Current Report Filing (8-k)

June 15 2022 - 4:01PM

Edgar (US Regulatory)

0001355250false00013552502022-06-092022-06-09iso4217:USDxbrli:sharesiso4217:USDxbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT TO

SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): June 9, 2022

INNOVATION PHARMACEUTICALS INC. |

(Exact Name of Registrant as Specified in Charter) |

Nevada | | 001-37357 | | 30-0565645 |

(State or Other Jurisdiction | | (Commission | | (IRS Employer |

of Incorporation) | | File Number) | | Identification No.) |

301 Edgewater Place - Suite 100 Wakefield, Massachusetts | | 01880 |

(Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (978) 921-4125

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered under Section 12(b) of the Exchange Act: none

Indicate by check mark whether the Registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On June 9, 2022, Innovation Pharmaceuticals Inc. (the “Company”) entered into a Series A Preferred Share Purchase Agreement (the “Purchase Agreement”) with Squalus Med Ltd., a company established under the laws of the State of Israel (“SML”), pursuant to which the Company purchased 55,556 shares of SML’s Series A Redeemable Preferred Shares (the “Series A Shares”) and a warrant (the “Warrant”) to purchase 27,778 Series A Shares for aggregate consideration of $4,000,000, or approximately $72.00 per Series A Share. Following the closing under the Purchase Agreement, the Company owns approximately 35.7% of SML’s issued and outstanding equity securities and approximately 41.6% of SML’s equity securities on a fully diluted basis. The Company also entered into customary investor rights and indemnification agreements with SML.

The Series A Shares are governed by SML’s Amended and Restated Articles of Association (the “Articles of Association”) and have the following rights and preferences, among others:

| · | Liquidation preference — In the event of any liquidation or winding up of SML, the holders of the Series A Shares will be entitled to receive, in preference to the holders of SML’s ordinary shares, an amount equal to the original purchase price of the Series A Shares or such higher amount as would be received if the Series A Shares were converted to ordinary shares immediately before the liquidation or winding up. |

| | |

| · | Conversion — The holders of the Series A Shares will have the right to convert the Series A Shares, at any time, into SML’s ordinary shares. The Series A Shares will also automatically convert into ordinary shares upon the occurrence of a qualified IPO. The initial conversion rate will be 1:1, subject to adjustment upon the occurrence of certain events set forth in the Articles of Association. |

| | |

| · | Dividends — Dividends will be paid on the Series A Shares on an on-converted basis when paid on SML’s ordinary shares. |

| | |

| · | Voting and consent rights — The Series A Shares will vote on an as-converted basis with SML’s ordinary shares. In addition, so long as at least 30% of the Series A Shares issued pursuant to the Purchase Agreement are outstanding, the holders of the Series A Shares will have consent rights over certain actions by SML, including, without limitation, amendments to the Articles of Association in a manner adverse to the Series A Shares, issuances of securities senior to the Series A Shares, and changes to the size of SML’s board of directors. |

| | |

| · | Board Representation — SML’s board of directors consists of three directors, including Leo Ehrlich, the Company’s Chief Executive Officer, as the designee of the preferred shareholders. SML will not take certain actions without approval of its board of directors including the designee of the preferred shareholders, including, without limitation, incurring indebtedness above certain levels, changing SML’s business, or enter into certain licensing or sales transactions involving SML’s technology or intellectual property. |

The Warrant has an exercise price of $108.00 per Series A Share and is exercisable until the earliest of (i) five years after FDA approval of SML’s medical device, as more fully set forth in the Articles of Association, (ii) the closing of a deemed liquidation, (iii) 30 days following consummation of a qualified financing event, or (iv) consummation of an initial public offering by SML.

The foregoing descriptions of the terms and conditions of the Purchase Agreement, Articles of Association and Warrant are not complete and are qualified in their entirety by the full text of the Purchase Agreement, Articles of Association and Warrant, which are filed herewith as Exhibit 10.1 and incorporated into this Item 1.01 by reference.

Item 7.01 Entry into a Material Definitive Agreement.

On June 15, 2022, the Company issued a press release regarding its investment in SML. A copy of the press release is furnished herewith as Exhibit 99.1.

The information in this Current Report on Form 8-K under this Item 7.01, including the accompanying press release, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by reference to such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | INNOVATION PHARMACEUTICALS INC. | |

| | | | |

| Dated: June 15, 2022 | By: | /s/ Leo Ehrlich | |

| Name: | Leo Ehrlich | |

| | Title: | Chief Executive Officer | |

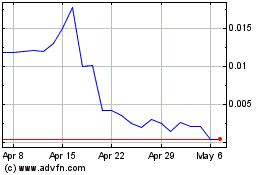

Innovation Pharmaceuticals (CE) (USOTC:IPIX)

Historical Stock Chart

From Aug 2024 to Sep 2024

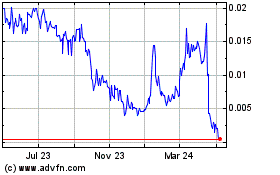

Innovation Pharmaceuticals (CE) (USOTC:IPIX)

Historical Stock Chart

From Sep 2023 to Sep 2024