![[F497CLASSAC001.JPG]](http://content.edgar-online.com/edgar_conv_img/2014/03/26/0000910472-14-001307_F497CLASSAC001.JPG)

PROSPECTUS

March 25, 2014

Total Income+ Real Estate Fund

Class A Shares (TIPRX) and Class C Shares (TIPPX) of Beneficial Interest

The Total Income+ Real Estate Fund (the "Fund") is a continuously offered, non-diversified, closed-end management investment company that is operated as an interval fund.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This prospectus is intended to concisely provide you, a prospective investor, with information about the Fund that you should know before investing in the shares of the Fund that are being offered through this prospectus. You are advised to thoroughly and carefully read this prospectus and retain it for future reference. Additional information about the Fund is also available on the Securities and Exchange Commission’s ("SEC") website at

http://www.sec.gov

, including the Fund’s Class A shares and Class C shares Statement of Additional Information dated March 25, 2014 (the "SAI"). The address of the SEC's website is provided solely for the information of prospective shareholders and is not intended to be an active link. The table of contents of the SAI appears on page 45 of this prospectus. The SAI is incorporated by reference into this prospectus (legally made a part of this prospectus). The SAI, Fund annual and semi-annual reports when available, and other information and shareholder inquiries regarding the Fund are available free of charge and may be requested by writing the Fund at c/o Gemini Fund Services, LLC, 80 Arkay Drive, Hauppauge, NY 11788 (the “Fund Administrator”), by calling the Fund Administrator toll-free 1-888-459-1059, or by visiting the Fund’s website at

http://www.bluerockfunds.com

.

Investment Objectives.

The Fund’s primary investment objective is to generate current income while secondarily seeking long-term capital appreciation with low to moderate volatility and low correlation to the broader markets.

Summary of Investment Strategy.

The Fund pursues its investment objectives using a multi-strategy, multi-manager, multi-sector approach, primarily investing in a strategic combination of what the Fund’s advisor believes are ‘best in class’ global institutional private equity real estate and institutional public real estate investment funds.

The Advisor.

The Fund’s investment advisor is Bluerock Fund Advisor LLC (the “Advisor”), a registered advisor under the Investment Advisers Act of 1940, as amended (the “Advisers Act”). The Advisor has engaged Mercer Investment Management, Inc. (“Mercer”), a registered advisor under the Advisers Act, to provide ongoing research, opinions and recommendations of institutional asset managers and their investment funds for consideration by the Advisor on behalf of the Fund. Mercer's related investment businesses have over 400 clients globally with $86 billion in assets under management and

over 3,700 clients globally with $7.0 trillion in assets under advisement as of December 2013. See “The Fund” and “Investment Objectives, Strategies and Investment Features.”

Securities Offered.

The Fund engages in a continuous offering of classes of shares of beneficial interest of the Fund. Class A shares and Class C shares are offered by this prospectus. The Fund has registered 20,000,000 shares, and is authorized as a Delaware statutory trust to issue an unlimited number of shares. The Fund is offering to sell, through its principal underwriter, Northern Lights Distributors, LLC (the "Distributor") on a continual basis under the terms of this prospectus, 20,000,000 shares of beneficial interest at net asset value (“NAV”) per share of the relevant share class, plus any applicable sales load. As of February 28, 2014 the Fund’s net asset value per share was $28.00 for Class A shares and no Class C shares were outstanding. Any sales load will be deducted from the proceeds to the Fund. The maximum sales load is 5.75% of the amount invested for Class A shares, while Class C shares are not subject to sales charges. The minimum initial investment by a shareholder for Class A and Class C shares is $2,500 for regular accounts and $1,000 for retirement plan accounts. Subsequent investments may be made with at least $100 for regular accounts and $50 for retirement plan accounts. The Distributor is not required to sell any specific number or dollar amount of the Fund's shares, but will use reasonable efforts to sell the shares. Monies received will be invested promptly and no arrangements have been made to place such monies in an escrow, trust or similar account. See "Plan of Distribution." The Fund's continuous offering is expected to continue in reliance on Rule 415 under the Securities Act of 1933, as amended until the Fund has sold shares in an amount equal to approximately $500 million.

The Fund’s shares have no history of public trading, nor is it intended that they will be listed on a public exchange at this time.

No secondary market is expected to develop for the Fund's shares, liquidity for the Fund's shares will be provided only through quarterly repurchase offers for no less than 5% of the Fund's shares at per-class net asset value, and there is no guarantee that an investor will be able to sell all the shares that the investor desires to sell in the repurchase offer. Investing in the Fund's shares involves substantial risks, including the risks set forth in the "Risk Factors" section of this prospectus, below.

Investment Advisor

Bluerock Fund Advisor, LLC (the "Advisor")

TABLE OF CONTENTS

|

|

|

I.

PROSPECTUS SUMMARY

|

1

|

|

II.

SUMMARY OF FUND EXPENSES

|

12

|

|

III.

FINANCIAL HIGHLIGHTS

|

13

|

|

IV.

THE FUND

|

14

|

|

V.

USE OF PROCEEDS

|

14

|

|

VI.

INVESTMENT OBJECTIVE, POLICIES AND STRATEGIES

|

14

|

|

VII.

RISK FACTORS

|

20

|

|

VIII.

MANAGEMENT OF THE FUND

|

26

|

|

IX.

DETERMINATION OF NET ASSET VALUE

|

29

|

|

X.

CONFLICTS OF INTEREST

|

30

|

|

XI.

QUARTERLY REPURCHASE OF SHARES

|

30

|

|

XII.

DISTRIBUTION POLICY

|

33

|

|

XIII.

DIVIDEND REINVESTMENT POLICY

|

34

|

|

XIV.

U.S. FEDERAL INCOME TAX MATTERS

|

34

|

|

XV.

DESCRIPTION OF CAPITAL STRUCTURE AND SHARES

|

35

|

|

XVI.

ANTI-TAKEOVER PROVISIONS IN DECLARATION OF TRUST

|

36

|

|

XVII.

PLAN OF DISTRIBUTION

|

37

|

|

XVIII.

LEGAL MATTERS

|

42

|

|

XIX.

REPORTS TO SHAREHOLDERS

|

42

|

|

XX.

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

|

42

|

|

XXI.

ADDITIONAL INFORMATION

|

42

|

|

XXII.

TABLE OF CONTENTS OF THE STATEMENT OF ADDITIONAL INFORMATION

|

43

|

|

XXIII.

NOTICE OF PRIVACY POLICY & PRACTICES

|

44

|

PROSPECTUS SUMMARY

This summary does not contain all of the information that you should consider before investing in the shares. You should review the more detailed information contained or incorporated by reference in this prospectus and in the Statement of Additional Information, particularly the information set forth below under the heading "Risk Factors."

|

|

|

The Fund

|

Total Income+ Real Estate Fund (the “Fund”) is a continuously offered, non-diversified, closed-end management investment company. See "The Fund." The Fund is an interval fund that provides investor liquidity by offering to make quarterly repurchases of each class of shares at that class of shares’ net asset value, which will be calculated on a daily basis. See "Quarterly Repurchases of Shares," and “Determination of Net Asset Value.”

|

|

Investment Objectives and Policies

|

The Fund’s primary investment objective is to generate current income while secondarily seeking long-term capital appreciation with low to moderate volatility and low correlation to the broader markets.

The Fund pursues its investment objectives by investing, under normal circumstances, at least 80% of net assets, plus the amount of any borrowings for investment purposes, in “real estate industry securities,” primarily in income producing equity and debt securities. The Fund invests in debt securities of any duration or maturity.

