Current Report Filing (8-k)

December 22 2020 - 9:07AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d) of the Securities and Exchange Act

of 1934

Date of Report (Date of earliest event reported): December 16,

2020

NATURALSHRIMP INCORPORATED

(Exact

name of Registrant as specified in its charter)

|

Nevada

|

|

000-54030

|

|

74-3262176

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

15150 Preston Road, Suite #300

Dallas, Texas 75248

(Address of principal executive offices, including zip

code)

(866) 351-5907

(Registrant’s telephone number, including area

code)

Check

the appropriate box below if the 8-K filing is intended to

simultaneously satisfy the filing obligations of the registrant

under any of the following provisions:

[

] Written

communication pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

[

] Soliciting material

pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

[

] Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17

CFR 240.14d-2(b))

[

] Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17

CFR 240.13e-4(c)).

Securities

registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

None

|

|

None

|

|

None

|

Indicate

by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (17 CFR

§230.405) or Rule 12b-2 of the Securities Exchange Act of 1934

(17 CFR §240.12b-2).

Emerging

growth company [ ]

If an

emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided

pursuant to Section 13(a) of the Exchange Act.

[ ]

Item

1.01. Entry

into a Material Definitive Agreement.

Securities Purchase Agreement

On

December 18, 2020, NaturalShrimp Incorporated (the

“Company”), entered into securities purchase agreements

(the “Purchase Agreement”) with GHS Investments LLC,

Platinum Point Capital LLC and BHP Capital NY (collectively, the

“Investors”) , whereby, at the closing, the Investors

have agreed to purchase from the Company an aggregate of 5,000

shares of the Company’s Series D Convertible Preferred Stock,

par value $0.0001 per share (the “Series D Preferred

Stock”), at a purchase price of $1,000 per share of Series D

Preferred Stock. The aggregate purchase price for the Series D

Preferred Stock is $5,000,000. In connection with the sale of the

Series D Preferred Stock, the Investors will receive 6,000,000

shares of the Company’s common stock, par value $0.0001 (the

“Commitment Shares”).

As

further described in Item 3.03, the shares of Series D Preferred

Stock have a stated value of $1,200 per share and are convertible

into Common Stock at a price of $0.10 per share, subject to

adjustment.

The

representations and warranties contained in the Purchase Agreement

were made by the parties to, and solely for the benefit of, the

other in the context of all of the terms and conditions of the

Purchase Agreement and in the context of the specific relationship

between the parties. The provisions of the Purchase Agreement,

including the representations and warranties contained therein, are

not for the benefit of any party other than the parties to the

Purchase Agreement. The Purchase Agreement is not intended for

investors and the public to obtain factual information about the

current state of affairs of the parties.

Item

1.01 of this Current Report on Form 8-K contains only a brief

description of the material terms of the Purchase Agreement and

does not purport to be a complete description of the rights and

obligations of the parties thereunder, and such description is

qualified in its entirety by reference to the full text of the

Purchase Agreement and the forms of which is attached as Exhibits

10.1 to this Current Report on Form 8-K, and are incorporated

herein by reference.

Item

3.02 Unregistered

Sales of Equity Securities.

The

information set forth in Item 1.01 of this Current Report on Form

8-K is incorporated by reference into this Item 3.02.

The

Series D Preferred Stock and Commitment Shares were not registered

under the Securities Act, but qualified for exemption under Section

4(a)(2) and/or Regulation D of the Securities Act. The securities

were exempt from registration under Section 4(a)(2) of the

Securities Act because the issuance of such securities by the

Company did not involve a “public offering,” as defined

in Section 4(a)(2) of the Securities Act, due to the insubstantial

number of persons involved in the transaction, size of the

offering, manner of the offering and number of securities offered.

The Company did not undertake an offering in which it sold a high

number of securities to a high number of investors. In addition,

the Investors had the necessary investment intent as required by

Section 4(a)(2) of the Securities Act since the Investors agreed

to, and received, the securities bearing a legend stating that such

securities are restricted pursuant to Rule 144 of the Securities

Act. This restriction ensures that these securities would not be

immediately redistributed into the market and therefore not be part

of a “public offering.” Based on an analysis of the

above factors, the Company has met the requirements to qualify for

exemption under Section 4(a)(2) of the Securities Act.

Item

3.03 Material

Modification to Rights of Security Holders.

The

information set forth in Item 1.01 and Item 3.02 of this Current

Report on Form 8-K is incorporated by reference into this Item

3.03.

