UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D. C. 20549

FORM

10-Q

x

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT

OF 1934

For

the

quarterly period ended June 30, 2008

¨

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT

OF 1934

For

the

transition period from __________ to __________

Commission

File Number 000-32585

SUNRISE

REAL ESTATE GROUP, INC.

(Exact

name of registrant as specified in its charter)

|

Texas

|

|

75-2713701

|

|

(State

or other jurisdiction of

incorporation

or organization)

|

|

(I.R.S.

Employer Identification No.)

|

Suite

701, No. 333, Zhaojiabang Road

Shanghai,

PRC 200032

(Address

of principal executive offices Zip Code)

Registrant’s

telephone number: + 86-21-6422-0505

Indicate

by check mark whether the registrant (1) has filed all reports required to

be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during

the

preceding 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements

for

the past 90 days.

Yes

x

No

¨

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company.

See

the definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large

accelerated filer

¨

Accelerated filer

¨

Non-accelerated

filer

¨

Smaller reporting company

x

Indicate

by checkmark whether the registrant is a shell company (as defined in Rule

12b-2

of the Exchange Act): Yes

¨

No

x

Indicate

the number of shares outstanding of each of the issuer's classes of common

stock, as of the latest practicable date: August 11, 2008 -

23,691,925

shares

of Common Stock

FORM

10-Q

For

the Quarter Ended June 30, 2008

INDEX

|

|

Page

|

|

PART

I. FINANCIAL INFORMATION

|

3

|

|

Item

1.

Financial

Statements

|

3

|

|

Consolidated

Balance Sheets

|

3

|

|

Consolidated

Statements of Operations

|

4

|

|

Consolidated

Statements of Cash Flows

|

5

|

|

Item

2.

Management’s

Discussion and Analysis of Financial Condition and Results of

Operations

|

16

|

|

Item

3.

Quantitative

and Qualitative Disclosures About Market Risk

|

22

|

|

Item

4.

Controls

and Procedures

|

22

|

|

|

|

|

PART

II. OTHER INFORMATION

|

23

|

|

Item

1.

Legal

Proceedings

|

23

|

|

Item

2.

Unregistered

Sales of Equity Securities and Use of Proceeds

|

23

|

|

Item

3.

Defaults

Upon Senior Securities

|

23

|

|

Item

4.

Submission

of Matters to a Vote of Security Holders

|

23

|

|

Item

5.

Other

Information

|

23

|

|

Item

6.

Exhibits

|

23

|

|

|

|

|

SIGNATURES

|

23

|

PART

I - FINANCIAL INFORMATION

ITEM

1. F

INANCIAL

STATEMENTS

Sunrise

Real Estate Group, Inc.

Consolidated

Balance Sheets

(Expressed

in US Dollars)

|

|

|

June

30,

|

|

December

31,

|

|

|

|

|

2008

|

|

2007

|

|

|

|

|

(Unaudited)

|

|

(Restated)

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current

assets

|

|

|

|

|

|

|

Cash

and cash equivalents

|

|

$

|

922,232

|

|

$

|

2,281,516

|

|

|

Restricted

cash (Note 9)

|

|

|

230,242

|

|

|

2,441,579

|

|

|

Accounts

receivable

|

|

|

601,476

|

|

|

842,868

|

|

|

Promissory

deposits (Note 3)

|

|

|

947,646

|

|

|

273,800

|

|

|

Amounts

due from venturers

|

|

|

-

|

|

|

79,662

|

|

|

Amount

due from related party (Note 11)

|

|

|

332,405

|

|

|

312,132

|

|

|

Other

receivables and deposits (Note 4)

|

|

|

838,006

|

|

|

602,373

|

|

|

|

|

|

|

|

|

|

|

|

Total

current assets

|

|

|

3,872,007

|

|

|

6,833,930

|

|

|

|

|

|

|

|

|

|

|

|

Property,

plant and equipment – net (Note 5)

|

|

|

2,745,848

|

|

|

2,519,585

|

|

|

Equity

investment (Note 6)

|

|

|

83,101

|

|

|

78,033

|

|

|

Investment

properties (Note 7)

|

|

|

8,044,389

|

|

|

7,800,228

|

|

|

Deferred

tax asset (Note 8)

|

|

|

1,367,962

|

|

|

1,284,532

|

|

|

Goodwill

|

|

|

13,307

|

|

|

13,307

|

|

|

|

|

|

|

|

|

|

|

|

Total

assets

|

|

$

|

16,126,614

|

|

$

|

18,529,615

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES

AND SHAREHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current

liabilities

|

|

|

|

|

|

|

|

|

Bank

loans (Note 9)

|

|

$

|

204,108

|

|

$

|

191,660

|

|

|

Promissory

notes payable (Note 10)

|

|

|

517,187

|

|

|

976,435

|

|

|

Accounts

payable

|

|

|

267,459

|

|

|

230,654

|

|

|

Amount

due to director (Note 11)

|

|

|

71,481

|

|

|

171,458

|

|

|

Amount

due to related party (Note 11)

|

|

|

127,443

|

|

|

159,561

|

|

|

Other

payables and accrued expenses (Note 12)

|

|

|

1,613,595

|

|

|

1,917,022

|

|

|

Other

tax payable (Note 13)

|

|

|

605,002

|

|

|

546,873

|

|

|

Income

tax payable

|

|

|

1,044,887

|

|

|

1,238,912

|

|

|

|

|

|

|

|

|

|

|

|

Total

current liabilities

|

|

|

4,451,162

|

|

|

5,432,575

|

|

|

|

|

|

|

|

|

|

|

|

Commitments

and contingencies (Note 14)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Long-term

bank loans (Note 9)

|

|

|

6,125,355

|

|

|

5,847,606

|

|

|

Long-term

promissory notes payable (Note 10)

|

|

|

57,223

|

|

|

111,112

|

|

|

Deposits

received from underwriting sales (Note 15)

|

|

|

8,246,164

|

|

|

7,743,240

|

|

|

Minority

interest

|

|

|

457,296

|

|

|

431,674

|

|

|

|

|

|

|

|

|

|

|

|

Shareholders’

equity

|

|

|

|

|

|

|

|

|

Common

stock, par value $0.01 per share; 200,000,000 shares authorized;

23,691,925 and 23,691,925 shares issued and outstanding as of June

30,

2008 and December 31, 2007, respectively

|

|

|

236,919

|

|

|

236,919

|

|

|

Additional

paid-in capital

|

|

|

3,620,008

|

|

|

3,620,008

|

|

|

Statutory

reserve (Note 16)

|

|

|

729,744

|

|

|

729,744

|

|

|

Accumulated

losses

|

|

|

(8,465,989

|

)

|

|

(6,348,261

|

)

|

|

Accumulated

other comprehensive income (Note 17)

|

|

|

668,732

|

|

|

724,998

|

|

|

|

|

|

|

|

|

|

|

|

Total

shareholders’ equity

|

|

|

(3,210,586

|

)

|

|

(1,036,592

|

)

|

|

|

|

|

|

|

|

|

|

|

Total

liabilities and shareholders’ equity

|

|

$

|

16,126,614

|

|

$

|

18,529,615

|

|

See

accompanying notes to consolidated financial statements.