The Fund concentrates investments in the real estate industry, meaning that under normal circumstances, it invests over 25% of its assets in real estate industry securities. The Fund’s investments may be targeted in any one or more of the many sectors of the real estate market, including but not limited to the retail, office, multifamily, hospitality, industrial, residential, medical and self-storage sectors. The Fund defines real estate industry securities to include the common stock partnership or similar interests, convertible or non-convertible preferred stock, and convertible or non-convertible secured or unsecured debt issued by: private real estate investment funds managed by institutional investment managers (“Institutional Investment Funds”); non-traded unregistered real estate investment trusts (“Private REITs”); publicly traded real estate securities such as publicly registered real estate investment trusts (“Public REITs”); exchange traded funds, index mutual funds, and other investment vehicles such as closed-end funds and mutual funds that invest principally, directly or indirectly, in real estate (collectively, “Other Public Investment Vehicles”) and unregistered funds that invest principally in real estate. In certain circumstances or market environments the Fund may reduce its investment in real estate industry securities and hold a larger position in cash or cash equivalents. The Fund will not invest in any issuers that are affiliated with the Fund, the Advisor or the Sub-Advisor.

The Fund’s real estate industry investment policy is fundamental and may not be changed without shareholder approval. The Fund’s Class A and Class C shares Statement of Additional Information (“SAI”) contains a list of all of the fundamental and non-fundamental investment policies of the Fund, under the heading "Investment Objectives and Policies."

|

1

|

|

|

Investment Strategy

|

The Fund pursues its investment objectives using a multi-strategy, multi-manager, multi-sector approach, primarily investing in a strategic combination of global ‘best in class’ institutional private equity real estate and institutional public real estate investment funds.

The Fund executes its investment strategy by seeking to invest in a proprietary portfolio of global ‘best in class’ Institutional Investment Funds in primarily two main categories – private equity real estate, and publicly traded real estate securities. The term ‘best in class’ refers to Institutional Investment Funds that Bluerock Fund Advisor, LLC (the “Advisor”) has identified as offering above average prospects using information provided by Mercer Investment Management, Inc. (“Mercer” or the “Sub-Advisor”), using the Sub-Advisor’s proprietary screening process. Mercer’s screening process applies multiple factors including quantitative and qualitative assessment (as described more fully below) of the management team and track record, and is not generally available to the individual investor through financial filings or published reports. Mercer is one of the leading advisors to endowments, pension funds, sovereign wealth funds, and family offices globally.

Many of the Institutional Investment Funds have a large minimum investment size and stringent investor qualification criteria that are intended to limit their direct investors to mainly institutions such as endowments and pension funds. As such, the Fund enables investors to invest with institutional investment managers that may not be otherwise permitted or available to them.

The Advisor will sell a security when other securities are available that offer higher expected current income, long-term capital appreciation, lower volatility or correlation to broader securities markets or a combination of the preceding.

In addition, the Fund enables investors to execute a multi-strategy, multi-manager, multi-sector strategy by making a single investment in the Fund, whereas due to the large minimums of many of the Institutional Investment Funds, such a strategy may not otherwise be permitted or available to the investor.

The Advisor also believes that the Fund may be able to provide an additional benefit in terms of lower fees from the Institutional Investment Funds as a result of volume discounts that may not otherwise be permitted or available to them.

|

|

Investment Advisor

|

Bluerock Fund Advisor, LLC was formed on May 11, 2012. The Advisor is a subsidiary of Bluerock Real Estate Holdings, LLC. Bluerock and its affiliates and principals have collectively sponsored or structured real estate transactions totaling approximately 30 million square feet and with approximately $10 billion in value.

|

|

Sub-Advisor (s)

|

The Advisor may, from time to time, engage one or more investment sub-advisors. Any sub-advisor chosen by the Advisor will be paid by the Advisor on only the portion of Fund assets allocated to any such sub-advisor. Shareholders do not pay any sub-advisor.

The

Advisor has engaged Mercer Investment Management, Inc., a registered advisor

under the Advisers Act, to provide both ongoing

|

2

|

|

|

|

research and opinions of institutional asset managers and their investment funds for consideration by the Advisor on behalf of the Fund as well as recommendations for the selection of investment funds for approval by the Advisor.

|

|

Advisor Fees and Expenses

|

The Advisor is entitled to receive a monthly fee at the annual rate of 1.50% of the Fund's daily net assets. The Advisor and the Fund have entered into an expense limitation and reimbursement agreement (the "Expense Limitation Agreement") under which the Advisor has contractually agreed to waive its fees and to pay or absorb the ordinary operating expenses of the Fund (including offering and organizational expenses, but excluding taxes, interest, brokerage commissions, acquired fund fees and expenses and extraordinary expenses), to the extent that such expenses exceed 1.84% and 2.59% per annum of the Fund's average daily net assets (the "Expense Limitation") attributable to Class A and Class C shares, respectively. In consideration of the Advisor’s agreement to limit the Fund\'s expenses, the Fund has agreed to repay the Advisor in the amount of any fees waived and Fund expenses paid or absorbed, subject to the limitations that: (1) the reimbursement for fees and expenses will be made only if payable not more than three years from the end of the fiscal year in which they were incurred; and (2) the reimbursement may not be made if it would cause the Expense Limitation to be exceeded. The Expense Limitation Agreement will remain in effect at least until March 31, 2015, unless and until the Board of Trustees of the Fund (the “Board”) approves its modification or termination. After March 31, 2015, the Expense Limitation Agreement may be renewed at the Advisor’s and Board's discretion. See "Management of the Fund."

|

|

Administrator, Accounting Agent

and Transfer Agent

|

Gemini Fund Services, LLC will serve as the administrator, accounting agent and transfer agent of the Fund. See "Management of the Fund."

|

|

Distribution Fees

|

The Class C shares will pay to the Distributor a distribution fee (the “Distribution Fee”) that will accrue at an annual rate equal to 0.75% of the Fund’s average daily net assets attributable to Class C shares and is payable on a quarterly basis. Class A shares are not subject to a Distribution Fee. See “Plan of Distribution.”

|

|

Closed-End Fund Structure

|

Closed-end funds differ from mutual funds in that closed-end funds do not typically redeem their shares at the option of the shareholder. Closed-end fund shares typically trade in the secondary market via a stock exchange. Unlike many closed-end funds, however, the Fund's shares will not be listed on a stock exchange. Instead, the Fund will provide limited liquidity to shareholders by offering to repurchase a limited amount of the Fund's shares (at least 5%) quarterly, which is discussed in more detail below. The Fund, similar to a mutual fund, is subject to continuous asset in-flows, although not subject to the continuous out-flows.

|

|

Share Classes

|

The Fund offers two classes of shares by this prospectus: Class A and Class C shares. The Fund began continuously offering its common shares on October 22, 2012. As of February 18, 2014, the Fund simultaneously redesignated

its issued and outstanding common shares as Class A shares and created

its Class C shares. An investment in any share class of the Fund

represents an investment in the same assets of the Fund. However, the

sales loads and

|

3

|

|

|

|

ongoing fees and expenses for each share class are different. The loads, fees and expenses for the Fund are set forth in “Summary of Fund Expenses.” If an investor has hired an intermediary and is eligible to invest in more than one class of shares, the intermediary may help determine which share class is appropriate for that investor. When selecting a share class, you should consider which share classes are available to you, how much you intend to invest, how long you expect to own shares, and the total costs and expenses associated with a particular share class. The Fund offers Class I shares, which are subject to higher investment minimums, through a separate prospectus.

