UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

|

Filed by the Registrant ☒

|

|

Filed by a Party other than the Registrant ☐

|

|

Check the appropriate box:

|

|

☐

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a–6(e)(2))

|

|

☒

|

Definitive Proxy Statement

|

|

☐

|

Definitive Additional Materials

|

|

☐

|

Soliciting Material under §240.14a–12

|

|

SILVER BULL RESOURCES, INC.

|

|

(Name of Registrant as Specified In Its Charter)

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

|

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

☒

|

No fee required.

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14a–6(i)(1) and 0–11.

|

|

|

(1)

|

Title of each class of securities to which

transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction

applies:

|

|

|

(3)

|

Per unit price or other underlying value of

transaction computed pursuant to Exchange Act Rule 0–11 (set forth the amount on which the filing fee is calculated

and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

(5)

|

Total fee paid:

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0–11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

(3)

|

Filing Party:

|

|

|

(4)

|

Date Filed:

|

SILVER BULL RESOURCES, INC.

777 Dunsmuir Street, Suite 1610

Vancouver, British Columbia V7Y 1K4

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON WEDNESDAY, DECEMBER 16,

2020

To the Shareholders of Silver Bull Resources,

Inc.:

A special meeting of shareholders of

Silver Bull Resources, Inc., a Nevada corporation (“Silver Bull” or the “Company”), will be held at the

Company’s offices at 777 Dunsmuir Street, Suite 1610, Vancouver, British Columbia V7Y 1K4, on Wednesday, December 16,

2020 at 10:00 a.m. local time for the purpose of considering and voting upon proposals to:

-

Approve and adopt amended and restated articles of incorporation of the Company to

increase the number of authorized shares of Silver Bull common stock from 37.5 million to 300 million and to make certain

non-substantive amendments;

-

Approve and adopt amended and restated articles of incorporation of the Company to

change the Company’s name to MaxMetals Corp. and to make certain non-substantive amendments; and

-

Transact such other business as may lawfully come before the meeting or any adjournment(s)

or postponement(s) thereof.

The Board of Directors has fixed

the close of business on October 23, 2020 as the record date for determination of the Company’s shareholders entitled to

vote at the meeting and any adjournment(s) or postponement(s) thereof. This Notice of Special Meeting of Shareholders and

related proxy materials are being distributed or made available to shareholders beginning on or about November 6, 2020.

Under

the U.S. Securities and Exchange Commission and Canadian securities rules, we have elected to use the Internet for delivery of

the special meeting materials to our shareholders, enabling us to provide them with the information they need, while lowering the

costs of delivery and reducing the environmental impact associated with the special meeting. Our proxy materials are available

at www.proxyvote.com. We also post our proxy materials on our website at www.silverbullresources.com/investors/agm.

We cordially invite you to attend the

special meeting. Whether or not you plan to attend, it is important that your shares be represented and voted at the meeting. Please

refer to your proxy card or Notice Regarding the Availability of Proxy Materials for more information on how to vote your shares

at the meeting and return your voting instructions as promptly as possible.

Thank you for your support.

|

|

BY ORDER OF THE BOARD OF DIRECTORS,

BRIAN D. EDGAR, CHAIRMAN

|

|

IMPORTANT NOTICE

REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE SPECIAL

MEETING OF SHAREHOLDERS TO BE HELD ON WEDNESDAY, DECEMBER 16, 2020

Our Notice of Special

Meeting of Shareholders and proxy statement are available at

www.proxyvote.com

If you

have questions regarding the Meeting or require assistance with voting, you may contact Laurel Hill Advisory Group at

1-877-452-7184 (North America toll free) or 1-416-304-0211 (calls outside North America) or by email at assistance@laurelhill.com

|

TABLE OF CONTENTS

|

ABOUT THE SPECIAL MEETING

|

1

|

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

|

6

|

|

PROPOSAL 1: to INCREASE THE NUMBER OF AUTHORIZED SHARES OF SILVER BULL COMMON STOCK

|

8

|

|

PROPOSAL 2: to CHANGE THE COMPANY’S NAME

|

10

|

|

OTHER MATTERS

|

12

|

|

SHAREHOLDER PROPOSALS

|

12

|

|

ANNEX A: AMENDED AND RESTATED ARTICLES OF INCORPORATION

|

A-1

|

|

Annex B:

MARKED VERSION OF AMENDED AND RESTATED ARTICLES OF INCORPORATION

|

B-1

|

SILVER BULL RESOURCES, INC.

777 Dunsmuir Street, Suite 1610

Vancouver, British Columbia V7Y 1K4

PROXY STATEMENT

SPECIAL MEETING OF SHAREHOLDERS

WEDNESDAY, DECEMBER 16, 2020

ABOUT

THE SPECIAL MEETING

This proxy statement (the “Proxy

Statement”) is furnished to shareholders of Silver Bull Resources, Inc. (“Silver Bull,” the “Company,”

“us,” or “we”) in connection with the solicitation of proxies by the Board of Directors of Silver Bull

(the “Board”), on behalf of the Company, to be voted at the Special Meeting of Shareholders (the “Meeting”).

The Meeting will be held at the Company’s offices at 777 Dunsmuir Street, Suite 1610, Vancouver, British Columbia V7Y

1K4, on Wednesday, December 16, 2020 at 10:00 a.m. local time, or at any adjournment or postponement thereof. The Meeting

is being held for the purposes set forth in the accompanying Notice of Special Meeting of Shareholders. The Meeting will be held

observing all COVID-19 protocols, including mandatory wearing of masks and social distancing of at least two meters. No refreshments

will be served and all attendees will disperse immediately after the meeting chair declares the Meeting adjourned.

We have elected to provide access to

our proxy materials on the Internet under the U.S. Securities and Exchange Commission (the “SEC”) and Canadian securities

regulators’ “notice and access” rules. Our proxy materials are available at www.proxyvote.com. We also post our

proxy materials on our website at www.silverbullresources.com/investors/agm. The Notice of Special Meeting of Shareholders and

related proxy materials are being made available to shareholders beginning on or about November 6, 2020.

