, which

took effect on the same day. In the Opinions, the General Office urges

provincial governments and the State Council’s committees to make their best

efforts in ensuring an adequate supply of social security housing. The central

government sets a three-year time frame to help lower-income households enhance

their living conditions by building more low-rent and low-price residences, and

renovating residences in poor condition. It also outlines favorable policies for

people purchasing their second residences to boost real estate sales. In order

to promote the resale of residences, the General Office provides tax exemptions

under certain conditions.

In

addition, the Opinions abolish the urban real estate tax. Both domestic and

foreign enterprises and individuals are entitled to the same tax rate provided

under the Interim Regulations on Real Estate Taxation of the People’s Republic

of China. It represents the Chinese government’s third adjustment to real estate

tax policies in 2008

Environmental

matters

None

Employees

As of

December 31, 2008, we had the following number of employees:

|

|

Employees

|

|

SRRE

|

|

|

Administration

Dept.

|

6

|

|

Accounting

Dept.

|

2

|

|

Investor

Relations Dept.

|

2

|

|

Research

& Development Dept.

|

5

|

|

|

|

|

SHXJY

|

|

|

Administration

Dept.

|

9

|

|

Accounting

Dept.

|

3

|

|

Research

& Development Dept.

|

9

|

|

Advertising

& Communication Planning Dept.

|

3

|

|

Marketing

Dept.

|

38

|

|

|

|

|

Nanchang

Branch of SHXJY

|

|

|

Marketing

Dept.

|

10

|

|

|

|

|

Yangzhou

Branch of SHXJY

|

|

|

Accounting

Dept.

|

2

|

|

Marketing

Dept.

|

17

|

|

|

|

|

Chongqing

Branch of SHXJY

|

|

|

Accounting

Dept.

|

2

|

|

Marketing

Dept.

|

11

|

|

|

|

|

SZXJY

and Nanjing Branch

|

|

|

Administration

Dept.

|

10

|

|

Accounting

Dept.

|

3

|

|

Research

& Development Dept.

|

8

|

|

Advertising

& Communication Planning Dept.

|

6

|

|

Marketing

Dept.

|

52

|

|

|

|

|

SZSY

|

|

|

Marketing

Dept.

|

24

|

|

|

|

|

SZXJYB

|

|

|

Marketing

Dept.

|

7

|

|

|

|

|

BJXJY

|

|

|

Administration

Dept.

|

1

|

|

|

|

|

SHSY

|

|

|

Administration

Dept.

|

5

|

|

Research

& Development Dept.

|

5

|

|

Accounting

Dept.

|

2

|

|

Marketing

Dept.

|

6

|

|

|

|

|

SYSY

|

|

|

Marketing

Dept.

|

12

|

|

|

|

|

SZGFH

|

|

|

Administration

Dept.

|

1

|

|

Accounting

Dept.

|

3

|

|

Marketing

Dept.

|

4

|

|

|

|

|

Total

|

268

|

ITEM 1A. RISK FACTORS

Not

Applicable

ITEM

1B. UNRESOLVED STAFF COMMENTS

None.

ITEM

2. DESCRIPTION OF PROPERTY

We

currently rent our facilities at 7

th

Floor,

No.333, Zhaojiabang Road, Shanghai, PRC. We also have regional field

support offices in various cities in Mainland China, namely Suzhou, Beijing,

Nanchang, Yangzhou, Chongqing, Nanjing and Hainan. We lease the facilities that

house our regional field support offices.

During

the past four years, the Company has also acquired two floors and four units of

the Sovereign Building in Suzhou, PRC. The properties under

development were completed on March 31, 2006, and we have paid the full purchase

price to the property developer. In 2007, the title for these properties were

transferred to the Company. The Company decided that one floor will be held for

the Company’s own use, and the remaining properties will be held for long-term

investment purposes. Accordingly, the costs of the properties for the Company’s

own use was $2,213,659 and the investment properties was

$9,059,905.

As of

December 31, 2008,

the bank loan

secured by the investment properties was $5,840,053 and bears interest at prime

rate as announced by

the People’s Bank of China

. The bank loan secured by the

properties for the Company’s own use was $

409,680, which is repayable before

December 15, 2010 in monthly installments and bears interest at prime rate as

announced by

the People’s Bank of China

.

ITEM 3. LEGAL PROCEEDINGS

The

Company is not a party to any legal proceedings of a material

nature.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY

HOLDERS

None.

PART II

ITEM 5. MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER

MATTERS

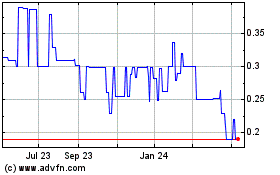

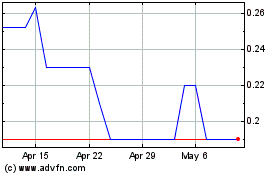

Our

common stock is quoted on the Over-the-Counter Bulletin Board system under the

symbol “SRRE.” The following table sets forth the high and low quotations of our

common stock reported by the OTCBB system for the periods

indicated.

