UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of

Report (Date of Earliest Event Reported): November 19, 2014

| |

|

PLASTIC2OIL,

Inc. |

|

|

| |

|

(Exact name of registrant

as specified in its charter) |

|

|

| Nevada |

|

000-52444 |

|

90-0822950 |

| (State or other jurisdiction |

|

(Commission |

|

(I.R.S. Employer |

| of incorporation) |

|

File Number) |

|

Identification No.) |

| |

|

|

|

|

20

Iroquois Street

Niagara

Falls, NY |

|

|

|

14303 |

| (Address of principal

executive offices) |

|

|

|

(Zip Code) |

Registrant’s

telephone number, including area code: (716) 278-0015

N/A

Former

name or former address, if changed since last report

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

o

Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c))

Section

1 – Registrant’s Business and Operations

Item 1.01 Entry

into a Material Definitive Agreement.

On November 19, 2014, Plastic2Oil,

Inc., a Nevada corporation (the “Company”), entered into a Subscription Agreement (the “Purchase Agreement”)

with Heddle Marine Service Inc. (the “Purchaser”), a company owned by Mr. Richard Heddle, the Company’s Chief

Executive Officer and a member of the Company board of directors, pursuant to which, on November 19, 2014, the Company sold to

the Purchaser in a private placement (the “Note Financing”) a $1 million principal amount 12% Secured Promissory Note

due November 19, 2019 (the “Note”), together with a five-year warrant to purchase up to one million shares of the

Company’s common stock at an exercise price of $0.12 per share (the “Warrant”). The gross proceeds to the Company

were $1 million, of which approximately $465,000 was used to repay the outstanding balance of short-term loans made by Mr. Heddle

to the Company, as reported in the Company’s most recent Quarterly Report on Form 10-Q.

In connection with the Note

Financing, the Company and the Purchaser entered into certain agreements described below. Such agreements, with certain exceptions,

are substantially identical to the transaction documents executed and delivered in the Company’s sale of like tenor 12%

secured promissory notes to Mr. Heddle, personally, in the third quarter of 2013, as reported in the Company’s Current Report

on Form 8-K dated August 29, 2013.

Purchase Agreement

The Purchase Agreement contains

customary representations, warranties and covenants in connection with the sale and issuance of the Notes and Warrants, including

without limitation, representations and warranties of the Purchaser as to its “accredited investor” status.

12% Secured Promissory

Note

The Note issued by the Company

bears interest at the rate of 12% per annum. All principal and interest on the Note is due and payable in full by the Company

on November 19, 2019, the fifth anniversary of the issuance date. The Note may be prepaid in full or part at any time without

penalty. Events of default under the Note include, without limitation, the failure to timely pay principal or interest when due

and the commencement of a bankruptcy, liquidation or similar proceeding against the Company. The Company’s obligations under

the Note are secured by a lien on substantially all of the assets of the Company and Plastic2Oil of NY#1, LLC and JBI RE #1, Inc.,

each a subsidiary of the Company.

Warrants

TheWarrant issued by the Company

has a five year term, is exercisable immediately, and has an initial exercise price of $0.12 per share of common stock were granted

to the Purchaser in connection with the shares of common stock issuance upon exercise of the Warrant.

Security Agreement

In connection with the Note

Financing, the Purchaser was a made a party to that certain existing Security Agreement (the “Security Agreement”)

by and among the Company, its subsidiaries named above, Mr. Heddle and Christiana Trust Company, as collateral agent, pursuant

to which the Company and subsidiaries granted a security interest in favor of the collateral agent and for the benefit of the

holders of the Company’s Notes in substantially all of the assets of such grantors. Following an event of default (as defined

in the Note), the collateral agent will act with respect to the collateral securing the Notes at the direction of the holders

of a majority of the aggregate principal amount of the outstanding Notes.

The foregoing summaries of

the Note Financing, the securities to be issued in connection therewith, the Purchase Agreement, the Note, the Warrant and the

Security Agreement (all of the foregoing are collectively referred to as the “Transaction Documents”), do not purport

to be complete and are qualified in their entirety by reference to the actual Transaction Documents. Copies of the Purchase Agreement,

the Note and the Warrant are attached to this Current Report on Form 8-K as Exhibits 10.1, 10.2 and 10.3, respectively, and the

Security Agreement is incorporated herein by reference to Exhibit 10.4 to the Company’s Current Report on Form 8-K dated

August 29, 2013. The Transaction Documents contain representations and warranties that the parties made solely for the benefit

of each other, in the context of all of the terms and conditions of the Transaction Documents. Accordingly, other investors and

stockholders of the Company may not rely on such representations and warranties. Furthermore, such representations and warranties

are made only as of the date of the applicable Transaction Document. Information concerning the subject matter of such representations

and warranties may change after the date of such Transaction Document, and any such changes may not be fully reflected in the

Company’s reports or other filings with the Securities and Exchange Commission.

Section

2 - Financial Information

Item 2.03 Creation of a

Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The disclosures contained

in Item 1.01 of this Report are incorporated herein by reference.

Section

3 — Securities and Trading Markets

Item 3.02 Unregistered

Sales of Equity Securities.

In connection with the Note

Financing described in Item 1.01, the Company agreed to issue the Note and Warrants described therein. Such issuances

were made in reliance on the exemption from registration provided by Section 4(a)(2) of the Securities Act of 1933, as amended

(the “Act”), and Regulation D promulgated thereunder on the basis that the issuances did not involve a public offering

and the Purchaser made certain representations to the Company in the Purchase Agreements, including without limitation, that

the Purchaser was an “accredited investor” as defined in Rule 501 under the Act.

Section

9 - Financial Statements and Exhibits

Item 9.01 Financial Statements

and Exhibits.

(d) Exhibits. The exhibits

required by this item are listed on the Exhibit Index hereto.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed

on its behalf by the undersigned hereunto duly authorized.

| |

Plastic2Oil, Inc. |

| |

|

| November 19, 2014 |

By: |

/S/Rahoul

Banerjea |

| |

Name: |

Rahoul Banerjea |

| |

Title: |

Chief Financial Officer |

EXHIBIT

INDEX

SUBSCRIPTION

AGREEMENT

in connection

with

PLASTIC2OIL,

INC.

