Morgan Stanley Institutional Fund Trust

Limited Duration Portfolio

Summary Prospectus

January 31, 2013, as amended October 1, 2013

|

Class:

|

|

I

|

|

Ticker Symbol:

|

|

MPLDX

|

|

|

|

|

A

|

|

|

|

MLDAX

|

|

|

|

|

L

|

|

|

|

MSJLX

|

|

Before you invest, you may want to review the Portfolio's statutory prospectus ("Prospectus"), which contains more information about the Portfolio and its risks. You can find the Portfolio's Prospectus and other information about the Portfolio, including the Statement of Additional Information ("SAI") and the most recent annual and semiannual reports to shareholders, online at

www.morganstanley.com/im

. You can also get this information at no cost by calling toll-free 1-866-414-6349 or by sending an e-mail request to

orders@mysummaryprospectus.com

. The Portfolio's Prospectus and SAI, both dated January 31, 2013, as may be supplemented from time to time, are incorporated by reference into this Summary Prospectus.

Objective

The Limited Duration Portfolio seeks above-average total return over a market cycle of three to five years.

Fees and Expenses

The table below describes the fees and expenses that you may pay if you buy and hold shares of the Portfolio. For purchases of Class A shares, you may qualify for a sales charge discount if the cumulative net asset value ("NAV") of Class A shares of the Portfolio purchased in a single transaction, together with the NAV of all Class A shares of other portfolios of Morgan Stanley Institutional Fund Trust (the "Fund") or Class A shares of other Morgan Stanley Multi-Class Funds (as defined in the "General Shareholder Information—Exchange Privilege" section on page 49 of the Prospectus) held in Related Accounts (as defined in the "Purchasing Class A Shares" section on page 43 of the Prospectus), amounts to $25,000 or more. More information about this combined purchase discount and other discounts is available from your financial adviser and in the "Purchasing Class A Shares" section on page 43 of the Prospectus.

Shareholder Fees

(fees paid directly from your investment)

|

|

|

Class I

|

|

Class A†

|

|

Class L

|

|

Maximum sales charge (load) imposed

on purchases (as a percentage of

offering price)

|

|

|

None

|

|

|

|

4.25

|

%

|

|

|

None

|

|

|

Annual Portfolio Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

|

|

|

Class I

|

|

Class A†

|

|

Class L

|

|

|

Advisory Fee

|

|

|

0.30

|

%

|

|

|

0.30

|

%

|

|

|

0.30

|

%

|

|

Distribution and/or Shareholder

Service (12b-1) Fee

|

|

|

None

|

|

|

|

0.25

|

%

|

|

|

0.50

|

%

|

|

|

Other Expenses

|

|

|

0.34

|

%

|

|

|

0.34

|

%

|

|

|

0.34

|

%‡

|

|

Total Annual Portfolio Operating

Expenses*

|

|

|

0.64

|

%

|

|

|

0.89

|

%

|

|

|

1.14

|

%

|

|

Fee Waiver and/or Expense

Reimbursement*

|

|

|

0.11

|

%

|

|

|

0.01

|

%

|

|

|

0.00

|

%

|

|

Total Annual Portfolio Operating

Expenses After Fee Waiver and/or

Expense Reimbursement*

|

|

|

0.53

|

%

|

|

|

0.88

|

%

|

|

|

1.14

|

%

|

|

Example

The example below is intended to help you compare the cost of investing in the Portfolio with the cost of investing in other mutual funds.

The example assumes that you invest $10,000 in the Portfolio, your investment has a 5% return each year and that the Portfolio's operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

|

|

1 Year

|

|

3 Years

|

|

5 Years

|

|

10 Years

|

|

|

Class I

|

|

$

|

54

|

|

|

$

|

170

|

|

|

$

|

296

|

|

|

$

|

665

|

|

|

|

Class A†

|

|

$

|

511

|

|

|

$

|

694

|

|

|

$

|

892

|

|

|

$

|

1,463

|

|

|

|

Class L

|

|

$

|

116

|

|

|

$

|

362

|

|

|

$

|

628

|

|

|

$

|

1,386

|

|

|

† Effective September 9, 2013, Class P and Class H shares were renamed Class A shares.

‡ Other expenses have been estimated for the Portfolio's Class L shares for the current fiscal year.

* The Portfolio's "Adviser," Morgan Stanley Investment Management Inc., has agreed to reduce its advisory fee and/or reimburse the Portfolio so that Total Annual Portfolio Operating Expenses, excluding certain investment related expenses, taxes, interest and other extraordinary expenses (including litigation), will not exceed 0.53% for Class I, 0.88% for Class A and 1.23% for Class L. The fee waivers and/or expense reimbursements will continue for at least one year or until such time as the Fund's Board of Trustees acts to discontinue all or a portion of such waivers and/or reimbursements when it deems such action is appropriate.