On

December 16, 2020, the Secretary of State of the State of Delaware

delivered confirmation of the effective filing of the

Company’s Certificate of Designations of the Preferred Stock,

which established 20,000 shares of the Company’s Series D

Preferred Stock, having such designations, rights and preferences

as set forth therein (the “Series D

Designation”).

The

shares of Series D Preferred Stock have a stated value of $1,200

per share (the “Series D Stated Value”) and are

convertible into Common Stock at the election of the holder of the

Series D Preferred Stock, at any time following a Qualified

Offering (as defined in the Series D Designation) at a price of

$0.10 per share, subject to adjustment (the “Conversion

Price”). Each holder of Series D Preferred Stock shall be

entitled to receive, with respect to each share of Series D

Preferred Stock then outstanding and held by such holder, dividends

at the rate of twelve percent (12%) per annum (the “Preferred

Dividends”).

The

Preferred Dividends shall accrue and be cumulative from and after

the date of issuance of any share of Series D Preferred Stock on a

daily basis computed on the basis of a 360-day year and compounded

daily. The Preferred Dividends are payable quarterly. The Company

shall pay such dividends in the form of cash or Series D Preferred

Stock, as determined by the Company.

The

holders of Series D Preferred Stock rank senior to the Common Stock

and Common Stock Equivalents (as defined in the Series D

Designation) with respect to payment of dividends and rights upon

liquidation and will vote together with the holders of the Common

Stock on an as-converted basis, subject to beneficial ownership

limitations, on each matter submitted to a vote of holders of

Common Stock (whether at a meeting of shareholders or by written

consent). In addition, as further described in the Series D

Designation, as long as any of the shares of Series D Preferred

Stock are outstanding, the Company will not take certain corporate

actions without the affirmative vote at a meeting (or the written

consent with or without a meeting) of the majority of the shares of

Series D Preferred Stock then outstanding.

Each share of Series D Preferred Stock shall be convertible, at any

time and from time to time after the Qualified Offering (as defined

in Series D Designation) the at

the option of the holder of such shares, into that number of shares

of Common Stock determined by dividing the Series D Stated Value by

the Conversion Price, subject to certain beneficial ownership

limitations.

The Series D Designation are subject to certain Registration

Rights, whereby if the Corporation does not complete a market

listing to the NYSE American, the Nasdaq Capital Market, the Nasdaq

Global Market, the Nasdaq Global Select Market or the New York

Stock Exchange (or any successors to any of the foregoing) within

one hundred twenty (120) calendar days from the issuance of the

Series D Preferred Stock, the Company will, within ten (10)

calendar days, file a registration statement covering the shares of

Common Stock underlying the Series D Preferred Shares.

Additionally, the Company will include the shares of Common Stock

underlying the Series D Preferred Shares in any registration

statement which is being filed by the Corporation’s existing

investment banker, provided, that said registration statement is

not yet effective with the SEC and provided that the Company

receives the prior written approval of said investment

banker.

The

foregoing description of the Series D Designation does not purport

to be complete and is subject to, and qualified in its entirety by

the Series D Designation, a copy of which is attached as Exhibit

3.1 to this Current Report on Form 8-K and incorporated herein by

reference.

Item

5.03 Amendments

to Articles of Incorporation or Bylaws; Change in Fiscal

Year.

The

information set forth in Item 1.01, Item 3.02, and Item 3.03 of

this Current Report on Form 8-K is incorporated by reference into

this Item 5.03.

Item

9.01. Financial

Statements and Exhibits.

(d)

Exhibits.

|

Exhibit Number

|

|

Description

|

|

|

|

Certificate

of Designations of the Series D Convertible Preferred

Stock

|

|

|

|

Form

Securities Purchase Agreement

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the

Registrant has duly caused this report to be signed on its behalf

by the undersigned, hereunto duly authorized.

|

|

NATURALSHRIMP

INCORPORATED

|

|

|

|

|

|

|

|

Date: December 22,

2020

|

By:

|

/s/

Gerald Easterling

|

|

|

|

Name:

|

Gerald

Easterling

|

|

|

|

Title:

|

Chief Executive

Officer

|

|

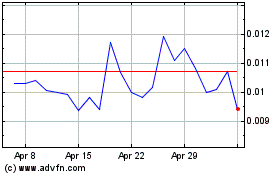

NaturalShrimp (QB) (USOTC:SHMP)

Historical Stock Chart

From Mar 2024 to Apr 2024

NaturalShrimp (QB) (USOTC:SHMP)

Historical Stock Chart

From Apr 2023 to Apr 2024