12% Secured Promissory

Notes

(together with

Warrants to Purchase shares of Common Stock)

November 19,

2014

SUBSCRIPTION

AGREEMENT

This

Subscription Agreement (the “Agreement”), is executed by the undersigned (the “Subscriber”) in connection

with the offering (the “Offering”) by Plastic2Oil, Inc., a Nevada corporation (the “Company”), of five-year

12% Secured Promissory Notes (the “Notes”) and Warrants (the “Warrants”) to purchase shares of Common

Stock, par value $.001 per share, of the Company (the “Shares”) (the Notes and the Warrants are collectively referred

to as the “Offered Securities” and the Offered Securities and the Shares issuable upon the exercise of the Warrants

are collectively referred to herein as the “Securities”). For every $100,000 principal amount of Notes purchased,

the Subscriber shall receive Warrants to purchase 100,000 shares of Common Stock. The Notes shall be substantially in the form

attached hereto as Exhibit A. The Warrants shall be substantially in the form attached hereto as Exhibit B. The

obligations under the Note will be secured pursuant to a Security Agreement substantially in the form attached hereto as Exhibit

C.

SECTION

1

| Section 1.1 |

Subscription.

The Subscriber, intending to be legally bound, hereby irrevocably subscribes for and agrees to purchase the principal amount

of Notes indicated on Page 10 hereof, on the terms and conditions described herein. |

| Section 1.2 |

Purchase.

The Subscriber understands and acknowledges that the purchase price to be remitted to the Company in exchange for the Offered

Securities shall be equal to the principal amount of Notes purchased. |

| Section 1.3 |

Payment

for Purchase. PAYMENT FOR THE SECURITIES SHALL BE BY WIRE TRANSFER OR CHECK PAYABLE TO: “PLASTIC2OIL” and

delivered to the Company, together with an original executed copy of this Agreement. Wire transfer instructions are available

upon request from Mr. Rahoul Banerjea at (716) 278-0015; Extension 257. |

| Section 1.4 |

Closings.

The Company may schedule any number of closings to consummate the sale and issuance of the Notes subscribed for by the Investors

in connection with the Offering (the “Closing”). |

SECTION

2

Section 2.1

Acceptance or Rejection.

| |

(a) |

The Subscriber

understands and agrees that the Company reserves the right to reject this subscription for the Offered Securities in whole

or in part in any order, if, in its reasonable judgment, it deems such action in the best interest of the Company, notwithstanding

prior receipt by the Subscriber of notice of acceptance of the Subscriber’s subscription. |

| |

(b) |

In the event of rejection of this subscription,

or in the event the sale of the Offered Securities is not consummated by the Company for any reason (in which event this Agreement

shall be deemed to be rejected), this Agreement and any other agreement entered into between the Subscriber and the Company

relating to this subscription shall thereafter have no force or effect and the Company shall promptly return or cause to be

returned to the Subscriber the purchase price remitted to the Company by the Subscriber in exchange for the Offered Securities. |

SECTION

3

| Section 3.1 |

Subscriber

Representations and Warranties. The Subscriber hereby acknowledges, represents and warrants to, and agrees with, the Company

and its affiliates as follows: |

| |

(a) |

The Subscriber is acquiring the Offered Securities

for the Subscriber’s own account as principal, not as a nominee or agent, for investment purposes only, and not with

a view to, or for, resale, distribution or fractionalization thereof in whole or in part and no other person has a direct

or indirect beneficial interest in such Offered Securities. Further, the Subscriber does not have any contract, undertaking,

agreement or arrangement with any person to sell, transfer or grant participations to such person or to any third person,

with respect to any of the Securities. |

| |

(b) |

The Subscriber acknowledges the Subscriber’s

understanding that the offering and sale of the Offered Securities is intended to be exempt from registration under the Securities

Act of 1933, as amended (the “Securities Act”) by virtue of Section 4(a)(2) of the Securities Act, the provisions

of Rule 506 of Regulation D promulgated under the Securities Act (“Regulation D”) and Regulation S promulgated

under the Securities Act (“Regulation S”). In furtherance thereof, the Subscriber represents and warrants to and

agrees with the Company and its affiliates as follows: |

| |

(i) |

The Subscriber realizes that the basis for the foregoing

exemptions may not be present, if, notwithstanding such representations, the Subscriber has in mind merely acquiring Securities

for a fixed or determinable period in the future, or for a market rise, or for sale if the market does not rise. The Subscriber

does not have any such intentions; |

| |

(ii) |

The Subscriber has the financial ability to bear

the economic risk of the Subscriber’s investment, has adequate means for providing for the Subscriber’s current

needs and personal contingencies and has no need for liquidity with respect to the Subscriber’s investment in the Company;

and |

| |

(iii) |

The Subscriber has such knowledge and experience

in financial and business matters as to be capable of evaluating the merits and risks of the prospective investment. If other

than an individual, the Subscriber also represents it has not been organized for the purpose of acquiring the Offered Securities. |

| |

(c) |

The Subscriber represents and warrants to the Company

as follows: |

| |

(i) |

The Subscriber has been given the opportunity for

a reasonable time prior to the date hereof to ask questions of, and receive answers from the Company or its representatives

concerning the terms and conditions of the Offering, and other matters pertaining to this investment, and has been given the

opportunity for a reasonable time prior to the date hereof to obtain such additional information in connection with the Company

in order for the Subscriber to evaluate the merits and risks of purchase of the Offered Securities, to the extent the Company

possesses such information or can acquire it without unreasonable effort or expense; and |

| |

(ii) |

The Subscriber has not been furnished with any oral

representation or oral information in connection with the offering of the Offered Securities; and |

| |

(iii) |

The Subscriber has determined that the Offered Securities

are a suitable investment for the Subscriber and that at this time the Subscriber could bear a complete loss of the Subscriber’s

investment; and |

| |

(iv) |

The Subscriber is not relying on the Company, or

its affiliates with respect to economic considerations involved in this investment; and |

| |

(v) |

The Subscriber realizes that it may not be able

to resell readily any of the Securities purchased hereunder because (A) there may only be a limited public market for any