Sunrise

Real Estate Group, Inc.

Consolidated

Statements of Operations

(Expressed

in US Dollars)

|

|

|

Three

Months Ended June 30,

|

|

Six

Months Ended June 30,

|

|

|

|

|

2008

|

|

2007

|

|

2008

|

|

2007

|

|

|

|

|

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

Revenues

|

|

$

|

2,641,681

|

|

$

|

1,520,047

|

|

$

|

3,961,226

|

|

$

|

2,655,202

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost

of Revenues

|

|

|

(1,820,183

|

)

|

|

(1,434,946

|

)

|

|

(3,137,830

|

)

|

|

(2,622,606

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross

Profit

|

|

|

821,498

|

|

|

85,101

|

|

|

823,396

|

|

|

32,596

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating

Expenses

|

|

|

(328,489

|

)

|

|

(255,412

|

)

|

|

(639,115

|

)

|

|

(494,921

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General

and Administrative Expenses

|

|

|

(1,098,242

|

)

|

|

(936,714

|

)

|

|

(1,991,464

|

)

|

|

(1,831,289

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating

Loss

|

|

|

(605,233

|

)

|

|

(1,107,025

|

)

|

|

(1,807,183

|

)

|

|

(2,293,614

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest

Income

|

|

|

3,561

|

|

|

3,344

|

|

|

9,330

|

|

|

7,571

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other

Income/(Expenses), Net

|

|

|

(1,394

|

)

|

|

(34,851

|

)

|

|

5,138

|

|

|

(42,242

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest

Expenses

|

|

|

(154,836

|

)

|

|

(222,785

|

)

|

|

(298,476

|

)

|

|

(425,347

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss

Before Income Tax and Minority Interest

|

|

|

(757,902

|

)

|

|

(1,361,317

|

)

|

|

(2,091,191

|

)

|

|

(2,753,632

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income

Tax

|

|

|

(23,388

|

)

|

|

(28,973

|

)

|

|

(28,884

|

)

|

|

(28,973

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss

Before Minority Interest

|

|

|

(781,290

|

)

|

|

(1,390,290

|

)

|

|

(2,120,075

|

)

|

|

(2,782,605

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Minority

Interest

|

|

|

(7,684

|

)

|

|

(38,533

|

)

|

|

2,347

|

|

|

(35,453

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

Loss

|

|

$

|

(788,974

|

)

|

$

|

(1,428,823

|

)

|

$

|

(2,117,728

|

)

|

$

|

(2,818,058

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss

Per Share – Basic and Fully Diluted

|

|

$

|

(0.03

|

)

|

$

|

(0.06

|

)

|

$

|

(0.09

|

)

|

$

|

(0.12

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted

average common shares outstanding

–

Basic and Fully Diluted

1

|

|

|

23,691,925

|

|

|

23,691,925

|

|

|

23,691,925

|

|

|

23,691,925

|

|

See

accompanying notes to

consolidated

financial statements.

1

Share

amounts have been retroactively restated to reflect the effect of a 3% stock

dividend of common stock for each share of common stock outstanding at

August 1, 2007.

Sunrise

Real Estate Group, Inc.

Consolidated

Statements of Cash Flows

(Decrease)

/Increase

in Cash and Cash Equivalents

(Expressed

in US Dollars)

|

|

|

Six

Months Ended June 30,

|

|

|

|

|

2008

|

|

2007

|

|

|

|

|

|

|

(Restated)

|

|

|

|

|

(Unaudited)

|

|

|

Cash

flows from operating activities

|

|

|

|

|

|

|

Net

Loss

|

|

$

|

(2,117,728

|

)

|

$

|

(2,818,058

|

)

|

Adjustments

to reconcile net loss to net cash used in operating

activities

|

|

|

|

|

|

|

|

|

Depreciation

of property, plant and equipment

|

|

|

389,097

|

|

|

240,757

|

|

|

(Gain)/loss

on disposal of property, plant and equipment

|

|

|

(1,019

|

)

|

|

848

|

|

|

Minority

interest

|

|

|

(2,347

|

)

|

|

35,453

|

|

|

Change

in:

|

|

|

|

|

|

|

|

|

Accounts

receivable

|

|

|

287,701

|

|

|

4,285,194

|

|

|

Promissory

deposits

|

|

|

(637,376

|

)

|

|

(647,752

|

)

|

|

Other

receivables and deposits

|

|

|

(190,911

|

)

|

|

(488,359

|

)

|

|

Accounts

payable

|

|

|

21,202

|

|

|

(387,163

|

)

|

|

Amount

with related party

|

|

|

(41,271

|

)

|

|

-

|

|

|

Amounts

with venturers

|

|

|

82,420

|

|

|

578,679

|

|

|

Other

payables and accrued expenses

|

|

|

(415,749

|

)

|

|

(4,826

|

)

|

|

Interest

payable on promissory notes

|

|

|

(119,142

|

)

|

|

186,238

|

|

|

Interest

payable on amount due to director

|

|

|

4,403

|

|

|

(10,974

|

)

|

|

Other

tax payable

|

|

|

21,965

|

|

|

(224,817

|

)

|

|

Income

tax payable

|

|

|

(266,674

|

)

|

|

(387,064

|

)

|

|

Net

cash (used in)/provided by operating activities

|

|

|

(2,980,735

|

)

|

|

358,156

|

|

|

|

|

|

|

|

|

|

|

|

Cash

flows from investing activities

|

|

|

|

|

|

|

|

|

Acquisition

of plant and equipment

|

|

|

(289,956

|

)

|

|

(167,373

|

)

|

|

Deposits

paid for acquisition of properties

|

|

|

-

|

|

|

(1,850,424

|

)

|

|

Proceeds

from disposal of property, plant and equipment

|

|

|

95,883

|

|

|

-

|

|

|

Restricted

cash

|

|

|

2,302,414

|

|

|

-

|

|

|

Net

cash

provided

by/(used in) investing activities

|

|

|

2,108,341

|

|

|

(2,017,797

|

)

|

|

|

|

|

|

|

|

|

|

|

Cash

flows from financing activities

|

|

|

|

|

|

|

|

|

Bank

loans repayment

|

|

|

(99,148

|

)

|

|

(630,508

|

)

|

|

Repayment

of promissory note

|

|

|

(393,995

|

)

|

|

(205,556

|

)

|

|

Proceeds

from promissory note

|

|

|

-

|

|

|

2,565,903

|

|

|

Repayment

to director

|

|

|

(104,380

|

)