Over-the-counter

market quotations reflect inter-dealer prices, without retail mark-up,

mark-down, or commissions, and may not necessarily represent actual

transactions.

(Expressed

in US Dollars)

|

|

|

2008

|

|

|

2007

|

|

|

|

|

High

|

|

|

Low

|

|

|

High

|

|

|

Low

|

|

|

First

quarter

|

|

$

|

0.38

|

|

|

$

|

0.15

|

|

|

$

|

1.98

|

|

|

$

|

1.65

|

|

|

Second

quarter

|

|

$

|

0.52

|

|

|

$

|

0.12

|

|

|

$

|

2.15

|

|

|

$

|

1.02

|

|

|

Third

quarter

|

|

$

|

0.70

|

|

|

$

|

0.12

|

|

|

$

|

1.95

|

|

|

$

|

0.25

|

|

|

Fourth

quarter

|

|

$

|

0.40

|

|

|

$

|

0.05

|

|

|

$

|

0.80

|

|

|

$

|

0.15

|

|

As of

March 31, 2009, we had approximately 1,271 record holders of our common stock.

On March 31, 2009, the closing price of our common stock was $0.62.

No cash

dividends were declared on our common stock in 2008 and 2007. The major reason

for not declaring any cash dividends is that we are still a growing company and

require sufficient liquidity to fund our business activities. In the future, in

the event we have funds available for distribution, we may consider paying cash

dividends on our common stock.

The

Company did not repurchase any of its outstanding equity securities during the

year ended December 31, 2008.

No

securities of the Company were issued pursuant to any equity compensation plan

during the year ended December 31, 2008.

ITEM

6. SELECTED FINANCIAL DATA

Not

Applicable

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The

following Management’s Discussion and Analysis (“MD&A”) is intended to help

the reader understand Sunrise Real Estate Group, Inc. (“SRRE”). MD&A is

provided as a supplement to, and should be read in conjunction with, our

financial statements and the accompanying notes.

OVERVIEW

In

October 2004, the former shareholders of Sunrise Real Estate Development Group,

Inc. (Cayman Islands) (“CY-SRRE”) and LIN RAY YANG Enterprise Ltd. (“LRY”)

acquired a majority of our voting interests in a share

exchange. Before the completion of the share exchange, SRRE had no

continuing operations, and its historical results would not be meaningful if

combined with the historical results of CY-SRRE, LRY and their

subsidiaries.

As a

result of the acquisition, the former owners of CY-SRRE and LRY hold a majority

interest in the combined entity. Generally accepted accounting

principles require in certain circumstances that a company whose shareholders

retain the majority voting interest in the combined business be treated as the

acquirer for financial reporting purposes. Accordingly, the

acquisition has been accounted for as a “reverse acquisition” arrangement

whereby CY-SRRE and LRY are deemed to have purchased SRRE. However,

SRRE remains the legal entity and the Registrant for Securities and Exchange

Commission reporting purposes. The historical financial statements

prior to October 5, 2004 are those of CY-SRRE and LRY and their

subsidiaries. All equity information and per share data prior to the

acquisition have been restated to reflect the stock issuance as a

recapitalization of CY-SRRE and LRY.

SRRE and

its subsidiaries, namely, CY-SRRE, LRY, Shanghai Xin Ji Yang Real Estate

Consultation Company Limited (“SHXJY”), Suzhou Xin Ji Yang Real Estate

Consultation Company Limited (“SZXJY”), Beijing Xin Ji Yang Real Estate

Consultation Company Limited (“BJXJY”), Shanghai Shangyang Real Estate

Consultation Company Limited (“SHSY”), Suzhou Gao Feng Hui Property Management

Company Limited (“SZGFH”), Suzhou Shang Yang Real Estate Consultation Company

Limited (“SZSY”), Suzhou Xin Ji Yang Real Estate Brokerage Company

Limited(“SZXJYB”), Kunshan Shang Yang Real Estate Brokerage Company Limited

(“KSSY”) and San Ya Shang Yang Real Estate Consultation Company Limited (“SYSY”)

are sometimes hereinafter collectively referred to as “the Company,” “our,” or

“us”.

The

principal activities of the Company are real estate agency sales, real estate

marketing services, real estate investments, property leasing services and

property management services in the PRC

.

RECENT

DEVELOPMENTS

Our major

business was agency sales, whereby our Chinese subsidiaries contracted with

property developers to market and sell their newly developed property

units. For these services we earned a commission fee calculated as a

percentage of the sales prices. We have focused our sales on the whole China

market, especially in secondary cities. To expand our agency business, we have

established subsidiaries in Shanghai, Suzhou, Beijing, Kunshan and Hainan, and

branches in NanChang, YangZhou, NanJing and ChongQing.