Each investor’s financial considerations are different. You should speak with your financial advisor to help you decide which share class is best for you. Not all financial intermediaries offer all classes of shares. If your financial intermediary offers more than one class of shares, you should carefully consider which class of shares to purchase.

|

|

Investor Suitability

|

An investment in the Fund involves a considerable amount of risk. It is possible that you will lose some or all of your money. An investment in the Fund is suitable only for investors who can bear the risks associated with the limited liquidity of the shares and should be viewed as a long-term investment. Before making your investment decision, you should (i) consider the suitability of this investment with respect to your investment objectives and personal financial situation and (ii) consider factors such as your personal net worth, income, age, risk tolerance and liquidity needs.

|

|

Repurchases of Shares

|

The Fund is an interval fund and, as such, has adopted a fundamental policy to make quarterly repurchase offers, at net asset value, of no less than 5% the Fund's shares outstanding. There is no guarantee that shareholders will be able to sell all of the shares they desire to sell in a quarterly repurchase offer, although each shareholder will have the right to require the Fund to purchase at least 5% of such shareholder's shares in each quarterly repurchase. Liquidity will be provided to shareholders only through the Fund's quarterly repurchases. See "Quarterly Repurchases of Shares."

|

|

Summary of Risks

|

Investing in the Fund involves risks, including the risk that you may receive little or no return on your investment or that you may lose part or all of your investment. Before investing you should consider carefully the risks that you assume when you invest in the Fund's shares. See "Risk Factors."

Allocation Risk.

The ability of the Fund to achieve its investment objective depends, in part, on the ability of the Advisor to allocate effectively the Fund's assets among the various Institutional Investment Funds, Private REITs, Public REITs and Other Public Investment Vehicles in which the Fund invests and, with respect to each such asset class, among equity and fixed income securities. There can be no assurance that the actual allocations will be effective in achieving the Fund's investment objective or delivering positive returns.

Convertible Securities Risk.

Convertible securities are typically issued as bonds or preferred shares with the option to convert to equities. As a result, convertible securities are a hybrid that have

|

4

|

|

characteristics of both bonds and common stocks and are subject to risks associated with both debt securities and equity securities. The market value of bonds and preferred shares tend to decline as interest rates increase. Fixed-income and preferred securities also are subject to credit risk, which is the risk that an issuer of a security may not be able to make principal and interest or dividend payments as due. Convertible securities may have characteristics similar to common stocks especially when their conversion value is higher than their value as a bond. The price of equity securities into which a convertible security may convert may fall because of economic or political changes. Stock prices in general may decline over short or even extended periods of time. Additionally, the value of the embedded conversion option may be difficult to value and evaluate because the option does not trade separately from the convertible security.

Correlation Risk.

The Fund seeks to produce returns that are not correlated to the broader financial markets. Although the prices of equity securities and fixed-income securities, as well as other asset classes, often rise and fall at different times so that a fall in the price of one may be offset by a rise in the price of the other, in down markets the prices of these securities and asset classes can also fall in tandem. Because the Fund allocates its investments among different real estate asset classes, the Fund is subject to correlation risk.

Credit Risk.

It is possible that issuers of debt securities may not make scheduled interest and principal payments, resulting in losses to the Fund. In addition, the credit quality of securities held may be lowered if an issuer's financial condition changes and this also may negatively impact the Fund’s returns on investment in such securities.

Distribution Policy Risk.

The Fund's distribution policy is designed to generate quarterly distributions. All or a portion of a distribution may consist of a return of capital (i.e. from your original investment). Shareholders should not assume that the source of a distribution from the Fund is net profit. Shareholders should note that return of capital will reduce the tax basis of their shares and potentially increase the taxable gain, if any, upon disposition of their shares.

Fixed Income Risk.

Typically, a rise in interest rates causes a decline in the value of fixed income securities. Fixed income securities are also subject to default risk.

Institutional Investment Fund Risk.

The Fund’s investment in Institutional Investment Funds will require it to bear a pro rata share of the vehicles’ expenses, including management and performance fees. The fees the Fund pays to invest in an Institutional Investment Fund may be higher than if the manager of the Institutional Investment Fund managed the Fund’s assets directly. The performance fees charged by certain Institutional Investment Funds may create an incentive for its manager to make investments that are riskier and/or more speculative than those it might have made in the absence of a performance fee. Furthermore, Institutional Investment Funds, like the other “Underlying Funds” in which the Fund may invest, are subject to specific risks, depending on the nature of the vehicle, and also may employ leverage such that their returns are more than one times that of their benchmark which could

|

5

|

|

amplify losses suffered by the Fund when compared to unleveraged investments. Shareholders of the Institutional Investment Funds are not entitled to the protections of the Investment Company Act of 1940, as amended (the “1940 Act”). For example, these funds need not have independent boards, shareholder approval of advisory contracts may not be required, these funds may leverage to an unlimited extent, and may engage in joint transactions with affiliates. These characteristics present additional risks for shareholders.

Issuer and Non-Diversification Risk.

The value of a specific security can perform differently from the market as a whole for reasons related to the investment manager or issuer, such as management performance, financial leverage and reduced demand for the respective properties and services. The Fund's performance may be more sensitive to any single economic, business, political or regulatory occurrence than the value of shares of a diversified investment company because as a non-diversified fund, the Fund may invest more than 5% of its total assets in the securities of one or more issuers.

Lack of Control Over Institutional Investment Funds and Other Portfolio Investments.

Once the Advisor has selected an Institutional Investment Fund, Private REIT, Public REIT, or Other Public Investment Vehicle (each, an “Underlying Fund” and together, the “Underlying Funds”), the Advisor will have no control over the investment decisions made by any such Underlying Fund. Although the Fund and the Advisor will evaluate regularly each Underlying Fund and its manager to determine whether their respective investment programs are consistent with the Fund’s investment objective, the Advisor will not have any control over the investments made by any Underlying Fund. Even though the Underlying Funds are subject to certain constraints, the managers may change aspects of their investment strategies. The managers may do so at any time (for example, such change may occur immediately after providing the Advisor with the quarterly unaudited financial information for an Institutional Investment Fund). The Advisor may reallocate the Fund’s investments among the Underlying Funds, but the Advisor’s ability to do so may be constrained by the withdrawal limitations imposed by the Underlying Funds, which may prevent the Fund from reacting rapidly to market changes should an Underlying Fund fail to effect portfolio changes consistent with such market changes and the demands of the Advisor. Such withdrawal limitations may also restrict the Advisor’s ability to terminate investments in Underlying Funds that are poorly performing or have otherwise had adverse changes. The Advisor will be dependent on information provided by the Underlying Fund, including quarterly unaudited financial statements, which if inaccurate could adversely affect the Advisor’s ability to manage the Fund’s investment portfolio in accordance with its investment objectives.

Leveraging Risk.

The use of leverage, such as borrowing money to purchase securities or otherwise invest the Fund’s assets, will cause the Fund to incur additional expenses and may significantly magnify the Fund's losses in the event of adverse performance of the Fund’s underlying investments.

Liquidity Risk

. There currently is no secondary market for the Fund's shares and the Advisor does not expect that a secondary market will

|

6

|

|

develop. Limited liquidity is provided to shareholders only through the Fund's quarterly repurchase offers for no less than 5% of the Fund's shares outstanding at net asset value. There is no guarantee that shareholders will be able to sell all of the shares they desire in a quarterly repurchase offer. The Fund's investments also are subject to liquidity risk. Liquidity risk exists when particular investments of the Fund would be difficult to purchase or sell, possibly preventing the Fund from selling such illiquid securities at an advantageous time or price, or possibly requiring the Fund to dispose of other investments at unfavorable times or prices in order to satisfy its obligations.