|

|

(79,026

|

)

|

|

Advances

from director

|

|

|

-

|

|

|

250,000

|

|

|

Net

cash (used in)/provided by financing activities

|

|

|

(597,523

|

)

|

|

1,900,813

|

|

|

|

|

|

|

|

|

|

|

|

Effect

of exchange rate changes on cash and cash

equivalents

|

|

|

110,633

|

|

|

62,691

|

|

|

|

|

|

|

|

|

|

|

|

Net

(decrease)/increase in cash and cash equivalents

|

|

|

(1,359,284

|

)

|

|

303,863

|

|

|

Cash

and cash equivalents at beginning of

period

|

|

|

2,281,516

|

|

|

945,727

|

|

|

Cash

and cash equivalents at end of period

|

|

$

|

922,232

|

|

$

|

1,249,590

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental

disclosure of cash flow

information

|

|

|

|

|

|

|

|

|

Cash

paid during the period:

|

|

|

|

|

|

|

|

|

Income

tax paid

|

|

|

295,558

|

|

|

428,513

|

|

|

Interest

paid

|

|

|

741,558

|

|

|

250,083

|

|

See

accompanying notes to consolidated financial statements.

NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS

(Expressed

in US Dollars)

NOTE

1 – ORGANIZATION AND DESCRIPTION OF BUSINESS

Sunrise

Real Estate Development Group, Inc. (“CY-SRRE”) was established in the Cayman

Islands on April 30, 2004 as a limited liability company. CY-SRRE was wholly

owned by Ace Develop Properties Limited, a corporation, (“Ace Develop”), of

which Lin Chi-Jung, an individual, is the principal and controlling shareholder.

Shanghai Xin Ji Yang Real Estate Consultation Company Limited (“SHXJY”) was

established in the People’s Republic of China (the “PRC”) on August 14, 2001 as

a limited liability company. SHXJY was originally owned by a Taiwanese company,

of which the principal and controlling shareholder was Lin Chi-Jung. On June

8,

2004, all the fully paid up capital of SHXJY was transferred to CY-SRRE. On

June

25, 2004 SHXJY and two individuals established a subsidiary, namely, Suzhou

Xin

Ji Yang Real Estate Consultation Company Limited (“SZXJY”) in the PRC, at which

point in time, SHXJY held a 90% equity interest in SZXJY. On December 24, 2004,

SHXJY acquired 85% of equity interest in Beijing Xin Ji Yang Real Estate

Consultation Company Limited (“BJXJY”), a PRC company incorporated on April 16,

2003 with limited liability. On August 9, 2005, SHXJY sold a 10% equity interest

in SZXJY to a company owned by a director of SZXJY, and transferred a 5% equity

interest in SZXJY to CY-SRRE. Following the disposal and the transfer, CY-SRRE

effectively held an 80% equity interest in SZXJY. On November 24, 2006, CY-SRRE,

SHXJY, a director of SZXJY and a third party established a subsidiary, namely,

Suzhou Shang Yang Real Estate Consultation Company Limited (“SZSY”) in the PRC,

with CY-SRRE holding a 12.5% equity interest, SHXJY holding a 26% equity

interest and the director of SZXJY holding a 12.5% equity interest in SZSY.

At

the date of incorporation, SRRE and the director of SZXJY entered into a voting

agreement that SRRE is entitled to exercise the voting right in respect of

his

12.5% equity interest in SZSY. Following that, SRRE effectively holds 51% equity

interest in SZSY. On September 24, 2007, CY-SRRE sold a 5% equity interest

in

SZXJY to a company owned by a director of SZXJY. Following the disposal, CY-SRRE

effectively holds 75% equity interest in SZXJY. On November 1, 2007, SZXJY

established a wholly owned subsidiary, Suzhou Xin Ji Yang Real Estate Brokerage

Company Limited (“SZXJYB”) in the PRC as a limited liability company. On May 8,

2008, SHXJY established a wholly owned subsidiary, Kunshan Shang Yang Real

Estate Brokerage Company Limited (“KSSY”) in the PRC as a limited liability

company.

LIN

RAY

YANG Enterprise Ltd. (“LRY”) was established in the British Virgin Islands on

November 13, 2003 as a limited liability company. LRY was owned by Ace Develop,

Planet Technology Corporation (“Planet Tech”) and Systems & Technology

Corporation (“Systems Tech”). On February 5, 2004, LRY established a wholly

owned subsidiary, Shanghai Shang Yang Real Estate Consultation Company Limited

(“SHSY”) in the PRC as a limited liability company. On January 10, 2005, LRY and

a PRC third party established a subsidiary, Suzhou Gao Feng Hui Property

Management Company Limited (“SZGFH”), in the PRC, with LRY holding 80% of the

equity interest in SZGFH. On May 8, 2006, LRY acquired 20% of the equity

interest in SZGFH from the third party. Following the acquisition, LRY

effectively holds 100% of the equity interest in SZGFH. On September 11, 2007

SHSY and other third parties established a subsidiary, namely, Suzhou Bin Fen

Nian Dai Administration Consultancy Company Limited (“SZBFND”) in the PRC, with

SHSY holding a 19% equity interest in SZBFND.

SHXJY,

SZXJY, BJXJY, SHSY, SZGFH, SZSY, SZXJYB and KSSY commenced operations in

November 2001, June 2004, January 2004, February 2004, January 2005, November

2006, November 2007 and May 2008 respectively. Each of SHXJY, SZXJY, BJXJY,

SHSY, SZGFH, SZSY, SZXJYB and KSSY has been granted a twenty-year operation

period from the PRC, which can be extended with approvals from relevant PRC

authorities.

On

August

31, 2004, Sunrise Real Estate Group, Inc. (“SRRE”), CY-SRRE and Lin Chi-Jung, an

individual and agent for the beneficial shareholder of CY-SRRE, i.e., Ace

Develop, entered into an exchange agreement under which SRRE issued 5,000,000

shares of common stock to the beneficial shareholder or its designees, in

exchange for all outstanding capital stock of CY-SRRE. The transaction closed

on

October 5, 2004. Lin Chi-Jung is Chairman of the Board of Directors of SRRE,

the

President of CY-SRRE and the principal and controlling shareholder of Ace

Develop.

Also

on

August 31, 2004, SRRE, LRY and Lin Chi-Jung, an individual and agent for

beneficial shareholders of LRY, i.e., Ace Develop, Planet Tech and Systems

Tech,

entered into an exchange agreement under which SRRE issued 10,000,000 shares

of

common stock to the beneficial shareholders, or their designees, in exchange

for

all outstanding capital stock of LRY. The transaction was closed on October

5,

2004. Lin Chi-Jung is Chairman of the Board of Directors of SRRE, the President

of LRY and the principal and controlling shareholder of Ace Develop. Regarding

the 10,000,000 shares of common stock of SRRE issued in this transaction, SRRE

issued 8,500,000 shares to Ace Develop, 750,000 shares to Planet Tech and

750,000 shares to Systems Tech.

