UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

Proxy

Statement Pursuant to Section 14(a) of the

Securities

Exchange Act of 1934

Filed

by the Registrant ☒ Filed by a Party other than the Registrant ☐

| ☐ |

Preliminary

Proxy Statement |

| |

|

| ☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

|

| ☐ |

Definitive

Proxy Statement |

| |

|

| ☒ |

Definitive

Additional Materials |

| |

|

| ☐ |

Soliciting

Material under §240.14a-12 |

| Provectus

Biopharmaceuticals, Inc. |

| (Name

of registrant as specified in its charter) |

| |

| |

| (Name

of person(s) filing proxy statement, if other than the registrant) |

| |

| Payment

of Filing Fee (Check the appropriate box): |

| ☒ |

No

fee required |

| |

|

| ☐ |

Fee

computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| |

(1) |

Title

of each class of securities to which transaction applies:

|

| |

|

|

| |

(2) |

Aggregate

number of securities to which transaction applies: |

| |

|

|

| |

|

|

| |

(3) |

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the

filing fee is calculated and state how it was determined): |

| |

|

|

| |

|

|

| |

(4) |

Proposed

maximum aggregate value of transaction: |

| |

|

|

| |

|

|

| |

(5) |

Total

fee paid: |

| |

|

|

| |

|

|

| ☐ |

Fee

paid previously with preliminary materials. |

| |

|

| ☐ |

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its

filing. |

| |

|

|

| |

(1) |

Amount

Previously Paid:

|

| |

|

|

| |

(2) |

Form,

Schedule or Registration Statement No.:

|

| |

|

|

| |

(3) |

Filing

Party: |

| |

|

|

| |

|

|

| |

(4) |

Date

Filed: |

| |

|

|

Provectus

Biopharmaceuticals Discusses 2022 Annual Stockholder Meeting Reverse Stock Split and Authorized Share Reduction Proposals

KNOXVILLE,

TN, May 26, 2022 (PROVECTUS NEWS) — Provectus (OTCQB: PVCT) today addressed a potential reverse stock split of the Company’s

outstanding common and preferred shares, and a proportional reduction in its authorized shares. At Provectus’ 2022 Annual

Meeting of Stockholders (2022 Annual Meeting) on June 22, the Company’s Board of Directors (Board) seeks approvals for, among other

proposals, the authority to undertake a reverse stock split (RSS)1 and an authorized share reduction (ASR)2.

Provectus

stockholders are encouraged to email their questions about the 2022 Annual Meeting proposals to the Board at ASM2022questions@pvct.com.

| |

1. |

The

RSS will not dilute the ownership of existing Provectus shareholders. |

The

Board expects that the RSS will result in the following:

| |

● |

The

share price will increase by the RSS ratio chosen by the Board, |

| |

|

|

| |

●

| Provectus’

market capitalization will remain the same, and |

| |

|

|

| |

●

| The

value of existing investors’ shareholdings will also remain the same. |

However,

the Company’s share price and market capitalization may be affected by other factors that may be unrelated to the number of shares

outstanding, including but not limited to Provectus’ financial results, general economic and/or stock market conditions, and investor

perception of the Company’s business. As a result, there can be no assurance that the results described above will occur.

| |

2. |

Potential

dilution remains the same before and after the RSS and ASR. |

| |

● |

The

number of outstanding, unissued, and authorized shares will be reduced at the same time by the same proportion of the chosen

RSS ratio. |

| |

3. |

The

Board believes that the RSS and ASR are a fundamental step in the business turnaround of Provectus. |

The

Board understands that RSSs may have a negative perception because an RSS is often done to increase a company’s share price in

order to maintain its major stock exchange listing. Each company’s RSS decision-making is unique to its circumstances, however,

and should be viewed as such.

Provectus’

situation is different because the Board is proposing the RSS and ASR as a fundamental step in the business turnaround that started in

2017, when a group of shareholders3 (Ed Pershing, Dominic Rodrigues, and Bruce Horowitz; collectively, the “PRH”)

closed a definitive financing with the Company4:

| |

● |

Between

June 30, 2002, the quarter during which the Company was founded, and March 31, 2017, Provectus’ fully diluted shares of common

stock outstanding increased by more than 6,400%, from 9 million to 564 million.5,6,7 |

| |

|

|

| |

●

| Whereas,

between April 1, 2017 and March 31, 2022, fully diluted shares of common stock outstanding decreased by 6% to 529 million as the

Company raised approximately $27 million .8,9 |

| |

4. |

The

Board believes that an RSS and ASR of the same ratio at the same time is in the best interests of Provectus stockholders. |

In

2016, Provectus sought to undertake an RSS of the Company’s outstanding common stock and to increase the number of authorized

common shares. The RSS was not approved by stockholders.10,11

In

contrast, at the 2022 Annual Meeting, Provectus is seeking approval to undertake an RSS of all outstanding equities and an ASR of

all equities by the same RSS ratio. The Board desires to demonstrate to stockholders that it will continue to be prudent in

approving additional issuances of common and preferred stocks in connection with potential future financings.