Securities and (B) none of the Securities have been registered under the “blue sky” laws; and |

| |

(vi) |

The Subscriber understands that the Company has

the absolute right to refuse to consent to the transfer or assignment of the Securities if such transfer or assignment does

not comply with applicable state and federal securities laws; and |

| |

(vii) |

No representations or warranties have been made

to the Subscriber by the Company, or any officer, employee, agent, affiliate or subsidiary of any of it, other than the representations

of the Company in this Agreement; and |

| |

(viii) |

Any information which the Subscriber has heretofore

furnished to the Company with respect to the Subscriber’s financial position and business experience is correct and

complete as of the date of this Agreement and if there should be any material change in such information the Subscriber will

immediately furnish such revised or corrected information to the Company; and |

| |

(ix) |

The Subscriber has received and reviewed the Company’s

Confidential Private Placement Memorandum dated as of August 9, 2013, as amended, and has had access to the reports of the

Company filed pursuant to the Securities Exchange Act of 1934, as amended; and |

| |

(x) |

The foregoing representations, warranties and agreements

shall survive the sale of the Securities and acceptance by the Company of the Subscriber’s subscription. |

SECTION

4

The Company represents and warrants to the

Subscriber as follows:

| Section 4.1 |

Organization,

Good Standing and Qualification. The Company is a corporation duly organized, validly existing and in good standing under

the laws of the State of Nevada and has all requisite corporate power and authority to carry on its business as now conducted

and as proposed to be conducted. The Company is duly qualified to transact business and is in good standing in each jurisdiction

in which the failure to so qualify would have a material adverse effect on the business or properties of the Company and its

subsidiaries taken as a whole. |

| Section 4.2 |

Authorization.

All corporate action on the part of the Company, its officers, directors and shareholders necessary for the authorization,

execution and delivery of this Agreement, the performance of all obligations of the Company hereunder and the authorization,

issuance (or reservation for issuance) and delivery of the Securities being sold hereunder have been taken, and this Agreement

constitutes a valid and legally binding obligation of the Company, enforceable in accordance with its terms. |

| Section 4.3 |

Valid

Issuance of Securities. The Securities, when issued, sold and delivered in accordance with the terms hereof for the consideration

expressed herein, will be validly issued, and, based in part upon the representations of the Subscriber in this Agreement,

will be issued in compliance with all applicable U.S. federal and state securities laws. |

| Section 4.4 |

No

Conflicts. The execution and delivery of this Agreement and the consummation of the issuance of the Securities and the

transactions contemplated by this Agreement do not and will not conflict with or result in a breach by the Company of any

of the terms or provisions of, or constitute a default under, the certificate of incorporation or bylaws of the Company, or

any indenture, mortgage, deed of trust or other material agreement or instrument to which the Company is a party or by which

it or any of its properties or assets are bound, or any existing applicable decree, judgment or order of any court, Federal

or State regulatory body, administrative agency or other governmental body having jurisdiction over the Company or any of

its properties or assets. |

| Section 4.5 |

Compliance

with Laws. As of the date hereof, the conduct of the business of the Company complies in all material respects with all

material statutes, laws, regulations, ordinances, rules, judgments, orders or decrees applicable thereto. The Company shall

comply with all applicable securities laws with respect to the sale of the Securities. |

SECTION

5 (CANADIAN SECURITIES REQUIREMENTS)

If

the Subscriber is a resident of Alberta, Ontario or British Columbia, such Subscriber’s subscription for Offered Securities

is subject to the terms and conditions of this Section 5.

Section 5.1

Offering Exemption.

If

the Subscriber is a resident of Alberta, Ontario or British Columbia, the sale of the Offered Securities by the Company to the

Subscriber is conditional upon such sale being exempt from the requirements as to the filing of a prospectus and as to the preparation

of an offering memorandum contained in any statute, regulation, instrument, rule or policy applicable to the sale of the Offered

Securities or upon the issue of such orders, consents or approvals as may be required to permit such sale without the requirement

of filing a prospectus or delivering an offering memorandum.

Section 5.2

Representations and Warranties.

By

the Subscriber’s acceptance of this Agreement, the Subscriber represents and warrants to the Company (which representations

and warranties shall survive the Closing) that:

| |

· |

the Subscriber is a resident of Alberta, Ontario

or British Columbia and the Subscriber complies with one of the following: |

(i)

the Subscriber is purchasing as principal or is deemed to be purchasing as principal in accordance with applicable Canadian securities

legislation and meets the definition of “accredited Subscriber” as such term is defined under NI 45-106 and has completed

and signed the Subscriber questionnaire set forth on Annex B; or

(ii)

the Subscriber is purchasing as principal and has purchased that number of Offered Securities having an acquisition cost to the

Subscriber of not less than $150,000 to be paid in cash on the date of Closing;

| |

· |

The Subscriber is not a person created or used solely

to purchase or hold securities in order to comply with an exemption from the prospectus requirements of applicable Canadian

securities legislation; and |

| |

· |

The Subscriber and any beneficial purchaser for

whom it is acting is resident in the jurisdiction set out in column (1) on Schedule I, such address was not created and is

not used solely for the purpose of acquiring the Offered Securities and the Subscriber was solicited to purchase in such jurisdiction. |

Section 5.3

Anti-Money Laundering.

The

Subscriber represents and warrants that the funds representing the Purchase Price for the Offered Securities being subscribed

for herein which will be advanced by the Subscriber to the Company hereunder will not represent proceeds of crime for the purposes

of the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (Canada)(the “PCMLTFA”) and the Subscriber

acknowledges that the Company may in the future be required by law to disclose the Subscriber’s name and other information

relating to this Agreement and the Subscriber’s subscription hereunder, on a confidential basis, pursuant to PCMLTFA. To

the best of the Subscriber’s knowledge: (a) none of the subscription funds to be provided by the Subscriber (i) have been

or will be derived from or related to any activity that is deemed criminal under the laws of Canada or the United States of America

or any other jurisdiction, or (ii) are being tendered on behalf of a person or entity who has not been identified to the Subscriber;

and (b) it shall promptly notify the Company if the Subscriber discovers that any of such representations ceases to be true, and

to provide the Company with appropriate information in connection therewith.

