Halitron, Inc. - HAON Announces $3 Million Asset, Stock Buyback to .01

January 22 2018 - 7:05AM

InvestorsHub NewsWire

Miami, FL --

January 22, 2018 -- InvestorsHub NewsWire -- EmergingGrowth.com, a leading

independent small cap media portal with an extensive history of

providing unparalleled content for the Emerging Growth markets and

companies, reports on Halitron, Inc. (OTC

Pink: HAON).

HAON

may not be at these levels much longer.

See the Press Release and more on Halitron, Inc. (OTC

Pink: HAON) at EmergingGrowth.com

http://emerginggrowth.com/?s=haon

Halitron, Inc. (OTC

Pink: HAON) just announced the successful negotiations to

modify an existing agreement to reflect the following impact on

Halitron’s financial books and records.

Halitron has returned 56 million restricted common shares and 80

million Life’s Time Capsule Services, Inc.’s (“LTCP”) Preferred

Stock C shares to LTCP in exchange for the receipt of a note

payable for $3 million, bearing interest of 4%, which matures in

July 2020.

In the transaction, the assets sold to LTCP in the original

transaction will revert to a Halitron asset on its balance

sheet. In 2020, upon receipt of the $3 million principal and

interest along with Halitron’s Board of Directors’ approval,

Management will submit corporation action paperwork to FINRA for

the issuance of a cash dividend to its shareholders, of which

record, and payment dates will be announced post receipts of the

settlement of the note payable for $3 million.

Halitron has also begun to buy back shares in the open market

according to the “black-out” periods disclosed in its filing to OTC

Markets with the objective to increase its share price to $0.01 per

share. The $0.01 share price is one of the requirements by

OTC markets to uplist to the OTC QB. The number of shares and

price paid will be listed in its quarterly filings.

Recently, Halitron, Inc. (OTC

Pink: HAON) announced that it booked $342,000 in revenue for

the fourth quarter 2017 which represents a 110% increase in sales

over the third quarter 2017.

The company stated in its press release… “With a market cap

of only approximately $1,324,000, Management is excited to announce

that its sales for the three months ended December 31, 2017, have

been recorded at approximately $342,000, which represents an

increase of 110% over its previous quarter sales of approximately

$163,000, for the three months ended September 30, 2017.”

If sales continue at only half this pace throughout 2018, the

company could be looking at over $3 million in sales for

2018.

The current market cap of Halitron, Inc. (OTC

Pink: HAON) is approximately $1.3 million, its shares can have

a dramatic upside.

Previously the company announced that margins are also expected to

increase due to its reduction of a manufacturing cell expenses by

65% after a move from Newton CT, to New Hide Park NY.

Halitron, Inc. (OTC

Pink: HAON) is also currently completing its audit which will

allow it to qualify for an up list to the OTCQB in the early part

of 2018.

HAON

may not be at these levels much longer.

See the Press Release and more on Halitron, Inc. (OTC

Pink: HAON) at EmergingGrowth.com

http://emerginggrowth.com/?s=haon

Other Companies in the news and featured on EmergingGrowth.com

NorthWest Biotherapeutics, Inc.

Northwest Biotherapeutics, Inc. (OTCQB:

NWBO), on Friday announced a Reg-D offering for accredited

investors. This Offering will be in the form of Series B

Preferred Stock convertible into the Company's common stock, and

each share of Series B Preferred Stock will be convertible into 10

shares of common stock at $2.30 per share. The company will

sell as many as 5.5 million shares of the series B. According

to OTC Markets, there is 335 million shares outstanding. This

could be an unwelcomed sign of dilution

Have a look at Halitron, Inc. (OTC

Pink: HAON)

ProText Mobility, Inc.

Shares of ProText Mobility (OTC:

TXTM) sored over 150% during the past two trading sessions

before giving back 20% but still remained over the upper portion of

the Bollinger Band. This run started before and traded

through news discussing a new acquisition. Shares are already up

300% since the latter half of December. It’s important to

note the capital structure according to the Company’s recently

filed 8K:

Capital of

TXTM consists of

10,000,000,000 authorized shares of Common Stock, par value

$0.0001, of which 1,946,690,324 shares are issued and

outstanding (“Common Stock”) , and

25,000,000 authorized shares of Preferred Stock (of which 9,550,055

are outstanding), par value of $0.001, of which 100,000 shares are

issued and outstanding (as amended), 550,055 shares are issued and

outstanding as Class B Preferred, and 9,000,000 shares are issued

and outstanding as Class C Preferred. Each share of Class C

has voting rights attached of 200 common shares on all

matters (“Preferred Stock”)

The Capital of

PLSA consists of

1,000 authorized shares, of which 100 shares are issued and

outstanding, which for the purposes of this agreement shall be

referred to as “Capital Shares”.

Alkame Holdings, Inc.

AKLM Holdings, Inc. (OTC:

AKLM) closed down 15% on Friday as predicted as investors are

awaiting some sort of information in the form of news on the

forefront.

In the meantime, have a look at Halitron,

Inc. (OTC

Pink: HAON). Here’s a trip two with a market cap of

$1,324,000 that just released a 110% increase in Q4 revenue

over Q3 to $342,000.00, a stock buyback to the point of .01, and $3

million in assets being added to the balance sheet.

About EmergingGrowth.com

EmergingGrowth.com is a leading

independent small cap media portal with an extensive history of

providing unparalleled content for the Emerging Growth markets and

companies. Through its evolution, EmergingGrowth.com found a niche in

identifying companies that can be overlooked by the markets due to,

among other reasons, trading price or market capitalization.

We look for strong management, innovation, strategy, execution, and

the overall potential for long- term growth. Aside from being

a trusted resource for the Emerging Growth info-seekers, we are

well known for discovering undervalued companies and bringing them

to the attention of the investment community. Through our

parent Company, we also have the ability to facilitate road shows

to present your products and services to the most influential

investment banks in the space.

Disclosure:

All information contained herein as

well as on the EmergingGrowth.com website is

obtained from sources believed to be reliable but not guaranteed to

be accurate or all-inclusive. All material is for informational

purposes only, is only the opinion of EmergingGrowth.com and should

not be construed as an offer or solicitation to buy or sell

securities. The information may include certain forward-looking

statements, which may be affected by unforeseen circumstances and /

or certain risks. This report is not without bias.

EmergingGrowth.com has motivation by means of either self-marketing

or EmergingGrowth.com has been compensated by or for a company or

companies discussed in this article. Full details about which can

be found in our full disclosure, which can be found

here, http://www.emerginggrowth.com/disclosure-4266/.

Please consult an investment professional before investing in

anything viewed within. When EmergingGrowth.com is long shares

it will sell those shares. In addition, please make sure you read

and understand the Terms of Use, Privacy Policy and the Disclosure

posted on the EmergingGrowth.com

website.

CONTACT:

Company: EmergingGrowth.com - http://www.EmergingGrowth.com

Contact Email: info@EmergingGrowth.com

SOURCE: EmergingGrowth.com

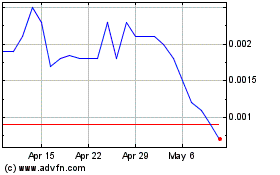

ProText Mobility (PK) (USOTC:TXTM)

Historical Stock Chart

From Oct 2024 to Nov 2024

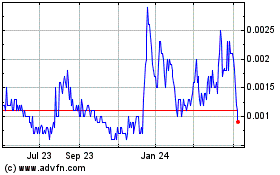

ProText Mobility (PK) (USOTC:TXTM)

Historical Stock Chart

From Nov 2023 to Nov 2024