During

the year of 2005 and 2006, SZGFH entered into leasing agreements with certain

buyers of the Sovereign Building underwriting project to lease the properties

for them. These leasing agreements on these properties are for 62% of the floor

space that was sold to third party buyers. In accordance with the leasing

agreements, the owners of the properties can have an annual rental return of

8.5% and 8.8% per annum for a period of 5 years and 8 years,

respectively. The leasing period started in the second quarter, 2006,

and the Company has the right to sublease the leased properties to cover these

lease commitments in the leasing period. As of March 31, 2009, 116 sub-leasing

agreements have been signed, the area of these sub-leasing agreements

represented 90% of total area with these lease commitments.

RISKS

ASSOCIATED WITH FORWARD-LOOKING STATEMENTS INCLUDED IN THIS FORM

10-K

In

addition to historical information, this Form 10-K contains forward-looking

statements. Forward-looking statements are based on our current beliefs and

expectations, information currently available to us, estimates, projections

about our industry, and certain assumptions made by our management. These

statements are not historical facts. We use words such as "anticipates",

"expects", "intends", "plans", "believes", "seeks", "estimates", and similar

expressions to identify our forward-looking statements, which include, among

other things, our anticipated revenue and cost of our agency and investment

business.

Because

we are unable to control or predict many of the factors that will determine our

future performance and financial results, including future economic,

competitive, and market conditions, our forward-looking statements are not

guarantees of future performance. They are subject to risks, uncertainties, and

errors in assumptions that could cause our actual results to differ materially

from those reflected in our forward-looking statements. We believe that the

assumptions underlying our forward-looking statements are reasonable. However,

the investor should not place undue reliance on these forward-looking

statements. They only reflect our view and expectations as of the date of this

Form 10-K. We undertake no obligation to publicly update or revise any

forward-looking statement in light of new information, future events, or other

occurrences.

There are

several risks and uncertainties, including those relating to our ability to

raise money and grow our business and potential difficulties in integrating new

acquisitions with our current operations, especially as they pertain to foreign

markets and market conditions. These risks and uncertainties can materially

affect the results predicted. The Company’s future operating results over both

the short and long term will be subject to annual and quarterly fluctuations due

to several factors, some of which are outside our control. These factors include

but are not limited to fluctuating market demand for our services, and general

economic conditions.

RECENTLY

ISSUED ACCOUNTING STANDARDS

In

October 2008, the FASB issued FSP No. FAS 157-3, “Determining the Fair

Value of a Financial Asset When the Market for That Asset is Not Active.” This

FSP clarifies the application of SFAS No. 157 in a market for that is not active

and provides an example to illustrate key considerations in determining the fair

value of a financial asset when the market for that financial asset is not

active. This FSP was effective for the Company upon issuance, including prior

periods for which financial statements have not been issued; and, therefore was

effective for the Company’s financial statements as of and for the three and

nine month periods ended September 30, 2008. There was no impact of adoption of

FAS 157 as the Company has no financial assets or liabilities which were not

classified as level I.

In May

2008, the FASB issued SFAS No. 162, “The Hierarchy of Generally Accepted

Accounting Principles.” SFAS No. 162 is intended to improve financial reporting

by identifying a consistent framework, or hierarchy, for selecting accounting

principles to be used in preparing financial statements that are presented in

conformity with U.S. generally accepted accounting principles (“GAAP”) for

nongovernmental entities. SFAS No. 162 is effective 60 days following the SEC's

approval of the Public Company Accounting Oversight Board Auditing amendments to

AU Section 411, The Meaning of Present Fairly in Conformity with Generally

Accepted Accounting Principles. Management does not anticipate that the

provisions of SFAS No. 162 will have an impact on the Company’s consolidated

results of operations or consolidated financial position.

In

December 2007, the FASB issued SFAS No. 141 (revised 2007), “Business

Combinations,” (“SFAS 141R”) to improve the relevance, representational

faithfulness, and comparability of the information that a reporting entity

provides in its financial reports about a business combination and its effects.

This Statement applies to all transactions or other events in which an entity

obtains control of one or more businesses, and combinations achieved without the

transfer of consideration. SFAS No. 141 (revised 2007) is effective for business

combinations for which the acquisition date is in on or after the beginning of

the first annual reporting period beginning on or after December 15,

2008. The impact of adopting SFAS 141R will depend on the nature and

size of the future business combinations the Company consummates after the

effective date.

FASB

statement No. 160 “Noncontrolling Interests in Consolidated Financial

Statements- an amendment of ARB No. 51” was issued December of 2007. This

Statement establishes accounting and reporting standards for the noncontrolling

interest in a subsidiary and for the deconsolidation of a

subsidiary. The Company believes that this new pronouncement

will have an immaterial impact on the Company’s financial statements in future

periods.

APPLICATION

OF CRITICAL ACCOUNTING POLICIES

The

preparation of financial statements in conformity with accounting principles

generally accepted in the United States requires management to make estimates

and assumptions that affect the reported amounts of assets and liabilities and

disclosure of contingent assets and liabilities at the date of the financial

statements and the reported amounts of revenues and expenses during the

reporting period. Critical accounting policies for us include revenue

recognition, net earnings per common share, income taxes and segment

information.