Section 5.4

Ontario Securities Commission Disclosure.

If

the Subscriber is resident in Ontario, it acknowledges it has been notified by the Company: (i) of the delivery to the Ontario

Securities Commission (the “OSC”) of the Subscriber’s personal information; (ii) that the Subscriber’s

personal information is being collected indirectly by the OSC under the authority granted to it in the securities legislation;

(iii) the Subscriber’s personal information is being collected for the purposes of the administration and enforcement of

the securities legislation of Ontario; and (iv) the contact information of the public official in Ontario who can answer questions

about the OSC’s indirect collection of personal information is, Administrative Assistant to the Director of Corporate Finance,

Ontario Securities Commission, Suite 1903, Box 5520 Queen Street West, Toronto, Ontario, M5H 3S8, telephone (416) 593-8086, facsimile

(416) 593-8252.

| Section 5.5 |

Stock

Legends. If the Subscriber is a resident of Alberta, Ontario or British Columbia, in addition to the securities legends

set forth in Section 3.7, such Subscriber hereby agrees with the Company as follows: the certificates evidencing the Securities

issued to such Subscriber, and each certificate issued in transfer thereof within the four month period after issuance of

the Securities, will bear the following or similar legend: |

UNLESS

PERMITTED UNDER SECURITIES LEGISLATION, THE HOLDER OF THIS SECURITY MUST NOT TRADE THE SECURITY BEFORE THE DATE THAT IS 4 MONTHS

AND A DAY AFTER THE LATER OF (I) [INSERT THE DISTRIBUTION DATE], AND (II) THE DATE THE ISSUER BECAME A REPORTING ISSUER IN ANY

PROVINCE OR TERRITORY OF CANADA.

SECTION

6

| Section 6.1 |

Additional

Representations and Warranties of Non-U.S. Persons. Each Subscriber that is not a U.S. Person (as defined under Regulation

S), severally and not jointly, further represents and warrants to the Company as follows: (i) at the time of (A) the offer

by the Company and (B) the acceptance of the offer by such Person, of the Securities, such Person was outside the U.S; (ii)

no offer to acquire the Securities or otherwise to participate in the transactions contemplated by this Agreement was made

to such Person or its representatives inside the U.S.; (iii) such Person is not purchasing the Securities for the account

or benefit of any U.S. Person, or with a view towards distribution to any U.S. Person, in violation of the registration requirements

of the Securities Act; (iv) such Person will make all subsequent offers and sales of the Securities either (A) outside of

the U.S. in compliance with Regulation S; (B) pursuant to a registration under the Securities Act; or (C) pursuant to an available

exemption from registration under the Securities Act; (v) such Person is acquiring the Securities for such Person’s

own account, for investment and not for distribution or resale to others; (vi) such Person has no present plan or intention

to sell the Securities in the U.S. or to a U.S. Person at any predetermined time, has made no predetermined arrangements to

sell the Securities and is not acting as an underwriter or dealer with respect to such securities or otherwise participating

in the distribution of such securities; (vii) neither such Person, its Affiliates nor any Person acting on behalf of such

Person, has entered into, has the intention of entering into, or will enter into any put option, short position or other similar

instrument or position in the U.S. with respect to the Securities at any time after the date of Closing through the one year

anniversary of the date of Closing except in compliance with the Securities Act; (viii) such Person consents to the placement

of a legend on any certificate or other document evidencing the Securities as required under applicable law (ix) such Person

is not acquiring the Securities in a transaction (or an element of a series of transactions) that is part of any plan or scheme

to evade the registration provisions of the Securities Act. |

| Section 6.2 |

Opinion.

Such Subscriber will not transfer any or all of such Subscriber’s Securities pursuant to Regulation S or absent an effective

registration statement under the Securities Act and applicable state securities law covering the disposition of such Subscriber’s

Securities, without first providing the Company with an opinion of counsel (which counsel and opinion are reasonably satisfactory

to the Company) to the effect that such transfer will be made in compliance with Regulation S or will be exempt from the registration

and the prospectus delivery requirements of the Securities Act and the registration or qualification requirements of any applicable

U.S. state securities laws. |

SECTION

7

| Section 7.1 |

Indemnity.

The Subscriber agrees to indemnify and hold harmless the Company, its officers and directors, employees and its affiliates

and each other person, if any, who controls any thereof, against any loss, liability, claim, damage and expense whatsoever

(including, but not limited to, any and all expenses whatsoever reasonably incurred in investigating, preparing or defending

against any litigation commenced or threatened or any claim whatsoever) arising out of or based upon any false representation

or warranty or breach or failure by the Subscriber to comply with any covenant or agreement made by the Subscriber herein

or in any other document furnished by the Subscriber to any of the foregoing in connection with this transaction. |

| Section 7.2 |

Modification.

Neither this Agreement nor any provisions hereof shall be waived, amended, modified, discharged or terminated except by

an instrument in writing signed by the party against whom any waiver, amendment, modification, discharge or termination is

sought. |

| Section 7.3 |

Notices.

Any notice, demand or other communication which any party hereto may be required, or may elect, to give to anyone interested

hereunder shall be in writing and shall be deemed given when (a) deposited, postage prepaid, in a United States mail letter

box, registered or certified mail, return receipt requested, addressed to such address as may be given herein, or (b) delivered

personally, to the other party hereto at their address set forth in this Agreement or such other address as a party hereto

may request by notifying the other party hereto. |

| Section 7.4 |

Counterparts.