As

a

result of the acquisition, the former owners of CY-SRRE and LRY hold a majority

interest in the combined entity. Generally accepted accounting principles

require in certain circumstances that a company whose shareholders retain the

majority voting interest in the combined business be treated as the acquirer

for

financial reporting purposes. Accordingly, the acquisition has been accounted

for as a “reverse acquisition” arrangement whereby CY-SRRE and LRY are deemed to

have purchased SRRE. However, SRRE remains the legal entity and the Registrant

for Securities and Exchange Commission reporting purposes. All shares and per

share data prior to the acquisition have been restated to reflect the stock

issuance as a recapitalization of CY-SRRE and LRY.

SRRE

was

initially incorporated in Texas on October 10, 1996, under the name of Parallax

Entertainment, Inc. (“Parallax”). On December 12, 2003, Parallax changed its

name to Sunrise Real Estate Development Group, Inc. On April 25, 2006, Sunrise

Estate Development Group, Inc. filed Articles of Amendment with the Texas

Secretary of State, changing the name of Sunrise Real Estate Development Group,

Inc. to Sunrise Real Estate Group, Inc., effective from May 23, 2006.

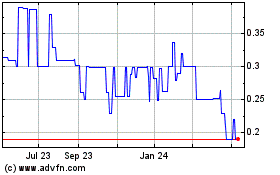

Figure

1:

Company Organization Chart

SRRE

and

its subsidiaries, namely, CY-SRRE, LRY, SHXJY, SZXJY, SZXJYB, SZSY, KSSY, BJXJY,

SHSY and SZGFH are sometimes hereinafter collectively referred to as “the

Company.”

The

principal activities of the Company are property brokerage services, real estate

marketing services, property leasing services and property management services

in the PRC

.

Restatement

Summary

The

Company discovered errors to previously issued financial statements for the

fiscal years ended December 31, 2007 and 2006 and the quarter ended March 31,

2008. The company intends to file the restated financial statements for these

periods as soon as practicable but has not filed them. However, the current

financial statements are stated as if the correction of the error had been

made

One

restatement

relates to the recognition of revenue from underwriting sales. The Company

entered into an agreement in 2004 to underwrite an office building in Suzhou,

known as Suzhou Sovereign Building. Under the Underwriting Model, our commission

revenue is equivalent to the price difference between the final selling price

and underwriting price. In marketing of the property, the Company also launched

a promotional package by entering into leasing agreements with certain buyers

to

lease the properties for them. The leasing period started in the second quarter

of 2006, and in the leasing period the Company has the right to sublease the

leased properties to earn rental income. The Company recognised commission

revenue from underwriting service when the property developer and the buyer

complete a property sales transaction, which is normally at the time when the

property developer has confirmed that the predetermined level of sales proceeds

have been received from buyers. The Company accounted for its liability for

its

obligations under a guarantee in accordance with FASB Interpretation No. 45,

(FIN45) Guarantor's Accounting and Disclosure Requirements for Guarantees,

Including Direct Guarantees of Indebtedness of Others. It is the only

underwriting agreement the Company entered since its incorporation.

The

Securities and Exchange Commission has provided the Company with comments

concerning the Company’s Form 10-K for the fiscal year ended December 31, 2006,

particularly with respect to certain revenue recognition policies on

underwriting sales.

The

Company has subsequently determined that the correct application of accounting

principles had not been applied for

the

recognition of underwriting sales revenue

.

In this

correction, the financial statements for the years ended December 31, 2007

and

2006 and the quarter ended March 31, 2008 were restated to increase the

Company’s deferred tax assets and deposits received from underwriting sales by

deferring revenue recognition to the consummation of the sale, generally when

the remaining maximum exposure to loss is reduced below the amount of gain

deferred. As a result, the Company’s net asset values as of December 31, 2007

and March 31, 2008 were reduced by $6,300,897 and $6,563,699, respectively.

The

correction of this error reduced the Company’s losses for the year ended

December, 2007 by $157,811 and gave no effect on the income statement of the

Company for each of the two quarters ended June 30, 2008 and 2007.

An

additional restatement relates to correct the overstatement of the minority

shareholders’ share of the Company’s result by US$106,759. As a result of the

correction of this item, the Company’s financial statements for the year ended

2007 were restated and the Company’s loss for the year ended December 31, 2007

and the accumulated losses as of December 31, 2007 were reduced by

US$106,759.

Certain

comparative figures have been reclassified in conformity of the current period’s

presentation.

NOTE

2 –SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis

of Accounting and Principles of Consolidation

The

consolidated financial statements are prepared in accordance with generally

accepted accounting principles in the United States of America and present

the

financial statements of SRRE and its subsidiaries, CY-SRRE, LRY, SHXJY, SZXJY,

SZXJYB, SZSY, KSSY, BJXJY, SHSY and SZGFH. All inter-company transactions and

balances have been eliminated.

Going

Concern

The

Company’s financial statements are prepared according to the accounting

principles generally accepted in the United States of America applicable to

a

going concern, which contemplates the realization of assets and liquidation

of

liabilities in the normal course of business. The Company has incurred losses

of

$2,117,728 for the first and second quarters of 2008 and had net working capital

deficiency of $579,155 as of June 30, 2008. The Company

’

s

net

working capital deficiency, recurring losses and negative cash flows from

operations raise substantial doubt about its ability to continue as a going

concern.

However,

management believes that the company is able to generate sufficient cash flow

to

meet its obligations on a timely basis and ultimately to attain successful

operations in respect of the agency sales and building management operations.

Accordingly, the accompanying financial statements do not include any

adjustments that may be necessary if the Company is unable to continue as a

going concern.

Foreign

Currency Translation and Transactions

The

functional currency of SRRE, CY-SRRE and LRY is United States Dollars (“US$”)

and the financial records are maintained and the financial statements prepared

in US $. The functional currency of SHXJY, SZXJY, SZXJYB, SZSY, KSSY, BJXJY,

SHSY and SZGFH is Renminbi (“RMB”) and the financial records are maintained and

the financial statements prepared in RMB.

Foreign

currency transactions during the period are translated into each company’s

denominated currency at the exchange rates ruling at the transaction dates.

Gain

and loss resulting from foreign currency transactions are included in the

consolidated statement of operations. Assets and liabilities denominated in

foreign currencies at the balance sheet date are translated into each company’s

denominated currency at period end exchange rates. All exchange differences

are

dealt with in the consolidated statements of operations.

The

financial statements of the Company’s operations based outside of the United

States have been translated into US$ in accordance with SFAS 52. Management

has

determined that the functional currency for each of the Company’s foreign

operations is its applicable local currency. When translating functional

currency financial statements into US$, period-end exchange rates are applied

to

the consolidated balance sheets, while average period rates are applied to

consolidated statements of operations. Translation gains and losses are recorded

in translation reserve as a component of shareholders’ equity.