Revenue

Recognition

Agency

commission revenue from property brokerage is recognized when the property

developer and the buyer complete a property sales transaction, and the property

developer grants confirmation to us to be able to invoice them accordingly. The

time when we receive the commission is normally at the time when the property

developer receives from the buyer a portion of the sales proceeds in accordance

with the terms of the relevant property sales agreement, or the balance of the

bank loan to the buyer has been funded, or recognized under the sales schedule

or other specific items of agency sales agreement with developer. At no point

does the Company handle any monetary transactions nor act as an escrow

intermediary between the developer and the buyer.

Revenue

from marketing consultancy services is recognized when services are provided to

clients.

Rental

revenue from property management and rental business is recognized on a

straight-line basis according to the time pattern of the leasing

agreements.

The

Company accounts for its underwriting sales revenue with underwriting rent

guarantees in accordance with SFAS No. 66 “Accounting for Sales of Real Estate”

(SFAS 66). Under SFAS 66, the deposit method should be used for the revenue from

the sales of floor space with underwriting rent guarantees until the rental

revenues generated by sub-leasing properties exceed the guaranteed rental amount

due to the purchasers.

All

revenues represent gross revenues less sales and business tax.

Net

Earnings per Common Share

The

Company computes net earnings per share in accordance with SFAS No. 128,

“Earnings per Share.” Under the provisions of SFAS No. 128, basic net

earnings per share is computed by dividing the net earnings available to common

shareholders for the period by the weighted average number of shares of common

stock outstanding during the period. The calculation of diluted net earnings per

share recognizes common stock equivalents, however; potential common stock in

the diluted EPS computation is excluded in net loss periods, as their effect is

anti-dilutive.

Income

Taxes

The

Company accounts for income taxes in accordance with SFAS No. 109 “Accounting

for Income Taxes.” Under SFAS No. 109, deferred tax liabilities or assets at the

end of each period are determined using the tax rate expected to be in effect

when taxes are actually paid or recovered. Valuation allowances are established

when necessary to reduce deferred tax assets to the amount expected to be

realized.

Segment

Information

The

Company believes that it operates in one business segment. Management views the

business as consisting of several revenue streams; however it is not possible to

attribute assets or indirect costs to the individual streams other than direct

expenses.

RESULTS OF OPERATIONS

We

provide the following discussion and analyses of our changes in financial

condition and results of operations for the year ended December 31, 2008,

with comparisons to the historical year ended December 31, 2007.

Revenue

The

following table shows the detail for net revenues by line of

business:

|

|

|

Years

ended December 31,

|

|

|

|

|

2008

|

|

|

%

to total

|

|

|

2007

|

|

|

%

to total

|

|

|

%

change

|

|

|

Agency

sales

|

|

|

5,087,634

|

|

|

|

63

|

|

|

|

6,655,582

|

|

|

|

82

|

|

|

|

(24

|

)

|

|

Underwriting

sales

|

|

|

-

|

|

|

|

-

|

|

|

|

275,465

|

|

|

|

3

|

|

|

|

(100

|

)

|

|

Property

management

|

|

|

2,987,559

|

|

|

|

37

|

|

|

|

1,170,277

|

|

|

|

15

|

|

|

|

155

|

|

|

Net

revenue

|

|

|

8,075,193

|

|

|

|

100

|

|

|

|

8,101,324

|

|

|

|

100

|

|

|

|

(1

|

)

|

The net

revenues for 2008 were $8,075,193, which decreased 1% from $8,101,324 of 2007.

In 2008, agency sales represented 63% of the total net revenues and property

management represented 37%. The decrease in 2008 was mainly due to the decrease

in our agency sales revenue.

Agency

sales

In 2008

63% of our net revenue was due to agency sales, which were from the business

activities of SHXJY, SHSY and their subsidiaries and branches. As compared with

2007, net revenue of agency sales in 2008 decreased 24%. Primary reasons for

this change was that in 2007 there were three projects that contributed net

revenue in the aggregate amount of $2.49million to SHXJY, and the net revenue

from these projects in 2008 decreased by $1.54million.

Because

of our diverse market locations, the current macro economic policies had little

impact on our business operations in agency sales in 2008, and we are seeking

stable growth in our agency sales business in 2009. However, there can be no

assurance that we will be able to do so.

Property

Management

During

the year of 2005 and 2006, SZGFH entered into leasing agreements with certain

buyers of the Sovereign Building underwriting project to lease the properties

for them. These leasing agreements on the Sovereign Building are for 62% of the

floor space that was sold to third party buyers. The leasing period started in

the second quarter of 2006, and in the leasing period SZGFH has the right to

sublease the leased properties to earn rental income. As of December 31, 2008,

125 sub-leasing agreements were signed. The area of these sub-leasing agreements

represents 94% of total area under these lease commitments. We expect that the

income from the sub-leasing business will be on a stable growth trend in 2009

and that it can cover the lease commitments in the leasing period as a whole.