This Agreement may be executed through the use of separate signature pages or in any number of counterparts, and each of such

counterparts shall, for all purposes, constitute one agreement binding on all parties, notwithstanding that all parties are

not signatories to the same counterpart. |

| Section 7.5 |

Binding

Effect. Except as otherwise provided herein, this Agreement shall be binding upon and inure to the benefit of the parties

and their heirs, executors, administrators, successors, legal representatives and assigns. If the Subscriber is more than

one person, the obligation of the Subscriber shall be joint and several and the agreements, representations, warranties and

acknowledgments herein contained shall be deemed to be made by and be binding upon each such person and his heirs, executors,

administrators and successors. |

| Section 7.6 |

Entire

Agreement. The Exhibits attached hereto are hereby incorporated herein by reference. This Agreement together with the

Annex and Exhibits contains the entire agreement of the parties and there are no representations, covenants or other agreements

except as stated or referred to herein. |

| Section 7.7 |

Assignability.

This Agreement is not transferable or assignable by the Subscriber except as may be provided herein. |

| Section 7.8 |

Applicable

Law. This Agreement shall be governed by and construed in accordance with the laws of the State of New York. |

| Section 7.9 |

Amendments.

The provisions of this Agreement may be amended at any time and from time to time, and particular provisions of this Agreement

may be waived, with and only with an agreement or consent in writing signed by the Company and by the Subscribers currently

holding fifty percent (50%) of the aggregate principal amount of the outstanding Notes as of the date of such amendment or

waiver. |

| Section 7.10 |

Neutral

Gender. The use in this Agreement of words in the male, female or neutral gender are for convenience only and shall not

affect or control any provisions of this Agreement. |

| Section 7.11 |

Captions.

The Section headings contained in this Agreement are for reference purposes only and shall not affect in any way the meaning

or interpretation of this Agreement. |

[Subscription

signature pages follow]

Principal Amount

of Note = $1,000,000.

| B. |

MANNER IN WHICH TITLE IS TO BE HELD (Please

check One): |

| |

|

|

|

|

|

|

| 1. |

o |

Individual |

|

7. |

o |

Trust/Estate/Pension

or Profit Sharing Plan, and

Date

Opened: _______________ |

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| 2. |

o |

Joint Tenants with Rights of Survivorship |

|

8. |

o |

As a

Custodian for ___________

___________________________

UGMA

____________ (State) |

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| 3. |

o |

Community Property |

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| 4. |

o |

Tenants in Common |

|

9. |

o |

Married with Separate Property |

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| 5. |

☒ |

Corporation/Partnership |

|

10. |

o |

Keogh |

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| 6. |

o |

IRA |

|

11. |

o |

Tenants by the Entirety |

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| 12. |

Other |

| |

|

| |

|

| C. |

ACCREDITED INVESTOR REPRESENTATION: |

| |

|

|

|

|

|

|

|

Subscriber

must complete and sign the Accredited Investor Questionnaire attached as Annex A and Annex B (for Canadian Subscribers only) to

this Agreement.

PLEASE

GIVE THE EXACT AND COMPLETE NAME IN WHICH TITLE TO THE SECURITIES ARE TO BE HELD: Heddle Marine Service Inc.

IN WITNESS WHEREOF,

the Subscriber has executed this Agreement on the 19th day of November , 2014.

Heddle Marine

Service Inc.

| Signature: /S/ Richard Heddle |

|

Signature: |

| Name: Richard Heddle |

|

Name: |

| Title President |

| |

| Address On File with Plastic2Oil, Inc. |

***DO NOT

WRITE BELOW DOTTED LINE***

| |

| |

| ACCEPTED ON BEHALF OF THE COMPANY: |

| |

| PLASTIC2OIL, INC. |

| |

By:

/S/ Rahoul Banerjea

Name:

Rahoul Banerjea

Title:

Chief Financial Officer |

|

Principal Amount of Notes: |

$1,000,000 |

| No. of

Warrants:

1,000,000 |

| |

|

|

THIS NOTE HAS NOT BEEN REGISTERED UNDER

THE SECURITIES ACT OF 1933, AS AMENDED (“SECURITIES ACT”), OR APPLICABLE STATE SECURITIES LAWS. THIS NOTE MAY NOT BE

SOLD, PLEDGED OR OTHERWISE TRANSFERRED IN THE ABSENCE OF SUCH REGISTRATION OR PURSUANT TO AN EXEMPTION THEREFROM UNDER THE SECURITIES

ACT AND SUCH STATE LAWS, SUPPORTED BY AN OPINION OF COUNSEL, REASONABLY SATISFACTORY TO THE COMPANY THAT SUCH REGISTRATION IS NOT

REQUIRED.

12% SECURED PROMISSORY NOTE

DUE NOVEMBER 19, 2019

| No. 2014-1 |

|

|

| $1,000,000 |

|

November 19, 2014 |

FOR VALUE RECEIVED, PLASTIC2OIL,

INC., a Nevada corporation (herein called the “Company”), for value received hereby promises to pay on November 19,

2019, to Heddle Marine Service Inc., with an address at 208 Hillyard St., Hamilton, Ontario, Canada L8L 6B6 (herein called the

“Holder”), the principal sum of One Million Dollars ($1,000,000), together with interest upon the principal hereof

at the rate of 12% per annum. Interest on this Note shall be compounded annually and shall accrue on the outstanding principal

amount on this Note from the date of issuance until the date of repayment of the principal and payment of accrued interest in full.

Interest shall be calculated on the basis of a 365 day year and shall be payable at maturity. Payments hereunder shall be made

at such place as the holder hereof shall designate to the undersigned, in writing, in lawful money of the United States of America.

Any payment which becomes due on a Saturday, Sunday or legal holiday shall be payable on the next business day.