All references to currency in this Proxy

Statement are in U.S. dollars, unless otherwise indicated.

Notice of Internet Availability of

Proxy Materials

On or about November 6, 2020, we

will furnish a Notice of Internet Availability of Proxy Materials (“Notice”) to our shareholders containing

instructions on how to access the proxy materials and vote online. In addition, instructions on how to request a printed copy

of these materials may be found on the Notice. If you received a Notice by mail, you will not receive a paper copy of the

proxy materials unless you request such materials by following the instructions contained on the Notice. Your vote is

important regardless of the extent of your holdings.

Solicitation Costs

The cost of preparing and mailing

the Notice, handling requests for proxy materials, and the cost of solicitation of proxies on behalf of the Board will be

borne by the Company. Proxies may be solicited personally or via mail, telephone or facsimile by directors, officers and

regular employees of the Company, none of whom will receive any additional compensation for such solicitations. The Company

has retained Laurel Hill Advisory Group (“Laurel Hill”) to act as its proxy solicitation agent. In connection with these

services, Laurel Hill will receive $30,000 plus reasonable out-of-pocket expenses.

If you have questions regarding

the Meeting or require assistance with voting, you may contact Laurel Hill at 1-877-452-7184 (North America toll free) or

1-416-304-0211 (calls outside North America) or by email at assistance@laurelhill.com.

Dissenters Rights

The proposed corporate actions on which

the Company’s shareholders are being asked to vote are not corporate actions for which shareholders of a Nevada corporation

have the right to dissent under the Nevada Private Corporations Chapter of the Nevada Revised Statutes, Nev. Rev. Stat. 78.

What is the purpose of the Meeting?

At our Meeting, shareholders will vote

on the following items of business:

-

Approve and adopt amended and restated articles of incorporation of the Company to

increase the number of authorized shares of Silver Bull common stock from 37.5 million to 300 million and to make certain

non-substantive amendments (the “Authorized Shares A&R Articles”); and

-

Approve and adopt amended and restated articles of incorporation of the Company to

change the Company’s name to MaxMetals Corp. and to make certain non-substantive amendments (the “Company Name Change

A&R Articles”).

You will also vote on such other matters

as may properly come before the Meeting or any postponement(s) or adjournment(s) thereof.

What are the Board’s recommendations?

The Board recommends that you vote:

|

|

1.

|

“FOR” the proposal to increase the number of authorized

shares of Silver Bull common stock by approving and adopting the Authorized Shares A&R Articles; and

|

|

|

2.

|

“FOR” the proposal to change the Company’s

name by approving and adopting the Company Name Change A&R Articles.

|

At this time, our management does not

intend to present other items of business and knows of no items of business that are likely to be brought before the Meeting, except

those described in this Proxy Statement. However, if any other matters should properly come before the Meeting, the persons named

in the enclosed proxy will have discretionary authority to vote the shares represented by such proxy in accordance with their best

judgment on the matters.

What shares are entitled to vote?

As of the close of business on

October 23, 2020, the record date for the Meeting, we had 29,542,365 shares of Silver Bull common stock outstanding. Each

share of Silver Bull common stock outstanding on the record date is entitled to one vote on all items being voted on at the

Meeting. You can vote all of the shares that you owned on the record date. These shares include (i) shares held directly

in your name as the shareholder of record and (ii) shares held for you as the beneficial owner through a broker, bank or

other nominee.

What is required to approve each

item and how will abstentions be counted?

-

For Proposal 1 (to approve and adopt the Authorized Shares A&R Articles),

the affirmative vote of the holders of a majority of the outstanding shares of Silver Bull common stock is required for approval,

provided a quorum is present. Abstentions with respect to Proposal 1 will have the same effect of a vote “AGAINST”

the proposal.

-

For Proposal 2 (to approve and adopt the Company Name Change A&R Articles),

the affirmative vote of the holders of a majority of the outstanding shares of Silver Bull common stock is required for approval,

provided a quorum is present. Abstentions with respect to Proposal 2 will have the same effect of a vote “AGAINST”

the proposal.

How do I vote my shares?

Each share of Silver Bull common stock

that you own entitles you to one vote. Your Notice or proxy card shows the number of shares of Silver Bull common stock that you

own. You may elect to vote in one of the following methods:

-

By Mail – If you have requested a paper copy of the proxy materials,

please date and sign the proxy card and return it promptly in the accompanying envelope.

-

By Internet – If you received a Notice of Internet Availability of Proxy

Materials, you can access our proxy materials and vote online. Instructions to vote online are provided in the Notice.

-

By Telephone – You may vote your shares by calling the telephone number

specified on your proxy card. You will need to follow the instructions on your proxy card and the voice prompts.

-

In Person – You may attend the Meeting and vote in person. We will give

you a ballot when you arrive. If your stock is held in the name of your broker, bank or another nominee (a “Nominee”),

then you must present a proxy from that Nominee in order to verify that the Nominee has not already voted your shares on your behalf.

If your shares are held in an account

at a brokerage firm, bank, dealer, or other similar organization, then you are the beneficial owner of shares held in “street

name,” and the Notice or proxy materials, as applicable, are being forwarded to you by that organization. The organization holding your account is considered the shareholder of record for purposes of voting at the Meeting.

Your Voting Instruction Form from Broadridge

Financial Solutions, Inc. (“Broadridge”) or your Notice provides information on how to vote your shares. Additionally,

Silver Bull may utilize the Broadridge Quickvote service to assist eligible beneficial owners with voting their shares. Eligible

beneficial owners may be contacted by Laurel Hill to conveniently provide their vote directly over the phone.

If you are a beneficial owner of shares

held in street name and do not provide the organization that holds your shares with specific voting instructions, the organization

that holds your shares may generally vote on “routine” matters such as Proposal 1 (to increase the number of authorized

shares of Silver Bull common stock) and Proposal 2 (to change the Company’s name), but cannot vote on “non-routine”

matters.

Proxies submitted properly by one of

the methods discussed above will be voted in accordance with the instructions contained therein. If the proxy is submitted but

voting directions are not provided, the proxy will be voted “FOR” the proposal to increase the number of authorized

shares of Silver Bull common stock and “FOR” the proposal to change the Company’s name, and in such manner as

the proxy holders named on the proxy, in their discretion, determine upon such other business as may properly come before the Meeting

or any adjournment or postponement thereof.