The

exchange rate between US$ and RMB had a little fluctuation during the periods

presented. The rates as of June 30, 2008 and December 31, 2007 are US$1:

RMB6.8591 and US$1: RMB7.3046, respectively.

Property,

Plant, Equipment and Depreciation

Property,

plant and equipment are stated at cost. Depreciation is computed using the

straight-line method to allocate the cost of depreciable assets over the

estimated useful lives of the assets as follows:

|

|

|

Estimated Useful Life (in years)

|

|

|

|

|

|

Furniture

and fixtures

|

|

5-10

|

|

Computer

and office equipment

|

|

5

|

|

Motor

vehicles

|

|

5

|

|

Properties

|

|

20

|

Maintenance,

repairs and minor renewals are charged directly to the statement of operations

as incurred. Additions and improvements are capitalized. When assets are

disposed of, the related cost and accumulated depreciation thereon are removed

from the accounts and any resulting gain or loss is included in the statement

of

operations.

Investment

property

Investment

properties are stated at cost. Depreciation is computed using the straight-line

method to allocate the cost of depreciable assets over the estimated useful

lives of 20 years.

Significant

additions that extend property lives are capitalized and are depreciated over

their respective estimated useful lives. Routine maintenance and repair costs

are expensed as incurred. The Company reviews its investment property for

impairment whenever events or changes in circumstances indicate that the

carrying amount of an investment property may not be recoverable.

Goodwill

SFAS

No.

142, “Goodwill and Other Intangible Assets,” requires that goodwill be tested

for impairment on an annual basis (December 31 for us) and between annual tests

if an event occurs or circumstances change that would more likely than not

reduce the fair value of a reporting unit below its carrying value. These events

or circumstances could include a significant change in the business climate,

legal factors, operating performance indicators, competition, sale or

disposition of a significant portion of a company. Application of the goodwill

impairment test requires judgment, including the determination of the fair

value

of a company. The fair value of a company is estimated using a discounted cash

flow methodology. This requires significant judgments including estimation

of

future cash flows, which is dependent on internal forecasts, estimation of

the

long-term rate of growth for our business, the useful life over which cash

flows

will occur, and the determination of our weighted average cost of capital.

Changes in these estimates and assumptions could materially affect the

determination of fair value and/or goodwill impairment for a

company.

Revenue

Recognition

Agency

commission revenue from property brokerage is recognized when the property

developer and the buyer complete a property sales transaction, and the property

developer

grants

confirmation to us to be able to invoice them accordingly. The time when we

receive the commission

is

normally at the time when the property developer receives from the buyer a

portion of the sales proceeds in accordance with the terms of the relevant

property sales agreement, or the balance of the bank loan to the buyer has

been

funded, or recognized under the sales schedule or other specific items of agency

sales agreement with developer. At no point does the Company handle any monetary

transactions nor act as an escrow intermediary between the developer and the

buyer.

Revenue

from marketing consultancy services is recognized when services are provided

to

clients.

Rental

revenue from property management and rental business is recognized on a

straight-line basis according to the time pattern of the leasing

agreements.

The

Company accounts for underwriting sales in accordance with SFAS No. 66

“Accounting for Sales of Real Estate” (SFAS 66). The gain on underwriting sales

is recognized when the criteria in SFAS No. 66 have been met, generally at

the

title is transferred and the Company no longer has substantial continuing

involvement with the real estate asset sold. If the Company provides certain

rent guarantees or other forms of support where the maximum exposure to loss

exceeds the gain, it defers the related commission income and expenses by

applying the deposit method. In future periods, the commission income and

related expenses are recognized when the remaining maximum exposure to loss

is

reduced below the amount of gain deferred.

All

revenues represent gross revenues less sales and business tax.

Net

Earnings per Common Share

The

Company computes net earnings per share in accordance with SFAS No. 128,

“Earnings per Share.” Under the provisions of SFAS No. 128, basic net earnings

per share is computed by dividing the net earnings available to common

shareholders for the period by the weighted average number of shares of common

stock outstanding during the period. The calculation of diluted net earnings

per

share gives recognizes common stock equivalents, however; potential common

stock

in the diluted EPS computation is excluded in net loss periods, as their effect

is anti-dilutive.

Income

Taxes

The

Company accounts for income taxes in accordance with SFAS No. 109 “Accounting

for Income Taxes.” Under SFAS No. 109, deferred tax liabilities or assets at the

end of each period are determined using the tax rate expected to be in effect

when taxes are actually paid or recovered. Valuation allowances are established

when necessary to reduce deferred tax assets to the amount expected to be

realized.

We

continue to account for income tax

contingencies

using a benefit recognition model.

Beginning

January 1, 2007, if we consider that a tax position is 'more likely than not'

of

being sustained upon audit, based solely on the technical merits of the

position, we recognize the benefit. We measure the benefit by determining the

amount that is greater than 50% likely of being realized upon settlement,

presuming that the tax position is examined by the appropriate taxing authority

that has full knowledge of all relevant information. These assessments can

be

complex and we often obtain assistance from external advisors.

Under

the

benefit recognition model, if our initial assessment fails to result in the

recognition of a tax benefit, we regularly monitor our position and subsequently

recognize the tax benefit if there are changes in tax law or analogous case

law

that sufficiently raise the likelihood of prevailing on the technical merits

of

the position to more likely than not; if the statute of limitations expires;

or

if there is a completion of an audit resulting in a settlement of that tax

year

with the appropriate agency.

Uncertain

tax positions, represented by liabilities on our balance sheet, are now

classified as current only when we expect to pay cash within the next 12 months.

Interest and penalties, if any, continue to be recorded in Provision for taxes

on income and are classified on the balance sheet with the related tax

liability.

Historically,

our policy had been to account for income tax contingencies based on whether

we

determined our tax position to be 'probable' under current tax law of being

sustained, as well as an analysis of potential outcomes under a given set of

facts and circumstances. In addition, we previously considered all tax

liabilities as current once the associated tax year was under

audit.

Non-employee

stock based compensation

The

cost

of stock based compensation awards issued to non-employees for services are

recorded at either the fair value of the services rendered or the instruments

issued in exchange for such services, whichever is more readily determinable,

using the measurement date guidelines enumerated in Emerging Issues Task Force

Issue ("EITF") 96-18, "Accounting for Equity Instruments That Are Issued to

Other Than Employees for Acquiring, or in Conjunction with Selling, Goods or

Services" ("EITF 96-18").

Segment

information

The

Company believes that it operates in one business segment. Management does

with

the business as consisting of several revenue streams; however it is not

possible to attribute assets or indirect costs to the individual streams other

than direct expenses.