This Note shall, (i) upon

declaration by the Holder or (ii) automatically upon acceleration pursuant to clause (c) below, become immediately due and payable

upon the occurrence of any of the following specified events of default:

| (a) |

If the Company shall default in the due and

punctual payment of the principal amount of this Note when and as the same shall become due and payable, whether at maturity or

by acceleration; or

|

| (b) |

If the Company shall default in the due and

punctual payment of interest on this Note when the same shall become due and payable; or

|

| (c) |

If the Company shall commence a voluntary case or other proceeding seeking liquidation, reorganization or other relief with respect to itself or its debts under any bankruptcy, insolvency or other similar law now or hereafter in effect or seeking the appointment of a trustee, receiver, liquidator, custodian or other similar official of it or any substantial part of its property, or shall consent to any such relief or to the appointment of or taking of possession by any such official in an involuntary case or other proceeding commenced against it, or shall make a general assignment for the benefit of creditors, or shall take any corporate action to authorize any of the foregoing; or an involuntary case or other proceeding shall be commenced against the Company seeking liquidation, reorganization or other relief with respect to it or its debts under any bankruptcy, insolvency or other similar law now or hereafter in effect or seeking the appointment of a trustee, receiver, liquidator, custodian or other similar official of it or any substantial part of its property, and such involuntary case or other proceeding shall remain undismissed or unstayed for a period of 60 consecutive days; or |

| (d) |

Company defaults in the performance of any

covenant or other provision with respect to this Note or any other agreement between Company and the Holder or the Collateral Agent

(as defined in the Security Agreement referred to below); or

|

| (e) |

Company fails to pay when due (whether at the

stated maturity, by acceleration or otherwise) any indebtedness for borrowed money owing to the Holder (other than under this Note),

any third party or the occurrence of any event which could result in acceleration of payment of any such indebtedness or the failure

to perform any agreement with any third party; or

|

| (f) |

any representation or warranty made in this

Note, any related document, any agreement between Company and the Holder or the Collateral Agent or in any financial statement

of Company proves to have been misleading in any material respect when made; Company omits to state a material fact necessary to

make the statements made in this Note, any related document, any agreement between Company and the Holder or the Collateral Agent

or any financial statement of Company not misleading in light of the circumstances in which they were made; or, if upon the date

of execution of this Note, there shall have been any material adverse change in any of the facts disclosed in any financial statement,

representation or warranty that was not disclosed in writing to the Holder at or prior to the time of execution hereof; or

|

| (g) |

any pension plan of Company fails to comply

with applicable law or has vested unfunded liabilities that, in the opinion of the Holder, might have a material adverse effect

on Company’s ability to repay its debts; or

|

| (h) |

if the validity of this Note or any mortgage,

pledge agreement, security agreement or any other collateral agreement, including without limitation the Security Agreement, shall

have been challenged or disaffirmed by or on behalf of any of such parties thereto; or if, other than as a direct result of any

action or inaction of the Holder, the liens created or intended to be created by any such collateral agreements shall at any time

cease to be valid and perfected first priority liens in favor of Holder’s collateral agent, subject to no equal or prior

liens.

|

Declaration of this Note being immediately

due and payable by the Holder may only be made by written notice to the Company declaring the unpaid balance of the principal amount

of this Note and accrued interest thereon to be due. Such declaration shall be deemed given upon the occurrence of any event specified

in clause (c) above. In the event of a default, all costs of collection, including reasonable attorneys’ fees, shall be paid

by the Company.

This Note may be prepaid by the Company in

whole or in part at any time or from time to time without penalty or premium. This Note is not assignable by the holder hereof

and any such purported assignment shall be null and void.

The Company for itself and its successors and

assigns hereby waives presentment, demand, notice, protest and all other demands and notices in connection with the delivery, acceptance,

performance or endorsement of this Note, and agrees that this Note shall be deemed to have been made under, and shall be interpreted

and governed by reference to, the laws of the State of New York.

Except as expressly agreed in writing by the

Holder, no extension of time for payment of this Note, or any installment hereof, and no alteration, amendment or waiver of any

provision of this Note shall release, discharge, modify, change or affect the liability of the Company under this Note.

All of the covenants, stipulations, promises

and agreements made by or contained in this Note on behalf of the undersigned shall bind its successors, whether so expressed or

not.

No failure on the part of the Holder to exercise,

and no delay in exercising, any right under this Note shall operate as a waiver thereof, nor shall any single or partial exercise

of such rights preclude any other or further exercise thereof or the exercise of any other right.

It is the intention of the Company and the

Holder that all payments due hereunder will be treated for accounting and tax purposes as indebtedness of the Company to the Holder.

Each of the Company and the Holder agrees to report such payments due hereunder for the purposes of all taxes in a manner consistent

with such intended characterization.

If any term or provision of this Note shall

be held invalid, illegal or unenforceable, the validity of all other terms and provisions herein shall in no way be affected thereby.

The Company’s obligations under this

Note shall be secured pursuant to that certain Security Agreement, dated as of August 29, 2013 (the “Security Agreement”),

by the Company and certain of its subsidiaries, each as grantor, in favor of the Collateral Agent for the benefit of the purchasers

of 12% secured promissory notes of like tenor issued by the Company, including Mr. Richard Heddle, personally, as purchaser of

12% secured promissory notes in August or September of 2013 in an aggregate principal amount of $2 million (this Note and such

other notes are collectively, the “12% Company Notes”). The Company’s obligations under this Note and the other

12% Company Notes are also secured by each of the following agreements made in favor of the holders of 12% Company Notes by the

Company (and if requested by the Collateral Agent or the Holder, one or more of its subsidiaries) (the “Additional Collateral

Documents”):

| (a) |

mortgages in the Company’s (or one of

its subsidiaries’, as applicable) real properties located in Niagara Falls, New York;

|

| (b) |

one or more intellectual property security agreements covering material intellectual property owned by the Company (or one of its subsidiaries, as applicable). |

IN WITNESS WHEREOF, the

Company has caused this Note to be signed in its corporate name by its Chief Financial Officer as of the date hereinabove set forth.

| |

PLASTIC2OIL, INC. |

| |

|

|

| |

By: |

/S/Rahoul Banerjea |

| |

|

Name: Rahoul Banerjea |

| |

|

Title: Chief Financial Officer |

THE SECURITIES REPRESENTED

BY THIS CERTIFICATE MAY NOT BE OFFERED FOR SALE, SOLD OR OTHERWISE TRANSFERRED EXCEPT IN ACCORDANCE WITH AN EFFECTIVE REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR IN ACCORDANCE WITH AN EXEMPTION FROM REGISTRATION UNDER THAT ACT, SUPPORTED

BY AN OPINION OF COUNSEL, REASONABLY SATISFACTORY TO THE COMPANY THAT SUCH REGISTRATION IS NOT REQUIRED.

