Statement of Changes in Beneficial Ownership (4)

October 31 2014 - 4:40PM

Edgar (US Regulatory)

|

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue.

See

Instruction 1(b).

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Alterna Core Capital Assets Fund II, L.P.

|

2. Issuer Name

and

Ticker or Trading Symbol

Midwest Energy Emissions Corp.

[

MEEC

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

_____ Director

__

X

__ 10% Owner

_____ Officer (give title below)

_____ Other (specify below)

|

|

(Last)

(First)

(Middle)

C/O ALTERNA CAPITAL PARTNERS LLC, 15 RIVER ROAD, SUITE 320

|

3. Date of Earliest Transaction

(MM/DD/YYYY)

10/31/2014

|

|

(Street)

WILTON, CT 06987

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

___ Form filed by One Reporting Person

_

X

_ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

Table II - Derivative Securities Beneficially Owned (

e.g.

, puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3)

|

2. Conversion or Exercise Price of Derivative Security

|

3. Trans. Date

|

3A. Deemed Execution Date, if any

|

4. Trans. Code

(Instr. 8)

|

5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

6. Date Exercisable and Expiration Date

|

7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4)

|

8. Price of Derivative Security

(Instr. 5)

|

9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4)

|

10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4)

|

11. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

(A)

|

(D)

|

Date Exercisable

|

Expiration Date

|

Title

|

Amount or Number of Shares

|

|

12% Senior Secured Convertible Note

|

$1

(1)

(2)

|

10/31/2014

|

|

J

(1)

(3)

|

|

$104993

(1)

(3)

|

|

10/31/2014

|

(4)

|

Common Stock

|

$104993

(1)

(3)

|

$0

(1)

(3)

|

22868249

(1)

(3)

|

I

(5)

(6)

(7)

|

By AC Midwest Energy LLC

(5)

(6)

(7)

|

|

Explanation of Responses:

|

|

(

1)

|

Pursuant to the terms of that certain Financing Agreement, dated as of August 14, 2014 (the "Financing Agreement"), by and among AC Midwest Energy LLC ("AC

Midwest"), the Issuer and the Issuer's wholly-owned subsidiary, AC Midwest purchased a 12% senior secured convertible note in the aggregate principal amount of $10 million

(the "Note") and a five year warrant (the "Warrant") to purchase up to an additional 12,500,000 shares of the Issuer's common stock, par value $0.001 per share (the "Common

Stock").

|

|

(

2)

|

The conversion price of the Note and exercise price of the Warrant are initially $1.00 per share of Common Stock, both subject to automatic adjustment, to $0.75, if the Issuer's EBITDA for the twelve-month period ended December 31, 2015 is less than $2,500,000, and further subject to weighted average anti-dilution protection (except with respect to certain excluded issuances). The Warrant is also subject to percentage based anti-dilution protection, requiring that the aggregate number of shares of Common Stock purchasable upon initial exercise of the Warrant not be less than an amount equal to 15% of the Issuer's then outstanding shares of capital stock on a fully diluted basis.

|

|

(

3)

|

Interest on the Note is payable in kind for the first year, at a rate of 2% in cash and 10% in kind for the second year and thereafter entirely in cash. Interest is calculated on the basis of a 360-day year and actual days elapsed, and it accrues or is payable, as applicable, monthly in arrears on or before the last day of each calendar month. On October 31, 2014 the outstanding principal balance of the Note increased by $104,993 (to the aggregate principal amount of $10,265,593). An additional $102,656 in interest will accrue through December 30, 2014.

|

|

(

4)

|

The maturity date of the Note is the earlier of: (i) July 31, 2018, or (ii) the date on which the unpaid balance of the Note becomes due and payable pursuant to the terms of the Note or the Financing Agreement.

|

|

(

5)

|

This statement is jointly filed by and on behalf of each of Alterna Core Capital Assets Fund II, L.P. ("Fund II"), Alterna Capital Partners LLC ("Alterna"), Alterna General Partner II LLC ("Fund II General Partner"), AC Midwest Entity Corp. ("AC Midwest Corp."), AC Midwest, Harry V. Toll, James C. Furnivall, Eric M. Press, Roger P. Miller and Earle Goldin. AC Midwest is the record and direct beneficial owner of the securities covered by this statement. AC Midwest Corp., together with Fund II, owns all of the outstanding equity interests of AC Midwest and may be deemed to beneficially own securities held by AC Midwest. Fund II owns all of the outstanding equity interests of AC Midwest Corp., and, together with AC Midwest Corp., owns all of the outstanding equity interests of AC Midwest and may be deemed to beneficially own securities held by AC Midwest.