NOTE

3 - PROMISSORY DEPOSITS

The

balance of $947,646 represents the deposits placed with several property

developers in respect of a number of real estate projects where the Company

is

appointed as sales agent.

NOTE

4 - OTHER RECEIVABLES AND DEPOSITS

|

|

|

June 30

|

|

December 31,

|

|

|

|

|

2008

|

|

2007

|

|

|

|

|

(Unaudited)

|

|

(Audited)

|

|

|

Advances

to staff

|

|

$

|

20,335

|

|

$

|

20,486

|

|

|

Rental

deposits

|

|

|

91,341

|

|

|

101,370

|

|

|

Prepaid

rental

|

|

|

362,876

|

|

|

406,833

|

|

|

Renovation

deposit

|

|

|

279,262

|

|

|

-

|

|

|

Other

receivables

|

|

|

84,192

|

|

|

73,684

|

|

|

|

|

$

|

838,006

|

|

$

|

602,373

|

|

NOTE

5 – PROPERTY, PLANT AND EQUIPMENT

–

NET

|

|

|

June 30,

|

|

December 31,

|

|

|

|

|

2008

|

|

2007

|

|

|

|

|

(Unaudited)

|

|

(Audited)

|

|

|

Furniture

and fixtures

|

|

$

|

146,348

|

|

$

|

133,970

|

|

|

Computer

and office equipment

|

|

|

318,107

|

|

|

275,988

|

|

|

Motor

vehicles

|

|

|

667,106

|

|

|

618,024

|

|

|

Properties

|

|

|

2,205,751

|

|

|

2,071,225

|

|

|

|

|

|

3,337,312

|

|

|

3,099,207

|

|

|

Less:

Accumulated depreciation

|

|

|

(591,464

|

)

|

|

(579,622

|

)

|

|

|

|

$

|

2,745,848

|

|

$

|

2,519,585

|

|

All

above

properties as of June 30, 2008 and as of December 31, 2007 were pledged to

secure a loan in note 9.

NOTE

6 – EQUITY INVESTMENT

On

September 11, 2007, SHSY invested a 19% equity interest in a PRC company named

Suzhou Bin Fen Nian Dai Administration Consultancy Company Limited (“SZBFND”).

NOTE

7 – INVESTMENT PROPERTIES

|

|

|

June 30,

|

|

December 31,

|

|

|

|

|

2008

|

|

2007

|

|

|

|

|

(Unaudited)

|

|

(Audited)

|

|

|

Investment

property

|

|

$

|

8,617,917

|

|

$

|

8,092,319

|

|

|

Less:

Accumulated depreciation

|

|

|

(573,528

|

)

|

|

(292,091

|

)

|

|

|

|

$

|

8,044,389

|

|

$

|

7,800,228

|

|

The

investment

properties included one floor and four units of a commercial building in Suzhou,

the PRC, from which the Company derives its underwriting sales income. The

investment properties were acquired by the Company for

long-term

investment purposes and were pledged to secure a loan in note 9

.

As

of

August 11, 2008, the four units of the investment properties were leased to

SZBFND, a related party of the Company, and 21% of the total area of the one

remaining floor was leased out.

NOTE

8

–

DEFERRED TAX ASSET

The

net

deferred tax assets from continuing operations are determined under the

liability method based on the difference between the financial statement and

tax

basis of assets and liabilities as measured by the enacted statutory tax rates.

The deferred tax provision (benefit) is the result of changes in these temporary

differences. As of December 31, 2007 and June 30, 2008, the tax effect of the

temporary differences mainly represent the deferred tax assets arising from

the

deferred gain of the underwriting sale using the deposit method.

NOTE

9 - BANK LOANS

Bank

loans of June 30, 2008 included two bank loans, as listed below:

First,

the balance includes a bank loan of $5,819,192. This bank loan is repayable

before August 2, 2010 and bears interest at a rate of 8.217% per annum. This

bank loan is secured by the properties as mentioned in Note 7 above. The

repayment schedule of this bank loan is as follows:

|

February

1, 2010

|

|

$

|

1,457,917

|

|

|

August

2, 2010

|

|

$

|

4,361,275

|

|

Pursuant

to the relevant loan agreement, the using of the bank loan is restricted to

pay

for deposits and expenditures incurred in performing any real estate marketing

projects of the Company, and approval from the lending bank is required for

any

drawings in excess of RMB1 million from the remaining balance. This balance

is

recorded as restricted cash on the balance sheet.

Second,

the remaining bank loan of $510,271 bears interest at 6.48% per annum, and

is

repayable before December 15, 2010 in monthly installments. The bank loan is

secured by the properties as mentioned in Note 5 above.

NOTE

10 – PROMISSORY NOTES PAYABLE

There

are

three promissory notes, as listed below:

First,

the balance includes a promissory note of $190,556. This promissory note of

$190,556 bears interest at a rate of 5% per annum. The promissory note is

unsecured and will be repayable before October 31, 2009.

Second,

the balance includes a promissory note of $75,000 and accrued interest of $8,854

thereon. This promissory note of $75,000 bears interest at a rate of 5% per

annum. This promissory note is unsecured and the term of repayment is not

specifically defined.

Third,

the balance includes a promissory note of $300,000. This promissory note of

$300,000 bears interest at a rate of 15% per annum. This promissory note is

unsecured and the term of repayment is not specifically

defined.

NOTE

11 – AMOUNTS WITH RELATED PARTIES AND DIRECTORS

A

related

party is an entity that can control or significantly influence the management

or

operating policies of another entity to the extent one of the entities may

be

prevented from pursuing its own interests. A related party may also be any

party

the entity deals with that can exercise that control.

Amount

due to director

The

amount due to one of the directors with interest at a rate of 9.6% per annum.

As

of June 30, 2008, the balance includes principal of

$62,742

and accrued interest of $8,739 thereon

.

The

principal is unsecured and

the

term

of repayment is not specifically defined

.

Amount

due from related party

The

amount represents an advance to SZBFND which is unsecured, interest free and

has

no fixed term of repayment.

Amount

due to related party

The

amount represents a rental deposits received from SZBFND. Rental income of

$288,878 is generated from leasing the investment properties to SZBFND during

the period. This amount is unsecured, interest free and repayable on

demand.

NOTE

12 - OTHER PAYABLES AND ACCRUED EXPENSES

|

|

|

June 30,

|

|

December 31,

|

|

|

|

|

2008

|

|

2007

|

|

|

|

|

(Unaudited)

|

|

(Audited)

|

|

|

Accrued

staff commission & bonus

|

|

$

|

344,448

|

|

$

|

1,013,650

|

|

|

Rental

deposits received

|

|

|

657,058

|

|

|

519,352

|

|

|

Other

payables

|

|

|

612,089

|

|

|

384,019

|

|

|

|

|

$

|

1,613,595

|

|

$

|

1,917,021

|

|

NOTE

13 – OTHER TAX PAYABLE

Other

tax

payable mainly represents PRC business tax which is charged at a rate of 5%

on

the revenue from services rendered. The amount of PRC business tax charged

for

the period ended June 30, 2008 was $208,539.