Portfolio Turnover

The Portfolio pays transaction costs when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Portfolio shares are held in a taxable account. These

costs, which are not reflected in Total Annual Portfolio Operating Expenses or in the Example, affect the Portfolio's performance. During the most recent fiscal year, the Portfolio's portfolio turnover rate was 51% of the average value of its portfolio.

Principal Investment Strategies

Under normal circumstances, at least 80% of the Portfolio's assets will be invested in fixed income securities. The Portfolio invests primarily in U.S. government securities, investment grade corporate bonds and mortgage- and asset-backed securities. The Portfolio will ordinarily seek to maintain an average duration similar to that of the Barclays Capital 1-3 Year U.S. Government/Credit Index, which generally ranges between zero and three years.

The Adviser employs a value approach toward fixed income investing and makes securities and sector decisions based on the anticipated tradeoff between long-run expected return and risk. The Portfolio seeks value in the fixed income market with only a limited sensitivity to changes in interest rates. The Adviser relies upon value measures such as the level of real interest rates, yield curve slopes and credit-adjusted spreads to guide its decisions regarding interest rate, country, sector and security exposure. A team of portfolio managers implements strategies based on these types of value measures. Certain team members focus on specific bonds within each sector. Others seek to ensure that the aggregate risk exposures to changes in the level of interest rates and yield spreads match the Portfolio's objective.

The Portfolio's mortgage securities may include collateralized mortgage obligations ("CMOs"), stripped mortgage-backed securities ("SMBS") and inverse floating rate obligations ("inverse floaters"). In addition, the Portfolio may invest in to-be-announced pass-through mortgage securities, which settle on a delayed delivery basis ("TBAs"). The Portfolio may also invest in securities of foreign issuers, including issuers located in emerging market or developing countries. The securities in which the Portfolio may invest may be denominated in U.S. dollars or in currencies other than U.S. dollars. The Portfolio may also invest in restricted and illiquid securities.

The Portfolio may, but it is not required to, use derivative instruments for a variety of purposes, including hedging, risk management, portfolio management or to earn income. The Portfolio's use of derivatives may involve the purchase and sale of derivative instruments such as futures, options, swaps and other related instruments and techniques. The Portfolio may utilize foreign currency forward exchange contracts, which are also derivatives, in connection with its investments in foreign securities.

Derivative instruments used by the Portfolio will be counted towards the 80% policy discussed above to the extent they have economic characteristics similar to the securities included within that policy.

Principal Risks

There is no assurance that the Portfolio will achieve its investment objective and you can lose money investing in this Portfolio. The principal risks of investing in the Portfolio include:

•

Fixed Income Securities.

Fixed income securities are subject to the risk of the issuer's inability to meet principal and interest

payments on its obligations (i.e., credit risk) and are subject to price volatility resulting from, among other things, interest rate sensitivity, market perception of the creditworthiness of the issuer and general market liquidity (i.e., market risk). Securities with longer durations are likely to be more sensitive to changes in interest rates, generally making them more volatile than securities with shorter durations. Lower rated fixed income securities have greater volatility because there is less certainty that principal and interest payments will be made as scheduled. A portion of the Portfolio's fixed income securities may be rated below investment grade.

•

Mortgage Securities.

Investments in mortgage securities are subject to the risk that if interest rates decline, borrowers may pay off their mortgages sooner than expected which may adversely affect the Portfolio's return. Rising interest rates tend to discourage refinancings, with the result that the average life and volatility of mortgage securities will increase and market price will decrease. Certain mortgage-backed securities may be more volatile and less liquid than other traditional types of debt securities. In addition, an unexpectedly high rate of defaults on the mortgages held by a mortgage pool may adversely affect the value of a mortgage-backed security and could result in losses to the Portfolio. Investments in TBAs may give rise to a form of leverage and may cause the Portfolio's turnover rate to appear higher. Leverage may cause the Portfolio to be more volatile than if the Portfolio had not been leveraged.

•

Asset-Backed Securities.

Asset-backed securities are subject to the risk that consumer laws, legal factors or economic and market factors may result in the collateral backing the securities being insufficient to support payment on the securities. Some asset-backed securities also entail prepayment risk, which may vary depending on the type of asset.

•

Foreign and Emerging Market Securities.

