Pet-Care Sales Feed Nestlé Growth -- Update

July 26 2019 - 4:01AM

Dow Jones News

By Saabira Chaudhuri

Nestlé SA reported higher first-half sales, buoyed by strong

growth in the U.S., where pet owners drove up sales of the food

giant's Purina brand.

The owner of brands including KitKat chocolate bars and Nescafe

coffee said Friday that all its categories globally boosted sales,

with petcare, coffee and infant nutrition the biggest

contributors.

Nestlé's first-half net profit dropped 15% to 5 billion Swiss

francs ($5.05 billion), largely because its year-earlier figure was

boosted by the sale of its U.S. confectionery arm. Stripping out

one-time items, profit increased 10%.

Sales in the first half totaled 45.47 billion francs, up 3.6% on

an organic basis, which strips out the effects of currency

fluctuations, acquisitions and divestments. That was in line with

analyst estimates.

When Chief Executive Mark Schneider took over in 2017, Nestle

was under pressure from investors to improve performance after

missing its own sales targets for a number of years. Since then,

Nestlé has faced added pressure to improve its financial

performance from U.S. activist investor Daniel Loeb, who in 2017

disclosed that his fund, Third Point LLC, owned about 1.25% of

Nestlé and pressed the company to sell its stake in L'Oréal SA.

Mr. Schneider has, so far, resisted those calls, but made other

changes including selling slower-growth, nonfood assets and placing

greater emphasis on nutrition, pet food, coffee and water. In May,

the company said it had struck a deal to sell its skin-health unit

for 10.2 billion Swiss francs and on Friday it said a review of its

charcuterie business will likely finish late this year. The company

has also made a string of acquisitions including splashing out $7

billion last summer to buy the rights to sell Starbucks Corp.'s

coffee and tea in grocery and retail stores.

On Friday, Mr. Schneider said the efforts to sharpen Nestlé's

focus on high-growth businesses are paying off, with the U.S. --

Nestlé's largest market -- performing "particularly well."

Its second-quarter organic sales growth in North America was the

strongest in eight years, according to Nestlé, driven by petcare,

where e-commerce and sales of pricey products like Tidy Cats Litter

and Purina Pro Plan did well. Pet owners also bought up veterinary

products, including new ones like a probiotic supplement for

dogs.

Petcare is a growing business, with Nestlé rivals JAB Ltd. and

Mars Inc. also making strides in the sector. As more people buy

fancier, organic food for themselves, they are doing the same for

their pets. Consumers also are seeking more varied medical care for

their pets such as cancer treatments for their cats and

reconstructive surgeries on their dogs' knees.

The company said its Starbucks products are selling strongly in

the U.S. and the beverages arm -- which includes Starbucks and

Nescafe -- saw high single-digit growth.

Nestlé plans to roll out Starbucks lines in grocery stores in

more countries and launch new products, according to Mr. Schneider.

Earlier this week, Nestlé launched refrigerated creamers under the

Starbucks brand in the U.S. in flavors like cinnamon dolce

latte.

Nestlé's water business was a laggard, with volumes dropping

3.3%, hurt by price rises in the U.S. and slower growth in Europe.

Nestlé blamed higher costs for packaging and distribution for the

former and bad weather for the latter.

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

(END) Dow Jones Newswires

July 26, 2019 03:46 ET (07:46 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

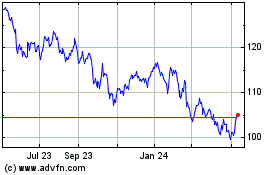

Nestle (PK) (USOTC:NSRGY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nestle (PK) (USOTC:NSRGY)

Historical Stock Chart

From Apr 2023 to Apr 2024