|

|

(

6)

|

Alterna, in its capacity as investment adviser to Fund II, has the ability to direct the investment decisions of the Fund II, including the power to vote and dispose of securities held by AC Midwest and may be deemed to beneficially own securities held by AC Midwest. Fund II General Partner, in its capacity as the general partner of Fund II, has the ability to direct the management of Fund II's business, including the power to direct the decisions of Fund II regarding the vote and disposition of securities held by AC Midwest and may be deemed to beneficially own securities held by AC Midwest.

|

|

(

7)

|

Each of Messrs. Toll, Furnivall, Press and Miller, by virtue of their role as managing members of Alterna, and Mr. Goldin, by virtue of his role as a member of Alterna, may be deemed to have the shared power regarding the vote and disposition of securities held by AC Midwest and may be deemed to beneficially own securities held by AC Midwest.

|

Reporting Owners

|

|

Reporting Owner Name / Address

|

Relationships

|

|

Director

|

10% Owner

|

Officer

|

Other

|

Alterna Core Capital Assets Fund II, L.P.

C/O ALTERNA CAPITAL PARTNERS LLC

15 RIVER ROAD, SUITE 320

WILTON, CT 06987

|

|

X

|

|

|

Alterna Capital Partners LLC

C/O ALTERNA CAPITAL PARTNERS LLC

15 RIVER ROAD, SUITE 320

WILTON, CT 06897

|

|

X

|

|

|

Alterna General Partner II LLC

C/O ALTERNA CAPITAL PARTNERS LLC

15 RIVER ROAD, SUITE 320

WILTON, CT 06897

|

|

X

|

|

|

AC Midwest Entity Corp.

C/O ALTERNA CAPITAL PARTNERS LLC

15 RIVER ROAD, SUITE 320

WILTON, CT 06897

|

|

X

|

|

|

AC Midwest Energy LLC

C/O ALTERNA CAPITAL PARTNERS LLC

15 RIVER ROAD, SUITE 320

WILTON, CT 06897

|

|

X

|

|

|

Toll Harry V.

C/O ALTERNA CAPITAL PARTNERS LLC

15 RIVER ROAD, SUITE 320

WILTON, CT 06897

|

|

X

|

|

|

Press Eric M.

C/O ALTERNA CAPITAL PARTNERS LLC

15 RIVER ROAD, SUITE 320

WILTON, CT 06897

|

|

X

|

|

|

Goldin Earle

C/O ALTERNA CAPITAL PARTNERS LLC

15 RIVER ROAD, SUITE 320

WILTON, CT 06897

|

|

X

|

|

|

FURNIVALL JAMES C

C/O ALTERNA CAPITAL PARTNERS LLC

15 RIVER ROAD, SUITE 230

WILTON, CT 06897

|

|

X

|

|

|

Miller Roger P.

C/O ALTERNA CAPITAL PARTNERS LLC

15 RIVER ROAD, SUITE 320

WILTON, CT 06897

|

|

X

|

|

|

Signatures

|

|

Richard Bertkau, Attorney-In-Fact

|

|

10/31/2014

|

|

**

Signature of Reporting Person

|

Date

|

|

Reminder: Report on a separate line for each class of securities beneficially owned directly or indirectly.

|

|

*

|

If the form is filed by more than one reporting person,

see

Instruction 4(b)(v).

|

|

**

|

Intentional misstatements or omissions of facts constitute Federal Criminal Violations.

See

18 U.S.C. 1001 and 15 U.S.C. 78ff(a).

|

|

Note:

|

File three copies of this Form, one of which must be manually signed. If space is insufficient,

see

Instruction 6 for procedure.

|

|

Persons who respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

|

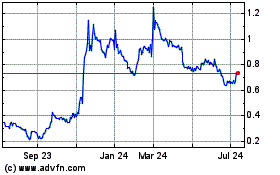

Midwest Energy Emissions (QB) (USOTC:MEEC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Midwest Energy Emissions (QB) (USOTC:MEEC)

Historical Stock Chart

From Jul 2023 to Jul 2024