Sunrise Real Estate Group Inc - Amended Current report filing (8-K/A)

August 27 2008 - 2:06PM

Edgar (US Regulatory)

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K/A

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of

Report (Date of earliest event reported) August 27, 2008 (August 15,

2008)

SUNRISE

REAL ESTATE GROUP, INC.

(Exact

name of registrant as specified in its charter)

|

Texas

|

000-32585

|

75-2713701

|

|

(State

of Incorporation)

|

(Commission

File Number)

|

(IRS

Employer Identification)

|

(Address

of principal executive offices)

Suite

701, No.333, Zhaojiabang Road

Shanghai,

PRC 200032

Registrant's

telephone number, including area code (86)-21-6422-0505

(Former

Name or Former Address if Changed Since Last Report)

Check

the

appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

|

|

o

|

Written

communications pursuant to Rule 425 under the Securities Act (17

CFR

230.425)

|

|

|

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

|

|

|

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17

CFR

240.14d-2(b))

|

|

|

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17

CFR

240.13e-4(c))

|

Item

4.02

(a).

Non-Reliance on Previously Issued Financial Statements or a Related Audit Report

or Completed Interim Review

After

extensive review of the interpretation on SFAS 66 and discussion between Company

management and independent auditors, on August 13

th

,

2008,

the Company has subsequently determined that the correct application of

accounting principles had not been applied for the recognition of underwriting

sales revenue and made the conclusion to restate the financial statements for

the periods in question.

In

this

correction, the financial statements for the years ended December 31, 2007

and

2006 and the quarter ended March 31, 2008 were restated to increase the

Company’s deferred tax assets and deposits received from underwriting sales by

deferring revenue recognition to the consummation of the sale, generally when

the remaining maximum exposure to loss is reduced below the amount of gain

deferred. As a result, the Company’s net asset values as of December 31, 2007

and March 31, 2008 were reduced by $6,300,897 and $6,563,699, respectively.

The

correction of this error reduced the Company’s losses for the year ended

December, 2007 by $157,811 and gave no effect on the income statement of the

Company for each of the two quarters ended June 30, 2008.

An

additional restatement relates to correct the overstatement of the minority

shareholders’ share of the Company’s result by US$106,759. As a result of the

correction of this item, the Company’s financial statements for the year ended

2007 were restated and the Company’s loss for the year ended December 31, 2007

and the accumulated losses as of December 31, 2007 were reduced by

US$106,759.

The

Company will be filing amendments to its Form 10-KSB for the year ended December

31, 2007 and its Form 10-Q for the quarter ended March 31, 2008, in order to

complete this restatement process.

Management

informed of and had discussed these matters with the Board of Directors. The

Company’s management has discussed this matter disclosed in the filing pursuant

to this Item 4.02(a) with our independent auditors.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant

has

duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

|

|

|

|

|

|

SUNRISE

REAL ESTATE GROUP, INC.

|

|

|

|

|

Dated:

August 27, 2008

|

By:

|

/s/ Wang

Wen

Yan

|

|

|

Name

:

Wang

Wen Yan

|

|

|

Chief

Financial

Officer

|

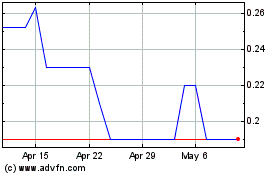

Sunrise Real Estate (PK) (USOTC:SRRE)

Historical Stock Chart

From May 2024 to Jun 2024

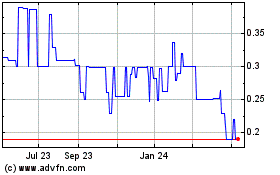

Sunrise Real Estate (PK) (USOTC:SRRE)

Historical Stock Chart

From Jun 2023 to Jun 2024