Management Risk.

The judgments of the Advisor or Sub-Advisor about the attractiveness, value and potential appreciation of particular real estate segment and securities in which the Fund invests may prove to be incorrect and may not produce the desired results.

Market Risk.

An investment in the Fund's shares is subject to investment risk, including the possible loss of the entire principal amount invested. An investment in the Fund's shares represents an indirect investment in the securities owned by the Fund. The value of these securities, like other market investments, may move up or down, sometimes rapidly and unpredictably.

Minimal Capitalization Risk.

The Fund is not obligated to raise any specific amount of capital. There is a risk that the amount of capital actually raised by the Fund through the offering of its shares may be insufficient to achieve profitability or allow the Fund to realize its investment objectives. An inability to raise additional capital may adversely affect the Fund’s financial condition, liquidity and results of operations, as well as its compliance with regulatory requirements.

Possible Competition Between Underlying Funds and Between the Fund and the Underlying Funds

. The Underlying Funds trade independently of each other and may pursue investment strategies that “compete” with each other for execution or that cause the Fund to participate in positions that offset each other (in which case the Fund would bear its pro rata share of commissions and fees without the potential for a profit). Also, the Fund’s investments in any particular Underlying Fund could increase the level of competition for the same trades that other Underlying Funds might otherwise make, including the priorities of order entry. This could make it difficult or impossible to take or liquidate a position in a particular security at a price consistent with the Advisor’s strategy.

Preferred Securities Risk.

Preferred securities are subject to credit risk and interest rate risk. Interest rate risk is, in general, that the price of a debt security falls when interest rates rise. Securities with longer maturities tend to be more sensitive to interest rate changes. Credit risk is the risk that an issuer of a security may not be able to make principal and interest or dividend payments on the security as they become. Holders of preferred securities may not receive dividends, or the payment can be deferred for some period of time. In bankruptcy, creditors are generally paid before the holders of preferred securities.

Real Estate Industry Concentration Risk.

The Fund will concentrate its

|

7

|

|

investments in securities real estate industry issuers, and it may invest in real estate directly. As such, its portfolio will be significantly impacted by the performance of the real estate market and may experience more volatility and be exposed to greater risk than a more diversified portfolio. The value of companies engaged in the real estate industry is affected by: (i) changes in general economic and market conditions; (ii) changes in the value of real estate properties; (iii) risks related to local economic conditions, overbuilding and increased competition; (iv) increases in property taxes and operating expenses; (v) changes in zoning laws; (vi) casualty and condemnation losses; (vii) variations in rental income, neighborhood values or the appeal of property to tenants; (viii) the availability of financing and (ix) changes in interest rates and leverage. There are also special risks associated with particular sectors, or real estate operations, including, but not limited to, those risks described below:

Retail Properties.

Retail properties are affected by shifts in consumer demand due to demographic changes, changes in spending patterns and lease terminations.

Office Properties.

Office properties are affected by a downturn in the businesses operated by their tenants.

Hospitality Properties.

Hotel properties and other properties in the hospitality real estate sector, such as motels and extended-stay properties, are affected by declines in business and leisure travel.

Healthcare Properties.

Healthcare properties are affected by potential federal, state and local laws governing licenses, certification, adequacy of care, pharmaceutical distribution, rates, equipment, personnel and other factors regarding operations, and the continued availability of revenue from government reimbursement programs.

Industrial Properties

. Industrial properties are affected by downturns in the manufacture, processing and shipping of goods.

Multifamily Properties.

Multifamily properties are affected by adverse economic conditions in the locale, oversupply and rent control laws.

Residential Properties

. Residential properties can be significantly affected by the national, regional and local real estate markets. This segment of the real estate industry also is sensitive to interest rate fluctuations which can cause changes in the availability of mortgage capital and directly affect the purchasing power of potential homebuyers. Thus, residential properties can be significantly affected by changes in government spending, consumer confidence, demographic patterns and the level of new and existing home sales.

Shopping Centers.

Shopping center properties are affected by changes in the local markets where their properties are located and dependent upon the successful operations and financial condition of their major tenants.

Self-Storage Properties.

Self-storage properties are affected by

|

8

|

|

changes to competing local properties, consumer and small business demand for storage space, and the ability of the management team.

Other factors may contribute to the risk of real estate investments:

Development Issues.

Real estate development companies in which the Underlying Funds or the Fund may invest are affected by construction delays and insufficient tenant demand to occupy newly developed properties.

Lack of Insurance.

Certain of the companies in the Fund's portfolio may fail to carry comprehensive liability, fire, flood, wind or earthquake extended coverage and rental loss insurance, or insurance and may be subject to various policy specifications, limits and deductibles.

Dependence on Tenants.

The ability of companies in the real estate industry in which the Fund may invest to make distributions to shareholders depends upon the ability of the tenants at their properties to generate enough income in excess of tenant operating expenses to make their lease payments.

Financial Leverage.

Companies in the real estate industry in which the Fund may invest may be highly leveraged and financial covenants may affect their ability to operate effectively.

Financing Issues.

Financial institutions in which the Fund may invest are subject to extensive government regulation. This regulation may limit both the amount and types of loans and other financial commitments a financial institution can make, and the interest rates and fees it can charge.

Environmental Issues.

Owners of properties that may contain hazardous or toxic substances may be responsible for removal or remediation costs.

Current Conditions

. Recent instability in the United States, European and other credit markets has made it more difficult for borrowers to obtain financing or refinancing on attractive terms or at all. In particular, because of the current conditions in the credit markets, borrowers may be subject to increased interest expenses for borrowed money and tightening underwriting standards. There is also a risk that a general lack of liquidity or other events in the credit markets may adversely affect the ability of issuers in whose securities the Fund invests to finance real estate developments and projects or refinance completed projects.

REIT Risk.

The value of investments in REIT shares may decline because of adverse developments affecting the real estate industry and real property values. In general, real estate values can be affected by a variety of factors, including supply and demand for properties, the economic health of the country or of different regions, and the strength of specific industries that rent properties. Also, qualification as a REIT under the Internal Revenue Code of 1986, as amended (the "Code") in any particular year is a complex analysis that depends on a number of factors. There can be no assurance that an entity in which the Fund invests with the expectation that it will be

|

9

|

|

taxed as a REIT will, in fact, qualify as a REIT. An entity that fails to qualify as a REIT would be subject to a corporate level tax, would not be entitled to a deduction for dividends paid to its shareholders and would not pass through to its shareholders the character of income earned by the entity.

Repurchase Policy Risks.

Quarterly repurchases by the Fund of its shares typically will be funded from available cash or sales of portfolio securities. The sale of securities to fund repurchases could reduce the market price of those securities, which in turn would reduce the Fund's net asset value.

Underlying Funds Risk

. Investments in real estate index funds (“Index Funds”), real estate exchange traded funds (“ETFs”), and Other Public Investment Vehicles are subject to investment advisory and other expenses, which will be indirectly paid by the Fund. As a result, the cost of investing in the Fund will be higher than the cost of investing directly in such Other Public Investment Vehicles, and also may be higher than other funds that invest directly in securities. Further, Other Public Investment Vehicles are subject to specific risks, depending on the nature of the fund.

Use of Leverage by Underlying Funds.