However there can be no assurance that we will achieve these

objectives.

Cost of

Revenues

The

following table shows the cost of revenues detail by line of

business:

|

|

|

Years

ended December 31,

|

|

|

|

|

2008

|

|

|

%

to total

|

|

|

2007

|

|

|

%

to total

|

|

|

%

change

|

|

|

Agency

sales

|

|

|

3,008,265

|

|

|

|

45

|

|

|

|

3,212,473

|

|

|

|

47

|

|

|

|

(6

|

)

|

|

Underwriting

sales

|

|

|

-

|

|

|

|

-

|

|

|

|

214,559

|

|

|

|

3

|

|

|

|

(100

|

)

|

|

Property

management

|

|

|

3,654,595

|

|

|

|

55

|

|

|

|

3,378,931

|

|

|

|

50

|

|

|

|

8

|

|

|

Cost

of revenue

|

|

|

6,662,860

|

|

|

|

100

|

|

|

|

6,805,963

|

|

|

|

100

|

|

|

|

(2

|

)

|

The cost

of revenues for 2008 was $6,662,860; this was a decrease of 2% from $6,805,963

in 2007. In 2008, agency sales represented 45% of total cost of

revenues and property management represented 55%. The decrease in

cost of revenues in 2008 was mainly due to the decrease in our agency

sales.

Agency

sales

As

compared with 2007, cost of revenue of agency sales in 2008 decreased 6%. The

primary reason for the change was the decrease in our commissions paid to

marketing staff. In 2008, our commissions paid to marketing staff decreased

$414,924 compared to 2007.

Property

management

During

the year of 2005 and 2006, SZGFH entered into leasing agreements with certain

buyers of the Sovereign Building underwriting project to lease the properties

for them. In accordance with the leasing agreements, the owners of the

properties can enjoy an annual rental return at 8.5% and 8.8% per annum for a

period of 5 years and 8 years, respectively.

The

leasing period started in the second quarter, 2006, and we recognized the rental

coverage that we pay under these leasing agreements as our cost. As certain

properties under this promotion package were not leased out in 2008, the Company

recorded a negative gross profit margin for 2008. We expect that these

properties will be leased out in 2009, the gross margin will be improved.

However, no assurance can be given that this will be the case.

An

accrual for onerous lease contracts, which is equal to the difference between

the present value of the sublease income and the present value of the associated

lease expense at appropriate discount rate, was recognised. The accrual for

onerous lease contacts was $535,811 as of December 31, 2007 and $446,456 as of

December 31, 2008.

Operating

Expenses

The

following table shows operating expenses detail by line of

business:

|

|

|

Years

ended December 31,

|

|

|

|

|

2008

|

|

|

%

to total

|

|

|

2007

|

|

|

%

to total

|

|

|

%

change

|

|

|

Agency

sales

|

|

|

1,180,917

|

|

|

|

92

|

|

|

|

853,309

|

|

|

|

75

|

|

|

|

38

|

|

|

Underwriting

sales

|

|

|

-

|

|

|

|

-

|

|

|

|

99,385

|

|

|

|

9

|

|

|

|

(100

|

)

|

|

Property

management

|

|

|

105,784

|

|

|

|

8

|

|

|

|

177,318

|

|

|

|

16

|

|

|

|

(40

|

)

|

|

Operating

expenses

|

|

|

1,286,701

|

|

|

|

100

|

|

|

|

1,130,012

|

|

|

|

100

|

|

|

|

14

|

|

The

operating expenses of 2008 were $1,286,701; these increased 14% from $1,130,012

in 2007. In 2008, agency sales represented 92% of the total operating

expenses and property management represented 8%. The increase in

operating expenses in 2008 was mainly due to the increase in our agency sales

expenses.

Agency

sales

When

compared to 2007, the operating expenses for agency sales in 2008 increased 38%.

The primary reason for the increase in 2008 was the increase in staff cost,

business travel expenses and lease expenses of $230,810, $42,647 and $39,080

respectively, compared to 2007. These increased costs are incurred to strengthen

our marketing workforce.

Property

management

When

compared to 2007, the operating expenses for property management in 2008

decreased 40%. The main reason for the decrease was the agency commissions of

SZGFH. In 2008, the agency commissions decreased $63,278, compared to

2007.