NOTE

14- COMMITMENTS AND CONTINGENCIES

Operating

Lease Commitments

During

the six months ended June 30, 2008 and 2007, the Company incurred lease expenses

amounting to $200,536 and $127,715, respectively. As of June 30, 2008, the

Company had commitments under operating leases, requiring annual minimum rentals

as follows:

|

|

|

June

30,

|

|

December

31,

|

|

|

|

|

2008

|

|

2007

|

|

|

|

|

(Unaudited)

|

|

(Audited)

|

|

|

Within

one year

|

|

$

|

192,562

|

|

$

|

132,628

|

|

|

Two

to five years

|

|

|

111,553

|

|

|

133,847

|

|

|

Operating

lease commitments

|

|

$

|

304,115

|

|

$

|

266,475

|

|

During

the year of 2005 and 2006, SZGFH entered into leasing agreements with certain

buyers of the Sovereign Building underwriting project to lease the properties

for them. These leasing agreements

on

these

properties

are for

62% of the floor space that was sold to third party buyers.

In

accordance with the leasing agreements, the owners of the properties can have

an

annual rental return of 8.5% and 8.8% per annum for a period of 5 years and

8

years, respectively. The leasing period started in the second quarter, 2006,

and

the Company has the right to sublease the leased properties to cover these

lease

commitments in the leasing period. As of

June

30

,

2008,

124 sub-leasing agreements have been signed, the area of these sub-leasing

agreements represented 95% of total area with these lease

commitments.

As

of

June 30, 2008, the lease commitments are as follows:

|

|

|

June

30,

|

|

December

31,

|

|

|

|

|

2008

|

|

2007

|

|

|

|

|

(Unaudited)

|

|

(Audited)

|

|

|

Within

one year

|

|

$

|

3,230,861

|

|

$

|

3,047,216

|

|

|

Two

to five years

|

|

|

7,510,217

|

|

|

8,412,157

|

|

|

Over

five years

|

|

|

2,370,280

|

|

|

2,181,446

|

|

|

Operating

lease commitments arising from the promotional package

|

|

$

|

13,111,358

|

|

$

|

13,640,819

|

|

According

to the leasing agreements, the Company has an option to terminate any agreement

by paying a predetermined compensation. As of June 30, 2008, the compensation

to

terminate all leasing agreements is $3,189,634. According to the sub-leasing

agreements that have been signed through June 30, 2008, the rental income from

these sub-leasing agreements will be $2,176,808 within one year and $3,440,809

within two to five years. However,

no

assurance can be given that we can collect all of the rental

income.

NOTE

15 –DEPOSITS RECEIVED FROM UNDERWRTING SALES

The

Company accounts for its underwriting sales revenue with underwriting rent

guarantees in accordance with SFAS No. 66 “Accounting for Sales of Real Estate”

(SFAS 66). Under SFAS 66, the deposit method should be used for the revenue

from

the sales of floor space with underwriting rent guarantees until the rental

revenues generated by sub-leasing properties exceed the guaranteed rental amount

due to the purchasers.

NOTE

16 – STATUTORY RESERVE

According

to the relevant corporation laws in the PRC, a PRC company is required to

transfer at least 10% of its profit after taxes, as determined under accounting

principles generally accepted in the PRC, to the statutory reserve until the

balance reaches 50% of its registered capital. The statutory reserve can be

used

to make good on losses or to increase the capital of the relevant

company.

NOTE

17 – ACCUMULATED OTHER COMPREHENSIVE INCOME

As

of

June 30, 2008, the only component of accumulated other comprehensive income

was

translation reserve.

NOTE

18 – COMPARATIVE FIGURES

Certain

comparative figures have been reclassified to conform with current period’s

presentation

NOTE

19 – CONCENTRATION OF CUSTOMERS

During

the three months and six months ended June 30, 2008 and 2007, the following

customers accounted for more than 10% of total net revenue:

|

|

|

Percentage of

Net Sales

Three Months

Ended June 30,

|

|

Percentage of

Net Sales

Six Months

Ended June 30,

|

|

Percentage of

Accounts Receivable

as of June 30,

|

|

|

|

|

2008

|

|

2007

|

|

2008

|

|

2007

|

|

2008

|

|

2007

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Customer

A

|

|

|

21

|

%

|

|

11

|

%

|

|

13

|

%

|

|

*

|

|

|

26

|

%

|

|

*

|

|

|

Customer

B

|

|

|

15

|

%

|

|

*

|

|

|

15

|

%

|

|

*

|

|

|

*

|

|

|

*

|

|

|

Customer

C

|

|

|

14

|

%

|

|

*

|

|

|

*

|

|

|

*

|

|

|

*

|

|

|

*

|

|

*

less

than 10%

ITEM

2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANICAL CONDITION AND RESULTS OF

OPERATIONS

CAUTIONARY

STATEMENT

The

following Management’s Discussion and Analysis (“MD&A”) is intended to help

the reader understand Sunrise Real Estate Group, Inc. (“SRRE”). The MD&A is

provided as a supplement to, and should be read in conjunction with, our

financial statements and the accompanying notes. The information contained

in

this quarterly report on Form 10-Q is not a complete description of our business

or the risks associated with an investment in our common stock. We urge you

to

carefully review and consider the various disclosures made by us in this report

and in our other reports filed with the Securities and Exchange Commission,

or

SEC, including but not limited to our annual report on Form 10-KSB for the

year

ended December 31, 2007, which discusses our business in greater detail.

In

this

report we make, and from time to time we otherwise make, written and oral

statements regarding our business and prospects, such as projections of future

performance, statements of management’s plans and objectives, forecasts of

market trends, and other matters that are forward-looking statements within

the

meaning of Section 27A of the Securities Act of 1933 and Section 21E of the

Securities Exchange Act of 1934. Statements containing the words or phrases

“will likely result,” “are expected to,” “will continue,” “is anticipated,”

“estimates,” “projects,” “seeks”, “believes,” “expects,” “anticipates,”

“intends,” “target,” “goal,” “plans,” “objective,” “should” or similar

expressions identify forward-looking statements, which may appear in documents,

reports, filings with the Securities and Exchange Commission, news releases,

written or oral presentations made by officers or other representatives made

by

us to analysts, stockholders, current or potential investors, news organizations

and others, and discussions with management and other of our representatives,

customer and suppliers. For such statements, we claim the protection of the

safe

harbor for forward-looking statements contained in the Private Securities

Litigation Reform Act of 1995.