WARRANT TO PURCHASE

SHARES OF COMMON STOCK OF

PLASTIC2OIL, INC.

This certifies that Richard

Heddle or any party to whom this Warrant is assigned in accordance with its terms is entitled to subscribe for and purchase 1,000,000

shares of the Common Stock of Plastic2Oil, Inc., a Nevada corporation, on the terms and conditions of this Warrant.

1. Definitions.

As used in this Warrant, the term:

1.1 “Business Day”

means any day other than a Saturday, Sunday, or a day on which banking institutions in the State of New York are authorized or

obligated to be closed by law or by executive order.

1.2 “Common Stock”

means the Common Stock, par value $.001 per share, of the Corporation.

1.3 “Corporation”

means Plastic2Oil, Inc. a Nevada corporation, or its successor.

1.4 “Expiration Date”

means November 19, 2019.

1.5 “Holder”

means Heddle Marine Service Inc. or any party to whom this Warrant is assigned in accordance with its terms.

1.6 “1933 Act”

means the Securities Act of 1933, as amended.

1.7 “Warrant”

means this Warrant and any warrants delivered in substitution or exchange for this Warrant in accordance with the provisions of

this Warrant.

1.8 “Warrant Price”

means $0.12 per share of Common Stock, as such amount may be adjusted pursuant to Section 4 hereof.

2. Exercise of Warrant.

At any time before the Expiration Date, the Holder may exercise the purchase rights represented by this Warrant, in whole or in

part, by surrendering this Warrant (with a duly executed subscription in the form attached) at the Corporation’s principal

corporate office (located on the date hereof in Niagara Falls, New York) and by paying the Corporation, by certified or cashier’s

check, the aggregate Warrant Price for the shares of Common Stock being purchased.

2.1 Delivery of Certificates.

Within thirty (30) days after each exercise of the purchase rights represented by this Warrant, the Corporation shall deliver a

certificate for the shares of Common Stock so purchased to the Holder and, unless this Warrant has been fully exercised or expired,

a new Warrant representing the balance of the shares of Common Stock subject to this Warrant.

2.2 Effect of Exercise. The

person entitled to receive the shares of Common Stock issuable upon any exercise of the purchase rights represented by this Warrant

shall be treated for all purposes as the holder of such shares of record as of the close of business on the date of exercise.

3. Stock Fully Paid;

Reservation of Shares. The Corporation covenants and agrees that all securities that it may issue upon the exercise of the

rights represented by this Warrant will, upon issuance, be fully paid and nonassessable and free from all taxes, liens and charges.

The Corporation further covenants and agrees that, during the period within which the Holder may exercise the rights represented

by this Warrant, the Corporation shall at all times have authorized and reserved for issuance enough shares of its Common Stock

or other securities for the full exercise of the rights represented by this Warrant. The Corporation shall not, by an amendment

to its Articles of Incorporation or through reorganization, consolidation, merger, dissolution, issue or sale of securities, sale

of assets or any other voluntary action, avoid or seek to avoid the observance or performance of any of the terms of this Warrant.

4. Adjustments.

The Warrant Price and the number of shares of Common Stock that the Corporation must issue upon exercise of this Warrant shall

be subject to adjustment in accordance with Sections 4.1 through 4.3.

4.1 Adjustment to Warrant

Price for Combinations or Subdivisions of Common Stock. If the Corporation at any time or from time to time after the date hereof

(1) declares or pays, without consideration, any dividend on the Common Stock payable in Common Stock; (2) creates any right to

acquire Common Stock for no consideration; (3) subdivides the outstanding shares of Common Stock (by stock split, reclassification

or otherwise); or (4) combines or consolidates the outstanding shares of Common Stock, by reclassification or otherwise, into a

lesser number of shares of Common Stock, the Corporation shall proportionately increase or decrease the Warrant Price, as appropriate.

4.2 Adjustments for Reclassification

and Reorganization. If the Common Stock issuable upon exercise of this Warrant changes into shares of any other class or classes

of security or into any other property for any reason other than a subdivision or combination of shares provided for in Section

4.1, including without limitation any reorganization, reclassification, merger or consolidation, the Corporation shall take all

steps necessary to give the Holder the right, by exercising this Warrant, to purchase the kind and amount of securities or other

property receivable upon any such change by the owner of the number of shares of Common Stock subject to this Warrant immediately

before the change.

4.3 Spin Offs. If the Corporation

spins off any subsidiary by distributing to the Corporation’s shareholders as a dividend or otherwise any stock or other

securities of the subsidiary, the Corporation shall reserve until the Expiration Date enough of such shares or other securities

for delivery to the Holders upon any exercise of the rights represented by this Warrant to the same extent as if the Holders owned

of record all Common Stock or other securities subject to this Warrant on the record date for the distribution of the subsidiary’s

shares or other securities.

4.4 Certificates as to Adjustments.

Upon each adjustment or readjustment required by this Section 4, the Corporation at its expense shall promptly compute such adjustment

or readjustment in accordance with this Section, cause independent public accountants selected by the Corporation to verify such

computation and prepare and furnish to the Holder a certificate setting forth such adjustment or readjustment and showing in detail

the facts upon which such adjustment or readjustment is based.

5. Fractional Shares.

The Corporation shall not issue any fractional shares in connection with any exercise of this Warrant.

6. Dissolution or Liquidation.

If the Corporation dissolves, liquidates or winds up its business before the exercise or expiration of this Warrant, the Holder

shall be entitled, upon exercising this Warrant, to receive in lieu of the shares of Common Stock or any other securities receivable

upon such exercise, the same kind and amount of assets as would have been issued, distributed or paid to it upon any such dissolution,

liquidation or winding up with respect to such shares of Common Stock or other securities, had the Holder been the holder of record

on the record date for the determination of those entitled to receive any such liquidating distribution or, if no record is taken,

upon the date of such liquidating distribution. If any such dissolution, liquidation or winding up results in a cash distribution

or distribution of property which the Corporation’s Board of Directors determines in good faith to have a cash value in excess

of the Warrant Price provided by this Warrant, then the Holder may, at its option, exercise this Warrant without paying the aggregate

Warrant Price and, in such case, the Corporation shall, in making settlement to Holder, deduct from the amount payable to Holder

an amount equal to such aggregate Warrant Price.