General and Administrative

Expenses

The

general and administrative expenses in 2008 were $4,380,662, decreasing 6% from

$4,654,995 in 2007. Primary reasons for the change were the

following:

|

i)

|

The

decrease in our staff cost. In 2008, our staff cost decreased $111,110,

compared to 2007.

|

|

|

|

|

ii)

|

The

decrease in legal fees. In 2008, legal fees decreased $120,942, compared

to 2007.

|

|

|

|

|

iii)

|

The

decrease in business travel expenses. In 2008, business travel expenses

decreased $145,807, compared to

2007.

|

|

|

|

|

iv)

|

The

decrease in consulting fees. In 2008, consulting fees decreased $113,217,

compared to 2007.

|

|

|

|

|

v)

|

In

2007, the bad debt expenses and fit-out expenses were $114,543 and

$80,579, and there was no such expenses in

2008.

|

|

|

|

|

vi)

|

In

2008, an impairment loss on equity investment of $83,399 and an impairment

loss on amount due from related party of $314,317 were

made

|

|

|

|

|

vii)

|

In

2008, an impairment loss on advances to minority interest of consolidated

project venturers of $989,822 was

made.

|

Interest

Expenses

When

compared to 2007, the interest expenses in 2008 decreased 34%. The interest

expenses relate to bank loans and promissory notes payable.

Major Related Party

Transaction

None.

LIQUIDITY AND CAPITAL RESOURCES

In 2008,

our principal sources of cash were revenues from our agency sales and property

management business. Most of our cash resources were used to fund our revenue

related expenses, such as salaries and commissions paid to the sales force,

daily administrative expenses and the maintenance of regional offices, and the

repayments of our bank loans and promissory notes.

We ended

the period with a cash position of $619,879 (including cash and cash equivalents

of $587,468 and restricted cash of $32,411). The Company’s operating activities

used cash in the amount of $3,746,656, which was primarily attributable to the

Company’s net loss in the amount of $6,028,907.

The

Company’s investing activities consumed cash resources of $630,032 in

2008.

The

Company’s financing activities used cash resources of $45,547 in 2008, which was

primarily attributable to the repayment to director and promissory

notes.

The

potential cash needs for 2009 will be the repayments of our bank loans and

promissory notes, the rental guarantee payments and promissory deposits for

various property projects.

We

anticipate that our current available funds, cash inflows from providing

property agency services and management services, and the proceeds from

investment properties will be sufficient to meet our anticipated needs for

working capital expenditures, business expansion and the potential cash needs

during 2009.

If our

business otherwise grows more rapidly than we currently predict, we plan to

raise funds through the issuance of additional shares of our equity securities

in one or more public or private offerings. We will also consider

raising funds through credit facilities obtained with lending

institutions. There can be no guarantee that we will be able to

obtain such funds through the issuance of debt or equity that are with terms

satisfactory to management and our board of directors.

The

Company has incurred losses of $6,028,907 for the year ended December

31, 2008 and had a net working capital deficiency of $7,014,364 as of December

31, 2008. The Company’s net working capital deficiency, recurring losses and

negative cash flows from operations raise substantial doubt about its ability to

continue as a going concern.

The

Company is negotiating a Share Purchase Agreement with Whole World Holding

Corporation (“Whole World”) to issue 57,000,000 underlying shares to Whole World

for a consideration of $20,000,000, which is scheduled to close on or before May

17, 2009. Management believes that the successful completion of the

aforesaid Share Purchase Agreement will enable the Company to have sufficient

cash flow to meet its obligations on a timely basis and ultimately to attain

successful operations in respect of the agency sales and building management

operations.

OFF BALANCE SHEET

ARRANGEMENTS

The Company has no off-balance sheet

arrangements.

RISK

FACTORS

SRRE has

identified a number of risk factors faced by the Company. These factors, among

others, may cause actual results, events or performance to differ materially

from those expressed in this 10-K or in press releases or other public

disclosures. You should be aware of the existence of these factors.

RISKS RELATING TO THE

GROUP

SRRE

is a holding company and depends on its subsidiaries’ cash flows to meet its

obligations.

SRRE is a

holding company, and it conducts all of its operations through its subsidiaries.

As a result, its ability to meet any obligations depends upon its subsidiaries’

cash flows and payment of funds as dividends, loans, advances or other payments.

In addition, the payment of dividends or the making of loans, advances or other

payments to SRRE may be subject to regulatory or contractual

restrictions.

Our

invoicing for commissions may be delayed.

Generally,

we recognize our commission revenues after the contracts signed with developers

are completed and confirmations are received from the developers. However,

sometimes we do not recognize income even when we have rendered our services for

any of the following reasons:

|

a.

|

The

developers have not received payments from potential purchasers who have

promised to pay the outstanding sum by

cash;

|

|

|

|

|

b.

|

The

purchasers, who need to obtain mortgage financing to pay the outstanding

balance due, are unable to obtain the necessary financing from their

banks;

|

|

|

|

|

c.

|

Banks

are sometimes unwilling to grant the necessary bridge loan to the

developers in time due to the developers’ relatively low credit

rating;

|

|

|

|

|

d.

|

The

developers tend to be in arrears with sales commissions; therefore, do not

grant confirmation to us to be able to invoice them

accordingly.

|

Development

of new business may stretch our cash flow and strain our operation

efficiency.

Business

expansion and the need to integrate operations arising from the expansion may

place a significant strain on our managerial, operational and financial

resources, and will further contribute to a needed increase in our financial

needs.

Risks

associated with a Guaranteed Rental Return Promotion.