| |

5. |

The

Board unanimously recommends that Provectus stockholders vote FOR all proposals, including the RSS (Proposal #4) and the ASR (Proposal

#5). |

The

Board asks the Company’s stockholders to:

| |

● |

Review

all of the information that Provectus has provided them, |

| |

|

|

| |

● |

Compare

and contrast the Company’s current approach to managing its capitalization structure with prior historical efforts,

and |

| |

|

|

| |

● |

Decide

if the Board’s RSS and ASR proposals are a good choice for them. |

The

Board believes that the proposed RSS and ASR can position Provectus’ share price and market capitalization to better reflect

continued fundamental progress as the Company’s business transformation and clinical development further unfold.

Availability

of Proxy Materials

The

Company’s 2022 Annual Meeting will be held to, among other things, consider reverse stock split and authorized share decrease proposals.

In connection with the 2022 Annual Meeting, the Company filed a definitive proxy statement with the Securities and Exchange Commission

(SEC) on April 29, 2022, which may be found here: https://www.sec.gov/Archives/edgar/data/315545/000149315222011474/formdef14a.htm.

Provectus

mailed a Notice of Internet Availability of Proxy Materials (Notice) to its stockholders on or about May 13, 2022. These materials are

available on the Company’s website and may be found here: https://www.provectusbio.com/annual-meeting/.

About

Provectus

Provectus

Biopharmaceuticals, Inc. (Provectus or the Company) is a clinical-stage biotechnology company developing immunotherapy medicines for

different disease areas based on a class of small molecules called halogenated xanthenes (HXs). The Company’s lead molecule is

RBS. A second HX molecule has been synthesized.

Provectus’

drug discovery and development programs include investigational drugs and drug targets in oncology (clinical-stage), dermatology (clinical-stage),

hematology, virology, microbiology, ophthalmology (clinical-stage), and animal health, and use multiple routes of administration, such

as intralesional (IL), topical (.top), oral (P.O.), inhaled (.inh), intranasal (IN), and intravenous (IV).

Information

about the Company’s clinical trials can be found at the National Institutes of Health (NIH) registry, www.clinicaltrials.gov.

For additional information about Provectus, please visit the Company’s website at www.provectusbio.com.

References

1

Proposal #4: “To authorize our Board of Directors to amend our Certificate of Incorporation, as amended by the Certificate

of Designation of Series D Convertible Preferred Stock and Certificate of Designation of Series D-1 Convertible Preferred Stock (the

“Certificates of Designation”), to effect a reverse stock split of our common stock, Series D Convertible Preferred Stock,

and Series D-1 Convertible Preferred Stock at a ratio of between 1-for-10 and 1-for-50, where the ratio would be determined by our Board

of Directors at its discretion, and to make corresponding amendments to the Certificates of Designation to provide for the proportional

adjustment of certain terms upon a reverse stock split”

2

Proposal #5: “To authorize our Board of Directors, if and only if Proposal 4 is approved, to amend our Certificate

of Incorporation, as amended by the Certificates of Designation, to decrease the number of authorized shares of our common stock and

preferred stock by the same reverse stock split ratio determined by our Board of Directors”

3

PRH has specifically disclaimed that it was or is a “group” as defined under U.S. federal securities laws.

4

“Provectus Biopharmaceuticals, Inc. Form 8-K.” EDGAR. SEC, 2017, https://www.sec.gov/Archives/edgar/data/315545/000119312517093889/d365732d8k.htm

5

“Provectus Biopharmaceuticals, Inc. Form 10-QSB for the quarter ending June 30, 2002.” EDGAR. SEC, 2002, https://www.sec.gov/Archives/edgar/data/315545/000107878202000181/ppi602qsb.htm

6

“Provectus Biopharmaceuticals, Inc. Form 10-K for the year ending December 31, 2016.” EDGAR. SEC, 2016, https://www.sec.gov/Archives/edgar/data/315545/000119312517165654/d373832d10q.htm

7

“Provectus Biopharmaceuticals, Inc. Form 10-Q for the quarter ending March 31, 2017.” EDGAR. SEC, 2017, https://www.sec.gov/Archives/edgar/data/315545/000119312517106543/d289943d10k.htm

8

“Provectus Biopharmaceuticals, Inc. Form 10-K for the year ending December 31, 2021.” EDGAR. SEC, 2021, https://www.sec.gov/ix?doc=/Archives/edgar/data/315545/000149315222008016/form10-k.htm

9

“Provectus Biopharmaceuticals, Inc. Form 10-Q for the quarter ending March 31, 2022.” EDGAR. SEC, 2022, https://www.sec.gov/ix?doc=/Archives/edgar/data/315545/000149315222012970/form10-q.htm