Investments in foreign markets entail special risks such as currency, political, economic and market risks. There also may be greater market volatility, less reliable financial information, higher transaction and custody costs, decreased market liquidity and less government and exchange regulation associated with investments in foreign markets. In addition, investments in certain foreign markets, which have historically been considered stable, may become more volatile and subject to increased risk due to ongoing developments and changing conditions in such markets. Moreover, the growing interconnectivity of global economies and financial markets has increased the probability that adverse developments and conditions in one country or region will affect the stability of economies and financial markets in other countries or regions. The risks of investing in emerging market countries are greater than risks associated with investments in foreign developed countries. In addition, the Portfolio's investments may be denominated in foreign currencies and therefore, to the extent unhedged, the value of the investment will fluctuate with the U.S. dollar exchange rates. The precise matching of the foreign currency forward exchange contract amounts and the value of the securities involved will not generally be possible because the future value of such securities in foreign currencies will change as a consequence of market movements in the value of those securities between the date on which the contract is entered into and the date it matures. There is additional risk to the extent that foreign currency forward exchange contracts create exposure to currencies in which the

2

Portfolio's securities are not denominated. The use of foreign currency forward exchange contracts involves the risk of loss from the insolvency or bankruptcy of the counterparty to the contract or the failure of the counterparty to make payments or otherwise comply with the terms of the contract.

•

Liquidity Risk.

The Portfolio's investments in restricted and illiquid securities may entail greater risk than investments in publicly traded securities. These securities may be more difficult to sell, particularly in times of market turmoil. Illiquid securities may be more difficult to value. If the Portfolio is forced to sell an illiquid security to fund redemptions or for other cash needs, it may be forced to sell the security at a loss.

•

Derivatives.

A derivative instrument often has risks similar to its underlying asset and may have additional risks, including imperfect correlation between the value of the derivative and the underlying asset, risks of default by the counterparty to certain transactions, magnification of losses incurred due to changes in the market value of the securities, instruments, indices or interest rates to which they relate, and risks that the transactions may not be liquid. Certain derivative transactions may give rise to a form of leverage. Leverage magnifies the potential for gain and the risk of loss.

Shares of the Portfolio are not bank deposits and are not guaranteed or insured by the Federal Deposit Insurance Corporation or any other government agency.

Performance Information

The bar chart and table below provide some indication of the risks of investing in the Portfolio by showing changes in the Portfolio's Class I shares' performance from year-to-year and by showing how the Portfolio's average annual returns for the past one, five and 10 year periods and since inception compare with those of a broad measure of market performance, as well as an index that represents a group of similar mutual funds, over time. The performance of the other Classes will differ because the Classes have different ongoing fees. The Portfolio's past performance, before and after taxes, is not necessarily an indication of how the Portfolio will perform in the future. Updated performance information is available online at

www.morganstanley.com/im

.

Annual Total Returns—Calendar Years

|

High Quarter

|

|

6/30/09

|

|

|

2.76

|

%

|

|

|

Low Quarter

|

|

9/30/08

|

|

|

–8.87

|

%

|

|

Average Annual Total Returns For Periods Ended

December 31, 2012

|

|

|

Past

One Year

|

|

Past

Five Years

|

|

Past

Ten Years

|

|

Since

Inception

|

|

|

Class I

(commenced operations on 3/31/92)

|

|

|

Return before Taxes

|

|

|

3.33

|

%

|

|

|

–1.96

|

%

|

|

|

0.29

|

%

|

|

|

3.25

|

%

|

|

Return after Taxes on

Distributions

|

|

|

2.67

|

%

|

|

|

–3.06

|

%

|

|

|

–0.90

|

%

|

|

|

1.57

|

%

|

|

Return after Taxes on

Distributions and Sale of

Fund Shares

|

|

|

2.16

|

%

|

|

|

–2.28

|

%

|

|

|

–0.42

|

%

|

|

|

1.76

|

%

|

|

|

Class A

† (commenced operations on 9/28/07)

|

|

|

Return before Taxes

|

|

|

–1.17

|

%

|

|

|

–3.03

|

%

|

|

|

—

|

|

|

|

–2.83

|

%

|

|

|

Class L*

(commenced operations on 4/27/12)

|

|

|

Return before Taxes

|

|

|

N/A

|

|

|

|

N/A

|

|

|

|

N/A

|

|

|

|

N/A

|

|

|

Barclays Capital 1-3 Year

U.S. Government/Credit

Index

1

|

|

|

1.26

|

%

|

|

|

2.88

|

%

|

|

|

3.13

|

%

|

|

|

4.77

|

%

3

|

|

Lipper Short Investment

Grade Debt Funds Index

(reflects no deduction

for taxes)

2

|

|

|

3.94

|

%

|

|

|

3.02

|

%

|

|

|

3.03

|

%

|

|

|

4.45

|

%

3

|

|

† Effective September 9, 2013, Class P and Class H shares were renamed Class A shares. The historical performance of Class A shares has been restated to reflect the current maximum initial sales charge of 4.25%.