Our

future results, including results related to forward-looking statements, involve

a number of risks and uncertainties. No assurance can be given that the results

reflected in any forward-looking statements will be achieved. Any

forward-looking statement speaks only as of the date on which such statement

is

made. Our forward-looking statements are based upon assumptions that are

sometimes based upon estimates, data, communications and other information

from

suppliers, government agencies and other sources that may be subject to

revision. Except as required by law, we do not undertake any obligation to

update or keep current either (i) any forward-looking statement to reflect

events or circumstances arising after the date of such statement, or (ii) the

important factors that could cause our future results to differ materially

from

historical results or trends, results anticipated or planned by us, or which

are

reflected from time to time in any forward-looking statement.

In

addition to other matters identified or described by us from time to time in

filings with the SEC, there are several important factors that could cause

our

future results to differ materially from historical results or trends, results

anticipated or planned by us, or results that are reflected from time to time

in

any forward-looking statement. Some of these important factors, but not

necessarily all important factors, include

those

relating to our ability to raise money and grow our business, and potential

difficulties in integrating new acquisitions with our current operations,

especially as they pertain to foreign markets and market conditions. Please

also

refer to the section entitled “Risk Factors” in our Annual Report on Form 10-KSB

for the year ended December 31, 2007.

OVERVIEW

In

October 2004, the former shareholders of Sunrise Real Estate Development Group,

Inc. (Cayman Islands) (“CY-SRRE”) and LIN RAY YANG Enterprise Ltd. (“LRY”)

acquired a majority of our voting interests in a share exchange. Before the

completion of the share exchange, SRRE had no continuing operations, and its

historical results would not be meaningful if combined with the historical

results of CY-SRRE, LRY and their subsidiaries.

As

a

result of the acquisition, the former owners of CY-SRRE and LRY hold a majority

interest in the combined entity. Generally accepted accounting principles

require in certain circumstances that a company whose shareholders retain the

majority voting interest in the combined business be treated as the acquirer

for

financial reporting purposes. Accordingly, the acquisition has been accounted

for as a “reverse acquisition” arrangement whereby CY-SRRE and LRY are deemed to

have purchased SRRE. However, SRRE remains the legal entity and the Registrant

for Securities and Exchange Commission reporting purposes. The historical

financial statements prior to October 5, 2004 are those of CY-SRRE and LRY

and

their subsidiaries. All equity information and per share data prior to the

acquisition have been restated to reflect the stock issuance as a

recapitalization of CY-SRRE and LRY.

SRRE

and

its subsidiaries, namely, CY-SRRE, LRY, Shanghai Xin Ji Yang Real Estate

Consultation Company Limited (“SHXJY”), Suzhou Xin Ji Yang Real Estate

Consultation Company Limited (“SZXJY”), Beijing Xin Ji Yang Real Estate

Consultation Company Limited (“BJXJY”), Shanghai Shangyang Real Estate

Consultation Company Limited (“SHSY”), Suzhou Gao Feng Hui Property Management

Company Limited (“SZGFH”),

Suzhou

Shang Yang Real Estate Consultation Company Limited (“SZSY”),

Suzhou

Xin Ji Yang Real Estate Brokerage Company Limited(“SZXJYB”)

and

Kunshan

Shang Yang Real Estate Brokerage Company Limited (“KSSY”)

are

sometimes hereinafter collectively referred to as “the Company,” “our,” or “us”.

The principal activities of the Company are real estate agency sales, real

estate marketing services, real estate investments, property leasing services

and property management services in the PRC

.

RECENT

DEVELOPMENTS

Our

major

business was agency sales, whereby our Chinese subsidiaries contracted with

property developers to market and sell their newly developed property units.

For

these services we earned a commission fee calculated as a percentage of the

sales prices. We have focused our sales on the whole China market, especially

in

secondary cities. To expand our agency business, we have established

subsidiaries in Shanghai, Suzhou and Beijing, and branches in NanChang,

YangZhou, NanJing and ChongQing.

During

the year of 2005 and 2006, SZGFH entered into leasing agreements with certain

buyers of the Sovereign Building underwriting project to lease the properties

for them. These leasing agreements

on

these

properties

are for

62% of the floor space that was sold to third party buyers.

In

accordance with the leasing agreements, the owners of the properties can have

an

annual rental return of 8.5% and 8.8% per annum for a period of 5 years and

8

years, respectively. The leasing period started in the second quarter, 2006,

and

the Company has the right to sublease the leased properties to cover these

lease

commitments in the leasing period. As of

August

11

,

2008,

124 sub-leasing agreements have been signed, the area of these sub-leasing

agreements represented 95% of total area with these lease

commitments.

RECENTLY

ISSUED ACCOUNTING STANDARDS

In

February 2008, the FASB issued FSP FAS 157-2, which delayed the effective date

of SFAS No 157 to fiscal years beginning after November 15, 2008 and interim

periods within those fiscal years for all non-financial assets and nonfinancial

liabilities, except those are recognized or disclosed at fair value in the

financial statements on a recurring basis (at least annually). The Company

does

not believe that the adoption of SFAS No. 157 will significantly impact its

financial statements.

In

December 2007, the FASB issued SFAS No. 141 (revised 2007), “Business

Combinations,” (“SFAS 141R”) to improve the relevance, representational

faithfulness, and comparability of the information that a reporting entity

provides in its financial reports about a business combination and its effects.

This Statement applies to all transactions or other events in which an entity

obtains control of one or more businesses, and combinations achieved without

the

transfer of consideration. SFAS No. 141 (revised 2007) is effective for business

combinations for which the acquisition date is in on or after the beginning

of

the first annual reporting period beginning on or after December 15, 2008.

The

impact of adopting SFAS 141R will depend on the nature and size of the future

business combinations the Company consummates after the effective

date.

FASB

statement No. 160 “Noncontrolling Interests in Consolidated Financial

Statements- an amendment of ARB No. 51” was issued December of 2007. This

Statement establishes accounting and reporting standards for the noncontrolling

interest in a subsidiary and for the deconsolidation of a

subsidiary. The Company believes that this new pronouncement

will have an immaterial impact on the Company’s financial statements in future

periods.

APPLICATION

OF CRITICAL ACCOUNTING POLICIES

The

preparation of financial statements in conformity with accounting principles

generally accepted in the United States requires management to make estimates

and assumptions that affect the reported amounts of assets and liabilities

and

disclosure of contingent assets and liabilities at the date of the financial

statements and the reported amounts of revenues and expenses during the

reporting period. Critical accounting policies for us include revenue

recognition, net earnings per common share, income taxes and segment

information.

Revenue

Recognition

Agency

commission revenue from property brokerage is recognized when the property

developer and the buyer complete a property sales transaction, and the property

developer

grants

confirmation to us to be able to invoice them accordingly. The time when we

receive the commission

is

normally at the time when the property developer receives from the buyer a

portion of the sales proceeds in accordance with the terms of the relevant

property sales agreement, or the balance of the bank loan to the buyer has

been

funded, or recognized under the sales schedule or other specific items of agency

sales agreement with developer. At no point does the Company handle any monetary