7. Transfer and Exchange.

7.1 Transfer. Subject to

Section 7.3, the Holder may transfer all or part of this Warrant at any time on the books of the Corporation at its principal office

upon surrender of this Warrant, properly endorsed. Upon such surrender, the Corporation shall issue and deliver to the transferee

a new Warrant or Warrants representing the Warrants so transferred. Upon any partial transfer, the Corporation shall issue and

deliver to the Holder a new Warrant or Warrants with respect to the Warrants not so transferred.

7.2 Exchange. The Holder

may exchange this Warrant at any time at the principal office of the Corporation for Warrants in such denominations as the Holder

may designate in writing. No such exchanges will increase the total number of shares of Common Stock or other securities that are

subject to this Warrant.

7.3 Securities Act of 1933.

By accepting this Warrant, the Holder agrees that this Warrant and the shares of the Common Stock issuable upon exercise of this

Warrant may not be offered or sold except in compliance with the 1933 Act, and then only with the recipient’s agreement to

comply with this Section 7 with respect to any resale or other disposition of such securities. The Corporation may make a notation

on its records in order to implement such restriction on transferability.

8. Loss or Mutilation.

Upon the Corporation’s receipt of reasonably satisfactory evidence of the ownership and the loss, theft, destruction or mutilation

of this Warrant and (in the case of loss, theft or destruction) of a reasonably satisfactory indemnity or (in the case of mutilation)

upon surrender and cancellation of this Warrant, the Corporation shall execute and deliver a new Warrant to the Holder.

9. Successors. All

the covenants and provisions of this Warrant shall bind and inure to the benefit of the Holder and the Corporation and their respective

successors and assigns.

10. Notices. All

notices and other communications given pursuant to this Warrant shall be in writing and shall be deemed to have been given when

personally delivered or when mailed by prepaid registered, certified or express mail, return receipt requested. Notices should

be addressed as follows:

|

(a)

If to Holder, then to:

Heddle

Marine Service Inc.

208

Hillyard Street Hamilton

Ontario,

Canada L8L6B6 |

|

(b)

If to the Corporation, then to:

Plastic2Oil,

Inc.

20

Iroquois Street

Niagara

Falls, NY 14303

Attention:

Chief Financial Officer |

| |

|

Such addresses for notices

may be changed by any party by notice to the other party pursuant to this Section 10.

11. Amendment. This

Warrant may be amended only by an instrument in writing signed by the Corporation and the Holder.

12. Construction of

Warrant. This Warrant shall be construed as a whole and in accordance with its fair meaning. A reference in this Warrant to

any section shall be deemed to include a reference to every section the number of which begins with the number of the section to

which reference is made. This Warrant has been negotiated by both parties and its language shall not be construed for or against

any party.

13. Law Governing.

This Warrant is executed, delivered and to be performed in the State of New York and shall be construed and enforced in accordance

with and governed by the New York law without regard to any conflicts of law or choice of forum provisions.

Dated as of November 19, 2014

| |

By: |

/S/ Rahoul Banerjea__ |

| |

|

Name: Rahoul Banerjea |

| |

|

Title: Chief Financial Officer |

SUBSCRIPTION FORM

(To be executed only upon exercise of Warrant)

The undersigned registered

owner of this Warrant irrevocably exercises this Warrant and agrees to purchase _______ shares of Common Stock of Plastic2Oil,

Inc., all at the price and on the terms and conditions specified in this Warrant.

The undersigned acknowledges

that, by issuing shares of Common Stock to the undersigned upon exercise of the Warrant, the Company is relying on an exemption

from the registration of such shares under the Securities Act of 1933, as amended, or other applicable law. In accordance therewith,

the undersigned represents and warrants that the representations and warranties of the undersigned contained in the Subscription

Agreement between the Company and the undersigned, pursuant to which the undersigned purchased the Warrant, along with the undersigned’s

answers to the applicable investor questionnaires annexed thereto, are true and correct in all material respects as of the date

hereof.

Dated: __________________

| |

|

| |

(Signature of Registered Holder) |

| |

|

| |

|

| |

(Street Address) |

| |

|

| |

|

| |

(City) (State) (Zip) |

ISSUE OF A NEW WARRANT

(To be executed only upon partial exercise,

exchange, or partial transfer of Warrant)

Please issue ______ Warrants,

each representing the right to purchase ________ shares of Common Stock of Plastic2Oil, Inc. to the registered holder.

Dated: ________________

| |

|

| |

(Signature of Registered Holder) |

FORM OF ASSIGNMENT

FOR VALUE RECEIVED, the

undersigned registered Holder of this Warrant sells, assigns and transfers unto the Assignee named below all of the rights of the

undersigned under the Warrant, with respect to the number of shares of Common Stock set forth below (the “Transfer”):

| Name of Assignee |

|

Address |

|

No. of Shares |

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

The undersigned irrevocably

constitutes and appoints _______ as the undersigned’s attorney-in-fact, with full power of substitution, to make the transfer

on the books of Plastic2Oil, Inc.

Dated: ________________

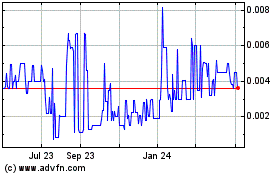

Plastic2Oil (PK) (USOTC:PTOI)

Historical Stock Chart

From Dec 2024 to Jan 2025

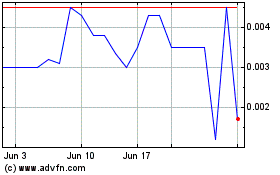

Plastic2Oil (PK) (USOTC:PTOI)

Historical Stock Chart

From Jan 2024 to Jan 2025