Who may attend the Meeting?

All shareholders as of the record

date, or their duly appointed proxies, may attend the Meeting. If you are not a shareholder of record but hold shares through

a broker or bank (i.e., in street name), you should provide proof of beneficial ownership on the record date, such as your

most recent account statement as of October 23, 2020, a copy of the voting instruction card provided by your broker, bank or

other holder of record, or other similar evidence of ownership. Cameras, recording devices and other electronic devices will

not be permitted at the Meeting.

How may I vote my shares in person

at the Meeting?

Shares held in your name as the shareholder

of record may be voted in person at the Meeting. Shares held beneficially in street name may be voted in person only if you obtain

a legal proxy from the broker, bank or other holder of record that holds your shares giving you the right to vote the shares. Even

if you plan to attend the Meeting, we recommend that you also submit your proxy or voting instructions prior to the Meeting as

described below so that your vote will be counted if you later decide not to attend the Meeting.

May I change my vote or revoke my

proxy after I return my proxy card?

Yes. Even after you have submitted your

proxy, you may change the votes you cast or revoke your proxy at any time before the votes are cast at the Meeting (i) by

delivering a written notice of your revocation to our principal executive office, if sent by regular mail, to Silver Bull Resources,

Inc., 777 Dunsmuir Street, Suite 1610, P.O. Box 10427, Vancouver, British Columbia, V7Y 1K4, Canada, or, if sent other than by

regular mail, to Silver Bull Resources, Inc., 777 Dunsmuir Street, Suite 1610, Vancouver, British Columbia, V7Y 1K4, Canada; or

(ii) by executing and delivering a later-dated proxy. In addition, the powers of the proxy holders will be suspended if you

attend the Meeting in person and so request, although attendance at the Meeting will not by itself revoke a previously granted

proxy. Notwithstanding the foregoing, no proxy will be counted unless it is received by the Company prior to the commencement of

the Meeting.

What constitutes a quorum?

The presence, in person or by proxy,

of one-third of the shares of Silver Bull common stock outstanding as of the record date constitutes a quorum for the transaction

of business at the Meeting. In the event there are not sufficient votes for a quorum or to approve any proposals at the time of

the Meeting, the Meeting may be adjourned in order to permit further solicitation of proxies. The inspector of election will treat

shares of Silver Bull common stock represented by a properly signed and returned proxy as present at the Meeting for purposes of

determining a quorum, without regard to whether the proxy is marked as casting a vote or abstaining. Abstentions as to particular

matters would nonetheless be counted for purposes of determining whether a quorum is present at the Meeting.

What does it mean if I receive more

than one proxy card?

If you receive more than one proxy card,

it means that you hold shares registered in more than one name or brokerage account. You should sign and return all proxies for

each proxy card that you receive in order to ensure that all of your shares are voted.

How may I vote on each of the proposals?

For each of Proposals 1 and 2,

you may vote “FOR” or “AGAINST” the proposal, or you may indicate that you wish to “ABSTAIN”

from voting on the proposal.

Who will count the proxy votes?

We currently expect that Broadridge

will tabulate the votes and that the Company’s Chief Financial Officer, Christopher Richards, will serve as inspector of

election for the Meeting.

How will voting on any other business

be conducted?

We do not expect any matters to be presented

for a vote at the Meeting other than the matters described in this Proxy Statement. If you grant a proxy, either of the officers

named as proxy holder, Timothy Barry or Christopher Richards, will have the discretion to vote your shares on any additional matters

that are properly presented for a vote at the Meeting.

Why

is the Company seeking approval to increase the number of authorized shares of Silver Bull common stock?

The proposed increase in the number

of authorized shares of Silver Bull common stock would enable the Company, without further shareholder approval, to issue shares

from time to time as may be required for various business purposes, including but not limited to raising additional capital to

further the development of the Sierra Mojada project in Mexico and the Beskauga property

(and other properties) located in Kazakhstan. Assuming the transactions contemplated by the previously disclosed option

agreement (the “Copperbelt Option Agreement”), dated as of August 12, 2020, with Copperbelt AG, a corporation

existing under the laws of Switzerland (“Copperbelt Parent”), and Dostyk LLP, an entity existing under the laws of

Kazakhstan and a wholly-owned subsidiary of Copperbelt Parent (“Copperbelt Sub,” and together with Copperbelt Parent,

“Copperbelt”), are completed, the Company will be required, among other things, (i) to incur $15 million

in cumulative exploration expenditures on the Beskauga property located in Kazakhstan by the fourth anniversary following the closing

date in order to maintain the effectiveness of the option to acquire the Beskauga property (the “Copperbelt Option”),

(ii) to pay Copperbelt up to $15 million in cash to exercise the Copperbelt Option, and (iii) to make up to $32 million

in cumulative bonus payments to Copperbelt Parent if the Beskauga property is the subject of a bankable feasibility study in compliance

with Canadian National Instrument 43-101 indicating specified amounts of gold equivalent resources. We expect to finance part,

if not all, of such costs through public and private issuances of Silver Bull common stock when we believe market conditions to

be favorable.

By increasing the number of authorized

shares of Silver Bull common stock now, we will be able to act in a timely manner when the need to raise equity capital arises

or when the Board believes it is in the best interests of the Company and our shareholders to take action, without the delay and

expense that would be required at that time to obtain shareholder approval to increase our authorized shares. Virtually all junior

exploration companies like Silver Bull remain as viable companies and conduct their mineral exploration activities by raising funds

by issuing shares from time to time. In the absence of an affirmative vote to increase the number of authorized shares of Silver

Bull common stock, the Company will have an insufficient number of authorized shares to raise funds to fund our general corporate

overhead or cover the costs associated with maintaining its interests in the Sierra Mojada project in Mexico or its potential mineral

interests in Kazakhstan.