In addition to any borrowing utilized by the Fund, the Underlying Funds in which the Fund invests may utilize financial leverage, subject to the limitations of their charters and operative documents. The Fund intends to limit its borrowing to an amount that does not exceed 33 1/3% of the Fund’s gross asset value. Leverage by Underlying Funds and/or the Fund has the effect of potentially increasing losses.

Valuation of Institutional Investment Funds.

The Institutional Investment Funds are not publicly traded, and the Fund may consider information provided by the institutional asset manager to determine the value of the Fund’s investment therein. The valuation provided by an institutional asset manager as of a specific date may vary from the actual sale price that may be obtained if such investment were sold to a third party. To determine the value of the Fund’s investment in Institutional Investment Funds, the Advisor considers, among other things, information provided by the Institutional Investment Funds, including quarterly unaudited financial statements, which if inaccurate could adversely affect the Advisor’s ability to value accurately the Fund’s shares. Institutional Investment Funds that invest primarily in publicly traded securities are more easily valued.

|

10

|

|

|

U.S. Federal Income Tax Matters

|

The Fund intends to elect to be treated and to qualify each year for taxation as a regulated investment company under Subchapter M of the Code. In order for the Fund to so qualify, it must meet an income and asset diversification test each year. If the Fund so qualifies and satisfies the applicable distribution requirements, the Fund (but not its shareholders) will not be subject to federal income tax to the extent it distributes its investment company taxable income and net capital gains (the excess of net long-term capital gains over net short-term capital loss) in a timely manner to its shareholders in the form of dividends or capital gain distributions. The Code imposes a 4% nondeductible excise tax on regulated investment companies, such as the Fund, to the extent they do not meet certain distribution requirements by the end of each calendar year. The Fund anticipates meeting these distribution requirements. See "U.S. Federal Income Tax Matters."

|

|

|

|

|

Dividend Policy

|

The Fund's distribution policy is to make quarterly distributions to shareholders. The level of distributions (including any return of capital) is not fixed. Unless a shareholder elects otherwise, the shareholder's distributions will be reinvested in additional shares of the same class under the Fund's dividend reinvestment policy. Shareholders who elect not to participate in the Fund's dividend reinvestment policy will receive all distributions in cash paid to the shareholder of record (or, if the shares are held in street or other nominee name, then to such nominee). See "Dividend Reinvestment Policy."

|

|

Custodian

|

Union Bank, N.A. ("Union Bank") will serve as the Fund's custodian. See "Management of the Fund."

|

11

SUMMARY OF FUND EXPENSES

|

|

|

|

|

Shareholder Transaction Expenses

|

|

Class A

|

Class C

|

|

Maximum Sales Load

(as a percent of offering price)

|

|

5.75%

|

None

|

|

Early Withdrawal Charges on Shares Repurchased Less Than 365 Days After Purchase (as a percent of original purchase price)

|

|

None

|

1.00%

|

|

Annual Expenses

(as a percentage of net assets attributable to shares)

|

|

|

|

|

Management Fees

|

|

1.50%

|

1.50%

|

|

Other Expenses

|

|

|

|

|

Shareholder Servicing Expenses

|

|

0.25%

|

0.25%

|

|

Distribution Fee

|

|

None

|

0.75%

3

|

|

Remaining Other Expenses

|

|

3.21%

|

3.21%

4

|

|

Acquired Fund Fees and Expenses

1

|

|

0.11%

|

0.11%

4

|

|

Total Annual Expenses

|

|

5.07%

|

5.82%

|

|

Fee Waiver and Reimbursement

2

|

|

(3.12)%

|

(3.12)%

|

|

Total Annual Expenses (after fee waiver and reimbursement)

|

|

1.95%

|

2.70%

|

1.

Acquired Fund Fees and Expenses are the indirect costs of investing in other investment companies. These indirect costs may include performance fees paid to the acquired fund’s advisor or its affiliates. It does not include brokerage or transaction costs incurred by the acquired funds. The operating expenses in this fee table will not correlate to the expense ratio in the Fund's financial highlights, when issued, because the financial statements, when issued, include only the direct operating expenses incurred by the Fund.

2.

The Advisor and the Fund have entered into an expense limitation and reimbursement agreement (the “Expense Limitation Agreement”) under which the Advisor has agreed contractually to waive its fees and to pay or absorb the ordinary annual operating expenses of the Fund (including offering and organizational expenses, but excluding taxes, interest, brokerage commissions,

acquired fund fees and expenses and extraordinary expenses) to the extent that they exceed 1.84% and 2.59% per annum of the Fund's average daily net assets attributable to Class A and Class C shares, respectively (the “Expense Limitation”). In consideration of the Advisor’s agreement to limit the Fund's expenses, the Fund has agreed to repay the Advisor in the amount of any fees waived and Fund expenses paid or absorbed, subject to the limitations that: (1) the reimbursement for fees and expenses will be made only if payable not more than three years from the end of the fiscal year in which they were incurred; and (2) the reimbursement may not be made if it would cause the expense limitation in effect at the time the expenses were waived or absorbed to be exceeded. The Expense Limitation Agreement will remain in effect at least until March 31, 2015, unless and until the Board approves its modification or termination. This agreement may be terminated only by the Fund's Board of Trustees. See "Management of the Fund."

3.

The Class C shares will pay to the Distributor a Distribution Fee that will

accrue at an annual rate equal to 0.75% of the average daily net assets

attributable to Class C shares and is payable on a quarterly basis. Class A

shares are not subject to a Distribution Fee. See “Plan of Distribution.”

4.

Based on estimated amounts for the current fiscal year for Class C shares.

The above Summary of Fund Expenses table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts on purchases of Class A shares if you and your family invest, or agree to invest in the future, at least $100,000 in the Fund. More information about these and other discounts is available from your financial professional and in Purchase Terms starting on page 37 of this prospectus. More information about management fees, fee waivers and other expenses is available in Management of the Fund starting on page 26 of this prospectus.

The following example illustrates the hypothetical expenses that you would pay on a $1,000 investment assuming annual expenses attributable to shares remain unchanged and shares earn a 5% annual return:

|

|

|

|

|

|

Share Class

|

1 Year

|

3 Years

|

5 Years

|

10 Years

|

|

Class A Shares

|

$76

|

$175

|

$273

|

$518

|

|

Class C Shares

|

$27

|

$145

|

$262

|

$544

|

Shareholders who choose to participate in repurchase offers by the Fund will not incur a repurchase fee. However, if shareholders request repurchase proceeds be paid by wire transfer, such shareholders will be assessed an outgoing wire transfer fee at prevailing rates charged by the Fund Administrator, currently $15. The purpose of the above table is to help a holder of shares understand the fees and expenses that such holder would bear directly or indirectly.

The example should not be considered a representation of actual future expenses. Actual expenses may be higher or lower than those shown.

12

III.

FINANCIAL HIGHLIGHTS

The table below sets forth financial data for one Class A share of beneficial interest outstanding throughout the period presented.

