Current Report Filing (8-k)

October 03 2014 - 4:30PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

---------------

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 2, 2014

Kraig Biocraft Laboratories, Inc.

---------------

(Exact name of Registrant as specified in charter)

|

Wyoming

|

|

333-146316

|

|

83-0459707

|

|

(State of Incorporation)

|

|

(Commission File No.)

|

|

(IRS Employer

Identification Number)

|

|

120 N. Washington Square, Suite 805, Lansing, Michigan

|

|

48933

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant's telephone number, including area code: (517) 336-0807

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17CFR230.425)

o Soliciting material pursuant to Rule14a-12 under the Exchange Act (17CFR240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17CFR240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17CFR240.13e-4(c))

Item 1.01 Entry into a Material Definitive Agreement.

On October 2, 2014, Kraig Biocraft Laboratories, Inc., a Wyoming corporation (the “Company”) entered into a letter agreement for an equity line of financing up to $7,500,000 (the “Letter Agreement”) with Calm Seas Capital, LLC (“Calm Seas”).

Under the Letter Agreement, over a 24 month period from the Effective Date (as defined below) we may put to Calm Seas up to an aggregate of $7,500,000 in shares of our Class A common stock for a purchase price equal to 80% of the lowest price of our Class A common stock during the five consecutive trading days immediately following the date we deliver notice to Calm Seas of our election to put shares pursuant to the Letter Agreement. We may put shares bi-monthly. The dollar value that will be permitted for each put pursuant to the Letter Agreement will be the lesser of: (A) the product of (i) 200% of the average daily volume in the US market of our Class A common stock for the ten trading days prior to the date we deliver our put notice to Calm Seas multiplied by (ii) the average of the daily closing prices for the ten (10) trading days immediately preceding the date we deliver our put notice to Calm Seas, or (B) $100,000. We will automatically withdraw our put notice to Calm Seas if the lowest closing bid price used to determine the purchase price of the put shares is not at least equal to seventy-five percent (75%) of the average closing “bid” price for our Class A common stock for the ten (10) trading days prior to the date we deliver our put notice to Calm Seas.

On the seventh business day after we deliver our put notice to it, Calm Seas will purchase the number of shares set forth in the put notice at the dollar value set forth in the put notice by delivering such amount to us by wire transfer.

Notwithstanding the $100,000 ceiling for each bi-monthly put, as described above, we may at any time request Calm Seas to purchase shares in excess of such ceiling, either as a part of bi-monthly puts or as an additional put(s) during such month. If Calm Seas, in its sole discretion, accepts such request to purchase additional shares, then we may include the put for additional shares in our monthly put request or submit an additional put for such additional shares in accordance with the procedure set forth above.

We agreed to file a registration statement covering the resale by Calm Seas of the shares to be issued under the Letter Agreement (the “Registration Statement”). We may issue the first put notice to Calm Seas during the first 5 business days of the month following the month when the Registration Statement has been declared effective (the “Effective Date”).

The Letter Agreement will terminate when any of the following events occur:

|

●

|

Calm Seas has purchased an aggregate of $7,500,000 of our Class A common stock; or

|

|

●

|

The second anniversary from the Effective Date.

|

The foregoing description of the Letter Amendment is qualified in its entirety by the text of the Letter Agreement which is annexed hereto as Exhibit 10.1.

Item 9.01 Financial Statements and Exhibits.

(d) The following exhibits are filed with this report:

|

Exhibit No.

|

|

Description

|

|

|

|

Letter Agreement dated October 2, 2014 by and between the Company and Calm Seas.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Current Report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: October 3, 2014

| |

Kraig Biocraft Laboratories, Inc.

|

|

| |

|

|

|

| |

By:

|

/s/ Kim Thompson

|

|

| |

|

Name: Kim Thompson

|

|

| |

|

Title: CEO

|

|

| |

|

|

|

3

CALM SEAS CAPITAL, LLC

4650 Wedekind Rd. Suite 2 Sparks, NV 89431

October 2nd, 2014

Kim Thompson, CEO

Kraig Biocraft Laboratories, Inc.

120 N. Washington Square, Suite 805

Lansing, MI 48933

In Re: Proposed Equity Line Transaction - Term Sheet

Dear Mr. Thompson:

This Letter is to serve as a binding Memorandum of Understanding for an Equity Line transaction by Calm Seas Capital, LLC (“Investor”) and Kraig Biocraft Laboratories, Inc. (the “Company”) in accordance with the terms and conditions on the attached Term Sheet, which is hereby incorporated herein by reference. If this transaction is acceptable to the Company, please so indicate by signing and dating where indicated below and returning this Letter MOU to us. In addition, please initial each of the pages of the attached Term Sheet and return it to us with the accepted Letter MOU.

Yours truly,

| CALM SEAS CAPITAL, LLC |

|

| |

|

|

|

| By: |

|

|

|

| |

|

AGREEMENT and ACCEPTANCE

The foregoing Letter MOU together with the attached and incorporated Term Sheet is approved as of this 2nd day of October, 2014:

|

KRAIG BIOCRAFT LABORATORIES, INC.

|

|

| |

|

|

|

| By: |

|

|

|

| Kim Thompson, CEO |

|

|

|

| |

KRAIG BIOCRAFT LABORATORIES, INC.