10

“Provectus Biopharmaceuticals, Inc. Schedule 14A.” EDGAR. SEC, 2016, https://www.sec.gov/Archives/edgar/data/315545/000119312516755796/d273727ddef14a.htm

11

“Provectus Biopharmaceuticals, Inc. Form 8-K.” EDGAR. SEC, 2016, https://www.sec.gov/Archives/edgar/data/315545/000119312516778114/d301002d8k.htm

FORWARD-LOOKING

STATEMENTS: The information in this Provectus News item includes “forward-looking statements,” within the meaning

of U.S. securities legislation, including forward-looking statements relating to the business of Provectus and its affiliates and the

potential effects of a reverse stock split and an authorized share reduction, which are based on the opinions and estimates of Company

management and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ

materially from those projected in the forward-looking statements. Forward-looking statements are often, but not always, identified by

the use of words such as “seek,” “anticipate,” “budget,” “plan,” “continue,”

“estimate,” “expect,” “forecast,” “may,” “will,” “project,” “predict,”

“potential,” “targeting,” “intend,” “could,” “might,” “should,”

“believe,” and similar words suggesting future outcomes or statements regarding an outlook.

The

safety and efficacy of the agents and/or uses under investigation have not been established. There is no guarantee that the agents will

receive health authority approval or become commercially available in any country for the uses being investigated or that such agents

as products will achieve any particular revenue levels.

Due

to the risks, uncertainties, and assumptions inherent in forward-looking statements, readers should not place undue reliance on these

forward-looking statements. The forward-looking statements contained in this Provectus News item are made as of the date hereof or as

of the date specifically specified herein, and Provectus undertakes no obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise, except in accordance with applicable securities laws. The forward-looking

statements are expressly qualified by this cautionary statement.

Risks,

uncertainties, and assumptions include those discussed in the Company’s filings with the SEC, including those described in Item

1A of the

Company’s Annual Report on Form 10-K for the year ended December 31, 2021 and Provectus’

Quarterly Report on Form 10-Q for the quarter ended March 31, 2022 and in the section entitled “Certain Risks Associated with

the Reverse Stock Split” in the Company’s definitive proxy statement.

Additional

Information and Where to Find It

This

communication may be deemed to be solicitation material in connection with the proposals to be submitted to the Company’s stockholders

at its 2022 Annual Meeting, including the reverse stock split and authorized share reduction proposals. STOCKHOLDERS ARE URGED TO READ

CAREFULLY AND, IN ITS ENTIRETY, THE DEFINITIVE PROXY STATEMENT FILED WITH THE SEC AND OTHER RELEVANT MATERIALS, BECAUSE THEY CONTAIN

IMPORTANT INFORMATION ABOUT THE COMPANY AND THE 2022 ANNUAL MEETING PROPOSALS. A Notice with instructions for accessing the definitive

proxy statement, 2021 Annual Report, and proxy card was mailed on or about May 13, 2022 to stockholders as of the record date of April

25, 2022. Stockholders may obtain free copies of the Company’s definitive proxy statement and its other SEC filings electronically

by accessing the SEC’s home page at http://www.sec.gov. Copies can also be obtained, free of charge, upon written request

to Provectus Biopharmaceuticals, Inc., Attn: Secretary, 10025 Investment Drive, Suite 250, Knoxville, Tennessee 37932, (866) 594-5999.

Copies can also be obtained electronically from the Company’s Annual Meeting webpage: https://www.provectusbio.com/annual-meeting/.

Participants

in Solicitation

The

Company and its directors, executive officers, and advisors may be deemed to be participants in the solicitation of proxies from the

holders of the Company’s Common Stock, Series D Convertible Preferred Stock, and Series D-1 Convertible Preferred Stock in respect

of the 2022 Annual Meeting proposals.

Investors

may obtain additional information regarding the interest of those participants by reading the Company’s definitive proxy statement

and other relevant proxy materials, and the Company’s annual reports on Form 10-K and quarterly reports on Form 10-Q, as filed

with the SEC.

###

Contact:

Provectus

Biopharmaceuticals, Inc.

Heather

Raines, CPA

Chief

Financial Officer

Phone:

(866) 594-5999

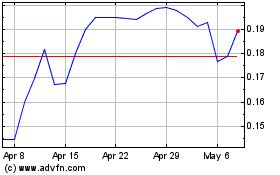

Provectus Biopharmaceuti... (QB) (USOTC:PVCT)

Historical Stock Chart

From Mar 2024 to Apr 2024

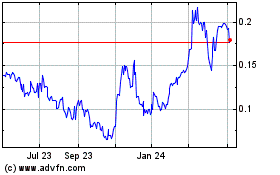

Provectus Biopharmaceuti... (QB) (USOTC:PVCT)

Historical Stock Chart

From Apr 2023 to Apr 2024