Because the Class C shares have only recently commenced investment operations, no financial highlights are available for the these share classes at this time. In the future, financial highlights for Class C shares, along with Class A shares will be presented in this section of the Prospectus.

|

|

|

|

For the Period*

|

|

|

Ended

|

|

|

September 30, 2013

|

|

|

|

|

Net Asset Value, Beginning of Period

|

$ 25.00

|

|

Increase From Operations:

|

|

|

Net investment income (a)

|

0.67

|

|

Net gain from investments

|

|

|

(both realized and unrealized)

|

2.40

|

|

Total from operations

|

3.07

|

|

|

|

|

Less Distributions:

|

|

|

From net investment income

|

(0.40)

|

|

From paid in capital

|

(0.20)

|

|

Total Distributions

|

(0.60)

|

|

Paid in capital from redemption fees (a)

|

0.00

(i)

|

|

|

|

|

Net Asset Value, End of Period

|

$ 27.47

|

|

|

|

|

|

|

|

|

|

|

Total Return (b)(e)(h)

|

12.36%

|

|

|

|

|

Ratios/Supplemental Data

|

|

|

Net assets, end of period (in 000's)

|

$ 38,122

|

|

Ratio to average net assets:

|

|

|

Expenses, Gross (c)(d)(f)

|

4.96%

|

|

Expenses, Net of Reimbursement (d)(f)

|

0.01%

|

|

Net investment income, Net of Reimbursement (d)(f)(g)

|

2.66%

|

|

Portfolio turnover rate (e)

|

35%

|

__________

* The Fund commenced operations on October 22, 2012.

(a) Per share amounts are calculated using the average shares method, which more appropriately presents the per share data for the period.

(b) Total returns are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distributions, if any. Had the Advisor not absorbed a portion of Fund expenses, total returns would have been lower.

(c) Represents the ratio of expenses to average net assets absent fee waivers and/or expense reimbursements by the Advisor.

(d) Annualized.

(e) Not annualized.

(f) The ratios of expenses to average net assets and net investment income to average net assets do not reflect the expenses of the underlying investment companies in which the Fund invests.

(g) Recognition of net investment income is affected by the timing and declaration of dividends by the underlying investment companies in which the Fund invests.

(h) Includes adjustments in accordance with accounting principles generally accepted in the United States and, consequently, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions.

(i) Less than $0.01 per share.

13

IV.

THE FUND

The Fund is a continuously offered, non-diversified, closed-end management investment company that is operated as an interval fund. The Fund was organized as a Delaware statutory trust on May 25, 2012. The Fund's principal office is located at c/o Gemini Fund Services, LLC, 80 Arkay Drive, Hauppauge, NY 11788, and its telephone number is 1-888-459-1059.

V.

USE OF PROCEEDS

The net proceeds of the Fund’s continuous offering of shares, after payment of the sales load (if applicable) and other associated expenses, will be invested in accordance with the Fund's investment objective and policies (as stated below) as soon as practicable after receipt. The Fund pays organizational costs and its offering expenses incurred with respect to its initial and continuous offering. Pending investment of the net proceeds in accordance with the Fund's investment objective and policies, the Fund will invest in money market or short-term fixed-income mutual funds. Investors should expect, therefore, that before the Fund has fully invested the proceeds of the offering in accordance with its investment objective and policies, the Fund's assets would earn interest income at a modest rate.

VI.

INVESTMENT OBJECTIVE, POLICIES AND STRATEGIES

Investment Objective and Policies

The Fund seeks primarily to generate current income while secondarily seeking long-term capital appreciation with low to moderate volatility and low correlation to the broader markets.

The Fund pursues its investment objectives by investing, under normal circumstances, at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in real estate industry securities, primarily in income producing equity and debt securities. The Fund’s investments may be targeted in any one or more of the many sectors of the real estate market, including but not limited to its retail, office, multifamily, hospitality, industrial, residential, medical and self-storage sectors. The Fund concentrates investments in the real estate industry, meaning that under normal circumstances, it invests over 25% of its assets in real estate industry securities.

The Fund defines real estate industry securities to include the common stock, partnership or similar interests, convertible or non-convertible preferred stock, and convertible or non-convertible secured or unsecured debt issued by: private real estate investment funds managed by institutional investment managers (“Institutional Investment Funds”); non-traded unregistered real estate investment trusts (“Private REITs”); publicly traded real estate securities such as publicly registered real estate investment trusts (“Public REITs”); exchange traded funds, index mutual funds, and other investment vehicles such as closed-end funds and mutual funds that invest principally, directly or indirectly, in real estate (collectively, “Other Public Investment Vehicles”) and unregistered funds that invest principally in real estate.

The Fund may invest in issuers of real estate industry securities of any credit quality. The Fund may invest in debt securities of any duration or maturity. The Fund may also, to a limited extent, make real estate-related investments other than through real estate industry securities. The Advisor will sell a security when other securities are available that offer higher expected current income, long-term capital appreciation, lower volatility or correlation to broader securities markets or a combination of the preceding.

The Fund’s SAI contains a list of the fundamental (those that may not be changed without a shareholder vote) and non-fundamental (if any) investment policies of the Fund under the heading "Investment Objective and Policies."

14

Fund’s Target Investment Portfolio

The Advisor executes the Fund’s real estate investment strategy through a strategic investment portfolio of global ‘best in class’ Institutional Investment Funds in primarily two main categories – private equity real estate, and publicly traded real estate securities. The Fund will not invest more than 10% of the Fund’s assets in private funds employing hedging strategies (commonly known as "hedge funds", i.e., investment funds that would be investment companies but for the exemptions under Rule 3(c)(1) or 3(c)(7) under the 1940 Act).

The Advisor has retained Mercer to provide ongoing research and investment opinions of and/or recommendations of institutional investment managers using the Mercer’s proprietary screening process, which applies multiple factors based on quantitative and qualitative assessment of the management team and track record.

Institutional Investment Funds

. Institutional Investment Funds are real estate investment funds managed by institutional investment managers with expertise in managing portfolios of real estate and real estate-related securities. Many Institutional Investment Funds have large minimum investment requirements and stringent investor qualification criteria intended to limit their direct investors to mainly institutions such as endowments and pension funds. The Fund enables investors to invest with Institutional Investment Funds that may not be otherwise permitted or available to them. The Fund also enables investors to execute a multi-strategy, multi-manager, multi-sector strategy by making a single investment in its Class A or Class C shares, whereas due to the large minimums of many of the Institutional Investment Funds, such a strategy may not otherwise be permitted or available to the investor.

The Advisor also believes that the Fund may provide an additional benefit in terms of better fee pricing from the Institutional Investment Funds as a result of volume discounts, which pricing benefits may not otherwise be permitted or available to the investor. In addition, the Fund’s investments in Institutional Investment Funds are intended to deliver returns which have a low correlation to the broader markets.

The Fund’s typical investments in Institutional Investment Funds will be made through the purchase of common stock, limited liability company units, and limited partnership interests (or similar interests). Investment criteria will include evaluating a combination of strength of the sponsor and management; prior investment performance of the target fund as well as the performance of other funds managed by the sponsor; the attractiveness of the property sectors and geographical allocations of the fund; expected stability of income; expected capital appreciation, and target leverage levels.

REITs.

The Institutional Investment Funds in which the Fund invests may invest in Real Estate Investment Trusts (“REITs”). REITs are investment vehicles that invest primarily in income-producing real estate or mortgages and other real estate-related loans or interests. Public REITs are listed on major stock exchanges such as the New York Stock Exchange, the American Stock Exchange and the National Association of Securities Dealers Automated Quotation System, and invest directly in real estate, typically through either properties or mortgages. Public REITs are typically much larger and financially more stable than Private REITs and, as such, are typically less risky than Private REITs.

Other Public Investment Vehicles

.

The Fund anticipates making limited investments in Other Public Investment Vehicles, including ETFs and Index Funds that invest primarily in real estate related assets, principally to temporarily invest the Fund’s capital pending its deployment into other higher-returning investment opportunities, or for temporary defensive purposes under adverse market conditions.