* Class L shares of the Portfolio had not completed a full calendar year of operations as of December 31, 2012 and therefore Class L does not have annualized return information to report. The returns for Class L shares would be lower than the returns for Class I shares of the Portfolio as expenses of Class L are higher. Return information for the Portfolio's Class L shares will be shown in future prospectuses offering the Portfolio's Class L shares after the Portfolio's Class L shares have a full calendar year of return information to report.

1

The Barclays Capital 1-3 Year U.S. Government/Credit Index tracks the securities in the 1-3 year maturity range of the Barclays Capital U.S. Government/Credit Index which tracks investment-grade (BBB-/Baa3) or higher publicly traded fixed rate U.S. government, U.S. agency, and corporate issues. It is not possible to invest directly in an index.

2

The Lipper Short Investment Grade Debt Funds Index is an equally weighted performance index of the largest qualifying funds (based on net assets) in the Lipper Short Investment Grade Debt Funds classification. There are currently 30 funds represented in this Index.

3

Since Inception reflects the inception date of Class I.

The after-tax returns shown in the table above are calculated using the historical highest individual federal marginal income tax rates during the period shown and do not reflect the impact of state and local taxes. After-tax returns for the Portfolio's other Classes will vary from Class I shares' returns. Actual after-tax returns depend on the investor's tax situation and may differ from those shown, and after-tax returns are not relevant to investors who hold their Portfolio shares through tax deferred arrangements such as 401(k) plans or individual retirement accounts. After-tax returns may be higher than before-tax returns due to foreign tax credits and/or an assumed benefit from capital losses that would have been realized had Portfolio shares been sold at the end of the relevant periods, as applicable.

Fund Management

Adviser.

Morgan Stanley Investment Management Inc.

Portfolio Managers.

The Portfolio is managed by members of the Taxable Fixed Income team. Information about the members

3

jointly and primarily responsible for the day-to-day management of the Portfolio is shown below:

|

Name

|

|

Title with

Adviser

|

|

Date Began

Managing Portfolio

|

|

|

Divya Chhibba

|

|

Vice President

|

|

January 2013

|

|

|

Joseph Mehlman

|

|

Executive Director

|

|

May 2008

|

|

|

Neil Stone

|

|

Managing Director

|

|

January 2011

|

|

Purchase and Sale of Fund Shares

The minimum initial investment generally is $5,000,000 for Class I shares and $1,000 for each of Class A and Class L shares of the Portfolio. You may not be subject to the minimum investment requirements under certain circumstances. For more information, please refer to the "Purchasing Class I and Class L Shares—Share Class Arrangements," "—Other Purchase Information" and "Purchasing Class A Shares" sections beginning on pages 41, 42 and 43, respectively, of the Prospectus.

Class I and Class L shares may be purchased or sold on any day the New York Stock Exchange ("NYSE") is open for business directly through the Fund by mail (c/o Boston Financial Data Services, Inc., P.O. Box 219804, Kansas City, MO 64121-9804) or by telephone (1-800-548-7786) or by contacting your authorized financial intermediary. For more information, please refer to the "Purchasing Class I and Class L Shares" and

"Redeeming Shares" sections beginning on pages 41 and 46, respectively, of the Prospectus.

Class A shares of the Portfolio may be purchased or sold by contacting your authorized financial intermediary. For more information, please refer to the "Purchasing Class A Shares" and "Redeeming Shares" sections beginning on pages 43 and 46, respectively, of the Prospectus.

Tax Information

The Portfolio intends to make distributions that may be taxed as ordinary income or capital gains, unless you are investing through a tax-deferred arrangement, such as a 401(k) plan or an individual retirement account.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase the Portfolio through a broker-dealer or other financial intermediary (such as a bank), the Adviser and/or the Portfolio's "Distributor," Morgan Stanley Distribution, Inc., may pay the intermediary for the sale of Portfolio shares and related services. These payments, which may be significant in amount, may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Portfolio over another investment. Ask your salesperson or visit your financial intermediary's web site for more information.

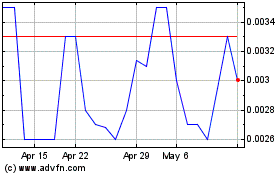

Stevia (PK) (USOTC:STEV)

Historical Stock Chart

From Sep 2024 to Oct 2024

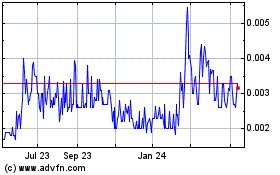

Stevia (PK) (USOTC:STEV)

Historical Stock Chart

From Oct 2023 to Oct 2024