During

2005 and 2006, we launched a promotional package that allows property buyers and

investors to enjoy a 5 or 8 year guaranteed rental return at 8.5% or 8.8% of the

property purchase costs per annum for a leasing period of 5 or 8 years,

respectively. We are continuing to promote this package. The return is

guaranteed by SZGFH, whereby SZGFH’s principal activities are real estate

leasing and property management services. However, we may not successfully

sublease the targeted properties at prices higher than what we committed in the

promotional package. Our failure to do so could adversely affect our financial

condition.

Our

acquisition of new property may involve risks.

These

acquisitions involve several risks including, but not limited to, the

following:

|

a.

|

The

acquired properties may not perform as well as we expected or ever become

profitable.

|

|

|

|

|

b.

|

Improvements

to the properties may ultimately cost significantly more than we had

originally estimated.

|

Additional

acquisitions might harm our business.

As part

of our business strategy, we may seek to acquire or invest in additional

businesses, products, services or technologies that we think could complement or

expand our business. If we identify an appropriate acquisition opportunity, we

might be unable to negotiate the terms of that acquisition successfully, finance

it, or integrate it into our existing business and operations. We may also be

unable to select, manage or absorb any future acquisitions successfully.

Furthermore, the negotiation of potential acquisitions, as well as the

integration of an acquired business, would divert management time and other

resources. We may have to use a substantial portion of our available cash to

consummate an acquisition. If we complete acquisitions through exchange of our

securities, our shareholders could suffer significant dilution. In addition, we

cannot assure you that any particular acquisition, even if successfully

completed, will ultimately benefit our business.

Our

real estate investments are subject to numerous risks.

We are

subject to risks that generally relate to investments in real estate. The

investment returns available from equity investments in real estate depend in

large part on the amount of income earned and capital appreciation generated by

the related properties, as well as the expenses incurred. In addition, a variety

of other factors affect income from properties and real estate values, including

governmental regulations, insurance, zoning, tax and eminent domain laws,

interest rate levels and the availability of financing. For example, new or

existing real estate zoning or tax laws can make it more expensive and/or

time-consuming to develop real property or expand, modify or renovate

properties. When interest rates increase, the cost of acquiring, developing,

expanding or renovating real property increases and real property values may

decrease as the number of potential buyers decrease. Similarly, as financing

becomes less available, it becomes more difficult both to acquire and to sell

real property. Finally, governments can, under eminent domain laws, take real

property. Sometimes this taking is for less compensation than the owner believes

the property is worth. Any of these factors could have a material adverse impact

on results of our operations or financial condition. In addition, equity real

estate investments, such as the investments we hold and any additional

properties that we may acquire, are relatively difficult to sell quickly. If our

properties do not generate sufficient revenue to meet operating expenses,

including debt servicing and capital expenditures, our income will be

reduced.

Competition,

economic conditions and similar factors affecting us, and the real estate

industry in general, could affect our performance.

Our

properties and business are subject to all operating risks common to the real

estate industry. These risks include:

|

a.

|

Adverse

effects of general and local economic

conditions;

|

|

|

|

|

b.

|

Increases

in operating costs attributable to inflation and other factors;

and

|

|

|

|

|

c.

|

Overbuilding

in certain property sectors.

|

These

factors could adversely affect our revenues, profitability and results of

operations.

Our business is susceptible to

fluctuations in the real estate market of China, especially in certain areas of

eastern China where a significant portion of our operations are concentrated,

which may adversely affect our revenues and results of

operations.

We

conduct our real estate services business primarily in China. Our business

depends substantially on the conditions of the PRC real estate market. Demand

for private residential real estate in China has grown rapidly in the recent

decade but such growth is often coupled with volatility in market conditions and

fluctuation in real estate prices. Following a period of rising real estate

prices and transaction volume in most major cities, the industry experienced a

severe downturn in 2008, with transaction volume in many major cities declining

by more than 40% compared to 2007. Average selling prices also declined in many

cities during 2008. Fluctuations of supply and demand in China’s real estate

market are caused by economic, social, political and other factors. To the

extent fluctuations in the real estate market adversely affect real estate

transaction volumes or prices, our financial condition and results of operations

may be materially and adversely affected.

As a

significant portion of our operations is concentrated in Shanghai, Jiangsu

Province, any decrease in demand or real estate prices or any other adverse

developments in these regions may materially and adversely affect our total real

estate transaction volumes and average selling prices, which may in turn

adversely affect our revenues and results of operations.

Our business may

be materially and adversely affected by government measures aimed at China’s

real estate industry.

The real

estate industry in China is subject to government regulations. Until 2008, the

real estate markets in a number of major cities in China had experienced rapid

and significant growth. Before the global economic crisis hit all the major

economies worldwide in 2008, the PRC government had adopted a series of measures

to restrain what it perceived as unsustainable growth in the real estate market.