Exchange Traded Funds ("ETFs")

. ETFs are typically managed by professionals and provide investors with diversification, cost and tax efficiency, liquidity, marginability, are useful for hedging, have the ability to go long and short, and some provide quarterly dividends. An ETF typically holds a portfolio of securities or contracts designed to track a particular market segment or index. ETFs are listed on major stock exchanges and are traded like stocks.

Index Funds

. An Index Fund is a mutual fund with an investment objective of seeking to replicate the performance of a specific securities index, such as the National Association of Real Estate Investment Trusts (NAREIT) Index or the MSCI REIT Index. Most Index Funds are not actively managed and generally provide broad market exposure, low operating expenses and low portfolio turnover.

Other

.

In addition to ETFs and Index Funds, and subject to the Fund's investment restrictions, the Fund may invest in investment companies that invest primarily in what the Advisor considers real estate industry securities,

15

including closed-end funds and mutual funds. Shares of Closed-end Funds are typically listed for trading on major stock exchanges and, in some cases, may be traded in other over-the-counter markets.

Investment Strategy, and Criteria Used in Selecting Investments

The Fund’s disciplined investment strategy focuses on identifying Institutional Investment Funds that have:

·

attractive risk-adjusted returns;

·

with low to moderate volatility;

·

low correlation to the broader markets;

·

with an emphasis on income generation.

The Fund utilizes a multi-manager, multi-sector, and multi-strategy approach. The Advisor primarily selects funds with the highest expected income from a real estate sector peer group of issuers with similar market capitalization and/or credit quality. Secondarily, the Advisor considers potential for capital appreciation. When constructing and balancing the Fund's portfolio, the Advisor selects funds from real estate sectors that it believes have relatively low volatility and will not be highly correlated to each other or to the equity or fixed income markets, generally.

The Advisor, working closely with the Sub-Advisor and in consideration of its recommendations, uses both a quantitative screening process and a qualitative selection process when selecting investments for the Fund to implement its real estate investment strategy. The Advisor and Mercer conduct research on various real estate investment managers and investment options in order to establish a selection of investments to fulfill the Fund’s investment objectives. Mercer’s assistance and recommendations for selection of investment funds are made according to asset allocation, return expectations and other guidelines set by the Advisor with oversight of the Board of Trustees. No assurance can be given that any or all investment strategies, or the Fund's investment program, will be successful.

Investment Strategy – Mercer Process

Mercer’s process begins with a proprietary database created and continuously maintained by its professionals - the Global Investment Manager Database (GIMD™) which gives Mercer access to up-to-date information and insights on a worldwide matrix of investment managers and strategies. GIMD™

contains information on numerous investment types across all asset classes,

including real estate. This information ranges from access to and analysis of

performance data to qualitative forward-looking research on investment managers

supported by screening functionality. In 2013 over 3,900 formal manager meetings were held and over 1,700 Research Notes were produced globally. As of December 2013, GIMD™ contained information on over 5,400 investment managers and over 26,000 investment strategies across more than 250 countries.

16

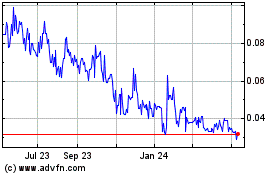

![[CHARTS002.GIF]](http://content.edgar-online.com/edgar_conv_img/2014/03/26/0000910472-14-001307_CHARTS002.GIF)

The Advisor, in conjunction with Mercer, employs a regimen of quantitative and qualitative criteria to arrive at a universe of investments which are considered to be ‘best in class.’ By combining historical quantitative analysis with a sound knowledge of key qualitative attributes, the Advisor will evaluate a prospective investment’s potential for generating sustainable, positive, risk-adjusted returns under a wide variety of market conditions. Mercer’s investment selection and due diligence process are outlined in the chart below.

![[CHARTS004.GIF]](http://content.edgar-online.com/edgar_conv_img/2014/03/26/0000910472-14-001307_CHARTS004.GIF)

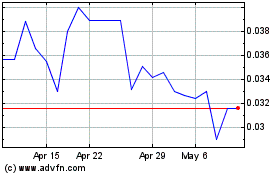

On-going monitoring of the Fund’s investments will be utilized to assist the Advisor in maintaining portfolio allocations and managing cash in-flows and outflows. The Advisor may strategically rebalance its investment strategies according to the current market conditions, but will remain true to its fundamental analysis with respect to real estate asset class and sector risk over time. The Advisor manages investments over a long-term time horizon while being mindful of the historical context of the markets. Mercer will provide to the Advisor investment performance reporting and analysis, including discussions on investment strategy, portfolio construction, and market update reports. The illustration below further outlines this monitoring process.

17

![[CHARTS006.GIF]](http://content.edgar-online.com/edgar_conv_img/2014/03/26/0000910472-14-001307_CHARTS006.GIF)

Investment Strategy - Multi-Manager Diversification

The Fund intends to employ a Multi-Manager approach by identifying and investing with ’best in class‘ institutional asset managers with expertise in managing portfolios of real estate and real estate-related securities. The term ‘best in class’ refers to Institutional Investment Funds that the Advisor and Mercer have identified through Mercer’s proprietary screening process as having above average prospects.

Many of the Institutional Investment Funds have large minimum investment size and stringent investor qualification criteria intended to limit their direct investors to mainly institutions such as endowments and pension funds - as such, the Fund enables investors to invest with institutional investment managers that may not be otherwise permitted or available to them.

The Fund also enables investors to execute a multi-strategy, multi-manager, multi-sector strategy by making a single investment in its shares, whereas due to the large minimums of many of the Institutional Investment Funds, such a strategy may not otherwise be permitted or available to the investor.

The sponsor believes that the Fund may provide an additional benefit in terms of lower fees from the Institutional Investment Funds as a result of volume discounts, which pricing benefits may not otherwise be permitted or available to them.

Investment Strategy - Multi-Strategy Diversification

The Fund intends to employ a Multi-Strategy approach to diversify the risk-reward profiles and the underlying types of real estate in which it invests, with the strategies noted below. Because each real estate strategy performs differently throughout the overall real estate and economic cycle, investment strategies that include multiple strategies generally have lower volatility than single strategy funds. Thus a multi-strategy approach should assist the Fund in achieving its objective of lower portfolio volatility as well as lower correlation with the broader markets.

·

Core

.

The Fund’s ‘core’ strategy targets high-quality portfolios with real estate assets that provide relatively lower and more stable returns. Such investments are typically located in primary markets and in the main property types (retail, office, industrial and multi-family). Properties are stable, well-maintained, well-leased and often of the Class A variety. For example, office properties tend to be Class A buildings with investment grade tenants. Multifamily properties are usually in major metropolitan cities with higher rental rates. Retail would typically be more traditional neighborhood and community strip-mall centers, as well as regional and super regional malls. The Advisor believes that warehouse and research and development properties in strong distribution centers typically offer better chances for predictable cash flow within the industrial sector. As an example, a Class A office property may broadly be defined as 100,000 square feet or larger (five or more floors), concrete and steel construction, recently built and/or very well maintained (excellent condition), with business/support amenities and in a strong identifiable location with good access to a primary metropolitan market. Class A properties are the most prestigious buildings competing for premier tenants with rents above average for the area.

18

·

Core Plus

.

The Fund’s ‘core plus’ strategy seeks moderate risk portfolios with real estate that provides moderate returns. Such investments are predominantly core but with an emphasis on a modest value add management approach. A core plus portfolio requires slightly more complex financial structuring and management intensive focus than core portfolio of investments. Focus is on the main property types, in both primary and secondary markets, in Class A or lower quality buildings that require some form of enhancement (i.e. repositioning, redevelopment and/or releasing). In comparison to the Class A example above, a Class B property may be renovated and/or in good condition, potentially smaller in size, in a good location in a primary or secondary metropolitan market. Class B properties compete for a wide range of users with rents in the average range for the area.