TERM SHEET

(October 2, 2014)

|

Issuer:

|

Kraig Biocraft Laboratories, Inc. ( KBLB).

|

|

Offering:

|

Up to $7,500,000 in shares of Common Stock.

|

|

Investor(s):

|

Calm Seas Capital, LLC, as lead investor, and associated entities.

|

| |

|

|

Execution Date

|

The Execution Date is the date on which the final documents for the Equity Line of Credit are signed by both the Company and the Investor(s).

|

|

Structure

|

Equity Line of Credit, with bi-monthly puts against the Commitment Amount (as defined below), during the “Term”.

|

|

Term

|

The Term shall be that period commencing with the Effective Date and ending on the earlier of (a) the drawing down of the entire Commitment Amount or (b) that date 24 months after the Effective Date (as defined below) (the “Term”).

|

|

Commitment Amount

|

The Investor shall commit to purchase up to $7,500,000 of the Company’s Common Stock over the course of no more than 24 months (the “Commitment Period”) after the date a registration statement for the resale of the Common Stock has been declared effective (the “Effective Date”) by the U.S. Securities and Exchange Commission (“SEC”).

|

|

First Put

|

The Company may issue its first “Put Notice” during the first 5 business days of the month succeeding the month in which the Effective Date occurs.

|

|

Put Date

|

The date of delivery of the Put Notice shall be the “Put Date”

|

|

Put Ceiling

|

The maximum amount which the Company shall be entitled to request by each Put shall be the lesser of (a) $100,000 or (b) 200% of the average daily volume (“ADV”) multiplied by the average of the daily closing prices for the ten (10) trading days immediately preceding the Put Date. The ADV shall be computed using the 10 trading days prior to the Put Date.

|

|

Put Floor

|

The Company shall automatically withdraw that portion of the Put Notice amount if the Market Price with respect to that put does not meet the Minimum Acceptable Price, which is defined as 75% of the average closing “bid” price for the Common Stock for the 10 trading days prior to the Put Date.

|

|

Put by

Mutual Agreement

|

Notwithstanding the ceiling for each Put, as described above, at any time either as a part of a monthly Put or as an additional Put(s) during a month, the Company may request permission to request funds in excess of the Put Ceiling for such month and may deliver to Investor(s) a Put or Puts in excess of the Put Ceiling, which Put or Puts Investor(s) may fund, in its/their sole discretion, subject to the terms and conditions herein applicable to the monthly Puts.

|

|

Pricing Period

|

The five (5) consecutive trading days immediately after the Put Date.

|

|

Market Price

|

The lowest price of the Common Stock during the Pricing Period.

|

|

Purchase Price

|

The purchase price shall be eighty percent (80%) of the Market Price.

|

|

Put Closing Date

|

Seven (7) business days after the Put Date; the Investor(s) shall make the investment required by the Put Notice, subject to the Put Ceiling. Payments of the Puts shall be made by wire transfer.

|

|

Registration Statement

|

The Investor(s) will work with the Company to have a registration statement covering the Common Stock (or a portion thereof if there is a Rule 415 cutback - see below) prepared and filed by the Company’s corporate counsel, at the Company’s expense, within 75 days after the Execution Date. Such Registration Statement shall be prosecuted with all due speed to be declared effective within 120 days after the Effective Date.

|

|

Expenses

|

The Company agrees to pay all expenses related to the preparation of the final documents to be signed on the Execution Date and the Company shall pay all expenses related to the filing and prosecution of the Registration Statement. The Company will select counsel of its choice to prepare the Registration Statement.

|

|

Commitment Fee

|

Waived.

|

|

Rule 415 Cutback

|

In the event that the SEC objects to the number of shares proposed to be registered, the Company shall use its best efforts to register the maximum number of shares permissible by the SEC to retain the status of the offering as a secondary offering under SEC Rule 415.

|

|

Equity Issuance

Restriction

|

Waved.

|

|

Right of First Offer

|

If the Company has a bona fide proposal to sell, or offers to sell, any New Security (as hereinafter defined) to any third party, the Company shall first offer such New Securities to the Investor (the “Offer Notice”). The Offer Notice shall be in writing and set forth all of the material terms of the offer of New Securities. The Investor shall have 10 business days from the date on which the Company delivers written Offer Notice to elect, in its sole discretion, to purchase some or all of the New Securities. The Company shall not offer or sell any New Securities until after such 10 business day period has expired. For the purposes of this letter agreement, “New Security” shall mean any equity securities of the Company, whether or not such equity securities is currently authorized, as well as any rights, options, or warrants to purchase such equity securities, and any securities of any type whatsoever that is, or may become, convertible or exchangeable into or exercisable for such equity securities.

|

|

Covenants

|

1. During the Term, the Company shall maintain the effectiveness of the Registration Statement.

2. During the Term, the Company shall maintain its status as a FULLY REPORTING SEC Public Company trading on the OTCBB and or the OTCQB and or AMEX and or NASDAQ or similar exchanges.

3. During the Term, the Company shall timely file all required SEC reports.

4. The Company shall maintain a contractual relationship for the performance of financial public relations services for a period of 36 months from the effective date, with the extent of the costs of such services to be proportional to the size and growth of the Company.

|

|

Short Sales

|

During the Term, the Investor(s) agree(s) not to engage in any short selling of the Company’s Common Stock.

|

|

Exclusivity

|

From the date of the execution of this Term Sheet until the Effective Date, the Company shall not pursue any other transaction of the nature contemplated herein with any other person unless and until good faith negotiations with the Investor have been terminated.

|

3

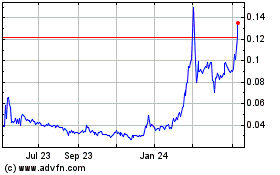

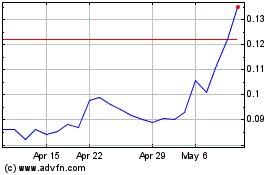

Kraig Biocraft Laborator... (QB) (USOTC:KBLB)

Historical Stock Chart

From May 2024 to Jun 2024

Kraig Biocraft Laborator... (QB) (USOTC:KBLB)

Historical Stock Chart

From Jun 2023 to Jun 2024