From 2003 to 2007, the PRC government introduced a series of specific

administrative and credit-control measures including, but not limited to,

setting minimum down payment requirements for residential and commercial real

estate transactions, limiting availability of mortgage loans, and tightening

governmental approval process for certain real estate transactions.

Since

2008, the PRC government has relaxed such restrictions and introduced measures

aimed at stimulating residential property purchases by individuals and

stabilizing the real estate market. On October 22, 2008, the Ministry of

Finance, the State Administration of Taxation and the People’s Bank of China

lowered transaction taxes, minimum down payment requirements, and the mortgage

interest rate for certain residential real estate transactions. In

December 2008, the General Office of the State Council promulgated rules

that exempted certain residential real estate transactions from business tax and

urban real estate tax.

However,

despite the recent government measures aimed at maintaining the long-term

stability of the real estate market, we cannot assure you that the PRC

government will not adopt new measures in the future that may result in

short-term downward adjustments and uncertainty in the real estate market. Our

business may be materially and adversely affected as a result of decreased

transaction volumes or real estate prices that may follow these adjustments or

market uncertainty.

We

operate in a highly competitive environment.

Our

competitors may be able to adapt more quickly to changes in customer needs or to

devote greater resources than we can to developing and expanding our services.

Such competitors could also attempt to increase their presence in our markets by

forming strategic alliances with other competitors, by offering new or improved

services or by increasing their efforts to gain and retain market share through

competitive pricing. As the market for our services matures, price competition

and penetration into the market will intensify. Such competition may adversely

affect our gross profits, margins and results of operations. There can be no

assurance that we will be able to compete successfully with existing or new

competitors.

We

may be unable to effectively manage our growth.

We will

need to manage our growth effectively, which may entail devising and effectively

implementing business and integration plans, training and managing our growing

workforce, managing our costs, and implementing adequate control and reporting

systems in a timely manner. We may not be able to successfully manage our growth

or to integrate and assimilate any acquired business operations. Our failure to

do so could affect our success in executing our business plan and adversely

affect our revenues, profitability and results of operations.

If

we fail to successfully manage our planned expansion of operations, our growth

prospects will be diminished and our operating expenses could exceed budgeted

amounts.

Our

ability to offer our services in an evolving market requires an effective

planning and management process. We have expanded our operations rapidly since

inception, and we intend to continue to expand them in the foreseeable future.

This rapid growth places significant demand on our managerial and operational

resources and our internal training capabilities. In addition, we have hired a

significant number of employees and plan to further increase our total work

force. This growth will continue to substantially burden our management team. To

manage growth effectively, we must:

|

a.

|

Implement

and improve our operational, financial and other systems, procedures and

controls on a timely basis.

|

|

|

|

|

b.

|

Expand,

train and manage our workforce, particularly our sales and marketing and

support organizations.

|

We cannot

be certain that our systems, procedures and controls will be adequate to support

our current or future operations or that our management will be able to handle

such expansion and still achieve the execution necessary to meet our growth

expectations. Failure to manage our growth effectively could diminish our growth

prospects and could result in lost opportunities as well as operating expenses

exceeding the amount budgeted.

We

may be unable to maintain internal funds or obtain financing or renew credit

facilities in the future.

Adequate

financing is one of the major factors, which can affect our ability to execute

our business plan in this regard. We finance our business mainly through

internal funds, bank loans or raising equity funds. There is no guarantee that

we will always have internal funds available for future developments or we will

not experience difficulties in obtaining financing and renewing credit

facilities granted by financial institutions in the future. In addition, there

may be a delay in equity fundraising activities. Our access to obtain debt or

equity financing depends on the banks' willingness to lend and on conditions in

the capital markets, and we may not be able to secure additional sources of

financing on commercially acceptable terms, if at all.

Our

recent transaction with Whole World Holding Corp may not be

consummated.

On March

10, 2009, the Company entered into a Share Purchase Agreement with Whole World

to issue 57 million shares to Whole World for US $20 million. This agreement,

subject to standard closing terms and conditions, is scheduled to close on or

before May 17, 2009. Our business will be adversely affected if we do not obtain

the $20 million to be paid by Whole World.

We

may need to raise additional capital that may not be available on terms

favorable to us, if at all.

We may

need to raise additional capital in the future, and we cannot be certain that we

will be able to obtain additional financing on favorable terms, if at all. If we

cannot raise additional capital on acceptable terms, we may not be able to

develop or enhance our services, take advantage of future opportunities or

respond to competitive pressures or unanticipated requirements. To fully realize

our business objectives and potential, we may require additional financing. We

cannot be sure that we will be able to secure the financing we will require, or

that it will be available on favorable terms. If we are unable to obtain any

necessary additional financing, we will be required to substantially curtail our

approach to implementing our business objectives. Additional financing may be

debt, equity or a combination of debt and equity. If equity is used, it could

result in significant dilution to our shareholders.

Our

operations and growth prospects may be significantly impeded if we are unable to

retain our key personnel or attract additional key personnel, particularly since

experienced personnel and new skilled personnel are in short

supply.

Competition