The foregoing description of the Copperbelt

Option Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Copperbelt

Option Agreement, a copy of which is filed as Exhibit 10.1 to Silver Bull’s current report on Form 8-K/A filed

with the SEC on November 5, 2020 and is incorporated herein by reference.

Why

is the Company seeking approval to change its name from Silver Bull Resources, Inc. to MaxMetals Corp.?

The

primary exploration project of the Company is its Sierra Mojada project in Mexico. As soon as the blockade by the cooperative of

local miners called Sociedad Cooperativa de Exploración Minera Mineros Norteños, S.C.L. (“Mineros Norteños”)

is resolved, the Company plans to resume its drilling program to explore its concessions at the Sierra Mojada property with respect

to silver and zinc mineralization. If the transactions contemplated by the Copperbelt Option Agreement are completed, the

Company will be required to, among other things, incur certain exploration expenditures on the Beskauga property located in Kazakhstan

and make certain bonus payments if the Beskauga property is the subject of a bankable feasibility study indicating specified amounts

of gold equivalent resources. Going forward, the Company believes its exploration efforts

at the Sierra Mojada project in Mexico, the Beskauga property in Kazakhstan, and/or other properties will focus on advancing the

exploration and potential development of silver and zinc, gold, and possibly other metal resources. Accordingly, the Board believes

that the proposed name change from Silver Bull Resources, Inc. to MaxMetals Corp. is appropriate to better describe the Company’s

focus and anticipated exploration activities.

What

are the non-substantive amendments that are included in each of the Authorized Shares A&R Articles and the Company Name Change

A&R Articles?

The two non-substantive amendments that

are reflected in each of the Authorized Shares A&R Articles and the Company Name Change A&R Articles are (i) including

the name of the Company’s registered agent to comply with Nevada law and (ii) revising the description of the Company’s

business purpose to simply provide that the Company is authorized to engage in any lawful activity permitted under Nevada law.

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

On September 18, 2020, the Company

completed a one-for-eight reverse stock split of the shares of Silver Bull common stock. All share and per share information in

this Proxy Statement has been adjusted to reflect the impact of the reverse stock split.

Security Ownership of Management

The number of shares of Silver

Bull common stock outstanding as of November 3, 2020 was 33,165,945. The following table sets forth as of November 3, 2020

the number of shares of Silver Bull common stock beneficially owned by each of the Company’s directors and named

executive officers and the number of shares beneficially owned by all of the directors and named executive officers as a

group:

|

Name and Address of Beneficial Owner (1)

|

|

Position

|

|

Amount and Nature of Beneficial Ownership (2)

|

|

Percent of Common Stock

|

|

Brian D. Edgar

|

|

Chairman and Director

|

|

|

1,574,954

|

(4)

|

|

|

4.66

|

%

|

|

Timothy T. Barry

|

|

President, Chief Executive Officer and Director

|

|

|

665,375

|

(5)

|

|

|

1.97

|

%

|

|

Sean C. Fallis

|

|

Former Chief Financial Officer (3)

|

|

|

515,000

|

(6)

|

|

|

1.53

|

%

|

|

Daniel J. Kunz

|

|

Director

|

|

|

355,625

|

(7)

|

|

|

*

|

|

|

John A. McClintock

|

|

Director

|

|

|

136,500

|

(8)

|

|

|

*

|

|

|

Christopher Richards

|

|

Chief Financial Officer

|

|

|

24,000

|

(9)

|

|

|

*

|

|

|

All directors and executive officers as a group (6 persons)

|

|

|

|

|

3,271,454

|

|

|

|

9.86

|

%

|

_________________________

|

|

*

|

The percentage of Silver Bull common stock beneficially owned is less than one percent (1%).

|

|

|

(1)

|

The address of these persons is c/o Silver Bull Resources, Inc., 777 Dunsmuir Street, Suite 1610,

Vancouver, British Columbia V7Y 1K4.

|

|

|

(2)

|

Calculated in accordance with Rule 13d-3 under the Securities Exchange Act of 1934, as amended

(the “Exchange Act”).

|

|

|

(3)

|

Mr. Fallis resigned from his position as the Company’s Chief Financial Officer effective

as of September 25, 2020.

|

|

|

(4)

|

Consists of (i) 706,352 shares of Silver Bull common stock held directly, (ii) 512,500

stock options, which are vested or will vest within 60 days, (iii) warrants to purchase 106,500 shares of Silver Bull

common stock that are exercisable or will be exercisable within 60 days, and (iv) 249,602 shares of Silver Bull common stock

owned by Tortuga Investments Corp., a company wholly owned by Mr. Edgar. Excludes (a) 425,000 shares of Silver Bull common

stock and (b) warrants to purchase 212,500 shares of Silver Bull common stock, in each case that are owned by 0893306 B.C.

Ltd., a company wholly owned by Mr. Edgar’s spouse, and of which Mr. Edgar disclaims beneficial ownership.

|

|

|

(5)

|

Consists of (i) 127,875 shares of Silver Bull common stock held directly and (ii) 537,500

stock options, which are vested or will vest within 60 days.

|

|

|

(6)

|

Consists of (i) 2,500 shares of Silver Bull common stock held directly and (ii) 512,500

stock options, which are vested or will vest within 60 days.

|

|

|

(7)

|

Consists of (i) 163,125 shares held directly, (ii) 112,500 stock options, which are vested

or will vest within 60 days, and (iii) warrants to purchase 80,000 shares of Silver Bull common stock that are exercisable

or will be exercisable within 60 days.

|

|

|

(8)

|

Consists of (i) 16,000 shares of Silver Bull common stock held directly, (ii) 112,500

stock options, which are vested or will vest within 60 days, and (iii) warrants to purchase 8,000 shares of Silver Bull common

stock that are exercisable or will be exercisable within 60 days.

|

|

|

(9)

|

Consists of (i) 16,000 shares of Silver Bull common stock held directly and (ii) warrants

to purchase 8,000 shares of Silver Bull common stock that are exercisable or will be exercisable within 60 days.

|

Security Ownership of Certain Beneficial

Owners

The following table sets forth the beneficial

ownership of Silver Bull common stock as of November 3, 2020 by each person (other than the directors and executive officers

of the Company) who owned of record, or was known to own beneficially, more than 5% of the outstanding voting shares of Silver

Bull common stock.

