Current Report Filing (8-k)

September 21 2020 - 11:00AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF

THE

SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): September 18, 2020

Resonate

Blends, Inc.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

|

000-21202

|

|

58-1588291

|

(State

or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S.

Employer

Identification No.)

|

|

26565

Agoura Road, Suite 200

Calabasas,

CA

|

|

91302

|

|

(Address

of principal executive offices)

|

|

(Zip

Code)

|

Registrant’s

telephone number, including area code: 571-888-0009

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered

|

|

Common

Shares

|

|

KOAN

|

|

OTCQB

Market

|

Emerging

growth company [ ]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

SECTION

1 - REGISTRANT’S BUSINESS AND OPERATIONS

ITEM

1.01 - ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

On

September 16, 2020, we entered into an addendum (the “Addendum”) to the Securities Purchase Agreement with FirstFire

Global Opportunities Fund, LLC (“FirstFire”) and convertible promissory note dated July 20, 2020 with a principal

amount of $225,000, a $25,000 original issue discount and interest at 8% per annum (the “Firstfire Note”).

Pursuant

to the Addendum, the Firstfire Note has been amended to provide as follows:

|

|

●

|

We

will make a $138,000 payment no later than September 21, 2020 to FirstFire that will take care of the first three (3) amortized

payments due on December 20, 2020 – January 20, 2021 and February 20, 2021. This payment was made.

|

|

|

●

|

$105,000

will be remaining on the principal and interest after the $138,000 payment.

|

|

|

●

|

Two

(2) additional payments of $52,500, which equals the remaining $105,000 due, will now be due on March 20, 2021 and April 20,

2021 to close out this Note in its entirety.

|

|

|

●

|

We

have the right to make the final two (2) payments of $52,500 each at any time up to the due date of March 20, 2021 and April

20, 2021.

|

|

|

●

|

FirstFire

can convert any amount due, but unpaid, into common shares at the applicable conversion price, and under the terms as set

forth in the Note. For example, the earliest FirstFire could convert on the $52,500 due on March 20, 2021 is on that date.

The earliest FirstFire could convert on the last payment of $52,500 is on April 20, 2021.

|

|

|

●

|

In

exchange for pushing out the last two payment beyond the original prepayment schedule of 180 days, We agreed to issue FirstFire

an additional 45,000 shares.

|

|

|

●

|

The

remaining provisions of the Note remain unchanged.

|

The

foregoing description of the Addendum and the transactions contemplated thereby does not purport to be complete and is subject

to, and qualified in its entirety by reference to, the full text of the Addendum, which is included in this Current Report as

Exhibits 10.1, and is incorporated herein by reference.

Section

3 - Securities and Trading Markets

Item

3.02 Unregistered Sales of Equity Securities.

On

September 21, 2020, we issued 2,400,000 shares of common stock to an accredited investor for total proceeds of $240,000.

These

securities were issued pursuant to Section 4(2) of the Securities Act and/or Rule 506 promulgated thereunder. The holders represented

their intention to acquire the securities for investment only and not with a view towards distribution. The investors were given

adequate information about us to make an informed investment decision. We did not engage in any general solicitation or advertising.

We directed our transfer agent to issue the stock certificates with the appropriate restrictive legend affixed to the restricted

stock.

As

previously disclosed, on July 18, 2020, we executed a convertible promissory note (the “Geneva Note”) with Geneva

Roth Remark Holdings, Inc. for $85,500 together with any interest at the rate of 10% per annum from the issue date. We also issued

the Firstfire Note with a principal amount of $225,000 and 8% annualized interest on July 20, 2020.

On

September 18, 2020, we paid off the Geneva Note in its entirety and paid down the FirstFire Note with proceeds acquired from the

above equity investment in the company.

SECTION

8 – Other Events

Item

8.01 Other Events

On

September 21, 2020, we issued a press release concerning the payoff of the Geneva Note and the pay down of the Firstfire Note.

A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K.

The

information in Item 8.01 of this Current Report on Form 8-K (including Exhibit 99.1) shall not be deemed “filed” for

purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities

of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange

Act, except as expressly set forth by specific reference in such a filing.

SECTION

9 – Financial Statements and Exhibits

Item

9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

Resonate

Blends, Inc.

|

|

|

|

|

|

/s/

Geoffrey Selzer

|

|

|

Geoffrey

Selzer

|

|

|

Chief

Executive Officer

|

|

|

Date:

September 21, 2020

|

|

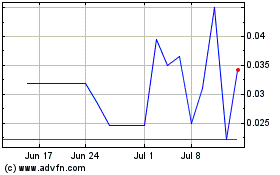

Resonate Blends (PK) (USOTC:KOAN)

Historical Stock Chart

From Oct 2024 to Nov 2024

Resonate Blends (PK) (USOTC:KOAN)

Historical Stock Chart

From Nov 2023 to Nov 2024