·

Value Add

.

The Fund’s ‘value add’ strategy typically focuses on more aggressive active asset management and often employs more leverage. Such investments typically are lower quality buildings, in both primary and secondary markets in the main property types. Properties are considered value add when they exhibit management or operational problems, require physical improvement, and/or suffer from capital constraints. Buildings often require enhancement to upgrade them to higher quality properties (i.e., redevelopment/repositioning/re-tenanting).

Investment Strategy - Multi-Sector Diversification

The Fund intends to employ a Multi-Sector approach to diversify its investments by property sector - for example, across retail, office, multifamily, hospitality, industrial, residential, medical and/or self-storage sectors. Because each real estate sector has its own investment cycle, correlations across property sectors are generally low. Thus employing a multi-sector approach should assist the fund in achieving its objective of lower portfolio volatility as well as lower correlation with the broader markets.

Additional Information Regarding Investment Strategy

The Fund may, from time to time, in attempting to respond to adverse market, economic, political or other similar conditions, take temporary defensive positions that are inconsistent with the Fund's principal, ‘long-only’ investment strategy. During such times, the Advisor may determine that the Fund should invest up to 100% of its assets in cash or cash equivalents, including money market instruments, prime commercial paper, repurchase agreements, Treasury bills and other short-term obligations of the U.S. Government, its agencies or instrumentalities. In addition to the foregoing, the Fund may utilize Other Public Investment Vehicles as temporary investments as the Fund raises capital or pending deployment of capital to other investment opportunities selected by the Advisor. In these and in other cases, the Fund may not achieve its investment objective. The Advisor may invest the Fund's cash balances in any investments it deems appropriate. The Advisor expects that such investments will be made, without limitation and as permitted under the 1940 Act, in money market mutual funds, repurchase agreements, U.S. Treasury and U.S. agency securities, municipal bonds and bank accounts. Any income earned from such investments is ordinarily reinvested by the Fund in accordance with its investment program. Many of the considerations entering into recommendations and decisions of the Advisor and the Fund's Co-Portfolio Managers are subjective.

The frequency and amount of portfolio purchases and sales (known as the "portfolio turnover rate") will vary from year to year. The portfolio turnover rate is not expected to exceed 100%, but may vary greatly from year to year and will not be a limiting factor if the Advisor determines that portfolio changes are appropriate. Although the Fund generally does not intend to trade for short-term profits, the Fund may engage in short-term trading strategies, and securities may be sold without regard to the length of time held when, in the opinion of the Advisor, investment considerations warrant such action. These policies may have the effect of increasing the annual rate of portfolio turnover of the Fund. Higher rates of portfolio turnover would likely result in higher brokerage commissions and may generate short-term capital gains taxable as ordinary income. If securities are not held for the applicable holding periods, dividends paid on them will not qualify for the advantageous federal tax rates. See "Tax Status" in the Fund’s SAI.

There is no assurance what portion, if any, of the Fund's investments will qualify for the reduced federal income tax rates applicable to qualified dividends under the Code. As a result, there can be no assurance as to what portion of the Fund's distributions will be designated as qualified dividend income. See "U.S. Federal Income Tax Matters."

19

RISK FACTORS

An investment in the Fund's shares is subject to risks. The value of the Fund's investments will increase or decrease based on changes in the prices of the investments it holds. This will cause the value of the Fund's shares to increase or decrease. You could lose money by investing in the Fund. By itself, the Fund does not constitute a balanced investment program. Before investing in the Fund you should consider carefully the following risks. There may be additional risks that the Fund does not currently foresee or consider material. You may wish to consult with your legal or tax advisors before deciding whether to invest in the Fund.

Allocation Risk.

The ability of the Fund to achieve its investment objective depends, in part, on the ability of the Advisor to allocate effectively the Fund's assets among the various Institutional Investment Funds, Private REITs, Public REITs and Other Public Investment Vehicles in which the Fund invests and, with respect to each such asset class, among equities and fixed income securities. There can be no assurance that the actual allocations will be effective in achieving the Fund's investment objectives or delivering positive returns.

Convertible Securities Risk.

Convertible securities are hybrid securities that have characteristics of both bonds and common stocks and are subject to risks associated with both debt securities and equity securities. Convertible securities are similar to fixed-income securities because they usually pay a fixed interest rate (or dividend) and are obligated to repay principal on a given date in the future. The market value of fixed-income and preferred securities tends to decline as interest rates increase and tends to increase as interest rates decline. Convertible securities have characteristics of a fixed-income security and are particularly sensitive to changes in interest rates when their conversion value is lower than the value of the bond or preferred share. Fixed-income and preferred securities also are subject to credit risk, which is the risk that an issuer of a security may not be able to make principal and interest or dividend payments on the security as they become due. Fixed-income and preferred securities also may be subject to prepayment or redemption risk. If a convertible security held by the Fund is called for redemption, the Fund will be required to surrender the security for redemption, convert it into the issuing company's common stock or cash or sell it to a third party at a time that may be unfavorable to the Fund. In addition, the Fund may invest in fixed-income and preferred securities rated less than investment grade that are sometimes referred to as high yield or "junk bonds." These securities are speculative investments that carry greater risks and are more susceptible to real or perceived adverse economic and competitive industry conditions than higher quality securities. Such securities also may be subject to resale restrictions. The lack of a liquid market for these securities could decrease the Fund's share price. Convertible securities have characteristics similar to common stocks especially when their conversion value is the same as the value of the bond or preferred share. The price of equity securities may rise or fall because of economic or political changes. Stock prices in general may decline over short or even extended periods of time. Market prices of equity securities in broad market segments may be adversely affected by a prominent issuer having experienced losses or by the lack of earnings or such an issuer's failure to meet the market's expectations with respect to new products or services, or even by factors wholly unrelated to the value or condition of the issuer, such as changes in interest rates.

Correlation Risk.

The Fund seeks to produce returns that are not correlated to the broader financial markets. Although the prices of equity securities and fixed-income securities, as well as other asset classes, often rise and fall at different times so that a fall in the price of one may be offset by a rise in the price of the other, in down markets the prices of these securities and asset classes can also fall in tandem. Because the Fund allocates its investments among different asset classes, the fund is subject to correlation risk.

Credit Risk.

There is a risk that debt issuers will not make payments, resulting in losses to the Fund. In addition, the credit quality of securities may be lowered if an issuer's financial condition changes. Lower credit quality may lead to greater volatility in the price of a security and in shares of the Fund. Lower credit quality also may affect liquidity and make it difficult to sell the security. Default, or the market's perception that an issuer is likely to default, could reduce the value and liquidity of securities, thereby reducing the value of your investment in Fund shares. In addition, default may cause the Fund to incur expenses in seeking recovery of principal or interest on its portfolio holdings.

Distribution Policy Risk.

The Fund's distribution policy is designed to generate quarterly distributions. Shareholders receiving periodic payments from the Fund may be under the impression that they are receiving net profits. However, all or a portion of a distribution may consist of a return of capital. Return of capital is the portion of a distribution that is a return of your original investment dollars in the Fund. Shareholders should not assume that the source of a distribution

20

from the Fund is net profit. Shareholders should note that return of capital will reduce the tax basis of their shares and potentially increase the taxable gain, if any, upon disposition of their shares.

Fixed Income Risk.