Name and

Address of Beneficial Owner

|

|

Amount and Nature of Beneficial Ownership (1)

|

|

Percent of Common Stock

|

Ibex Microcap Fund LLLP (2)

c/o Ibex Investors LLC

3200 Cherry Creek South Drive, Suite 670

Denver, Colorado 80209

|

|

|

2,181,020

|

|

|

|

6.58%

|

|

_________________________

|

|

(1)

|

Calculated in accordance with Rule 13d-3 under the Exchange Act.

|

|

|

(2)

|

This information is based on a Schedule 13G/A filed on January 24, 2020 by Justin B.

Borus, Ibex Investors LLC (“Ibex Investors”), Ibex Microcap Fund LLLP (“Ibex Microcap”), Lazarus Macro

Micro Partners LLLP (“Macro Micro Partners”), and Ibex Investment Holdings LLC (“Ibex Investment Holdings”).

The securities set forth above consist of 2,179,732 shares of Silver Bull common stock held by Ibex Microcap and 1,288 shares of

Silver Bull common stock held by Macro Micro Partners. Ibex Investors is the investment manager and general partner of Ibex Microcap

and Macro Micro Partners. Ibex Investment Holdings is the sole member of Ibex Investors. Justin B. Borus is the manager of Ibex

Investors and Ibex Investment Holdings. Justin B. Borus, Ibex Investors and Ibex Investment Holdings may be deemed to beneficially

own the shares of Silver Bull common stock directly beneficially owned by Ibex Microcap and Macro Micro Partners. Each of Ibex

Investors, Ibex Microcap, Macro Micro Partners, Ibex Investment Holdings and Mr. Borus disclaims beneficial ownership with

respect to any shares other than the shares directly beneficially owned by such entity or person.

|

PROPOSAL 1:

to INCREASE THE NUMBER OF AUTHORIZED SHARES OF SILVER BULL COMMON STOCK

On October 22,

2020, the Board adopted a resolution to amend and restate the articles of incorporation of the Company to increase the number of

authorized shares of Silver Bull common stock from 37.5 million to 300 million and to make certain non-substantive amendments

(the “Authorized Shares A&R Articles”). The adoption of the resolution is subject to shareholder approval.

As of November 3,

2020, we were authorized to issue up to 37.5 million shares of Silver Bull common stock, of which 33,165,945 shares of

Silver Bull common stock were issued and outstanding.

The proposed increase in the number

of authorized shares of Silver Bull common stock would enable the Company, without further shareholder approval, to issue shares

from time to time as may be required for various business purposes, including but not limited to raising additional capital to

further the development of the Sierra Mojada project in Mexico as soon as the blockade by

Mineros Norteños is resolved and the Beskauga property in Kazakhstan. Assuming the transactions contemplated by the

Copperbelt Option Agreement are completed, the Company will be required, among other things, (i) to incur $15 million

in cumulative exploration expenditures on the Beskauga property located in Kazakhstan by the fourth anniversary following the closing

date in order to maintain the effectiveness of the Copperbelt Option, (ii) to pay Copperbelt up to $15 million in cash

to exercise the Copperbelt Option, and (iii) to make up to $32 million in cumulative bonus payments to Copperbelt Parent

if the Beskauga property is the subject of a bankable feasibility study in compliance with Canadian National Instrument 43-101

indicating specified amounts of gold equivalent resources. We expect to finance part, if not all, of such costs through public

and private issuances of Silver Bull common stock when we believe market conditions to be favorable.

The proposed increase in the number

of authorized shares of Silver Bull common stock would not change the terms of Silver Bull common stock, and the additional shares

of Silver Bull common stock would have rights identical to the currently outstanding Silver Bull common stock. The Company does

not currently have any specific plans to issue additional shares of Silver Bull common stock but expects to continue to issue shares

of Silver Bull common stock under its equity compensation plans from time to time. In addition, the Board will continue to assess

opportunities to issue shares of Silver Bull common stock from time to time in potential offerings for capital-raising purposes.

The Board has not proposed an increase in the number of authorized shares of Silver Bull common stock with the intention of discouraging

tender offers or takeover attempts relating to the Company.

The Board recognizes that the issuance

of additional shares of Silver Bull common stock may dilute the existing holders of our common stock. However, the Board believes

that these potential risks are outweighed by the benefit that an increase in the number of available shares would provide in terms

of additional financing flexibility. The Board believes that retaining the ability to act quickly on future opportunities that

may require or be facilitated by additional stock issuances will benefit existing shareholders.

By increasing to the number of authorized

shares of Silver Bull common stock now, we will be able to act in a timely manner when the need to raise equity capital arises

or when the Board believes it is in the best interests of the Company and our shareholders to take action, without the delay and

expense that would be required at that time to obtain shareholder approval of such an increase.

In addition to the proposed increase

in the number of authorized shares of Silver Bull common stock, the Authorized Shares A&R Articles include the following two

non-substantive amendments:

|

|

1.

|

The Authorized Shares A&R Articles have been revised to reflect

an amendment to Article No. 2 to include the name of the Company’s registered agent.

|

|

|

2.

|

Nevada law provides that subject to such limitations, if any, as

may be contained in a corporation’s articles of incorporation, every corporation has certain enumerated powers. The Board

believes that the description of the purpose of the Company, as reflected in Article No. 3 of the Company’s articles

of incorporation currently in effect, may be interpreted to unnecessarily limit the broad purpose of the Company that is otherwise

provided for statutorily. As permitted under Nevada law, the Authorized Shares A&R Articles reflect an amendment to Article

No. 3 to allow the Company to engage in any lawful activity permitted under Nevada law. No change to the Company’s business

strategy is being considered by the Board.

|

Clean and marked versions of the Authorized

Shares A&R Articles, noting the proposed changes to the current articles of incorporation of the Company in annotated footnotes

and strikethrough and underlined text, as applicable, are attached to this Proxy Statement as Annex A and Annex B,

respectively, and are incorporated by reference herein.

If the Authorized Shares A&R Articles

are approved, we intend to file with the Secretary of State of the State of Nevada amended and restated articles of incorporation

reflecting the amendments contemplated by this proposal. If both the Authorized Shares A&R Articles and the Company Name Change

A&R Articles are approved, we intend to file with the Secretary of State of the State of Nevada amended and restated articles

of incorporation reflecting the amendments contemplated by both proposals. The amended and restated articles of incorporation will

be effective immediately upon filing with the Secretary of State of the State of Nevada. At any time prior to the filing of the

amended and restated articles of incorporation with the Secretary of State of the State of Nevada, notwithstanding shareholder

approval thereof and without further action by the shareholders, the Board, in its sole discretion, may abandon or delay the filing

of either or both of the Authorized Shares A&R Articles and the Company Name Change A&R Articles.

Based on the foregoing, the

Board deems it advisable and in the best interest of the Company that its shareholders approve the Authorized Shares A&R Articles.

Appraisal

Rights

Dissenting shareholders do not have

appraisal rights under Nevada state law or under the Company’s articles of incorporation or bylaws in connection with the

Authorized Shares A&R Articles.

Effectiveness

of Authorized Shares A&R Articles

The Authorized Shares A&R Articles

will become effective once they are approved at the Meeting and, at the Board’s sole discretion, filed with the Secretary

of State of the State of Nevada.

Vote

Required for Approval

Approval of the Authorized Shares A&R

Articles will require the affirmative vote of the holders of a majority of the outstanding shares of Silver Bull common stock,

provided a quorum is present.

Board

Recommendation

The Board unanimously recommends that

you vote “FOR” the Authorized Shares A&R Articles.

PROPOSAL 2:

to CHANGE THE COMPANY’S NAME

Silver Bull Resources, Inc. has been

the Company’s legal name since April 2011. On October 22, 2020, the Board adopted a resolution to amend and restate

the articles of incorporation of the Company to change the name of the Company to MaxMetals Corp. and to make certain non-substantive

amendments (the “Company Name Change A&R Articles”). The adoption of the resolution is subject to shareholder approval.

The

primary exploration project of the Company is its Sierra Mojada project in Mexico. As soon as the blockade by Mineros Norteños

is resolved, the Company plans to resume its drilling program to explore its concessions at the Sierra Mojada property with respect

to silver and zinc mineralization. If the transactions contemplated by the Copperbelt Option Agreement are completed, the

Company will be required to, among other things, incur certain exploration expenditures on the Beskauga property located in Kazakhstan

and make certain bonus payments if the Beskauga property is the subject of a bankable feasibility study indicating specified amounts

of gold equivalent resources. Going forward, the Company believes its exploration efforts

at the Sierra Mojada project in Mexico, the Beskauga property in Kazakhstan, and/or other properties will focus on advancing the

exploration and potential development of silver and zinc, gold, and possibly other metal resources. Accordingly, the Board believes

that the proposed name change from Silver Bull Resources, Inc. to MaxMetals Corp. is appropriate to better describe the Company’s

focus and anticipated exploration activities.

In addition to the proposed change to

the Company’s name, the Company Name Change A&R Articles include the same two non-substantive amendments that are reflected

in the Authorized Shares A&R Articles: (i) including the name of the Company’s registered agent to comply with Nevada

law and (ii) changing the Company’s business purpose to allow the Company to engage in any lawful activity permitted

under Nevada law.

Clean and marked versions of the Company

Name Change A&R Articles, noting the proposed changes to the current articles of incorporation of the Company in annotated

footnotes and strikethrough and underlined text, as applicable, are attached to this Proxy Statement as Annex A and

Annex B, respectively, and are incorporated by reference herein.

If the Company Name Change Articles

are approved, we intend to file with the Secretary of State of the State of Nevada amended and restated articles of incorporation

reflecting the amendments contemplated by this proposal and work with the Financial Industry Regulatory Authority (FINRA) to obtain

a new trading symbol for Silver Bull common stock. If both the Authorized Shares A&R Articles and the Company Name Change A&R

Articles are approved, we intend to file with the Secretary of State of the State of Nevada amended and restated articles of incorporation

reflecting the amendments contemplated by both proposals. The amended and restated articles of incorporation will be effective

immediately upon filing with the Secretary of State of the State of Nevada. At any time prior to the filing of the amended and

restated articles of incorporation with the Secretary of State of the State of Nevada, notwithstanding shareholder approval thereof

and without further action by the shareholders, the Board, in its sole discretion, may abandon or delay the filing of either or

both of the Company Name Change A&R Articles and the Authorized Shares A&R Articles. The change of the Company’s

name to MaxMetals Corp. may not be reflected in the general market until after it is effective under Nevada law, and the Company

may not be assigned a new trading symbol for some time (if at all).

Based on the foregoing, the

Board deems it advisable and in the best interest of the Company that its shareholders approve the Company Name Change A&R

Articles.

Effectiveness

of Company Name Change A&R Articles

The Company Name Change A&R Articles

will become effective once they are approved at the Meeting and, at the Board’s sole discretion, filed with the Secretary

of State of the State of Nevada.

Vote

Required for Approval

Approval of the Company Name Change

A&R Articles will require the affirmative vote of the holders of a majority of the outstanding shares of Silver Bull common

stock, provided a quorum is present.

Board

Recommendation

The Board unanimously recommends that

you vote “FOR” the approval of the Company Name Change A&R Articles.

OTHER

MATTERS

Management and the Board of the Company

know of no matters to be brought before the Meeting other than as set forth herein. However, if any such other matters properly

are presented to the Company’s shareholders for action at the Meeting and any adjournment(s) or postponement(s) thereof,

it is the intention of the proxy holders named in the enclosed proxy to vote in their discretion on all matters on which the shares

represented by such proxy are entitled to vote.

SHAREHOLDER

PROPOSALS

Shareholders may submit proposals or

director nominations for inclusion by the Company in the proxy statement for next year’s annual meeting of shareholders.

For your proposal or director nomination to be considered for inclusion in our proxy statement for next year’s annual meeting,

your written proposal must be received by our corporate secretary at our principal executive office no later than 120 days before

the anniversary of the release date of our proxy statement distributed in connection with our 2020 annual meeting of shareholders,

unless the date of next year’s annual meeting is changed by more than 30 days from the date of our 2020 annual meeting of

shareholders. After such date, any shareholder proposal will be considered untimely.

If we change the date of next year’s

annual meeting by more than thirty (30) days from the date of our 2020 annual meeting of shareholders, then the deadline is

a reasonable time before we begin to print and distribute our proxy materials. You should also be aware that your proposal must

comply with SEC regulations regarding inclusion of shareholder proposals in company-sponsored proxy materials, and with any provision

in our bylaws regarding the same.

Silver Bull Resources, Inc. expects

to hold its next annual meeting of shareholders in April 2021. Proposals from shareholders intended to be present at the next annual

meeting of shareholders should be addressed, if sent by regular mail, to Silver Bull Resources, Inc., 777 Dunsmuir Street, Suite

1610, P.O. Box 10427, Vancouver, British Columbia, V7Y 1K4, Canada, Attention: Corporate Secretary or, if sent other than by regular

mail, to Silver Bull Resources, Inc., 777 Dunsmuir Street, Suite 1610, Vancouver, British Columbia, V7Y 1K4, Canada, Attention:

Corporate Secretary. We must receive the proposals by Thursday, October 29, 2020. Upon receipt of any such proposal, we shall

determine whether or not to include any such proposal in the proxy statement and proxy in accordance with applicable law. It is

suggested that shareholders forward such proposals by Certified Mail-Return Receipt Requested. After Thursday, October 29,

2020, any shareholder proposal will be considered to be untimely.

As to any proposal that a shareholder

intends to present to shareholders other than by inclusion in our proxy statement for our 2021 annual meeting of shareholders,

the proxies named in our proxy for that meeting will be entitled to exercise their discretionary voting authority on that proposal

unless we receive notice of the matter to be proposed not later than Tuesday, January 12, 2021. Even if proper notice is received

on or prior to that date, the proxies named in our proxy for that meeting may nevertheless exercise their discretionary authority

with respect to such matter by advising shareholders of that proposal and how they intend to exercise their discretion to vote

on such matter, unless the shareholder making the proposal solicits proxies with respect to the proposal to the extent required

by Rule 14a-4(c)(2) under the Exchange Act.

|

|

BY ORDER OF THE BOARD

OF DIRECTORS:

SILVER BULL RESOURCES,

INC.

Brian D. Edgar, Chairman

|

ANNEX A:

AMENDED AND RESTATED ARTICLES OF INCORPORATION

CERTIFICATE OF

AMENDED AND RESTATED ARTICLES OF INCORPORATION

OF [SILVER BULL RESOURCES, INC.][1]

Pursuant to the

provisions of Nevada Revised Statutes §§ 78.390 and 78.403, the undersigned officer of Silver Bull Resources, Inc.,

a Nevada corporation, does hereby certify as follows:

A. The

board of directors of the corporation has duly adopted resolutions proposing to amend and restate the articles of incorporation

of the corporation as set forth below, declaring such amendment and restatement to be advisable and in the best interests of the

corporation.

B. The

amendment and restatement of the articles of incorporation as set forth below has been approved by a majority of the voting power

of the stockholders of the corporation, which is sufficient for approval thereof.

C. This

certificate sets forth the text of the articles of incorporation of the corporation as amended and restated in their entirety to

this date as follows:

AMENDED AND RESTATED ARTICLES OF INCORPORATION

OF [SILVER BULL RESOURCES, INC.]1

No. 1

NAME

The name of the corporation shall be:

[Silver Bull Resources, Inc.]1

No. 2

LOCATION

The name and address of the registered

agent is:

Laughlin Associates, Inc.

9120 Double Diamond Parkway

Reno, Nevada 89521

No. 3

PURPOSE

The purpose of the corporation is to

engage in any lawful activity permitted under the Nevada Revised Statutes.

No. 4

CAPITALIZATION

The total authorized capital stock of

this corporation shall be [THREE HUNDRED MILLION (300,000,000)][2]

shares of COMMON STOCK, each of which shall have the par value of ONE CENT ($0.01).

[1]

If the Company Name Change A&R Articles are approved, then the Company’s name will be changed to “MaxMetals Corp.”

[2]

If the Authorized Shares A&R Articles are not approved, then the number of authorized shares will remain “THIRTY-SEVEN

MILLION FIVE HUNDRED THOUSAND (37,500,000).”

No. 5

GOVERNING BOARD

This Corporation shall be governed by

at least three directors and not more than nine directors. The directors shall be elected at the annual meetings or any special

meeting of the stockholders called for the purpose of electing directors, the holder of each share of stock of this corporation

shall have one vote and a plurality of the votes cast at the election shall decide the persons to hold such directorships.

The Board of Directors during a term

may decrease in number by the resignation or death of one or more members, but the maximum number of directors cannot be increased.

The majority of the surviving directors, in the case of a vacancy by resignation or death, may appoint a person or persons to fill

a vacancy or vacancies.

No. 6

ASSESSABILITY OF STOCK

The shares issued by this corporation,

once the par value has been paid in full, shall not be assessable, and any shares issued for services, or property, or considerations

other than cash, shall be deemed fully paid up and shall be forever nonassessable.

No. 7

TERM OF EXISTENCE

The term of existence of this corporation

shall be perpetual.

No. 8

BY-LAWS

The directors shall have power to make

such By-Laws as they may deem proper for the management of the affairs of said corporation according to the statute in such case

made and provided.

No. 9

VOTING

Each stockholder will have one vote

for each share registered in his or her name. Cumulative voting shall not be allowed.

No. 10

SUBSCRIPTION RIGHTS

The

stockholders of this corporation shall have no preferential right or rights to subscribe to any subsequent issues of the authorized

shares of this corporation, unless certain rights or warrants for a specific issue are authorized by the Board of Directors or

the Stockholders.

The

Company’s President has signed this Amended and Restated Articles of Incorporation on the ___ day of December, 2020.

[SILVER

BULL RESOURCES, INC.]1

By:

Timothy

Barry, President

ANNEX B:

MARKED VERSION OF AMENDED AND RESTATED ARTICLES OF INCORPORATION

CERTIFICATE OF

AMENDED AND RESTATED ARTICLES OF INCORPORATION

OF [SILVER BULL RESOURCES, INC.][3]

Pursuant

to the provisions of Nevada Revised Statutes §§ 78.390 and 78.403, the undersigned officer of Silver Bull Resources,

Inc., a Nevada corporation, does hereby certify as follows:

A. The

board of directors of the corporation has duly adopted resolutions proposing to amend and restate the articles of incorporation

of the corporation as set forth below, declaring such amendment and restatement to be advisable and in the best interests of the

corporation.

B. The

amendment and restatement of the articles of incorporation as set forth below has been approved by a majority of the voting power

of the stockholders of the corporation, which is sufficient for approval thereof.

C. This

certificate sets forth the text of the articles of incorporation of the corporation as amended and restated in their entirety to

this date as follows:

AMENDED

AND RESTATED ARTICLES OF INCORPORATION

OF METALLINE MINING CORPORATION[SILVER

BULL RESOURCES, INC.]3

The following sets

forth the Restated Articles of Incorporation for Metalline Mining Company (the “Corporation”), adopted by resolution

of the Board of Directors on June 22, 2010, pursuant to N.R.S. §74.403. The President of the Corporation has been authorized

to sign this certificate by resolution of the board of directors adopted on June 22, 2010. These Restated Articles of Incorporation

correctly sets forth the text of the Articles of Incorporation as amended to the date hereof.

No. 1

NAME

The name of the corporation shall be:

Metalline Mining Company[Silver Bull Resources,

Inc.]3

No. 2

LOCATION

The name and address of the registered

agent is:

Laughlin Associates,

Inc.

9120 Double Diamond Parkway2533

North Carson Street

Reno, Nevada 89521Carson

City, NV 89706

No. 3

PURPOSE

The

purpose of the corporation is to engage in any lawful activity permitted under the Nevada Revised Statutes. The

nature or object or purpose of the business of this corporation shall be:

(a)

To engage in any lawful business activity.

[3]

If the Company Name Change A&R Articles are approved, then the Company’s name will be changed to “MaxMetals Corp.”

(b)

To borrow and/or lend money with or without security.

(c)

To buy, or sell, or trade in commodities of every nature, including securities, notes, bonds, mortgages, agricultural products,

mining products, minerals, metals, commodity futures contracts, titles to or equities in land, buildings, mining claims, oil properties,

oil leases, royalty interests, and options to buy or sell any or all of the foregoing.

(d)

To have and exercise all the rights, powers, and privileges which are now or which may hereafter be conferred upon corporations

organized under the same statute as this corporation; and to have and exercise all such rights, powers and privileges as may be

necessary, convenient or proper to effectuate and accomplish the objectives and purposes specified in this certificate, and said

specified objectives and purposes shall not limit or restrict in any manner the powers of this corporation.

No. 4

CAPITALIZATION

The total authorized capital stock of

this corporation shall be THIRTY-SEVEN MILLION FIVE HUNDRED THOUSAND (37,500,000)[THREE

HUNDRED MILLION (300,000,000)][4] shares

of COMMON STOCK, each of which shall have the par value of ONE CENT ($0.01).

No. 5

GOVERNING BOARD

This Corporation shall be governed by

at least three directors and not more than nine directors. The directors shall be elected at the annual meetings or any special

meeting of the stockholders called for the purpose of electing directors, the holder of each share of stock of this corporation

shall have one vote and a plurality of the votes cast at the election shall decide the persons to hold such directorships.

The Board of Directors during a term

may decrease in number by the resignation or death of one or more members, but the maximum number of directors cannot be increased.

The majority of the surviving directors, in the case of a vacancy by resignation or death, may appoint a person or persons to fill

a vacancy or vacancies.

No. 6

ASSESSABILITY OF STOCK

The shares issued by this corporation,

once the par value has been paid in full, shall not be assessable, and any shares issued for services, or property, or considerations

other than cash, shall be deemed fully paid up and shall be forever nonassessable.

No. 7

TERM OF EXISTENCE

The term of existence of this corporation

shall be perpetual.

No. 8

BY-LAWS

The directors shall have power to make

such By-Laws as they may deem proper for the management of the affairs of said corporation according to the statute in such case

made and provided.

[4]

If the Authorized Shares A&R Articles are not approved, then the number of authorized shares will remain “THIRTY-SEVEN

MILLION FIVE HUNDRED THOUSAND (37,500,000).”

No. 9

VOTING

Each stockholder will have one vote

for each share registered in his or her name. Cumulative voting shall not be allowed.

No. 10

SUBSCRIPTION RIGHTS

The

stockholders of this corporation shall have no preferential right or rights to subscribe to any subsequent issues of the authorized

shares of this corporation, unless certain rights or warrants for a specific issue are authorized by the Board of Directors or

the Stockholders.

The

Company’s President has signed this Amended and Restated Articles of Incorporation

on the 22nd___ day of JuneDecember,

20102020.

METALLINE

MINING COMPANY[SILVER BULL RESOURCES, INC.]3

By:

Timothy

Barry, President

QUESTIONS MAY BE DIRECTED TO THE PROXY

SOLICITATION AGENT:

NORTH AMERICA TOLL FREE:

1-877-452-7184

COLLECT OUTSIDE NORTH AMERICA:

1-416-304-0211

EMAIL: ASSISTANCE@LAURELHILL.COM

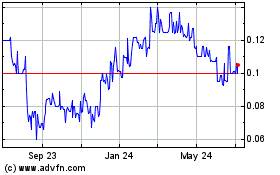

Silver Bull Resources (QB) (USOTC:SVBL)

Historical Stock Chart

From Mar 2024 to Apr 2024

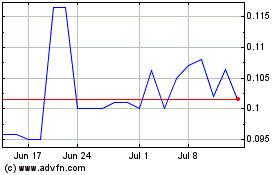

Silver Bull Resources (QB) (USOTC:SVBL)

Historical Stock Chart

From Apr 2023 to Apr 2024